LEGAL REQUIREMENTS REGARDING INVENTORY OF ACCOUNTS RECEIVABLE

It is necessary to timely inventory accounts receivable for a number of important reasons. Firstly , this is a legal requirement. According to paragraph 1 of Art. 11 of Federal Law No. 402-FZ dated December 6, 2011 (as amended on November 28, 2018) “On Accounting” (hereinafter referred to as Federal Law No. 402-FZ), assets and liabilities are subject to inventory.

Secondly , current data is needed for management accounting purposes. It is impossible to draw the right conclusions and make the right decisions if you have outdated information. Thirdly , inventory as one of the forms of control over the amount of accounts receivable is very important in order to maintain the required amount of working capital of the enterprise.

It would be irrational to make different inventories for different purposes. One for accounting, the second for management, etc. The inventory results must be impeccably documented so that they are recognized by third parties - counterparties, tax authorities, courts.

For whatever reasons an inventory of payments is carried out, it is important to know and comply with the legal requirements in this regard. Therefore, let us familiarize ourselves with the relevant provisions of regulations.

According to clause 27 of the Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n (as amended on April 11, 2018) “On approval of the Regulations on accounting and financial reporting in the Russian Federation,” inventory is mandatory :

- when transferring property for rent, redemption, sale;

- when transforming a state or municipal unitary enterprise;

- before drawing up annual financial statements (except for property, the inventory of which was carried out no earlier than October 1 of the reporting year);

- when changing financially responsible persons (on the day of acceptance and transfer of cases);

- when facts of theft, abuse or damage to property are revealed (immediately upon establishment of such facts);

- in the event of a natural disaster, fire or other emergency situations caused by extreme conditions (immediately after the end of the fire or natural disaster);

- during reorganization or liquidation of the organization;

- in other cases provided for by the legislation of the Russian Federation.

Similar norms are contained in clause 1.5 of the Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49 (as amended on November 8, 2010) “On approval of the Methodological Guidelines for the Inventory of Property and Financial Liabilities.”

An important point: inventory is carried out not only in cases established by regulatory legal acts. Inventory at an enterprise can be carried out in other cases, as well as at other times.

The cases, timing and procedure for conducting an inventory, as well as the list of objects subject to inventory, are determined by the economic entity, with the exception of the mandatory inventory (Article 11 of Federal Law No. 402-FZ).

The manager, due to the specifics of the activities of his enterprise and the characteristics of the production process, determines with what frequency and in what time frame it is advisable to carry out inventories, as well as the procedure for their implementation.

This point is specified in the order on the accounting policy of the enterprise. This is a legal requirement. Clause 4 of the Accounting Regulations “Accounting Policy of the Organization” (PBU 1/2008), approved by Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n (as amended on April 28, 2017) instructs an economic entity, when developing an accounting policy, to provide for the procedure for conducting an inventory of assets and obligations.

To carry out inventory, the enterprise creates a permanent (working) inventory commission, the composition of which is approved by the head of the organization. The commission may include accounting and administrative staff, economists, representatives of the internal audit service or independent audit organizations.

NOTE

To carry out an inventory, the presence of all members of the inventory commission is necessary. The absence of at least one member of the commission serves as grounds for declaring the inventory results invalid.

The inventory is preceded by the issuance of an order to conduct an inventory. Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88 (as amended on May 3, 2000) “On approval of unified forms of primary accounting documentation for recording cash transactions and recording inventory results” approved a special form of such an order - No. INV-22 .

An important point: from 01/01/2013, the forms of primary accounting documents contained in albums of unified forms of primary accounting documentation are not mandatory for use. In this regard, the enterprise can issue an order (decree, instruction) to conduct an inventory in any form. The main thing is to comply with legal requirements regarding the availability of mandatory document details.

The order under consideration appoints the chairman and members of the inventory commission, indicates the specific object of the inventory, the timing of its implementation and the date of submission of materials to the accounting department.

The order (resolution, instruction) is signed by the head of the organization and handed over to the chairman of the inventory commission. It must be registered in the Logbook for monitoring the implementation of orders (decrees, instructions) on inventory ( form No. INV-23 ).

Need for inventory

Information about the presence of outstanding debts is used in the formation of the annual balance sheet, drawing up an appendix to the statements and must meet the criterion of reliability. The practical benefit of carrying out an inventory is the use of data for the timely collection of funds used as part of working capital.

These accounts receivable status data are used by third parties when making decisions on granting a loan or joining an enterprise. Based on the comparability of receivables and payables, a liquidity analysis is carried out. The current liquidity ratio indicator indicates financial stability - the excess of current assets over liabilities or the opposite situation - the enterprise is in a crisis situation.

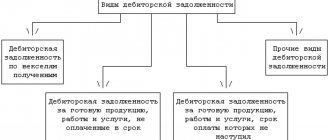

FEATURES OF INVENTORY OF ACCOUNTS RECEIVABLE

The main purpose of inventory of accounts receivable is to check the validity of the amounts in the accounting accounts. Accounts receivable can arise and be accounted for in the following accounting accounts:

- 60 “Settlements with suppliers and contractors”;

- 62 “Settlements with buyers and customers”;

- 68 “Calculations for taxes and fees”;

- 69 “Calculations for social insurance and security”;

- 70 “Settlements with personnel for wages”;

- 71 “Settlements with accountable persons”;

- 73 “Settlements with personnel for other operations”;

- 75 “Settlements with founders”;

- 76 “Settlements with various debtors and creditors.”

Arrears must be confirmed by primary documents: contracts, invoices, certificates of work performed (services rendered), universal transfer documents ( UTD ), salary statements, payment orders, cash receipts and debit orders, advance reports, accounting statements, etc. .

Accounts subject to verification

Inventory calculations differ from checking material assets. The audit is carried out on the basis of data from primary documents and reconciliations with counterparties. The amounts reflected in the accounts receivable accounts are subject to verification.

| Counterparties | Accounts |

| Suppliers in relation to listed advances or claims ordered by a court decision | 60, 76 |

| Buyers for payments for delivered goods, products, materials | 62 |

| Customers for payments for services rendered or work performed | 62 |

| Insurance companies regarding payments of compensations, premiums and other types of debts | 76 |

| Managers of budget funds in relation to overpaid taxes and contributions subject to refund | 68, 69 |

| Founders of the organization regarding unpaid shares of contributions to the management company | 75 |

| Employees of the enterprise for debts issued on account of the amounts of advances received from the company of loans, outstanding arrears for damage caused | 70, 71, 73, 76 |

Current accounting of an enterprise's receivables is carried out using analytical accounting in the context of counterparties and each debt obligation (agreement).

INVENTORY OF ACCOUNTS RECEIVABLE FOR WAGES AND ACCOUNTABLE PERSONS

During the inventory of receivables for wages, in addition to confirming the validity of the amounts listed, the reasons for the overpayment are established. They check the primary documents that served as the basis for the payment. In this case, there is no need to carry out an inventory of receivables for wages with a complete check of labor calculations. Accruals and payments are verified only to the extent necessary to confirm the validity and reality of the debts.

It is necessary to find out whether there are any debts owed by dismissed employees, to assess the reality of the amounts listed and the possibility of repaying them by returning funds from the employee or offsetting them with accruals for the reporting period.

Accountable persons control the dates of payments and the intended purpose. They check whether the dismissed employees have any outstanding debts. Find out whether accountable advances are overdue. The debt will be overdue if the deadline for submitting the advance report has expired.

According to clause 6.3 of the Bank of Russia Directive No. 3210-U dated March 11, 2014 (as amended on June 19, 2017) “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses,” the accountable entity is obliged to , not exceeding three working days after the expiration date for which cash was issued on account, or from the date of going to work, present to the chief accountant or accountant (in their absence - to the manager) an advance report with attached supporting documents. An important point: the deadline for the report is set by the head of the enterprise.

The commission examines the availability of documents confirming the intended use of the amounts issued, payments to the employee and refunds, if any.

Posting examples:

- D 62 K 91.1 – after the expiration of the claim period, accounts payable to the buyer are charged to other expenses.

- D 91.2 K 62 – the customer’s receivables were included in other income due to the expiration of the statute of limitations of 3 years. No reserve was created.

- D 007 – the written-off receivables are recorded on the off-balance sheet account. According to the Chart of Accounts No. 94n, for the possibility of collection, control of receivables must be maintained for 5 years from the date of write-off in accounting.

- D 91.2 K 63 – a reserve has been formed for doubtful debt identified as a result of the inventory.

- D 63 K 62 - due to the previously formed reserve, the amount of receivables that is not realistic for further collection was written off.

- D 007 – written off receivables are recorded on the off-balance sheet account.

INVENTORY OF ACCOUNTS RECEIVABLES OF SUPPLIERS AND BUYERS

For advances to suppliers, the relevant documents are checked - the basis for such payments (invoices, contracts, memos). It is advisable to check the availability of all necessary approvals at the enterprise in accordance with internal regulations regarding payments made.

The process of confirming the validity of amounts for suppliers and buyers will involve the formation of special documents - reconciliation reports in the context of the calculations being carried out.

The reconciliation report indicates in chronological order all transactions for a given partner, an agreement with him, or another basis. Then the total settlement amounts for the reconciled period are displayed. For suppliers, these are the amounts of payments and the receipt of goods, works, services; for buyers, these are payments and shipment of products, performance of work, provision of services. Based on this data, the final amount of debt is derived in favor of one or the other party.

The reconciliation report is signed by the head of the enterprise, and by proxy - by any person authorized by him. Having a power of attorney for an authorized person is very important. Thus, in the Determination of the Supreme Arbitration Court of the Russian Federation dated August 21, 2013 No. VAS-11147/13 in case No. A67-6327/2012 it is stated that by virtue of Art. 53 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), the chief accountant is not a person entitled to act on behalf of the enterprise without a power of attorney. The reconciliation act can be signed as authorized persons by the sole executive body of the defendant or by a representative acting on the basis of a power of attorney issued by such body, which contains the authority to perform a particular action.

If there is no power of attorney in the file confirming the authority of the chief accountant to acknowledge the debt, his signature on the reconciliation act does not constitute an acknowledgment of the debt by the defendant; the act itself is a basis for interrupting the limitation period.

If the counterparty agrees with the data given in the reconciliation report, he also signs this document. If there are discrepancies, the partner indicates his data and his results. In this case, you have to check the validity of its amounts and clarify whether an error has crept into your own accounting.

In a similar way, an inventory of the amounts of “receivables” listed on account 76 “Settlements with various debtors and creditors” is carried out.

It is advisable to highlight debt incurred in connection with the sale of goods, performance of work, and provision of services. The fact is that only for such debt the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation) allows the creation of a reserve for doubtful debts. For the purpose of possible formation of such a reserve, it is better to provide in advance for the separate allocation of such debts.

IN WHAT ORDER SHOULD INVENTORY BE CARRIED OUT?

As noted in the Letter of the Ministry of Finance of the Russian Federation dated March 24, 2016 No. 02-07-10/17037, the accounting entity, for the purpose of organizing accounting, based on the characteristics of its structure, industry and other features of the institution’s activities and the powers it exercises in accordance with the legislation of the Russian Federation, forms the procedure for conducting an inventory of property and liabilities within the framework of its accounting policies. Therefore, each institution has its own procedure. Let us note that when developing it, you can use the Guidelines for inventory of property and liabilities, approved by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49. However, a draft is posted on the website of the financial department, according to which the norms of the designated document do not apply to state (municipal) institutions . The changes are due to the fact that, by virtue of clause 6 of Instruction No. 157n, this control event is carried out in accordance with the procedure approved by the accounting policy of the institution, developed based on the provisions of the legislation of the Russian Federation.

Note that, based on practice, the inventory of settlement obligations is carried out in the form of reconciliation of calculations. The purpose of reconciliation of calculations is to compare the data of the parties, check the validity of the identified discrepancies (differences) and, taking into account the availability of primary accounting documents, bring your accounting data into line with the actual obligations of the parties.

To implement this event, preparatory measures are necessary. First of all, the financial department of the institution must raise contracts and prepare supporting documents.

The indicated procedure is documented by acts of reconciliation of settlements with counterparties, which indicate the date and number of documents for shipment, the cost of goods (work, services), the amount of VAT, as well as the payment amounts and details of payment documents. Reconciliation reports are drawn up as of the reporting date. The form of this act is not legally approved, so an institution can develop it independently and approve it as a separate annex to the organization’s accounting policies.

Let us note that in the past, in order to sign the act, the procedure of visiting the counterparty was mandatory. Currently there is no such need; the prepared reconciliation report with data reflecting the status of settlements is sent to the counterparty by email. If the supplier (contractor) has no claims regarding the settlement, then he confirms his consent with a signature.

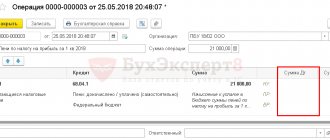

INVENTORY OF ACCOUNTS RECEIVABLE OF THE FTS OF THE RF AND OFF-BUDGETARY FUNDS

It is impossible to get by with formal confirmation of the validity of the amounts taken into account for these entities. It is necessary to assess the reasons for the overpayment, whether it is possible to return it from the budget or offset it against other taxes, whether it is worth starting a long process of return or whether the overpayment will be taken into account in the reporting tax liabilities.

To reconcile with the budget, you can use certificates issued by the tax authority (the form of a certificate on the status of settlements for taxes, fees, penalties, fines, interest of organizations and individual entrepreneurs is given in Order of the Federal Tax Service of Russia dated December 28, 2016 No. ММВ-7-17 / [email protected ] “On approval of forms of certificates on the status of settlements for taxes, fees, insurance premiums, penalties, fines, interest, the procedure for filling them out and formats for submitting certificates in electronic form”). You can also order a reconciliation report.

Inventory of accounts payable

By analogy with creditor contracts, a short-term contract can be correctly identified based on the results of reconciliation of mutual settlements with creditor counterparties. An inventory of settlements with suppliers and contractors involves an analysis of credit account entries:

| Check | What is analyzed |

| 60 | Debt to suppliers and contractors for goods or services received |

| 62 | Amount of advances received from buyers |

| 75 | Debt to the founders of the business for the payment of dividends |

| 76 | The amount of VAT accepted for deduction when paying advances to suppliers, debt to other contractors |

IMPORTANT! At the same time, there is a plus in terms of taxation: if the company regularly signed reconciliation acts, then the debt on such counterparties does not need to be included in taxable income after the expiration of 3 years from the date of debt formation.

In order to identify the actual amounts of debt to the budget (for taxes), as well as extra-budgetary funds (for insurance premiums), it is advisable to contact the Federal Tax Service or the Social Insurance Fund with a request to issue a certificate about the status of settlements with the tax service, as well as for insurance premiums. In addition, at the initiative of either party, a joint reconciliation of calculations can be carried out. Currently, reconciliation of taxes and contributions (in terms of contributions administered by tax authorities) is carried out with the Federal Tax Service of Russia and is drawn up on a form approved by Order of the Federal Tax Service dated December 16, 2016 No. ММВ [ email protected] (letter of the Federal Tax Service of Russia No. BS-4-11/ [email protected] , Pension Fund of the Russian Federation No. NP-30-26/947, FSS of the Russian Federation No. 02-11-10/06-308-P dated January 26, 2017).

Inventory of settlements with creditors for wages is also of great importance in identifying the actual volumes of the organization's payroll and payroll, since the level of payroll pay directly affects the team and its performance. In this context, account 70 is checked to identify cases of non-payment of wages, as well as the reasons for this (clause 3.46 of the Guidelines).

IMPORTANT! For the audit to be effective, the organization should analyze all payroll statements, as well as cash receipts and payment orders.

Since often the main shortfall in an organization is debt to banks and other financial institutions, it is mandatory to check credit balances on accounts 66 and 67. In this case, it is important to correctly assess which balances represent short-term and which long-term shortfalls. An analysis of the organization’s accounting registers, as well as documents received from the bank (repayment schedule for the loan, certificates and payment statements) will help complete the task.

IMPORTANT! When analyzing the credit card, one should not forget that the debt for each creditor and each reason must be checked for overdue status. If it turns out that the statute of limitations on the claim has expired or, for example, the creditor has been liquidated, such a claim must be written off in accordance with the current procedure.

How to correctly write off accounts payable with an expired statute of limitations, read here.

See also:

- “Write-off of accounts payable - postings and deadlines”;

- “Writing off accounts payable upon liquidation of a creditor”.

INVENTORY OF OTHER ACCOUNTS RECEIVABLE

During the inventory, the validity of the debts of the organization’s personnel for issued loans, for compensation for various material damage caused to the organization, the debt of LLC participants (joint-stock shareholders) for payment of shares (shares), for the amounts of overpaid dividends, etc. is checked.

The timing of the formation of these amounts, the reasons and reality of existing debts, as well as the possibility of collecting them are clarified. As a result, the inventory commission, through a documentary check, must establish the correctness and validity of :

- the amount of accounts receivable listed in the accounting records, including debt for shortages and thefts;

- amounts of receivables, including amounts of “receivables” with an expired statute of limitations.

FOR YOUR INFORMATION

The general limitation period is three years (Article 196 of the Civil Code of the Russian Federation), and the limitation period begins from the day when the person learned or should have learned about the violation of his right and who is the proper defendant in the claim for the protection of this right ( Article 200 of the Civil Code of the Russian Federation).

It is important to take into account that in accordance with Art. 203 of the Civil Code of the Russian Federation, the limitation period is interrupted by the obligated person taking actions indicating recognition of the debt.

In paragraph 20 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated September 29, 2015 No. 43 (as amended on February 7, 2017) “On some issues related to the application of the norms of the Civil Code of the Russian Federation on the limitation period” it is stated that actions indicating the recognition of a debt in order to interrupt the limitation period, may include: recognition of the claim; a change in the contract by an authorized person, from which it follows that the debtor acknowledges the existence of a debt, as well as a request from the debtor for such a change in the contract (for example, a deferment or installment plan); act of reconciliation of mutual settlements, signed by an authorized person.

A response to a claim that does not contain an indication of the acknowledgment of a debt does not in itself indicate an acknowledgment of a debt. Recognition of a part of the debt, including by paying part of it, does not indicate recognition of the debt as a whole, unless otherwise agreed by the debtor.

After the break, the limitation period begins anew; the time elapsed before the break does not count towards the new term.

Thus, the following fact must be taken into account: by approving the reconciliation act and fulfilling the legal requirements regarding the inventory, the organization resets the already expired statute of limitations.

NOTE

If the debtor is excluded from the Unified State Register of Legal Entities, then all his obligations at the moment have been terminated, and therefore there are no legal grounds for calculating the limitation period after this date (Resolution of the Arbitration Court of the Moscow District dated November 7, 2017 No. F05-16302/2017 in case No. A40-106253/2016).

In addition to formal confirmation of the validity of the debt amounts recorded during the inventory, it is necessary to highlight doubtful accounts receivable . Signs of such debt:

- lack of contact with the counterparty;

- significant delay in fulfillment of contractual obligations;

- the appearance in the extract from the Unified State Register of Legal Entities of information about the unreliability of data;

- large amounts of debt to the Federal Tax Service of Russia;

- blocking of current accounts;

- signs ;

- lack of property, etc.

In order to control the limitation period, it is important to identify the start date of the limitation period, the expired limitation period, taking into account the interruption in the running of the period.

Preparing for an inventory in an organization

To begin the inventory, an order is issued in the form INV-22 (→). The composition of the persons whose responsibilities are charged with carrying out the inventory is approved by order of the manager. Important aspects of document flow include:

- The commission must consist of at least 3 responsible persons. The commission is headed by the chairman responsible for conducting the audit.

- The permanent commission is reflected in the order of the beginning of the year, issued separately or included in the annex to the accounting policies.

- When forming the composition of a one-time convening of the commission (for special reasons for inventory), an order on the responsible persons is issued immediately before the audit.

Before starting the inventory, it is necessary to carry out reconciliations with counterparties who act as debtors of the enterprise. There is the added benefit of conducting a documented data reconciliation. It is possible to claim receivables only within the limitation period established by the Civil Code of the Russian Federation within 3 years.

The statute of limitations for debt confirmed by bilateral (or with a large number of parties to the agreement) reconciliation is recalculated from the date of signing the document. Resetting the period to zero must be taken into account when writing off uncollectible debt.

EXAMPLE OF INVENTORY OF ACCOUNTS RECEIVABLE

According to accounting data, Universal LLC includes the following amounts of accounts receivable in the context of synthetic accounting accounts (Table 1).

| Table 1. Extract from the balance sheet of the enterprise as of 04/30/2019 | |

| Account | Debit balance, rub. |

| 60 “Settlements with suppliers and contractors” | 1 720 165 |

| 62 “Settlements with buyers and customers” | 4 757 874 |

| 68 “Calculations for taxes and fees” | 310 000 |

| 69 “Calculations for social insurance and security” | 302 |

| 70 “Settlements with personnel for wages” | 18 475 |

| 71 “Settlements with accountable persons” | 94 000 |

| Total | 6 900 816 |

On 05/06/2019, the director of the enterprise, Ivanov R.I., issued an order according to which, from May 6 to May 10, 2021, the working inventory commission must conduct an inventory of settlements in relation to the amounts of the enterprise’s receivables. Documents must be submitted to the accounting department on May 10, 2019.

Fulfilling this order, the accountant prepared reconciliation reports with each counterparty.

Based on reconciliation reports and primary documentation, the following was established. According to settlements with suppliers and contractors, there are errors in accounting data . The accounting department did not reflect the invoice presented by the supplier in April 2019 in the amount of RUB 74,590. for the supplied materials necessary for Universal LLC to provide services.

It was also revealed that the debt in the amount of 168,575 rubles. is real, but it was not possible to obtain signed reconciliation reports with suppliers for various technical reasons. Debt in the amount of 203,450 rubles. was classified as unreal (due to the expiration of the statute of limitations for one enterprise, or the exclusion of an organization from the Unified State Register of Legal Entities - in another way).

Another 303,000 rubles. were recognized as a doubtful debt, since it was possible to establish that the debtor was overdue for the fulfillment of his obligations under the contract. According to open sources, he has significant tax arrears.

When taking inventory of debtors from the category of buyers and customers, it turned out that the amount of 1,710,000 rubles, which was expected to be received in June 2021 (it was planned for the purchase of an additional volume of inventory), most likely will not arrive within this time frame. The fact is that this consumer was sued by a third party in the amount of 33 million rubles, and his current account was blocked.

When taking inventory of settlements with accountable persons, it turned out that 4800 rubles. hanging behind a fired employee. During a telephone conversation, this debtor rudely refused to pay off the debt. Taking into account his antisocial lifestyle and lack of permanent work, the commission members concluded that it was inappropriate to collect this debt through the court and proposed to write it off.

The generalized working materials of the inventory commission are presented in table. 2.

| Table 2. Generalized working materials of the inventory commission | ||||||

| Account | Accounts receivable, rub. | Differences subject to adjustment in accounting | ||||

| Registered | Actually revealed | From the amount actually revealed | ||||

| the debt is real, but not confirmed by debtors | debt unrecoverable | doubtful debt | ||||

| Settlements with suppliers and contractors | 1 720 165 | 1 645 575 | 168 575 | 203 450 | 303 000 | 278 040 |

| Settlements with buyers and customers | 4 757 874 | 4 757 874 | 0 | 0 | 1 710 000 | 0 |

| Calculations for taxes and fees | 310 000 | 310 000 | 0 | 0 | 0 | 0 |

| Calculations for social insurance and security | 302 | 302 | 0 | 0 | 0 | 0 |

| Payments to personnel regarding wages | 18 475 | 18 475 | 0 | 0 | 0 | 0 |

| Calculations with accountable persons | 94 000 | 94 000 | 0 | 0 | 4800 | 4800 |

| Total | 6 900 816 | 6 826 226 | 168 575 | 203 450 | 2 017 800 | 282 840 |

The essence of the document

So, a reconciliation act is a document that confirms the debt of one party to the other. With its help, you can monitor the correctness of calculations for transactions of the quality of the relationship between two counterparties for a certain period. Accordingly, using acts for different periods, it is possible to study the dynamics of relationships, determine the reliability of a partner and his integrity. Russian legislation does not provide for strict forms of execution of the act, so in principle it can be drawn up in the way that is convenient for you, but there are general rules that must be followed so that the document has legal force and can, if necessary, be used as evidence in court or during proceedings. It should contain:

- Document's name.

- The time period for which settlements are reconciled.

- The full name of the two counterparties and their details.

- Indication of the reason for reconciling settlements (for example, an agreement, received payment orders, invoices, accountable acts and other primary documentation).

- The amount (in words) for each transaction that was carried out during a specific period.

- The final balance of transactions, indicating who exactly should make the final payment.

- Details and signatures of the counterparties who conclude the transaction.

Correctly completed form

Attention:

the act is filled out by two parties who enter into it data on their obligations, as well as on completed agreements (supplies). If the amounts agree, then the counterparties have no mutual claims and all calculations were carried out as correctly as possible.

Please note that if the numbers do not match or something is not entered into the document, this does not mean that the reconciliation was incorrect. The only exception is the signature of one of the parties; they must be there. The main objective of the document is that it shows the state of settlements between two entities acting on the basis of certain agreements in a specific period in the context of specific actions on either side. If companies have seals, the signatures must be sealed with them. Please note that if the document is signed by anyone from the company other than the manager, then he must have an official power of attorney for such actions, otherwise the court will not consider such an act.

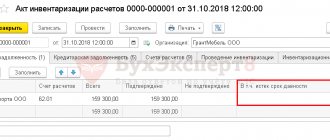

REGISTRATION OF DEBT INVENTORY RESULTS

For inventoried debts, a certificate is drawn up, which is the basis for drawing up an act in form No. INV-17 with the results of an inventory of settlements with buyers, suppliers and other debtors and creditors. The act is drawn up in two copies and signed by the responsible persons of the inventory commission. One copy of the act is transferred to the accounting department, the second remains with the commission.

Based on the results of the inventory and the results identified, Universal LLC prepared the relevant documentation.

Report “Help to Form INV-17”

As noted above, the basis for drawing up an act in form No. INV-17 is a certificate (attachment to form No. INV-17, see Fig. 7, 8), which must be attached to the settlement inventory act. To compile a certificate, use the report “Certificate for Form INV-17”.

Rice. 7. Details of the certificate for form INV-17.

Rice. 8. Printed form of the certificate for the INV-17 form.

Unlike the “Inventory of settlements with counterparties” report, the report can provide information about the debt as of the date of generation of the report on settlement accounts for which accounting is kept not only for the “Counterparties” subaccount, but also for the “Students” and “Employees” subaccounts. , "Children". Thus, this report can also be used to take inventory of payments to students, employees, and parental pay. If necessary, the information received can be entered manually into the “Inventory of settlements with counterparties” report after it is automatically filled with data on settlements with counterparties.

To generate a certificate you should:

- set the date as of which data should be issued;

- check the box next to those subaccounts for which a report is needed;

- click the “Generate” button.

The report is generated according to a unified form (Appendix to INV-17).

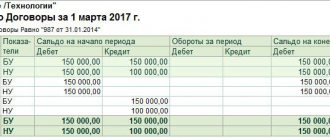

The information in the report is sorted by counterparties (students, employees, children). The amounts of receivables (payables) are given in the context of accounting subaccounts.

The amounts of receivables (payables) for counterparties are also given for each basis of calculation - in the context of elements of the subordinate reference book “Bases” for which there is a debit (credit) balance as of the reporting date.

Column 1 gives the report line number in order.

Column 2 provides the full name, legal address and telephone numbers indicated in the counterparty card or full name of the employee (student, child).

Column 3 contains the information specified in the details “Agreement”, “Summary of the agreement” of the agreement card (Directory “Grounds”).

Column 4 reflects the date of the last transaction that generated the debt. For debt that arose before January 1 of the year for which the report is being generated, “Before January 1.” is indicated. If there is such a debt, it is necessary to conduct an investigation, determine the date the debt arose and enter it in the editing mode of the generated report.

Columns 5 and 6 reflect the accounting account for which there is a debt as of the date the report is generated, and the amount of receivables or payables.

Columns 7, 8, 9 provide the name, number and date of the last transaction that gave rise to the debt.

In the lines of the report, it is possible to detail the data: when deciphering the columns “Counterparty”, “Agreement”, elements of the directories are opened for viewing; when decoding the columns “Accounts Receivable”, “Accounts Payable”, the “Account Balance Sheet” report is generated with the possibility of further detailing the data; when deciphering columns 7, 8, 9, the operation opens.

We also recommend using this report to identify accounting errors. For example, when grouping “by counterparties”, it is possible to identify for the same counterparty the same amounts of receivables and payables for different calculation bases or subaccounts.