Labor Code of the Russian Federation on the timing of receiving vacation benefits

Annual paid leave is provided to each employee. This right is enshrined in law by the corresponding article of the Labor Code of the Russian Federation.

The duration of annual paid leave usually does not exceed 28 calendar days. Longer vacations are established for certain categories of workers, for example, for workers of the Far North, employees of hazardous industries, etc.

The legislator provided for the preservation of the average earnings of the working person during the annual rest period allotted to him. Payment for this period is set according to a formula.

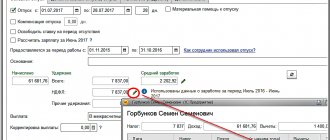

By multiplying the number of days of rest by average earnings, the amount of vacation pay is determined. To calculate average daily earnings, a calculation period of 12 months is taken and payments are made only for the time actually worked. Disability benefits and various social benefits are not taken into account.

The period for which vacation pay is paid is established by Part 9 of Article 136 of the Labor Code of the Russian Federation. Vacation pay must be paid at least 3 days before the start date of the vacation. Earlier you can pay vacation pay, but later you can’t. In case of delay in payment of benefits due to the fault of the enterprise, the employee is entitled to compensation.

It is also not very convenient to make a payment earlier than three days in advance. Various circumstances may arise in which going on vacation will have to be postponed (for example, illness). Therefore, it is optimal to accrue and pay vacation pay 3 days before the start date of the vacation.

Despite the fact that the above-mentioned article of the law does not specify the status (calendar or working) of these three days, there is a special letter from Rostrud (No. 1693-6-1 dated July 30, 2014), according to which the counting must be carried out in calendar days. Three calendar days before the start of the vacation, benefits must be paid.

What is the correct way to pay vacation pay: together with the salary or immediately

The law does not prohibit paying salary with vacation pay. As was written above, an employee can only ask for salary and vacation pay to be paid on the same day. Vacation pay is paid three days before the actual start of the vacation, and salary is paid twice a month.

Important ! Accordingly, payment days may not coincide.

The employer has the opportunity to pay vacation pay ahead of schedule. This is not prohibited by law.

The employer can issue vacation pay earlier

How to receive vacation pay along with salary? If the employer has such an opportunity, then he can pay the funds to the employee along with vacation pay. In addition, an employee can receive funds for temporary disability and funds for not going on vacation. All these funds are paid to the employee from the fund according to the salary.

Important ! In the case when the money comes from the bank, it is worth remembering that the funds will arrive only the next day.

The amount of vacation pay will be different for everyone. When employees have the same salary, even then they may end up receiving different amounts. It all depends on the number of days that are considered worked per year. Not subject to accounting:

- days of receiving average salary income;

- days when the employee is sick;

- days when the employee takes vacation at his own expense.

Important ! At such moments, accounting employees should be especially vigilant when working with documents and reports, and monitor each payment to a specific employee.

You can ask the employer to pay salary and vacation pay immediately

In the event that an employee has not received a salary while on vacation, he will have the opportunity to receive funds on the day of settlement of the salary. If it is possible to make calculations and accrue salary during vacation, the employee will be able to receive it.

FAQ

Is the company obliged to pay wages along with vacation pay for the days worked in a given month? An employee goes on vacation in the middle of the month.

According to the law (Article 136 of the Labor Code of the Russian Federation), 3 days before going on vacation, only the vacation itself is paid. The law does not provide for the payment of vacation pay along with payment for days actually worked.

It follows from this that the day before the vacation, the employer must pay the employee only the average earnings for the vacation period. The salary for employees on vacation for the period of work before going on vacation is paid within a single set time frame - on a day determined by the regulations within the enterprise and the contract.

However, the Labor Code of the Russian Federation allows for an improvement in the employee’s situation - salary can be accrued more often than twice a month.

Salary can be paid more than twice a month

Consequently, the company can pay the employee funds before the start of the vacation, immediately with vacation pay, i.e. before the due date for salary deduction. In this case, all the nuances of salary payment are agreed upon with the employee.

If the preliminary payment of the salary was a one-time payment, then it will be enough to write a statement indicating the desire to issue the salary earlier than the deadline.

If employees wish to continue to receive salaries earlier than the established period, we would recommend discussing this condition in the employment contract and other documents.

Procedure for granting leave

In order to understand how vacation pay is paid, it is necessary to pay attention to a certain procedure for granting leave from work.

As is known, leave cannot be granted to persons who have not worked a certain amount of time at a particular enterprise since receiving the job (usually this period is a year). However, not every citizen knows about the opportunity to get a few days of rest after six months of work. At the same time, for these days, according to the Labor Code of the Russian Federation, accrual and payment of vacation pay must be realized.

Annual paid leave must be included in a special vacation schedule and also agreed with the employee himself. It is also worth noting that the worker has the right to transfer vacation (however, this possibility exists for no more than two years in a row). Vacation can be divided; Moreover, each part of it should not be less than 14 days.

General accrual algorithm

Every employer is required by law to pay statutory holiday pay strictly in the prescribed amount. If this rule is not followed, the company or individual entrepreneur will be assessed a certain fine. Calculating the amount of holiday pay required by law is relatively simple. It is carried out as follows:

- The estimated time period is determined. By default, its standard value is 12 full months preceding the start of vacation or dismissal. If such a billing period is slightly different, you will need to set the year and month yourself;

- Time periods that are not used to calculate compensation are excluded. A detailed list of days is presented in the official government decree;

- In conclusion, the personnel employee multiplies the total number of days by the average daily earnings established in the organization. After this, personal income tax is calculated, the amount of which is subtracted from the final amount.

This is also important to know:

Can an employer refuse leave: how the right to rest is regulated, reasons for refusing leave

The amount received after calculations must be transferred to the employee within the period established by modern legislation.

The process of crediting vacation pay is carried out using the usual method - card, cash at the cash desk. The payment of the required amount is reflected in the accounting report. Failure to comply with this rule will automatically result in the appointment of an official desk audit. This situation, in turn, will lead to rather unpleasant consequences for the employer. These may include fines and other equally serious sanctions.

What amounts should be included in the calculation?

When calculating average earnings for a working year, it includes those payments that are approved by the organization. Such payments include: salary at the approved rate; compensation for overtime work; premium; other payments for labor performance. But there are payments that can be issued along with the salary, but will not be taken into account when calculating vacation pay. These are: travel payment; compensation for food and the use of personal transport; sick leave; other non-labor or social benefits.

When is it paid?

Every employee who is authorized to calculate and accrue funds is required to know when vacation pay is paid? The legislation has established a certain period for this - three days before the start of the holiday.

But this issue also has its own nuances. For example, what to do if the accrual date falls on a weekend and the accounting department is closed. In this situation, the money must be transferred on the last working day before the weekend. The same applies to holidays. According to the law, none of the holidays, especially long ones, can interfere with the payment of vacation pay.

Therefore, if vacation starts on Monday, when are vacation pay paid? Funds can be transferred on Friday. In addition, tax is also charged on vacation pay. This fact should not be forgotten when calculating funds.

Another fact that cannot but concern employees is whether vacation pay is paid along with their salary or not? The law does not provide for such a rule. Not a single legislative act speaks of this as an obligation, which means that the employer should not pay both wages and vacation pay at the same time. The employee must receive vacation pay three days before the rest, and the salary must be accrued on time.

The issue of payment of vacation pay along with salary

Legislatively, salary payments and all the nuances are enshrined in Article 136 of the Labor Code of the Russian Federation, which also stipulates the deadlines. Funds are paid twice a month, unless there are other conditions in the employment contract.

In addition, the employee has the right to receive funds for temporary disability and other compensation, including for not using legal leave. It is worth remembering that, as a rule, it is impossible to receive money for annual leave along with your salary, but this is not prohibited by law. In this case, however, all funds for vacation pay and salaries are calculated from the organization’s single reserve.

Important ! It is clear that it is better for accountants to deduct funds up to three days before the employee goes on vacation. This is due to the fact that documentation may be delayed and if funds go through the cash register, then it is better to pre-pay the required funds to the employee.

As a rule, wages and vacation pay are not paid together

Vacation pay is not a constant amount - everything is calculated based on the duration of the settlement period, total income, payments, average earnings per day and the number of vacation days.

The amount of vacation pay varies for everyone. These funds are not paid as a lump sum with the salary. Three days are specifically provided before the start of the vacation.

Explanations from the Ministry of Labor - how to count 3 days?

The Ministry of Labor was forced to answer numerous questions from employer representatives regarding the period for payment of vacation pay.

- How to count 3 days?

- Do they include payday or not?

This is also important to know:

Can an employer refuse leave: how the right to rest is regulated, reasons for refusing leave

First, in an information letter dated June 16, 2014, the Ministry of Labor and Social Protection of Russia spoke in the spirit that the established period begins the next day after payment, that is, the day of payment is not included in the deadline (see explanations in the document “On the need for recalculation vacation amounts taking into account changes in the average monthly number of calendar days"). This position is consistent with the general procedure for calculating terms adopted in Russian legislation, however, such a rule is not enshrined in the Labor Code; on the contrary, in Art. 14 states that the period of time associated with the emergence of any rights of employees begins from a specific date that determines their beginning. The special procedure for calculating deadlines is always specified separately by the legislator.

It is not surprising that an explanatory letter No. 1693-6-1 dated July 30, 2014 followed, from the text of which it could be concluded that Rostrud (Federal Service for Labor and Employment, under the jurisdiction of the Ministry of Labor and Social Protection) is of the opinion that in widespread situations where an employee goes on vacation on Monday, payment can be made on Friday. Thus, Rostrud ambiguously spoke in favor of the position of calculating the three-day period directly from the date of payment.

However, not all courts supported Rostrud at that time; there was no uniformity in judicial practice. Perhaps the only provision that has not been questioned is that the law deals with calendar days, not working days. But how to count these 3 days, neither legislators nor law enforcement officials could give a clear answer.

Who can claim paid leave?

Russia currently has a population of 145 million people. Of the total population, only 28% of residents vacation in the Russian Federation, and only 12% travel abroad. Based on this, we can conclude that more than half of all citizens do not travel at all. The main reason is the lack of basic financial opportunity.

The new bill makes it possible to solve several problems at once - to ease the financial situation of enterprise employees, provide the opportunity to travel and become familiar with the culture of the Russian Federation. In this case, not only the employee of the enterprise benefits, but also the country’s economy. On the one hand, tax will be paid on the compensation received, on the other hand, the rapidly developing tourism sector will begin to transfer tax on profits to the budget.

The opportunity to go on vacation profitably and entirely at the employer’s expense is provided to all employees, without exception, along with their families. The manager can easily pay expenses for the following categories of persons:

- Directly the employee himself;

- Employee's spouse;

- Parents;

- The employee’s children and all his wards are under 18 years of age in the usual case and up to 24 years of age if he is studying at a university.

Based on this, we can conclude that the opportunity to rest is open to all employees, without exception, as well as their loved ones. For many, this opens up unique opportunities.

Responsibility for violation of deadlines for payment of vacation pay

But, if such a violation did occur, or occurs at the enterprise, then you should remember that if the terms of payment of vacation pay are violated, the employer is subject to liability: financial, criminal and administrative.

The employer's financial liability is provided for in Article 236 of the Labor Code of the Russian Federation. It states that for delays in wages, vacation payments, dismissal payments, etc., the organization is obliged to pay monetary compensation to the employee. Such compensation may be provided for in labor or collective agreements, and can, in principle, be any amount agreed upon with the employees.

But there is one important “but”: compensation for delayed payments cannot be calculated less than 1/300 of the refinancing rate of the Central Bank of the Russian Federation on the day of actual payment of vacation pay for each day of delay. Delay in payment of vacation pay is considered from the next day after the due date and ends on the day of actual payment (including this day).

The timing of payment of vacation pay to the employee must be strictly observed, special attention must be paid to days falling on weekends and holidays, since the employer will bear financial responsibility in any case, regardless of whether he himself is to blame for the delay or some circumstances beyond his control.

Delay of money

If the employer delays vacation pay, then financial liability arises under the Labor Code of the Russian Federation - Art. 236. The employer must pay for each day of delay in payment of vacation pay.

Its amount is 1/300 of the Central Bank refinancing rate at the location of the organization.

Compensation must be provided from the moment the delay begins until the day vacation pay is paid. Payments must be made regardless of the employer’s fault for delaying vacation pay.

What are the consequences of failure to pay on time?

Find out when you should transfer money for vacation and what to do if the employer is delaying payments to protect your rights.

If the organization delays with payments, the employee has the right to demand that the vacation be postponed to another period.

Administrative liability may follow in the form of a fine of 5 thousand - 30 thousand rubles. and removal of the director of the organization from a leadership position. The state inspectorate has the right to fine an employer an unlimited number of times.

If violations become regular, then the head of the organization is subject to criminal liability with restriction of freedom, a prison term of up to 3 years and (or) payment of a large fine.

Employee actions

You must contact the state labor inspectorate. Its employees will carry out the necessary checks and force the employer to pay vacation pay.

If he turns out to do this voluntarily, then he needs to go to court.

A sample statement of claim to the court for non-payment of vacation pay is here.

Claims for labor disputes are not subject to state duty when the application is filed by an employee.

Vacation pay for less than a month is calculated using a special formula. Is compensation due for delayed vacation pay? Read here.

When should vacation pay be paid according to the law? Details in this article.

The State Labor Inspectorate will assist in filing a claim, help determine the jurisdiction of the case and, if necessary, provide a qualified defense lawyer for low-income families or disabled people who are unable to defend their rights on their own.

Other categories of workers can contact public and human rights organizations that specialize in free protection of the rights of the population.

Opinion of Rostrud: what is the period for payment of vacation pay?

It echoes the norms of Art. 136 of the Labor Code of the Russian Federation and letter of Rostrud dated July 30, 2014 No. 1693-6-1, defining a three-day minimum in calendar days counted before the start of vacation. The document also notes the need to take into account non-working days. If they exist, the period by which payments must be made increases, i.e. The required amounts will have to be paid out in 4, 5 or more days. For example, when providing leave from June 14, 2021, payment is made not on the 10th, but on the 9th of June on Saturday (it was a working day), since the 10th and 11th of June are weekends, and the 12th is a holiday day.

This is also important to know:

Can an employer refuse leave: how the right to rest is regulated, reasons for refusing leave

However, letter No. 1693-6-1 does not clarify this circumstance: whether the day of payment should be counted within the three-day period. Only the possibility of issuing vacation pay on Thursday or Friday to an employee who goes on vacation on Monday is mentioned.

The absence of this clarification has given rise to differences in the interpretation of deadlines in different regional labor inspectorates. Thus, in the Irkutsk region, it is considered legal to pay vacation pay 2 days on the 3rd day before the vacation, and in the St. Petersburg GIT it is recommended to transfer or issue money for vacation 3 days on the 4th.

In practice, based on legal regulations, security considerations and simple everyday caution, accountants make payments exactly on the 4th day. In addition, there are many conflicting decisions of the Arbitration Court.

When must vacation pay be transferred by law in 2021?

Vacation pay by law must be paid at least 3 days before the start of the vacation. Violation of deadlines is fraught with fines for the company. If the application for leave was submitted late and the employer may not have time to transfer the money on time, the organization has the right to refuse such leave or postpone it to a later date.

It is noteworthy, but judicial practice insists that vacation pay must be paid for 3 full days, i.e. The day of money transfer is not included. Thus, it is better to transfer funds as early as possible, at least 4 days before the start of the vacation. And also take into account the days the bank transfers money to the employee’s card. In this case, misunderstandings will definitely be settled.

When to pay personal income tax on vacation pay in 2021

It is worth noting that in most cases it is not necessary to apply for annual paid leave. The fact is that enterprises draw up a vacation schedule, of which the employee is notified in advance, against signature. When the deadline established by the schedule approaches, the director issues an order to grant vacation, and the accounting department calculates vacation pay based on it. The employee, having read the order, puts his signature on it as a sign of consent.

If an employee requires paid leave, but not at the time established by the vacation schedule, he must write an application at least 4-14 days before the expected date of departure. About the timing of payment of vacation pay, see the video below: If the last of the three days before the issuance of vacation pay coincides with a weekend As mentioned above, vacation pay must be issued no less than three days before the first day of vacation.

What is the employer entitled to for providing compensation?

As already mentioned, for providing employees with paid leave, the employer receives an established tax benefit.

Providing benefits is possible only if there is compensation for workers for a trip to a sanatorium or resort. Otherwise, the organization does not receive this privilege.

Read also: Calculation of vacation pay in 2021

An equally important point is that you can receive this payment only by carefully ensuring that the costs incurred do not exceed 6 percent of the total amount of expenses aimed at paying for labor activities. For companies and firms with small payroll funds, such an introduction is unprofitable and irrelevant.

The established changes in legislation are suitable for enterprises that pay “white” salaries to their employees.

According to experts, such a bill is also convenient for large and medium-sized companies. However, most of these companies already provide paid leave to their employees. In addition, employees in these organizations earn enough to provide themselves and their families with a good rest both in Russia and abroad. For small companies, the introduction of the bill is irrelevant due to the lack of sufficient profits and a small staff.

On the other hand, according to the same experts, recently small businesses are increasingly trying to increase the growth of social consciousness. So, now you can book collective outings into nature as excursion services. Before the introduction of the changes, identifying such expenses under a specific item was problematic.

How is vacation calculated?

The payroll period can be worked by the employee completely or partially. Depending on this, different formulas are used to calculate average earnings for vacation.

If the period is worked out in full and leave is granted to the employee in calendar days, then the average daily earnings are determined as follows (Article 139 of the Labor Code of the Russian Federation, clause 10 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922):

29.3 is the average monthly number of calendar days in a year.

If the billing period is not fully worked out, another formula is used:

In turn, the last indicator - the number of days worked in months not fully worked - is determined taking into account the proportion separately for each such month.

A formula that takes into account months not fully worked is used if the employee’s pay period included excluded periods: vacations, business trips, periods of temporary disability, etc. (Clause 5 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922).

Having determined the amount of the employee’s average daily earnings, you can calculate the amount of vacation pay (clause 9 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922):

Labor Code provisions on vacation pay

When going on vacation, the employee is paid compensation for these days in the form of vacation pay. They are calculated based on average earnings for the previous 12 months. This includes not only salary, but also bonuses and allowances. A full calendar month is considered a settlement month. Article 139 of the Labor Code of the Russian Federation states that the average daily earnings must be divided into 12 (months) and 29.3 (the average number of days in a month). Thus, the formula is obtained:

Vacation pay = (Average salary including bonuses and allowances for 12 months: 12: 29.3) * number of vacation days.

Accrual of vacation in 2021: example

Example 1. Calculation of vacation pay for a fully worked pay period

Manager Safonov A.N. in accordance with the vacation schedule, from May 21, 2021, another paid vacation of 14 calendar days should be granted. The billing period is from May 1, 2021 to April 30, 2021. The amount of payments taken into account when calculating average earnings was 516,000 rubles.

Solution.

Average daily earnings: 1467.58 rubles. (RUB 516,000 / 12 months / 29.3)

This is also important to know:

Paternity leave for fathers

Amount of vacation pay: 20,546.12 rubles. (RUB 1,467.58 x 14 days)

Example 2. Calculation of vacation pay when the billing period is not fully worked

Let's use the condition of the previous example and assume that Safonov A.N. from October 11 to October 13, 2021, he was on a business trip, and from March 19 to March 26, 2021, he was on sick leave. The amount of payments taken into account when calculating average earnings was 509,000 rubles.

Solution.

Average monthly number of days worked in October 2021: 26.5 days. (29.3 / 31 days x (31 days – 3 days)).

Average monthly number of days worked in March 2019: 21.7 days. (29.3 / 31 days x (31 days – 8 days)).

Average daily earnings: RUB 1,491.79. (RUB 509,000 / (29.3 x 10 months + 26.5 days + 21.7 days))

Amount of vacation pay: RUB 20,885.06. (RUB 1,491.79 x 14 days)

Changes in vacation pay payment terms from July 1, 2021

In such a situation, in the employment contract, the director of the company makes reference to a specific provision of the collective agreement. When paying an employee his salary, the accountant indicates the following information on the pay slip:

Free legal consultation

We will answer your question in 5 minutes!

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

Ask a Question

- the main part of the salary, which is accrued for a specific month;

- the size and basis of the deductions, if any;

- monetary compensation, vacation pay, severance pay, etc.

Deadlines for payment of advance payments in 2021 From October 3, 2021, the changes provided for by 272-FZ came into force. Some amendments to the law also apply to advance payments.

The employer prescribes salary accrual periods here. He can also prescribe the issuance periods, describe them in another act, and leave a link to the document in the contract;

- Rules of routine. The head of the company must indicate the periods for calculating wages in the rules of the schedule, and in other documents leave a reference to this provision. The fact is that the rules of the schedule are followed by all employees, and the employment contract is followed only by a specific employee. The company may not have a collective agreement;

- Collective agreement. In this document, the head of the enterprise indicates the point in which the periods for accrual of salary are entered.

However, the legislation does not indicate whether this should be 3 full days or whether rest can begin on the third day after payment of vacation pay. It is also not indicated which days we are talking about: working days or calendar days. Three days can be interpreted in different ways. In the situation that became the basis for the decision of the Perm Regional Court, the State Labor Inspectorate came to the organization with an unscheduled inspection of compliance with labor legislation and other regulatory legal acts containing labor law norms. The inspectors found a violation in the timing of payment of vacation pay.

They indicated that after payment of vacation pay, at least 3 full calendar days must pass before the start of the vacation. If this requirement is not met, the employee's rights are violated.

In the inspection report, GIT inspectors classified all situations where employees received vacation pay 3 days in advance as violations of deadlines, taking into account the day of going on vacation itself.

You can get a vacation after working a full six months. But this is a vacation “in advance”. Then leave will be granted every 11 months. At the end of each calendar year, a vacation schedule is drawn up, according to which all employees “walk” in the next calendar year.

Vacation can be divided into several parts, but one of them should not be less than 14 calendar days. Then you can “split” your vacation into at least 1 calendar day.

The procedure for “leaving” for a well-deserved work holiday is as follows:

- the HR department notifies the employee in writing 2 weeks before the scheduled leave date;

- the employee writes a leave application;

- the employer signs the application and an order is issued based on it;

- the employee receives “vacation pay” - compensation for the fact that he does not work on these days.

This is also important to know:

Can an employer refuse leave: how the right to rest is regulated, reasons for refusing leave

Vacation pay is paid based on the employee’s average earnings for 1 working day in the previous working year. To do this, you need to know the billing period - that is, the start and end date of the working year. For example, an employee goes on vacation in 2021 on July 8, and he got a job on March 23, 2021. The calculation period for vacation pay in 2021 is from March 23, 2021 to March 22, 2019.

To calculate average earnings, it is necessary to add up all labor payments to the employee and divide by the number of days he actually worked in the last working year. The result is the average employee's earnings per 1 working day. This number must be multiplied by the number of days of rest.

The main essence of the adopted law

Vacation at the expense of the employer, as a right of an officially working citizen, fully complies with the rules and requirements of the modern labor code. The rule will come into force on January 1, 2021. Despite some remoteness, an application for such a vacation can be written today. If the manager accepts it and puts the appropriate stamp, you can go on your next vacation with full rights at a pre-planned and approved time.

The adopted decision makes special changes to Articles 270 and 255 of the Labor Code and to the modern tax code of the Russian Federation. They mostly concern enterprises that are official taxpayers. In the process of determining the organization’s profit, within the framework of paying the required taxes, it is possible to reduce the profit by the amount of previously spent expenses aimed at resting its employees and their families.

The employer pays vacation to subordinates and receives certain tax benefits for this.

Financial assistance and health benefits

Financial assistance to an employee paid in the period for which vacation pay is calculated is not taken into account.

By decision of the management team, additional allowances may be applied to the vacation accruals of employees of this enterprise, in addition to the accrued money as basic ones. In particular, such additional payment can be financial assistance. It can act as a fixed equal amount for each employee, the best specialists of the enterprise who have shown high performance or have no penalties or comments for the period being calculated.

This kind of financial assistance can act as compensation for a trip to a sanatorium or dispensary (so-called health benefits).

But, one should take into account the fact that neither financial assistance nor health contributions should be taken into account when calculating vacation amounts.

Problems of calculating the period for payment of vacation pay

There are no special rules for calculating the period for payment of vacation pay. In this regard, in law enforcement practice there has not been a single position on the issue of calculating the period for paying leave. So, for example, from the Information of the Ministry of Labor and Social Protection of the Russian Federation dated June 16, 2014 “On the need to recalculate vacation amounts taking into account changes in the average monthly number of calendar days,” it follows that specialists from the Ministry of Labor and Social Protection believe that the three-day period begins the next day after payment for vacation.

And from the above letter dated July 30, 2014 No. 1693-6-1, in our opinion, it follows that Rostrud adheres to the position that the three-day period should be calculated directly from the day of payment of vacation (the letter states that payment of vacation pay can be made on Friday (three days before the start of the vacation), and within the meaning of the explanations contained therein, we are talking about a situation where the employee is granted vacation on Monday).

Judicial practice on this issue is also not uniform. Thus, some courts believe that the payment day is included in these three calendar days (decision of the Moscow City Court dated 02/18/2014 No. 7-764/14, decision of the Pavlovo-Posad City Court of the Moscow Region dated 09/03/2012 in case No. 2-1590/ 2012, ruling of the Investigative Committee for civil cases of the Moscow City Court dated 09/02/2010 No. 33-23757, decision of the Shilkinsky District Court of the Trans-Baikal Territory dated 10/19/2012 in case No. 2-843/12), others - that between the date of granting leave and the date of payment should be at least three full days (see, for example, the decision of the Bezhitsky District Court of Bryansk, Bryansk Region dated October 20, 2014 in case No. 2-2266/14, the decision of the Industrial District Court of Khabarovsk, Khabarovsk Territory dated November 13, 2012 in case No. 2 -5201/2012; decision of the Penza Regional Court of July 23, 2015 in case No. 7-288/2015).

Subscribe to the latest news

How is vacation paid if you did not have time to pay vacation pay for 3 days according to the Labor Code of the Russian Federation?

It is sometimes difficult to meet the deadlines for paying vacation according to the Labor Code of the Russian Federation. For example, if before this the employee was sick and went to work 1-2 days before the start of annual leave. In this case, the employee has the right to submit an application in accordance with Part 2 of Art. 124 of the Labor Code, on postponing vacation.

If such an application was not submitted and the employee went on vacation as scheduled, then subsequently there can be no talk of postponing the vacation. After all, this is the right of an employee, but not an obligation for the management of an enterprise - this is the opinion of the judicial authorities in the event of such a dispute (for example, the appeal ruling of the Moscow City Court dated November 18, 2013 No. 11-32401/13). In this case, if the employee was not given vacation pay on time, then it must be paid as soon as possible.