Acquiring is the acceptance of payments for goods, services or work performed using a plastic card. A bank that acts as an intermediary between plastic card holders and the organization that accepts card payments is called an acquiring bank. The acquirer charges a certain commission percentage for its services. To make payments, POS terminals or imprinters are used. In this article we will talk about acquiring accounting and give its main characteristics.

Types of acquiring:

- Shopping – the most common type, carried out in stores, shopping centers, catering organizations and service providers. Payment is made through a POS terminal.

- ATM acquiring is ATMs with which you can pay for services and withdraw cash.

- Mobile – payments are made through a mobile terminal, which is not tied to a specific location; the seller can take it with him.

- Internet acquiring – used for sales via the Internet.

Description of acquiring, advantages and disadvantages

How acquiring occurs: (click to expand)

- During the transaction, the cashier activates the client’s card through the payment machine;

- Account status data is sent to the information center;

- The remaining funds are checked, the cashier enters the payment amount, and the buyer enters a PIN code, the terminal issues a slip (check) in 2 copies.

- The cashier signs one copy and gives it to the buyer, and the buyer signs the second copy and gives it to the seller. The signatures on the card and on the slip must be the same; this must be checked.

- The cashier punches the check through the cash register and gives it to the client.

- Non-cash transactions are recorded in a separate section of the cash register and are included in the Z-report as non-cash revenue.

- Non-cash payments are entered in the cash register: in column 12 - how many transactions, in 13 - the amount of settlements.

- Revenue from cash and non-cash payments is entered into the cashier's certificate report.

- At the end of the day, the organization sends an electronic journal printed from the terminal to the servicing bank.

- The bank checks the transactions, during the day (or the next day) transfers its proceeds minus the commission (its remuneration) to the organization’s personal account.

Advantages and disadvantages of non-cash payments:

| Advantages | Flaws |

| Protection against counterfeit bills and theft | Possible server failure |

| Customer convenience | The danger of hacking by hackers |

| Turnover increases by an average of 30% | The organization shares part of the proceeds with the bank |

| Saving the organization's money on collection | The need to purchase a terminal or whether to rent it |

Acquiring settings in 1C

To be able to reflect transactions on payment cards (bank loans):

- in the program functionality, check the Payment cards on the Bank and cash desk (section Main - Settings - Functionality).

- set up an acquiring agreement with a bank or other credit institution: Type of agreement - Other .

Accounting for individual entrepreneurs without a cash register

Individual entrepreneurs who are UTII have the right to make cash and non-cash payments without using cash registers (in accordance with Federal Law No. 290-FZ, Article 7). In this case, the entrepreneur accepting non-cash payments must fill out a strict reporting form and issue a cash receipt at the client’s request.

Funds received through payment by plastic cards are recorded as “Revenue”, and the bank commission goes to “Expenses”.

When is acquiring possible without a cash desk?

In Art. 2 of Law No. 54-FZ lists cases when a business can operate without an online cash register:

- sale of ice cream, magazines, newspapers, shoe covers, peddling and so on;

- sale of housing and communal services;

- Individual entrepreneurs without employees selling goods or services of their own making - for them a deferment until July 10, 2021;

- An individual entrepreneur on a patent, if the entrepreneur issues the client a strict reporting form confirming the fact of payments.

We will help you choose a trade acquiring partner

Choose a partner

Taxation under OSNO and simplified tax system

Expenses associated with paying a commission to the bank are classified as other expenses or may be included in non-operating expenses. They reduce the tax base for calculating the Income Tax and are not subject to VAT.

| With OSNO | VAT | Income tax |

| The tax base | Full revenue, including bank commission | Income (revenue minus VAT) minus bank commission |

| Base definition date | Date of transfer of the goods to the client | Date of transfer of the goods into ownership of the buyer |

| With simplified tax system | "Income" | "Income - expenses" |

| The tax base | All revenue is included in the “Revenue” section | The acquiring fee is included in “Expenses” |

| Base definition date | Date of receipt of funds on the account | Date of receipt of funds on the account |

Return of goods upon acquiring

If the product was purchased by bank transfer, then when it is returned, the funds must go back to the buyer’s card. Documents that the buyer must provide to the seller: (click to expand)

- Passport;

- Check;

- Plastic card;

- Statement.

Only the cardholder can apply for a refund. The application indicates: client’s full name, circumstances of return (reason), amount, receipt details, card details. A copy of the passport and the original receipt are attached to it. If the item is returned on the day of purchase and the report has not yet been withdrawn from the terminal, then payment for it is canceled by the cashier using a special operation on the terminal.

A KKM check for return is punched, a return certificate is issued f. KM-3, in the cashier-operator’s journal, line 15 reflects the refund amount.

If the item is returned the next day or later, the refund will be processed as follows:

- The seller prepares a return invoice and a receipt for the return;

- The seller sends the buyer’s application with attached documents to the servicing bank;

- Documents are reviewed by the bank within 3 working days and submitted for execution;

- The next day, the acquiring bank transfers the buyer’s money to the general account of the bank servicing his card.

- The receipt of funds on the buyer’s card depends on the policy of his bank.

Postings when returning goods

Operations are reversed:

- Dt62 – Kt90.1 – returned goods;

- Dt90 – Kt68 – for the amount of VAT on the returned goods;

- Dt90 – Kt41 – cost of returned goods;

Accounting for returned goods:

- Dt90 – Kt62 – goods are returned;

- Dt62 – Kt57 – the bank received a return application from the buyer;

- Dt57 – Kt51 – refund to the buyer minus commission;

- Dt57 – Kt91 – refund of the commission amount.

How does Internet acquiring differ from mobile and retail

The most important difference is the absence of a physical terminal. The service is aimed at clients who operate on the Internet, that is, we are primarily talking about online stores of any type. The option can also be connected to a mobile application. For example, many food delivery organizations develop applications for their clients in addition to the main website. This significantly increases sales.

Main features of Internet acquiring:

- no terminal. And this is a big plus, since you don’t need to pay for equipment rental or buy it. The bank provides the client with a payment module, which is installed on the customer’s website;

- the ability to accept payments from any bank cards, including virtual ones. Many banks allow you to accept payments from UnionPay and JCB cards via online acquiring;

- the standard fee is higher than for other types of services.

If necessary, you can connect to several types of acquiring at once. For example, if we are talking about a cafe that also delivers food. It can accept payment locally through merchant acquiring, at the customer's home for delivery through mobile acquiring, and online through Internet acquiring when accepting an order through a website or mobile app. Each type of service is charged separately.

Reporting and documents for acquiring

Documents for acquiring:

| Documentation | Forms to fill out |

| Source documents | Cash receipt, slip from the terminal |

| Cash documents | Z-report |

| Accounting documents | Cashier-operator's journal, electronic journal from the terminal, register for non-cash payments |

The results should be reconciled at the end of the working day every day. You also need to check every day whether the amounts of their Z-report are correctly allocated to accounts 50 and 57; not only daily receipts are compared, but also the cumulative total. To determine the correct distribution of the bank commission, the turnover on credit 57 and debit 91 is compared daily.

If card transfers are made on the same day, then account 57 should not have a balance. If the transfer arrives the next day, then the balance should be equal to the debit turnover of the previous day.

Regulations:

- Federal Law No. 161-FZ dated June 27, 2011;

- Instructions for using the Chart of Accounts;

- Tax Code of the Russian Federation

How to connect Internet acquiring

Please note that the bank may refuse to provide the service. Many organizations check the functionality of the site and the service provided to customers. The website of the online store should contain complete information about the service: delivery times and methods, and return conditions. It is also important that the website contains all the necessary contact information, details of the organization and its work schedule.

You can find out the exact requirements for the organization and its website from the bank manager, who will call you back after you submit your online application. For example, Alfa Bank has established a list of goods and services prohibited for sale online. The bank will not provide access to Internet acquiring if the company sells antiques and art objects, sells goods for adults, alcohol and tobacco products, weapons, medicines and dietary supplements.

If you understand what Internet acquiring is and understand that you need it, you can start connecting it step by step:

- Choosing a bank and submitting an application, it is more convenient to do this through the website.

- Visiting the bank or meeting with its representative in your office. Here you need to submit company documents to the manager. They usually require a passport and a certificate of registration, and the company is required to have constituent documents.

- Receiving a plugin or module and installing it on the site.

- Testing the option. Place your order yourself and pay by card. If, in addition to the website, there is also a mobile application, conduct a test through it as well. If the transaction is not completed, contact the bank's technical support, they usually work around the clock.

Typical Accountant Mistakes

- Reflection of revenue at the time of receipt of funds to the current account, and not at the time of transfer of ownership of the goods to the buyer. This distorts reporting, especially when payment by card and transfer of funds occur in different reporting periods.

- Reflecting revenue minus commission to the bank is also a mistake. There is an underestimation of sales revenue and expenses, which leads to distortion of accounting and tax reporting. Under the simplified tax system, such an error underestimates the tax base.

- Violations include the sale of goods without the use of cash registers, failure to reflect revenue from non-cash payments in the cashier-operator's journal or in the certificate report.

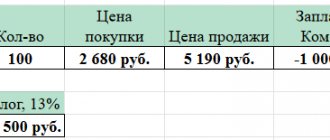

Reflection of retail sales in the program

It occurs through an automated point of sale using an accounting system document called the “Retail Sales Report” (in the sales section), the type of operation is “Retail Store”. This report provides the opportunity to maintain separate accounting of income in tax and accounting received under the main taxation system (STS) and from business activities that have a special taxation procedure.

In order to be able to generate financial results for the main activity and for activities of a special taxation procedure, “Accounting 8” also provides for the presence of separate sub-accounts for account 90.

In our example, income from the retail sale of clothing should be accounted for in the credit of account 90.01.1 (i.e., “Revenue from activities with the main tax system”). Income from a business transferred to pay for a patent (clothing repair) must be taken into account in the credit of account 90.01.2 (namely “Revenue from certain types of activities with a special taxation procedure”).

In this case, expenses must be taken into account in the debit of account 90.02, called “Cost of sales”, as well as 90.07 “Sales expenses” and 90.08 “Administrative expenses” for 3rd order accounts:

- to keep track of expenses of the main activity (STS);

- to take into account expenses for activities of a special taxation procedure.

To save a list of accounts where operations involving a special procedure for calculating taxes (in particular, taxable PSN or UTII) were taken into account, you need to use the appropriate register of information about income and expense accounts. You can access it from the register of the accounting chart of accounts using the “More” link - then the accounts we need.

To automatically present income/expenses from sales accounts for various types of activities in documents, you need to configure the register of item accounting accounts accordingly. To open it, click the link of the same name in the nomenclature directory, located in the general section of directories.