Basic provisions for submitting a declaration under the simplified tax system in 2020-2021

Organizations and individual entrepreneurs operating under a simplified taxation system are required to submit a simplified taxation system (STS) declaration-2020 in the prescribed form with a certain filling out procedure. Declaration of the simplified tax system-2020 - its form, as well as the format for submitting the report in electronic form - were approved by order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3 / [email protected]

Companies operating on the simplified tax system must submit declarations of the simplified tax system annually before the cutoff date - March 31. Thus, the 2021 simplified tax system declaration for simplified legal entities must be submitted by 03/31/2021 (this is working Tuesday).

Those using the simplified individual entrepreneurs have more time to submit the declaration - based on the results of 2021, they will have to report no later than 04/30/2021.

Submitting a declaration after the established deadline will result in a fine.

Important! ConsultantPlus warns The fine will be 5% of the amount... And the head of the organization (chief accountant or other official) can... Individual entrepreneurs face administrative liability... Read more in K+. Trial access is available for free.

The tax return under the simplified tax system is submitted to the inspectorate at the place of residence of the individual entrepreneur or the place of registration of the organization. You can submit a declaration in one of three ways:

- on paper in person or through a representative when visiting the tax office;

- on paper by mail;

- via electronic communication channels;

Confirmation of submission of the declaration in the first case will be a mark from the tax inspector on your copy of the declaration, in the second case - a mark on the postal receipt and an inventory of the attachment, in the third - confirmation from a specialized telecom operator.

Tax return for simplified tax system in 2021

Home / Tax returns

| Table of contents: 1. Place and deadline for submitting the declaration according to the simplified tax system 2. Methods of reporting 3. Declaration structure | 4. Instructions for filling out the simplified taxation system declaration 5. Fine for failure to submit a simplified taxation system declaration 6. Programs for preparing a report |

Declaration of the simplified tax system is an annual tax reporting that must be submitted by business entities applying the simplified taxation regime.

KND declaration form 1152017 was approved by order of the Federal Tax Service dated February 26, 2016 No. ММВ-7-3/ [email protected]

Download the declaration form

Sample declarations according to the simplified tax system: “income” or “income – expenses”

Sample zero declaration of the simplified tax system

Where to submit the declaration

Organizations submit reports at their location (legal address), individual entrepreneurs – at their place of residence.

At the same time, legal entities that have separate divisions include information on divisions in their declaration under the simplified tax system. There is no need to submit a separate report on the OP.

Deadlines for submitting a declaration under the simplified tax system

The tax period according to the simplified tax system is a calendar year. Reporting periods are: 1st quarter, half year, 9 months.

The declaration is submitted at the end of the tax period.

In this case, business entities submit reports within the following deadlines:

| Subject | Last day for filing a simplified tax return |

| Legal entity | March 31 of the year following the expired tax period |

| IP | April 30 of the year following the end of the tax period |

If the last day for filing a declaration falls on a weekend (holiday), then the deadline for submitting the report is postponed to the next working day. Thus:

- For 2021, legal entities must report by April 2 (inclusive) 2021, individual entrepreneurs - no later than 04/30/2021.

- For 2021: for companies - no later than April 1, 2021, individual entrepreneurs - no later than April 30, 2021.

If the taxpayer no longer meets the conditions for applying the simplified regime, reporting is submitted by the 25th day of the month following the reporting period in which the right to the simplified regime was lost.

A citizen closing an individual entrepreneur submits a report no later than the 25th day of the month following the month in which an entry was made about the termination of activities in the status of an individual entrepreneur in the Unified State Register of Individual Entrepreneurs or before the date of deregistration from tax registration (if these are the requirements of the local INFS).

When an organization is liquidated, a report on the simplified tax system is presented together with an interim or final liquidation balance sheet.

The date of submission of the report according to the simplified tax system is recognized as:

- When submitting to the tax authorities in person or through an authorized representative - date of filing;

- When sent through a post office - the date on the postal stamp;

- When transmitted via TCS channels (via the Internet) - the date specified in the confirmation of the EDF operator.

Reporting methods

You can submit a declaration in the following ways:

1) Printed out (filled out manually) on paper - in person, through an authorized person (with the obligatory presentation of a power of attorney: notarized - for a representative of an individual entrepreneur, ordinary - for a representative of a legal entity) or by post (with a list of attachments).

Tax reporting on paper is submitted:

- in 2 copies. – upon submission to the Federal Tax Service;

- in 1 copy. – when sent via Russian Post.

Note: some inspections accept a paper declaration only with a duplicate file attached on a flash drive.

2) Electronically via the Internet: directly on the Federal Tax Service website or through an EDF operator.

Declaration structure

Tax reporting under the simplified tax system includes:

- title page;

- section 1.1, which contains the amounts of the single tax according to the simplified tax system (advance tax payment) subject to payment (reduction) in connection with the use of the simplified regime (object “income”), based on information from the business entity;

- section 1.2, which records the amounts of the unified tax (advance) and the minimum tax payable (reduced) according to the simplified tax system (the object “income minus expenses”);

- section 2.1.1 – is intended for calculating the amount of the unified tax according to the simplified tax system “income”;

- section 2.1.2, which indicates the amount of the trade fee that reduces the EH under the simplified tax system “income”;

- section 2.2 – includes the calculation of the unified tax according to the simplified tax system “income minus expenses”;

- section 3 – data on funds received as part of targeted financing and charitable activities is reflected here.

The composition of the submitted declaration depends on the selected taxation object:

| Taxpayers | What sections are presented? |

| All organizations (IP), regardless of the object of taxation | Title page |

| Subjects who have chosen “income” as the object of the simplified tax system | Sections: 1.1; 2.1.1 and 2.1.2 (only if the organization (IP) is the payer of the trade tax) |

| Entities applying the simplified tax system “income minus expenses” | Sections: 1.2 and 2.2 |

| Subjects who received targeted funds, regardless of the object of taxation | Section 3 (usually not included in the declaration for commercial firms and individual entrepreneurs) |

In this case, the total indicators of section 2.1 (2.2) are first calculated and reflected, and then, based on these indicators, section 1.1 (1.2) is filled out.

It should be noted that only accrued tax amounts must be reflected in the sections of the declaration; paid tax amounts are not indicated in the report.

Instructions for filling out the simplified taxation system declaration

The procedure for filling out the declaration (hereinafter referred to as the Procedure) is contained in Appendix No. 3 to the Federal Tax Service order No. MMV-7-3 dated February 26, 2016 / [email protected]

General requirements

1. Amounts indicated in the declaration are rounded to whole rubles in accordance with the mathematical rules of rounding.

2. When filling out the declaration manually, it is allowed to use purple (black, blue) ink.

3. When preparing reports, it is prohibited:

- fasten sheets with a stapler;

- make corrections, including using white corrector or other means;

- Print report pages on both sides.

4. Pages are numbered in continuous order, regardless of the composition of the declaration, as follows: “001”, “002”, “003”, etc.

5. For each individual line of the report, a certain number of acquaintances is provided, and only one indicator is entered in one line.

To record decimal fractions (tax percentages), fields are provided, separated by a period symbol.

6. Numerical, text and code indicators are written into the form from left to right, from the leftmost cell. When using software to generate a report, the values of numerical indicators are aligned to the last right acquaintance.

7. Text information is written in the document fields in capital letters. If the document is filled out using software, Courier New font should be used (16 - 18 points high).

8. If after recording the indicator there are empty cells left in the line, dashes are placed in them (for example: the organization’s TIN is indicated in the following format: “1356785795–”).

9. If there are no indicators, empty lines are also crossed out. Moreover, if the reporting is prepared using software, then when printed there may be no cell boundaries and dashes in empty spaces.

10. Tax reporting generated through the software can be printed as a machine-readable form containing a two-dimensional barcode.

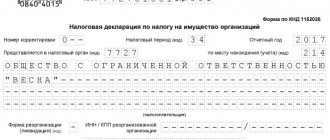

Title page

1. The data on the title page is filled out by the organization (IP), except for the block “To be filled out by an employee of the Federal Tax Service”.

2. INN/KPP. The corresponding codes are indicated. Individual entrepreneurs fill out only the TIN (a checkpoint code is not assigned to entrepreneurs).

3. Corrective report number. If reporting is submitted for the first time, you need to write down the code: “0–”. When submitting an updated declaration, the serial number of the adjustment is filled in: “1–”, “2–”, etc.

4. Taxable period. The period for which the report is submitted is indicated:

| Code | Period |

| 34 | Year |

| Last tax period: | |

| 50 | upon liquidation (reorganization) of an organization when closing an individual enterprise |

| 95 | when switching to another tax regime |

| 96 | upon termination of business activity when closing activities on the simplified tax system |

5. Reporting year. The year for which the declaration is submitted is completed.

6. Inspection code. The four-digit code of the inspection to which the document is being submitted is filled in.

7. Code at the place of registration. The code for the place of presentation of the document is indicated:

| Code | Name |

| 120 | At the place of residence of the individual entrepreneur |

| 210 | At the location of the Russian legal entity |

| 215 | At the location of the legal successor who is not one of the largest taxpayers |

8. Below, fill in the full name of the legal entity or full name of the individual entrepreneur (line by line).

9. Then the OKVED code from the OKVED2 classifier is entered.

10. Liquidation (reorganization) code and TIN/KPP of the liquidated (reorganized) legal entity. These fields are filled in only in cases of liquidation (reorganization) of a legal entity in accordance with Appendix No. 3 to the Procedure:

| Code | Name |

| 1 | Conversion |

| 2 | Merger |

| 3 | Separation |

| 5 | Accession |

| 6 | Division with simultaneous accession |

| 0 | Liquidation |

11. Next, indicate the taxpayer’s contact phone number.

12. The number of pages of the submitted reporting and the number of pages of annexes to the declaration are indicated.

13. Field “Confirmation of information accuracy”. The code of the individual submitting tax reporting is entered:

- 1 – if the taxpayer submits the declaration;

- 2 – if the document is transmitted through an authorized representative.

The fields Full name, signature, date are filled in in the following order:

| Who submits the declaration | What data is indicated? |

| IP | signs and puts down the date of signing the declaration, does not fill in the full name |

| Organization | The full name of the head of the legal entity is filled in, dated and signed |

| Representative – individual | indicate the name of the representative, date and signature; below, fill in the details of the power of attorney or other document confirming the authority of the representative |

| Representative – legal entity | First, the full name of the authorized person of the representative company is indicated, then the name of the representative company itself is entered, the signature, date and details of the confirming document on the authority of the individual submitting the report are put |

Note: if an individual does not sign the declaration, but simply submits it to the Federal Tax Service on behalf of the entity, the full name of such person does not need to be indicated on the title page.

Section 2.1.1

This section is drawn up only by business entities using the simplified tax system “income”.

| Line code | Content |

| 102 | You should indicate the payer's attribute: “1” – for an organization (IP) that makes payments of remuneration to individuals; “2” – for individual entrepreneurs without employees |

| 110-113 | The amounts of income received by the taxpayer are recorded on an accrual basis for the 1st quarter, half year, 9 months, and year. The procedure for determining income is approved in Art. 346.15 Tax Code of the Russian Federation. If the declaration is submitted in connection with the termination of activity or loss of the right to the simplified tax system (before the end of the tax period), the indicator for the last working reporting period (reflected in lines: 110, 111, 112) is duplicated on line 113. |

| 120-123 | The tax rate is indicated as a percentage, line by line: for 1 quarter, half a year, 9 months, a year. When submitting a declaration before the end of the calendar year, the tax rate indicated for the last period of business (from lines: 120, 121, 122) is duplicated on line 123. |

| 130-133 | Advance payments for the Unified National Tax and the amount of tax for the calendar year are reflected according to the following formulas: |

| 130 | Line 130 = line 110 * line 120 / 100 |

| 131 | Line 131 = line 111 * line 121 / 100 |

| 132 | Line 132 = line 112 * line 122 / 100 |

| 133 | Line 133 = line 113 * line 123 / 100. When submitting reports before the end of the year, the value of the indicator for the last working reporting period (from lines: 130, 131, 132) is repeated on line 133. |

| 140-143 | Filled in with a cumulative total of the amounts of insurance premiums and benefits paid to hired personnel (in accordance with clause 3.1 of Article 346.21), by which the subject has the right to reduce the amount of advances for the unified tax (single tax amount) accrued for the reporting (tax) period. At the same time, taxpayers who indicated on line 102: “1” – they can reduce the amount of advances for the Unified National Tax (tax) by no more than 50%, i.e. the indicators of lines 140-143 cannot be more than 1/2 of the indicators of lines 130-133, respectively; “2” – they can reduce the amount of advances for the unified tax (tax) by the entire amount of contributions paid, while the indicators of lines 140-143 should not exceed the indicators of lines 130-133. When submitting reports before the end of the year, the value of the indicator for the last working reporting period (from lines: 140, 141, 142) is repeated on line 143. |

Section 2.1.2

This section is formed only by entities that apply the simplified tax system “income” and are payers of the trade tax.

The need for a separate section is due to the fact that the amount of the trade fee can only be deducted from income received from activities that are directly subject to this fee.

Consequently, if the taxpayer has types of activities that do not fall under the trade tax, then income from them is not included in this section.

The section consists of two sheets.

The first sheet is filled out similarly to section 2.1.1:

| Line code | Content |

| 110-113 | Fill in with a cumulative total (line by line: for 1 quarter, half a year, 9 months and a year) of the amount of income from activities subject to trade tax. If the subject does not conduct any other type of activity other than trade, the data in lines 110-113 of section 2.1.1 is duplicated |

| 130-133 | The amount of the advance payment for the Unified Tax (tax amount) is calculated: |

| 130 | Line 130 = line 110 * line 120 of section 2.1.1 / 100 |

| 131 | Line 131 = line 111 * line 121 of section 2.1.1 / 100 |

| 132 | Line 132 = line 112 * line 122 of section 2.1.1 / 100 |

| 133 | Line 133 = line 113 * line 123 of section 2.1.1 / 100 |

| 140-143 | The amounts of insurance payments (only for employees engaged in trading activities) are indicated as a cumulative total, reducing advances for the unified social security (tax), in accordance with clause 3.1 of Art. 346.21 If the organization (IP) does not conduct other activities other than trade, the information reflected in lines 140-143 of section 2.1.1 is duplicated In this case, the procedure for filling out lines 140-143 of section 2.1.2. (depending on the taxpayer’s characteristics) fully complies with the procedure for filling out lines 140-143 of section 2.1.1 |

The second sheet of the section is formed in the following order:

| Line code | Content |

| 150-153 | Filled in with a cumulative total of the amount of trade tax that the taxpayer actually paid during the tax (reporting) period |

| 160-163 | The collection amounts by which the amounts of advance payments for the Unified Tax (tax) can be reduced are indicated. The trade fee can reduce the accrued advances under EN (tax) to zero. In order to calculate the amount of the fee that reduces the tax, you need to subtract the corresponding indicators of lines 140-143 from the indicators of lines 130-133, while:

|

Section 1.1

Filled out only by taxpayers using the simplified tax system “income”. It is formed on the basis of the data reflected in sections 2.1.1 and 2.1.2.

| Line code | Content |

| 010, 030, 060, 090 | The OKTMO location of registration of a legal entity or place of residence of an individual entrepreneur is indicated. If the OKTMO code has not changed during the calendar year, it is enough to fill in only line 010. The remaining lines are filled with dashes. If OKTMO consists of 8 characters, then the remaining three cells are also crossed out (for example: “25896374—”) |

| 020 | Fill in the amount of the advance payment for the unified tax due no later than April 25 of the reporting year. To calculate the advance amount, the data in sections 2.1.1 and 2.1.2 are used. If the business entity is not a payer of the trade tax: Line 020 = line 130 of section 2.1.1 – line 140 of section 2.1.1. If the taxpayer pays a trade tax: Line 020 = section 2.1.1 line 130 – section 2.1.1 line 140 – section 2.1.2 line 160 This indicator is indicated if its value is ≥ 0. |

| 040 | Fill in the amount of the advance payment for the unified tax due no later than July 25 of the reporting year. In this case, entities that do not pay the trade fee calculate this indicator as follows: Line 040 = (line 131 – line 141) section 2.1.1 – line 020, Fee payers make calculations using a different formula: Line 040 = (line 131 – line 141) of section 2.1.1 – line 161 of section 2.1.2 – line 020. This indicator is filled in if its value is ≥ 0. When the result of the calculation is negative, it is reflected as a tax to be reduced (on line 050), and not to be paid. In this case, the indicator is written in line 050 without the minus sign |

| 050 | The amount of the advance payment for the Unified National Tax is indicated for reduction no later than July 25 of the reporting year. |

| 070 | Fill in the amount of the advance payment for the unified tax no later than October 25 of the reporting year. Calculation for non-payers of the fee: Line 070 = (line 132 - line 142) section 2.1.1 - line 020 - line 040 + line 050. Calculation for fee payers: Line 070 = (line 132 – line 142) of section 2.1.1 – line 162 of section 2.1.2 – line 020 – line 040 + line 050. When the calculation result is negative, it is transferred to line 080. |

| 080 | The amount of the advance payment for the unified tax is indicated for reduction no later than October 25 of the reporting year |

| 100 | The amount of EUR to be paid additionally for the calendar year is reflected, taking into account previously accrued advance payments. For non-payers: Line 100 = (line 133 – line 143) of section 2.1.1 – line 020 – line 040 + line 050 – line 070 + line 080. For fee payers: Line 100 = (line 133 – line 143) of section 2.1.1 – line 163 of section 2.1.2 – line 020 – line 040 + line 050 – line 070 + line 080. When the calculation result is negative, it is reflected on line 110. Note: according to the letter of the Federal Tax Service dated June 29, 2017 No. SD-4-3/ [email protected] , before changes are made to the current simplified taxation tax declaration form, entrepreneurs applying the simplified tax system (income) + PSN and who have lost the right to PSN during the tax period, reduce the amount tax on line 100 on the cost of the patent. |

| 110 | The amount of EUR to be reduced for the tax period is indicated. |

Section 2.2

Formed by business entities using the simplified tax system “income minus expenses”.

| Line code | Content |

| 210-213 | The amounts of income received by the entity for the 1st quarter, half year, 9 months, year are recorded as a cumulative total. Income is determined in accordance with Art. 346.15 Tax Code of the Russian Federation. If the declaration is submitted in connection with the termination of activity or loss of the right to the simplified tax system (before the end of the tax period), the amount of income indicated for the last period of activity (from lines: 210, 211, 212) is duplicated on line 213 |

| 220-223 | Indicated as a cumulative total of the amount of expenses that were incurred by the entity for the 1st quarter, half year, 9 months, year. The procedure for determining expenses is approved in Art. 346.16 Tax Code of the Russian Federation. When submitting a declaration before the end of the calendar year, the amount of expenses indicated for the last period of business (from lines: 220, 221, 222) is duplicated on line 223 |

| 230 | Fill in the amount of loss received in previous years by which the tax base for the tax period can be reduced |

| 240-243 | The tax base is calculated and reflected as the difference between income received and expenses incurred: |

| 240 | Line 240 = line 210 – line 220, Moreover, if the calculation result is negative, it is transferred to line 250 without the minus sign |

| 241 | Line 241 = line 211 – line 221, if total < 0, then → line 251 |

| 242 | Line 242 = line 212 – line 222, if total < 0, then → line 252 |

| 243 | Line 243 = line 213 – line 223 – line 230, if the total is < 0, then → line 253. When filing a declaration before the end of the calendar year, the value of line 243 will be equal to the tax base indicated for the last period of business (from lines: 240, 241 , 242) minus the loss from line 230 |

| 250-253 | Fill in the amount of losses received for the 1st quarter, half year, 9 months. and year |

| 260-263 | Tax rates for the 1st quarter, half-year, 9 months, and year, established by the legislative acts of the region in which the taxpayer operates under a simplified regime, are indicated line by line. When filing a declaration before the end of the calendar year, the tax rate indicated for the last period of business (from lines: 260, 261, 262) is duplicated on line 263 |

| 270-273 | Advance payments for the Unified National Tax and the amount of tax for the calendar year are reflected using the following formulas (if losses were incurred at the end of the reporting or tax periods, these indicators are not filled in): |

| 270 | Line 270 = line 240 * line 260 / 100 |

| 271 | Line 271 = line 241 * line 261 / 100 |

| 272 | Line 272 = line 242 * line 262 / 100 |

| 273 | Line 273 = line 243 * line 263 / 100. When submitting a declaration before the end of the year, the value of the indicator indicated for the last period of business (from lines: 270, 271, 272) is duplicated on line 273 |

| 280 | The amount of the minimum tax calculated for the tax period is entered: Line 280 = line 213 * 1/100. This line of the report must be completed, even if the taxpayer does not have to pay the minimum tax at the end of the calendar year |

Section 1.2

This section is filled out by payers using the simplified tax system with the object of taxation “income reduced by expenses.”

The section is formed on the basis of the information reflected in section 2.2.

| Line code | Content |

| 010, 030, 060, 090 | The OKTMO code of the location of the legal entity or the place of residence of the individual entrepreneur is indicated. If the OKTMO code has not changed during the tax period, you only need to fill in line 010. The remaining lines are filled with dashes. If OKTMO consists of 8 characters, then the remaining three cells are also crossed out (for example: “25896374—”) |

| 020 | Fill in the amount of the advance payment for the unified tax due no later than April 25 of the reporting year. Line 020 = line 270 of section 2.2 |

| 040 | The amount of the advance payment for the Unified National Tax is recorded no later than July 25 of the reporting year. Line 040 = line 271 of section 2.2 – line 020, This indicator is filled in if its value is ≥ 0. When the result of the calculation is negative, it is reflected as a tax to be reduced (on line 050), and not to be paid. In this case, the indicator is written in line 050 without the minus sign |

| 050 | The amount of the advance payment for the Unified National Tax is indicated for reduction no later than July 25 of the reporting year. |

| 070 | Fill in the amount of the advance payment for the unified tax no later than October 25 of the reporting year. Line 070 = line 272 of section 2.2 – line 020 – line 040 + line 050, if total < 0, then → line 080 |

| 080 | The amount of the advance payment for the unified tax is indicated for reduction no later than October 25 of the reporting year |

| 100 | The amount of EUR to be paid additionally for the calendar year is reflected, taking into account previously accrued advance payments. Line 100 = line 273 of section 2.2 – line 020 – line 040 + line 050 – line 070 + line 080. This indicator is filled in if the total ≥ 0 and line 273 of section 2.2 ≥ line 280 of section 2.2, if the total < 0, then → line 110 Note: according to the letter of the Federal Tax Service dated June 29, 2017 No. SD-4-3/ [email protected] , before changes are made to the current simplified tax return form, entrepreneurs applying the simplified tax system (income minus expenses) + PSN and who have lost the right to PSN during the tax period, reduce the amount of tax on line 100 by the cost of the patent. |

| 110 | The amount of EUR to be reduced for the tax period is indicated. |

| 120 | Fill in the amount of the minimum tax payable for the tax period. This indicator is formed if line 280 of section 2.2 > line 273 of section 2.2. Line 120 = line 280 of section 2.2 – line 020 – line 040 + line 050 – line 070 + line 080. If the total < 0, then → line 110. This means that the taxpayer offsets the advances paid under the unified tax against the minimum tax. In this case, an application for offset is submitted to the inspectorate, accompanied by copies of payment orders for advances paid. |

Section 3

This section is completed only by those taxpayers who received targeted funds (with the exception of subsidies issued to autonomous institutions).

Types of targeted financing are approved in clauses 1, 2 of Art. 251 Tax Code of the Russian Federation.

This section contains information from Section 3 of the previous tax period about unspent target funds, the period of use of which has not yet expired, as well as about funds for which the period of use has not been established.

| Column number | Content |

| 1 | The code of the type of receipts from Appendix No. 5 to the Procedure is recorded |

| 2 / 5 | The date of receipt of the target funds and the period for their use established by the transferring party are indicated. If the period for using targeted funding is not set, these columns are not filled in |

| 3 / 6 | The amount of target funds received in expired tax periods, the period of use of which has not yet expired, is recorded, as well as the amount of funds received in previous periods, for which the period of use was not initially established. |

| 4 / 7 | The amount of funds used on time for the intended purpose is indicated, as well as the amount of funds not used on time or spent for other purposes. Receipts reflected in column 7 are subject to inclusion in non-operating income at the moment when the recipient did not use them for the intended purpose. |

Below, in the “Report Total” line, the total indicators for columns 3, 4, 6, 7 are reflected.

Penalty for failure to submit a simplified taxation system declaration

If a business entity does not submit a declaration on time, then the sanctions will range from 5% to 30% of the amount of unpaid tax reflected in the reporting for each full or partial month of delay, but not less than 1,000 rubles.

Moreover, if the single tax itself is paid on time, then failure to submit a declaration within the prescribed period will result in a fine of 1,000 rubles. Responsibility for a delay in a report under the simplified tax system imposed on the head of a legal entity of the Code of Administrative Offenses of the Russian Federation can range from 300 to 500 rubles.

In addition, if the deadline for submitting a declaration is exceeded by more than 10 working days, the Federal Tax Service has the right to suspend operations on the taxpayer’s current account.

Report preparation programs

A declaration under the simplified tax system can be prepared using the following software:

| Software name | Website |

| "Taxpayer Legal Entity" | https://www.nalog.ru/rn77/program/5961229/ |

| "Bukhsoft" | https://www.buhsoft.ru/download/ |

| "1C" | 1c.ru |

| "Kontur-Elba" | https://e-kontur.ru/landing_usn/ |

| "Kontur.Accounting" | https://www.b-kontur.ru/lp/usn |

| "Sky" | nebopro.ru |

| "Taxpayer PRO" | https://nalogypro.ru/nalogovaya-otchetnost/usn/ |

| "My business" | https://www.moedelo.org/landingpage/reporting-usn/ |

Read in more detail: Changes to the simplified tax system from January 1

Did you like the article? Share on social media networks:

- Related Posts

- Explanatory note to the tax return for UTII

- Sample of filling out a UTII declaration for an LLC

- Sample of filling out the simplified taxation system “income” declaration

- Sample of filling out the Unified Agricultural Tax declaration for individual entrepreneurs

- Sample of filling out the Unified Agricultural Tax declaration for an LLC

- Sample of filling out the UTII declaration for individual entrepreneurs

- Zero declaration of the simplified tax system in 2021

- Tax return of the Unified Agricultural Tax

Leave a comment Cancel reply

Declaration of simplified tax system-2020: download form

Declarations of the simplified tax system for 2021 and 2021 are submitted according to the form approved in February 2021. Before this reporting document, prepare the following information to fill it out:

- about the amount of income received in 2021 (if you pay tax on income) and the amount of expenses allowed for the simplified tax system (if the base for calculating the simplified tax system is calculated as the difference between income and expenses);

- the amount of insurance premiums paid, temporary disability benefits paid to employees, and trade fees paid to the budget (if the type of activity carried out by the taxpayer falls under this fee);

- tax advances paid for reporting periods - they will reduce the total amount payable to the budget;

Declaration of the simplified tax system - income minus expenses - the form for filling out in 2021 is the same as in the reporting for the previous year.

You can download the declaration form for the simplified tax system for 2020 for free on our website.

Sample of filling out a declaration according to the simplified tax system 6% for an LLC

Initial data

Organization: Kurs-invest LLC

Reporting period: 2021

Inspectorate of the Federal Tax Service: for the city of Mytishchi, Moscow region

Type of activity: Retail sale of other food products in specialized stores

OKVED: 47.29

Revenue (quarterly):

1st quarter – 920,000 rub.

2nd quarter – 820,000 rub.

3rd quarter – RUB 1,020,000.

4th quarter – RUB 1,560,000.

Insurance premiums for employees – 108,000 rubles each. every quarter

Title page

| Column/Row | Note |

| INN/KPP | TIN and checkpoint of the organization |

| Correction number | If the declaration is submitted for the first time (primary), then the adjustment number will be “0—”. If the second and subsequent times (in order to correct an error in previously submitted reports), then the number “2—” , “3–” , etc. depending on which updated declaration is submitted |

| Taxable period | «34» – if reporting is submitted annually «50» – when submitting a declaration after the liquidation of the organization «95» – when switching to a different taxation regime «96» – upon termination of activities under the simplified tax system |

| Reporting year | Year for which the declaration is submitted |

| Submitted to the tax authority | Four-digit code of the tax authority with which the LLC is registered |

| By location (code) | “210” – at the location of LLC “215” – at the location of the legal successor |

| Taxpayer | Full name of the organization in capital letters. Please note that there must be one empty cell between LLC (in decrypted form) and the name itself, even if the name falls on the next line |

| OKVED code | Code of the main activity, in accordance with OK 029-2014 (NACE Rev. 2) |

| Contact phone number | An up-to-date telephone number by which the inspector can contact the taxpayer and clarify any questions he has. The telephone number is indicated in the format + 7 (…)……. |

| On... pages | If the organization is not a payer of the trade tax and has not received targeted financing, the number of sheets will be«003» |

| I confirm the accuracy and completeness of the information... | “1” – if the declaration is filled out and submitted by the director of the LLC, his full name is indicated in the lines below. “2” – if the declaration is submitted by a representative, the full name of the representative and the name of the document that confirms his authority are indicated below |

| date | Date the document was completed |

Section 1.1

| Column/Row | Note |

| 010, 030, 060, 090 | If the OKTMO code has not changed during the tax period, it is indicated once on line 010, in the remaining lines 030, 060 and 090 dashes are placed |

| 020 | The advance amount to be paid to the budget. It is calculated using the formula: p. 130-p. 140 |

| 040 | The amount of the advance payment based on the results of the half-year, calculated using the formula: (line 131 – page 141) – line 020 |

| 050 | If according to the formula: (page 131-page 141) – page 020 If the result is a negative value (overpayment), it is entered in this line. |

| 070 | Advance amount payable for 9 months: page (132 – page 142) – (page 020 + page 040 – page 050) If the value comes with a minus sign (overpayment), it must be entered in line 080 |

| 100 | The amount of tax payable to the budget for the year, taking into account previously paid advance payments: (p. 133 – p. 143) – (p. 020+p.040-p.050 + p.070 – p.080) If the value is positive, it is entered in line 110. Please note that the organization can return the amount of overpayment on line 110 to the account or offset it against future payments |

Section 2.1.1

| Column/Row | Note |

| 102 | Organizations always indicate code “1”, since they have at least one employee to whom insurance premiums are paid - the general director |

| 110 | The amount of income received for the 1st quarter, excluding insurance premiums |

| 111 | Cumulative income for the half year (1st quarter + 2nd quarter) |

| 112 | Income for 9 months from the beginning of the year |

| 113 | The total amount of income received for the year |

| 120-123 | The tax rate (if preferential is not applied) is indicated in the format: 6.0 |

| 130 | Advance amount payable for the 1st quarter, excluding insurance premiums: line 110: 6% |

| 131 | Advance amount payable for half a year: page 111: 6% |

| 132 | Advance amount payable for 9 months: page 112: 6% |

| 133 | Tax amount at the end of the year: page 113: 6% |

| 140 | The indicated lines reflect the amount of insurance premiums paid on an accrual basis. Please note that the value for these lines will be calculated using the formula: page 140 = page 130:2 page 141 = page 131:2 page 142 = page 132:2 page 143 = page 133:2 |

| 141 | |

| 142 | |

| 143 |

Composition of the declaration

The declaration under the simplified tax system consists of a title page and three sections:

| Section number of the declaration according to the simplified tax system | Name of section of the declaration according to the simplified tax system |

| 1.1 | The amount of tax (advance tax payment) paid in connection with the application of the simplified tax system (object of taxation - income), subject to payment (reduction), according to the taxpayer |

| 1.2 | The amount of tax (advance tax payment) paid in connection with the application of the simplified tax system (the object of taxation is income reduced by the amount of expenses), and the minimum tax subject to payment (reduction), according to the taxpayer |

| 2.1.1 | Calculation of tax paid in connection with the application of the simplified tax system (object of taxation - income) |

| 2.1.2 | Calculation of the amount of trade tax that reduces the amount of tax (advance tax payment) paid in connection with the application of the simplified tax system (object of taxation - income), calculated based on the results of the tax (reporting) period for the object of taxation from the type of business activity in respect of which, in accordance with Ch. 33 of the Tax Code of the Russian Federation establishes a trade tax |

| 2.2 | Calculation of the tax paid in connection with the application of the simplified tax system and the minimum tax (the object of taxation is income reduced by the amount of expenses) |

| 3 | Report on the intended use of property (including funds), works, services received as part of charitable activities, targeted income, targeted financing |

The taxpayer fills out the sections in accordance with the applicable taxation object.

When sending a declaration via electronic communication channels, in most cases, an automatic check of the control ratios of indicators is carried out, which makes it possible to identify errors or discrepancies (both logical and arithmetic).

If you want to check your declaration yourself before sending it, take the control ratios from the Federal Tax Service letter dated May 30, 2016 No. SD-4-3/ [email protected]

Find out which sections are filled out by “simplified people” depending on the object of taxation in the next section.

When will I need to submit a declaration using the new form?

To date, the project to amend the declaration has not yet been approved. It is quite possible that additional points will be added to it.

When a new declaration form is adopted, this article will be adjusted.

One thing is clear, the new declaration form under the simplified tax system will be valid no earlier than January 1, 2021:

3. This order comes into force two months from the date of its official publication, and is applied starting with the submission of a tax return for the tax paid in connection with the application of the simplified taxation system for the tax period 2021.

That is, we submit reports for 2021 under the simplified tax system using the old form, but when submitting reports for 2021, our automatic completion service will switch to the new declaration form. Also, the new form must be applied in 2021 to those individual entrepreneurs and legal entities that have ceased their activities.

We'll keep you posted!

The procedure for filling out a declaration under the simplified tax system with different objects of taxation

The USN-2020 declaration is filled out differently depending on the object of taxation: “income” or “income minus expenses”.

ConsultantPlus experts gave a line-by-line procedure for filling out the simplified taxation system declaration “income” and “income minus expenses”. Get trial access to the system for free and move on to the Ready-made solution.

For taxpayers using the simplified tax system with the object “income”, the following sections are required to be completed:

- title page;

- section 1.1, which reflects the amount of the advance payment or tax when applying the simplified “income” taxation system;

- Section 2.1, where tax is calculated for the selected object of taxation “income”.

Sample of filling out the USN-2020 “income” declaration:

Organizations and individual entrepreneurs that are on the simplified tax system with the object of taxation “income minus expenses” are required to fill out the following sections:

- title page;

- section 1.2, where, based on the taxpayer’s data, the amount of tax paid, advance payments or the amount of the minimum tax to be paid (reduced) is indicated;

- Section 2.2, where the tax is calculated for the selected object of taxation “income minus expenses” or the minimum tax.

For a sample of filling out the simplified tax system declaration 2021 (“income minus expenses”), see below.

The features of filling out a zero declaration under the simplified tax system are discussed here.

Based on the results of the desk audit, the Federal Tax Service may request clarification. A sample of explanations for the simplified tax system and the reasons for discrepancies with tax authorities’ data were prepared by ConsultantPlus experts. Get trial access to the system for free.

Filling Features

As we noted above, the procedure for filling out the document depends on the selected tax object:

| An object | What to fill out |

| "Income" | Title page. Section No. 1.1. Section No. 2.1. Section No. 2.1.1 is required to be completed, but No. 2.1.2 is required to be completed if the entity pays a trade fee by type of activity. Section No. 3 (when using targeted financing - clause 1 and clause 2 of Article 251 of the Tax Code of the Russian Federation). |

| "Income minus expenses" | Title page. Section No. 1.2. Section No. 2.2. Section No. 3 (when using targeted financing - clause 1 and clause 2 of Article 251 of the Tax Code of the Russian Federation). |

Step-by-step instructions for filling out the report: “How to fill out the 2021 tax return for individual entrepreneurs under the simplified tax system.”

Results

In order to report for 2021, a simplified person will need a declaration form according to the simplified tax system, approved by order of the Federal Tax Service dated February 26, 2016 No. ММВ-7-3/ [email protected]

Simplified people who pay tax on income and on the difference between income and expenses use the same simplified taxation system declaration form - only the composition of the sections to be filled out changes.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Where can I get a form to fill out a simplified taxation system declaration?

Tax reporting forms can be obtained free of charge from your Federal Tax Service, but this will be a paper document. It is much easier to fill out the declaration on a computer. The reporting form can be downloaded in electronic form on the Federal Tax Service website, legal systems or other reliable resources, for example, on our website.

Please note that the form you downloaded was approved by Order of the Federal Tax Service of Russia dated February 26, 2016 N ММВ-7-3/ [email protected] The same form was valid in 2021. The current tax return under the simplified tax system differs from earlier versions by barcodes. For example, the barcode of the first page should include the following numbers: 0301 2017.

If you filled out the declaration under the simplified tax system in 2021 yourself, then preparing it again will not be difficult. Just look at the samples below. And for beginners we will give instructions on how to fill it out.

We recommend filling out a declaration under the simplified tax system in a specialized online service. This will reduce the time for preparing reports and keep errors to a minimum.

Prepare a simplified taxation system declaration