Taxpayer of Legal Entities is a program that helps entrepreneurs, businessmen, and individuals in preparing reports to the tax authorities. The program is supplied free of charge and can be used by any individual or legal entity.

Ministry of Finance of the Russian Federation - on the use of the “Legal Taxpayer” program .

Regardless of the version of the Taxpayer Legal Entity, its installation on the computer’s hard drive occurs in several stages, which we will fully describe in the version that is current at the moment.

In order to use the program, first of all, you need to download it (relevance - February 2021 ):

Additions: first, second, third.

STAGE 1

Launch the program by double-clicking on the downloaded installation file. Windows will most likely ask you if you agree to open the executable file, click yes or OK.

Next, a window with a license agreement will open in front of you:

Read it carefully, check the menu item “I accept the terms of the license agreement” and click “Next” below. Accordingly, if you do not accept the program license terms, the installation will not continue.

When purchasing software, the user receives a license - a non-exclusive right to use the software. The exclusive right will only be for software that is created by the user himself or at his request, or purchased under a special agreement. How to take into account non-exclusive rights to licensed software? View answer

Setting up Taxpayer Legal Entity after launch

As soon as the program launches for the first time on your device, it will offer to configure itself. A window will pop up called “Adding a taxpayer”:

Here you need to select from the fields presented, according to what reports you are going to generate: an entrepreneur, a legal entity or an individual. The choice of Foreign organization and Separate division is also available.

We will outline the further steps for the Individual Entrepreneur, since the majority of our visitors are individual entrepreneurs. So, by selecting “Individual Entrepreneur” and clicking “OK”, we are offered to configure the individual entrepreneur’s data for use in further reports and documents.

Fill out the fields in any order. A sample of how to fill them out is shown in the screenshot.

I would like to pay attention to the “Taxpayer Category” field. By clicking on the square framed by a dotted line, you can select your status.

We select line 05: Individual entrepreneur who does not make payments to individuals.

Note! Each square framed by a dotted line is a function button. You can click on it, and an additional window will open, which is designed to select information entered into the corresponding field. It is available for almost every field, except for “when and by whom the passport was issued,” “stay address,” and “place of birth.”

Once you have filled in all the required fields, click “Apply” and “OK”. Remember: you can edit the entered information at any time by simply clicking on the person registered in the program, whose name is in the upper right corner under the menu:

This completes the installation and initial configuration of the Taxpayer. Be sure to save the page so you can easily find it when needed.

Source

STAGE 2

Type of installation. Here you are asked to choose to install the full version or the client part of the program. If this is your first time installing Taxpayer Legal Entity, it is better to select “full installation” and click “next”.

Software and text components of the client side of Internet sites from the standpoint of intellectual property rights.

What settings does “Taxpayer Legal Entity” have and how to configure them for convenient work

Competent and timely preparation of tax reporting is the key to successful operation of an enterprise. This is why most accountants use various programs in their work. They greatly simplify the process of preparing reports and other documents, and also reduce the likelihood of errors. One of such programs is Taxpayer Legal Entity. Let's try to figure out how to install and use this tool.

The program under consideration is the development of the Federal State Unitary Enterprise “Main Research Center of the Federal Tax Service”. When writing it, all the requirements of modern tax legislation, as well as the rules for filling out forms, were taken into account. We will consider further what functions this distribution is endowed with.

STAGE 3

Destination folder

At this stage of installation, you are asked to select the location where the program will be located. We do not recommend storing important work files on the same disk on which the system is installed. In most cases, Windows is located on the C drive, which means it is better to select another drive to install the program, of course, if it is available.

This is done so that if Windows loses its functionality (and this happens), the program’s working files are not damaged and remain safe on another drive.

If you don’t have a logical drive other than C on your computer, you will have to select a folder there, or leave the default path: C:\Taxpayer Legal Entity\ Click next.

Taxpayer legal entity version 4.67 dated October 19, 2021

Taxpayer of Legal Entities is a program that helps entrepreneurs, businessmen, and individuals in preparing reports to the tax authorities. The program is supplied free of charge and can be used by any individual or legal entity.

Regardless of the version of the Taxpayer Legal Entity, its installation on the computer’s hard drive occurs in several stages, which we will fully describe in the version that is current at the moment.

In order to use the program, first of all, you need to download it (relevance - October 2020 ):

STAGE 5

After the files are successfully installed into the directory, a window should appear as in the picture above. This means that the installation was successful and the program is ready to launch. You can check the box with the description “Run a program” if you want to use it immediately after installation.

Click “ready”. The installation of the Legal Entity Taxpayer program is complete.

If you minimize all active windows, you will see a program shortcut on the desktop:

Now, to use the program, you need to double-click on it and the program will open.

How to transfer Taxpayer Legal Entity to another computer

An easy way to transfer Taxpayer to another computer

Right-click on the program shortcut, then select “File Location”.

Go to the folder with the program.

You may have a different path to the program. Now we go up a level and copy the entire folder to a flash drive.

My program “Taxpayer Legal Entity” is located at the path “C:\NP Legal Entity\INPUTDOC”. This means I will copy the folder from the path “C:\NP Legal Entity”, the folder “INPUTDOC”.

After copying the program to the USB flash drive is completed, you can copy it to a new computer. In order to run the program on a new computer, go to the folder with the program and open the file “inputdoc.exe”

After this, your “Taxpayer Legal Entity” will be launched and you can start working fully.

Now let's look at a more complex method.

A difficult way to transfer Taxpayer to another computer

This method is divided into two stages. First stage.

We save our database. We need to go to the “Service” tab. In this tab we need the “Save information” item. Let's choose it.

Next is the most important point. Before making a backup copy of the Taxpayer Legal Entity database, we need to understand whether to make a copy of the entire database or just some people.

Now let's copy our backup to a second computer.

Now on the second computer we need to install the “Legal Taxpayer” program.

After we have installed the “Taxpayer” program on the second computer and copied the backup copy, we will proceed to the second stage.

Second phase. We restore data.

To do this, we need to open the “Legal Taxpayer” program. Next, go to the “Service” menu and select “Information Recovery”.

Next, we need to indicate the location to which you copied the database backup. Please note that you only need to specify the folder in which the backup is stored; you will not see the backup file itself. For example. My path to the backup copy looks like this “C:\Backup copy of NP Legal Entity”, in this folder I have a file with a backup copy.

This means I will have to specify exactly the path “C:\Backup copy of NP Legal Entity”.

If you did everything correctly, you will see information about how much data will be recovered.

Now click “Continue”.

Next, we choose what exactly we will restore. If you need to restore the entire database, then select the “For all taxpayers” item. If only some organizations, then select the item “For selected taxpayers”. I select the item “For all taxpayers”. Click “Continue”.

Then the database recovery procedure will start. After the database is restored, you will see a window like this, all you have to do is click “Finish”.

Source

How to work in the new version of Taxpayer Legal Entity 2021

Work in the program begins with creating a taxpayer profile. This procedure consists of entering all the necessary data about a legal entity or individual for work. To do this, you need to click on the “Add taxpayer” button at the top of the window. In addition, the first time you launch it, the menu to add it appears automatically. First of all, you need to select the type of payer. For example, a legal entity, an individual entrepreneur, an individual, and so on.

After this, a window with several tabs will appear. Each tab has cells in which you must enter the relevant data. In particular, the first tab is devoted to general information, the second - information for submission to the Federal Tax Service.

The program allows you to work with several profiles and automatically saves all entered data. Once the payer profile has been created, you can begin directly preparing the necessary reports or documents. To do this, you need to select the document of interest in the menu located on the left side of the window. Then the following window will open in which you need to click the “Create” button.

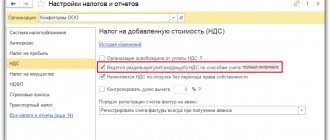

The figure shows an example of creating a register of VAT information.

Legal Entity Taxpayer Program 2021

The service is designed to automate the process of generating tax reporting and other documents. It can be used by individuals and legal entities. The distribution is equipped with many useful functions related to preparation:

- accounting and tax reporting;

- reports on personal income tax (2-NDFL, 3-NDFL, 4-NDFL, 6-NDFL);

- settlements of insurance premiums;

- documents for registering cash registers;

- information on the VAT return;

- documents for work under the simplified tax system, unified agricultural tax, patent taxation system;

- applications for taxpayer registration;

- special declaration.

This is not a complete list of operations that the program can perform. In addition to the main functions, there are a number of additional features that can significantly simplify the work of an entrepreneur. For example, it comes with a tax calendar that appears on the main page.

Above the tax calendar there is a row of buttons, when clicked you can:

- go to the personal account of the tax service;

- check yourself and your counterparty;

- find updates;

- use the forum;

- obtain background information on the FIAS website;

- find out OKTMO.

One of the useful features of the distribution is the “Document Wizard”. With its help you can prepare various documents. In particular, a book of purchases and sales, a notice of registration as a tax payer, an invoice and much more.

Installing the application

Before installing the product on your computer, you need to download the file with the new version of the program. The Federal Tax Service provides it to us free of charge on the official website. You can find the download link at the very bottom of the page, in the “Software” section. Next, a list of services will open, from them you need to select “Taxpayer Legal Entity” and click on it.

On the page that opens, you will be asked to download the complete installation kit in one file. Typically, users are offered the new version by default. To start downloading, click “Download”.

By default, new files are automatically saved in the Downloads folder. You can choose the location where the “Legal Taxpayer” will be saved. After downloading, you can begin installation.

Before you begin installing Taxpayer Legal Entity on your computer, it is recommended to disable your antivirus.

The installation process may take a lot of time, you will have to be patient.

Taxpayer legal entity is adapted only for Windows OS.

- Find the folder with the downloaded file on your device, double-click on it. Give permission to run the file.

- Then you need to extract it from the archive, this may take several minutes.

- All extracted files are saved to the INSTALL folder located below.

- After unloading the components, the installation window will open. You must confirm that you accept the terms of the agreement and click the “Next” button.

- You will then be offered different installation options. The choice is your own, but it is recommended that you opt for a full installation. After making your selection, click “Next” again.

- In the new window you need to select a location for the “Legal Taxpayer” on your device. By default, the folder has already been created and a location has been defined for it. It is recommended to continue the process without changing anything.

- All that remains is to run the installation. The process will take a few minutes.

- When everything is finished, click “Done” in the window that opens.

A shortcut will appear on the desktop. Double-click on it, “Taxpayer Legal Entity” will launch and re-indexing will begin.

In simple words, this is an internal setting. There is no need to confirm anything here; everything is done automatically. The procedure is carried out once, after downloading and installation. There will be no re-indexing during further work. When it's finished, you'll be prompted to add the taxpayer and the required information.

It happens that it is not possible to download the installation file on the Federal Tax Service portal. You can quickly download it from here. This is the official website of the developer, where you will find the latest version of the Legal Entity Taxpayer. The installation procedure follows the instructions described above.

Possible installation problems

Often, when installing “Legal Taxpayer”, one or another problem arises. The most common one is the requirement to restart the computer, after which the application does not want to open. You need to restart the installation. To avoid problems, it is recommended to exit the browser and close other active applications.

The second common problem is the appearance on the screen of information that the program contains dangerous viruses. If you downloaded “Legal Taxpayer” on the Federal Tax Service portal or the developer’s website, there are no malicious files in it. An antivirus tends to perceive individual components of an application as a potential threat, hence the conflict during installation. Most likely, you forgot to disable security software.

During installation, a message may appear indicating that some installation files are damaged. The solution is to delete the download file and download it again (the download may have failed). Before doing this, check your network connection. If you were provided with an installation file on a disk or flash drive at a tax office branch, the source of the problem may be damaged media. Rewrite the application to a new disk, or contact the Federal Tax Service with a similar request.

Source

System requirements

Any program has requirements for the parameters of the device where the installation will be performed. If at least one item does not match, installation will be impossible or the application will not work correctly. In fact, Taxpayer Legal Entity is a standard office application that works without problems on modern laptops and computers. The table below provides the basic device requirements for installing the new version of the program.

| operating system | Windows vista, XP, 7, 8, 8.1, 10 |

| RAM | At least 512 MB |

| HDD | At least 600 MB |

| Video card | 1020*768 |

Update Taxpayer Legal Entity

An important point when using this distribution is its timely updating. After all, if you start working in an outdated version, there is a risk of preparing documents according to irrelevant Federal Tax Service requirements. Therefore, it is recommended to check for updates periodically. You can update Taxpayer Legal Entity to the latest version for free in two ways.

The first way is to go to the Federal Tax Service website and check the name of the latest version of the program and updates with those installed on the computer.

Current version of the program

The Taxpayer Legal Complex 4.67, which can be downloaded without registration on our website, is the latest, updated version released by the developer. This installation package with a patch is characterized by expanded functionality, accuracy of all operations, and speed of operation. It helps to generate a variety of reports, working documents, maintain invoice logs, perform analytics, and send requests. This application will allow you to create documents on payments, on opening and closing accounts in banking institutions.

The Taxpayer Legal 4.67 program, with adjustments made to the distribution, will function on users’ PCs. Installing the Russian version is not difficult. If difficulties arise, you should disable your antivirus. After installation, all functions of the complex will be available. Download software that will help solve current problems related to the preparation and execution of various documentation.

Functions that the program performs

It is necessary for citizens, non-profit organizations and legal entities to download Taxpayer Legal Entity 4.67 for free from the official website to generate documents for the Pension Fund and the Federal Tax Service. Such software is not just for creating reports. Using it will allow you to find out OKATO codes. All data that this complex helps to generate complies with tax legislation. Despite the fact that it changes quite often in Russia, the developer manages to update his solution.

Among the key features of the Taxpayer Legal 4.67 program:

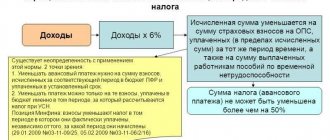

- generation of a tax return for personal income tax;

- creation of tax returns for companies on the simplified tax system and on UTII;

- submission of information on the average number of personnel of the organization;

- preparation of property tax returns;

- preparation of VAT returns;

- generation of profit and loss statements.

New unified calculation of insurance premiums to the Federal Tax Service in 2021

You can download the insurance premium calculation form valid in 2021 for free at. You can look at a sample of filling out a calculation of insurance premiums at. Calculation of insurance premiums must be submitted to the Federal Tax Service quarterly (based on the results of the 1st quarter, half a year, 9 months and a year).

The deadline for submission is no later than the 30th day of the month following the reporting period. Note: if the due date falls on a weekend or holiday, the deadline for submitting the calculation is moved to the next business day.

Reporting month Deadline 1st quarter April 30, 2021 Half year July 30, 2021 9 months October 30, 2021 2021 January 30, 2021 Calculation of insurance premiums is submitted to the Federal Tax Service:

- LLC at its location.

- Individual entrepreneur at his place of residence.

Note: separate divisions that accrue payments and other remuneration in favor of individuals submit reports at their location.