Recognizing future expenses

The main task when accounting for BPR is to differentiate costs between expenses and assets, which are subsequently allocated into a separate object of the same name. Recognition of assets as deferred expenses is determined by its controllability by the company and the possibility of obtaining from it the economic benefits that it will bring if:

- used in the production of products/services for sale independently or together with other assets;

- exchanged for another asset;

- suitable for repaying obligations.

These features serve as a kind of indicator that allows you to attribute costs to BPR as an asset. As a rule, the company forms criteria for such attribution (usually by type/item of costs, taking into account industry characteristics) and is enshrined in the section defining the rules of accounting and accounting policies.

Inventory of "Expense.budget periods"

To account for “expenditure periods,” an inventory of these expenses should be carried out annually.

Inventory of “expenses.budget periods” is a reconciliation of turnover and account balances at the beginning and end of the year with the data of primary documents (accounting certificates for writing off these expenses). The purpose of the inventory is to control the timeliness and correctness of the write-off of “Exp.bud.periods”.

During the inventory, it is necessary to analyze the correctness of attributing production expenses to future expenses, as indicated in paragraph 3.35 of the order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49). If something is purchased that can later be resold or exchanged, then these costs for purchased goods cannot be attributed to “Expenditure of working periods”. Thus, these amounts should be attributed to assets, for example, fixed assets, materials, etc.

Based on the results of the inventory, an inventory act is formed according to “Form No. INV-11”, or the results are entered on an independently developed document.

In the form of the “Balance Sheet” “Expenditure of working periods” according to the lines “1110 – intangible assets”, “1150 – fixed assets”, “1210 – inventories”, “1260 – other current assets”.

What applies to deferred expenses?

PBU defines two types of costs that can be recognized as part of the RBP:

- expenses spent on future construction. For example, materials sent to the construction site;

- licensed software.

In addition, there are specific costs that a company can recognize as a PBU, since none of the PBUs indicate how to account for them, but, logically, they should be written off gradually over a certain time. Such costs, for example, include the following:

- for preparation for work (maintenance of equipment and mechanisms) in seasonal industries;

- to master the production of the latest types of consumer goods;

- for land reclamation;

- for the transfer of company divisions;

- for product certification or compulsory/voluntary health insurance.

Deferred expenses in tax accounting

Tax legislation does not provide for the concept of BPR, but there is a special procedure for recognizing certain costs. For example, such expenses include financing for the development of natural resources, R&D, property insurance, and loss arising from the sale of depreciable assets (Articles 261,262,263,268 of the Tax Code of the Russian Federation).

The Tax Code of the Russian Federation establishes that expenses are recognized as such in the reporting period in which they arise from the terms of agreements or transactions. If the documents confirm that the costs relate to a number of periods, then the payer will have to take them into account when calculating the income tax for the entire specified period.

For example, a one-time payment for the right to use a brand is included in taxable expenses in equal shares for the duration of the license agreement.

If it is impossible to determine the period of occurrence of costs from the terms of the transaction, then the company has the right to independently establish the write-off period, having previously fixed the distribution procedure in the tax section of the accounting policy.

Postings to account 97 “Deferred expenses”

Since RBPs are an asset, the debit of account 97 records the amount of funds spent (for example, to obtain a certificate), and the credit records the write-off of these expenses in a certain time period (for example, the validity period of the document).

Deferred expenses are accounted for in accounting as follows:

- D/t 97 K/t 51 (60) – for the amount of costs accounted for as RBP;

- D/t 20 (26, 44, 91) K/t 97 – for parts written off in each period.

In the balance sheet, RBP are reflected as a separate item on line 1210 “Inventories” or line 1260 as part of other current assets. To confirm the timeliness and correctness of their write-off, companies periodically conduct an audit of deferred expenses , in which they reconcile the amount of turnover and account balances with the information from primary accounting documents.

How are deferred expenses taken into account in 1C 8.3

Step 1. The non-exclusive right to use the software has been registered

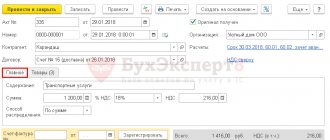

You are recording the non-exclusive right to use the software with posting Dt 97.21 Kt 60, the document “Receipt (act, invoice)”, type of operation “Services”. At the same time, in 1C 8.3 an entry is made in the register “Expenses of the simplified tax system” and the rights accepted for use Dt 012 are reflected in off-balance sheet accounting.

Let's enter the software receipt document:

Next, it is important to correctly fill out the cost account - Other deferred expenses, cost division and Expenses (OU) are accepted:

You also fill out the costs in the BPR directory, where you indicate the total amount, how they are written off and where they are written off, the cost account and the cost item, this is for accounting:

How to reflect deferred expenses in 1C 8.3 is discussed in more detail in our article.

Step 2. Funds are transferred to the supplier

Payment to the supplier is formalized by posting Dt 60.01 Kt 51 with the document “Write-off from the current account.” Select the type of transaction “Other”, indicate account 60.01, counterparty and agreement:

If you indicate “Other write-off” and not “Payment to supplier”, then you can include these expenses in the KUDiR at a time and indicate the amount that will be included in the KUDiR:

If it is necessary that every month expenses be included evenly in KUDiR, as in accounting, then in this case a document “Write-off from the current account” with the type “Payment to supplier” is generated. Then in 1C 8.3 everything will be automatically written off evenly. But under the simplified tax system we have the right to immediately write it off as expenses.

Thus, the amount of costs fell into the expenses of KUDiR:

How to reflect the purchase of a 1C program in the 1C 8.3 Accounting database using an example, read our article.

Step 3. Software costs are evenly included in expenses (accounting)

If you set the transaction type to “Payment to supplier”, then when closing the month, the 1C 8.3 program will, as in accounting, evenly write off account 97, and postings for expenses in KUDiR will be added here according to the same even write-off.

Prepared by the document “Write-off of deferred expenses”:

Postings are generated for monthly write-offs:

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Future expenses under the simplified tax system

Accounting for RBP is usually carried out by companies using OSNO. “Simplers” do not work with account 97. When switching to the simplified tax system, the balances of the RBP amounts (if they exist) are written off in full as expenses and reflected in the KUDiR. However, it is not always possible to take such expenses into account when calculating the single simplified tax. It depends on the moment of payment of these costs. If deferred expenses were paid before the transition to the simplified tax system, then they cannot be taken into account as expenses that reduce the tax base, since only the document paid for in the reporting period is recognized as an expense of a simplified enterprise.

If the company pays for the RBP after the transition to the simplified tax system, then it has the right to take these costs into account as expenses. True, this is only possible when the expenses are listed in Article 346.16 of the Tax Code of the Russian Federation.

Transition from OSN to simplified tax system

The procedure for accounting for expenses applies only to those who will pay a “simplified” tax on the difference between income and expenses. If you have chosen “income” as the object of taxation, then expenses do not matter to you.

Cash method

If you used the cash method of tax accounting under the general regime, then you will not have “transitional” expenses.

Accrual method

With the accrual method, “transitional” costs cannot be avoided.

Costs that arose under the general tax regime, but were already paid under the simplified tax system, are not considered “simplified” expenses. They do not reduce the base for the simplified tax system, which they pay from the difference between income and expenses (clause 5, clause 1, article 346.25 of the Tax Code of the Russian Federation).

Include the costs that you incurred during the “simplification” into expenses (clause 4, clause 1, article 346.25 of the Tax Code of the Russian Federation):

- on the day of implementation (writing off materials for production, selling goods, etc.), if they were paid for on the OSN;

- on the day of payment, if made after expenses have been incurred.

Example.

How to take into account the cost of materials when switching to the simplified tax system . In 2021, Aktiv LLC operated under the general tax regime. From January 1, 2021, the company switched to the simplified tax system. Situation 1 “Asset” purchased and paid for materials worth 100,000 rubles. (VAT exempt) in November 2021. Part of the materials in the amount of 60,000 rubles. written off for production in January 2021. In January 2021, the accountant reduced the company’s taxable income by 60,000 rubles. Situation 2 “Asset” purchased materials worth 100,000 rubles. (VAT exempt) in January 2021. Part of the materials in the amount of 60,000 rubles. written off for production in February, and they were paid in March 2019. In March 2021, the accountant reduced the company’s taxable income by 60,000 rubles.

Future expenses

When the tax regime changes, you may have unwritten off expenses for future periods (account 97). Article 346.25 of the Tax Code does not say anything about the features of the transition period. But that doesn't mean you can't take them into account. “Simplers” can evenly take into account in expenses the cost not written off in the general mode and the paid cost (clause 1 of Article 346.16 of the Tax Code of the Russian Federation, clause 4 of clause 1 of Article 346.25 of the Tax Code of the Russian Federation):

- computer programs and databases purchased under license agreements, as well as updates to them (clause 19 of article 346.16 of the Tax Code of the Russian Federation);

- costs for the preparation and development of new production facilities, workshops and units (clause 21, article 346.16 of the Tax Code of the Russian Federation);

- work carried out unevenly throughout the year to restore or repair fixed assets (clause 3 of article 346.16 of the Tax Code of the Russian Federation).

But, for example, expenses associated with the organized recruitment of employees cannot be taken into account in “simplified” expenses, since they are not on the closed list. It is also impossible to reduce taxable profit on the eve of the abandonment of the OSN.

Reserves

If at the time of the transition to the “simplified” system you have unused reserves (for example, to pay for vacations, repairs of fixed assets, etc.), they need to be written off before the end of the year. After switching to the simplified tax system, you cannot create reserves.

Losses from previous years

In previous years of working under the general tax regime, you may have incurred losses. With “simplification” it will not be possible to take them into account. But this can be done when returning to the general tax regime.