At what rates are insurance premiums paid for payments to citizens of EAEU member countries?

Since citizens of EAEU member countries have the same social security as Russian citizens, tariffs for both categories will be the same.

Read more about insurance premium rates here.

Insurance premiums from payments to citizens of the EAEU member countries are paid to compulsory medical insurance and compulsory health insurance. The exception is highly qualified specialists. They do not pay insurance premiums for compulsory health insurance (clause Art. 7 of the Federal Law of December 15, 2001 No. 167-FZ).

It is worth noting that contributions for injuries are paid only if this is provided for in the GPC agreement (Federal Law of July 24, 1998 No. 125-FZ). If the GPC agreement does not provide for this, there will be no contributions (paragraph 1, article 5 of the Federal Law of July 24, 1998 No. 125-FZ).

Transaction with a non-resident - settlement features

Purchase and sale of real estate in Russia with the participation of non-residents (citizens and non-citizens of Russia)

Attention - currency transactions in real estate transactions

How to avoid large fines in transactions with non-residents

Sale of real estate to a foreigner. Money to a foreign account, perhaps?

Lawyer Gordon A.E.

In Russia, real estate transactions with the participation of foreigners have been a long-standing practice. But even experienced realtors do not pay enough attention to the peculiarities of settlements involving foreigners and Russian citizens living abroad for a long time; perhaps this applies to the latter even to a greater extent.

In 2021, the Russian Tax Service is beginning to intensively look for violations of the Russian Law “On Currency Regulation and Currency Control” No. 173-FZ, which can lead the parties to the transaction to disastrous results due to significant fines.

A Russian real estate transaction with a foreigner or non-resident has features that need to be taken into account at the stage of planning the transaction and making an advance payment.

At real estate consultations or tax consultations with foreigners, questions are regularly asked about the tax consequences of transactions with real estate located in Russia. At the same time, both sellers of Russian real estate and buyers do not pay any attention to the danger that appears to be an elementary stage of a real estate transaction - payments for real estate.

Meanwhile, liability for violations of Russian currency legislation ranges from 75 to 100% of the transaction amount. Moreover, depending on the specific circumstances, both parties to the transaction - both the seller and the buyer - may be subject to this fine.

Foreigner and currency resident - the relationship between concepts and significance for a real estate transaction

Currency resident of Russia - individuals citizens of Russia, with the exception of citizens of the Russian Federation, permanently residing in a foreign state for at least one year, including those who have a residence permit issued by an authorized state body of the relevant foreign state, or temporarily staying in a foreign state for at least one year for on the basis of a work visa or study visa with a validity period of at least one year or on the basis of a combination of such visas with a total validity period of at least one year.

Foreigners can also be currency residents if they permanently reside in the Russian Federation on the basis of a residence permit issued in accordance with the legislation of the Russian Federation.

Foreign exchange non-resident - individuals who do not comply with the above rules:

Citizens of the Russian Federation permanently residing in a foreign country for at least one year on the basis of a residence permit, or on a work or study visa with a period of at least one year or for a cumulative period;

Foreigners – not residing in the Russian Federation on the basis of a residence permit.

What can you stumble on when making payments on real estate transactions if a foreigner is involved in the transaction?

For carrying out prohibited currency transactions or for carrying out currency transactions in violation of the law, liability is established in the form of fines from 75% to 100% of the currency transaction.

Currency transactions are controlled by banks and the Federal Tax Service of the Russian Federation (FTS RF) represented by territorial tax inspectorates. Since 100% of real estate transactions are controlled by the Federal Tax Service of the Russian Federation online, and some transactions go through banks, it is not difficult to “get into” a difficult situation.

Russian currency legislation is confusing, difficult to understand, and on many issues is prohibitive in nature.

Legislation has changed significantly in the past few years, which collectively has led to widespread violations of foreign exchange transactions.

According to Russian legislation, currency transactions between residents of the Russian Federation and non-residents are carried out without restrictions. This phrase in the law “On Currency Regulation and Currency Control” is easy to read, remember, and creates a false impression.

At the same time, there is another article in the law, according to which settlements when carrying out foreign exchange transactions are made by resident individuals through bank accounts in authorized banks. This means that, in fact, settlements between a resident of the Russian Federation and a non-resident of the Russian Federation in cash foreign currency are prohibited. For violation of such a ban, a fine is established (Part 1 of Article 15.25 of the Code of Administrative Offenses of the Russian Federation) of 75-100% of the amount of the currency transaction .

Contains foreign exchange regulation law and other surprises.

Currency transactions in real estate transactions

There is a misconception that foreign exchange transactions are the purchase and sale of foreign currency, and therefore, in a real estate transaction with payment in rubles, there are no foreign exchange transactions; currency legislation can be ignored.

According to Russian currency legislation, a foreign exchange operation is a transaction established by law with foreign exchange values and the currency of the Russian Federation (with Russian rubles), with securities, and most importantly, foreign exchange operations are the use of foreign exchange values and the currency of the Russian Federation as a means of payment!

Foreign exchange transactions in Russia are:

— use between residents of Russia as a means of payment of foreign currency and the currency of the Russian Federation (Russian rubles);

— import into the Russian Federation and export from the Russian Federation of currency values, the currency of the Russian Federation and domestic securities;

- transfer of foreign currency, currency of the Russian Federation from an account opened outside the territory of the Russian Federation to the account of the same person opened in the territory of the Russian Federation, and from an account opened in the territory of the Russian Federation to the account of the same person opened outside the territory of the Russian Federation;

— transfer of Russian currency from a resident’s account opened outside the territory of the Russian Federation to the account of another resident opened in the territory of the Russian Federation, and from a resident’s account opened in the territory of the Russian Federation to the account of another resident opened outside the territory of the Russian Federation;

— transfer of Russian currency from a resident’s account opened outside the territory of the Russian Federation to the account of another resident opened outside the territory of the Russian Federation;

— transfer of Russian currency from a resident’s account opened outside the territory of the Russian Federation to the account of the same resident opened outside the territory of the Russian Federation.

If a non-Russian resident is involved in a transaction with Russian real estate, one currency transaction will definitely be the use of foreign currency or Russian currency as a means of payment. In real transactions there will be several foreign exchange transactions. Violations can be committed in each. The amount of the fine can significantly exceed the amount of the real estate transaction.

What are currency values?

According to the currency law, currency values are foreign currency and foreign securities. Moreover, currency values include cash foreign currency and funds in foreign currency in bank accounts.

Thus, settlements in real estate transactions between residents and non-residents, and sometimes settlements between residents of Russia, may turn out to be foreign exchange transactions. Therefore, currency transactions when making payments for real estate must be identified in advance and settlements must be planned in advance in compliance with currency legislation.

A foreigner buys real estate in Russia - what are the currency transactions?

A foreign buyer of real estate is, in most cases, a foreign currency non-resident of Russia; a seller of real estate in Russia, as a rule, is a foreign currency resident.

Payment for real estate located in Russia under transactions is carried out in cash or non-cash form. Russians do not trust banks and prefer cash payments in rubles rather than in foreign currency.

When preparing to buy real estate in Russia, a foreigner needs to take into account. Payment for real estate in cash in foreign currency to a resident of Russia is prohibited, and non-cash foreign currency can only be transferred to a Russian citizen to an account in an authorized bank. (Authorized bank is a bank that has a license from the Central Bank of the Russian Federation for operations with foreign currency). Such authorized banks are almost all banks in Russia. Obviously, it is convenient and safe to pay through a bank account. But here, too, not everything is simple.

Now we need to take into account the peculiarities of Russian legislation: The buyer will become the owner of the property only after making a record of the rights to the purchased property and a record of the termination of the seller’s ownership in the Unified State Register of Real Estate (USRN). The period for making an entry in the Unified State Register is 7 working days. Paying even when signing an agreement is dangerous, what if the property is not registered?

Safe payments for real estate transactions in Russia are carried out through a bank - through a safe deposit box or letter of credit, with access conditions (disclosure of the letter of credit). In one case, a foreigner needs to legally receive cash and deposit it in a safe deposit box, in the other, he needs to place money in an account in an authorized Russian bank in Russia (letter of credit). In any of these options, in order to comply with currency laws, a foreigner must legally bring money into Russia - bring in cash or transfer it to an account opened in his name in Russia.

They regularly offer to make payments through foreign accounts of Russian sellers who are residents of the Russian Federation.

In what cases can money for an apartment in Russia be credited to the foreign account of the seller, a citizen of Russia? - read here.

A foreigner sells real estate located in Russia

The conditions for compliance with Russian currency legislation and security of payments are similar to the procedure for a foreigner purchasing real estate in Russia, with the exception of two circumstances.

1) Foreign exchange non-residents have the right, without restrictions, to transfer funds from their accounts in authorized banks in Russia to their accounts in foreign banks. Transfers are possible in Russian rubles and foreign currencies. Accordingly, Russian banks, as currency control agents, will verify the legality of foreign exchange transactions performed by a foreigner.

2) When planning to transfer money from the sale of real estate located in Russia to a non-resident’s foreign account, it is necessary to ensure that the amounts transferred to the accounts correspond to the amounts completed in Russia for transactions and reflected in contracts. This information is controlled by foreign banks when crediting money to foreign accounts of non-residents by source of origin, in order to detect tax evasion and money laundering.

Accessed 16 October 2021.

Moscow

Currency control lawyer Gordon A.E.

GPC agreement with a foreigner: about the form, structure, features

The legal system distinguishes several types of GPC agreements concluded in various situations with migrants, however, the most common in this group are contract agreements and agreements for the provision of services (one-time or systematic).

The subject of such agreements is the performance by a migrant of specifically designated types of work or provision of services.

The forms of GPC agreements for the performance of work or provision of services concluded with foreign individuals have not been standardized by current legislation, therefore they do not have a unified template.

In its structure, the GPC agreement with a foreign citizen does not have significant differences with similar agreements concluded with citizens of the Russian Federation. However, some features are still present in this document. So:

- a GPC agreement with a migrant can be concluded only on the condition that his presence on the territory of the Russian Federation is legalized and he has the right to work (for example, a GPC agreement can be signed with a foreign citizen under a patent, or if he has a work permit);

- information about the availability of a patent for the right to work (or a work permit) is stated in the preamble of the contract;

- a contract with a foreigner must not only indicate its subject matter, but also the deadline for completing the ordered work, and in the contract concluded for the provision of services by a migrant, it is necessary to specify both the type of services and their cost;

- contract agreement, in accordance with paragraph 1 of Art. 420 of the Civil Code of the Russian Federation, can be concluded with either one or several individuals with foreign citizenship at the same time.

In the case of a “brigade” contract format:

- in its installation part (preamble) all performers should be listed,

- Each foreigner listed as a performer of work must put his signature on the agreement, and upon completion of the work, on the acceptance certificate.

Please note: work contracts concluded with a foreigner must indicate the end date of their validity. This date cannot exceed the calendar limit for the permitted stay of a foreigner in Russia. What does this mean:

- For foreigners who have received a patent or work permit, migration authorities establish a period of stay on the territory of the Russian Federation. After this period, the migrant is obliged to leave Russia, and all agreements concluded with him are considered void.

- Cooperation under a GPC agreement with a foreigner beyond the established period of stay in Russia (after which his stay is considered illegal) is a direct violation of current legislation and entails liability for the customer of the work (services).

Regulation of banking operations with non-residents of the Russian Federation

For foreigners living in Russia, there are no legal restrictions on conducting banking operations, such as lending, issuing plastic cards, or opening a debit account in Russian banks. However, of all the listed operations, lending is the most risky mechanism.

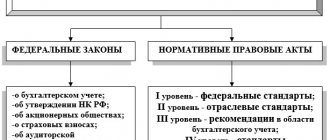

As for debit transactions, issuing bank cards and opening accounts for non-residents of Russia are very standard procedures. They are mainly regulated by the Federal Law “On Currency Regulation and Currency Control” No. 173 - Federal Law of December 10, 2003 (as amended, which came into force on December 25, 2018).

According to Article No. 13 of the above Law, “Non-residents on the territory of the Russian Federation have the right to open bank accounts (bank deposits) in foreign currency and the currency of the Russian Federation only in authorized banks.” That is, those banks that have the appropriate license for these operations. Such banks in Russia are:

- Sberbank;

- Alfa Bank;

- VTB 24;

- Binbank;

- JSC Raiffeisenbank;

- Tinkoff Bank;

- JSC CB Citibank;

- PJSC Promsvyazbank;

- Avangard Bank;

- Credit Europe Bank;

- FC Otkritie;

- UniCredit Bank;

- Eastern Express Bank.

The procedure for opening, maintaining and closing client accounts in rubles and foreign currency by the bank is also established by other regulatory documents, namely:

- Federal Law “On Banks and Banking Activities” No. 395-1-FZ of December 2, 1990;

- Instruction of the Central Bank of the Russian Federation No. 93-I dated October 12, 2000.