Let's consider the features of reflecting in 1C the acceptance of VAT for deduction when offsetting advances received from customers.

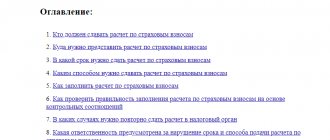

You will learn:

- features of crediting advance payments when selling goods (works, services);

- what document is used to document in 1C the acceptance of VAT for deduction when offsetting an advance payment;

- what transactions and movements are generated in the VAT tax register - the purchase book;

- what lines of the VAT declaration are filled out.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Offsetting advances received in 1C 8.3: step-by-step instructions

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

The organization entered into an agreement with the buyer LLC Architectural Workshop for the supply of office furniture in the amount of 354,000 rubles. (including VAT 18%).

On September 30, a 100% advance payment from the buyer was received into the bank account.

On October 11, office furniture was sold to the buyer:

- MIKKE desk – 15 pcs. at a price of 5,900 rubles. (including VAT 18%);

- Chair MARCUS – 15 pcs. at a price of 11,800 rubles. (including VAT 18%);

- File cabinet ERIC – 10 pcs. at a price of 8,850 rubles. (including VAT 18%).

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Sales of goods | |||||||

| October 11 | 62.01 | 90.01.1 | 354 000 | 354 000 | 300 000 | Revenue from sales of goods | Sales (act, invoice) - Goods (invoice) |

| 90.02 | 41.01 | 245 000 | 245 000 | 245 000 | Write-off of the cost of goods | ||

| 90.03 | 68.02 | 54 000 | VAT accrual on revenue | ||||

| 62.02 | 62.01 | 354 000 | 354 000 | 354 000 | Advance offset | ||

| Issuance of SF for shipment to the buyer | |||||||

| October 11 | — | — | 354 000 | Issuing SF for shipment | Invoice issued for sales | ||

| — | — | 54 000 | Reflection of VAT in the Sales Book | Sales book report | |||

| Acceptance of VAT for deduction when offsetting the buyer's advance payment | |||||||

| 31th of December | 68.02 | 76.AB | 54 000 | Acceptance of VAT for deduction | Generating purchase ledger entries | ||

| — | — | 54 000 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

For the beginning of the example, see the publications:

- Issuing an invoice to the buyer and receiving an advance from him

- Calculation of VAT on advances

- Sales of goods

Postings for advances issued and advances received

In accounting, an advance is considered to be full or partial prepayment of a concluded transaction. How advances are reflected in accounting, what entries are generated when receiving an advance from a buyer, as well as entries for advances issued, we will consider further.

The difference between an advance and a deposit

An advance is often confused with a deposit. Both the advance and the deposit have one function - advance payment for a product or service, partial or full. There is no clear definition in the legislation to separate these concepts, but according to established practice, an advance payment is considered to be the amount of prepayment for the transfer of which a separate agreement to the contract has not been drawn up:

Advances issued

An advance payment is an advance payment to the supplier against future deliveries, work performed or services performed.

Transferring an advance payment to a supplier does not mean receiving economic benefits, since the supplier may, for various reasons, fail to fulfill its obligations under the contract: fail to ship goods, fail to provide a service.

In this case, the advance payment is returned to the buyer’s account if it was transferred through a bank, or to the cashier if received in cash.

In general, there is no obligation to return the deposit from the supplier.

To account for VAT on advances in the chart of accounts, there is a subaccount on account 76, most often its code is 76.AB.

The buyer can accept VAT as a deduction only if the following conditions are met:

Get 267 video lessons on 1C for free:

- Presence of an advance payment clause in the contract;

- Documents confirming the transfer of prepayment;

- The supply of goods (services, etc.) is intended for use in activities subject to VAT;

- Availability of a supplier's SF with a dedicated tax.

The buyer does not have the right to accept VAT as a deduction if all of the above conditions are not met. Acceptance of VAT deduction is not an obligation, but a right of the purchasing organization.

If an organization decides to use VAT deduction from an advance issued, then after the provision of the service and the closing of this advance, it will be obliged to restore this VAT to the budget.

Example

Let's say Altavista LLC transfers an advance in the amount of 23,600 rubles. (including VAT). Then Altavista LLC receives goods worth RUB 23,600 from this supplier.

https://www.youtube.com/watch?v=vv88mPEpN0s

The rate and amount of incoming VAT are indicated in the supplier's invoice.

Advances issued - postings

| Column number | |||

| Meaning | 1234567 from 06/25/2021 | JSC "Magma" | 120 000,00 |

| Dt | CT | Operation description | Sum | Document |

| 60.2 | 51 | Transfer of advance payment | 23 600 | Payment order ref. |

| 19 | 60.2 | VAT on advance | 3 600 | Advance invoice (received) |

| 68 | 76(advances) | VAT deduction from advance payment | 3 600 | Book of purchases |

| 10 | 60.1 | The received goods are registered | 20 000 | Invoice |

| 19 | 60.1 | Incoming VAT reflected | 3 600 | SF supplier |

| 60.1 | 60.2 | Advance offset | 23 600 | Accounting information |

| 60.2 | 68 | Recovered VAT from advance payment | 3 600 | Sales book |

Advances received

When an organization sells goods, works or services, the buyer can make an advance payment before the moment of sale.

According to the requirements of the Tax Code, the seller is obliged to charge VAT on the advance received. VAT is calculated using the formula:

VAT on the advance received = Sales amount *18/100

Advances received - postings

When receiving an advance from a buyer, the accountant makes the following entries:

| Dt | CT | Operation description | Sum | Document |

| 51 | 62.2 | Advance received from buyer (including VAT) | 23 600 | Payment order in. |

| 76(advances) | 68 | VAT accrual on advance payment | 3 600 | Invoice issued, accounting certificate |

| 62.1 | 90.1 | Sales revenue accrued | 23 600 | Sales certificate, invoice |

| 90(VAT) | 68 | VAT on sales | 3 600 | SF issued, accounting certificate |

| 68 | 76(advances) | Accepted for deduction of VAT on advances (after sale) | 3 600 | Book of purchases |

Advances received and issued in the balance sheet

When forming the balance sheet, outstanding balances on advances received and issued are reflected in accounts payable (line 1520) and accounts receivable (line 1230). Moreover, the amounts of these advances and prepayments are taken together with VAT. VAT on advances (account 76 (advances)) falls into the lines of other current assets (1260) and other current liabilities (1550).

Source: https://BuhSpravka46.ru/buhgalterskie-provodki/provodki-po-avansam-vyidannyim-i-avansam-poluchennyim.html

VAT paid on advance payment cannot be deducted

Let us recall that the seller’s obligation to calculate and pay VAT to the budget upon receipt of payment (partial payment) for the upcoming delivery of goods under the contract follows from the provisions of paragraph 1 of Article 154 of the Tax Code of the Russian Federation.

But what about the tax paid when, at the buyer’s request, the trading organization counts the amounts received as payment under another agreement?

Position of officials

The main tax document provides for only two cases when VAT calculated from an advance payment is accepted for deduction: - after the shipment of goods for which this advance was received (clause 8 of Article 171 and clause 6 of Article 172 of the Tax Code of the Russian Federation);

- after the advance payment is returned to the buyer due to changes in the terms of the contract or its termination (clause 5 of Article 171 of the Tax Code of the Russian Federation).

However, formally the transfer of an advance payment does not fall under either the first or the second case. After all, the shipment of goods does not occur here at all. And even if the first contract is terminated or its terms are changed, the advance payment to the buyer is still not returned. Consequently, there are no grounds for a tax deduction.

This interpretation of the legislation allows tax authorities to refuse to deduct VAT in such situations. Moreover, their actions completely coincide with the position of specialists from the Russian Ministry of Finance (letter dated September 17, 2009 No. 03-07-11/231).

Alternative point of view

The above position is not indisputable, and if desired, a trading company can try to prove that it is right.

If the buyer’s request to transfer the advance payment to another contract is related to the termination of the first contract, the offset of the advance payment is actually its return.

True, the seller’s obligation for such a return is terminated not by the transfer of funds, but by offset (Article 410 of the Civil Code of the Russian Federation).

Arbitration judges also recognize as legitimate the deduction of VAT on an advance payment that is returned in a way other than cash. This is evidenced by the resolutions of the Federal Antimonopoly Service of the Volga District dated October 16, 2007 No. A65-17384/06, the Federal Antimonopoly Service of the West Siberian District dated April 20, 2006 No. F04-2278/2006 (21647-A03-27).

Make changes…

When receiving an advance on account of an upcoming delivery, a trading organization must issue the corresponding invoices in duplicate (clause 3 of Article 168 of the Tax Code of the Russian Federation). The seller transfers one of the documents to the buyer, and registers the second in the sales book (clauses 16 and 18 of the Rules, approved by Decree of the Government of the Russian Federation of December 2, 2000 No. 914).

…TO INVOICES

It is logical to assume that after the transfer of advance amounts, the trading company again has the obligation to calculate VAT and issue an invoice, but under the second agreement. However, this is where the organization needs to do things differently.

In such a situation, corrections should be made to the “advance” invoice issued under the first contract*.

In particular, in the “Name of Product” column, indicate the name of the new product (which is subject to sale under the second contract).

And if other VAT rates are applied to such products (for example, 10% instead of 18%), then the data in the “Tax rate” and “Tax amount” columns will also have to be changed.

* Be sure to make corrections to the buyer's copy.

Adjustments must be certified by the signature of the manager and the seal of the trading company, indicating the date they were made.

Please note that from the point of view of tax risks, this procedure is more beneficial for sellers than issuing new documents.

After all, it eliminates the need to deduct VAT on the invoice issued under the first contract. In addition, this procedure is consistent with the position of the Russian Ministry of Finance, expressed in letters dated September 17, 2009.

No. 03-07-11/231 and dated November 18, 2008 No. 03-07-11/363. This means that the risk of claims from tax authorities is minimal.

ISSUING AN INVOICE FOR ADVANCE

A special form of invoice, which is issued upon receipt of an advance payment, has not been approved. Therefore, in its letter dated March 6, 2009 No. 03-07-15/39, the Russian Ministry of Finance recommended using the generally established form of this document.

The list of details of such an invoice is given in paragraph 5.1 of Article 169 of the Tax Code of the Russian Federation. Thus, when filling out, the serial number and date of issue of the document are mandatory; name, address, TIN of the seller and buyer; payment and settlement document number; name of the goods supplied; payment amount (partial payment); the rate and amount of tax presented to the buyer.

Moreover, in the column “Name of goods” it is allowed to use the general name of the product (letter of the Ministry of Finance of Russia dated April 9, 2009 No. 03-07-11/103).

...TO THE SALES BOOK

Such an adjustment must be made in an additional sheet of the book for the tax period in which the invoice was registered before corrections were made to it (clause 16 of the Rules).

To do this, the totals of the sales book for this quarter are first transferred to the first line of the additional sheet. The next two lines reflect the data of the document being canceled and the indicators of the corrected invoice.

Next, in the “Total” line, the totals are summed up by columns: from the amounts in the “Total” line, the indicators of the canceled document are subtracted (by columns) and the amounts from the corrected invoice are added.

Such recommendations are set out in the letter of the Federal Tax Service of Russia dated September 6, 2006 No. MM-6-03/ [email protected]

It happens that as a result of such adjustments, the amount of tax that must be paid to the budget changes.

This is often due to the fact that the goods for which the advance payment was originally received are taxed at different tax rates than the goods for which the advance payment was offset.

In this case, the trading company should recalculate its VAT obligations by submitting an updated declaration to the inspectorate.

Sales of goods

The sale of goods and the simultaneous offset of the advance received from the buyer is reflected in the document Sales (act, invoice) transaction type Goods (invoice) in the section Sales – Sales – Sales (acts, invoices) – Goods (invoice).

Please note that when offsetting advances received in 1s 8.3, when filling out the Calculations , indicate:

- Method of offset of advance payment – Automatically , it starts automatic offset of advance payment in the context of the Counterparty and the Agreement when posting a document.

See also the key points for registering the sale of goods in wholesale trade

Offsetting the buyer's advance in 1C 8.3 - postings

When posting a document, the advance previously received from the buyer is offset in the amount of the advance payment under the contract, but not more than the total amount under the document:

- Dt 62.02 Kt 62.01 – offset of the buyer’s advance in 1s 8.3.

Advances, prepayments, loans: how to issue checks in 1C (using the example of UT 11)

We will place a customer order in the amount of RUB 16,094.90. Let the client want to make a prepayment of 30,000 rubles, so that the remaining amount will be credited to him as an advance payment for subsequent orders. Based on the order, we will enter the PKO in the amount of 30,000 rubles and issue the check:

In this case, in addition to the goods themselves, the receipt will contain the line “Payment from...” for the amount of the difference between the payment and the order amount. In this case, in the lines with the goods there will be a calculation method “Advance payment”, and in the line “Payment from...” - “Advance payment”. That's right: 16,094.90 is a 100% prepayment for the order, the rest is an advance payment that we will use in other orders.

Comment. In fact, we have 100% prepayment, so in the lines with the goods, generally speaking, the calculation method should be “100% Advance Payment”, and not just “Advance Payment”. Unfortunately, we will not be able to influence this moment without making changes to the configuration logic. How the Federal Tax Service will react to this is a question for the Federal Tax Service, from the point of view of the order dated March 21, 2017 No. ММВ-7-20 / [email protected] the calculation method is indicated incorrectly (see Table 28 of Appendix 2).

We will ship the current order with 100% prepayment. We will formalize the sale of goods and issue a receipt for shipment from it:

As an advance payment, 1C offers to offset the entire amount along with the advance payment. We don’t need the entire amount, since we will use it in other orders, so we’ll correct the prepayment amount to the order amount and issue a check:

Since we are running a check for shipment, the subject of payment will be “Goods”. “Full payment” is indicated as the payment method, since the goods have already been paid in full.

Let’s place another order from this client in the amount of 6,555 rubles and use the “Payment Settlement” button:

We will subtract the available advance payment for this order. Since we have already issued a check for the advance payment and the balance of the advance payment exceeds the amount of the order, we will not need new checks to reflect receipt of payment. Let’s make sure that the advance payment has been successfully credited to the order:

All that remains is to place the sales on the basis of the order and issue a receipt for the shipment of goods (there is no need to edit the “Prepayment” field, since we have credited the amount equal to the order amount):

The cash receipt will be similar in structure to the receipt that we issued for shipment earlier in the same example:

We remember that we still have an unused advance payment for the client. Now we will place an order, the amount of which will exceed the amount of the advance balance. Click the “Payment Offset” button to offset the balance of the advance:

The buyer is verified, so we will arrange shipment to him with partial payment. We remember that when transferring goods, we print a receipt from the sales document. Since we ship goods with partial payment, the subject of payment in the check will be “Product”, and the “Method of payment” will be “Partial payment and credit”:

In my case, because of the discounts, I didn’t want to get the check through, even the format-logical control didn’t help, so I offset the prepayment in the check by 10 kopecks less. Now the most important thing is not to forget these 10 kopecks when punching a check for postpayment!

Based on the sales of the PKO, we will issue the remaining amount and display a preview of the receipt:

By default, 1C offers to credit 10 kopecks. This does not suit us: our goal is to break through a check for 5,760 rubles. The only way is to edit the PQ document itself and open the check preview window again when opening:

Now the amounts are “conditionally” correct. Punching a check:

Now all that remains is to correct the amount in the PKO so that these 10 kopecks do not hang as our debt to the client in 1C:

Comment. Again, if you follow all the requirements of the law, from these checks we can conclude that the client overpaid us for the order by 10 kopecks, since we credited him with an advance payment of 10 kopecks less and because of this, with the “closing” PKO we charged 10 kopecks more. In fact, he did not pay us these 10 kopecks and there is no debt. What can be done in this case? For beauty, of course, you can take these 10 kopecks from the buyer and “hang” them as an advance in 1C, without correcting the amount of the closing PKO. The second option is probably the most correct - in the customer’s order, offset the payment initially by 10 kopecks less, and, accordingly, when receiving postpayment from the buyer, demand 10 kopecks more. And then deal with the debt that has arisen. So be careful with discounts and roundings!

Issuing an invoice for shipment to the buyer

An invoice for shipped goods is issued using the Issue invoice , located at the bottom of the Sales document (act, invoice) .

Invoice document is automatically filled with data from the Sales document (act, invoice) .

- Operation type code – “” Sale of goods, works, services...”

Please note that the tabular section Payment documents is automatically filled in with data from the fields According to document No. from , specified in the Receipt to current account . PDF

Find out more about VAT calculation when selling goods in wholesale trade

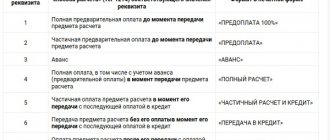

How to register prepayments and advances at the checkout

Modern online cash registers are able to register payments in several ways, each of which has its own conditions of use and designations in paper and electronic forms of a cash receipt. In the electronic form of a cash receipt, the sign of the payment method is indicated by a conditional code, which, as part of the subject of payment, is necessarily transmitted to the tax office. In the paper form of a cash receipt, the indication of the payment method can be printed as part of each calculation item.

IMPORTANT If there is no indication of the payment method in the paper form of a cash receipt, this does not mean that it is not in electronic form. This means that you do not control the composition of the fiscal document that goes to the tax office. Starting from July 1, 2019, the Federal Tax Service begins to take into account the payment method indicator transmitted in the cash receipt.

The characteristics of the calculation method are established by order of the Federal Tax Service dated March 21, 2017 N ММВ-7-20/ [email protected]

- FULL PAYMENT - this is the most common payment method - full payment at the time of transfer of the item of payment, including fully prepaid, for example, in an online store;

- ADVANCE PAYMENT 100% and ADVANCE PAYMENT - as the name suggests - full or partial advance payment before the transfer of the item of payment with its subsequent receipt. A typical example of full prepayment is payment for goods in an online store. Upon delivery of the goods, a receipt must be punched with the indication of the payment method FULL SETTLEMENT;

- ADVANCE – also an advance payment, but only for goods not specified at the time of payment. A typical example is a gift card, the denomination of which can be used to pay for any of the goods provided;

- PARTIAL SETTLEMENT AND CREDIT - partial payment of the subject of payment at the time of its transfer with subsequent payment on credit;

- TRANSFER ON CREDIT - transfer of the subject of payment without payment at the time of its transfer with subsequent payment on credit;

- LOAN PAYMENT – payment for the subject of payment after its transfer with payment on credit (loan payment).

In addition to the indication of the method of payment for the goods, the cash register receipt also contains an indication of the subject of payment itself. The sign of the subject of payment in the electronic form of a cash receipt is also indicated by a conditional code, which, as part of the subject of payment, is necessarily transmitted to the tax office. In the paper form of a cash receipt, the attribute of the settlement item can also be printed as part of each settlement item.

IMPORTANT If there is no indication of the subject of payment in the paper form of a cash receipt, this does not mean that it is not in electronic form. This means that you do not control the composition of the fiscal document that goes to the tax office. Starting from July 1, 2019, the Federal Tax Service begins to take into account the attribute of the subject of payment transmitted in the cash receipt.

The characteristics of the subject of settlement are established by order of the Federal Tax Service dated March 21, 2017 N ММВ-7-20/ [email protected]

- GOODS, EXCISE GOODS - when paying for goods at the time of transfer, when transferring prepaid goods, when subsequently paying (additional payment) for the goods specified in the item;

- SERVICE – the same cases for services;

- PAYMENT – if a preliminary payment, advance or loan payment is registered;

- There are other signs of the subject of calculation, for example, WORK , AGENCY REMUNERATION , DEPOSIT , etc.

Acceptance of VAT for deduction when offsetting the buyer's advance payment

Regulatory regulation

The organization has the right to deduct VAT from advances received from customers as of the date:

- shipment of goods (work, services) to the buyer (clause 6 of Article 172 of the Tax Code of the Russian Federation);

- refund of the advance due to changes in conditions or termination of the contract (clause 5 of Article 171 of the Tax Code of the Russian Federation).

Tax authorities believe that if an advance payment under a terminated contract was offset against payments under another contract with the same customer, then VAT deduction cannot be used at this moment (clause 5 of Article 171 of the Tax Code of the Russian Federation).

At the same time, VAT calculated and paid by the seller from the amount of this advance payment can be deducted upon actual shipment under another agreement (Letters of the Ministry of Finance of the Russian Federation dated July 18, 2016 N 03-07-11/41972, dated October 14, 2015 N 03-07-11/58845).

VAT is deducted in the amount of tax calculated from the cost of shipped goods (work, services), for which an advance payment was previously received (clause 6 of Article 172 of the Tax Code of the Russian Federation). This means that if you have charged VAT on advances at a rate of 18/118%, and goods are shipped at a rate of 10%, then only that part of the VAT that is calculated at a rate of 10/110% can be taken into account (Letter of the Ministry of Finance of the Russian Federation dated November 28. 2014 N 03-07-11/60891).

In the 1C program, VAT is automatically deducted in the amount in which VAT was calculated on advances. The offset mechanism provided for by the current edition of clause 6 of Art. 172 of the Tax Code of the Russian Federation, has not yet been implemented in the program. Be careful!

For the amount of VAT accepted for deduction:

- in the purchase book, a registration entry is made of the advance invoice, on which VAT was previously calculated, with the transaction type code “Advances received”;

- In accounting, the entry Dt 68.02 Kt 76.AV “VAT on advances and prepayments” is generated.

Accounting in 1C

Acceptance of VAT for deduction when offsetting advances received from the buyer is formalized by the document Formation of purchase ledger entries in the section Operations - Closing the period - Regular VAT operations.

To automatically fill out the Advances received , use the Fill .

Postings according to the document

The document generates transactions:

- Dt 68.02 Kt 76.AV – acceptance of VAT for deduction on offset advance payment.

The document generates movements in the VAT Purchases :

- record of an advance invoice with transaction type code 22 “Advances received” for the amount of accepted VAT for deduction.

Purchase Book report can be generated from the Reports – VAT – Purchase Book section. PDF

Let's check the calculation of the amount of VAT accepted for deduction when offsetting the buyer's advance using the following algorithm:

- Let's determine the amount of the credited advance payment, on which VAT was previously calculated - Dt 62.02 Kt 62.01 RUB 354,000.

- Let's carry out an arithmetic check of the VAT accepted for deduction from the credited advance payment using the formula:

VAT deductible = 354,000 * 18/118 = 54,000 rub.

To check the amount of VAT accepted for deduction, you can generate the report Turnover balance sheet for account 76.AB by counterparty.

The amount of VAT accepted for deduction under Kt 76.AB in 1C coincides with the verified amount. There is no balance on the invoice on which VAT was previously calculated. This means that VAT has been deducted correctly for the entire amount of the advance invoice.

VAT declaration

The VAT amount subject to recovery is reflected in the declaration:

In Section 3, page 170 “The amount of tax calculated by the seller from the amounts of payment, partial payment, subject to deduction from the seller from the date of shipment...”: PDF

- the amount of VAT subject to deduction.

In Section 8 “Information from the purchase book”:

- advance invoice issued, transaction type code "".

We make an advance payment via cash register

To begin with, let’s remove the question that often arises among beginners: what is the difference between an advance payment and an advance payment at an online cash register? The ability to determine exactly what the buyer gave money to the seller for.

If it is possible to count the number of goods (or services) for which money has already been paid, then this is an advance payment. For example, a client paid in advance for 5 visits to, say, a fitness club. Visits are date and time specific and have a fixed cost. This means that the client made an advance payment to the club.

There are situations when it is impossible to clearly determine what exactly the money was received for. For example, a buyer entered into an agreement with a store for the purchase of a built-in kitchen with delivery and assembly (in one invoice) and, according to the agreement, paid 50% of the order cost. It is difficult to determine what exactly he paid with this 50%. This means that the buyer made an advance payment.

To “show” the online cash register that an advance payment has been made, you need to indicate the “payment method indicator” when punching the check. Be careful, there are several options. They are described in detail in Appendix No. 2 to the order of the Federal Tax Service No. MMV-7-20 / [email protected]

We briefly present them in the table:

| What is the advance payment? | Characteristics of the event (what we are breaking through) | In what case should you punch |

| Prepayment 100% | Full prepayment before the transfer of the subject of payment | If, when paying, you can determine the list of goods, works or services |

| Prepayment | Partial advance payment before the transfer of goods or provision of services | If, when paying, you can determine the list of goods, works or services |

| Prepaid expense | Partial or full prepayment of goods or services | When paying, it is impossible to determine the list of goods, works or services to be transferred |