Home / Taxes

Back

Published: 07/08/2019

Reading time: 7 min

0

387

The mineral extraction tax is levied on all subsoil users and is a federal tax.

- Legal and regulatory framework for mineral extraction tax

- Objects of taxation

- Taxpayers

- Mineral extraction tax rates

- Methods for calculating mineral extraction tax

- Ktd coefficient

- Changes in the procedure for calculating mineral extraction tax regarding losses during oil production

- Other changes

- How to fill out a mineral extraction tax declaration

Legal and regulatory framework for mineral extraction tax

The main regulatory normative act is Chapter 26 of the Tax Code of the Russian Federation, which received legal force on July 24, 2002 in accordance with the provisions of Federal Law No. 104.

The process of collecting and calculating mineral extraction tax is also regulated by:

- Art. 336 of the Tax Code of the Russian Federation , which lists the categories of mined minerals.

- Art. 334 of the Tax Code of the Russian Federation , which lists those citizens and organizations obligated to pay the specified tax.

- In Art. 335 of the Tax Code of the Russian Federation provides instructions regarding the registration of subsoil users depending on the location of the subsoil plot provided to them for use.

- In Art. 337 of the Tax Code of the Russian Federation provides a definition of extracted minerals.

The legal framework also includes:

- Letter of the Ministry of Finance dated May 31, 2012 No. 03-06-05-01/66.

- Federal Law No. 204 of November 29, 2012.

Indirect calculation method

Use the indirect method for determining the amount of extracted mineral resources for the purpose of calculating the mineral extraction tax when the direct method cannot be used. The method consists in determining the amount of extracted minerals by calculation based on the proportion of its content in the extracted mineral raw materials. In this case, the very amount of extracted raw materials is determined by measuring instruments. Such requirements are established in paragraph 2 of Article 339 of the Tax Code of the Russian Federation.

Situation: is it possible to apply a 0 percent rate when calculating the mineral extraction tax on standard losses of mineral resources? The organization uses an indirect method to determine the amount of minerals extracted.

Yes, you can.

The mineral extraction tax on standard losses of mineral resources is calculated at a rate of 0 percent (subclause 1, clause 1, article 342 of the Tax Code of the Russian Federation). At the same time, Article 342 of the Tax Code of the Russian Federation does not limit the right to apply a zero tax rate depending on the method of determining the amount of extracted mineral resources (direct or indirect). Consequently, an organization using an indirect method for determining the amount of extracted minerals can calculate the mineral extraction tax at a rate of 0 percent in relation to actual losses that do not exceed the standard value.

The legitimacy of this conclusion is confirmed by letters of the Ministry of Finance of Russia dated May 22, 2007 No. 03-06-06-01/21 and dated February 19, 2007 No. 03-06-06-01/7, as well as arbitration practice (see, for example , determinations of the Supreme Arbitration Court of the Russian Federation dated December 22, 2008 No. VAS-16551/08 and dated April 10, 2009 No. VAS-3275/09, resolutions of the Federal Antimonopoly Service of the Moscow District dated August 28, 2008 No. KA-A40/7979-08, Ural District dated November 27, 2008 No. F09-6261/08-S3, West Siberian District dated September 17, 2009 No. F04-5633/2009(19823-A75-43)).

Mineral extraction tax rates

The amount of ad valorem interest rates charged from subsoil users is established by clause 2 of Art. 342 Tax Code of the Russian Federation:

- when extracting potassium salts, its size will be 3.8%;

- when extracting peat, apatite and other ores, the rate will be 4%;

- when mining standard ores of ferrous metals, the rate will be 4.8%, and its size must be multiplied by the corresponding coefficient (Kpodz);

- when extracting radioactive raw materials, salts, thermal waters, bauxites, etc., the rate will be 5.5%;

- when extracting mining non-metallic raw materials, concentrates , etc., the rate will be 6%;

- when extracting raw materials with impurities of precious metals – 6,5%;

- when extracting thermal waters and mud – 7,5%;

- When mining rare metals and stones, the rate will be 8%.

Certain categories are subject to specific rates:

- for 1 ton of gas condensate, a rate of 42 rubles is charged , which must be multiplied by the base value of a unit of standard fuel and by a coefficient established depending on the complexity of production, as well as by a correction factor, the amount of which is specified in Article 343.4 of the Tax Code of the Russian Federation. Changes also came into force on January 1, 2019, according to which the amount received should also be increased by the product of the Kman indicator specified in paragraph 7 of Article 342.5 of the Tax Code of the Russian Federation and a coefficient characterizing the amount of gas condensate produced, in respect of which Kman cannot be applied , and equal to 0.75;

- oil - 919 rubles (from January 1, 2017) per 1 ton . The resulting amount should also be multiplied by the Dm indicator, which characterizes the features of the mining process.

Mineral extraction tax calculation

Calculate the mineral extraction tax monthly separately for each type of mineral (clause 2 of article 343 of the Tax Code of the Russian Federation).

Calculate the amount of mineral extraction tax payable to the budget using the formula:

| Mineral extraction tax payable to the budget | = | Tax base (amount of minerals extracted) | × | Tax rate |

This procedure is provided for in paragraph 1 of Article 343 of the Tax Code of the Russian Federation.

Methods for calculating mineral extraction tax

The tax amount can be calculated in one of the following ways:

- The first method can be used to calculate the mineral extraction tax for the extraction of most minerals . It is calculated as the total amount of raw materials extracted from the subsoil, and the current rates are taken from the corresponding article of the Tax Code of the Russian Federation.

- The second method of calculation is used in gas production . In this case, the total volume of extracted raw materials and specific rates determined by the Tax Code of the Russian Federation are taken into account.

- The third method is used when calculating the mineral extraction tax on precious metals . The tax base depends on the cost of selling finished raw materials or nuggets that were mined locally.

- The fourth method was created for calculating the mineral extraction tax during oil production . The base is determined in tons, and the rate is adjusted by the coefficients established by the Tax Code of the Russian Federation.

The formula by which the mineral extraction tax is calculated looks like this:

Mineral extraction tax = NB * NS , where NB means the tax base calculated for the reporting period, and NS is the interest rate established by the Tax Code of the Russian Federation.

Tax base calculation

As a general rule, the amount of extracted minerals is recognized as the tax base for the mineral extraction tax only when extracted:

- oil (dehydrated, desalted and stabilized);

- natural combustible gas extracted from all types of hydrocarbon deposits;

- associated gas;

- gas condensate;

- coal

When extracting other minerals, the tax base for the mineral extraction tax is their value.

In addition, the cost of minerals is the tax base for oil, gas and gas condensate produced from new offshore hydrocarbon deposits.

This procedure is established by paragraph 2 of Article 338 of the Tax Code of the Russian Federation.

Regardless of how the tax base for mineral extraction tax is determined, to calculate the tax, the amount of extracted minerals must be known (paragraph 7, paragraph 2, article 340 of the Tax Code of the Russian Federation).

Determine the amount of extracted minerals in physical terms (subclause 3, clause 2, article 338 of the Tax Code of the Russian Federation). This indicator can be calculated either by a direct or indirect method (clause 2 of Article 339 of the Tax Code of the Russian Federation).

The selected calculation method for each extracted mineral resource (or developed deposit) is fixed in the accounting policy for tax purposes. This method cannot be changed during the entire period of mineral extraction. An exception is the case when an organization changes its production technology and technological design for field development. This is stated in paragraph 2 of paragraph 2 of Article 339 of the Tax Code of the Russian Federation.

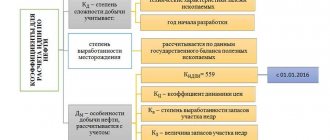

Ktd coefficient

Ktd is a coefficient used to characterize mineral extraction territories (Article 342.3 of the Tax Code of the Russian Federation). Its use is justified by the provisions of paragraphs. 1 clause 1 art. 28.5 of the Tax Code of the Russian Federation in relation to participants in regional investment projects who have the status of residents of territories that are advancing socio-economic development.

The size of this coefficient is equal to zero until the moment when a participant in a regional investment project begins to apply the tax rate on the organization’s profit (in accordance with the norms described in paragraph 1.5 of Article 284 of the Tax Code of the Russian Federation).

Over the course of 120 reporting periods, starting from the moment the corporate income tax rate is applied for a project participant, the CTD is set at the following values:

- during the first 24 periods – 0.

- from 25 to 48 period inclusive – 0,2.

- from 49 to 72 period – 0,4.

- from 73 to 96 period – 0,6.

- starting from the 97th period and all subsequent – 1.

Payment upon liquidation

If an organization is liquidated, the obligation to pay the mineral extraction tax is fulfilled by the liquidation commission (Clause 1, Article 49 of the Tax Code of the Russian Federation). It draws up an interim liquidation balance sheet, which reflects all the obligations of the organization. Tax debts are repaid only after the following have been repaid:

– debt to citizens to whom the liquidated organization is liable for causing harm to life or health (for example, the organization must compensate for harm caused to health due to an injury at work);

– debts for payment of royalties, severance pay and salaries to employees;

– debt to pledgees (at the expense of funds from the sale of the pledged item).

This follows from paragraph 3 of Article 49 of the Tax Code of the Russian Federation and Article 64 of the Civil Code of the Russian Federation.

Changes in the procedure for calculating mineral extraction tax regarding losses during oil production

In relation to oil extracted from those subsoil areas in respect of which the tax on additional income from the extraction of hydrocarbons (AIT) was in effect throughout the reporting period, the mineral extraction tax rate is established by the legislation of the Russian Federation at the level of 1 ruble per 1 ton of extracted raw materials , however, the amount received must be multiplied by a coefficient characterizing the level of oil taxation, the amounts of which are determined in Article 342.6 of the Tax Code of the Russian Federation.

Also, in accordance with the explanations of the Ministry of Finance dated May 17 and 24, 2021, taxation in terms of regulatory losses of extracted raw materials should be carried out at a zero rate.

What is mineral extraction tax

What is mineral extraction tax in simple words - this is the main expense item of the oil and gas business. For each ton of extracted products, a certain amount must be paid to the state. All money is sent to the federal budget.

Answering the question, mineral extraction tax - which tax is federal or regional, we can say that the mineral extraction tax is a direct federal tax that is levied on subsoil users. It is the main instrument for taxation of extractive industries.

The general characteristics of the tax on mineral resources show that with its help, funds for the use of natural resources are redistributed and directed to the benefit of citizens and the entire country.

Submitting a tax return

Based on para. 1 clause 3 art. 80 of the Tax Code of the Russian Federation, the tax return must be submitted to the tax authority at the place of registration of the taxpayer.

Does this mean that the tax return for mineral extraction tax must be submitted to the tax authority where the subsoil user is registered as a mineral extraction tax payer? In paragraph 1 of Art. 346 of the Tax Code of the Russian Federation states: a tax return for mineral extraction tax is submitted by the user of subsoil to the tax authorities at the location (place of residence) of the taxpayer. This norm, as indicated by the Federal Tax Service, is imperative, therefore the place for submitting the tax return for mineral extraction tax should be considered the Federal Tax Service inspection at the location (residence) of the taxpayer ( Letter dated 06.06.2013 No. ED-4-3 / [email protected] ). There is an exception to this rule for taxpayers classified as the largest taxpayers. These submit a mineral extraction tax declaration to the interregional (interdistrict) inspectorate of the Federal Tax Service for the largest taxpayers, in which they are registered ( paragraph 4, paragraph 3, article 80 of the Tax Code of the Russian Federation ).