Types of reporting under the simplified taxation system

Depending on the data reflected in the reporting, we can distinguish:

- Declaration with charges.

- Zero declaration.

The difference between these declarations is that zero reporting is submitted if the activity was not actually carried out and (or) there was no tax base under the simplified tax system. In all other cases, reporting with accruals is submitted.

Depending on the type of object selected, the following can be distinguished:

- Declaration according to simplified tax system 6%.

- Declaration according to the simplified tax system 15%.

Despite the fact that declarations are filled out using one form, the type of object (“income” or “income minus expenses”) affects which sheets are filled out.

Individual entrepreneurs and LLCs on the simplified tax system of 6% (income) fill out the Title Page, Sections 1.1 and 2.1.1, as well as Section 2.1.2 if they are payers of the trade tax.

Individual entrepreneurs and LLCs on the simplified tax system of 15% (income minus expenses) fill out the Title Page, Sections 1.2 and 2.2, respectively.

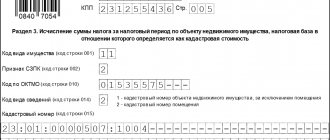

Section 3 is filled out at any facility (6% or 15%) if the simplification received targeted financing funds, targeted revenues and other funds referred to in clauses 1 and 2 of Art. 251 Tax Code of the Russian Federation.

Declaration form 2021

The Tax Service accepts tax returns under the simplified tax system in 2021 in the same form as in 2021. Nothing new has appeared and nothing old has changed: no forms, no deadlines, no forms. For LLCs and individual entrepreneurs, everything is submitted to the simplified tax system absolutely unchanged within the same time frame.

But the simplification still creates some features that make the simplified tax system declaration for individual entrepreneurs individual, depending on some factors, such as, for example, the presence of employees in the organization. For individual entrepreneurs using the simplified tax system without employees, there is a great opportunity to reduce the tax rate from 6% down to zero. This may be due to proper payments and compliance with the quarterly payment scheme.

It is also important to mention that in some special cases additional information is included in the declaration - closure of an individual entrepreneur, as an example. Indeed, the declaration under the simplified tax system when closing an individual entrepreneur must contain relevant information about the termination of the operation of the enterprise. Also, with any changes and reorganizations in the company, this must also be included in the declaration, as reference information for the Federal Tax Service. In this case, the submitted reports will be checked and, if such data is found in it, everything will be entered into the register.

Submitting a declaration under the simplified tax system in 2021, in addition to including all the same amendments and forms as before, has the same numbers for any system, even a simplified one. The filing deadlines, as before, remain the same for entrepreneurs on the simplified tax system of 6 percent and 15 percent - until March 31 of the year following the reporting year. According to tax laws, everything must be submitted on time, otherwise the entrepreneur will be held liable in the form of an administrative fine. Therefore, it is worth making sure in advance and preparing everything for the deadline.

Declaration form 2021

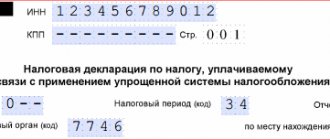

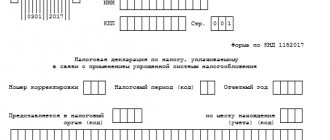

In 2021, reporting under the simplified tax system has not changed and is still submitted in the form approved by Order of the Federal Tax Service of Russia dated February 26, 2016 N ММВ-7-3/ [email protected]

tax return for tax paid in connection with the application of the simplified taxation system.

Note: to understand that you have an up-to-date reporting form, you need to pay attention to the last 4 digits of the barcode. When changing the declaration form, the value of the barcode changes. The current tax return for 2021 has the last 4 digits of the code: 2017

Reporting period for filing a tax return under the simplified tax system

The main reporting form in “simplified” form is a declaration on the tax paid under the simplified tax system (form approved by Order of the Federal Tax Service of the Russian Federation dated February 26, 2016 No. ММВ-7-3/99).

The tax period under the simplified tax system is equal to a calendar year (Article 346.19 of the Tax Code of the Russian Federation). The declaration is submitted to the Federal Tax Service once a year, and the deadlines for its submission are different for legal entities and entrepreneurs: March 31 and April 30 of the next year, respectively (Article 346.23 of the Tax Code of the Russian Federation).

The reporting period of the simplified tax system is a quarter, half a year, 9 months. There is no need to submit reports for these periods to the simplified tax system.

Thus, you need to submit your “simplified” tax return for 2017 within the following deadlines:

- no later than 04/02/2018 for organizations (since March 31 is a day off - Saturday),

- no later than 05/03/2018 for entrepreneurs (the deadline was postponed due to the “long” weekend - the May holidays).

General requirements for filling out reports

- All cost indicators are indicated in full rubles.

Values over 50 kopecks are rounded to the nearest ruble, and values below are discarded.

- The pages of the declaration are numbered in a special order.

The page number is displayed in a three-digit format, for example, for the first page the value is “001”, for the tenth - “010”.

- All information in the declaration is entered from left to right.

But, if the document is filled out on a computer, the numerical indicators (tax amount, income, expenses, insurance premiums) are aligned to the right.

- Text indicators (full name of individual entrepreneur, name of organization) are indicated in capital block letters.

This rule applies to both filling out the declaration by hand and using a computer.

- When entering information manually, blue, purple or black pens are used.

If reporting is generated using software, then you must use the font - CourierNew 16 - 18.

- In empty cells and lines, dashes are placed.

If any of the fields is left blank or incompletely filled, dashes (when filling in on a computer) or one solid line (when filling in manually) are placed in the empty cells.

- The use of corrective agents is not permitted.

If an error is made, the declaration must be filled out again; the legislator does not allow the use of putties, erasers and other corrective means.

- Double-sided printing, as well as binding of document sheets, leading to damage to the barcode, is not allowed.

Each sheet of page is printed on one side, and is stapled at the end with either a stapler (outside the barcode) or a paper clip.

Deadline for submitting a declaration after losing the right to the simplified tax system

A tax regime such as the simplified tax system has certain restrictions, they are located under the spoiler.

+ Deadlines for filing a return under the simplified tax system in 2021 for most taxpayers

+ Conditions for applying the simplified tax system in 2021 for legal entities and individual entrepreneurs

+ Who is prohibited from using the simplified tax system in 2021

If these conditions are exceeded, then the legal entity or entrepreneur will lose the right to the simplified tax system (clause 4 of article 346.13 of the Tax Code of the Russian Federation) and will switch to the simplified tax system from the beginning of the next quarter.

In this case, a tax return under the simplified tax system is submitted to the tax office no later than the 25th day of the month following the quarter in which the subject lost the right to apply the simplified tax system (clause 3 of article 346.23 of the Tax Code of the Russian Federation).

Methods for filling out the declaration

A declaration under the simplified taxation system can be filled out:

- By hand, using a reporting form received from the tax authority, or downloaded from the Internet.

You can obtain a current form from any tax authority; an inspector has no right to refuse to issue it.

- Using a computer.

You can also fill out the reports yourself using a computer, having first downloaded the form from the Internet, for example, from the website of the Federal Tax Service of the Russian Federation.

- Using third-party services and programs.

For individual entrepreneurs without employees

Individual entrepreneurs who do not have employees report only to the tax authorities. The penalty for being late is 5% of the tax, but not less than 1,000 rubles and not more than 30% of the payment amount.

OSN

Entrepreneurs using the general taxation system submit three reports to the tax office:

- once a year 3-NDFL, report for 2017 - until April 2;

- 4-NDFL can be primary and specified. The primary one is provided at the beginning of the year - a month and 5 days from the date of the first income of the year. In it, individual entrepreneurs indicate how much income they expect to receive. If an entrepreneur does not have time to report, he pays a fine of 200 rubles to the tax authorities. If the actual income turns out to be 50% higher or lower than expected, then you can send an updated 4-NDFL, but if you don’t do this, there will be no fine;

- Individual entrepreneurs submit VAT returns based on the results of each quarter - by the 25th day of the month following the reporting period: by January 25, April, July, October.

simplified tax system

Entrepreneurs using the simplified tax system send only a declaration under the simplified tax system for 2021 until May 3, 2018.

UTII

Entrepreneurs on imputation submit a UTII declaration every three months:

- for the 4th quarter of 2021 - January 22;

- for the 1st quarter of 2018 - April 20;

- for the 2nd quarter of 2018 - July 20;

- for the 3rd quarter of 2018 - October 22.

PSN

Entrepreneurs on a patent without employees are not required to report.

Unified agricultural tax

Entrepreneurs on the unified agricultural tax provide only a declaration for 2021, this must be done before April 2, 2021.

Simplified reporting deadline

A simplified declaration is submitted once a year, based on the results of the tax period, which is a calendar year.

Note: at the end of the reporting periods, the declaration is not submitted, but insurance premiums are paid.

Individual entrepreneurs report for the year no later than April 30 of the year following the reporting year.

Organizations no later than March 31 of the year following the reporting year.

Table No. 1. Deadlines for submitting the declaration for 2017-2019.

| Taxable period | 2017 | 2018 | 2019 |

| Organizations | April 2, 2021 | April 1, 2021 | April 1, 2021 |

| IP | April 30, 2021 | April 30, 2021 | April 30, 2021 |

| Organizations and individual entrepreneurs ceasing their activities | No later than the 25th day of the month in which the individual entrepreneur or organization ceased operations (was excluded from the Unified State Register of Individual Entrepreneurs or the Unified State Register of Legal Entities) | ||

Note: if the reporting deadline falls on a weekend or holiday, it is postponed to the first working day.

Deadlines for submitting reports according to the simplified tax system

Conventionally, there are four deadlines for filing a declaration under the simplified taxation system:

- General. The usual deadline for submitting reports is established for those cases when the declaration is submitted based on the results of the past year.

- When closing an individual enterprise. For those simplifiers who decided to deregister as individual entrepreneurs, the law sets a separate deadline for submitting reports. It is tied to the date of entering information into the Unified State Register of Individual Entrepreneurs about the termination of activities as an individual entrepreneur.

- Upon termination of activities on the simplified tax system. For individual entrepreneurs who have completed their activities under the simplified tax system, the deadline for submitting the declaration is tied to the notification informing them of the end of their activities under the simplified tax system. More precisely, by the date specified in this document.

- In case of loss of the right to use the simplified tax system. A separate deadline for submitting reports is also established for individual entrepreneurs who have lost the right to use the simplified tax system. It is tied to the quarter in which the entrepreneur ceased to meet the requirements of the simplified regime and lost the right to apply this regime.

As we can see, the deadline for submitting a declaration under the simplified tax system depends on the basis on which it is submitted. Let's take a closer look at each of the above cases.

Deadlines for submitting documents in 2021

- For the single temporary income tax (UTII), individual entrepreneurs fill out and submit reports for each quarter. Deadlines in 2021: 20th of April, July, October and January (2018).

- Individual entrepreneurs submit the VAT return to the Federal Tax Service by the 20th day of the month following the day when the purchased imported goods were registered.

- According to the law, zero, like regular, reporting under the simplified tax system for the reporting period must be transferred to the Federal Tax Service by April 30, 2021. Submitted to the inspectorate at the place of residence.

- If an entrepreneur terminates his activities, he is required to submit a declaration by the 25th day of the month following the month of completion of his activities.

- An individual entrepreneur who has lost the opportunity to use the simplified tax system is obliged to submit a declaration by the 25th day of the month following the quarter in which this opportunity was lost.

There are several reporting methods:

- Personal visit to the Federal Tax Service and handover of documents.

- Send the person with the papers with a power of attorney, which is best certified by a notary.

- Electronic reporting is available to those who have passed the appropriate registration.

- By mail. The papers are sent by a valuable letter with a description of the attachments. Choosing this method saves time. Anyone can send a letter.

We are sure that you will find useful information on how to register in your personal taxpayer account.