Basic moments

An enterprise whose product output requires continuity of the production process switches to a shift work schedule using summarized accounting. The duration of the time period under consideration is twelve months:

- The production will operate in four shifts.

- When drawing up the work schedule, management took into account the standard working hours.

- The standard working time for 12 months is 1986 hours.

- Employees are notified by signature that they will work according to the new schedule.

At the end of the twelve-month working period, it was time for the employees to take vacations.

Calculation of vacation pay: we define average earnings in a new way

Clause 15 of the Regulations determines how to take into account bonuses when calculating average earnings, remuneration based on the results of work for the year, one-time remuneration for length of service (work experience), other remunerations based on the results of work for the year, accrued for the calendar year preceding the event, regardless of the time the remuneration was accrued .

According to the old rules, remunerations based on the results of work for the previous calendar year were taken into account when calculating average earnings in the amount of 1/12 for each month of the billing period and also regardless of the time of accrual (clause 14 of the Regulations on the average salary).

As you can see, now you no longer need to distribute annual bonuses accrued for the previous year to each month of the reporting period. That is, the entire amount of annual remuneration relating to the previous calendar year can be taken into account in full when calculating average earnings. Moreover, such payment is included in the calculation regardless of when it is accrued. The main condition is that the billing period must be worked out in full and the periods provided for in paragraph 5 of the Regulations must not be excluded from it.

Monthly bonuses and rewards actually accrued in the billing period are taken into account in full, but no more than one payment for each indicator for each month of the billing period.

Bonuses and remunerations for a period of work exceeding one month are taken into account in the month of their accrual for each indicator, if the duration of the period for which they are accrued does not exceed the billing period.

If the period for which they are accrued exceeds the duration of the billing period, then such a premium is included in the calculation in the amount of the monthly portion for each month of the billing period.

That is, as before, only four quarterly bonuses are taken into account when calculating vacation pay, even if there were five bonuses in the calculation period. Which of the accrued quarterly bonuses should be taken into account - the larger ones or the last four accrued - should be specified in the collective agreement or other document of the organization. If, for example, the premium is accrued over three years, then it can be taken into account in the amount of 1/36 for each of the 12 months of the billing period.

Now let's figure out how to take into account bonuses if the employee did not fully work the time falling within the billing period, or time was excluded from it in accordance with paragraph 5 of the Regulations. In this case, bonuses and remunerations are taken into account when determining average earnings in proportion to the time worked during the billing period. The exception is remuneration accrued for time actually worked in the billing period (monthly, quarterly, etc.). In practice, this means that if the bonus is not accrued in full, but based on the time worked, then it does not need to be divided again in proportion to the time worked taken into account in the billing period. If the bonus was accrued for all time worked, but some periods were excluded from it in accordance with paragraph 5 of the Regulations, then a recalculation must be made.

According to the old rules, an accountant, when calculating average earnings, had to recalculate any bonuses for incomplete months, even if they were accrued taking into account the actual time worked.

If an employee has worked an incomplete working period for which bonuses and rewards are accrued, and they were accrued in proportion to the time worked, they are taken into account when determining average earnings based on the amounts actually accrued in the manner established by paragraph 15 of the Regulations.

How are employee vacations reflected?

The Labor Code regulates work on summary accounting (Article 104 of the Labor Code of the Russian Federation), namely, it prohibits exceeding the normal amount of working time for the period under consideration (month, quarter, year). The normal working hours are assigned to employees by the Labor Code of the Russian Federation, based on the categories to which they belong. For certain categories of workers, the standard working hours differs: for example, a miner (who works in particularly harmful and dangerous conditions) and a seamstress.

Any work schedule is guided by the fact that the duration of the labor process per working week cannot exceed 40 hours.

Order of the Ministry of Health and Social Development of Russia dated August 13, 2009 No. 588n determines working hours:

- Like a five-day week with an eight-hour working day and two days off (Saturday and Sunday).

- The working day on pre-holiday days is seven hours.

- The work shift on the day before the holiday is also reduced by an hour (Article 95 of the Labor Code of the Russian Federation).

- A shift taking place at night is reduced by 1 hour (Article 96 of the Labor Code of the Russian Federation).

- It is prohibited to work for two shifts in a row (Article 103 of the Labor Code of the Russian Federation).

- One shift can last up to 12 hours.

- The lunch break does not count towards working hours (from 30 minutes to two hours).

Article 114 of the Labor Code of the Russian Federation guarantees workers an annual leave, during which the employee retains his job and is paid an average salary. The Labor Code provides for the procedure by which citizens receive vacations. Annual leave is required to be paid. Vacation is provided for the year worked and the countdown begins from the date the employee is hired by the enterprise. Art. 123 of the Labor Code of the Russian Federation provides for the approval of the vacation schedule for the enterprise no later than 14 days before the start of the new calendar year.

Summarized recording of working time: how to take into account employee vacations when calculating standard hours?

author of the answer,

Question

In the company, the summarized accounting of working hours is a yearly accounting period. They work 2/2 for 12 hours.

- Should annual paid leave be taken into account when calculating standard hours? If an employee goes on vacation, is it necessary to subtract the number of vacation hours from his standard hours? But then he will have a “defect”, should we pay for it?

- If an employee takes days without pay, he also has a shortfall. In this case, do we pay it according to the average?

Answer

- The standard working time of an employee who is absent for a valid reason provided for by law (any vacation, sick leave) is reduced by the hours of absence compared to the standard working time according to the production calendar. Hours of absence for a valid reason should not be worked out in the future.

- In the situation under consideration, the employee’s being on leave (annual, without pay) is not a defect. Average earnings for these periods of absence from work are not paid.

Rationale

According to Art. 104 of the Labor Code of the Russian Federation, when, due to the conditions of production (work) for an individual entrepreneur, in the organization as a whole, or when performing certain types of work, the established for this category of workers cannot be observed (including workers engaged in work with harmful and (or) dangerous working conditions ) daily or weekly working time, it is allowed to introduce summarized working time recording so that the working time for the accounting period (month, quarter and other periods) does not exceed the normal number of working hours. The accounting period cannot exceed one year, and for recording the working time of workers engaged in work with harmful and (or) dangerous working conditions - three months.

According to Art. 155 of the Labor Code of the Russian Federation, the employer is obliged to ensure that the employee works the total number of working hours during the accounting period. If an employee fails to comply with labor standards (job duties) due to the fault of the employer, payment is made for the time actually worked or for the work performed, but not lower than the average salary of the employee calculated for the same period of time or for the work performed.

Note that the initially calculated standard of working hours may change by the end of the accounting period. The fact is that from the number of working days it is necessary to exclude days when the employee did not actually work (was on vacation, was sick, underwent a medical examination, etc.). If days of absence were not initially included in the calculation, the norm will have to be recalculated, reducing it by hours of absence. The same point of view is supported by regulatory authorities.

Rostrud in Letter No. 550-6-1 dated 01.03.2010 indicated that when calculating the norm of working hours that must be worked in the accounting period, the time during which the employee was released from performing labor duties while maintaining his place of work is excluded from this period (in in particular, annual leave, study leave, leave without pay, temporary disability, the period of performing state and public duties). The standard working time in these cases should be reduced by the number of hours of such absence falling within working hours.

In addition, from the Letter of the Ministry of Labor of Russia dated December 25, 2013 No. 14-2-337, it also follows that if an employee is on vacation or temporarily disabled, the standard working time should be reduced for the duration of the employee’s absence, and when sent on a business trip - by the amount business trip time.

The Letter of the Ministry of Health and Social Development of Russia dated October 13, 2011 No. 22-2/377333-782 states that the hours of absence of an employee with summarized accounting of working time at the workplace in the accounting period in cases provided for by law (vacation, temporary disability, etc.), should not be worked on by them in the future. Consequently, the standard working time in these cases should be reduced by the number of hours missed by the employee according to his work schedule. However, current legislation does not define this situation as a deficiency and does not oblige the employer to pay for this period according to the average.

In addition, since the employee was absent from work for certain reasons provided for by law (in the situation under consideration, vacation), these periods of absence are paid in accordance with current legislation (vacation pay has already been paid for vacation). The legislation does not provide for double payment for one period, i.e. one period is not paid twice (vacation pay and average earnings).

Thus:

The standard working time of an employee who is absent for a valid reason provided for by law (any vacation, sick leave) is reduced by the hours of absence compared to the standard working time according to the production calendar. Hours of absence for a valid reason should not be worked out in the future.

In the situation under consideration, the employee’s being on leave (annual, without pay) is not a defect.

Average earnings for these periods of absence are not paid.

| She answered the question: I.V. Tarasova, leading expert of IPC "Consultant + Askon" |

Does vacation count towards working hours?

It is clear that under any working regime, a worker cannot work the hours that he was on legal leave. Accordingly, the norm of working hours for the year for an employee will be less by the number of hours that fell on any type of leave (annual, educational, at one’s own expense, sick leave or leave taken to fulfill civic duty). Vacation time during working hours must be deducted from the employee's total vacation period.

That is, the standard working hours for a certain period are initially determined without subtracting missed working days. Next, the total number of working hours attributable to vacation is subtracted from this standard. The Labor Code does not prohibit employers from drawing up shift work schedules taking into account all types of employee leave. Moreover, these vacations are planned in advance and their time frames are known.

The Labor Code does not prohibit employers from drawing up shift work schedules taking into account all types of employee leave.

Upon careful study of Art. 123 of the Labor Code of the Russian Federation, it becomes clear that a vacation schedule for an enterprise can be formed and signed long before the two-week limit at the end of the year. This will help the organization’s management to combine the vacation schedule with a shift work schedule, which means it is possible to reduce the accounting working time in the shift schedule during the employee’s vacation.

Vacation in the month of hiring

If an employee goes on vacation in the same month when he was hired, then the vacation is provided to him in advance.

Therefore, he does not have actually accrued wages or actually worked days for the pay period and before the start of the pay period. In this case, the average earnings are determined based on the amount of wages accrued for the days actually worked by the employee in the month of hiring (clause 7 of the Regulations approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922).

Calculate earnings for days actually worked by the employee in the month of hiring as follows:

| Earnings for days actually worked by the employee in the month of hiring | = | Employee monthly salary | : | Total number of working days in the month of hiring | × | Number of working days worked by an employee in the month of hiring |

Since vacation is provided to an employee in calendar days, to calculate average earnings it is necessary to determine the number of calendar days in an incompletely worked calendar month (paragraph 3 of clause 10 of the Regulations approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922).

Calculate the number of calendar days in an incompletely worked calendar month using the formula:

| Number of calendar days in an incompletely worked calendar month | = | 29,3 | : | Number of calendar days of the month | × | The number of calendar days corresponding to the time worked by the employee in an incompletely worked month before he is granted leave |

Calculate your average daily earnings as follows:

| Average daily earnings | = | Earnings accrued for the days actually worked by the employee in the month of hiring | : | Number of calendar days in an incompletely worked calendar month |

An example of how to determine the average daily earnings for calculating vacation pay. An employee goes on vacation in the month of hiring

A.S. Kondratyev was hired by the organization on May 10, 2016. And from May 20, 2021, at his request, he was granted annual paid leave in advance. The employee's monthly salary is 60,000 rubles; he receives no other payments.

The employee does not have an actual accrued salary or actually worked days for the pay period and before the start of the pay period. Therefore, the accountant determined the average salary based on the amount of salary actually accrued for the days actually worked by the employee in the month of hiring.

Earnings for the days actually worked by Kondratiev in the month of hiring are equal to:

(60,000 rubles: 19 days × 8 days) = 25,263.16 rubles.

The number of calendar days in an incompletely worked calendar month is equal to:

29.3 days/month: 31 days * 10 days = 9.4516 days.

Average daily earnings are:

RUB 25,263.16 : 9.4516 days = 2672.90 rub.

How are vacation pay calculated?

Calculation of vacation pay for cumulative accounting of working hours is carried out in exactly the same way as for people working in normal working hours. To calculate the amount of vacation pay, the calculated numerical value of the average daily salary is used. To calculate the average salary for a vacationer (any mode of work), the actual accrued payments, including bonuses, and the time actually worked by him for the previous year from the start of the current vacation are summed up. You can take no more than one type of payment in one month. For example, one bonus if there were two. The concept of “calendar year” includes the concept of “calendar month”. “Calendar month” is the period from the 1st day of the month to the last day of the month. The totality of twelve “calendar months” constitutes a “calendar year.”

If the employee has worked in full for the previous “calendar year”, then payment for vacation during the summarized accounting of working hours is made in the following order: the total amount of all accruals for the period is divided by the number of calendar days for the period and multiplied by the vacation time (in calendar days).

For example:

- The employee received a salary of 420,000 rubles + 18,000 rubles for the year preceding the vacation. bonus + 5,000 rub. monetary incentives for innovation proposals. Total, 443,000 rubles.

- Worked 363 working days per year.

- We determine the average annual salary for 1 day: 443,000 rubles. divide by 363 days (calendar year) = 1220.00 rubles.

- We calculate the amount of vacation pay: multiply the number of vacation days by 1220.00 rubles. (average salary per day).

How to calculate vacation pay

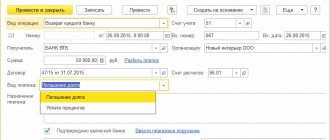

The basis for calculating vacation pay is the manager’s order to grant leave to an employee in form No. T-6 “Order (instruction) on granting leave to an employee” or in form No. T-6a “Order (instruction) on granting leave to employees.” The calculation is usually drawn up in a special unified form No. T-60 “Note-calculation on granting leave to an employee.” These forms were approved by Decree of the State Statistics Committee of Russia dated January 5, 2004 No. 1.

Stay up to date with the latest changes in accounting and taxation! Subscribe to Our news in Yandex Zen!

Subscribe