Where and when are data on the average headcount used?

When compiling annual information for the Federal Tax Service

Information on the average number of employees (as part of the calculation of insurance premiums) must be submitted to the tax office by all organizations without exception, as well as individual entrepreneurs who made payments to employees (clause 3 of Article of the Tax Code of the Russian Federation). The RSV form, which contains a field for the average number of employees, was approved by order of the Federal Tax Service dated October 15, 2020 No. ED-7-11/ [email protected] Calculation of insurance premiums is submitted no later than the 30th day of the month following the quarter, half-year, 9 months and year.

The RSV for 2021 must be submitted by February 1. Fill out, check and submit the RSV according to the current rules

When choosing a method for reporting taxes and contributions

The method of submitting tax reports (via the Internet or on paper) directly depends on the average number of employees. Paragraph 3 of Article of the Tax Code of the Russian Federation states that taxpayers whose average headcount for the previous calendar year exceeds 100 people can submit a declaration only via the Internet. If the average headcount is 100 people or less, companies and individual entrepreneurs have a choice - they can report either via the Internet or on paper.

However, there is one exception to this rule - value added tax. VAT payers, regardless of the number of employees, are required to submit declarations only via the Internet (see “How to submit an electronic VAT return”). This requirement is enshrined in paragraph 5 of Article 174 of the Tax Code of the Russian Federation.

Reporting on insurance premiums is also tied to the average headcount. Policyholders whose average number of employees for the previous year exceeded 10 people are required to submit calculations for insurance premiums exclusively via the Internet (clause 10 of Article 431 of the Tax Code of the Russian Federation).

In addition, if the number of personnel is more than 25 people, it is necessary to submit Form 4-FSS electronically (Clause 1, Article 24 of the Federal Law of July 24, 1998 No. 125-FZ “On Compulsory Social Insurance against Industrial Accidents and Occupational Diseases”) and annual information on length of service and other reports to the Pension Fund of the Russian Federation, including the SZV-TD form (clause 2 of Article 8 of the Federal Law of 01.04.96 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system”). With a more modest number of personnel, reporting can be done on paper.

Fill out and submit a new form 4‑FSS for free via the Internet

When resolving various tax issues (benefits, branch profits, special regimes)

The Tax Code has many rules and restrictions, to comply with which you need to know the average number of employees. We have combined them into a table.

Questions for which you need to know the average number of employees

| Question | Norm of the Tax Code of the Russian Federation |

| Providing benefits | |

| VAT exemption for companies whose authorized capital consists of contributions from public organizations of disabled people | subp. 2 p. 3 art. 149 Tax Code of the Russian Federation |

| VAT exemption for state unitary enterprises and municipal unitary enterprises whose staff includes at least half of the disabled people | subp. 2 p. 3 art. 149 Tax Code of the Russian Federation |

| the right to write off expenses for social protection of disabled people for companies whose staff includes at least half of them with disabilities | subp. 38 clause 1 art. 264 Tax Code of the Russian Federation |

| exemption from property tax for organizations whose authorized capital consists of contributions from public organizations of disabled people | subp. 3 tbsp. 381 Tax Code of the Russian Federation |

| exemption from land tax for organizations whose authorized capital consists of contributions from public organizations of disabled people | subp. 5 tbsp. 395 Tax Code of the Russian Federation |

| Share of profit of the branch and member of the consolidated group | |

| calculation of the share of profit attributable to a separate division (for the correct payment of income tax to the regional budget) | clause 2 art. 288 Tax Code of the Russian Federation |

| calculation of the share of profit attributable to a member of the consolidated group (for the correct payment of income tax to the regional budget) | clause 6 art. 288 Tax Code of the Russian Federation |

| Application of special modes | |

| the right to apply the simplified tax system for organizations whose authorized capital consists of contributions from public organizations of disabled people | subp. 14 clause 3 art. 346.12 Tax Code of the Russian Federation |

When filling out form 4-FSS and RSV-1

Payers of contributions for compulsory insurance against accidents at work and occupational diseases must report to the social insurance fund in form 4-FSS (approved by order of the Federal Social Insurance Fund of Russia dated September 26, 2016 No. 381). On the title page of this form there is a field called “Average number of employees.”

A similar field is provided in the calculation according to the RSV-1 form, submitted to the Pension Fund for periods up to 2021 (approved by Resolution of the Board of the Pension Fund of the Russian Federation dated January 16, 2014 No. 2p).

When preparing statistical reports

Organizations and individual entrepreneurs that are not representatives of small businesses submit Form No. P-4 “Information on the number and wages of employees” to the statistical authorities. In some cases, Form No. 1-T with the same name is submitted instead. Among other indicators, these reports must indicate the average number, which includes the average number of employees.

Fill out and submit all reports to Rosstat using today’s current forms via the Internet

Deadlines for submitting information on the average number of employees

Report on the NSR, according to Art. 80 of the Tax Code of the Russian Federation must be filed no later than January 20 of the next reporting period. The reporting period in this case will be the calendar year. The report is signed by the manager and certifies this document with the seal of the organization, if any. The form is provided in paper form, however, if the company’s staff exceeds 100 people, the report must be submitted electronically.

For new organizations, a slightly different procedure for submitting the form is provided. The company is required to submit a CFR report by the 20th day of the following month from the date of its registration.

In case of violation of the deadline for submitting the average number of employees, the company will be subject to penalties in the amount of 200 rubles. For the chief accountant and manager, administrative fines in the amount of 300 - 500 rubles are provided.

Which employees are taken into account when calculating the average headcount?

In all the situations mentioned above, the average number must be calculated in accordance with paragraphs 76-79 of the instructions for filling out statistical observation forms (approved by Rosstat order No. 711 dated November 27, 2019 (hereinafter referred to as the Instructions).

According to the Guidelines, the average headcount includes employees with whom an employment contract has been concluded. The duration of the contract and the nature of the work (permanent, temporary or seasonal) do not matter. Even if a person worked for the company for only one day and then quit, he must be included in the calculations.

The average headcount includes not only those who were actually present at the workplace, but also those who were on vacation (including at their own expense), on sick leave (except for maternity leave), or on a business trip. Persons on parental leave are generally not included in the average headcount. An exception is made for those who, during care leave, work part-time or at home while maintaining the right to receive benefits. Such employees should be included in the average headcount.

Internal part-time workers are also taken into account, that is, employees who simultaneously occupy several positions in one company. Please note: regardless of the number of combined positions, such an employee must be counted once at the place of main work. The same rule applies to employees receiving more than one rate - they should also be counted as a unit. A complete list of employees included in the average number of employees is given in paragraph 77 of the Instructions.

Where to display “Information on the average headcount” for 2020

The previously valid form “Information on the average payroll” in 2021 is not generated and is not accepted by the Federal Tax Service as a separate report - a reporting form approved by Order of the Federal Tax Service No. MM-3-25/174 dated March 29, 2007, in which until recently information on the average payroll was recorded number, is not valid today.

Law No. 5-FZ of January 28, 2020 amended paragraph 3 of Art. 80 Tax Code of the Russian Federation. According to its updated version, information on the average number of employees is included in the “Calculation of insurance premiums” (DC). Thus, the legislator abolished the headcount report, simultaneously combining it with the DAM form.

Changes made to the “Calculation of Insurance Premiums” form and the procedure for filling it out were recorded by Federal Tax Service Order No. ED-7-11/ [email protected] dated 10/15/2020. This document also updated the electronic format of the Calculation.

In accordance with these changes, to record data on the average number of personnel of the policyholder, a new detail of the same name has been added to the title page of the “Calculation of Insurance Premiums” - “Average number”.

This indicator is calculated, still guided by the procedure approved by Rosstat in order No. 711 of November 27, 2019, i.e. in the same way as this value was determined in the previously valid “Information” form.

Let us remind you what the differences are between “average” and “average” numbers. The calculation of the “average headcount” includes only employees working at the enterprise under employment contracts (without taking into account external part-time workers), and the “average headcount” indicator is formed from data on the average payroll, part-time workers (external), and employees under GPC contracts. Those. information on the “average” number in 2021, as before, will be formed on the basis of data on the number of employees in labor relations with the company. The detailed calculation methodology is given in paragraphs 75-81 of Rosstat Order No. 711.

Which employees are not taken into account when calculating the average headcount?

The average number of employees does not need to take into account women on maternity leave. In addition, persons who took leave in connection with the adoption of a newborn are not taken into account. Finally, employees who have taken parental leave are not taken into account (except for those who work part-time or at home while receiving benefits). Students and applicants who have taken leave without pay, as well as some other categories of workers (their list is given in paragraph 78 of the Instructions) should not be taken into account.

External part-time workers are excluded from the average headcount, that is, employees whose main place of work is another company or another individual entrepreneur. Persons working under civil contracts are also not included in the calculation. In a situation where the same person works simultaneously under an employment contract and a contract, he must be counted once in the average headcount.

What should employers do?

Many people have a question: if nothing has changed, why cancel one form and introduce another? Only officials know the answer. But, most likely, it is easier for statisticians to issue a new order than to make minor changes to the existing one. To confuse respondents less.

However, companies need to take into account that there is a new form on which to report this year. We remind you that statistical reports on the number of employees include only those subordinates who work under employment contracts, including part-time work. Does not include:

- persons hired part-time from other organizations;

- citizens who perform work under construction contracts and other civil contracts;

- women on maternity leave or child care leave;

- military personnel in the performance of military service duties.

If one employee combines several professions in an organization, he is counted only once - for his main profession.

In order not to make mistakes in professional groups, Rosstat recommends following the All-Russian Classification of Occupations (OKZ), approved. By Order of the Federal Agency for Technical Regulation and Metrology dated December 12, 2014 No. 2020-st. You can also use the directory for the distribution of employees by subgroups and OKZ groups, which is posted on the Rosstat website.

As for the needs of organizations for workers to fill vacant jobs (Column 5 of the form), it is calculated taking into account vacancies (after the dismissal of employees or going on leave for BIR, child care) and newly created jobs for which it is planned to hire employees within 30 days after the reporting period. If jobs are occupied by part-time workers, the last column of the report is not filled in.

Should the founder and entrepreneur be taken into account?

As a general rule, the owner is included in the average payroll only if he works in his company under an employment contract and receives a salary. The founder, who is paid dividends but not a salary, must be excluded from the calculations.

In practice, the following situation is common: the director is the owner appointed by the general meeting of founders (without an employment contract). There are no clear instructions as to whether such a director should be included in the average headcount. Typically, in such circumstances, directors are counted as a unit, despite the absence of an agreement.

But if the only founder acts as a director, then, in our opinion, he cannot be taken into account in the average headcount. The fact is that the only founder is not able to hire himself and pay himself a salary. This was also recognized by the Russian Ministry of Finance (see “Ministry of Finance: the director - the only founder should not pay his own salary”). This means that such a manager a priori cannot relate to the company’s personnel.

An individual entrepreneur is also not taken into account in the average headcount, because, like the sole founder, he is not able to conclude an employment contract with himself.

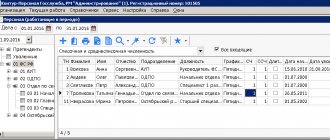

How to calculate the average number of employees per month (full-time)

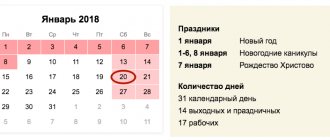

First of all, it is necessary to find out what the number of employees was (accounted for according to the above rules) on each of the calendar days of the month, including weekends and holidays. The number on a non-working day is assumed to be equal to the number on the previous working day.

The number for each day of the month must be summed up and divided by the number of calendar days of the month. The resulting number should be rounded to the nearest whole value (a remainder of less than 0.5 is discarded, a remainder of 0.5 or more is rounded up).

Example 1

The organization operates on a five-day work week schedule. All employees are employed full time. The number of people on each day of the month is shown in Table 2. The average headcount for the month is 17,097 (530: 31 days), after rounding it takes the value 17.

Day of the month Number of employees taken into account when calculating the average headcount 1 15 2 14 3(Sat.) 14 4(sun.) 14 5 16 6 17 7 17 8 18 9 20 10(Sat.) 20 11(Sun.) 20 12 20 13 20 14 18 15 18 16 18 17(Sat.) 18 18(Sun.) 18 19 17 20 17 21 16 22 16 23 16 24(Sat.) 16 25(Sun.) 16 26 16 27 15 28 17 29 17 30 18 31(Sat.) 18 Total: 530

Sometimes organizations do not work for a full month. This happens to companies created in the middle of the month, or to those who are engaged in seasonal business. The average headcount for an incomplete month is calculated in exactly the same way as for a full month: the headcount indicators for each day are summed up, and the resulting result is divided by the number of calendar days of the month. Simply put, if there are 31 days in a month, then you need to divide by 31, regardless of how many days are actually worked.

Keep timesheets and prepare all personnel reports in the “Kontur.Personnel” service

Example 2

The company began operating on March 28, 2021. The number of people on each day of the month is shown in Table 3.

To find the average headcount, the accountant divided the total number by 31, since March has 31 calendar days. It turned out that the average number for March is 1.71 (53: 31 days), and after rounding it takes the value 2.

Day of the month Number of employees taken into account when calculating the average headcount 28 10 29 10 30 15 31 18 Total 53

Deadline

The average number of employees (deadlines are defined below) is given both as of the established date and on average for the reporting period (month, quarter, year-to-date, year). The average number of employees for 2021 (the deadline for submitting the annual report expired on January 22, 2018) should have been submitted to the tax office according to the established rules by January 20, 2018. Since this day fell on a weekend, the deadline was 01/22/2018.

Institutions registered in the current period will have to report twice:

- for the first time - before the 20th day of the month following the month of registration;

- for the second time - based on the results of the year, that is, until January 20.

Please note that the average number of employees for 2021 (the deadlines for submission will shift due to the report date falling on a weekend) will have to be submitted no later than 01/21/2019.

If the reporting period is not fully worked out

Among individual entrepreneurs and organizations there are many whose activities began or ceased in the middle of the year. In such a situation, the reporting period has not been fully worked out. However, the algorithm for calculating the average headcount remains the same: first, you should add up the indicators for each month of the period, and then divide by the number of months of this period. Please note: you need to divide by the number of calendar months, not the number of months actually worked.

Example 4

The company was registered in September 2015, all employees are full-time. The average number of employees was 8 in September, 9 in October, 12 in November and 11 in December.

To find the average headcount for 2015, the accountant determined the total average headcount for all months of the year. It was 40 (8 + 9 + 12 + 11). The accountant divided this figure by 12, since there are 12 months in a year. It turned out that the average headcount for 2015 is 3.33 (40: 12 months), after rounding it takes the value 3.

Example 5

An individual entrepreneur is engaged in seasonal business. In the period from May 1 to September 30 (5 full months), he employed 5 people, all full-time. During the remaining months of the year there were no employees.

The accountant needs to determine the average headcount for 9 months. To do this, the accountant determined the total number for all months of the period. It was 25 (5 + 5 + 5 + 5 + 5). The accountant divided this figure by 9. It turned out that the average headcount for nine months is 2.78 (25: 9 months), after rounding it takes the value 3.

Instructions for working with the service for collecting information on the number of employees for employers

You must first register on the government services portal if you do not have an account.

1. On the main page of the “Work in Russia” website, select the “Employer” tab, click “Login”.

2. On the “Login for Employers” page, select “Log in via ESIA” (registration through the government services portal will be required).

3. The login page will open. Enter your login/password, and on the “log in as” tab, select the one you need from the list provided (what you plan to register is an individual/individual entrepreneur/organization).

4. The system will go to the portal “Work in Russia” → “Registration of an organization” and offer you to join a registered company if the specified OGRN is on the portal. Choose what you need.

5. Select role → Owner → Save.

Your personal account has been created.

How to open the page for filling out information? Either click on the banner “Submit information” → submit information, or through “Menu” → “.

Next, fill out all the fields of the form that opens.

All fields on the form are required except the middle name. First, select a region; if the company has branches, fill out the data for each separately.

1. General information about the legal entity:

- Name;

- type of ownership;

- OKVED code;

- organizational form;

- OGRN, INN.

2. Address:

- legal/factual.

3. Applicant details:

- indicate your name and contacts.

4. Fill out information about changes in headcount and salary arrears.

5. Submit information.

Data is entered on an ongoing basis and updated when changes occur.

Calculation of the average number of employees for part-time work

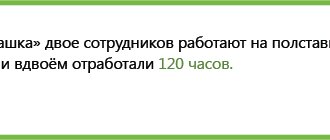

Part-time workers should be counted separately. True, this applies only to those who were transferred to a part-time schedule under an employment contract, staffing schedule, or gave written consent to part-time work.

People for whom reduced working hours are established on the basis of law (disabled people, minors, etc.) are counted on a general basis as whole units. In addition, specialists who switched to part-time work not voluntarily, but on the initiative of the employer, are taken into account on a general basis.

Separate accounting implies that each part-time employee is counted in the average number in proportion to the time worked. The calculation algorithm is as follows. To determine the monthly indicator, you need to take the number of man-hours worked by all part-time employees in a given month. An important detail: if a person was absent on a working day due to illness, vacation or absenteeism, the number of man-hours is taken for the previous working day.

The result obtained must be divided by the length of the working day (the rules for calculating it are shown in Table 4). The result is the number of person-days for a given month.

Length of the working day depending on the length of the working week

| Length of working week | Working hours | |

| 5 day work week | 6 day work week | |

| 40 hours | 8 ocloc'k | 6.67 hours |

| 36 hours | 7.2 hours | 6 hours |

| 24 hours | 4.8 hours | 4 hours |

Next, the indicator of man-days for a month must be divided by the number of working days according to the calendar of a given month. The resulting value is the average number of part-time workers per month.

Example 6

The company operates on a five-day work week schedule. According to the staffing schedule, employee Ivanov works 4 hours a day, employee Petrov - 3.2 hours a day.

In March 2021, Ivanov and Petrov worked for 21 days.

The number of man hours in March is 151.2 (4 hours × 21 days) + (3.2 hours × 21 days)). The number of person days in March is 18.9 (151.2: 8). Based on the fact that there are 21 working days in March 2021, the average number of part-time employees for March is 0.9 (18.9: 21 days), after rounding it takes the value 1.

Who submits and what information

To carry out operational control over the labor market, the Ministry of Labor ordered employment services to establish information interaction with all employers who are reducing the number of employees, transferring them to part-time work, remote work, etc.

Before figuring out how to submit information about the number of employees working and not working, we will list data on changes in the number of employees. Employees need to be informed:

- part-time;

- on leave without pay;

- those laid off due to the introduction of quarantine;

- in idle time;

- transferred to remote mode;

- planned for dismissal;

- if there is arrears of wages.

Indicators are submitted only if changes are related to coronavirus quarantine. There is no paper form for providing information on the number of employees of organizations and individual entrepreneurs. All information is entered electronically on the “Work in Russia” portal. Weekly reporting on this form is planned, but there are no strict requirements - information is transmitted only if it has changed.

How to calculate the average number of full-time and part-time employees

If some of the employees are employed full-time, and the other part is employed part-time, the average number of employees should be calculated as follows. First, determine the average number of employees on the full schedule for each month of the reporting period. Then find the average number of employees on the incomplete chart for each month of the reporting period. Add the resulting values, divide by the number of months in the reporting period and round.

Example 7

The organization has full-time employees. There are also employees who are hired at 0.5 rates. The accountant determined the average number of those and others separately for each month of the reporting year (see Table 5).

The average headcount for the year is 16.42 ((155 + 42): 12 months), after rounding it takes the value 16.

| Month | Average number of full-time employees | Average number of employees per 0.5 rate |

| January | 10 | 5 |

| February | 10 | 5 |

| March | 15 | 4 |

| April | 10 | 4 |

| March | 9 | 3 |

| June | 15 | 3 |

| July | 16 | 3 |

| August | 14 | 3 |

| September | 14 | 2 |

| October | 14 | 3 |

| november | 13 | 3 |

| December | 15 | 4 |

| Total: | 155 | 42 |

Calculate a “complex” salary with coefficients and bonuses for a large number of employees Try for free

How to calculate the average headcount

The rules for calculating the number from 2021 are established by Rosstat order No. 711 dated November 27, 2019. From January 15, 2021, it will be replaced by instructions from Rosstat order No. 412 dated July 24, 2020.

In general, the calculation formula looks like this:

Average year = (Average 1 + Average 2 + … + Average 12) / 12,

where: Average year is the average headcount for the year;

Average number 1, 2, etc. - the average number for the corresponding months of the year (January, February, ..., December).

For more information about the calculation procedure, read the article “How to calculate the average number of employees?” .

The information is certified by the signature of the entrepreneur or the head of the company, but can also be signed by a representative of the taxpayer. In the latter case, it is necessary to indicate a document confirming the authority of the representative (for example, it may be a power of attorney), and a copy of it must be submitted along with the ERSV.

NOTE! The power of attorney of the representative of the individual entrepreneur must be notarized (Article 29 of the Tax Code of the Russian Federation).

What to indicate in the report if the average headcount is zero

A common situation is when the average headcount of a small company or individual entrepreneur, calculated according to all the rules, after rounding takes the value 0. The question arises, is it possible to indicate a zero figure in the reporting intended for the Federal Tax Service and the Social Insurance Fund?

Unfortunately, not a single regulatory legal act provides a clear answer. In practice, tax officials strongly recommend putting 1 instead of zero. This is explained by the fact that, according to the internal regulations of the Federal Tax Service, if there is “zero” information about the average headcount, the inspector must close the personal income tax card. And then, when an organization or entrepreneur begins to report income taxes, difficulties arise. To avoid confusion, it is better to specify the unit in advance. FSS specialists also advise not to enter a zero indicator, especially if salary accruals were not zero.

In our opinion, it is easier for employers to follow the advice of officials than to subsequently provide additional explanations. Moreover, such an overestimation of the average number of employees does not threaten any unpleasant consequences.

True, artificial inflation is unacceptable for individual entrepreneurs without staff and for organizations where there are no other employees except the sole founder. As mentioned above, entrepreneurs and sole founders are not taken into account in the average headcount. Therefore, rounding to one in this case will greatly distort the real state of affairs.