OFD what is it?

The new legislation “54-FZ” defines a mandatory requirement for cash registers - the transfer of an electronic version of fiscal receipts to the OFD.

The broadcast is carried out using an online cash register and a fiscal drive (FN), the choice of which is described in the article at the link. FDO is an organization that carries out the function of collecting and storing fiscal data and has the appropriate licenses for this. After the sale is completed, the cash register automatically generates a fiscal receipt and sends it to the OFD. In turn, the OFD checks the fiscal indicator and sends confirmation of receipt of the data to the client. Next, the OFD processes and transmits information to the Federal Tax Service of Russia (FTS).

In other words, the OFD acts as an information intermediary between the Federal Tax Service and business. Direct transfer of data is not possible; this is indicated by law.

What is fiscalization

The term “fiscalization” can be understood in different ways. There are 3 common interpretations:

- When fiscalization is understood as a procedure in which an authorized state body (Federal Tax Service) in the prescribed manner receives information about the revenue (and expenses) of an economic entity and then uses it as part of its activities in the interests of the state treasury.

So, in the general case, this information is subsequently used within the framework of tax control (when checking declarations) or in another way that is provided for by the regulations of the Federal Tax Service and complements tax control.

[adsp-pro-1]

In this case, we have the right to correlate the concept of “fiscalization” with the term “fiscal” - that is, related to the activities of a government body related to ensuring the interests of the budget and treasury. The Federal Tax Service collects taxes (controls their payment) - and, accordingly, compares them with the revenue (or expenses) of the business entity, which affects its tax base. This comparison is carried out in the interests of the treasury - it is “fiscal”. Therefore, it forms “fiscalization” in the interpretation under consideration.

In practice, such fiscalization can be carried out based on revenue:

- received only at the cash register where cash register equipment is used (in accordance with Law No. 54-FZ);

- received only at the checkout, where cash register is not used (as an option, thanks to the exceptions prescribed in Law No. 54-FZ);

- received only from receipts to a current account (or other non-cash resource for payments);

- received both at the checkout (of one type or another), and through receipts to the current account (and to alternative resources for non-cash payments).

The same applies to expenses, which can be recorded in one way or another. It turns out that fiscalization in the interpretation under consideration can be understood very broadly, including as a procedure that has nothing to do with control over cash transactions in general. Even if the Federal Tax Service does not look at the “cash registers,” then it continues to perform, while controlling revenues and expenses, a fiscal function, which means it carries out fiscalization.

- When fiscalization is understood as a technical procedure for activating (putting into operation) cash register equipment that is equipped with fiscal hardware components, carried out in accordance with the established procedure - that is, the technical means with which the procedure under paragraph 1 is carried out (in the variety when revenues and expenses are fiscalized at the cash register with cash register).

In the case of modern cash registers, we will be talking about fiscal drives (FS) - high-tech devices that provide data storage in a protected mode (when they cannot be modified without violating the integrity of the drive). Previously, fiscal memory with ECLZ was used, before it - other technical means that were subject to commissioning in the prescribed manner.

The concept of fiscalization as a procedure for putting cash registers into operation (which can be called differently - for example, as “activation of the fiscal regime”) is enshrined in a number of regulations. For example, in the Technical Requirements for the fiscal memory of cash registers (approved by the Decision of the GMEC dated June 23, 1995, protocol No. 5/21-95). There is no such correspondence in Law No. 54-FZ, but the content of this act essentially allows us to say that the legislator provides for fiscalization as such a procedure - similar to that carried out during the periods of application of the specified Technical Requirements (and accompanying documents that regulate the use of KKT).

[adsp-pro-4]

Thus, on the one hand, it is legitimate to say that fiscalization according to the law is strictly the commissioning of cash registers. On the other hand, this definition is enshrined in standards that:

- do not have the status of a federal law or government regulation;

- are not fully applied by modern trading enterprises - due to the specifics of innovative online cash registers (and their practical location under the jurisdiction of other regulations - including at the level of federal laws).

In turn, the federal laws do not say anything about the fact that fiscalization is only the commissioning of cash registers. Therefore, it is legitimate not to limit ourselves to the interpretation enshrined in a number of technical standards - and to understand the term “fiscalization” more broadly.

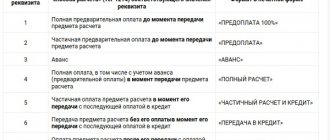

- When fiscalization refers to the formation and processing of a cash receipt - the main carrier of data on the revenue (expenses) of an economic entity in the manner prescribed by law - similarly, within the framework of the procedure under paragraph 1 (again, for a cash register with a cash register).

One way or another, all 3 given interpretations are interconnected. To carry out the “fiscalization” of revenue (at a cash register with a cash register), it is necessary to “fiscalize” the cash register and the receipt. In turn, the second and third procedures are, in principle, carried out for the sake of the first (and thus necessarily precede it).

Let us consider how the above fiscalization scenarios are implemented in practice.

Payments (revenue and expenses)

So, the first interpretation of fiscalization corresponds to the procedure in which the Federal Tax Service receives information about payments (revenue and expenses) that were generated as a result of certain settlements carried out by an economic entity at the cash desk or outside it.

In the case of fiscalization at the cash register with cash registers, tax authorities receive this information:

- In the general case, accepting payment data at the checkout via the Internet.

The intermediary between the Federal Tax Service and the business entity is a specialized organization - the Fiscal Data Operator. The company must have an agreement with him. Cash desks located at the enterprise must be connected to the OFD servers in the prescribed manner.

- If it is impossible to obtain data via the Internet, by obtaining, in accordance with the established procedure, access to fiscal drives that are located at the cash desks of the business entity.

This scenario is possible if the enterprise has the right to use cash registers in a mode without transmitting fiscal data. This right appears for business entities located in areas remote from communication networks. These are recognized as settlements with a population of no more than 10 thousand people (Order of the Ministry of Telecom and Mass Communications of Russia dated December 5, 2016 No. 616 - LINK).

[adsp-pro-6]

It is therefore assumed that the trade enterprise will use a cash register that meets the requirements of Law No. 54-FZ - that is, equipped with a fiscal drive, but without an agreement with the OFD (since technically there will be no connection to the Operator’s servers). As a result, data from the drive is transferred to the Federal Tax Service without using the Internet in the prescribed manner.

Thus, in accordance with paragraph 14 of Article 4.2 (LINK), the enterprise that owns the cash register, in the event of its re-registration in connection with the replacement of the fiscal drive (or deregistration of the cash register), is obliged to:

- reading fiscal documents that are recorded in the drive;

- submit these documents to the Federal Tax Service - along with an application for registration (re-registration) of the cash register (or deregistration of the cash register).

In practice, “reading” can be done at the Federal Tax Service office: the fiscal drive must be taken there, and the department employees themselves read the necessary data from the device (letter of the Federal Tax Service of Russia dated February 16, 2018 No. AS-4-20 / [email protected] - LINK) . Since the application for re-registration in this case will most likely be on paper, a visit to the Federal Tax Service is, one way or another, expected, and the scheme with reading by its employees can be considered as the main one.

An important nuance: one should not confuse the status of the indicated settlements remote from communication networks with those that meet the criterion of being difficult to reach - in accordance with paragraph 3 of Article 2 of Law No. 54-FZ - LINK. Business entities located in hard-to-reach areas have the right not to use cash registers in principle - and, accordingly, do not fall under the fiscalization of revenue received at the cash register with cash registers. The Federal Tax Service “fiscalizes” their revenue (and expenses) in other ways - outside the jurisdiction of Law No. 54-FZ.

In practice, fiscalization at the cash desk without cash register is carried out as part of various tax control measures, during which inspectors, as a rule, look at:

- documents alternative to cash register receipts (sales receipts, BSO);

- cash orders (receipts, expenses);

- cash books and other supporting documents.

A separate procedure is the fiscalization of revenue reflected in the current account of a business entity. It involves the inspectors obtaining access to this account or sending to them documentation reflecting transactions on the account (statements, receipts) - in accordance with the requests of the Federal Tax Service as part of the inspections. But this procedure, in principle, has nothing to do with the organization of the work of cash registers by an economic entity - although it is part of “fiscalization” (understood in a broad sense).

Cash register

The following interpretation of the concept of fiscalization corresponds to the technical procedure in which a cash register with a fiscal drive - through which the Federal Tax Service will receive data on revenues and expenses (online or offline - depending on the mode of use of the cash register), is put into operation in the prescribed manner.

We advise you to look at this useful article about how the cash register is fiscalized using the example of Atol cash register - LINK.

In general, the fiscalization of online cash registers is carried out as part of a larger procedure - registration of cash registers with the Federal Tax Service. This procedure is carried out according to the following algorithm:

- An economic entity enters into an agreement with the OFD (let’s agree that it operates on the territory, which does not apply to those remote from communication networks).

- The business entity registers in the Personal Account on the Federal Tax Service website (if not registered before).

- The business entity draws up a qualified digital signature, which is suitable for document flow with the Federal Tax Service (if it does not already exist).

Note that if there is a signature for tax reporting, then in general it will do.

- The EDS certificate is integrated in the prescribed manner with the account of the business entity on the Federal Tax Service website.

- The online cash register (if there are several of them, then a similar procedure must be performed for each) is connected to a computer from which you can access the Federal Tax Service website.

- Each cash register is registered with the Federal Tax Service.

For these purposes, an application for registration is sent to the Federal Tax Service in the prescribed form. If the online cash register is used in data transfer mode (that is, if there is a contract with the OFD), then the application is submitted through the Personal Account of the business entity on the Tax Service website.

[adsp-pro-9]

You need to log into your personal account, then select “Cash Accounting”. Next, click on “fill in parameters manually”, and then enter the required information. These include the model of the cash register and drive, their serial numbers. It is also necessary to indicate the name of the OFD.

After entering all the data, you need to click on “Sign and send”. Within a few minutes, the KKM registration number assigned by the Tax Service should appear in the “KKT Accounting” section.

- The drive is activated—in fact, its fiscalization (essentially the “fiscalization” of the cash register itself, since the drive is legitimately considered a key hardware component) on each cash register.

To do this, a program from the cash register manufacturer is used. How to install it and run it, you need to find out from the specific cash register supplier. In the program you need to specify a number of key information - which will then be registered in the cash register connected to the computer. These include the registration number. Only if it is available will the fiscalization of the drive be possible.

Video - fiscalization of the Evotor 5 cash register:

Upon completion of activation of the drive, the “fiscalized” cash register will print a test cash receipt. Its details will be useful at the final stage of registering a cash register with the Federal Tax Service. To start it, you need to go to the “CCP Accounting” section in your personal account, and then click on the link “CCP RN”.

On the page that opens there will be a “Complete registration” item. You need to select it, and then indicate the required details of the test receipt in the window that opens. You will also need to indicate its number - 1. Once you have completed entering the data, click on “Sign” and send.

After the cash register will be considered put into operation in accordance with the algorithms established by law for interaction between a business entity and the Federal Tax Service.

Video - fiscalization of cash registers of the Atol family:

In practice, these algorithms, as a rule, are complemented by a number of others - related to ensuring the functioning of the online cash register in the mode of data exchange with the OFD. For these purposes, the cash register registered with the Federal Tax Service is subject to integration with the Operator’s servers. This procedure is carried out in accordance with the rules of a particular OFD - you need to find out about them from the operator himself.

Note that many OFDs (for example, HERE) have ready-made interfaces for registering cash registers with the Federal Tax Service. Or - there is a service for carrying out such registration. The specifics of using both mechanisms that allow you to register cash registers with the Federal Tax Service - that is, to fiscalize them from the point of view of ensuring the commissioning of cash registers - should also be learned through direct interaction with representatives of the Fiscal Data Operator.

Online cash register receipt

“Fiscalization” as a procedure for collecting data on revenue at the cash register (subject to preliminary fiscalization - as a stage of putting cash registers into operation) is in practice carried out within the framework of “fiscalization” as an established procedure for creating and processing a cash register receipt.

A cash receipt can be:

- paper;

- electronic.

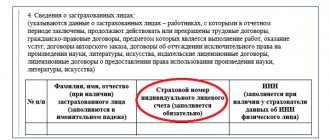

When making payments in a regular store, it is mandatory to form it in paper form; in electronic form, it is required by the buyer. When making payments on the Internet - only electronically. Both types of check must include the details provided for:

- the provisions of Article 4.7 of Law No. 54-FZ (LINK);

- Formats of fiscal documents that were approved by order of the Federal Tax Service of Russia dated March 21, 2017 No. ММВ-7-20/ [email protected] (LINK).

A cash receipt is the main carrier of information about revenues (expenses) that are of interest to the Federal Tax Service. And it is he, and not any other document, that is transferred from the OFD to the tax authorities. For this purpose, unified formats are used - so that the sent check is fully recognized by the recipient, and before that - generated at the checkout so that it can be transferred to the Operator, subject to its subsequent correct recognition.

Thus, the fiscalization of a cash receipt essentially consists of 3 procedures:

- creating a check in accordance with the FFD (and the requirements of Law No. 54-FZ for details);

- transfer of the check (corresponding to the FFD) to the OFD;

- transfer of the check to the Federal Tax Service.

Let us note that, as part of the exchange of data between a business entity, the OFD and the Federal Tax Service, the circulation of, in principle, a fairly wide range of fiscal documents can be carried out (a check is only a special case). For example, reports on the closing and opening of a shift. But, one way or another, it is the check that is the main source of data for the Federal Tax Service on revenue. It is its “fiscalization” that is a prerequisite for “fiscalization” as a procedure aimed at ensuring the interests of the state treasury.

[adsp-pro-10]

In all cases, electronic copies of checks are stored on the servers of the Federal Tax Service (as a rule, the OFD too). Any interested person can access them if necessary - if he has the key identifiers of the original check in his hands. In all cases, they are encrypted in a QR code, which is placed on the fiscal document in question (and is considered one of its mandatory details).

If there is an image of a QR code (optionally, photographed by a smartphone camera), then using it you can download a full-fledged electronic receipt from the Federal Tax Service database using the “Cash Receipt Check” application (read more about how to check a receipt using a QR code).

If it is not possible to download an electronic receipt using a QR code, then it can be verified for authenticity using other details - using, in turn, resources from the OFD. As a rule, these include (using the example of the check verification service OFD.ru - LINK):

- fiscal storage number;

- fiscal document number;

- fiscal sign of the document.

All of them are available on the original receipt.

If an interested person - for example, a buyer of a product - discovers that the receipt he received in the store did not pass verification, he can report this to the Federal Tax Service. As a result, such a person will become one of the subjects of the check fiscalization procedure.

What is needed to work with OFD?

You can enter into an agreement for the processing of fiscal data with the OFD at any time, but to begin full-fledged work you need to make sure that you have met the following conditions:

- The retail outlet is provided with Internet access;

- Cash register equipment has been updated in accordance with current legislation (online cash register with FN);

- Your cash register is registered with the tax office, for this you can use a qualified electronic digital signature (CES) and the taxpayer’s personal account;

- The data in the OFD personal account is completely filled out, the personal account is replenished.

If you have fulfilled all the conditions, you can safely activate the cash register in your OFD personal account! Our specialists will help you register the cash register and enter into an agreement with the OFD.

Software for online cash registers

Now about the issue of automation software based on online cash registers. If you have to automate from scratch, then it makes sense to do it competently and with the ability to scale the system. Now the choice of such software products and services is very large, and the price range for a more or less sane system is from 1000 rubles. per month for cloud services, up to tens of thousands of rubles for full-fledged cash register programs for a local server. But in this article we are not even talking about the need for such software, but about the tax deduction, which dried up for us already at the stage of purchasing a cash register with FN and an annual contract with the OFD, so we’ll stop there.

Scheme of operation of the OFD

Let's analyze the process from the very beginning - the moment of selling a product or providing a service to a buyer. The buyer purchases a set of goods at the point of sale. The cashier scans the barcode of the product using a scanner, or enters it manually, depending on the configuration of the cash register. The cash register software generates a check, and the FN signs the check with a fiscal sign (FP). After this, information from the FN is automatically sent to the OFD.

The OFD checks the receipt and sends the receipt back from the FP to the online cash register. The final stage is the registration of the FI in the financial fund of your cash register. All this happens automatically and does not take up your time. Further work with the data and transferring it to the Federal Tax Service is the work of the OFD. In turn, at the time of sale you issue a check that meets the new requirements to your client.

Fiscal Data Format (FFD)

Fiscal data format (FFD) is an algorithm approved by law, according to which various details (reflecting the content of a particular cash transaction carried out on the device) are placed on the fiscal document generated by the online cash register. Fiscal data formats are designed to ensure that all participants in the exchange of information on fiscal transactions do so in a single format.

It must be said that talking about these formats, and how crude the first version 1.0 was at the time the law was released, is a whole story. Even after a year and the launch of the new version of FNA 1.1, businesses (and us, software developers) still have a lot of questions. There is still a crutch in the solution and a disconnection of legislators and regulators from the realities of business. But this is a topic for a separate article.

Here we will briefly focus on the main points. So, now there are three types of FNs, and they have different periods of use permitted by the state:

- FFD version 1.0 - initial, limited use until January 1, 2019

- FFD version 1.05 - transitional, unlimited period

- FFD version 1.1 - final, unlimited period

The transition from version 1.0 to version 1.05 is possible without replacing the FN. The transition from versions 1.0 and 1.05 to version 1.1 is possible only with the replacement of the FN.

The differences between the versions lie in the lists of details that, in accordance with one or another format, must be included in the fiscal document, as well as in the order in which the relevant details are included in the fiscal document. We will talk more about fiscal data formats, the nuances of moving from version to version, aspects of processing cash transactions and related difficulties in the next article.

Our recommendations for entrepreneurs

In conclusion, I would like to note that the potential of the Russian market for online cash registers, which, in accordance with the law, will have to issue electronic receipts, was estimated at 1.3-1.5 million units in 2021 (according to open sources, in fact, in the first wave FZ-54, only 1.0 million cash registers were modernized).

We and our business colleagues, cash register salesmen and automation operators, still remember the hysteria and shortages of the first wave that the market faced (when FNs worth 7-8 thousand rubles were sold on Avito for 50 thousand rubles and other horrors). According to analytical estimates, up to 3.5 million online cash registers are planned to be put into operation in 2021. And here we will just be silent. The main and main recommendation to entrepreneurs is not to wait until the last moment! There is no point in now engaging in discussions on the topic “how hard the life of a businessman is” or hoping “maybe it will blow over.” It won't get through. This is a legislative inevitability, and the penalties are extremely severe. Even if the state makes concessions to businesses at the time of peak loads of market re-automation, as was the case in the first wave due to shortages (they were allowed to delay implementation if they already had a contract for the supply of cash registers), then in any case they will have to install an online cash register in 2021 year.

Now, you need to choose an automation solution for yourself. Purchase a cash register with FN. When purchasing an online cash register, you should definitely pay attention to the FNA model, or more precisely to the version of the fiscal data format (FDF).

It is difficult to predict how simple the procedure for obtaining a tax deduction will be. At the moment, we can only say that there is a Letter from the Federal Tax Service dated February 20, 2018 No. SD-4-3/3375 on the procedure for obtaining a deduction for UTII.

At the moment, the current tax return form does not provide for a deduction for CCP, and a new tax return form is being developed (planned entry date - April 2018).

We sincerely wish our Russian business seafarers not to drown in the tsunami of global re-automation and to resolve this issue for their enterprise in time, because the wave of introduction of the law will certainly be followed by an equally large-scale wave of control and sanctions. Be prepared, automate wisely.

How to choose a cash register for an individual entrepreneur

The choice of an online cash register primarily depends on the type of activity. Features of business processes often require the use of mobile cash registers or cash register equipment with high throughput. Let us dwell on the appropriate types of online cash registers depending on the type of activity of the individual entrepreneur.

Outbound trade and courier services

Autonomous cash registers are suitable for trading outside a fixed point and when providing courier services. Their features are as follows:

- compact sizes - online cash registers fit into a pocket or bag compartment, so they are always at hand for financial transactions;

- work wirelessly – devices are equipped with powerful batteries;

- high level of protection from moisture and frost, which allows you to use the equipment in all weather conditions;

- wireless connection to the network – via Wi-Fi, 2G/3G or Bluetooth, which ensures unhindered data transfer to the OFD.

When choosing a mobile cash register, study the basic functionality and features of entering items. Please note that the speed of printing receipts on mobile devices is low. The equipment does not integrate with scales, PCs and barcode scanners. The nomenclature will have to be entered manually.

Popular stand-alone models:

- Mercury 185 F;

- PTK Iras 900 K;

- Elwes MF;

- Atol 15;

- Pioneer 114F.

1. Ask our specialist a question at the end of the article. 2. Get detailed advice and a full description of the nuances! 3. Or find a ready-made answer in the comments of our readers.

Vending business

Vending activities involve automated trading. When choosing a cash register, pay attention to compatibility with the business equipment you are using. Some vending machines do not support online cash registers or require certain cash register models for integration.

Recommended cash registers for vending business:

- PAY ONLINE 01-FA;

- Treasurer-FA;

- Iskra Prim 21 FA;

- Umka 01-FA.

The presented models transmit information in real time about the amount of revenue and the quantity of products sold, simplifying accounting. Additionally, online cash registers support setting up notifications - receive notifications about product stock or vending machine malfunctions.

Stationary trade

If the outlet is already equipped with a cash terminal or PC, purchase an additional fiscal recorder. The equipment is responsible for printing receipts and sending data to the operator. Connection to a trading computer occurs via Wi-Fi or via a USB interface. The device has a high printing speed, so it is suitable even for retail outlets with high throughput.

Popular models of fiscal recorders for stores:

- Atol FPrint 22PTK;

- Cashier 57F;

- Atol 77F;

- Shtrikh M 01F;

- Mercury FS.

Smart terminals are also suitable for retail outlets. In one case of “smart cash registers” there is a tablet, a fiscal drive, and a printer for printing receipts. The OS and a large number of trading programs are installed to simplify accounting. The design provides a large set of interfaces for connecting scales, a scanner for reading markings, a banking terminal and other devices. “Smart” equipment is configured to transmit data to the Unified State Automated Information System, which is important when selling alcoholic products.

Suitable smart terminals for stores are Evotor in modifications 7.2, and Alco.

Online store

When choosing an online cash register for an online store, the specifics of conducting business are taken into account. If applications are accepted through the site, but payments take place at the point of delivery of goods, install a smart terminal. When the online store is fully automated and customers immediately pay for goods by credit card, through electronic payment systems and other methods, choose a cash register that supports integration with CMS.

Suitable models for online trading:

- Evotor 5;

- Evotor 10;

- Cashier 57F;

- Dreamkas F.

Catering establishments

For catering establishments, equipment with UTM support, a deferred check function, the ability to connect a cash drawer, scales, and other devices for maximum automation of customer service is suitable. Therefore, it is better to choose smart terminals from the Evotor series, which are also recommended for specialized stores and boutiques.

We'll tell you which cash register from our catalog is suitable for your business.

Leave a request and receive a consultation within 5 minutes.

How can they be punished for violating 54-FZ?

The presence of a cash register without the Internet and the absence of data transmitted to the tax office through the operator entails the imposition of sanctions. Of course, all fines will be applied only if a Federal Tax Service employee catches a store trading incorrectly.

Half of the companies are not even aware of changes in legislation and have not changed anything yet. They work according to the old rules. Most shoppers are unaware that they are eligible to receive an electronic check.

Responsibility will depend on the form of organization. For officials:

- If there is no cash register – 10,000 rubles.

- Repeated absence is disqualification for a period of 1 to 2 years.

- The cash register does not meet the requirements - from 1500 to 3000 rubles.

- The Federal Tax Service does not receive data or arrives with a long delay - from 1,500 to 3,000 rubles.

- A printed or electronic check is not issued - 2000 rubles each.

The sanctions for individual entrepreneurs and legal entities are the same:

- No cash register – 30,000 rubles.

- If absence is detected for the second and subsequent times, then the punishment is to suspend activities for 90 days.

- The cash register does not meet the requirements or the information does not come to the Federal Tax Service according to the rules - from 5,000 to 10,000 rubles.

- Receipts are not printed - 10,000 rubles for each offense.