Who is responsible for delivery?

Before clarifying the main issue - when there is no protocol from the Pension Fund for SZV-M - you need to understand the terminology.

What is "SZV-M"? This is a special form according to which a company or individual entrepreneur keeps a report to the Pension Fund of the Russian Federation. Stands for incoming information about the insured. That is, which the company submits to the fund. And the letter “M” indicates that this reporting is monthly (PFR Resolution No. 83p dated 02/01/2016).

Also see “New SZV-M report form from 2021”.

The head of the company appoints the person responsible for maintaining such documentation at his own discretion. But, as a rule, this is done by someone from the HR department (or an accountant): they have access to all personal affairs and contracts with employees.

Every month, SZV-M provides a list of all employees who worked for the organization during the reporting period (month). Even if a person worked for the company for only one day, information about this still needs to be reflected.

Also see “Instructions for filling out the SZV-M form in 2021.”

Definition of concepts

SZV-M is a reporting form with which employers report to the pension fund about their insured employees.

The document was developed by the PRF and put into effect in 2021. The primary goal of introducing this paper is to control the number of employed people of retirement age. The state does not index their pensions. Pensioners will be able to receive them in full only after dismissal.

The abbreviation “SZV” means that the form contains incoming information about the insured persons. The letter “M” in the name of the form indicates that the report is monthly. It was approved by Resolution of the Foundation Board No. 83p dated 02/01/16. All legal entities and individual entrepreneurs using the labor of individuals must provide information from April 2020.

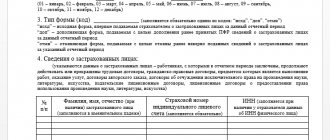

SZV-M indicates:

- short name of the company (full name of the individual entrepreneur), INN, KPP, Pension Fund number;

- reporting month (01, 02, etc.) and year;

- type of form (filling options are given in the form);

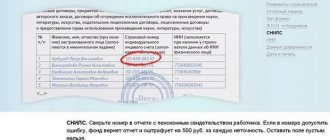

- information about employees: full name, SNILS, INN;

- date, signature, seal.

The head of the legal entity appoints an employee responsible for drawing up the form. This is usually an accountant or human resources officer who has access to staff employment agreements and personnel files.

The form provides a list of persons who worked for the employer in the reporting month. It does not matter how long a person has worked. The main criterion for including workers in the list is the conclusion of an agreement with them: labor or civil law.

The form includes part-time workers, foreign employees, including those without citizenship, who are insured by the Pension Fund. Highly qualified foreign specialists are not included in SZV-M, since they do not need to register in the pension insurance system of the Russian Federation.

If a citizen working under an employment agreement did not receive payments within a month, he still needs to be included in the SZV-M, and if he had no income and worked under the GPA, he does not need to be included in the form.

Form SZV-M

What are the consequences of not having a protocol?

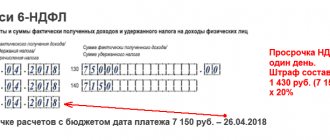

This is the first thing that most accountants and personnel officers are interested in. After all, the law has strict limits that determine when SZV-M needs to be sent. Namely, no later than the 15th of every month.

In case of delay, sanctions will immediately follow: 500 rubles for each person whose data the Pension Fund did not receive on time. This is spelled out in Article 17 of the Law “Penalties for late submission of SZV-M: 2017.”

Naturally, any employer begins to get nervous if they do not receive a protocol from the Pension Fund on the acceptance of the report. After all, only by it can one judge whether the fund will give the go-ahead for the sent SZV-M or not. And if there is no protocol from the Pension Fund for SZV-M , then there is a high probability of sanctions.

A similar situation arose in the spring of 2021, when a large number of organizations and businessmen found themselves in the role of “guilty parties.” All of them did not receive a positive protocol for SZV-M, although they sent the data on time. The reason became known very soon. It turned out that the fund had technical difficulties that no one could influence. As a result, it took time to fix this glitch. But in the end, no one paid the fine, since it was not the fault of the policyholders.

If your organization finds itself in a similar situation - when time passes and there is no SZV-M protocol , they begin to accuse you of being late, write a claim against the fund’s act. Of course, that the report was sent on time. And fight all charges.

What is the SZV-M error log

Insurers with a staff of 25 or more people. are required to provide personalized information only in electronic format. When the SZV-M is submitted, the protocol is the final confirmation that the report has been accepted by the fund. Do not confuse the protocol with a receipt, which only confirms the Pension Fund's receipt of the form, but not its acceptance. A positive protocol means that the report has been verified, accepted, and the authenticity of the digital signature has been confirmed.

Note! Sometimes, upon receipt of the SZV-M protocol, the time frame increases by 2-3 days. Delays may occur due to failures in the FIU system. You can consult about this at the fund branch itself.

Read: How to fill out SZV-M without employees

What steps to take

If enough time has passed and there is still no protocol for taking SZV-M, then:

- First of all, contact your special operator, who acts as an intermediary in transferring reports to the Pension Fund.

- The second option is to call the fund branch directly. It's even faster. And if the delay is again caused by a large influx of documents, then the staff will try to respond to the person who applied first.

It is quite possible that he is aware of the situation and will be able to shed light on the reason for the delay. For example, he will say that there is simply a large influx of documents in your branch of the Pension Fund and specialists do not have time to send return protocols to everyone. This, by the way, is one of the most common reasons.

If there is no protocol from the Pension Fund for SZV-M , this does not mean that you did not submit a report. And even more so, this does not constitute a violation. If everything is done correctly and on time, no one can blame you for being late in sending the report.

The most unpleasant reason why a protocol does not arrive for a long time is when the report is drawn up incorrectly. In this case, the fund creates a negative protocol, and this takes much more time. Moreover, once you receive it, there will be virtually no time left to correct errors.

For more information, see “SZV-M: negative protocol.”

Therefore, in any case, we advise you to always play it safe and call the Pension Fund branch. And if they say that the fund’s employees are preparing a negative protocol, you can act proactively: find the errors yourself and send a corrected version of the SZV-M. In this case, there is a chance to avoid fines.

Read also

14.11.2016

What is a protocol on administrative offense SZV-M

According to stat. 15.33.2 of the Code of Administrative Offenses of the Russian Federation, failure to submit the form within the established time frame or submission of false information entails the collection of a fine from an official of the employer. The size of the sanction is 300-500 rubles. When such a punishment is imposed on the head of the policyholder, the Pension Fund of the Russian Federation draws up a protocol on the administrative violation.

Therefore, with regard to the SZV-M form, 2 types of punishment are possible. First according to stat. 17 No. 27-FZ, the second according to the Code of Administrative Offenses of the Russian Federation. If the statute of limitations has expired, the fund does not have the right to bring the official to administrative liability. What period are we talking about? According to Part 1 of Stat. 4.5 of the Administrative Code in this situation, the statute of limitations is 1 year from the date of the violation. If the date of drawing up the protocol “falls” beyond the specified period, bringing to administrative liability is legally illegal.

Frequent mistakes when passing SZV-M

In block 4 of this form, it is necessary to list all the company’s employees with whom employment contracts or GPC agreements were in force in the reporting month (only for those GPC agreements from which insurance premiums were calculated). You need to include even those employees who were fired on the 1st day of the month or hired on its last day.

| No. | Errors in SZV-M | Correction method |

| 1 | Forgotten employee |

All employees indicated in the primary report do not need to be listed |

| 2 | Extra employee |

There is no need to list all personnel, otherwise the initial information on them will be reset to zero |

| 3 | Errors in employee data |

|

We suggest you read: How to check a VAT return using a balance sheet

SZV-M must also be issued to the resigning employee.

Read about what points in this regard deserve attention in the publication “The month is over, the employee quits, the SZV-M has not yet been handed over - what to do?”

Deadlines for submitting SZV-M adjustments

Currently, absolutely all companies and individual entrepreneurs that make payments to hired employees and persons under GPC agreements are required to report in the SZV-M form.

You will find all the details of filling out the report in this article.

We also recommend downloading our checklist for filling out the SZV-M.

This report can be submitted on paper if there are 24 employees or fewer. The report is submitted electronically if the employer employs 25 or more people (Clause 2, Article 8 of the Law “On Individual (Personalized) Accounting...” dated 04/01/1996 No. 27-FZ).

The completed form is submitted to the Pension Fund monthly, no later than the 15th day of the month following the end of the reporting period (Clause 22, Article 11 of Law No. 27-FZ).

In order not to miss important dates for reporting, follow our section “Accountant’s Calendar”.

Important! ConsultantPlus warns: Often, audits by tax authorities or extra-budgetary funds result in a fine. However, you can try to reduce its amount if there are extenuating circumstances. They can be used by both inspectors and courts. Find out what circumstances you need to refer to in order to reduce the fine in K+.

The policyholder can correct self-identified errors in the information accepted by the Pension Fund of the Russian Federation in the SZV-M form without negative consequences for himself until these errors are identified by the fund. Moreover, if an error is detected at the time of acceptance of the report, then sanctions can be avoided by submitting a clarification no later than 5 working days from the date of receipt of the notification to eliminate the discrepancies (clause 39 of the instructions approved by Order of the Ministry of Labor of Russia dated December 21, 2016 No. 766n).

Let us remind you that 1 mistake will cost the company 500 rubles. The total amount of penalties is calculated based on the number of insured persons listed in the tabular part of the document (paragraph 4, article 17 of law No. 27-FZ).

How to check SZV-M

Information can be presented in two ways: electronically or on paper. The paper version will be accepted only from policyholders whose number of insured persons is less than 24 people. If the organization has 25 or more employees, it will have to be submitted electronically. The unified electronic form was approved by Resolution of the Pension Fund of December 7, 2016 No. 1077p.

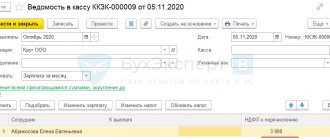

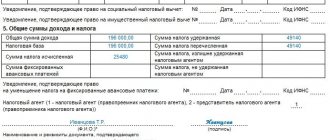

The generated data must be checked for errors. The verification algorithm will generate a protocol assessing the correctness of the information provided:

- personal data - in terms of correct completion of SNILS and TIN, compliance with the individual data of the insured person;

- organization data - regarding the correctness of filling in the details of the policyholder;

- report format for compliance with current approved forms.

Identified “errors” and “warnings” must be eliminated without fail, otherwise the Pension Fund will not accept the reports.

You can check the completed form via the Internet, for example, checking SZV-M online without registration is implemented on the official websites of the Pension Fund or the Federal Tax Service. To do this, upload the XML file to the online application and run the check.

Check SZV-M PF RF

The generated and verified file is sent to the territorial branch of the Pension Fund. If there are no errors or warnings, the report is considered accepted. Then the Pension Fund employee conducts a desk audit. If no defects are identified, the SZV-M is considered passed.

1. Information about the policyholder. Here you need to indicate the details of the organization, individual entrepreneur or individual:

- name of the organization, a short version is acceptable;

- PFR registration number;

- TIN;

- Checkpoint.

It is necessary to check the information entered with the constituent documents.

2. Reporting period. Display information about the reporting month for which we generate reports.

3. Form type. Select from the available types: “ref” - primary (original), “add” - containing additions, “cancel” - form with canceling data.

4. Information about the insured persons. Here indicate the full name, SNILS and INN for each employee. Check the information for each insured person with the employee cards.