Where is salary information required?

Salary certificate is a document that contains information about an employee’s accruals for a certain period of time, as well as information about the length of work experience, position and information about the employer.

There are quite a few situations in which information about the average salary may be required, for example:

- filling out an application for a loan, loan or loan;

- when registering with the employment center;

- to obtain a visa of a foreign country;

- registration of social benefits and insurance payments (pensions and sick leave);

- litigation and disputes;

- receiving subsidies established by law.

Please note that for each case a different form of certificate of average earnings can be used. Any employee, even those fired, has the right to receive an official document. Moreover, the employer is obliged to issue information about wages within three days from the date of application on the basis of Art. 62 Labor Code of the Russian Federation. Below you will find a sample of filling out a certificate of average earnings for each specific case.

Calculation of average earnings for the Employment Center: formula and examples

Average earnings for an employment center calculation in Excel

A certificate of average earnings for the employment center is submitted in any form (there is no approved form). As a general rule, three months are taken as the billing period. Only those payments provided for in employment contracts are taken into account. How to calculate average earnings for a job center in Excel?

For the calculation, payments are taken for the 3 calendar months preceding the dismissal. If an employee was fired on October 10, 2015, then for the calculation we take the time from July 1 to September 30 of the same year.

The following periods are excluded from the calculation:

- business trip days, paid vacation and other periods when the employee was paid at average rates;

- days when the person was on sick leave or on parental leave;

- when an employee was released from work for any reason, with or without salary.

- The three months preceding dismissal consist only of excluded days - the next 3 calendar months with days worked are taken.

- The employee has not even worked for a month at the enterprise - days worked are taken from the first day until the day of dismissal.

Data for determining the boundaries of the billing period are taken from the personnel department (date of acceptance, dismissal, time sheet) and accounting department.

All types of payments related to wages. Social and other payments cannot be included:

- cheaper food,

- reimbursement of transportation costs, communication services;

- vacation pay;

- business trips;

- payment for sick leave, additional days off for mothers of disabled children, etc.

Features of bonus accounting:

- Monthly – in full, one for each indicator. If, for example, two premiums are awarded for the maximum number of concluded contracts, then only the one with the largest amount is included in the calculation.

- Quarterly and semi-annual – in the amount of a monthly part. One for each indicator.

- Annual (for the calendar year preceding dismissal) – in the amount of ? for each indicator (even if the employee received the money not in the billing period).

If the period for calculating the average salary was less than three months or there were excluded days, monthly bonuses are included in the calculation as usual. All others - in an amount proportional to the time worked. Calculation formula:

Bonus amount for calculation = bonus accrued in the billing months / number of working days in the period for calculation (according to the schedule) * actual number of days worked.

Indexation of payments

If there was a salary increase in the analyzed three-month period or after it, but before the date of dismissal, all payments must be indexed to calculate average earnings:

- If the salary increased in the analyzed months, the payments involved in the calculation of average earnings in those months that preceded the salary increase are indexed. For example, a person quit in mid-February. And from January 1, salaries were increased. Payments for November and December are indexed.

- If the administration increased the salary after the billing period, the average salary is indexed. The employee quit in mid-January. The salary increase is from January 1. Average earnings for three months of the billing period are indexed.

Formula for calculating the increase factor:

“new” salary size / “old” salary size.

How to calculate average earnings for an employment center

SZ = BB / CHOD * (NBR / 3).

- SZ – average earnings;

- ВВ – all payments included in the calculation;

- CHOD – number of days worked;

- NWD – number of working days (according to the enterprise’s work schedule);

- 3 is the number of calendar months preceding the dismissal.

Calculation of average earnings for the Employment Center: formula and examples

Not everyone and not always manages to find a job right away. That’s why job seekers go to the Employment Center: some in the hope that they will help them find a job, while others need benefits from the state while they are searching.

For registration actions, exchange employees require the submission of a documentary package , which includes a certificate from the accounting department about the applicant’s average earnings during the last three months of employment.

The amount of future benefits for the unemployed depends on this indicator. But to get it, you will need to clarify several calculation operations :

- size of the billing period;

- accruals paid and included in the calculation formula;

- how to determine the average salary if it all consists of one month;

- where to include bonuses;

- the procedure for calculating the average salary for various fluctuations in the monthly salary and the occurrence of additional payments with allowances.

Lawmakers have made recommendations regarding a reference form that will accompany a former financial services employee to his last job if he files a petition to that effect. An unemployed citizen will need a document of this type to register with the Employment Center and calculate future payments.

Billing period

A retired employee needs to know that when determining the period included in the certificate, the following days :

- spent on treatment, included in the sick leave, maternity period and vacation pay for women, which they spent caring for children;

- regular, educational and unpaid leaves;

- designed to care for children with disabilities or illnesses;

- previously worked, for which the employer gave time off;

- business trips;

- strikes, even if the employee is not a participant, but did not start work at that time.

Although absenteeism and strikes can be allocated if the applicant so desires, it will not add funds. When starting to calculate the average salary, the financier takes into account all accrued money with the exception of the period that is included in the list presented above.

What is included and what is excluded

Since the billing period includes only the last calendar months, three of which precede the dismissal, when calculating average earnings, the following values must be sampled :

- accrued earnings in accordance with the wage regulations of this enterprise;

- bonuses paid in each billing month;

- proportional amount of quarterly bonuses;

- annual, one-time remunerations that do not depend on the month in which calculations and payments were made (the sample is taken from the year preceding the dismissal, distributed in one part per month, dividing the total amount by 12);

- incomplete completion of the billing period allows the financier to divide bonuses (this does not include monthly ones, only length of service or one-time bonuses) by the time actually spent.

The following income is not included in the calculation:

- received from social benefits, anniversary bonuses, financial assistance;

- payments made from Social Insurance Fund accounts;

- vacation pay and compensation;

- payments for downtime when it is established that employers are at fault.

It should be taken into account that if, when conducting a sample, it turns out that the last three months contain the above cases and, according to legislative provisions, they must be excluded from the calculations, the accountant will take the period preceding them, fully worked out.

When there is not the required number of days in the time period, they choose the salary from the first day of employment, including the last shift worked.

Features of calculations with examples for central locking, based on the parameters of various production cases

First of all, the accountant needs to decide in practice on the period that covers the salary required for the sample.

For employee Sidorov K.P. an order was received to dismiss him effective November 16, 2021. The report card notes that he worked on 11/15/16 inclusive. This means that entire months worked are counted in reverse order, from August 1 to October 31.

To determine average earnings, use the formula:

S = V / Od * Rd / 3, where

S - the amount of the average salary, V - a sample of all payments, Od - days actually worked, Rd - the period for which you need to work according to the work schedule, 3 - the number of months worked.

Using three different examples, a practical calculation will show the following values.

Still the same Sidorov K.P. worked at the company for several years, while:

- working days according to schedule and actually worked are 63;

- payments collected from the amounts included in the calculation represent 90,500 rubles;

- average salary of 30,166.67 rubles.

90,500 / 63 * 63 / 3 = 30,166.67 rubles.

Ivanov M.I. After submitting an application for pay, I found out that he had not worked at the company for three months. He was fired on March 31, 2015, and hired on the 1st of the same month, during which time he was paid 25,000 rubles.

The average salary will be equal to the same value, provided that the citizen has worked days that coincide with the number according to the schedule.

Citizen Prikhodko I.I. The digital parameters included in the calculation are as follows:

- according to the schedule of days 62;

- in fact, Prikhodko was present at work for 48 shifts;

- earned money in the amount of 96,700 rubles;

- The average salary is 41,634.72 rubles.

96,700 / 48 * 62 / 3 = 41,634.72 rubles.

There are more complex examples with the need to establish a summarized accounting of the time period worked.

You will need to determine the average hourly earnings using the formula:

Sch = Zf / Kch Sz = Sch * Srch, where

Sch - average payment per hour, Zf - selected earnings included in the calculation period, Sz - average salary, Srch - working hours, on average according to the work schedule, this value is influenced by the length of the week in each month, Kch - hours worked.

Calculation of average earnings for an employment center: formula, rules, sample

Finance August 1, 2017

Any Russian citizen may find himself in unemployed status. No one is immune from dismissal due to staff reduction as a result of the liquidation of an enterprise or position, from dismissal by agreement of the parties due to changes in working conditions or disagreements with management, or simply when changing jobs on one’s own initiative.

A temporarily unemployed citizen can register at the employment center not only to find a new job, but also to receive cash benefits.

To obtain unemployed status and apply for benefits, you will need a number of documents, of which the main one, which determines the amount of monthly payments, is a certificate calculating the average earnings for the employment center.

Where to get a certificate from the employment center

Upon dismissal of an employee, the employer issues:

- work book;

- 2NDFL certificate;

- certificate 182n.

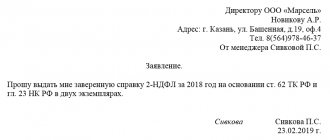

Upon a written application from a former employee, the employer is obliged, within three days, to issue any certificates and certified copies of documents that determined his relationship with the applicant.

Thus, in order to obtain a certificate calculating the average earnings for an employment center, a citizen should submit an application to his former employer.

The application form can be arbitrary. A sample is presented below.

Help to the employment center: basic details

The current legislative acts do not establish a single form for a certificate of average earnings for three months. It is necessary to apply for benefits for the unemployed.

Employers have the right to draw up a document in any form, and the salary certificate, a sample of which is given below, must contain the following data:

- name of the company (organization, enterprise);

- address (legal and actual);

- TIN of the organization (enterprise);

- Full name (of the person to whom the certificate is issued);

- period of work in this organization;

- data for calculating average monthly earnings.

The certificate is endorsed by the manager and chief accountant, and sealed for financial documents.

Filling out the document is allowed in the same handwriting and ink of the same color; corrections in the certificate are certified in the prescribed manner and sealed.

Some employment centers offer their own certificate forms to fill out.

Employment center forms are issued to applicants to provide their former employers with information on average earnings to fill out.

Below is a sample free form certificate.

Documents upon dismissal

For all resigning employees, regardless of the reason for termination of employment, the employer is required to provide the following documentation:

| Mandatory | On request |

|

|

IMPORTANT!

Generate information about your salary in a unified document form approved by Order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n. Information in form No. 182n is generated for the period worked in the current year, as well as for the two previous calendar years.

Sample of filling out a certificate of average earnings

When an employee retires, another document may be required, for example, a certificate of average earnings for the Pension Fund. This form indicates not only the amount of accrued wages, but also the amount of insurance contributions made by the employer to the insured person (employee). Information is generated for the entire period of employment. Based on this document, representatives of the Pension Fund calculate the amount of the insurance pension.

What items must be completed in the certificate?

The certificate form was recommended by the Ministry of Labor in letter No. 16-5/B-421 dated August 15, 2016. However, the text of the document contains a clarification that if the certificate is not issued in the specified form, but contains all the necessary details, there are no grounds for refusing to accept it.

Therefore, it is important to comply with the conditions for the availability of the necessary information and follow the rules for filling it out.

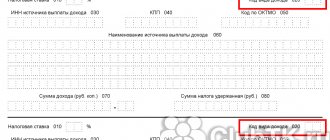

The certificate for the employment service must be filled out on the organization's letterhead or A4 sheet, where the employer's stamp with its full name is affixed in the upper left corner. The document must contain the following information:

- TIN of the employer who issued the certificate;

- OKVED organization;

- Full name of the citizen at whose request the certificate is issued;

- the period of work of the citizen in this organization (start and end date);

- full name of the company or full name of the individual entrepreneur;

- working conditions are filled in in the corresponding lines of a full or part-time working day or week (number of hours of the working day and days of the working week);

- if the employee worked part-time or a week, the article of labor legislation on the basis of which such work mode was applied should be clarified below;

- average earnings based on the last three calendar months of work in numbers and words;

- documents that served as the basis for calculating average earnings (employee personal accounts and other payment documents);

- signatures of the head of the company and the chief accountant with a transcript;

- date of completion and contact telephone number;

- seal of the organization (if available).

If there are periods that were not taken into account in the calculation, they must be listed in the certificate, indicating the beginning, end and reason for not being included.

This is important to know: Appeal against a court decision: deadline and procedure for filing, sample 2021

Data for the employment center

A resigned employee, in addition to the documentation required by law, may need a certificate from the Central Labor Office regarding average earnings. The information is necessary for the employees of the Central Employment Service to calculate and assign unemployment benefits (clause 2, article 3 of the Federal Law of April 19, 1991 No. 1032-1). To prepare information, use the unified form approved in Letter of the Ministry of Labor dated August 15, 2016 No. 16-5/B-421. But providing another form containing all the necessary details will not be considered a violation.

The procedure for calculating and assigning state unemployment benefits is enshrined in Resolution of the Ministry of Labor dated August 12, 2003 No. 62.

Accounting in 1C

On April 13, employee A.P. Vorobiev was dismissed from the Organization.

In the billing period (January - March):

- accrued: wages - 77,000 rubles;

- vacation pay - 10,000 rubles;

- financial assistance - 5,000 rubles;

- employee worked - 47 days;

- a total of 55 working days according to the production calendar.

Step 1. Generate a certificate for receiving unemployment benefits from the document Dismissal by clicking the Print button - Certificate for unemployment benefits (section Salaries and Personnel - Personnel Documents - button Create - Dismissal).

The certificate is filled in with data automatically, including the average earnings calculated by the program.

Step 2. The 1C Accounting program does not take into account manual adjustments in Payroll documents (manually entered accruals, changes to hours worked, etc.). Therefore, check the calculation made by the program using the formula:

To get data for calculation, use the Salary Analysis Report to calculate average earnings

Calculation according to our example:

- 77,000 / 47 *(55 / 3) = 30,035.46 rubles. (vacation pay and financial assistance are not taken into account in the calculation).

Step 3. If the amount calculated outside of 1C does not coincide with that specified in the program, correct it manually in the help by turning on the editing mode.

Fill in the required information:

Print out the certificate, certify it with a seal and signatures, and give it to the employee:

- Certificate for unemployment benefits - sample. PDF

Information for credit institutions

Most banking organizations providing loans, installment plans and financial loans have abandoned individual forms in favor of 2-NDFL. Why? Tax form KND 1151078 contains all the necessary details and data not only about the individual and his income, but also about his employer. Moreover, administrative liability and fines are provided for errors and inaccuracies in the tax document.

Please note that officials have developed and approved a new reporting structure in form 2-NDFL, according to Order of the Federal Tax Service of Russia dated 10/02/2018 No. ММВ-7-11/ [email protected] Now two forms are filled out: one for the tax inspectorate, and the second for for an employee. To provide information to the bank, for example, to obtain a mortgage or consumer loan, use the new 2-NDFL form (for an employee).

We apply for a visa, social benefits or subsidies

To obtain a visa to enter a foreign country, representatives of a foreign embassy require confirmation of the citizen’s official employment. Some representatives of European countries also prefer 2-NDFL, explaining this by the fact that the tax form KND 1151078 is documentary evidence of employment, and a certificate of average earnings for a visa can be easily falsified.

To receive social benefits and other financial assistance, for example, social protection authorities will also require confirmation of average income. This is necessary to establish preferential status for the applying citizen.

The certificate of average earnings for social security (sample) does not have a unified form and is compiled in any order. When generating information, please provide the required details:

- name of the organization, its registration and contact details;

- last name, first name and patronymic (if any) of the employee, position;

- information on accruals with a monthly breakdown.

The paperwork for receiving subsidies is prepared in a similar way.

Certificate of average daily earnings for the court, sample

You may be required to confirm your income and other receipts in court. For example, when assigning alimony, when considering a case of causing material damage or in violation of the Labor Code. The need to provide data is determined by the prosecutor or lawyer. Fill out the document in accordance with Art. 139 Labor Code of the Russian Federation.

How to fill out sick leave and benefits from a previous job

A certificate of average earnings for sick leave (sample form No. 182n) must be provided to the employee on the day of his dismissal or on the last working day, and it is mandatory. The document is required to be provided at a new place of work in order to take into account insurance periods and accrued earnings in the calculation of benefits for temporary disability and in connection with maternity.

IMPORTANT!

If an employee provided Form 182n from his previous place of work after the assignment and payment of benefits, the employer is obliged to recalculate. Such rules apply to all benefits paid within three years at a new place of work preceding the day the document was provided.

Calculation procedure

The procedure for calculating the average wage for unemployment benefits was approved by the Ministry of Labor in a separate document, and is reflected in the Appendix to the Resolution of the Ministry of Labor of the Russian Federation No. 62 of August 12, 2003. It is in many ways similar to the scheme for calculating travel allowances, vacation pay and other payments calculated taking into account average earnings, but still has some differences.

This is important to know: How to remove the encumbrance after paying off the mortgage

Thus, for the employment service, average earnings are calculated for the last 3 months of work preceding the month of dismissal (as opposed to 12 months taken into account in other cases). The calculation includes all types of payments provided for by the remuneration system, incl. it includes (clause 2 of the Procedure):

salary (including those paid in kind),

various coefficients, bonuses and additional payments (regional, under special working conditions, for length of service, combining positions, etc.),

bonuses, remunerations, including annual and one-time ones for length of service,

royalties, royalties (to employees of creative organizations, media),

other employee benefits accepted by the company.

The periods specified in clause 4 of the Procedure are not included in the calculation, including the time when:

the employee retained his average salary,

the employee was paid benefits (sick leave or maternity leave),

the employee was idle due to the fault of the employer (or for other reasons beyond the control of the parties),

additional paid days off were used to care for a disabled child,

the employee could not work due to the strike, although he did not participate in it,

the employee was released from work (with or without preservation of earnings),

When working on a rotational basis, time off was provided for overtime, as well as in other cases provided for by law.

If the employee did not have accrued earnings in the billing period, or the entire period consists of excluded days, the previous three-month period in which the accruals were taken is taken for the calculation. When there was no earnings in previous periods, the average earnings are calculated from the actual salary for the days worked in the month in which the employee was fired.

First, the employee’s average daily earnings are determined by dividing the amount of payments by the days worked in the billing period. The result obtained is multiplied by the average monthly number of working days in the same period. The result will be the average earnings for 3 months, reflected in the certificate.