What are sales and cash receipts: the difference

A cash receipt (CR) is a document printed on a cash register, intended for the initial accounting of the purchase of goods. It is an attachment to the commodity.

A sales receipt (PR) is a fixed version of confirmation of a purchase made from a seller. Owners of companies subject to a single tax on imputed income are exempt from installing a cash register. In this case, it is allowed to issue a sales receipt without a cash receipt. There are nuances that must be taken into account when issuing a payment form. Let's talk about them further.

What is the difference between a sales receipt and a cash receipt?

Secondly, each unit of goods must be entered on the receipt on a separate line indicating the specific name. For example, when purchasing office supplies, you need to write down all purchases, and not make one generalized entry “office supplies.” This mistake is very common in practice, and often the buyers themselves ask to write in general terms on the check. As a result, accounting cannot always accept the costs incurred as expenses, and the tax inspectorate may make a comment about this when conducting audits.

- If this check is issued as an addition to a cash document, then the inscription “valid with a cash receipt” must be displayed. The amount of “VAT” in this case is stated separately.

- To avoid conflict situations with clients, it is advisable to put a wet stamp on the document.

- Since the sales receipt is confirmation of the mutual settlement between the manufacturer and the consumer, there is no need to affix “received” and “paid” stamps. However, if this imprint is displayed on the document, this will not be considered a violation.

- You cannot leave blank columns in the document, so the extra ones must be crossed out.

Interesting read: Agreement on alimony

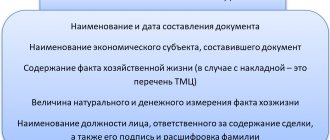

Requirements for sales and cash receipts

Today there are no established rules for what a sales receipt without a cash receipt should look like. Each owner has the right to decide for himself how the payslip will be drawn up. It is important to remember that the sales receipt or cash register is considered valid. Let's look at what is written on each check:

| Sales receipt | Cash receipt |

|

|

Data from checks must be clear, printed using thermal paper, on which information is not stored for a long time (Article 4.7, 54-FZ). According to accounting standards, the PM contains a transcript of the cash register, because Not in all cases the latest version of the forms contains the necessary information about the purchase.

Is it possible to accept a sales receipt instead of a bill of lading?

At the same time, it is impossible to say unequivocally that the document you have was issued by the UTII payer. After all, the sales receipt, as a rule, does not indicate that the seller applies imputation. Therefore, tax authorities may say that there is no document confirming payment of expenses.

Question

At the same time, keep in mind that if the sales receipt does not contain the above details, then a cash register receipt is also required. Without it, it is better not to take into account expenses (clause 2 of article 346.16 and clause 1 of article 252 of the Tax Code of the Russian Federation and Federal Law dated May 22, 2003 N 54-FZ and letters of the Ministry of Finance of Russia dated September 6, 2021 N 03-11-11/272 and dated January 19, 2021 N 03-03-06/4/2).

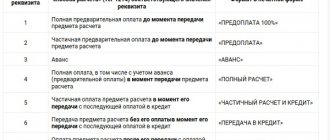

In all other cases, the delivery note is accepted for accounting without a cash receipt. If this is not enough for the buyer, he has the right to ask the seller to draw up a separate document for payment of funds (for example, a receipt for a cash order or a delivery note).

The payer will be the purchasing organization under the contract . The consignee may be a third party organization, a subsidiary, a branch or a representative office of the buyer. The delivery contract or an additional agreement to it must indicate where the cargo will be delivered and who the consignee is.

We recommend reading: Do they provide Dairy Kitchen in the Moscow Region to Children from 3 Years of Age from Large Families?

Can there be a technical specification for services?

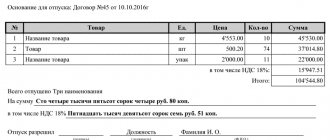

The sale of goods, namely the transfer of goods and materials from one person to another on a reimbursable basis, must be documented with accompanying documents. Based on TORG-12, accounting records reflect the entries for the movement of inventory items from the warehouse and entries for settlements with customers.

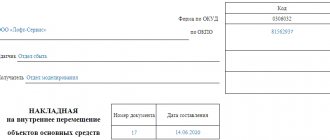

Invoice is a document on the basis of which goods and other material assets are released. There is no specific form for an invoice, but there are standardized forms that can be used in different situations, for example, for releasing materials from a warehouse or selling goods.

Design rules

If the enterprise does not have a cash register, the entrepreneur issues a form confirming the receipt of money for a product or service, if the buyer requests it. In such cases, a sales receipt is issued without a cash receipt. For a sheet to be considered valid, it must be compiled correctly.

So, a sales receipt for an individual entrepreneur without a cash receipt contains:

- Company details. The absence of any one point is grounds to consider the sheet invalid. There are cases when entrepreneurs place advertising on the back and front sides of the form. Such an action is not prohibited by law. But when registering, you should remember that advertising should not cover the details.

- List of products. The name of each new item or service is entered on a separate line. For example, if a buyer purchases office supplies, each new item (pen, pencil, notepad, etc.) will need to be indicated in the deed. It is wrong to describe “office supplies” in general terms.

- Total purchase amount. The information is written in a specially designated column. This rule is mandatory, and it does not depend on the number of goods purchased. To be on the safe side, you can make a double entry: in numbers and in words.

- Cross out the remaining empty lines so that no one can add additional products in the future. This is done in cases where the number of lines in the form is greater than the number of goods purchased.

The procedure for issuing PM requires care during registration. This entails high demands on both the entrepreneur and his employees making cash payments.

Sales Invoice

It should also be borne in mind that in some cases the invoice may acquire the status of a legally significant document - when one of the parties, due to some unfavorable circumstances, decides to go to court.

What is the invoice form used for?

And it is absolutely forbidden to enter unreliable or deliberately false information into the form - if such facts are revealed by regulatory authorities, the responsible persons or even the organization may incur serious administrative punishment, in the form of large fines.

We recommend reading: Tatristan commentary by year

It doesn't matter what you call this document. This could be, for example, a sales receipt or receipt. In addition, the entrepreneur has the right to develop the form of the document himself, produce it himself or in a printing house. A sample is below. The Federal Tax Service agrees with this approach (answers to questions on the Federal Tax Service website nalog.ru).

Entrepreneurs with a patent have the right to issue another document to the client instead of a cash receipt. But there are two conditions. Firstly, the rule does not apply to all entrepreneurs (clause 2.1 of Article 2 of the Federal Law of May 22, 2003 No. 54-FZ). For example, individual entrepreneurs with a patent can work without a cash register and are engaged in the repair and sewing of shoes, garments, leather production, key making, furniture or home repair, provide dry cleaning services, a photo studio, provide interpretation and translation, and conduct excursions.

Other new documents for small businesses

1. An individual entrepreneur on a patent and simplified law does not have the right to apply a zero rate if he was registered twice after the subject adopted the tax holiday law.

If an entrepreneur registers his status again, then the right to a tax holiday depends on when he first became an individual entrepreneur. If this happened after a constituent entity of the Russian Federation adopted a law on tax holidays, then the zero rate cannot be applied a second time. Even if the individual entrepreneur did not conduct business for the first time (Decision of the Supreme Court dated April 19, 2021 No. 309-ES19-4374). If the first registration was before the Vacation Law, tax authorities allow the application of a zero rate. In this case, it does not matter that the entrepreneur already had such a status. This is what the Federal Tax Service thinks (answer to the question on the website nalog.ru, paragraph 14 of the Review, approved by the Presidium of the Supreme Court on 07/04/2021).

- serial number, date of compilation;

- name of the company or full name of an individual entrepreneur - supplier of goods or services;

- supplier's tax identification number;

- a list of goods and services paid for by the employee with accountable funds, their quantity;

- the amount that the employee deposited into the supplier’s cash desk in rubles;

- position, full name, initials of the employee who issued the sales receipt, his signature.

And most importantly: the receipt for the PKO only confirms the fact of payment. Using it to confirm the type of expenses, for example, the name of purchased goods and materials or services, is problematic. Therefore, in addition to the receipt to the recipient, a document indicating the type of expenses incurred must be attached to the advance report: invoice, act, etc.

We recommend reading: Finish the maneuver at an intersection on a red light, Ukraine 2021

We supplement the advance report with a sales receipt

- the supplier's seal (if any) must be affixed simultaneously on both elements of the PQS - thus, approximately half of it will be visible on the receipt;

- in the “Amount” column of the PKO receipt, the amount of funds should be recorded in numbers, in the column below - in words.

What is the new list of documents for the expense report in 2021? What documents have changed? What should I include in the report following the trip? Is there a new list in the law? Let us explain what exactly has changed.

What document replaces a sales receipt?

When purchasing certain types of goods, you cannot do without issuing a sales receipt. It is possible to obtain a so-called consignment note in a form defined by law and having all the necessary details: the goods must be designated (name), counted (quantity) and assessed (price and amount). However, a bill of lading will be issued only to legal entities, but an individual needs a sales receipt.

To confirm expenses of accountable amounts (and, as I understand it, this is precisely the point the question concerns), a document containing all the mandatory details of the primary document is sufficient, such as: name of the document, number and date of the document, name of the organization (indicating the TIN) of the organization or individual entrepreneur, carrying out a business transaction, the essence of the business transaction (for example, purchase, sale, service, etc.), its quantitative and/or cost measurement, amount, position of the person who carried out the business transaction, his surname, initials (or other information that allows one to clearly identify it person) and signature, and also, preferably, the seal of the organization or individual entrepreneur.

How to fill out a sales receipt correctly: requirements and mandatory details

Any monetary transactions made, no matter whether it is the purchase of something or payment for a service, must be accompanied by the necessary documents confirming this fact. To do this, the seller is required to issue a receipt. It records the date and time of purchase, its name and, of course, the cost. But you need to understand that a check can be not only a cash receipt, but also a commodity one.

When an accountable person reports for the amount of money issued to him, he is obliged to present all documents confirming the expenses. Such a form is direct evidence of what exactly a person purchased and must be accompanied by an advance report along with a cash receipt, if any.

05 Aug 2021 stopurist 2662

Share this post

- Related Posts

- What benefits are available to large families in 2021 in the Moscow region when opening a business?

- List of Subjects for Recovery by Priests

- Transport tax Vologda region for 2021 for pensioners

- Mikhailova 9 housing department queue for housing

Invoice

The invoice controls the movement of VAT. Invoices are usually issued in conjunction with delivery notes or acts.

An invoice is the basis for accepting the presented VAT amounts for deduction. All enterprises paying VAT are required to write it out.

Thus, in order not to be punished for violating the rules established by the Law of December 6, 2011 No. 402-FZ, keep the invoices for at least five years.

According to this letter, the storage period for primary accounting documents and appendices to them, which recorded the fact of a business transaction and were the basis for accounting records, must be stored for at least 5 years.

St. Petersburg consignment note

Answer: A consignment note (or consignment note) differs from a consignment note in that it implies a different operation. Filling out the consignment note implies the movement of cargo, not necessarily during sale; the consignment note has to be filled out, even when a certain batch of goods is moved from one warehouse to another. And TN is the sale of cargo without moving it. Of course, sometimes a goods transport vehicle “includes” a goods transport vehicle, for example, when certain materials are transferred into the ownership of another person and transported over a certain distance.

Any consignment note must contain comprehensive information about all parties to the transaction, cargo, route, commodity and financial relations and some other information: • Who is the sender • Who is the recipient • Name of the cargo • Are there any accompanying documents • Cost of the goods • Date of delivery of the cargo • Date of receipt of the cargo • Who transports the goods and under what conditions

31 Jan 2021 uristland 300

Share this post

- Related Posts

- Personal income tax from Belarusians in 2021

- He left without noticing the accident and left

- In what cases can you go on maternity leave earlier?

- Where to get sales receipts for individual entrepreneurs

How to fill out a document: algorithm

You can use the completed invoice form as an example.

Worth considering:

- Made in duplicate for both participants.

- Signing by representatives is accompanied by a transcript.

- When issuing inventory items according to the RN, the basis must be indicated.

This paper is usually drawn up earlier than the power of attorney to receive the goods. Therefore, first, the details for the supply agreement are written down. And when delivering products, new information is included here.

If additional documentation is attached, then the primary document contains an indication of this. When registering the number of the invoice itself and the date of its creation, the latter must coincide with the moment of shipment, unless there were other agreements between the customer and the supplier. Compilation in advance (that is, retroactively) is not prohibited in order to enter all final and missing information at the time of the transaction. Most often, RNs in an organization are formed at the end of the shift of the employees responsible for this or based on the results of the operating day.

Do you want to implement “Store 15”? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted.

Persons who signed the paper are held accountable even under criminal law. For example, in case of theft or theft by intruders. Therefore, it is worth monitoring the availability of all items (including paintings). It’s easy to fill out an invoice using the online sample. The question arises about further steps when obtaining a RN.

Difference between the forms of invoice and delivery note

Registration of product documentation occurs before the buyer sends the order, but is completed on the spot. This allows you to reserve inventory items before the arrival of such a purchaser, since the technical document confirms the fact of delivery of the ordered products. The following is written down here: the name (type) of the product, its price, quantity and generalized cost, details of both parties, names of positions and signatures of those involved, seals of enterprises. Registration also occurs in two copies.

A common feature of the documents under consideration is that they accompany the movement of property from one point to another. They are part of accounting, but they are far from identical. RN differs in that it can be used for internal movement of valuables (between employees and structural divisions). And the “alternative” mentioned here is applicable only when selling goods and materials to third-party purchasers.

We looked at what an invoice is and why it is needed.

The main conclusion is that the document is extremely convenient for use in various situations, which confirms its versatility. It is allowed to use standardized forms to generate documentation or invent your own. But they must comply with the rules of business document flow and, in order to protect the interests of both parties, must contain some information sections. Number of impressions: 3251