Object of taxation

Based on accounting theory, the object is the base that is taxed, and the subject of taxation is the one who pays. From the name of the tax it is clear that the object refers to profit. But the profit is not all, but very accurately calculated in accordance with the rules of the Tax Code. This is the main element of income tax.

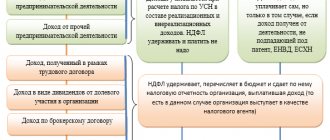

Tax payers are both domestic and foreign companies, of course, with some exceptions. For Russian companies, profit means the amount of income minus costs.

If we are talking about a foreign organization, then income received on the territory of our country is taken.

As a general rule, economic benefits are recognized as income, provided that three rules are observed:

- It is received in cash or other property;

- It can be assessed;

- It is determined according to the rules of Chapter 25 of the Tax Code of the Russian Federation.

But this is the so-called net profit; for tax purposes it must be reduced by expenses.

Income, as well as expenses, are divided into those that are taken into account when calculating taxes and those that are not taken into account. The latter, in turn, are divided into income from sales and from non-operating activities.

The income will not include the amount of taxes that the company will present to its customers, for example, VAT.

The amount of income and expenses can be taken into account and determined only on the basis of documents, including primary, tax documents, which include: contracts, invoices, bills, acts, reports, etc.

If we follow the logic, when discussing the emergence of a taxpayer’s obligation, we will be faced with the fact that we will have to discover the object of taxation. After all, if there is no object, then there is no obligation. Before we begin characterizing profit as an object of taxation, it is necessary to understand how the Tax Code of the Russian Federation interprets such a concept as an object of taxation as a whole. To do this, we need to turn to Part 1 of Chapter. 7 tbsp. 38 Tax Code of the Russian Federation. This article provides a clear definition of the object of taxation, which we need to understand, and subsequently determine what will become this object when calculating income tax. So: the object of taxation is the sale of goods (work, services), property, profit, income, expense or other circumstance that has a cost, quantitative or physical characteristic, the presence of which is linked by the legislation on taxes and fees to the taxpayer’s obligation to pay tax. Let us explain the main terms specified in this definition and analyze them: 1. The sale of goods (work, services) in the legislation of the Russian Federation means the transfer on a paid basis (exchange of goods, work, services) of ownership of goods, the results of work performed by one person for another person, the provision of services for a fee by one person to another person, and in some cases the transfer of ownership of goods, the provision of services by one person for another person - on a gratuitous basis. That is, simply put, an example of the sale of goods for an organization can be the shipment of finished products from the supplier’s warehouse to the buyer’s warehouse. And the provision of services can serve as an example of installation of equipment for a customer organization. 2. Property here refers to the types of objects of civil rights, to which the Civil Code of the Russian Federation in Art. 128 includes immovable and movable things, money and securities, other property, including property rights; works and services; protected results of intellectual activity and intellectual property; intangible benefits. As a rule, property must have a valuation; if there is no valuation, then it is usually valued at the market value of the same type of property or its analogues, which do not differ much in basic characteristics. 3. Goods mean any property sold or intended for sale. Accordingly, everything that has a value and can be sold if necessary will be a product for the enterprise. 4. Work is an activity whose results have a material expression and can be implemented to meet the needs of the organization and (or) individuals. 5. For tax purposes, a service is an activity whose results do not have material expression and are sold and consumed in the process of carrying out this activity. It should also be noted that if all of the above concepts are interpreted in the same way for all taxes, then the object of taxation is different for each tax. So, the object of taxation under the Income Tax is nothing more than the profit itself received by the taxpayer. According to Art. 247 of the Tax Code of the Russian Federation, profit is understood as the difference between the income that an organization received and the expenses accepted for tax purposes that it incurred in accordance with the Tax Code of the Russian Federation, if we talk about Russian organizations. For foreign organizations operating through a permanent representative office, the profit will be equal to the income of the representative office minus the expenses of the representative office (Article 247 of the Tax Code of the Russian Federation). For other foreign organizations - income received from sources in the Russian Federation. The list of these incomes is specified in Art. 309 of the Tax Code of the Russian Federation and is discussed in this book in paragraph 1.2 of Chapter 1. Now that we have defined the object of taxation as a concept, we have come to the definition of the very concept of profit. In order to give it a clear description, we suggest first understanding the fundamental elements that require more detailed consideration. These elements when talking about income tax, of course, will be the income and expenses of the organization. These two concepts, like nothing else, affect the calculation of this tax and require careful study. We will begin our acquaintance with these elements of the organization’s income, then we will move on to expenses.

The tax base

The element of income tax that is formed as a result of the excess of income over expenses is the tax base. If a company has no income, but has a loss, then the tax base is zero. Profit is calculated on an accrual basis from the beginning of each calendar year.

In order to avoid problems with the tax authorities, it is necessary to accurately determine the tax base from which the tax to be transferred is obtained, that is, to accurately determine which amounts relate to taxable income, and which amounts can be taken into account in expenses in strict accordance with the Tax Code of the Russian Federation.

There are a number of rules for determining the tax base:

- If the tax rate is one, then the tax base is also one. If there are activities taxed at different rates (for example, dividends from Russian and foreign organizations), then the tax base for such income is formed separately.

- There are transactions for which a special procedure for accounting for profit and loss is established. Profit from such transactions increases the organization’s income, and losses are recognized in a special manner. They must be accounted for separately. Such operations include: activities for trust management of property, participation in a simple partnership agreement, etc.

- Income and expenses from activities that are not subject to income tax are also taken out of the equation and separate accounting must be kept for them. Such activities, in particular, include the gambling business, special regimes are applied, etc.

The tax base is calculated based on the calculation. It is a document in free form with analytical accounting information. It reflects information about the financial result from the sale, while separately recording data on the sale of self-produced services, other property, securities, fixed assets, etc. Activities related to the special taxation procedure in accordance with the Tax Code are taken into account separately. The calculation also indicates income from non-operating activities. Separate accounting is maintained for transactions with financial instruments of futures transactions.

To calculate the tax base for the reporting period, profit (loss) from sales is summed up with profit (loss) from non-operating activities. If the result is a loss, then the tax base is zero; if there is a profit, then we can reduce it by losses from previous periods. The remaining amount is the basis for calculating income tax and is multiplied when applying the regular rate by 20%. After calculating the tax, a tax return is completed.

The economic essence of income tax and its place in the tax system

The article examines the economic essence of corporate income tax and its role in the tax system. The history of the development and reform of the tax under study is considered. An analysis of tax revenues to the consolidated budget of the Russian Federation was carried out.

Key words: profit of organizations, tax, corporate profit tax, tax system, consolidated budget of the Russian Federation, tax accounting.

Profit is one of the most significant indicators of the financial results of the economic activities of business entities, as well as the purpose of the functioning of a commercial organization.

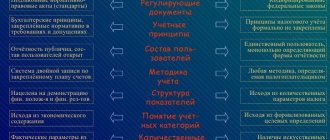

It represents the excess of income, that is, proceeds from the sale of goods, performance of work, provision of services over the costs of production, acquisition and sale of these goods, works, services in monetary terms. It is possible to identify a number of characteristics of the profit of an economic entity in market conditions presented in Figure 1.

Rice. 1. The role of profit in the economy

Source: compiled based on [4]

The profit received by the organization is distributed between the state, the owners of the organization and the organization itself. As for the relationship between the state and organizations, they are built on the basis of taxation of profits, when, in turn, the taxable profit itself is calculated on the basis of tax accounting data, since the procedure established by the Tax Code of the Russian Federation for grouping and accounting for individual objects and business transactions for tax purposes differs from the procedure that operates in accounting [3]. Namely, the taxpayer independently calculates the tax base for income tax for the reporting or tax period according to tax accounting data and on the basis of the norms established by Chapter 25 of the Tax Code of the Russian Federation, on an accrual basis from the beginning of the year in order to fill out a tax return.

Income tax is the most important type of direct income tax, which is levied on organizations and also directly depends on the final financial results of its activities. Speaking about the taxpayers of this tax, it is worth noting that they are both Russian organizations and foreign organizations that can carry out their activities in the Russian Federation through permanent missions or receive income from sources in the Russian Federation. The taxpayer’s profit itself is recognized as the object of taxation for income tax, and the tax base is directly the monetary expression of the profit itself, which is subject to taxation [1].

Corporate income tax plays a fairly significant fiscal role, but at the same time has significant regulatory potential in relation to the economy and social sphere [2].

This type of tax serves as a good tool for the state to regulate the economy and finances using tax methods, and also has a significant source of budget revenues, productively influences investment activity and the process of capital accumulation in various sectors of the economy and regions. It can be added that this tax also plays a great role in the development of small businesses, as well as in attracting foreign investment into the country’s economy by providing the state with various benefits and setting tax rates.

In the Russian Federation, income tax was included in the tax system from the very beginning of its formation. It should be noted that it is the only tax that, since its adoption in 1991, has been subject to serious reform throughout the entire period of economic changes in Russia. Until January 1, 2002, numerous tax benefits were introduced and abolished for this tax, and there was also a wide range of benefits for small enterprises, organizations making capital investments in production, etc. Various preferences were introduced until in 2002 with the adoption Chapter 25 of the Tax Code of the Russian Federation, they were not reduced to the maximum, but in the future some benefits are being returned and new preferences are being provided to taxpayers depending on the economic development of the country.

As for tax rates, unlike other taxes, the income tax rate for a long time worked on the principle of relatively low rates for organizations and higher rates for intermediaries, banks and insurance organizations. At the same time, rates changed over a short period of transformation, either downward or upward. But with the adoption of the Tax Code of the Russian Federation, a single profit tax rate was introduced for all organizations, which in turn was reduced since 2002 from 35% to 24%. And during the crisis in 2009, the tax rate was reduced to 20%. Moreover, in 2017–2020, 3% goes to the federal budget, and 17%, respectively, to the consolidated budgets of the constituent entities of the Russian Federation [3].

The role of this tax in budget formation is significant, and the economic essence can be seen through its characteristic functions, which are performed precisely in the taxation process (Figure 2).

Rice. 2. Functions of income tax

Source: compiled based on [5]

Let's consider the structure and dynamics of tax revenues to the consolidated budget of the Russian Federation in order to determine the place of income tax in the country's tax system (Table 1).

Table 1

Structure of tax revenues to the consolidated budget of the Russian Federation for 2014–2018 .

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | ||||

| Tax | Billion rubles | Billion rubles | in % to 2014 | Billion rubles | in % to 2015 | Billion rubles | in % to 2016 | Billion rubles | in % to 2017 |

| MET | 2 904,2 | 3 226,8 | 111,11 | 2 929,4 | 90,8 | 4 130,4 | 141,00 | 6 127,4 | 148,35 |

| Income tax | 2 372,8 | 2 598,8 | 109,52 | 2 770,2 | 106,6 | 3 290,0 | 118,77 | 4 100,00 | 124,62 |

| Personal income tax | 2 688,7 | 2 806,5 | 104,38 | 3 017,3 | 107,5 | 3 251,1 | 107,75 | 3 652,99 | 112,36 |

| VAT | 2 300,7 | 2 590,1 | 112,58 | 2 808 | 108,4 | 3 236,3 | 115,25 | 3 761,17 | 116,22 |

| Excise taxes | 999,0 | 1 014,4 | 101,55 | 1 293,9 | 127,6 | 1 521,3 | 117,57 | 1 493,16 | 98,15 |

| Property taxes | 955,1 | 1 068,4 | 111,9 | 1 116,9 | 104,5 | 1 250,3 | 111,9 | 1 396,8 | 111,7 |

Source: compiled based on [7]

The table shows that income tax revenues to the budget have increased over the past 5 years. You can also notice an increase in the growth rate compared to the previous year. Income to the consolidated budget from this tax increased from 2014 to 2018 by 73% and amounted to 4,100 billion rubles in 2021. The rate of increase in tax does not have an abrupt nature, but a gradual increase in this indicator is observed.

The graph shows the dynamics of corporate income tax revenues to the consolidated budget of the Russian Federation in the period 2014–2018.

Rice. 3. Dynamics of corporate income tax revenues to the consolidated budget of the Russian Federation for 2014–2018, billion rubles.

Source: compiled based on [7]

The graph shows that income tax revenues to the consolidated budget of the Russian Federation are increasing every year. Income in 2018 reached 4,100 billion rubles compared to 2021, where the amount of revenue to the state budget amounted to 3,290 billion rubles.

According to the head of the Federal Tax Service, Mikhail Mishustin, the increase in income from income tax collection is associated with rising oil prices. “The key factor is the growth in revenue of organizations in systemically important industries, including oil and gas and metallurgy, due to a favorable price environment,” noted Mishustin [6].

The pie chart shows that the largest share of budget revenues is the mineral extraction tax, about 30%, followed by corporate income tax with a share of revenues in the consolidated budget of the Russian Federation approximately equal to 20%.

Rice. 4. Structure of revenues of the consolidated budget of the Russian Federation in 2018

Source: compiled based on [7]

The tax under study ranks 2nd among budget-forming ones, which means that it plays an important role in the development and regulation of the country's economy.

Thus, we can conclude that corporate income tax serves as an integral element of the tax system of the Russian Federation and occupies one of the key places. It plays an important role in the formation of the country’s budget revenues and allows the state to actively influence the development of the economy through the mechanism of its application.

Literature:

- Tax Code of the Russian Federation: Parts 1, 2: [as of May 7, 2021: adopted by the State Duma on July 31, 1998]. - Consultant Plus. — Access mode: https://base.consultant.ru.

- Goncharenko, L. I. Taxes and the tax system of the Russian Federation: textbook / L. I. Goncharenko. — textbook and workshop for undergraduate studies. - 2nd ed., trans. and additional - M.: Yurayt Publishing House, 2019. - 524 p.

- Panskov, V. G. Taxes and taxation: theory and practice in 2 volumes. Volume 1: textbook and workshop for academic undergraduates / V. G. Panskov. — 6th ed., revised. and additional - M.: Yurayt Publishing House, 2019. - 363 p.

- Chernik, D. G. Taxes and taxation: textbook and workshop for academic undergraduates / D. G. Chernik [et al.]; edited by D. G. Chernika, Yu. D. Shmeleva. — 3rd ed., revised. and additional - M.: Yurayt Publishing House, 2021. - 408 p.

- Taxes and the tax system of the Russian Federation [Electronic resource]: a textbook for university students studying in the direction of “Economics” / B. Kh. Aliev [and others]. — Electron. text data. - M.: UNITY-DANA, 2015. - 439 p. — Access mode: https://www.iprbookshop.ru/59296.html. — EBS “IPRbooks”.

- Tax revenues to the consolidated budget of Russia increased by 23% [Electronic resource]. — Access mode: https://www.rbc.ru/rbcfreenews/5c6d0d6d9a7947bbeb7e4548.

- Federal Tax Service [Electronic resource]. — Access mode: www.nalog.ru.

Taxable period

There are concepts of tax period and reporting period. The element of income tax - the tax period, when it comes to income tax, is understood as a calendar year. During the year, the tax base is created and the exact amount of tax payable arises. And in the reporting period, subtotals are generated and advance payments are made.

For newly created organizations, the tax period begins from the day of registration until the end of the year. And if the company was created in December, then the “year” for such newcomers will be counted from the date of registration until the end of the next calendar year.

If a company is liquidated or reorganized, the tax period is considered to be the period from the beginning of the year until the day of termination of activities.

The reporting period can be quarterly (1 quarter, half a year, 9 months) and monthly.

Tax rate

This is another element of income tax. The tax rate is fixed in the Tax Code and is generally 20%, but there are exceptions that are specified in the code. The tax is transferred in the amount of 2% to the federal budget and 18% to the regional budget in separate payment orders.

The Tax Code also provided for separate tax rates for certain categories of taxpayers. For example, the income of foreign companies is taxed at a rate of 20% to the federal budget.

Subjects of the Russian Federation can introduce reduced rates for their taxpayers, but not less than 13.5%. There are other restrictions on rates, for example, for residents of a special economic zone, the tax rate payable to the regional budget cannot be higher than 13.5%.

Tax calculation procedure

This element of income tax depends on the size of the company's income. If the company's revenue is less than 60 million rubles. for the four previous quarters, then payments are made quarterly. If the organization has more income, then you can pay monthly during the quarter and quarterly advances or advance payments every month based on actual profits.

Only quarterly payments are made by budgetary institutions (with the exception of theaters, museums, concert venues), representative offices of foreign companies, non-profit organizations (without profit from the sale of work, services), participants in simple partnerships, beneficiaries under trust management agreements.

To calculate the quarterly payment, the tax base is taken on an accrual basis from the beginning of the year to the end of the reporting period and multiplied by a rate of 20%. The tax is also calculated separately for budgets. The amounts received are recorded in the tax return.

But to obtain the amount payable, you need to subtract from the quarterly payment received for this reporting period the amounts of payments that were paid for previous reporting periods in this tax period.

If there are monthly payments in addition to quarterly payments, they are calculated as follows:

In the 1st quarter of 2021:

Advance for 4 quarters 2021 / 3

In fact, the payment will be equal to payments for Q4. previous year.

In the 2nd quarter of 2021. The advance payment is calculated based on the results of the first quarter and 1/3 of the amount received is paid monthly:

Advance for 1 sq. 2021 / 3

In the 3rd quarter of 2021:

Advance for 2 quarters 2021 – Advance for 1 sq. 2021 / 3

In the 4th quarter of 2021:

Advance for 9 months. – Advance for 2 quarters/3

Monthly payments based on actual profits are calculated similarly to quarterly advance payments, that is, the amount of previously paid payments is subtracted from the calculated amount for the reporting period (tax base on an accrual basis of 20%).

Corporate income tax: characteristics of taxation elements

Corporate income tax is classified as a federal tax in the Russian Federation.

According to ch. 25 of the Tax Code of the Russian Federation, tax payers are:

– Russian organizations;

– foreign organizations operating in the Russian Federation through permanent representative offices and (or) receiving income from sources in the Russian Federation.

The object of taxation for corporate income tax is the profit received by the taxpayer, which represents the income reduced by the amount of expenses .

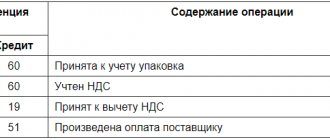

for tax purposes includes: income from the sale of goods (work, services), the sale of property rights and non-operating income.

Sales income includes proceeds from the sale of goods, works, services, both own production and previously acquired, as well as proceeds from the sale of property rights. When determining income, taxes imposed by the taxpayer on the buyer of goods (VAT, excise taxes, export duties, etc.) are excluded from them.

Non-operating income is income not related to sales. These include, for example, fines, penalties; main income of previous years identified in the reporting period; positive exchange rate difference; property received for free use; the amount of accounts payable written off due to the expiration of the statute of limitations.

Expenses are recognized as justified and documented expenses incurred by the taxpayer. Justified expenses mean economically justified expenses, the assessment of which is expressed in monetary form. Any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income.

Expenses, depending on their nature, as well as the conditions for implementation and areas of activity of the taxpayer, are divided into expenses associated with production and sales , and non-operating expenses .

Costs associated with production and sales are divided into the following elements: material costs, labor costs, depreciation and other costs.

The tax base is calculated separately for each type of activity if they are taxed at different rates.

The taxpayer has the right to reduce the tax base by the amount of losses received in the previous tax period:

1) The general tax rate is set at 20%. In this case, the amount of tax calculated at a tax rate of 2% is credited to the federal budget; the amount calculated at the rate of 18% goes to the budgets of the constituent entities of the Russian Federation. The tax rate of this tax, subject to credit to the budgets of the constituent entities of the Russian Federation, can be reduced by the laws of the constituent entities of the Russian Federation for certain categories of taxpayers. In this case, the specified tax rate cannot be lower than 13.5%.

2) tax rates on the income of foreign organizations not related to activities in the Russian Federation through permanent missions: 10% of the use, maintenance, rental of ships, aircraft and other vehicles during international transportation; 20% from other income.

3) Russian legal entities. and physical persons who received dividends from Russian organizations must pay tax on dividends - 9%, if between Russian and foreign organizations - 15%.

4) income from state and municipal securities: 15% of state interest. and muniz. securities;

The tax period is a calendar year, and the reporting periods are 1st quarter, half a year, 9 months. For taxpayers paying monthly payments on actually received profits, the reporting periods are months, 2 months. etc. until the end of the calendar year.

Taxpayers are required to independently calculate the amount of income tax. At the end of the next tax period, organizations calculate the size of the tax base on an accrual basis from the beginning of the year to the end of the 1st quarter, half a year, nine months, or year. Taxpayers must make advance payments each month during the quarter. The tax payment deadline is no later than the 28th day of each month of this reporting period.

Tax amount according to with Chapter 25 of the Tax Code the following is determined. thus: in the 1st quarter of the current year, the amount of tax = similar to the amount paid by the organization in the last quarter of the previous year; in the 2nd quarter - 1/3 of the payment for the 1st quarter of the current year; in Q3 – 1/3 of the difference between the amounts of advance payments for the six months and Q1; in Q4 – 1/3 of the difference between the amounts of advance payments for 9 months and half a year.

There are 3 options for paying income tax to the budget:

1. The enterprise makes monthly advance tax payments by the 28th day of the current month, calculated as 1/3 of the tax amount for the previous reporting period.

2. The company calculates the actual income tax on a monthly basis and pays it by the 28th of the next month.

3. For taxpayers whose average quarterly revenue does not exceed 10 million rubles, non-profit organizations, permanent representative offices of foreign organizations, tax holidays are established: tax is paid quarterly until the 28th day of the month following the reporting period, and at the end of the tax period - until March 28 next year.

The following are installed. deadlines for filing a tax return for taxpayers and tax agents: no later than 28 days from the date of completion of the relevant report. period (quarter) based on the results of the reporting period (quarter); no later than March 28 of the year following the expired tax. period based on the results of the tax period (year); taxpayers paying monthly advance payments on actually received profits submit tax returns within the deadlines established for making advance payments, that is, by the 28th of each month.

Procedure and deadlines for tax payment

Depending on how income tax is paid, the following deadlines exist:

- Monthly payments based on actual profits are paid no later than the 28th day of the following month following the reporting month, that is, the tax for September must be transferred before October 28th.

- We pay quarterly payments until April 28, July 28 and October 28 of this year and until March 28 of the next year, the same period for submitting reports.

If the last day falls on a weekend or holiday, then, as a general rule, the deadline is postponed to the next working day. But in any case, you must pay for the year no later than March 28 of the next year. Reports must be submitted within the same period. That is, you must fully report for 2021 by March 28, 2017.

In case of untimely transfer of advance payments, penalties are calculated for each day of delay. However, fines under Article 122 of the Tax Code of the Russian Federation cannot be applied, since it is impossible to hold people accountable for failure to pay advance payments.

How is tax calculated and paid?

The tax is calculated in a given order: the tax base for the tax must be multiplied with the tax rate. This means that if the company’s revenue does not rise above 15 million rubles. per quarter, then only payments are calculated based on the results of the quarter; if the situation is exactly the opposite, then during the reporting period the organization determines and then pays a monthly advance.

Read our article about depreciation in tax accounting

The procedure and deadlines for paying taxes are fixed by specific dates. No later than March 28 of the following reporting year, income tax is paid. And the organization pays the advance payment no later than the 28th day of the month following the reporting period, for example, for January you have to pay no later than February 29, February is paid until March 29.

At the same time, for some enterprises a different procedure is defined in accordance with the Tax Code.

Similar articles

- Object of taxation for income tax

- Tax base of the Unified Agricultural Tax

- How to calculate income tax

- How to calculate income tax: example

- Income tax in Russia