Filling out field 107 in the payment order. Situations

The Client-Bank program does not allow you to enter a date in field 107 of the payment order. In this case, you need to put GD.00.2016 or the month in the field, for example MS.09.2016. And you need to send a letter to the bank stating that “Client-Bank” is not working correctly.

If “Client-Bank” does not allow you to fill in the date in field 107 of the personal income tax payment order, fill out the field as the program allows. In any case, the payment will go into the budget, but inspectors may have questions. Then it will be enough to clarify the payment.

The company transferred personal income tax from wages for August, and wrote MS.09.2016 in field 107 of the payment order. The Federal Tax Service's program considered that the tax had not been paid. In this case, you must submit an application to the inspectorate to clarify the payment. But do not remit the tax.

Inspectors believe that when filling out field 107 in a payment order in 2021, you should focus on the month in which the individual received income. For example, if a company issues wages for August in September, you need to put MS.08.2016 in the payment slip, not MS.09.2016. After all, the date of receipt of income is August 31 (clause 2 of Article 223 of the Tax Code of the Russian Federation). But in any case, the tax falls into the budget, so it is enough to clarify the payment.

If “Client Bank” allows you to enter a date in field 107, then you must indicate it. Then there will be no confusion with payments.

The company issued salaries for December in January, and wrote MS.12.2015 in field 107 of the payment slip. The tax program calculated penalties. In this case, you must submit an application to the inspectorate with a request to recalculate the fines.

If a company issues salaries for December in January, the payment is shown in section 2 of the 6-NDFL calculation. The Federal Tax Service program checks the dates and amounts in section 2 with payment information. If the company wrote MS.12.2015 in field 107 of the payment order, the program considers that this is tax for the previous year and discards payments. As a result, inspectors charge penalties on the tax withheld in January from the 2015 salary. This is illegal, so demand that the fines be recalculated.

Have a question? Our experts will help you within 24 hours! Get answer New

conclusions

Filling out field 109 directly depends on the value of field 106 and helps tax authorities determine on what basis the tax transfer to the budget was made, and also facilitates the task of distributing taxes. Failure to fill in the field is not critical; the obligation will be considered extinguished in any case. This error is classified as safe and will not lead to underpayment. Be that as it may, in order to fully correctly process payment orders, an accounting employee needs to know the filling rules provided for by law.

Similar articles

- Reason for payment 106 explanation

- Field 107 in the payment order

- How to fill out a payment order to pay a fine?

- Basis of payment

- Filling out a payment order in 2021ː sample

Payment order for the transfer of VAT by the taxpayer - 2019-2020

There is no special code specifically for this situation in the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n, which determines the procedure for filling out this detail. In this regard, we believe that it is possible to set status 01, corresponding to the category “taxpayer-legal entity” or status 09 if VAT is paid by an individual entrepreneur. The remaining details must also be filled out according to the rules established for VAT taxpayers.

NOTE! These persons do not have the right to pay tax in installments (clause 4 of Art.

174 of the Tax Code of the Russian Federation).

The procedure for filling out a payment order in case of payment for another person is described in the information of the Federal Tax Service of Russia “On tax payments transferred by another person.” When paying VAT for another person in the field:

101 “Payer status” indicates the status of the person for whom the tax is transferred.

60 “TIN of the payer”, 102 “KPP of the payer” indicates the TIN and KPP of the payer for whom the tax is transferred.

The payer's details indicate the details of the person who fills out the payment order for the transfer of tax to the budget.

Fields 22, 104–109 are filled in with data provided by the person whose tax obligation is being fulfilled.

In the “Purpose of payment” field, you need to indicate your INN, KPP, then through the “//” sign the name of the organization for which you are transferring the tax, and through the “//” sign the purpose of payment.

An exception is made for vacation pay and sick leave: tax on them must be paid no later than the last day of the month in which the employee was given the appropriate funds. For example, payment of benefits and deduction of personal income tax from it is November 18, 2019, the deadline for transferring tax to the budget is from November 18, 2019 to December 2, 2019, because November 30, 2019 is a day off.

How to correctly display the timing of tax transfers in Form 6-NDFL, see here.

If personal income tax is calculated and transferred directly by the individual taxpayer or individual entrepreneur, then the deadline for paying the tax is July 15 of the year following the tax period (clause 6 of article 227, clause 4 of article 228 of the Tax Code of the Russian Federation). IP on OSNO also transfers advance payments. In 2021, the deadline for their payment is until the 15th day of the month following the reporting quarter. From 2021 the deadlines will be as follows:

- for the 1st quarter - no later than April 25;

- for half a year - no later than July 25;

- for nine months - no later than October 25.

The procedure for calculating advances will also change.

When is it necessary to fill out a payment order?

A payment order is a document in a prescribed form that regulates the account holder’s instructions to make non-cash transfers in favor of the recipient of funds. The instruction has been sent to the bank that maintains the payer’s account. Funds are transferred from a deposit account. If for some reason the account does not have the required amount of money, but the agreement between the bank and the payer provides for an overdraft, the transfer will be carried out. This document must be drawn up and submitted to the bank for execution in electronic or paper form.

Individuals can also process payment orders without opening a bank account. In this case, an order to the bank from an individual can be drawn up in the form of an application, in which the following information must be indicated:

- payer details;

- details of the recipient of funds;

- bank details of the payer and recipient;

- amount of money;

- purpose or purpose of payment;

- other information established by the bank.

Based on the order, the bank employee generates a payment order.

When drawing up an order to the bank electronically, it is very important to correctly indicate the payer, recipient of the transfer, amount, and purpose of payment.

What is “field 109” in a payment order

Forms of payment documents, including instructions, are approved in Regulations of the Bank of the Russian Federation No. 383-P dated June 19, 2012 (as amended on July 5, 2017). The same regulatory act regulates the procedure for filling out forms. In accordance with clause 4 of Appendix 1, the list of required details includes field 109, which must be filled in when transferring funds to the Russian budget system.

The procedure for entering data is given in Order of the Ministry of Finance No. 107n dated November 12, 2013 (as amended on April 5, 2017). According to clause 10 of Appendix 2, which regulates the rules for identifying information when transferring funds for the payment of taxes, contributions and other fees to the budget of the Russian Federation, field 109 indicates the date of the document on the basis of which the payment is made. The details are filled in digitally and consist of 10 acquaintances.

In what format should I write the date?

Field 109 consists of ten acquaintances, of which:

- the first two indicators contain the calendar day;

- the next place is intended for putting a dot;

- the month is indicated in the 4th and 5th fields;

- then a separator in the form “.” is inserted;

- the last sections serve to reflect the year.

It is important to remember that field 109 does not serve to reflect the date of payment in the payment order, but to indicate the moment of creation of the document serving as the basis for transfers in favor of the budget system of the Russian Federation.

Enter the date in the numeric format “DD.MM.YYYY” (for example, “03/18/2019”). If the arrears are voluntarily repaid (not at the request of the Federal Tax Service or an inspection report) and “ZD” is entered in field 106, then in field 109 record “0” (zero).

Special field 109 in the 2021 payment order is filled in when amounts are paid to the budget of the Russian Federation, in other cases it remains empty. How exactly to reflect information on this detail? What value should be entered if it is impossible to determine the exact date? Read more about how the document date is entered in the 2021 payment order below.

How to fill out a tax payment order

Please indicate the amount in full rubles. The rule applies: transfer taxes to the budget in full rubles, rounding kopecks according to the rules of arithmetic: if less than 50 kopecks, discard them, and if more, round to the nearest full ruble.

All fields are required. The date and amount of the write-off are indicated in numbers and in words. Payment orders are numbered in chronological order.

Each field is assigned its own number. Let's look at the rules in more detail.

Field 101 must indicate the payer status. When paying personal income tax, a budget organization is a tax agent, so we indicate code 02.

In the “Recipient” column, indicate “Federal Treasury Department for the corresponding region”, in brackets - the name of the tax office. In other columns, the TIN and checkpoint of the inspection are indicated.

Another important detail is the KBK code; in the payment order for this you need to fill in a special detail - field 104.

IMPORTANT! In 2021, you will need the KBK code for personal income tax 18210102010 011000110. It is the same for paying personal income tax on wages and benefits, and for paying personal income tax on dividends

Props 21 indicates the order. It is determined in accordance with Article 855. Civil Code of the Russian Federation. When transferring tax, the values “3” and “5” can be indicated. They determine in what order the bank will carry out operations if there are not enough funds in the organization’s account. When transferring personal income tax on a monthly basis, the value “5” is indicated in field 21. If you transfer tax at the request of the Federal Tax Service, then indicate the value “3”.

In field 105 OKTMO is indicated in accordance with the All-Russian Classifier, which was approved by Order of Rosstandart dated June 14, 2013 No. 159-ST. From April 25, 2017, payment orders must indicate the 8-digit OKTMO code.

Field 106 is intended to identify the payment by its intended purpose. The bases are indicated using a letter code:

- TP - for current payments;

- ZD - for debt repaid voluntarily;

- TR - debt repaid at the request of regulatory authorities;

- AP - arrears repaid on the basis of an inspection report before the inspection requirement is issued.

If it is impossible to specify the value of the indicator, set it to 0.

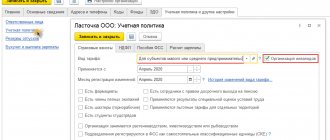

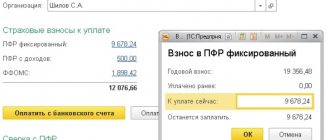

In field 107 you must indicate the frequency of payment of the tax amount or a specific date. Periodicity is essentially the tax period for which money is transferred. Maybe: once a month, a quarter, once every six months or a year. For transfers for October 2020, you need to indicate “MS.10.2018”.

The rules are described in more detail in the article on how to fill out fields 106 and 107.

Attribute 108 is written “0”. The exception is cases of debt repayment at the request of regulatory authorities. Then you need to put his number.

Field 109 indicates the date of signing the declaration for the tax paid or “0” if the tax is transferred to the budget before the submission of the declaration. If the debt is repaid at the request of the tax authorities, its date is indicated in this field.

How to fill out a payment order correctly?

The completion and form of the payment order is regulated by the Regulation of the Bank of Russia dated June 19, 2012 No. 383-P “On the rules for the transfer of funds.”

Filling out a payment order is regulated by regulations, namely Regulation No. 383-P and Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107-N.

| Filling stage | Explanation |

| Payment order number, date | Indicate the serial number of the document, date in the format DD.MM.YYYY |

| Type of payment | “Urgent” – in this case, the transfer of funds will be carried out by means of urgent transfer. If the payment type remains blank, then such an order is classified as non-urgent using the appropriate means of transfer. |

| Status | It is necessary to indicate only when making a transfer in favor of the budget. Status codes are located in the previously mentioned Order No. 107-N (101) |

| Sum | Indicate the amount in words with a capital letter, while writing the words “rubles” and “kopecks” in full, but write the number of kopecks in numbers. Digital designation of the amount:

For example: seventeen thousand one hundred fifty rubles 17 kopecks (17150-17) |

| Payer |

|

| Recipient | See Payer, but the Recipient's details are entered |

| Type of operation | The payment is always coded 01 |

| Payment order | As a rule, stage 5 (tax deductions, insurance premiums, transfer of payments to counterparties) |

| Code | In the case of current payments, 0 is entered in the column. If the payment is made in accordance with the UIP, then its code is entered, specified in the document on the basis of which the payment order is generated (22) |

| Purpose of payment | The number of the contract, invoice, etc. is indicated. If the payment is tax, then the cells located above the “Purpose of payment” cell are filled in in the following order: KBK (104); OKTMO (105); two-digit payment basis code; tax period (quarter, half-year, year, or simply indicate the date of tax payment): MS.03.2017, KV.01.2017, GD.00.2017, 03.20.2017 (107); basis of payment (106); number of the document on the basis of which the payment is made (108); the date of drawing up the document on the basis of which the payment is made (in the case of a tax payment, the date of signing the declaration is indicated) (109); leave payment type blank. |

How to fill out field 109 in a payment order in 2021

The format of field 109 requires entering 10 characters, of which 8 are numbers, and another 2 are punctuation marks. The first group of numbers (1 and 2 places) indicate the date according to the calendar, the second group (4 and 5 places) - the month, the third group (from 7 to 10 places) - the year. In this case, values can be accepted from 01 to 31/12 for the date/month. Accordingly, the 3rd and 6th separating places are points.

What date should I enter in field 109? The answer is given in paragraph 10 of Order No. 107n. The value of the indicator varies depending on the type of budget payment, as well as the period for which it is transferred.

The date is filled in according to the following rules:

- When transferring payments of the current period - year (the value “TP” is entered in field 106) - the date of signing by the taxpayer of the calculation or declaration submitted to the tax authorities is given. In case of transfer of payments before the corresponding reports have been prepared, signed and submitted, “0” should be indicated in field 109.

- When voluntarily transferring debts for past tax or reporting periods (filled in as “ZD” in field 106), the value “0” is given.

- When transferring payments based on the requirements of the Federal Tax Service (indicate “TR” in field 106), the value of the date of the tax authorities’ requirement is given.

- When transferring restructured, deferred debts; obligations arising during the bankruptcy of a company; when paying amounts based on inspection results or investment loans; and also according to executive documents - field 109 must be filled out only if there is a documentary basis for payment (tax claim, decision to defer/installment payment, decision of an arbitration court, etc.).

This field is about the document date

In field 109, indicate the date of the document - the basis for the payment, depending on what was indicated in field 106 of the payment.

Here are the options:

- if “TP” is indicated in field 106, indicate the date of signing the tax return (calculation) for which the tax or insurance premiums were paid. And if you transfer the tax before filing a declaration, then reflect “0” (zero);

- if “TR” is indicated in field 106, record the date of the Federal Tax Service’s request;

- if “AP” is indicated in field 106, show the date of the decision on the tax audit of the Federal Tax Service.

Options for filling out field 101

The rules for filling out the payer status in field 101 are contained in Appendix 5 to Order No. 107n of the Ministry of Finance of Russia dated November 12, 2013.

Read about what problems with choosing a status occurred when making payments for insurance premiums in 2021 in the material “Main payer statuses in a payment order - 2018”.

The following codes can be considered the main operating details:

- 01 - taxpayer-organization, any legal entity.

- 02 - tax agent. This status is most often found when paying personal income tax for employees, VAT for lease agreements concluded with municipal organizations.

- 08 - this code is used by enterprises and other individuals who pay insurance premiums for employees.

- 09, 10, 11, 12 - self-employed persons (individual entrepreneurs, notaries, lawyers, farmers) paying taxes for themselves.

- 13 - taxpayers - other individuals.

For more information about the situation with the 110th field, read the article “The issue of the 110th field of the payment card has been finally resolved.”

Codes 15 and 20 are used by credit organizations or their branches, payment agents who transfer funds for individuals on the basis of a general register or individually.

Code 24 is indicated by individuals making payments of insurance premiums or other payments to the budget.

Thus, if a business entity transfers insurance premiums for injuries to the Social Insurance Fund for its employees, the payer’s status is indicated with code 08, regardless of whether it is an organization or an individual entrepreneur.

Example 1

What code should be entered in field 101 when transferring personal income tax? It is incorrect to use status 01, which indicates the payer is a legal entity. In this case, when transferring funds by tax agents for their employees, it is necessary to enter 02. Entrepreneurs paying income tax use the code value 09.

Example 2

Field 101 is filled in depending on the owner of the land plot. For organizations, the payer status is 01. Entrepreneurs who use land in their activities related to making a profit enter code 09. Land tax in cases where the owners are other individuals is paid with code 13.

Since November 2021, the rule has come into force that payment of tax is possible by a third party. Filling out a payment document in this case has its own characteristics.

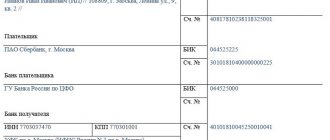

Payer's bank details

- 01 - taxpayer (payer of fees) - legal entity;

- 02 - tax agent;

- 08 - payer-legal entity (IP) paying insurance premiums and other payments to the budget system of the Russian Federation;

- 09 - taxpayer (payer of fees) - individual entrepreneur;

- 14 - taxpayer making payments to individuals;

- 24 - an individual payer who pays insurance premiums and other payments to the budget system of the Russian Federation.

Find out how to fill out insurance premium payments.

- 8 - it provides the full or abbreviated name of the legal entity, full name of the entrepreneur and his legal status, or full name and indication of the type of activity of private practitioners;

- 60 - TIN;

- 102 - checkpoint.

Read about the specifics of filling out a payment document when paying taxes by a third party in the articles:

- account number - field 9;

- bank name - field 10 (filled out only in a paper order);

- BIC - field 11;

- bank correspondent account - field 12.

IMPORTANT! Be careful when specifying your bank! If you make a mistake, the tax (contribution) may be declared unpaid (clause 4 of Art.

45 of the Tax Code of the Russian Federation). This means that penalties will be charged.

In payments for taxes and contributions, those organizations that administer them appear as recipients. In this case, the abbreviated name of the Federal Treasury body and in brackets the abbreviated name of the administrator are indicated, for example: “UFK for Moscow (Inspectorate of the Federal Tax Service of Russia No. 16 for Moscow).” The name must be contained in 160 characters - this length of the details is provided for in Appendix 11 to Regulation No. 383-P.

The TIN and checkpoint can be found on the websites of the Federal Tax Service of Russia and the Social Insurance Fund.

Read about where to find out the details for tax payments here.

In payments for taxes and contributions, fields 104–110 are also required to be filled in. In this case, you need to be guided by the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. Let's look at these fields further.

Field 106 in a payment order in 2020

The corresponding code in field 106 of the payment order is the basis for the payment made to the budget and will help it be correctly identified by the tax authority. We’ll figure out how to fill it out in 2021 further.

Requirements for filling it out

In accordance with Regulation No. 383-P, approved by the Bank of Russia, field 106 in a payment order is limited to two characters. The code is written in capital letters of the Russian alphabet.

The main parameters for filling out details in a payment order for taxes and other payments to the budget are regulated by the Rules approved by Order of the Ministry of Finance dated November 12, 2013 No. 107n.

Sample of a completed field in a payment:

Basic codes for filling out field 106

According to Appendix No. 2, transfer of funds for payments accounted for by the tax office, field 106 can have the following meanings:

| TP | Current year payments (current payments) |

| ZD | Repayment of debts incurred during previous tax periods on a voluntary basis |

| BF | Current payment paid from the account of an individual - the owner of this account |

| TR | Repayment of debt made on the basis of a demand for payment issued by the tax authority |

| RS | Repayment of debt by installments |

| FROM | Deferred debt repayment |

| RT | Debt repayment under a debt restructuring scheme |

| PB | Paying off debt when bankruptcy proceedings are applied |

| TL | Repayment by the owner of the debtor's property (founder, participant) of a unitary enterprise or a third party of debts in the event of opening a bankruptcy case |

| ST | Payment of current debt in a bankruptcy case |

| ETC | Repayment of debt that has been suspended for collection |

| AP | Funds are transferred to pay off the debt specified in the tax authority’s audit report |

| AR | Repayment of debt collected during enforcement procedures |

| IN | Investment tax credit payment |

Appendix No. 3 contains field 106 codes for customs and other payments:

| DE | Declaration for goods, excluding declarations for goods for which payers pay customs duties, guided by Articles 114, 115 and 116 of Law No. 311-FZ of November 27, 2010, through electronic or payment terminals, ATMs. |

| PD | Passenger customs declaration |

| BY | Customs receipt order (except for orders for which payments are made in accordance with Articles 114, 115 and 116 of Law 311-FZ through electronic or payment terminals, ATMs) |

| CT | Adjustment of the declaration for goods (except for adjustments for goods for which payments are made in accordance with Articles 114, 115 and 116 of Law 311-FZ through electronic or payment terminals, ATMs) |

| THAT | Requirement for payment of customs duties (except for those for which payments are made in accordance with Articles 114, 115 and 116 of Law 311-FZ through electronic or payment terminals, ATMs) |

| ID | Executive document |

| DB | Documents related to the activities of customs authorities |

| IP | Collection order |

| IN | Collection document |

| KP | Agreement on interaction in relation to large payers of payments in the order of centralization |

| DK | Declaration for goods for which payments are made by payers on the basis of Art. 114, 115, 116 of Law 311-FZ through electronic or payment terminals, ATMs |

| PC | Customs receipt order, when payments are made by payers on the basis of Art. 114, 115, 116 of Law 311-FZ through electronic or payment terminals, ATMs |

| QC | Adjustment of the goods declaration, for which payments are made by payers on the basis of Art. 114, 115, 116 of Law 311-FZ through electronic or payment terminals, ATMs |

| TK | The requirement to pay customs duties, for which payments are made by payers on the basis of Art. 114, 115, 116 of Law 311-FZ through electronic or payment terminals, ATMs |

| HF | International mail recipient's receipt |

| 00 | Code for other cases |

The indicator entered in field 106 affects the completion of the following parameters of the payment order:

- field 107 – indicates the tax period for which payment is made;

- field 108 – the date is entered in accordance with the document - the basis for payment.

Filling rules

The rules for filling out payment orders when transferring payments to the budget in 2021 are determined by Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. These rules apply to everyone who transfers payments to the budget system of the Russian Federation:

- payers of taxes, fees and insurance premiums;

- tax agents;

- payers of customs and other payments to the budget;

- third parties who pay taxes or insurance premiums “for others.” See “Third parties now have the right to pay taxes, fees and insurance premiums for others.”

The listed individuals must correctly understand how to fill out payment orders in 2021 so that their payments are received as intended and do not have to look for paid taxes or insurance premiums. For these purposes, it recommends paying attention to the table, which contains a breakdown of the fields of the payment order and provides recommendations for drawing up and filling out individual codes. The table already takes into account all changes that came into force on January 1, 2021.

| Payment field | Filling | |

| Payer information | ||

| TIN | Enter the TIN of the payer of payments into the budget (including the tax agent). In this case, the first and second characters cannot immediately be zeros. The field may not be filled in for individuals if they indicated SNILS in field 108 or UIP in field 22. In all other cases, it is necessary to indicate the TIN | |

| checkpoint | Specify the checkpoint of the payer of payments to the budget (including a participant in foreign economic activity, a tax agent). Payers - individuals indicate zero (“0”) in this field. For organizations, the first and second characters cannot be zeros at the same time | |

| Payer | Organizations (separate divisions) indicate their name of the organization | |

| Individual entrepreneurs indicate the surname, first name, patronymic (if any) and in brackets - “IP”, registration address at the place of residence or registration address at the place of residence (if there is no place of residence). Please include a “//” sign before and after the address information. | ||

| Notaries engaged in private practice indicate the last name, first name, patronymic (if any) and in brackets - “notary”, registration address at the place of residence or registration address at the place of residence (if there is no place of residence). Please include a “//” sign before and after the address information. | ||

| Lawyers who have established law offices indicate their last name, first name, patronymic (if any) and in brackets - “lawyer”, registration address at the place of residence or registration address at the place of residence (if there is no place of residence). Please include a “//” sign before and after the address information. | ||

| The heads of peasant (farm) households indicate the last name, first name, patronymic (if any) and in brackets - “peasant farm”, registration address at the place of residence or registration address at the place of residence (if there is no place of residence). Please include a “//” sign before and after the address information. | ||

| Information about the payer (if taxes are paid by a responsible member of a consolidated group of taxpayers) | ||

| TIN | Indicate the TIN of the responsible participant in the consolidated group of taxpayers. The first and second characters cannot be zeros at the same time. | |

| If the payment order is drawn up by a member of a consolidated group, the field shall indicate the TIN of the responsible member of the consolidated group, whose tax obligation is being fulfilled | ||

| checkpoint | Indicate the checkpoint of the responsible participant in the consolidated group of taxpayers. The first and second characters cannot be zeros at the same time. | |

| If the payment order is drawn up by a member of a consolidated group, the field indicates the checkpoint of the responsible member of the consolidated group, whose obligation to pay tax is fulfilled | ||

| Payer | Indicate the name of the responsible participant in the consolidated group of taxpayers. | |

| If the payment order is drawn up by a member of a consolidated group, indicate the name of the member of the consolidated group of taxpayers and in brackets the abbreviated name of the responsible participant whose tax obligation is being fulfilled | ||

| Field number | Field code | Field code value |

| Payer status | ||

| 101 | 1 | Taxpayer (payer of fees) – legal entity |

| 2 | Tax agent | |

| 6 | Participant in foreign economic activity – legal entity | |

| 8 | An organization (individual entrepreneur) that transfers other obligatory payments to the budget | |

| 9 | Taxpayer (payer of fees) – individual entrepreneur | |

| 10 | Taxpayer (payer of fees) – notary engaged in private practice | |

| 11 | Taxpayer (payer of fees) – a lawyer who has established a law office | |

| 12 | Taxpayer (payer of fees) – head of a peasant (farm) enterprise | |

| 13 | Taxpayer (payer of fees) - another individual - bank client (account holder) | |

| 14 | Taxpayer making payments to individuals | |

| 16 | Participant in foreign economic activity – individual | |

| 17 | Participant in foreign economic activity - individual entrepreneur | |

| 18 | A payer of customs duties who is not a declarant, who is obligated by Russian legislation to pay customs duties | |

| 19 | Organizations and their branches that withheld funds from the salary (income) of a debtor - an individual to repay debts on payments to the budget on the basis of a writ of execution | |

| 21 | Responsible participant of a consolidated group of taxpayers | |

| 22 | Member of a consolidated group of taxpayers | |

| 24 | Payer – an individual who transfers other obligatory payments to the budget | |

| 26 | Founders (participants) of the debtor, owners of the property of the debtor - a unitary enterprise or third parties who have drawn up an order for the transfer of funds to repay claims against the debtor for the payment of mandatory payments included in the register of creditors' claims during the procedures applied in a bankruptcy case | |

| 27 | Credit organizations (branches of credit organizations) that have drawn up an order for the transfer of funds transferred from the budget system, not credited to the recipient and subject to return to the budget system | |

| 28 | Legal or authorized representative of the taxpayer | |

| 29 | Other organizations | |

| 30 | Other individuals | |

| KBK | ||

| 104 | Budget classification code (20 digits) | |

| OKTMO | ||

| 105 | In the payment order, the organization must indicate OKTMO in accordance with the All-Russian Classifier, approved by order of Rosstandart dated June 14, 2013 No. 159-ST (8 digits) | |

| Basis of payment | ||

| 106 | 0 | Contributions for injuries |

| TP | Tax payments (insurance contributions) of the current year | |

| ZD | Voluntary repayment of debts for expired tax periods in the absence of a requirement from the tax inspectorate to pay taxes (fees) | |

| TR | Repayment of debt at the request of the tax inspectorate | |

| RS | Repayment of overdue debt | |

| FROM | Repayment of deferred debt | |

| RT | Repayment of restructured debt | |

| VU | Repayment of deferred debt due to the introduction of external management | |

| ETC | Repayment of debt suspended for collection | |

| AP | Repayment of debt according to the inspection report | |

| AR | Repayment of debt under a writ of execution | |

| IN | Repaying the investment tax credit | |

| TL | Repayment by the founder (participant) of the debtor organization, the owner of the property of the debtor - a unitary enterprise or a third party of debt during bankruptcy | |

| RK | Repayment by the debtor of debt included in the register of creditors' claims during bankruptcy | |

| ST | Repayment of current debts during the specified procedures | |

| Tax period and document number | ||

| Field value 106 “Basis of payment” | The value that must be indicated in field 107 “Tax period indicator” | The value that must be specified in field 108 “Document number” |

| When filling out the field, do not put the “No” sign | ||

| TP, ZD | See table below | 0 |

| TR | The payment deadline established in the request for payment of taxes (fees). Enter the data in the format “DD.MM.YYYY” (for example, “04.09.2017”) | Number of the request for payment of taxes (insurance premium, fees) |

| RS | The date of payment of a portion of the installment tax amount in accordance with the established installment schedule. Enter the data in the format “DD.MM.YYYY” (for example, “04.09.2017”) | Installment decision number |

| FROM | Deferment end date. Enter the data in the format “DD.MM.YYYY” (for example, “04.09.2017”) | Postponement decision number |

| RT | The date of payment of part of the restructured debt in accordance with the restructuring schedule. Enter the data in the format “DD.MM.YYYY” (for example, “04.09.2017”) | Restructuring decision number |

| PB | The date of completion of the procedure used in the bankruptcy case. Enter the data in the format “DD.MM.YYYY” (for example, “04.09.2017”) | Number of the case or material considered by the arbitration court |

| ETC | The date on which the suspension of collection ends. Enter the data in the format “DD.MM.YYYY” (for example, “04.09.2017”) | Number of the decision to suspend collection |

| IN | Date of payment of part of the investment tax credit. Enter the data in the format “DD.MM.YYYY” (for example, “04.09.2017”) | Number of the decision on granting an investment tax credit |

| VU | External management completion date. Enter the data in the format “DD.MM.YYYY” (for example, “04.09.2017”) | Number of the case or material considered by the arbitration court |

| AP | 0 | Inspection report number |

| AR | 0 | Number of the enforcement document and the enforcement proceedings initiated on the basis of it |

| 0 | 0 | 0 |

| Tax period, if the basis of payment is “TP, ZD” | ||

| The value that the field takes | Description | |

| The first two digits of the indicator are intended to determine the frequency of payment of taxes (insurance premiums, fees) established by the legislation on taxes and fees | ||

| MS | Monthly payments | |

| HF | Quarterly payments | |

| PL | Semi-annual payments | |

| GD | Annual payments | |

| In the 4th and 5th digits of the tax period indicator, enter the number: | ||

| from 01 to 12 | Months | |

| from 01 to 04 | Quarter | |

| 01 or 02 | Half-year | |

| In the 3rd and 6th digits of the tax period indicator, put dots as dividing marks | ||

| The year for which the tax is transferred is indicated in 7–10 digits of the tax period indicator | ||

| When paying tax once a year, enter zeros in the 4th and 5th digits of the tax period indicator | ||

| If the annual payment provides for more than one deadline for paying the tax (fee) and specific dates for paying the tax (fee) are established for each deadline, then indicate these dates in the tax period indicator | ||

| For example, the payment frequency indicator is indicated as follows: | ||

| "MS.03.2017"; "KV.01.2017"; "PL.02.2017"; "GD.00.2017" | ||

| Date of payment basis document | ||

| Payment basis code (field 106) | What date is entered in field 109 | |

| TP | date of signing the tax return (calculation) | |

| ZD | «0» | |

| TR | date of the tax authority's request for payment of tax (insurance contribution, fee) | |

| RS | date of decision on installment plan | |

| FROM | date of decision to postpone | |

| RT | date of decision on restructuring | |

| PB | date of the arbitration court's decision to initiate bankruptcy proceedings | |

| ETC | date of decision to suspend collection | |

| AP | date of the decision to prosecute for committing a tax offense or to refuse to prosecute for committing a tax offense | |

| AR | date of the writ of execution and the enforcement proceedings initiated on its basis | |

| IN | date of decision to grant investment tax credit | |

| TL | date of the arbitration court ruling on the satisfaction of the statement of intention to repay the claims against the debtor | |

| Payment order | ||

| Field number | The value that the field takes | Reasons for writing off funds |

| 21 | 3 | When transferring taxes and mandatory insurance contributions (as well as penalties and fines for these payments), the values “3” and “5” can be indicated in field 21 “Payment order”. These values determine the order in which the bank will make payments if there are not enough funds in the organization's account. The value “3” is indicated in payment documents issued by tax inspectorates and branches of extra-budgetary funds during forced debt collection. The value “5” is indicated in payment documents that organizations draw up independently. Thus, other things being equal, orders from organizations to transfer current tax payments will be executed later than requests from regulatory agencies to pay off arrears. This follows from the provisions of paragraph 2 of Article 855 of the Civil Code of the Russian Federation and is confirmed by letter of the Ministry of Finance of Russia dated January 20, 2014 No. 02-03-11/1603 |

| 5 | ||

| Unique Payment Identifier (UPI) | ||

| Props number | Props value | |

| 22 | The “Code” field must contain a unique payment identifier (UPI). This is 20 or 25 characters. The UIP must be reflected in the payment order only if it is established by the recipient of the funds. The values of the UIP must also be communicated to payers by recipients of funds. This is stated in paragraph 1.1 of the Bank of Russia instruction dated July 15, 2013 No. 3025-U. | |

| When paying current taxes, fees, insurance premiums calculated by payers independently, additional identification of payments is not required - the identifiers are KBK, INN, KPP and other details of payment orders. In these cases, it is enough to indicate the value “0” in the “Code” field. Banks are obliged to execute such orders and do not have the right to require filling out the “Code” field if the payer’s TIN is indicated (letter of the Federal Tax Service of Russia dated April 8, 2021 No. ZN-4-1/6133). | ||

| If the payment of taxes, fees, and insurance premiums is made at the request of regulatory agencies, the value of the UIP must be indicated directly in the request issued to the payer. Similar explanations are contained on the official website of the Federal Tax Service of Russia and in the letter of the Federal Tax Service of Russia dated February 21, 2014 No. 17-03-11/14–2337 |