The amount of wages depends on how many days an employee works in a month. If the month is worked in full, then the employee is entitled to a salary in the amount of the established salary. And if he did not work in full for a month, then his wages will need to be calculated. In addition, the salary will also depend on whether the employee worked on weekends or not. In this article we will look in detail at how the company calculates salaries for less than a full month.

When an employee has worked for a full month, he is entitled to a salary, and it does not matter how many working days there were in the month - 17, 18 or even 23. When an employee did not get a job at the organization from the beginning of the month or was on vacation, he does not work for a full month and his salary will depend on how much time the employee worked.

Payroll calculation if an employee just got a job

When hiring an employee not from the first day of the month, for example, in the middle or at the end, salary calculations are carried out in the same way as when calculating for an incomplete month.

Let's take a closer look at the example

Ivanov I.I. I got a job at Continent LLC not from the beginning of the month, but from August 4, 2021. Ivanov’s salary is set at 50,000 rubles. From August 4 to August 31 there are 20 working days. Let’s calculate Ivanov’s salary for the first working month:

50,000 / 23 x 20 = 43,478.26 rubles.

We take 23 to be the number of working days in August according to the production calendar.

Important! An employee's salary is one of the main conditions for cooperation between the employee and the employer. It must be specified in the employment contract with the employee.

How to calculate salary for less than a month

To calculate wages for an incomplete month , find out what the hourly rate for the work done, the daily rate and the monthly salary are. If the wage per hour is fully established, then it is not difficult to calculate the salary for an incomplete month. To do this, you need to multiply the number of hours that the employee worked by the tariff amount per hour. Most likely, an employee who worked part-time cannot count on a bonus, but sometimes such employees are paid. To correctly calculate the bonus, you need to divide its amount by the number of hours of the billing period and multiply by the number of hours that were worked. The salary for less than a full month also depends on the bonus and the regional coefficient. The bonus is calculated based on the days actually worked. The regional coefficient is calculated based on the amount of actual earnings. An income tax of 13 percent is deducted from the entire amount earned.

Sometimes employees themselves want to know how to calculate salaries for less than a month. To do this, you need the amount of your salary per month, and know the number of your working days per month. Divide the amount of your salary by the amount of hours worked, so you will know the amount of your payment for a working day. To find out the amount you earn per hour, you must divide your salary by the number of hours you work in a given month.

If there are holidays at the beginning of the month

There are often situations when an employee gets a job on a day other than the first day of the month, but only because the first days were holidays.

For example, an employee gets a job immediately after the New Year or after the May holidays. He, like other employees, will work the same number of days this month; accordingly, he will receive his salary in full, despite the fact that he did not get a job from the beginning of the month.

Let's take a closer look at an example: (click to expand)

Kolosova N.P. are hired at the beginning of the new year. His first working day is January 9, 2021, since 1 to 8 are public holidays. Kolosov’s salary was assigned 35,000 rubles. Kolosov is entitled to his full salary for January. Despite the fact that he was registered at work only on the 9th, he worked all working days of the month, since the 1st to the 8th were weekends.

However, if a situation arises when an employee writes an application for leave of his own free will from January 9, 2021, the calculation will be different. In this case, the employee is not entitled to a salary, since he has not worked a single day. From January 1 to January 8 there were holidays, and from the 9th to the end of the month he was on vacation.

When is a working month considered not fully worked?

As stated in the Labor Code of the Russian Federation, the generally accepted working hours cannot be more than 40 hours per week. Thus, the norm is a 40 hour week.

If an employee is employed on special grounds specified in the contract, the norm for him changes by agreement of the parties.

According to the above information, it can be considered that any reduction in working hours established in accordance with the legislative framework can be considered part-time work.

Also, a month may not be fully worked for the following reasons:

- the employee was not employed on the 1st day of the current month;

- the employee quit before the end of the pay period;

- there was a vacation, business trip or sick leave in the billing period;

- there were absenteeism and absenteeism for various reasons.

To calculate wages as accurately as possible when working less than a full month, you need to take into account each factor individually, the applied wage system and the regional coefficient.

Formulas for calculating wages

Calculating wages for an incomplete month is a proportional calculation of the number of days worked.

In case of incomplete working of a month, the following formula must be used to calculate salary:

Formula:

Salary = Employee salary / Number of working days in a month * Number of days worked in a month

Note! The employee retains the right to agree with the employer on a reduction in working days per week or reduce the length of the working day.

But, even with mutual consent of the two parties, such a decision must be confirmed by an addition to the employment contract.

How to calculate salary for the month in which there was a vacation or business trip.

Salary examples

To calculate an employee’s salary for an incomplete month worked, you need to know all the necessary data. To do this, consider an organization with a five-day week and an employee I.S. Ivanov, whose salary is 30 thousand rubles.

Method No. 1

Ivanov I.S. went on vacation from January 9 to January 26 of this year. In January, including holidays from January 1 to January 8, there are 17 working days.

From January 27 to January 31 inclusive, Ivanov has 5 working days according to his schedule.

So, in addition to vacation pay, I.S. Ivanov should receive:

30000/17*5=8823.53 rub.

Method No. 2

Ivanov I.S. was on vacation from January 9 to January 31 of the current year inclusive. Thus, for January the employee will receive only vacation pay, and the first eight days of January will not be paid (holiday weekends).

For February, Ivanov will receive his full salary - 30 thousand rubles, provided that he works for a full month.

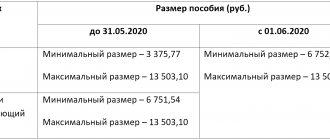

If wage calculations are carried out for an incomplete month, the employer is not obliged to pay the work of its employees less than the minimum wage (minimum wage) established by law.

Therefore, payment for a month not fully worked may be less than the minimum wage, because its amount is taken into account only when calculating payments for a full month worked.

Upon dismissal

Since the employment and dismissal of employees, as well as the calculation of their wages, are regulated by the employment contract, unless otherwise provided, the employer is obliged to pay the dismissed person:

- salary on the day of dismissal;

- compensation for unused vacation (if any);

- severance pay if justified.

At the time of dismissal of an employee, his salary is calculated for the time actually worked.

As established in Article 140 of the Labor Code, final wage payments to an employee upon dismissal must be made no later than the employee’s last day of work (dismissal day).

But, every rule has its exceptions, for example:

- actual absence from work (according to the legislative framework, he retains his position);

- when the employee did not work on the day of dismissal (in this case, payment is made no later than the day following the day the employee submits a request for payment).

Of course, there are situations when the employer and the resigning employee cannot agree on the amount of severance payments.

In such cases, the quitter has every right to file a complaint with the labor inspectorate and file a lawsuit against the employer in court.

Read more about calculating wages upon dismissal.

Example

In the event that an employee decides to quit without working a full month, wages are calculated according to the remuneration system used at the enterprise.

It is also worth taking into account compensation for unused vacation if the employee worked more than 15 days.

Initial data:

As an example, consider employee D.A. Petrov, who quits on April 15th. At the same time, Petrov’s salary is 20 thousand rubles.

Calculation:

If we assume that there are 22 working days in April, then the salary of D.A. Petrov is for less than a month in which the dismissal occurs will be:

20000/22*15=13636.36 rub.

If the employee worked on weekends

Even if an employee did not work fully for the whole month, for example, due to illness, he can work on weekends or holidays. But this does not mean that some days can be replaced by others, that is, if an employee was sick for 3 days and worked on weekends for 3 days in the same month, this will not mean that he worked the entire month. That is, it is impossible to simply pay him the required salary; it is necessary to make a calculation.

Let's take a closer look at an example: (click to expand)

Employee Turkina M.A. in October 2021, I took vacation at my own expense on the 4th, 5th and 6th. At the same time, in October she worked 3 days off – October 14, 21 and 28.

She worked 22 days in October, that is, as much as indicated in the production calendar, but she simply cannot pay the salary. Let’s calculate Turkina’s salary based on the fact that her salary is 30,000 rubles.

Work on weekends in the organization is paid at double the rate.

30,000 / 22 x 19 + 30,000 / 22 x 3 x 2 = 25,909.09 + 8,181.82 = 34,090.91 rubles.

How to correctly calculate wages for an incomplete month with a salary in 2021

In this case, it will be necessary to carry out calculations based on the average wage for one working day and unit of time. In this case, you will need to take into account a large number of different nuances.

The hiring was carried out on September 16, 2014, the salary is 20 thousand rubles. The period was fully worked out - there was no sick leave or vacation for various reasons. Payments for September 2021 amount to 10.4 thousand rubles.

We recommend reading: What subsidies are available to a labor veteran?

Payroll calculation using a piecework payment system

The piecework payment system involves receiving remuneration only for the result of work, and is used where the results are expressed in material equivalent. As a rule, if such a system is used in production, then a daily production rate is established for each employee, for which he receives remuneration.

Salary calculation in this case does not differ for a full and partial month; it takes into account only the quantitative result of work and is made according to the formula:

Monthly salary = Quantity of products produced*unit cost of production

Piecework wages (calculation examples):

A factory worker works on a 5/2 schedule, producing 10 products per day. In September, he missed 5 working days, taking leave without pay, and actually worked 17 days out of 22. For one product, a worker receives 200 rubles. the salary for September will be:

17*10*200 = 34,000 rub.

How to calculate salary for less than a month

How to calculate wages for an incomplete month largely depends on the wage system established at a particular enterprise. You can understand how to calculate your salary for less than a full month by diving a little deeper into local regulations and the basics of accounting.

When using a commission-based pay system, an employee receives a salary that is directly dependent on how much money he makes for the company. Most often, the commission form is used in trading. The employee receives a percentage of the sales he makes, agreed upon upon employment.

We recommend reading: What questions to ask when applying for a job

How to calculate salary for less than a month

It often happens in enterprises that an employee was assigned a certain number of hours in a particular month, but for some reason he did not work for a full month. In this case, wages, wage taxes and the amount of the regional coefficient are calculated from the actual time worked. Calculating the average hourly wage for the work of a given employee is the main thing that needs to be done when calculating wages for a part-time working month.

If wages are set at an hourly rate,

then you need to do the following: multiply the number of hours actually worked in a given billing period by the hourly tariff amount.

Regarding the bonus, it is usually not paid if the working month is not fully worked. If your company is an exception, then the bonus amount must be divided by the number of hours present in the billing period, and then multiplied by the number of hours that were actually worked. 25 Jul 2021 jurist7sib 85

Share this post

- Related Posts

- Can Mutation Testing Be Wrong?

- Time of Commitment of the Offense Coap

- Registering for employment under a civil law contract

- Compensation is paid for unused vacation upon dismissal