Services can be freely alienated by one person to another person - just like things (Articles 128, 129 of the Civil Code of the Russian Federation). The parties to such an agreement are the contractor and the customer of the services.

From the article you will learn:

- how to reflect the implementation of services in 1C;

- how to show income from the sale of services in accounting and financial accounting and what transactions are generated;

- why it is important to indicate the correct product groups and what is needed to automatically fill them in;

- in which lines of income tax and VAT declarations should income from the sale of services be reflected?

- how direct costs are calculated if the organization decides not to calculate the cost of 1 unit of services.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

Implementation of services in 1C - step-by-step instructions

The organization entered into an agreement with the customer Lambriken LLC for the provision of services for the development of an office interior design project in the amount of 826,000 rubles. (including VAT 18%).

Direct costs for providing services amounted to RUB 165,100:

- Salary - 50,000 rubles.

- Insurance premiums - 15,100 rubles.

- Services of third parties - RUB 100,000.

On December 25, the parties signed an act for the provision of services for the development of an office interior design project under contract No. 137.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Sales of services | |||||||

| December 25 | 62.01 | 90.01.1 | 826 000 | 826 000 | 700 000 | Revenue from sales of services | Sales (act, invoice) - Services (act) |

| 90.03 | 68.02 | 126 000 | VAT accrual on revenue | ||||

| Issuance of SF for shipment to the buyer | |||||||

| December 25 | — | — | 826 000 | Issuing SF for shipment | Invoice issued for sales | ||

| — | — | 126 000 | Reflection of VAT in the Sales Book | Sales book report | |||

| Writing off as expenses the actual cost of services provided | |||||||

| 31th of December | 90.02.1 | 20.01 | 165 100 | 165 100 | 165 100 | Writing off as expenses the actual cost of services provided | Closing the month - Closing accounts 20, 23, 25, 26 |

Provision of services - regulatory regulation

The provision of services by one person to another person on a reimbursable basis is recognized as sales (Article 39 of the Tax Code of the Russian Federation). For the purpose of calculating income tax, organizations engaged in the provision of services take into account the income received and expenses incurred related to the provision of services.

Income:

- In the accounting system, revenue from the provision of services refers to income from ordinary activities (clause 5 of PBU 9/99) and is recognized at the time the service is provided (clause 12 of PBU 9/99). It is reflected in the credit of account 90.01.1 “Revenue from activities with the basic taxation system."

- In NU, income is revenue from sales excluding VAT (Clause 1, Article 248 of the Tax Code of the Russian Federation). The date of receipt of income using the accrual method is the date of provision of services (Article 271 of the Tax Code of the Russian Federation).

Expenses:

- In accounting, these are expenses the implementation of which is associated with the provision of services (clause 5, clause 9 of PBU 10/99). The composition of direct costs is determined by the technological process and type of activity. Accounting for services until they are provided is carried out mainly on the cost account 20.01 (Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n). At the time of provision of services, direct costs are written off to the debit of account 90.02.1 “Cost of sales for activities with the main taxation system.”

- In NU, the amount of expenses that reduce sales income includes direct expenses directly related to the provision of these services (clause 1 of Article 253 of the Tax Code of the Russian Federation), subject to economic justification and the availability of supporting accounting documents (Article 252 of the Tax Code of the Russian Federation). Direct expenses may include (Article 320 of the Tax Code of the Russian Federation): Expenses for raw materials and supplies used in the provision of services .

- Remuneration of workers providing services (including insurance premiums).

- Depreciation of fixed assets directly related to the provision of services.

- Other expenses taken into account in the accounting system on account 20.01 “Main production”.

The composition of direct expenses must be fixed in the Accounting Policy.

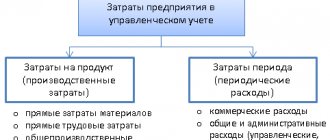

Composition of direct and indirect income tax expenses

The composition of direct and indirect costs depends on whether they are related to production or trading activities. Non-operating expenses do not need to be divided into direct and indirect. This follows from paragraph 1 of Art. 318, art. 320 Tax Code of the Russian Federation.

You determine a specific list of direct expenses based on the conditions of your activities and enshrine them in your accounting policy (clause 1 of Article 318 of the Tax Code of the Russian Federation).

In the production of goods, performance of work, provision of services, direct expenses may include, in particular (clause 1 of Article 318 of the Tax Code of the Russian Federation):

costs of purchasing raw materials and supplies used in production;

expenses for remuneration of personnel employed in the production process, as well as insurance contributions for compulsory social insurance accrued on these amounts;

the amount of accrued depreciation on fixed assets used in the production of goods, works, and services.

Indirect are all expenses that you did not classify as direct and that are not non-operating (clause 1 of Article 318 of the Tax Code of the Russian Federation).

In trading activities, the following categories of expenses are classified as direct expenses (Article 320 of the Tax Code of the Russian Federation):

the cost of purchasing goods sold in the current reporting (tax) period;

costs of delivering purchased goods to the taxpayer-buyer, if these costs are not included in the purchase price of the goods.

All other expenses (except for non-operating expenses) are classified as indirect expenses (Article 320 of the Tax Code of the Russian Federation).

Distribution of indirect costs

Indirect costs include production and sales costs that you did not classify as direct costs. Non-operating expenses are not considered indirect. These conclusions follow from paragraph 1 of Art. 318, art. 320 Tax Code of the Russian Federation.

The composition of indirect costs is determined differently (clause 1 of Article 318, Article 320 of the Tax Code of the Russian Federation):

for activities related to the production of goods (performance of work, provision of services);

for trading activities.

Services in 1C 8.3

In the 1C Accounting 8 3 program, services are documented with the document Sales (act, invoice) transaction type Services (Act) in the section Sales – Sales – Sales (acts, invoices).

If for a service in 1C 8.3 it is necessary to automate the calculation of the cost of 1 unit of services, then you must use the document Provision of production services in the section Production - Production - Provision of production services.

Learn more Sales of production services. Calculation of the cost of 1 unit of services

Providing services in 1C

The header of the document states:

- Agreement - a document according to which settlements are made with the customer. Type of agreement - With the buyer .

In our example, calculations are carried out in rubles, which is noted in 1C in the PDF service agreement. Therefore, in the Sales document (act, invoice) the following sub-accounts are automatically established for settlements with the buyer:

- Account for settlements with the counterparty - 62.01 “Settlements with buyers and customers”.

- Account for accounting of settlements for advances - 62.02 “Settlements for advances received.”

If necessary, accounts for settlements with the buyer can be corrected in the document manually or configured for the automatic insertion of other accounts for settlements with the counterparty.

The tabular part indicates the services being sold from the Nomenclature directory with the Nomenclature Type Service . PDF

- Accounts are filled in the document automatically, depending on the settings in the Item Accounts .

Find out more about setting up item accounting accounts

- Income account - 90.01.1 “Revenue from activities with the main tax system.”

- Expense account - 90.02.1 “Cost of sales for activities with the main tax system.”

- VAT account - 90.03 “Value added tax”.

- Nomenclature groups - a nomenclature group related to the services sold is selected from the Nomenclature Groups directory.

The nomenclature group related to the sale of your own services must be indicated in the Nomenclature groups for the sale of products and services PDF in the Main section - Settings - Taxes and reports - Income Tax tab - link Nomenclature groups for the sale of products and services. The correct completion of the income tax return depends on this setting.

Read more Setting up accounting policies

Provision of services - postings in 1C 8.3

When posting the Sales document (act, invoice), only income from the sale of services is recognized (Dt 62.01 Kt 90.01.1). Recognition of expenses for services provided (Dt 90.02.1 Kt 20.01) is carried out at the Closing of the month.

Services in 1s 8.3 - postings:

- Dt 62.01 Kt 90.01.1 - revenue from the sale of services: in accounting accounting, including VAT;

- in NU excluding VAT.

Documenting

The organization must approve the forms of primary documents, including the document for the sale of services. The following basic forms are used in 1C:

- Certificate of provision of services PDF

- Universal Transfer Document PDF

Forms can be printed by clicking the Print button - Certificate of provision of services and Print - Universal Transfer Document (UDD).

Consider other printed forms of the Implementation document (act, invoice)

Income tax return

In the income tax return, the amount of revenue from the sale of services is reflected as income from sales:

Sheet 02 Appendix No. 1:

- page 010 “Proceeds from sales - total”, including: page 011 “... revenue from the sale of goods (works, services) of own production.” PDF

Collection of expenses for representative services

general information

During the trial, the parties, willy-nilly, have to bear significant expenses, including payment for the services of a representative.

However, the field of jurisprudence is the legal field. And that means there is no place for injustice in it.

Therefore, the right of the winning party to reimbursement of costs incurred during the consideration of the dispute is established at the legislative level.

In accordance with the provisions of paragraph 1 of Article 98 of the Code of Civil Procedure of the Russian Federation,

the party in whose favor the court decision was made, the court awards the other party to reimburse all legal costs incurred in the case.

This means that the party in whose favor the court made a decision has the right to recover the costs incurred from the losing party. Moreover, this right can be used by both the plaintiff and the defendant.

The same article imposes restrictions on the amount of expenses recovered in case of partial satisfaction of claims:

if the claim is partially satisfied, the legal costs specified in this article are awarded to the plaintiff in proportion to the amount of the claims satisfied by the court, and to the defendant in proportion to the part of the claims that were denied to the plaintiff.

However, this article will not talk about the recovery of the entire amount of legal costs, but about compensation specifically for the costs of legal services.

Why should this expense item be considered in such detail? The fact is that other legal expenses (postage, transportation, expenses for expert services, etc.) are reimbursed in full. But with regard to reimbursement of expenses for the services of a representative, judicial practice is sadly unfair - in 90% of cases the judge recovers about a third of the amount spent. What is this connected with?

Issuance of SF for shipment to the buyer

The organization is obliged to issue an invoice within 5 calendar days from the date of shipment and register it in the sales book (clause 3 of article 168 of the Tax Code of the Russian Federation).

You can issue an invoice to the buyer by clicking the Issue an invoice document (act, invoice) . Invoice data is automatically filled in based on the Sales document (act, invoice) .

- Operation type code : “Sales of goods, works, services and operations equivalent to it.”

Documenting

You can print the form of the completed invoice by clicking the button Print the document Invoice issued or the document Sales (act, invoice) . PDF

Sales Book report can be generated from the Reports – VAT – Sales Book section. PDF

VAT declaration

The amount of accrued VAT is reflected in the VAT return:

In Section 3 p. 010 “Implementation (transfer on the territory of the Russian Federation...): PDF

- the amount of sales proceeds, excluding VAT;

- the amount of accrued VAT.

In Section 9 “Information from the sales book”:

- invoice issued, transaction type code "".

Writing off as expenses the actual cost of services provided

If there were no sales of services in the reporting period, then direct costs for them can be taken into account (clause 2 of Article 318 of the Tax Code of the Russian Federation):

- at the time of sale: costs are distributed to the balances of work in progress;

- completely included in the expenses of the reporting period: without distribution to the balances of work in progress.

The chosen method must be fixed in the accounting policy

In 1C, to recognize direct expenses at the time of sale, you must set the following in the Accounting Policy settings: PDF

- Checkbox Perform work, provide services to customers .

- Costs are written off - Taking into account all revenue .

When providing services, direct costs are recorded in different documents depending on the type of costs, for example:

- Document Payroll PDF - to reflect labor costs (insurance contributions) of employees providing the service.

- Document Receipt (act, invoice) transaction type Services (act) PDF - to reflect expenses for services provided by third parties.

In order for costs to be taken into account when calculating the cost of services, they must be reflected in the same product group as sales.

Direct costs will be taken into account in the cost of services in the month of their implementation (December) when performing the operation Closing accounts 20, 23, 25,26 of the Month Closing procedure in the Operations – Period Closing – Month Closing section.

Postings according to the document

The document generates the posting:

- Dt 90.02.1 Kt 20.01 - writing off as expenses the actual cost of services provided.

Control

In November, for the Interior Design Project , costs were taken into account in the amount of:

- Salary - 25,000 rubles.

- Insurance premiums (including from NS and PZ) - 7,550 rubles.

- Services of third parties - RUB 100,000.

- Total for the month - 132,550 rubles.

Since the accounting policy establishes that direct costs are taken into account at the time of sale, at the end of November direct costs for services provided will remain in the balance in account 20.01 “Main production”. PDF.

In December, for the Interior Design Project , direct costs for services provided were also taken into account in the amount of:

- Salary - 25,000 rubles.

- Insurance premiums (including from NS and PZ) - 7,550 rubles.

- Total for the month - 32,550 rubles.

Let's generate a report Analysis of invoice 20.01 “Main production” for December for the product group Interior design project in the section Reports – Standard reports – Invoice analysis.

The report shows that according to the nomenclature group Interior Design Project :

- at the beginning of the month there was unfinished production of services - 132,550 rubles.

- at the end of the month all direct costs in the amount of 165,100 rubles. were written off as cost of services sold.

Income tax return

In the income tax return, the cost of services sold is reflected as direct expenses:

Sheet 02 Appendix No. 2:

- page 010 “Direct costs related to goods sold (work, services).” PDF

Test yourself! Take a test on this topic using the link >>

How to take into account direct and indirect costs in production

You take into account direct and indirect costs associated with production and sales in different ways (clause 2 of Article 318 of the Tax Code of the Russian Federation).

Direct production costs

You determine the composition of direct costs in the production of goods (performing work, providing services) yourself, taking into account the specifics of your production, based on the requirements of paragraph 1 of Art. 318 Tax Code of the Russian Federation.

You can recognize as expenses of the current period only those direct expenses that are attributable to products sold in this period. To do this, it is necessary to distribute direct costs related to sold products, work in progress (WIP), balances of finished products in the warehouse and balances of shipped but not sold products (clause 2 of Article 318, Article 319 of the Tax Code of the Russian Federation). The procedure for accounting for direct costs when performing work and providing services has some features.

Composition of direct production costs

Direct costs for production and sales include, in particular (clause 1 of Article 318 of the Tax Code of the Russian Federation):

expenses for the purchase of raw materials and supplies used in production (clause 1, clause 1, article 254 of the Tax Code of the Russian Federation);

expenses for the purchase of components and semi-finished products specified in paragraphs. 4 paragraphs 1 art. 254 Tax Code of the Russian Federation;

expenses for remuneration of personnel who are employed in the production process, as well as insurance premiums accrued on these amounts for compulsory medical insurance, compulsory medical insurance and VNiM, insurance premiums against accidents;

the amount of accrued depreciation on fixed assets used in production.

You determine the specific composition of direct expenses yourself based on the specifics of your activities and fix it in your accounting policy (clause 1 of Article 318 of the Tax Code of the Russian Federation).

Important: when determining the composition of direct expenses, keep in mind that your choice must be justified. That is, the procedure for attributing costs to direct expenses must contain economically sound indicators and take into account the features of the technological process (Letters of the Ministry of Finance of Russia dated 09/05/2018 N 03-03-06/1/63428, dated 03/13/2017 N 03-03-06/1/ 13785, dated 05/19/2014 N 03-03-РЗ/23603, Federal Tax Service of Russia dated 02/24/2011 N KE-4-3/).

How are direct costs distributed?

direct costs in the production of products (clause 2 of article 318, article 319 of the Tax Code of the Russian Federation):

on expenses that arise from products sold in the current reporting (tax) period;

work in progress (WIP);

balances of finished products in the warehouse;

remnants of shipped but unsold products.

You can take into account in the expenses of the current reporting (tax) period only those direct expenses that are attributable to products sold in this period (clause 2 of Article 318 of the Tax Code of the Russian Federation).

Direct costs for performing work are allocated only to those related to completed work and work in progress (clause 1 of Article 319 of the Tax Code of the Russian Federation).

pay direct costs for the provision of services at your choice (clause 2 of Article 318, clause 1 of Article 319 of the Tax Code of the Russian Federation):

or distribute among those related to sold services and work in progress,

or not distribute at all, but recognize in full in the period when they are implemented.

You determine the procedure for distributing direct costs for work in progress and for products manufactured in the current month (work performed, services rendered). This procedure must be enshrined in the accounting policy (clause 1 of Article 319 of the Tax Code of the Russian Federation).

Indirect production costs

Indirect expenses include expenses that were not included in direct or non-operating expenses (clause 1 of Article 318 of the Tax Code of the Russian Federation).

For example, indirect costs include the cost of wages for management personnel, as well as employees of departments not directly involved in production.

There is no need to list indirect costs in the accounting policy: production and sales costs that you did not indicate as direct costs will be classified as indirect costs (clause 2 of Article 318 of the Tax Code of the Russian Federation).

Indirect expenses are written off immediately in the period to which they relate; there is no need to wait for the sale of products (clause 2 of Article 318 of the Tax Code of the Russian Federation). Therefore, for the fastest write-off, it is more convenient to classify expenses as indirect. But this should not be abused. The distribution of costs into direct and indirect must be economically justified and take into account the specifics of the technological process. Classify expenses as indirect only when there is no real possibility of classifying them as direct (Letters of the Ministry of Finance of Russia dated 09/05/2018 N 03-03-06/1/63428, dated 03/13/2017 N 03-03-06/1/13785, dated 19.05 .2014 N 03-03-РЗ/23603, Federal Tax Service of Russia dated 02/24/2011 N KE-4-3/).

Can costs for third party services be classified as indirect?

We believe that it is risky to classify as indirect costs those services of third-party organizations that are part of your technological process and (or) they can be correlated with specific production results.

In this case, we are guided by a general principle: expenses can be classified as indirect only if there is no real possibility of classifying these expenses as direct. This conclusion can be drawn from the analysis of Art. Art. 318, 319 Tax Code of the Russian Federation. This position is also shared by the Russian Ministry of Finance (see Letters dated 09/05/2018 N 03-03-06/1/63428, dated 03/13/2017 N 03-03-06/1/13785, dated 05/19/2014 N 03-03-РЗ /23603), and the Federal Tax Service of Russia (Letter dated February 24, 2011 N KE-4-3/).