The culture of doing manicures in salons rather than at home is firmly entrenched. Such a business does not require large investments (start-up capital is only 300-400 thousand rubles), but it brings in 100 thousand net profit monthly. In the future, you can offer additional services in the field of beauty and personal care.

According to surveys, 42% of manicure and pedicure specialists have a weekly flow of clients from 10 to 30 people, and 23% have more than 30. About 55% of Russian women do manicures, 37% do not forget about pedicures. Economic instability in the country has almost no effect on profit volumes in the nail service industry. Interest in this area is also growing on the world market. A report from Grand View Research, Inc shows that the global nail market will reach $15.55 billion by 2024 (9.5% annual growth rate).

50% of beauty salon services are manicures. The disadvantage of this business is high competition. The niche for premium services has been filled, the market segment aimed at clients with middle and low incomes has been formed by 50%. Networks of salons are poorly developed.

Next, we will present a detailed business plan for a nail salon with prices current in 2021.

1. Target audience 2. Types of manicure business 3. Documents 4. Premises 5. Equipment 6. Personnel 7. Advertising 8. How much does it cost to open a manicure studio: business plan with calculations 9. Is it worth working as a franchise? 10. What is more profitable: a nail salon or a home business? 11. Business risks 12. Conclusion

The target audience

The main audience (95%) are women aged 16 to 50 years. Basically, they work and visit the salon from 1 to 4 times a month (depending on needs and income level). A separate subgroup is the non-working population (mothers on maternity leave, housewives, students). 5% of the entire target audience are men.

To make it easier to create a set of services and tools for their promotion, we will draw up a portrait of the client. It is important to consider:

- life style;

- wage level;

- preferences;

- needs;

- values.

Conduct an in-depth analysis and collect the following information:

- Full name, contact details;

- date of first visit to the salon;

- total number of visits;

- optimal time to visit;

- the client’s opinion about the quality of services and the salon as a whole;

- what craftsmen served the client.

This is how the regular clientele is determined, the degree of their loyalty to the salon, and the quality of the employees’ work is monitored. This information is invaluable when developing a strategy to attract and retain your customer base.

Tax system

OSN – General taxation system

A type that requires complex accounting. It makes no sense for a start-up business to apply a general taxation system. Therefore, when registering, it is necessary not to forget to immediately submit an application for the transition to a simplified taxation system.

STS - Simplified taxation system

A system designed for small businesses and allowing to reduce the tax burden. It is easy to maintain financial statements. The simplified tax system has two forms:

- " Income ". Tax deductions amount to 6% of the total amount of income;

- " Income minus expenses ." A tax of 15% is paid on the amount of income minus expenses incurred.

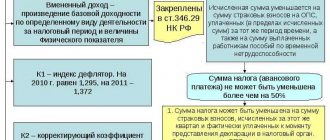

UTII – Unified tax on imputed income

A special regime in which tax is paid based on the possible income of the enterprise. Potential income is determined based on several factors:

- Number of employees;

- Room area;

- The coefficient established by the Ministry of Economic Development every year.

The entrepreneur pays to the treasury from 7.5 to 15%.

PSN – patent tax system

A preferential form is available for small businesses where the number of employees does not exceed 15 people. The businessman pays the tax included in the cost of the patent. The final cost of the patent is set by regional authorities.

Only individual entrepreneurs can use the preferential form; it is not available to legal entities. A patent is purchased for a period of 1 to 12 months.

Types of manicure business

At the planning stage, it is important to choose a format:

- Manicure salon. A room designed to accommodate a maximum of 2 craftsmen. Advantages: classic format, standard services, low start-up costs. Disadvantages - small area, difficulties with expansion.

- Studio. Beauty salon with all types of manicure and pedicure and qualified personnel. Advantages: above-average prices, wide-skilled specialists. Disadvantages: large investments, long payback period. In addition, it is not always possible to fill the salon with clients.

- Express manicure (nail bar). Open counters in shopping centers. The advantage is the location in a high traffic area. Disadvantages - expensive rent, psychological factor (many clients cannot relax when undergoing cosmetic procedures in front of everyone), reputation as a budget establishment (repels many). The business cannot be expanded.

- Manicure at home. Business with minimal investment. At the initial stage it will not even require registration. A good option for both a beginner who wants to have an independent source of income, and an experienced one with an established client base. A home studio has a lot of advantages - small investments, the ability to record at any convenient time. Disadvantage: lack of reputation. People don't trust home craftsmen - it's unknown what their skill level is.

Let's look at what it takes to open a manicure studio from scratch.

Legal form

Depending on the plans of the future businessman and his capabilities, the nail salon is registered as an individual entrepreneur or as an LLC. The chosen form determines a number of rights and obligations for the businessman.

Individual entrepreneurship

Advantages:

- There is no need to keep records, you can immediately use the income received and at the same time pay a symbolic tax;

- An individual entrepreneur can be registered at the place of residence, without reference to registration;

- Small fines. Individual entrepreneurs are punished a little more severely than individuals, but much more loyally than legal entities;

- To close an individual entrepreneur, only an application is required and everything, as a rule, is done in one day;

Flaws

- It is registered only for one person, that is, it will not be possible to open a joint business and have it documented;

- IP cannot be sold or re-registered.

Entity

Advantages:

- The opportunity to open a joint business by registering several co-founders, there can be up to 50 people;

- The business can be sold;

Flaws:

- The fines are higher;

- Taxes are higher;

- Complicated liquidation procedure.

Documentation

Individual entrepreneurs and LLCs are suitable for registering a business. Typically, an individual entrepreneur is opened with a simplified taxation system or a single tax on imputed income. You will need an open bank account.

Package of documents:

- Certificate of registration of individual entrepreneur or LLC.

- License.

- Permission from the sanitary and epidemiological station.

- Fire inspection permit.

- Certificate of registration with the tax authorities.

- Registration with the Social Insurance Fund and the Pension Fund as an employer. Needed to hire workers according to Labor Code.

A manicure business does not require a large package of documents, but you need to be prepared for inspections by the sanitary and epidemiological station, control that employees undergo a medical examination (marks in the medical book are updated every 6 months), and maintain the conditions in the salon necessary for servicing clients.

If the owner of the premises has not entered into an agreement for the disposal of fluorescent lamps, solid waste, or garbage removal, the solution to these issues will fall on your shoulders.

Patent for hairdressing and cosmetic services

A patent for hairdressing and cosmetic services is issued by entrepreneurs who personally provide this type of service to the population or have a beauty salon with hired employees.

This patent can be issued by both the master (specialist) himself and the owner of the beauty salon, depending on the chosen cost optimization scheme.

Conditions for using PSN:

- Be registered as an individual entrepreneur

- There are no more than 15 employees on staff

- Annual turnover should not exceed 60 million rubles

Necessary documents for the transition to PSN

- Copy of the passport of an individual entrepreneur

- Copies of TIN and OGRNIP

- A copy of the lease agreement or certificate of ownership of the premises (required in some cases)

Take advantage of our patent registration services!

We will help you:

- determine whether your type of activity falls under the patent tax system (PTS)

- calculate the cost of a patent for your activity

- draw up the necessary documents to obtain a patent

- submit documents for obtaining a patent to the Federal Tax Service

Order a service for registering the transition to PSN.

Select the appropriate patent registration option

| Package "Patent-1" | Package "Patent-maxi" | Package “IP + Patent” | Package “IP + Patent maxi” |

| Filing an application for a patent | Preparation of a package of documents for registration of a patent | Preparation of a package of documents for registration of individual entrepreneurs | Preparation of a package of documents for registration of individual entrepreneurs |

| Submission of documents to the Federal Tax Service (without client participation)* | Selection of OKVED, preparation of an application for the transition to the simplified tax system | Selection of OKVED, preparation of an application for the transition to the simplified tax system | |

| Receiving ready documents from the Federal Tax Service | Preparation of a document package for registration of a patent | Submission and receipt of documents to the Federal Tax Service | |

| Transfer of completed documents to the client | Assistance in opening a bank account (Sberbank, Tochka, Tinkoff) | Preparation of a package of documents for registration of a patent | |

| Filing an application for a patent with the Federal Tax Service | |||

| Transfer of completed documents to the client | |||

| Assistance in opening a bank account (Sberbank, Tochka, Tinkoff) | |||

| Issue of digital signature for individual entrepreneur registration electronically | |||

| Duration - 1 day | Duration 7-10 days (depending on the timing of the Federal Tax Service | Duration – 1-2 days | Duration – 7 days for registration of an individual entrepreneur, 7-10 days before receiving a patent after registration of an individual entrepreneur. |

| 2200 rub. | 4500 rub. | 4700 rub. | 9000 rub. |

* Additionally, you will need a notarized power of attorney for our employee (approximate cost of notary services is 1200 rubles)

| REMAINING UNTIL SUBMITTING DOCUMENTS TO THE IFTS FOR REGISTRATION OF PATENTS VALID FROM 01 March 2021 |

For more detailed information on the patent for hairdressing and cosmetic services, watch the video created by our specialists.

The cost of a patent for hairdressing and cosmetic services in Moscow is 59,400 rubles and does not depend on the district, rental area and number of employees (the main thing is no more than 15 people)

The cost of a patent for hairdressing and cosmetic services in the Moscow region depends on the number of employees on the staff of an individual entrepreneur.

| The number of employees | The cost of a patent for 12 months. |

| 0-1 employee | 57,540 rub.. |

| 2 employees | RUB 60,240 |

| 3 employees | RUB 62,940 |

further on a progressive scale depending on the number of employees, but not more than 15 people.

We also remind you that from January 1, 2021, patent tax can be reduced through fixed insurance premiums.

Advantages of the patent tax system:

- no need to pay tax according to the simplified tax system

- no need to submit a tax return

- a patent can be obtained at any time. The validity period of the patent can be chosen at the discretion of the entrepreneur

- simplified accounting procedure

Why is it profitable to order patent registration services from FEP?

| You'll get: |

| 1. Fast and high-quality order fulfillment |

| 2. Payment documents for payment of PSN tax |

| 3. PSN income book + sample filling |

| 4. Free consultations from our specialists for the entire duration of the patent |

What do you need to do to start cooperation with us?

To order a service, call us by phone or click “Order” and we will call you back and discuss the details of cooperation.

We provide services in Moscow and the Moscow region.

Is it necessary to come to our office to receive services?

We always welcome guests and are ready to meet you in our office, treating you to delicious coffee, but if you do not have enough free time, we begin work immediately after receiving the necessary documents from you by email. If you need to receive original documents from you, our specialists will be able to meet with you at a place convenient for you.

Still have questions? Call +7 495 162-64-24

Additional services

| Name of service | Price |

| Amendments to OKVED (preparation of an application) | 1500 rub. |

| Notification of Rospotrebnadzor (preparation of application) | 1000 rub. |

| Courier delivery of documents in Moscow | 300 rub. |

| Registration of cash register machines | 1900 rub. |

Go back to the page about PSN >>>

Room

The location and area of the room depend on the format. It is better to open a salon and manicure office in high traffic areas - in the central part of the city, near public transport stops and intersections in residential areas, in shopping centers.

The nail studio must meet sanitary requirements:

- availability of cold and hot water supply;

- the area of one workplace is not less than 4.5 m²;

- utility room;

- separate rooms or areas for manicure and pedicure;

- high-quality ventilation system;

- a room for cleaning and sterilizing instruments (instruments and furniture are disinfected after each client appointment).

You can study the requirements in more detail in Resolution No. 59 dated May 18, 2010 “On approval of SanPiN 2.1.2.2631–10.”

For 3 workplaces (2 for manicure work and one for pedicure work) you will need at least 30 m². The area is designed for work areas, utility rooms and a foyer where visitors will wait their turn. Our business plan for a manicure salon involves renting a one-room apartment on the ground floor. The average rental price in Russia is 25,000 rubles. Repairs will require 30,000 rubles.

Do you need a cash register?

In connection with the release of Federal Law 54 “On the use of cash register equipment,” entrepreneurs are wondering whether they need an online cash register. The timing of the transition, as well as the types of businesses exempt from immediate transition, is constantly changing.

Today, owners of nail salons and offices may not install an online cash register only in one case - if they do not have employees. After drawing up the first employment contract, the owner is given 30 calendar days to purchase and register the device.

From July 1, 2021, everyone who provides services or sells goods is required to switch to online cash registers. This rule is regulated by Federal Law dated July 3, 2016 No. 290-FZ.

Equipment

Table No. 1. Furniture for a manicure room:

| Furniture | Cost, rub.) |

| Chairs for craftsmen | 30 000 |

| Chairs for clients | 30 000 |

| Manicure table (height no lower than 70 cm) | 10 000 |

| Racks for storing tools and consumables | 8 000 |

| Reception desk | 5 000 |

| Sofa for visitors | 10 000 |

| TV for the hall | 6 000 |

| Pedicure chair | 30 000 |

| Cooler | 3 000 |

| Total amount: | 132 000 |

Table No. 2. Equipment for manicure salon:

| Equipment | Cost (Russian rubles) |

| UF lamps for building and drying gel polish | 2 000 |

| Sets for manicure and pedicure | 6 000 |

| Sterilization equipment | 3 000 |

| Milling cutter for manicure and pedicure | 6 000 |

| Baths, coasters and pillows | 8 000 |

| Paraffin furnace | 3 000 |

| Nail brushes | 1 000 |

| Lamp | 2 000 |

| Manicure hood | 4 000 |

| Total amount: | 35 000 |

Table No. 3. Materials for the manicure salon:

| Materials | Cost (Russian rubles) |

| Palettes of varnishes, gel polishes | 10 000 |

| Products for removing nail polish/shellac, softening cuticles, etc. | 10 000 |

| Care products | 6 000 |

| Napkins, gloves, etc. | 3 000 |

| Total amount: | 29 000 |

Staff

Customer loyalty—and therefore your income—depends on the level of service. Therefore, do not hire people on staff without making sure of their qualifications.

Criteria that the candidate must meet:

- education in the specialty, availability of a resume;

- availability of a health certificate with a completed medical examination;

- politeness, neat appearance;

- Diplomas from competitions, certificates of master classes will be advantages.

Table No. 4. A list of employees:

| Job title | Amount of workers | Salary (rub.) |

| Administrator (2 shifts) | 2 | 40 000 |

| Accountant (outsourced) | 1 | 6 000 |

| Master | 3 | 75 000 |

| Cleaning lady (several hours a day) | 1 | 5 000 |

| Total: | 126 000 |

In the beauty industry, word of mouth is considered the best advertising. A man got a beautiful manicure in your salon and attracted the attention of others. They also wanted to visit you. The business owner only needs to invest in the quality of services, and the client himself will become effective and free advertising.

But if you need to speed up business promotion (especially in areas with high competition), you can use marketing tools:

- Printable advertisement. Flyers, leaflets, booklets, announcements for posting. For design and printing - about 10,000 rubles.

- Business cards. We distribute at themed events and in any places with a potential audience. Expenses - 6,000 rubles.

- Website, groups on social networks, Instagram account. Most consumers prefer to search for a product or service of interest via the Internet. To underestimate this fact means to lose an impressive share of clients. When advertising services online, keep in mind that consumers want to see reviews, examples of work, prices and current promotions. You will spend from 15,000 rubles on advertising on the Internet.

- Participation in competitions, master classes, competitions.

- Implementation of client-oriented strategies. Having collected a database of telephone numbers, you can congratulate customers on the holidays, offer discounts, and lucrative special offers.

- Signboard. There must be an intriguing, attractive office sign. Its production and installation will require 15,000 rubles.

To attract attention, organize a grand opening of the salon - with decorations, gifts, raffles, master classes. Post photo reports on social networks or order an advertising block in the media. This method of advertising will require from 15,000 to 20,000 rubles.

Pay attention to the design of printed products. Bright, creative, stylish design of business cards, flyers, posters, advertisements will arouse trust and interest in the audience.

How much does it cost to open a manicure studio: business plan with calculations

Let's calculate the costs required to open a salon with 3 workplaces in a one-room apartment on the 1st floor:

- Registration of a business, payment of state duties and taxes – 10,000 rubles;

- Apartment rental – 25,000 rubles;

- Cosmetic repairs – 30,000 rubles;

- Furniture – 132,000 rubles;

- Equipment – 35,000 rubles;

- Materials – 29,000 rubles;

- Advertising – 40,000 rubles;

- Additional expenses (training of craftsmen, opening, transportation costs) – 50,000 rubles.

In total, you will need 351,000 rubles to start.

Monthly expenses:

- Taxes – 8,000 rubles;

- Apartment rental – 25,000 rubles;

- Utility bills – 10,000 rubles;

- Salary to employees – 126,000 rubles;

- Materials – 5,000 rubles;

- Advertising – 5,000 rubles.

Total monthly expenses: 179,000 rubles.

To calculate profit, you need to create a list of services.

There are many different procedures for nail care and treatment. The standard ones include manicure, pedicure, scrubs, masks, paraffin therapy, wraps, moisturizing, massage, modeling and strengthening of nails with gel, acrylic, as well as nail design itself (varnish coating, artistic painting). Additional services:

- SPA procedures;

- aroma peeling;

- aroma massage;

- healing coatings.

Offer only popular services at first to save on equipment and materials. According to statistics, manicures are in high demand. Its share among all procedures performed by manicure salons and salons is 30%. Nail extensions also account for 30%. For pedicure – 15%. Subsequently, you can expand the range of services - for example, eyelash extensions, eyebrow tinting.

Table No. 5. Manicure services and their cost.

| Services | Price (Russian rub.) |

| Manicure without coating | 400 |

| Hardware manicure | 700 |

| Varnish coating | 100 |

| Gel coating | 500 |

| Removing varnish | 200 |

| Gel extension | 1 300 |

| Design (art painting, rhinestones, etc.) | 300 |

| Correction | 650 |

| Paraffin therapy for hands | 250 |

| Massage | 200 |

| Pedicure | 1000 |

| Paraffin therapy for feet | 400 |

To set accurate prices, monitor prices of competitors in the region. To attract an audience at the opening stage, offer low prices.

The average profit of 3 masters per day will be 9,000 rubles.

This is about 252,000 rubles per month.

Net income: 252,000 – 179,000 = 73,000 rubles.

Payback period: 5 months.

Business plan

If you are serious, before you start looking for premises and collecting documents, draw up a business plan. It will help you take a sober look at the risks, possible income and required costs.

Even a simple calculation of initial investments, expected expenses and income will help to realistically assess the prospects of the project.

Required sections of a business plan:

- Description of services . Think through all the services, down to the smallest, that will be provided in your salon. The amount of initial costs for materials, equipment and tools depends on this;

- Marketing . How will you promote your business, where to advertise, how to interest consumers. This point is especially important for those who do not have their own clients;

- Production plan . Pay special attention to this section if you plan to open a salon with hired employees. Indicate all personnel - craftsmen, administrators, cleaners, as well as the costs associated with their maintenance - wages, contributions to the Pension Fund of the Russian Federation, insurance premiums and taxes;

- Financial section . Calculate all costs - from nail polish to the first month's rent. This is necessary in order to determine the exact amount needed to start. It is also good to calculate the payback period, that is, the period of time during which all initial costs will be covered and the enterprise will begin to generate net profit. For nail salons, the average payback period is 5-8 months;

Beauty salon business plan

Is it worth working on a franchise?

When opening an office under a franchising scheme, the franchisor takes on a huge share of the tasks. This includes developing a business plan, searching for premises, repair and design work, purchasing equipment and materials, and advertising. The franchisor has experience and a supplier base - therefore, you will save time, money and get rid of the risk of running into the pitfalls that await a newcomer on the path to creating a startup from scratch. Support is usually provided at all stages - from registration to organizing work processes. A ready-made, practice-tested model guarantees income.

The downside of a franchise is the need to give away part of the profit every month.

Basic Steps

All activities related to creating a business are conditionally combined into 4 main steps:

- Preparatory . More theoretical preparation for opening a salon. Includes analysis of basic business formats, choice of legal form and other organizational and theoretical issues;

- Searching for premises for a future salon;

- Collection of documents . Documentary preparation for registration of an entrepreneur, as well as obtaining the necessary permits and conclusions;

- Hiring . A conditionally obligatory step that is excluded when working independently without the involvement of employees.

What GOST R regulates for nail services

What is more profitable: a nail salon or a home business?

If you are a professional master and do not have the capital to open your own office, a home salon will be the best solution. What's good about it?

There is no need to take responsibility for the quality of work of other craftsmen, or waste time and money on organizing business processes. Some people are put off by the prospect of doing a manicure at someone’s home, but with high-quality service, you will have a base of regular and loyal customers. And with it a constant source of income. When it comes to profits, when running a home-based business, your profit margin will be limited by your time.

Business risks

- High competition. To attract a central office, you will have to introduce new technologies, promotions, special offers, and develop strategies for retaining your client base.

- It is necessary to constantly monitor the level of service. One dissatisfied customer will cause significant damage to your business.

- High qualification requirements. The field is becoming more complex, new standards are emerging - it is important to keep up with the latest trends. The professionalism of the master determines the loyalty of the audience.

- Difficulties with procurement. The niche is full of unscrupulous manufacturers and suppliers, so caution is required.