The employer has not paid the withheld personal income tax: what to do and where to go?

Organizations and individual entrepreneurs become tax agents from the moment an employment contract is signed with a citizen. The agent is obliged to calculate income tax, withhold it from salary and pay it to the budget (Article 226 of the Tax Code of the Russian Federation). Personal income tax is transferred monthly. If income tax has been withheld, the employer is responsible for paying it, not the employee.

You can find out how conscientiously a tax agent pays personal income tax in the following ways:

- request a 2-NDFL certificate from the accounting department, which reflects the withheld income tax (even if the certificate is falsified, it will be required when filing a complaint against the employer);

- register on the official portal of the Federal Tax Service, use your personal account;

- submit a request through the State Services portal (the user will receive a statement with the amounts paid to the budget by his employers).

If the taxpayer remains inactive, the fact of non-payment of income tax will sooner or later be revealed, for example, when filing a declaration.

What to do if personal income tax was not transferred to the budget

If an employee has established for sure that the employer withholds income tax from him, but does not transfer it to the budget, he can contact the following authorities:

- Labor inspectorate or prosecutor's office;

- Tax office at the place of registration of the employer.

Documentary evidence must be attached to the application. As evidence that the tax is withheld, an employment contract (which states the salary before tax) and payslips and statements about receipts of funds on the card (where it is clear that the amount of money is transferred minus 13%) can be used.

As evidence that the withheld tax did not go to the budget, you can use 2-NDFL certificates and data from your personal account on the tax website.

The right to deduction is retained if the employer has not paid personal income tax

Most workers face the problem of non-payment of income taxes by their employer after filing their return. 3-NDFL is submitted to apply a property deduction (Article 220 of the Tax Code). A citizen has the right to use a deduction and receive a tax refund even if the employer did not transfer it to the budget. This rule applies if tax was withheld from salary.

The Letter of the Federal Tax Service No. ED-3-3/ dated June 15, 2012 states that the possibility of applying the deduction should not depend on how the tax agent fulfills his duties. Thus, if the employer has not paid the tax, the tax inspector does not have the right to refuse to provide a deduction.

Attention! A citizen is released from liability for non-payment of tax from the moment personal income tax is withheld by the employer. The employee has the right to file a complaint against the employer.

Responsibilities of tax agents

According to the Tax Code of the Russian Federation, all employers will be tax agents for employees with whom they have signed an employment contract. An exception is the situation when an individual acts as an employer, without registration as an individual entrepreneur.

The tax agent is obliged:

- Calculate the amount of income tax on employee wages.

- Withhold it, that is, pay the salary minus the previously calculated tax amount.

- Transfer the withheld tax amount to the budget.

According to the law, a person who has a tax agent (that is, an employee whose employer is this agent) is considered to have fulfilled his obligation under tax law after the tax is withheld from him, that is, if the employer does not transfer the withheld amounts to the budget, the employee has already will not be held responsible.

Filing a complaint against an employer for non-payment of personal income tax

If a worker is convinced that a tax agent withholds but does not pay taxes for him, he must contact the following authorities:

- local department of the State Labor Inspectorate;

- prosecutor's office;

- Federal Tax Service branch at the location of the organization.

Let's look at how to file complaints with the above authorities. The procedure for submitting appeals to regulatory and supervisory structures is regulated by Federal Law No. 59 of May 2, 2006.

Complaint to the State Tax Inspectorate

The State Labor Inspectorate accepts statements/complaints about violations of labor laws written in free form. You can fill out a standard form when visiting a regional GIT office in person. The Inspectorate also accepts requests via the website. The application must be accompanied by documents that prove the fact of withholding and non-transfer of tax.

DOWNLOAD Complaint against the employer to the labor inspectorate

The State Tax Inspectorate can hold the employer administratively liable, initiate an inspection, transfer materials to the prosecutor's office, and remove those responsible from work.

Complaint to the Federal Tax Service

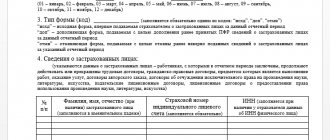

The complaint is sent to the inspectorate at the location of the employer's office. The exact form of the document is not established by law, so you can write an appeal in free form. Sometimes the form is available at the Federal Tax Service office among sample applications. The complaint must contain the following information:

- name and address of the Federal Tax Service division;

- employee details (full name, address, telephone);

- name of the employing organization, position of the applicant;

- a brief description of the violation, requirements and legal basis;

- list of applications, date.

The tax authorities will consider the application anonymously if it includes a request to maintain the confidentiality of the applicant’s identity.

The document is prepared in two copies. The first is submitted to the Federal Tax Service, the second copy with the registration mark remains with the employee.

Appeals are considered within 30 days from the date of registration. The Tax Inspectorate accepts complaints submitted in person, sent by Russian Post, as well as through your personal account on the Federal Tax Service portal.

Application to the prosecutor's office

A complaint to the prosecutor's office against an employer is drawn up in any form. A sample application can be obtained from the duty prosecutor. The application is submitted free of charge. The document must indicate the following information:

- name of the prosecutor's office;

- general and contact information of the applicant;

- information about labor relations (position, period of work, employment contract number);

- grounds for appeal (violations, references to laws and evidence);

- request for an inspection.

Before submitting an application, you must collect a package of supporting documents. If the application is accepted, the prosecutor's office will organize an inspection or transfer the appeal to the State Tax Inspectorate.

DOWNLOAD Application/complaint to the prosecutor's office against the employer

Personal income tax was transferred late - how to avoid a fine

So, you may be fined 20% of the amount of tax you pay within the established time frame (clause 1 of Article 123 of the Tax Code of the Russian Federation):

- did not retain it or did not retain it in full (for any reason, including incorrectly calculating it);

- withheld, but not paid to the budget in full or in part.

IMPORTANT! The general deadline for personal income tax payment is no later than the day following the day of payment of income. A special case is personal income tax on vacation and sick leave, which can be transferred on the last day of the month.

You can avoid a fine provided that you (clause 2 of Article 123 of the Tax Code of the Russian Federation):

- submitted 6-NDFL on time;

- reflected the tax in the report without distortions or understatements;

- paid the tax with penalties before they learned that the tax authorities had discovered a delay or assigned you an on-site audit for the corresponding period.

Since a fine is due for two different actions: the tax was not withheld or the tax was not paid, the measures that need to be taken to avoid a fine will be somewhat different. We present them for each situation.

Withholding personal income tax if there are no amounts left to be paid in salary

If there are no amounts left for payment in salary for an employee, since he was paid an advance for the first half of the month, and the employee was absent for the entire second half of the month, for example, he was sick or was on vacation, then personal income tax is not withheld from him, a difference arises between the calculated and withheld tax. What to do in this case - see our publication.

In this case, when paying wages, the employee is not included in the Sheet.... Because of this, personal income tax is not withheld, although the employee was accrued for the month, for example, 30,000 rubles, and was paid in advance minus personal income tax - 26,100 rubles:

- 30,000 (income) – 3,900 (personal income tax) = 26,100 rubles.

If you follow the Tax Code of the Russian Federation, then personal income tax will be withheld for the next payment. However, with a large payroll, this can be considered as a way to evade taxes.

Therefore, in ZUP 3, to register personal income tax withholding, if the entire amount was paid in advance, a “technical” Statement should be created... . Manually click the Select to add an employee to the document. The personal income tax amount will be adjusted automatically:

To correctly fill out line 130 in 6-NDFL, in the For payment , the amount of the previously paid advance with a minus will automatically be loaded (in the column Document basis - Accrual for the first half of the month ) and exactly the same amount with a plus for the accrued salary (in the column Document basis - document Calculation of salaries and contributions ):

Then the accumulation register of Taxpayers’ Calculations with the Budget for Personal Income Tax (e1cib/list/Register of Accumulation. Taxpayers’ Calculations with the Budget for Personal Income Tax) will contain the amount of withheld personal income tax – 3,900 rubles. and paid income - 30,000 rubles.

In 6-NDFL, Section 2 will reflect exactly the same data

See also:

- Filling out 6-NDFL in 1C 8.3 ZUP

- Filling out 6-NDFL and 2-NDFL in 1C using examples

- Recalculations in personal income tax reporting

- How to check the completion of 6-NDFL

- Information about the impossibility of withholding personal income tax

- How to find the difference between the amounts in 6-NDFL and RSV

If you haven't subscribed yet:

Activate demo access for free →

or

Subscribe to Rubricator →

After subscribing, you will have access to all materials on 1C:ZUP, recordings of supporting broadcasts, and you will be able to ask any questions about 1C.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- What to do with personal income tax if payment for a business trip is paid in advance? ...

- How to register a personal income tax transfer if a tax refund was made to an employee? ...

- Withholding personal income tax from natural income received on the nearest date of payment of other employee income...

- Accounting for the “accounting balance” (ZUP 3.1.4) ...

Provisions by law

Personal income tax must be paid within the time limits specified in Article 226 of the Tax Code of the Russian Federation. If the date is missed, the Federal Tax Service has the right to fine the violator. The amount of sanctions will be 20% of the payment amount. This rule applies to all taxpayers.

More severe penalties apply to tax agents. They can be legally held accountable even under criminal law.

Article 226. Peculiarities of tax calculation by tax agents

The deadlines for payment for employers are prescribed in Article 226 of the Tax Code of the Russian Federation. At the same time, they do not need to rely on the norms of Articles 227 and 228.

Article 227. Accidents subject to investigation and recording

The collection of a fine can be carried out by the inspectorate in two cases. In the first, a fine is applied if there is no tax withholding from the funds transferred to the employee. Sanctions are also applied to organizations that do not transfer fees to the state budget in a timely manner.

Article 228. Peculiarities of tax calculation in relation to certain types of income. Tax payment procedure

Such norms are reflected in Article 123 of the Tax Code of the Russian Federation. In addition, the payment rules are prescribed in Letter of the Ministry of Finance of the Russian Federation No. 03-02-07/1/8500, which was issued on March 19, 2013.

Article 123. Sequence of granting annual paid leave

Despite the accrued fine, the tax agent must still deduct personal income tax. Based on paragraph 1 of Article 46 and paragraph 1 of Article 47 of the Tax Code of the Russian Federation, collection can be carried out by tax authorities forcibly. If payment deadlines are violated, the organization will be required to pay a penalty. The amount is determined in accordance with the duration of the delay.