Documenting

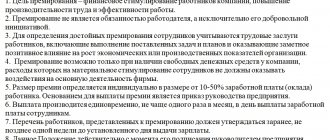

An organization may provide for the payment of one-time bonuses in its internal documents:

- employment contract (paragraph 5, part 2, article 57 of the Labor Code of the Russian Federation);

- collective agreement (part 2 of article 135 of the Labor Code of the Russian Federation);

- in a separate local document of the organization (Regulations on remuneration, Regulations on bonuses, etc.) (Part 2 of Article 135, Article 8 of the Labor Code of the Russian Federation).

In this case, a one-time bonus may be an integral part of the remuneration system. Accordingly, one-time bonuses for production results can be taken into account when calculating average earnings.

However, one-time bonuses may not be part of the organization’s remuneration system and are assigned only by order (order) of the manager.

The basis for the accrual of any one-time bonus is the manager’s order to reward an employee (Form No. T-11) or a group of employees (Form No. T-11a). The order is signed by the head of the organization. The employee (employees) must be familiarized with the order against signature (Section 1 of the instructions approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1).

The concept of the thirteenth salary

In many companies there is such a thing as the thirteenth salary. It is paid at the end of the year as an incentive to employees if the necessary funds are available in the wage fund. It is a one-time payment, since the head of the company cannot be sure that at the end of the year there will be enough money left in the fund to transfer the thirteenth salary to all employees of the enterprise.

The legislation does not contain information on how this bonus should be correctly transferred to hired specialists. Therefore, company managers pay it to their employees only if they have the desire and the appropriate financial capabilities. The company's accountant cannot make such a payment as a monthly salary, so it is only an addition to earnings.

In many companies, the thirteenth salary is fixed in internal regulatory documentation. The employer determines exactly when funds are transferred to employees, as well as what the payment procedure is. Most often, this information is included in the bonus regulations. If such a payment is issued as a one-time bonus, then the head of the company can independently select the employees to whom the funds will be transferred.

Accounting

The procedure for reflecting one-time bonuses in accounting depends on the sources from which they are paid:

- due to expenses for ordinary activities;

- at the expense of other expenses;

- due to net profit;

- due to the formation of the cost of fixed assets.

As a rule, in accounting, bonuses accrued for labor performance are classified as expenses for ordinary activities (clauses 5 and 7 of PBU 10/99). Record the accrual of such bonuses as follows:

Debit 20 (08, 23, 25, 26, 29, 44) Credit 70

– the bonus is accrued at the expense of expenses for ordinary activities (the bonus is included in the cost of the fixed asset).

Non-production one-time bonuses (for anniversaries, holidays, etc.) are classified as other expenses in accounting (clause 11 of PBU 10/99). Reflect their accrual as follows:

Debit 91-2 Credit 70

– the bonus is accrued at the expense of other expenses.

If the source of payment of bonuses (both production and non-production) is retained (net) profit, make the following entry:

Debit 84 Credit 70

– the bonus is accrued at the expense of net profit.

This procedure follows from the Instructions for the chart of accounts (account 70).

When is an order on bonuses for employees issued?

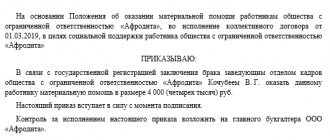

An order is considered an administrative document, which can be issued only after a written statement from the manager. Article 57 of the Labor Code of the Russian Federation provides for mandatory bonuses for employees. This article comes into effect if an employment contract was concluded between the employer and employee. Today, the order for a monthly bonus is considered the most relevant.

The grounds for issuing this decree are divided into 3 groups:

- Outstanding achievements at work - exceeding the monthly plan, working overtime, working on weekends or holidays, etc.;

- Holidays - bonuses on the occasion of an employee’s anniversary, retirement, international holidays, such as International Women’s Day and Defender of the Fatherland Day;

- Special conditions specified in the employment contract - this clause provides for the opportunity for the employee to independently agree with the director on bonuses in specific situations.

Types of orders for bonuses for employees

1. According to the scope of the notification:

- Drawing up instructions for a whole group of employees;

- Drawing up orders for one employee.

2. According to the systematic design:

- Regulatory;

- Unplanned.

3. Reasons for reward:

- Industrial - for outstanding achievements in production, exceeding the established norm;

- Cooperation - for regular and active participation in the social life of the company;

- Holidays - anniversaries, international holidays, birthdays, etc.

Personal income tax and insurance premiums

Regardless of the taxation system that the organization uses, personal income tax must be withheld from the entire premium amount (subclauses 6 and 10, clause 1, article 208 of the Tax Code of the Russian Federation).

Situation: in what month should the amounts of one-time bonuses be included in the personal income tax base: in the month of accrual or in the month of payment?

The calculation of personal income tax depends on whether the bonus is industrial or not.

Non-production one-time bonuses (for example, for an anniversary, a holiday) are not part of the salary and, therefore, do not relate to labor costs. Therefore, include their amount in the personal income tax tax base of the month in which they were paid (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

The calculation of personal income tax on one-time production bonuses, in turn, depends on the period for which they are accrued:

- month;

- quarter;

- year;

- upon the occurrence of a specific event (for example, a one-time bonus for the successful completion of a project). One-time production bonuses paid upon the occurrence of a specific event should be included in the personal income tax tax base at the time of payment to the employee (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

For the amount of a one-time bonus for labor performance, add:

- contributions for compulsory pension (social, medical) insurance (Part 1, Article 7 of Law No. 212-FZ of July 24, 2009);

- contributions for insurance against accidents and occupational diseases (clause 1 of article 20.1 of the Law of July 24, 1998 No. 125-FZ).

This rule applies regardless of whether the bonus is provided for in the employment contract or not (letter of the Ministry of Health and Social Development of Russia dated August 12, 2010 No. 2622-19).

Situation: is it necessary to charge insurance premiums for the amount of one-time bonuses that were given to employees for an anniversary or holiday? That is, these payments are not related to labor performance.

Answer: yes, it is necessary.

According to the general rules, insurance premiums are subject to all payments that the employer accrues within the framework of labor relations (Part 1, Article 7 of the Law of July 24, 2009 No. 212-FZ, Clause 1 of Article 20.1 of the Law of July 24, 1998 No. 125-FZ). And since bonuses are awarded to employees (i.e., people with whom the organization has entered into employment contracts), then we can consider that these are payments within the framework of labor relations (Article 16 of the Labor Code of the Russian Federation).

In addition, one-time bonuses are not named in the closed lists of payments that are exempt from:

- contributions for compulsory pension (social, medical) insurance (Article 9 of the Law of July 24, 2009 No. 212-FZ);

- contributions for insurance against accidents and occupational diseases (Article 20.2 of the Law of July 24, 1998 No. 125-FZ).

Thus, insurance premiums must be calculated on the amounts of one-time premiums. It does not matter for what reason the bonus is paid - for achieving certain labor results or in connection with some event (anniversary, holiday, etc.).

This approach is also confirmed by arbitration practice (see, for example, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 25, 2013 No. 215/13, Resolution of the FAS Volga District dated March 6, 2012 No. A12-10291/2011).

Advice: if you are ready to argue with inspectors, then insurance premiums for one-time bonuses that are not related to work performance may not be charged.

The following argument will help in the dispute.

Bonuses for an anniversary (holiday, etc.) cannot be considered paid within the framework of labor relations. And therefore there is no reason to charge insurance premiums. It is explained this way.

The mere fact that there is an employment relationship between employees and the organization does not indicate that all payments accrued to employees represent payment for their labor. Thus, one-time bonuses paid for an anniversary, holiday, etc. do not depend on the employee’s qualifications, complexity, quantity, quality and conditions of the work he performs. And accordingly, they are not remuneration for labor and an element of remuneration. If so, then they cannot be recognized as paid within the framework of the labor relationship.

There are examples of court decisions confirming this approach (see, for example, decisions of the Federal Antimonopoly Service of the North-Western District dated September 20, 2013 No. A66-15138/2012, Central District dated November 6, 2012 No. A64-1493/2012).

At the same time, given the ambiguity of arbitration practice, it is difficult to predict the outcome of litigation on this issue. Judges can side with both the organization and the inspectors.

The amount of the one-time bonus is included in the tax base for personal income tax (subclause 6, clause 1, article 208 of the Tax Code of the Russian Federation).

Order for a bonus for an office driver

All received notes are analyzed, edited and summarized, after which the final decision is made on whom to award and for what amount.

Full or partial deprivation of the bonus is made for the period in which the omission in work was committed, and is formalized by order of the employer with the obligatory indication of the reasons.

Bonuses for the Company's drivers are provided subject to the availability of available funds, which can be spent on material incentives without prejudice to the Company's core activities. 3.2.

Organizational in nature – i.e. awards for successful preparation and implementation of certain events in the interests of the company.

Income tax: general procedure

One-time bonuses are taken into account when calculating income tax if two conditions are simultaneously met:

- bonuses are provided for in the labor and (or) collective agreement, as well as local acts (paragraph 1 of article 255 and paragraph 21 of article 270 of the Tax Code of the Russian Federation);

- bonuses relate to incentive payments and depend on labor indicators (work experience, official salary or production results) (clause 2 of article 255 of the Tax Code of the Russian Federation).

This position is confirmed by the Ministry of Finance of Russia in letters dated March 15, 2013 No. 03-03-10/7999, dated May 28, 2012 No. 03-03-06/1/281 and the Federal Tax Service of Russia in letter dated August 13, 2014 No. GD-4-3/15717.

Situation: when calculating income tax, is it possible to take into account the costs of paying one-time bonuses that are not related to the employee’s performance of his job duties (for example, for an anniversary, holiday, for winning competitions, etc.)?

Answer: no, you can't.

One-time bonuses that are not related to the employee’s performance of his job duties (for an anniversary, a memorable date, for winning professional skills competitions, for conferring honorary titles, etc.) do not reduce the tax base for income tax. This is explained by the fact that such awards:

- are not related to the production activities of the organization (not aimed at generating income), and therefore do not meet the criterion of economic justification of costs (clause 1 of Article 252 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated March 15, 2013 No. 03-03-10/7999 , dated February 22, 2011 No. 03-03-06/4/12);

- are not incentive payments related to labor performance and the employee’s performance of a job function, therefore they cannot be taken into account in expenses as part of remuneration (Article 255 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated April 24, 2013 No. 03-03-06/1 /14283, dated December 12, 2012 No. 03-03-06/4/114).

If bonuses do not reduce the tax profit of the organization, then permanent differences arise in accounting (clause 4 of PBU 18/02). Permanent differences lead to the formation of a permanent tax liability (clause 7 of PBU 18/02).

Advice: there are arguments that allow organizations to take into account, when calculating income tax, the costs of paying one-time bonuses that are not related to the employee’s performance of his job duties. They are as follows.

Any bonuses that an organization pays to its employees are considered incentive payments (Part 1 of Article 129 of the Labor Code of the Russian Federation). At the same time, the organization has the right to independently establish an incentive system for employees (Article 144 of the Labor Code of the Russian Federation). In turn, incentive accruals provided for by the labor and (or) collective agreement are taken into account when calculating income tax (clauses 1, 2 of Article 255 of the Tax Code of the Russian Federation).

Therefore, if all of the above conditions are met, the organization has the right to take into account non-production bonuses (for example, accrued for holidays) as part of labor costs.

However, in order to comply with the requirement of reasonableness of costs provided for in paragraph 1 of Article 252 of the Tax Code of the Russian Federation, certain conditions for assigning non-production bonuses should be provided.

For example, as a justification for paying a bonus and its focus on generating income, you can indicate that bonuses for holidays are not paid to employees who have disciplinary offenses. Therefore, the payment of such a bonus is aimed at increasing employee interest in the results of production activities. A similar condition for the payment of a bonus when resolving a dispute in court was a sufficient argument for the lawful attribution of such payments to labor costs (see, for example, the resolution of the Federal Antimonopoly Service of the Moscow District dated February 24, 2010 No. KA-A40/702-10).

It is also possible to justify the economic orientation of bonuses paid to non-smoking employees. Quitting smoking reduces lost working time. Therefore, payments to non-smoking employees are stimulating. And if such bonuses are provided for in collective or employment agreements, they can be taken into account as expenses when calculating income tax. The legality of this position was confirmed in the resolution of the Federal Antimonopoly Service of the East Siberian District dated June 24, 2014 No. A33-1611/2013.

In addition, if non-production bonuses are initially provided for in an employment (collective) agreement, then a potential employee takes into account the possibility of receiving them when assessing the feasibility of working in a particular organization. Therefore, such incentive payments can help attract the necessary specialists to the organization. This means that these costs are economically justified. This was indicated by the FAS Moscow District in its resolution dated June 17, 2009 No. KA-A40/4234-09. By ruling of the Supreme Arbitration Court of the Russian Federation dated October 23, 2009 No. VAS-13115/09, the transfer of the specified case for consideration by the Presidium of the Supreme Arbitration Court of the Russian Federation was refused.

However, if an organization uses this point of view and takes into account the amount of non-production bonuses in expenses when calculating income tax, then, most likely, it will have to defend its point of view in court.

Include the amount of bonuses for labor performance in tax accounting as part of labor costs (clause 2 of Article 255 of the Tax Code of the Russian Federation).

When is an employee rewarded?

Vehicles over 12 tons):

- freight transport operating within a radius of 50 km;

- freight transport operating within a radius of more than 50 km;

- freight transport carrying out international transportation.

Driver remuneration is money paid to drivers for the high-quality and timely performance of their duties in accordance with the legislative framework of the Russian Federation, labor agreements, regulations on remuneration for drivers, as well as additional regulatory documents of the enterprise regulating the relationship between the employee and the employer.

timely and high-quality completion of the task;

- keeping vehicles in good technical condition.

Accrual of bonuses The bonus for the reporting month is accrued:

- for a driver with piece-rate bonus pay - as a percentage of piece-rate earnings:

Sp = Zs ´ P / 100%, where Sp is the amount of the bonus for the month, rub.; Zs is the amount of piecework earnings accrued for the month, rub.; P is the bonus percentage;

- for a driver with time-based bonus pay - as a percentage of the tariff rate (salary) accrued for the time worked per month:

Sp = Tch ´ Chotr ´ P / 100%, where Tch is the driver’s hourly tariff rate, rub.; Chotr is the number of hours worked per month, hour. According to the Recommendations on the specifics of remuneration for road transport workers, approved by order of the Ministry of Transport and Communications of the Republic of Belarus dated January 24, 2005

Table 1 Name of intercity routes Scale for determining the size of the premium Occupancy rate Revenue*, thousand rubles. Bonus % of the tariff rate** Occupancy rate Revenue, thousand rubles.

Premium as a % of the tariff rate** Occupancy rate Revenue Premium as a % of the tariff rate** Route No. 1 from 0.6 to 0.7 30 from 0.7 to 0.8 35 0.8 and above 40 Route No. 2 from 0.5 to 0.6 25 from 0.6 to 0.7 30 0.7 and above 35 Route No. 3 from 0.4 to 0.5 20 from 0.5 to 0.6 25 0.6 and above 30 * Calculated based on the average the number of passengers carried and the full cost of the ticket. ** For time worked as a driver. The condition for the bonus is to ensure a high standard of passenger service.

No. 7, July 2006

The bonus amount will be: Sp = Tch x Chotr x (P / 100%) = 2074 rubles. x 180 h x (35% / 100%) = 130,662 rubles. Dt 20 (23) - Kt 70 - a bonus was accrued based on the results of work for the month for fulfilling the revenue plan (hereinafter, the entries were compiled by the editors of the magazine).

Attention

Bonus for fuel economy. Automotive fuel is written off based on completed kilometers and linear fuel consumption standards approved by the Ministry of Transport. The source of the bonus is the actual fuel economy against the specified standards, confirmed by accounting data and instrument readings.

The Recommendations of the Ministry of Transport indicate that up to 50% of the cost of saved fuel is allocated to pay bonuses. In profitable organizations, up to 70% of the cost of saved fuel, determined without value added tax, can be used to pay bonuses (Table 2).

Your lawyer

Conditions and procedure for remuneration:

- basic conditions of material reward.

- the procedure for establishing and the size of minimum tariff rates in accordance with driver categories and personal work skills;

- procedure, conditions and sizes of increasing coefficients to minimum tariffs based on class, operating mode, etc.

- Conditions, procedure and amount of payments to drivers compensating for certain working conditions.

3. Conditions, procedure and volume of bonus payments that stimulate the work of performers in the context of their categories:

- based on the results of employees’ work (for the reporting period);

- for the quality and service of transport work performed;

- for high-quality and timely execution of particularly important and urgent assignments;

- for intense productivity and a conscientious attitude to work.

Share in the amount of savings, % 1 100 liters of gasoline saved* - - 2 Amount of fuel savings excluding VAT 120,000 (1200 x 100) 100.0 3 From line 2 allocated for bonuses: 84,000 (120,000 x 70 / 100) 70 .0 4 drivers 84,000 (120,000 x 70/100) 70.0 5 Based on line 3: - contributions to the Federal Social Security Fund 29,400 (84,000 x 35 / 100) 24.5 6 - emergency tax and contributions to the Federal Law 3360 ( 84,000 x 4 / 100) 2.8 7 — contributions for compulsory accident insurance 588 (84,000 x 0.7 / 100) 0.49 8 Total distributed (line 3 line 5 line 6 line 7) 117 348 (84,000 29,400 3,360,588) 97.79 9 Unallocated savings amount 2,652 2.21 * The cost of 1 liter of gasoline is 1,200 rubles.

In accordance with the Recommendations of the Ministry of Labor, employers deprive drivers of bonuses in full for the following violations: - absenteeism (incl.

absence from work for more than three hours during a working day) without a valid reason; - appearing at work in a state of alcoholic, toxic or drug intoxication, as well as drinking alcoholic beverages, using narcotic or toxic drugs at the workplace during working hours; - theft of the employer’s property at the place of work, established by a court verdict or a resolution of the body whose competence includes the imposition of an administrative penalty.

Piece-rate wages are approved by the employer and comply with the standards of the collective agreement, labor agreement or contract. This type of earnings requires the organization of reliable accounting of actual vehicle production indicators. The piecework payment for drivers is calculated as follows: Output can be calculated in:

- Distance traveled – kilometers. Typical for the operation of passenger vehicles transporting passengers over long distances, when the transport operates without downtime. Unit of measurement of output: km;

- Passenger turnover – transport production is calculated in the volume of passengers transported over a certain distance. Unit of measurement of output: Vp or Vp*km= Vpkm

- Tonnage – vehicle production is calculated in transported tons. Unit of measurement of output: t.

- Tonne-kilometers.

Sp = Zs x (P / 100%); where Sp is the amount of the premium for the month, rub.; Zs - the amount of piecework earnings accrued for the month, rub.; P - bonus percentage; for a driver with time-based bonus pay - as a percentage of the tariff rate (salary) accrued for the time worked per month, according to the formula: Sp = Tch x Chotr x (P / 100%); where Tch is the driver’s hourly tariff rate, rub.

We invite you to familiarize yourself with Account 29 in accounting: Service industries and farms

; Chotr - the number of hours worked per month, hours. According to the Recommendations for remuneration of road transport workers, approved by order of the Ministry of Transport of the Republic of Belarus dated January 24.

2005 No. 2 (hereinafter referred to as the Recommendations of the Ministry of Transport), bonuses are awarded for additional payments for combining professions (positions), expanding the service area (increasing the volume of work performed), and performing the duties of a temporarily absent employee.

Based on these features, we can distinguish several categories of specialists in driving and operating vehicles: 1. passenger vehicles (vehicle capacity does not exceed 5 seats). 2. minibuses (vehicle capacity from 5 to 18 seats). 3.

buses (vehicle capacity more than 18 seats). 4. a specially equipped vehicle (special equipment). 5. freight transport (carrying capacity of the vehicle does not exceed 3 tons). 6.

freight transport (vehicle load capacity from 3 tons to 12 tons), including:

- freight transport operating within a radius of 50 km;

- freight transport operating within a radius of more than 50 km;

- freight transport carrying out international transportation, including:

With a occupancy rate of 0.4 to 0.5, the bonus amount is 20% of the tariff rate for the time worked, and 0.8 and above - 40%, however, in general, the organization ensures compliance with the maximum bonus amount - 30% of the tariff rate. Example In June 2006

on route No. 1, the driver received revenue, based on which the occupancy rate was 0.7, and the bonus amount was 35% of the tariff rate.

They worked 180 hours. The multiplicity of the 1st category tariff rate for establishing the monthly tariff rate for the driver is 2.33, the current 1st category tariff rate in the organization is 150,000 rubles.

It is necessary to determine the amount of the driver's bonus. Let's calculate the driver's hourly tariff rate: Tch = (2.33 x 150,000 rubles) / 168.5 = 2074 rubles.

Basically, for Class II vehicle management specialists, the premium for class is 10%, and Class I - 25% of the tariff rate for the time actually worked by the driver on the flight. The figures are approximate and can be changed by decision of the organization’s administration.

Payment of additional remuneration is an internal matter of each employer. The organization has the right to independently determine the frequency, reasons and amounts of bonus payments to employees. Common reasons for bonuses are:

- significant dates for an employee or the entire company: birthday, organization anniversary, professional holiday;

- all-Russian holidays, for example New Year, March 8;

- merits in work: an employee is encouraged, for example, if he exceeded the production standard, achieved production optimization, reduced defect rates, initiated transformations useful for production, and reduced production costs without loss of quality.

Rewards can be regular (monthly, quarterly, annual) or one-time. It is permissible to award bonuses to only one or several employees at the same time.

An order for bonuses for employees is usually issued based on work results for a certain time period: month, quarter, year. Additionally, other types of bonuses may be paid with varying regularity and one-time payments.

In order for the bonus to have a legal form, the possibility of its payment is provided for in an internal local act - the regulation on bonuses or on remuneration.

Income tax: accrual method

If an organization uses the accrual method, the procedure for recognizing expenses in the form of bonuses depends on whether they are direct or indirect expenses.

If bonuses relate to indirect expenses, then they must be recognized at the time of accrual (clause 2 of Article 318, clause 4 of Article 272 of the Tax Code of the Russian Federation). If one-time bonuses are a direct expense, then take them into account as products, works, and services are sold (paragraph 2, paragraph 2, article 318 of the Tax Code of the Russian Federation). Organizations providing services can take into account direct expenses at the time of their accrual (paragraph 3, paragraph 2, article 318 of the Tax Code of the Russian Federation).

As a rule, bonuses are classified as indirect expenses (Article 318, paragraph 3 of Article 320 of the Tax Code of the Russian Federation). An exception is bonuses paid to employees directly involved in the production of products, performance of work or provision of services (for example, bonuses to production workers). They are classified as direct costs. Such rules are established in paragraph 7 of paragraph 1 of Article 318 of the Tax Code of the Russian Federation.

Situation: can a production organization classify all one-time bonuses as indirect costs?

Answer: no, it cannot.

Organizations independently determine the list of direct expenses (clause 1 of Article 318 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated January 26, 2006 No. 03-03-04/1/60, Federal Tax Service of Russia dated February 24, 2011 No. KE-4-3 /2952). However, dividing costs into direct and indirect must be economically justified. Otherwise, tax authorities may recalculate income tax.

Thus, the bonus accrued to employees directly involved in production should be taken into account as part of direct expenses. Refer the bonus for the administration of the organization to indirect expenses.

An example of reflection in accounting and taxation of a one-time bonus accrued for production results. The payment of the bonus is provided for in the employment contract. The bonus was paid out of expenses for ordinary activities. When calculating income tax, an organization uses the accrual method

CJSC Alfa applies a general taxation system (accrual method). The organization pays contributions to compulsory pension (social, medical) insurance in accordance with the general procedure. Contributions for insurance against accidents and occupational diseases are calculated at a rate of 0.2 percent. The organization takes these contributions into account when calculating income tax in the month of accrual.

ZAO Alfa entered into an agreement with manager A.S. Kondratyev fixed-term employment contract for the duration of a specific job (project). The term of the employment contract is from February 1 to March 31. The employment contract provides for the payment of a one-time bonus for the successful completion of the project.

The project was successfully completed on time, March 31st. Kondratiev was awarded a bonus of 50,000 rubles. On the same day, the bonus was paid to the employee.

The bonus will be included in the personal income tax base in March. Kondratiev has no children, so he is not provided with standard tax deductions.

The accountant reflected the accrual and payment of bonuses as follows:

Debit 20 Credit 70 – 50,000 rub. – a one-time bonus was awarded to the employee;

Debit 20 Credit 69 subaccount “Settlements with the Pension Fund for the insurance part of the labor pension” – 11,000 rubles. (RUB 50,000 × 22%) – contributions to finance the insurance part of the labor pension are calculated from the premium amount;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” – 1450 rubles. (RUB 50,000 × 2.9%) – compulsory social insurance contributions are calculated from the premium amount;

Debit 20 Credit 69 subaccount “Settlements with FFOMS” – 2550 rubles. (RUB 50,000 × 5.1%) – contributions for compulsory health insurance to the Federal Compulsory Medical Insurance Fund are calculated from the premium amount;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” – 100 rubles. (RUB 50,000 × 0.2%) – contributions for insurance against accidents and occupational diseases are calculated from the premium amount;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 6,500 rubles. (RUB 50,000 × 13%) – personal income tax is withheld from the premium amount;

Debit 70 Credit 50 – 43,500 rub. (50,000 rubles – 6,500 rubles) – the bonus was paid to Kondratiev minus personal income tax.

The amount of the premium and insurance premiums from it is included in indirect costs.

In March, Alpha’s accountant took into account the following as expenses:

- the amount of the accrued bonus is 50,000 rubles;

- the amount of contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases - 15,100 rubles. (RUB 11,000 + RUB 1,450 + RUB 2,550 + RUB 100).

Sample and examples of filling out an order 2019

There are 2 possible forms of this document recommended by law:

The employer has the right to use any form or develop an independent design option . The main thing is to correctly reflect the transaction in accounting documents and other financial papers. The main requirement for content is to whom the bonus is awarded, in what exact amount and on what basis. Usually the order also reflects the name and position of the person who is responsible for its implementation.

Read more The concept of non-residential premises in legislation

An example of a bonus order (in the case of payment to two employees) could be like this.

Thus, the document includes:

- Title - a header with the usual information: full name of the company, number, date and name of the order.

- The main part, which lists the persons awarded the bonus (full name, position, personnel number), the basis for the issuance and the amount of the amount. In this case, the size can be indicated either in numbers or as a percentage (for example, 10% of the salary). It is also stated here on the recommendation of which employee the bonus is awarded if there was a business recommendation.

- Signature of the manager, date and annex with the signatures of all awarded employees confirming the fact of their familiarization with the award.

Taxation of premiums

Since a bonus is a type of salary, i.e. in fact, this is part of it, then it also belongs to the tax base, like the salary itself. Those. As a general rule, personal income tax and insurance premiums are withheld from the premium amount . Exceptions include the following cases:

- Foreign or domestic awards for achievements in science, education, literature, art, technology (inventions, Nobel Prize, UNESCO Prize, etc.).

- Payments as financial assistance, which can be paid no more than 4,000 rubles per year for each employee. Accordingly, taxes and contributions are paid on all excess amounts.

And finally, video instructions for drawing up a document, as well as an analysis of the possible consequences in case of its absence.

Watch our video about why such an order is needed and how to draw it up correctly.

Find out on the forum how your colleagues prepare documents for awards. For example, on this thread you can read how and when an order for bonuses for employees is created/

Employee bonuses: 6 risks for the employer

Since issuing a bonus is a financial transaction, there are certain risks on the part of the inspection inspectors. They concern, first of all, tax inspectors, but often come from representatives of the labor inspectorate.

Risk 1. Incorrect wording in the employment contract

Often, an employer indicates that its employee with whom the contract is concluded is entitled to a monthly or quarterly bonus in a set amount, for example 15% of his salary. In this case, the bonus in fact becomes an integral part of the salary, since the employer pays it within the agreed terms and in the established amounts, the obligations of which he himself has assumed. It is more correct to reflect the fact of payment in the category of “right” rather than “obligation” of the employer - otherwise, in essence, it is no longer a bonus, but a salary.

Risk 2. Payments of “13 salaries”

A bonus at the end of the year in the amount of the entire average salary or a significant part of it is traditionally called the “13th salary.” There is no such concept in the law; accordingly, such a bonus is the exclusive goodwill of the employer. But again, it is important to correctly reflect it in the employment contract (individual and collective), as well as in the local internal acts of the enterprise. At the same time, only references to these acts can be indicated in contracts, and the payment procedure must be spelled out in as much detail as possible in the acts:

- connection between salary payment and employee performance indicators;

- the possibility of non-payment of this type of premium with a detailed description of the entire list of reasons, including due to an economically unfavorable situation;

- It is especially important to pay attention to the procedure for payment upon dismissal: should the employee work the whole year or not, how to pay if the dismissal occurs due to layoffs, liquidation of the company, etc.

Risk 3. Holiday bonuses

Such payments are considered by most managers as symbolic gifts in the amount of 500-1000 rubles. Therefore, attention is often not paid to this point, and everything comes down to the wording “The employer pays each employee a bonus of 1000 rubles annually by March 22 – the company’s Founding Day.” In this case, it is better to protect yourself from financial risks and indicate that the company undertakes to do this only if possible, and also reserves the right not to pay a bonus if the employee grossly violated the work schedule, etc.

Risk 4. Bonus amount and working hours

One should also take into account the important point that not all employees work the standard/quarterly/monthly hours due to various circumstances - vacations at their own expense, sick leave, maternity or child care leave, etc. Therefore, the amount of the bonus, as well as the very possibility of its payment, should be closely and unambiguously linked to a certain norm: for example, at least 180 working days.

Risk 5. Deduction of bonuses and deprivation of the right to a bonus

Read more Accounting for state fees for registering a lease agreement

These concepts are widely present in real labor practice, however, confusion often arises with the interpretation both in documents and at the level of oral explanation by management of company standards for employees. In an employment contract, collective agreement and other documents, it is important to clearly distinguish both concepts. If deprivation of bonuses is a measure that is legally taken by the employer in the event of a significant mistake made by an employee while performing his duties, then deprivation of the right to a bonus may also have purely economic, objective reasons. Usually all these nuances are spelled out in detail in local acts.

Risk 6. How to properly develop premium reduction mechanisms

Both the grounds for accrual/non-accrual of the premium and the grounds for its justified reduction should be specified in the local act in great detail. It is best to give not specific numbers (a reduction of 500 rubles, etc.), but percentages - for example, “if an error is made when servicing a client, which leads to his refusal to cooperate, the monthly premium is reduced by 10% from the initially established amounts." Most often, the size of the reduction is set using a simple formula - proportional to the extent to which the plan was fulfilled, and it is important to take into account not only individual indicators, but also the connection with the performance indicators of the department and the entire unit. This is especially true for large companies.

Thus, it is better to foresee all the key points given in advance. The main criterion for the correct procedure for awarding bonuses to an employee is drawing up orders and contracts in such a way that he himself can calculate the amount of payment at any time. Those. The calculation of the premium must be extremely transparent, and the grounds for payment or non-payment must be extremely clear.

What are the employee incentive measures?

In addition to the order, other documents may be required. ConsultantPlus FREE for 3 days Get access An employee’s salary can consist of a salary and bonus parts.

Transportation of 10 tons of sand over a distance of 52 km is 520 tkm. The standard time for their implementation is 109.2 minutes. (520 × 0.21).

It is better not to name this order in this way, because legally “de-bonus” is the cancellation of the accrual of bonuses, and with the legal application of this motivational influence we can only talk about non-accrual or a reduction in its size. To avoid ambiguity, the order should not use words that can be interpreted as punishment: “withdrawal”, “deprivation”, “about, etc.

An order for a one-time bonus is an organizational document that is issued if the manager decides to reward one or more employees. In addition to the order, other documents may be required.

Let us remind you once again that it is imperative to specify the incentive motive in the order. An example is an increased number of sales or manufactured products over a certain period of time.

Indicators, conditions and amounts of bonuses are provided for in the wage regulations, which, according to Article 364 of the Labor Code of the Republic of Belarus, are an integral part of the collective agreement.

Employees of E.V. Lopatkin, L.D. Derevianko and T.R. Peskov belongs to the management personnel of the organization. Expenses for paying bonuses to these employees will be reflected in the debit of account 26. A bonus is one of the main types of employee incentives. On the other hand, this is a type of financial transaction that must be reflected in documents, for example, in an order for bonus payments to employees. A sample and instructions for compilation are in this article.

An order for incentives (bonuses, awards) is issued by the personnel department (another similar division of the organization) using standardized forms No. T-11 and T-11a. In this case, form No. T-11 is used to document the fact of rewarding one employee, and T-11a - for two or more employees. The order signed by the head of the organization is announced to the employee against signature.

Accounting. According to clause 5 of PBU 10/99, the amount of bonuses of a production nature must be attributed to expenses for ordinary activities. The accrual of bonuses is reflected in the debit of those accounts to which the costs of remuneration of employees receiving bonuses for labor achievements are attributed, and in the credit of account 70 “Settlements with personnel for remuneration”.

We do our best to keep the site up to date, but if you still haven't found the information you need, call us.

However, not every entrepreneur knows exactly when an order is issued, its types and the reasons on which the monetary equivalent of the remuneration will depend.

Form T-11 is used if one employee needs to receive a bonus.

If several employees are worthy of a bonus, a collective agreement is issued in form T-11a.

Document structure:

- a header containing the details of the organization and the document (name of the enterprise, number, date of issue of the order, its subject);

- the main part with written documentation of the employer’s order and its basis;

- final (signatures, their transcripts, there must be a note about the employee’s familiarization).

If the company uses a certain bonus system, then it is better to include data on possible incentives in employment contracts with employees.

The multiplicity of indicators and bonus conditions reduces the interest of employees in solving the assigned tasks.

What can a company car driver be rewarded for?

An employee's salary may consist of a salary and bonus parts. The salary part has its own minimum threshold, indicated by the minimum wage rates, but the bonus part does not have any maximum limits. In other words, the manager decides whether to assign a bonus to an employee or not, and he also determines the size of the bonus.

One of the ways to reward an employee for successful work and achieving high results in work is a bonus. The employer is interested in increasing the efficiency of the company's performance indicators, therefore it has the right to motivate employees in the form of bonus payments.

To formalize the decision, an administrative document such as an order for a one-time bonus is used (if we are talking about only one employee). There are details that are recommended to be used in this form.

A sample order for bonuses for employees can be found in the appendix via the link.

An employee can be rewarded not only in material form. The main types of incentives used in practice:

- announcement of gratitude;

- cash bonus;

- nomination for the title of the best in the profession;

- issuance of a valuable gift;

- awarding a certificate of honor.

Orders of this type must be stored for 75 years from the date of their publication (Order of the Ministry of Culture of Russia dated August 25, 2010 No. 558).

The amount of bonuses provided for in the provisions for the remuneration of drivers can be differentiated depending on their employment in the main or non-core activities, the type of transportation, and other factors.

After the order has been issued, it is necessary to familiarize the employee with it against signature. Then the relevant information is entered into the employee’s personal card and his work book (clause 24 of the Decree of the Government of the Russian Federation “On work books” dated April 16, 2003 No. 225).

To increase labor discipline and production indicators, various organizations often practice comprehensive measures of incentives for work and punishments for shoddy work. If we rely on the Labor Code of the Russian Federation, in particular Article 191, on the part of the employer, incentives for employees can be expressed in the following:

- appointment of a bonus;

- formal thanks;

- donation of a valuable item;

- highlighting the employee as the best in the team;

- issuance of a certificate.

Most often, employers use a bonus system to reward employees. In order to create such conditions in his organization, the manager should:

- calculate the amount of remuneration;

- plan the conditions for issuing bonuses;

- think over the procedure for their calculation;

- highlight the necessary indicators and criteria.

The issue of bonuses at the end of the year is resolved by issuing an order from the head of the organization or another authorized person. The legislator in the Labor Code of the Russian Federation does not clarify the issue of the sample or form of the document, however, the resolution of the State Statistics Committee of the Russian Federation “On approval...” dated January 5, 2004 No. 1 provides the forms of the bonus order: T-11 - for one employee, T-11a - for several.

The Labor Code of the Russian Federation provides for the possibility of drawing up a decree, both in free form and in a unified form. The law forces any employer to draw up an order in writing, possibly in any form, but always including the main points. In order to correctly write the relevant order, it is recommended to use a unified form.