Let us pay attention to one of the types of periodic inspections of the organization’s condition. Today, inventory before drawing up annual financial statements is carried out, in fact, without fail, and below we will look at why this happens, why, and what it gives. We will separately touch on the tasks and deadlines and go through all its stages. So much information - so that you understand how to act, and also realize the importance and relevance of the measures being taken.

Let us immediately note that literally all the nuances of this complex procedure are regulated by various documents. And this is even convenient in practice, since it protects against repeated mistakes: having corrected all the mistakes, you will not make them the second time. Below we will try to highlight all the nuances and pitfalls in as much detail as possible, so that there are initially fewer “filled bumps”.

Justification for the mandatory annual inventory

Yes, the audit is not carried out at will - it must be carried out by legal entities of any legal entity (organizational form), no matter what tax regime they apply. Two documents talk about this at once:

- Federal Law No. 402 of December 6, 2011, namely paragraph three of Article 11;

- PBU (accounting regulations) approved by the Ministry of Finance of the Russian Federation No. 34n dated July 29, 1998 - clause 27.

According to them, the procedure is necessary to ensure up-to-date accounting data. On the other hand, Article 14 of the same Federal Law No. 402 says that the results of the audit are not included in the reporting. This means that in the standard case, the tax office will not look at whether you performed an inventory at all. But if they suspect something and come with an inspection, it will turn out that you acted illegally, and this will entail sanctions.

However, it’s not just about compliance with regulations and legal business, but also about practical benefits. This procedure will allow you to assess the real state of affairs: directly verify the presence/absence of inventories (inventories) and debts, detect thefts and arrears, unaccounted income and expenses, violations by employees, and the like. So we suggest that you think positively and perceive it as an opportunity to analyze the state of the company, and not as an inappropriate necessity.

Examples of accounting consultations

Library of the Online School “Become a Chief Accountant”!

January 2021

Situation:

Until December 31, 2019 The organization did not have time to take inventory. Is it possible to carry out an inventory in 2021? before the date of preparation of financial statements for 2021.

Short answer:

The timing of the inventory is one of the conditions of the accounting policy.

In our opinion, the annual inventory can be carried out in 2020. before preparing annual accounting (financial) statements for 2021.

If the specified inventory was carried out before the preparation of financial statements and the results of the inventory are reflected in the accounting records for December 2021, there are no grounds for holding the Organization liable and recognizing the financial statements as unreliable.

At the same time, companies whose financial statements are subject to mandatory audit, or those intending to conduct an initiative audit, must keep in mind that, in accordance with international auditing standards, the auditor does not issue an unconditionally positive audit opinion if he does not participate in the inventory before drawing up the annual accounting report. reporting.

Rationale:

In accordance with Federal Law No. 402-FZ “On Accounting”, assets and liabilities are subject to inventory.

The cases, timing and procedure for conducting an inventory, as well as the list of objects subject to inventory, are determined by the economic entity, with the exception of the mandatory inventory.

Mandatory inventory is established by the legislation of the Russian Federation, federal and industry standards (Article 11).

In accordance with

— clause 27 of the Regulations on accounting and financial reporting in the Russian Federation, approved. By Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n and

-P. 1.5 Guidelines for inventory of property and financial obligations, approved by order of the Ministry of Finance of Russia dated June 13, 1995 N 49

An inventory is required, including before drawing up annual financial statements (except for property, the inventory of which was carried out no earlier than October 1 of the reporting year).

According to the Russian Ministry of Finance, the inventory should be carried out as of December 31 inclusive (Appendix to the Letter of the Russian Ministry of Finance dated January 9, 2013 N 07-02-18/01).

Based on clause 5.5 of the Methodological Instructions for Inventory of Property, the results of the annual inventory must be reflected in the annual accounting report .

From the above norms we can conclude that an inventory can be carried out even after the end of the reporting year, but before the preparation of financial statements.

In this case, the inventory is carried out on December 31 of the reporting year.

In accordance with clause 4 of the Accounting Regulations “Accounting Policy of the Organization”, approved. By Order of the Ministry of Finance of Russia dated October 6, 2008 N 106n (hereinafter referred to as PBU 1/2008), the procedure for conducting an inventory of an organization’s assets and liabilities is an element of the accounting policy .

There is no direct liability for violation of inventory deadlines in the legislation.

So, in accordance with paragraph 8 of Art. 3, paragraph 1, art. 9 of Federal Law No. 402-FZ “On Accounting”, the documents used to document inventory results are primary accounting documents.

According to paragraph 3 of Art. 120 of the Tax Code of the Russian Federation, a gross violation of the rules for accounting for income and expenses and objects of taxation for the purposes of this article means , inter alia, the absence of primary documents , untimely or incorrect reflection in accounting accounts, in tax accounting registers and in the reporting of business transactions , monetary funds, material assets, intangible assets and financial investments.

From the above article it follows that the Organization may be held liable under Art. 120 of the Tax Code of the Russian Federation only in the absence of inventory or untimely reflection in the accounting of inventory results - surpluses and shortages.

At the same time, we draw the attention of the Organization to the fact that in accordance with the Accounting Regulations “Correction of errors in accounting and reporting, approved. By Order of the Ministry of Finance of Russia dated June 28, 2010 N 63n (PBU 22/2010), incorrect application of an organization’s accounting policies can lead to incorrect reflection (non-reflection) of the facts of economic activity in the accounting and (or) financial statements of the organization - an error (clause 2).

In this case, such an error may be caused by the identification of surpluses and shortages during the inventory.

Based on clause 6 of PBU 22/2010 , an error in the reporting year identified after the end of this year, but before the date of signing the financial statements for this year, is corrected by entries in the corresponding accounting accounts for December of the reporting year (the year for which the annual financial statements are prepared) .

Based on the above, according to the consultants, if the Organization conducts an inventory of assets and liabilities for 2021. in 2021 – before the preparation of financial statements, the identified surpluses and shortages will be reflected in entries in the accounting accounts for December 2021; there are also no grounds for recognizing its statements as unreliable.

Additional Information.

However, companies whose financial statements are subject to mandatory audit, or those intending to conduct an initiative audit, must keep the following in mind.

In the financial statements for 2021. information is indicated

— on the mandatory nature of the audit,

— name of the audit organization (full name of the individual auditor), TIN, OGRN (OGRNIP).

In turn, in accordance with international auditing standards, the auditor does not issue an unconditionally positive audit opinion if he does not participate in the inventory before drawing up the annual financial statements. The annual inventory is usually carried out from October 1 to December 31 of the reporting year.

Thus, to conduct an audit of financial statements, it is advisable to conclude an agreement with an audit organization before December 31 of the reporting year and conduct an inventory with the participation of auditors.

A button to download or print the article will appear here if you are logged into the site. (To enter the site, scroll down the page and log in or register)

What does an annual inventory give: reasons for conducting it

It is useful because:

- helps to identify actual assets (their volume and quantity), as well as establish the level of future expenses and the degree of fulfillment of undertaken obligations;

- makes it possible to notice shortages, surpluses, misgrading based on the results of comparison of statements of actual availability with the data of the last accounting;

- allows you to identify inconsistencies with the approved and used recognition criteria;

- detects property that has partially lost its consumer properties and initial qualities, is physically and morally obsolete, unused (applies to both material objects and not).

Agree, each of the listed factors is already a significant reason for verification, and brings practical benefits to the manager.

Inventory notification

The mechanism for notifying all interested parties about the upcoming inventory involves familiarizing them with the following documents:

- inventory schedule;

- order to carry out audit activities.

An additional, but optional measure is the official delivery of a written notice to the materially responsible employee. The procedure for conducting an inventory involves handing over this document to the employee personally against signature or by sending it by mail. To confirm the fact that interested parties have been notified of the upcoming inspection, the employer can use the received receipt or receipt of the postal item being accepted by the communications center operator.

What is subject to inventory before annual reporting

According to the first paragraph of Article 11 of the same Federal Law No. 402, these are objects of four categories. Let's look at each of them right now.

Money

An extensive group that includes:

- office and industrial buildings, utility rooms, land plots and other real estate;

- production equipment, special equipment used, automobiles and other vehicles;

- already produced products and raw materials for their production, as well as goods available for sale;

- any other stock that does not fall within any of the above cases.

Attention, both your own property and those in custody or taken for temporary use are subject to accounting, that is, the same passenger cars rented by the company are also included in this subcategory.

Company finances

An annual inventory is a mandatory check of money, both cash in the cash register and funds lying in the organization’s accounts. And not only them, but in general all assets of a similar nature: shares, investments, deposits.

Accounts receivable deserve special attention. It is necessary to make sure that they are supported by relevant business papers, for example, concluded and valid contracts or receipts drawn up according to all the rules.

The company's own debts

You need to look especially carefully at your current creditor obligations: loans, financial assets in reserve, payments not yet made to counterparties, partners, suppliers. You should also check your latest bank payments to ensure your balance is up to date and interest charges are up to date.

Intangible assets

Indeed, a competent annual inventory of property should take into account everything that the company spent money on (and continues to own at the moment). Including:

- registered trademarks, brands, trade names;

- licensed copies of software products, for example, all installed versions of 1C: Accounting.

Please note that the property and liabilities of all four of the above groups are subject to verification, regardless of their actual location. Even if some objects (for example, vehicles or industrial machines) are transported to a branch located in another city, they will still need to be reflected in the results, since they are on the organization’s balance sheet.

Objectives and goals of conducting an annual inventory of property

The essence of the procedure is to update the data presented in the reporting for the current period. It identifies all the changes that could have occurred over 12 months.

Ensuring all measures for implementation falls on the shoulders of either the owner of the company or an official authorized by him - the manager (according to the constituent documents). He also needs to create and maintain all the conditions for performing the inspection, outline its scope and duration (although in mandatory cases the latter is known in advance, as well as the frequency). He should also ensure that those carrying out the inspection have unhindered access to assets and archives.

Stages of inventory

The inventory stages can be divided into several blocks:

- preparatory activities;

- counting, measuring and weighing property;

- comparison of actual data with reported data;

- documentary recording of the audit results.

Step-by-step instructions for conducting an inventory:

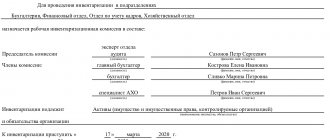

- Formation of an inventory commission.

- Familiarization with accounting information on the quantitative composition of property.

- Drawing up a receipt by the financially responsible person.

- The inventory begins - the assets of the enterprise are recalculated in physical terms. It is important to check the technical serviceability of each object. It is possible to implement reconciliation with counterparties.

- The next stages of conducting an inventory involve entering the information received about actual availability into inventory records. Next, the fact is compared with the data contained in the reporting documentation.

- The inventory stages must be carried out in strict accordance with the sequence. The final step will be to identify discrepancies and record them in the minutes of the commission meeting and the final act, adjusting accounting data (if necessary).

When is the annual inventory carried out at the enterprise?

Strictly before the balance sheet date and in accordance with paragraph 4 of PBU 1/2008, in accordance with Order of the Ministry of Finance of the Russian Federation No. 106n dated October 6, 2008.

The start of work depends on the type of property:

1. If these are income, expenses, debts, liabilities (not counting unrealized provisions, mandatory insurance contributions, budgetary calculations), current biological objects, inventories, non-current assets (in the last two cases, the exception is items temporarily located outside the company’s possession) – You need to start 3 months before the day of summing up the results.

2. If this is money, deductions for targeted financing, investments, unfinished capital investments, semi-finished or unfinished products - then 60 calendar days before the balance is completed.

3. If these are assets sent somewhere for long periods of time (for example, ships and cars leaving on voyages) or material assets that will definitely be outside the company - then up to temporary disposal.

Yes, the reason for inventory is annual reporting, but there are still three exceptions:

- it is permissible not to inspect property that has already been inspected during the period from October to December of the year that has not yet expired;

- the frequency of all work on updating available data is once every 36 months for fixed assets and once every 5 years for library collections;

- those companies and organizations that operate in the Far North have the right to inspect materials, goods and raw materials stored on their balance sheet during periods when their availability is running out (with the smallest balance).

Please note that if the owner wishes, this issue can be dealt with more often, but not less often than required.

Stages of the annual inventory

In general, the procedure can be divided into 4 steps - they are simple, logical and understandable, so we will consider them briefly.

Preparatory

At this stage, commission members are appointed who take preliminary measures - sealing warehouses and so on. We will present a more complete list of actions separately below.

Check

Direct work takes place here: counting the amount of inventory, establishing the condition of assets, measuring the dimensions of goods or equipment (if necessary) and drawing up statements. The latter are especially important; they are filled out separately and in two copies - by the authorized auditor and the financially responsible person.

Comparative-analytical

At this stage, previously compiled inventories are compared with each other and/or with existing documents. This is done to identify inconsistencies, errors or even cases of fraud. Exactly what caused the data discrepancy is clarified during the consideration of each problematic case.

Final

A protocol is filled out, which indicates all controversial issues and measures to resolve them - the need for a repeat inspection, testimony of financially responsible persons, statements to law enforcement agencies regarding theft or theft. If there are no difficulties, this document is also prepared. And in both cases, it goes to the head of the enterprise for consideration. As soon as the head of the company puts his signature, the business paper acquires administrative force, and statistical information from it is transferred to the financial statements.

Preparatory activities

Before conducting a direct inventory at the end of the year, you need to:

- issue an order for inspection - this is done by the head of the company;

- establish deadlines for the completion of all work depending on the volume and types of property being inspected;

- form a commission, distributing roles and responsibilities among its members, and instruct them;

- stock up on forms for filling out inventories and protocols;

- display the balances of assets for the previous reporting period.

The auditors themselves need to do something, for example, limit general access to storage facilities - seal them - and collect receipts from responsible persons. Such preparation will take literally a couple of days (and with proper planning, even less), but it will significantly simplify the further stages of the procedure.

Regulatory documents governing the inventory procedure

When planning and conducting an inventory, it is necessary to use regulatory documents governing the procedure for conducting an inventory of the organization’s property.

One of the main legal acts is the Federal Law “On Accounting”. This document sets out the rules for accounting and assessing the property of an enterprise. It also provides a definition of inventory and lists the reasons why it becomes a mandatory procedure. This Federal Law is the main regulatory document regulating the inventory procedure. It specifies how the identified data and discrepancies obtained during the audit should be displayed.

When studying the inventory procedure, you should pay attention to PBU No. 34-N. It was approved back in 1998, but has undergone some changes over time. It is this document that regulates inventory. It contains information on how to properly evaluate results and conduct due diligence regarding the company's assets and liabilities.

You should also pay attention to Resolution of the State Statistics Committee of the Russian Federation No. 88. It came into force in 1998. The document displays forms of primary inventory reporting. But the regulatory documents regulating the inventory procedure do not oblige the use of unified forms of acts. An enterprise can develop its own forms.

When conducting an inventory, you must be guided by the methodological guidelines that came into force after the release of Order No. 49 of the Ministry of Finance of the Russian Federation in 1995. This is where the procedure for checking the financial and property obligations of an enterprise and how to display and format the information received are displayed. On the basis of this regulatory document, an inventory of certain types of obligations is carried out.

In the case of an on-site inspection, the responsible persons are guided by the order of the Ministry of Finance of the Russian Federation and the Ministry of Taxes of the Russian Federation No. 20n GB-3-04/39. It was after its adoption that the regulation on the procedure for conducting such an inspection came into force. It is carried out by tax authorities in relation to taxpayers.

But the inventory regulatory framework used by the organization can be expanded. In this case, the existing forms of ownership, the specifics of the work and its scale are taken into account. All together, this allows the head of the organization to conduct an inventory on the basis of laws and regulations that clearly regulate the work procedure.

Procedure for conducting annual inventory

In general, it takes only 5 steps. Each of them separately does not represent anything complicated and will be discussed below.

Create a commission

It is formed from representatives of different departments of the company: it should include a member of the administration, an accountant, leading specialists (chief economist, engineer, technician, and so on). It is also possible to attract independent experts and outsourcers to obtain an objective opinion from the outside. It is approved by the manager.

If audits are carried out regularly, its composition and nature of activities can be constant. If a significant amount of work is expected and there is a need to perform operations in different warehouses, several groups can be involved in resolving the issue at once, which will inspect the assets in parallel.

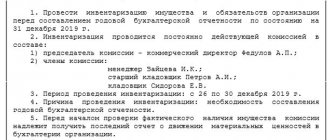

Issue an order to conduct an inventory before annual reporting at the enterprise

This document must contain:

- clearly stated duration of activities;

- reason for inspection;

- composition of the commission.

This business paper should also be registered in the control book, in accordance with clause 2.3 of the MU.

Determine asset balances at the start of the audit

Inspectors need to obtain information on receipts/expenses, cash flow reports, inventory items (inventory items) and inventories. All this must be endorsed by the chairman, making sure to put the date.

In addition, financially responsible persons are required to submit receipts in which they confirm that they provided all the necessary documentation and capitalized valuables or accountable amounts/powers of attorney, and wrote off all disposed assets.

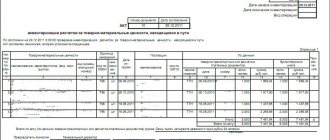

Direct inventory for annual reporting

At this stage, the actual presence of objects and the reality of the obligations taken are clarified. All information, measurements and identified inconsistencies are entered into the corresponding inventories and acts, each of which must be made in (at least) two copies - for subsequent comparison.

The inspection must be carried out in the presence of the person bearing financial responsibility (in accordance with clause 2.8 of the MU).

Registration of results

All received data is entered into statements, which are then correlated with financial statements. If surpluses are identified during the audit, they are entered into the general income item, while shortages are written off separately (with consideration of why they occurred).

Rules for filling out inventory documents

- All these materials are compiled in quantities of 2 copies; You can enter values into them either by hand or electronically.

- Objects in inventories must be clearly presented - divided by name (article), units of measurement, subaccounts, storage location, and responsible person.

- The serial number and total natural amount of assets must be written down in words on each page.

- It is imperative that the audit object be identified and comparable with the financial statements.

- All lines on each sheet should be filled in with the exception of the last one, on which the empty space should be crossed out.

- The document requires the signature of each member of the commission and all financially responsible persons.

- Erasures and blots are strictly prohibited - if a mistake is made, it must be crossed out by writing the correct version on top (and this is important to do with all copies).

When is inventory required?

It is important for employees of an organization to know not only how to properly conduct an inventory, but also when this activity is necessary. Among the legal grounds for conducting an inventory, the legislator includes such circumstances as:

- change of financially responsible persons;

- the onset of the annual reporting period;

- detection of theft;

- searching for information about fraud or damage to company property;

- reorganization of a legal entity;

- liquidation of the organization;

- the occurrence of a natural disaster, fire or other emergency.

We compare the results with the credentials

All endorsed materials are sent to the accounting department, whose employees make comparisons and fill out statements for fixed assets and intangible assets in a general manner or separately - in relation to assets temporarily owned by the company.

The reasons for the discrepancies are clarified and recorded in special protocols. These documents are submitted to the head of the organization, who approves them within 5 working days, along with the decisions and recommendations of experts. Thus, business papers acquire administrative power and become primary. It is on their basis that accounting entries are updated.

What happens if inventory is not carried out before the annual report?

There are no separate penalties for this, but a completed check will help show that everything is in order at the enterprise if the tax office suddenly discovers something suspicious and comes with an inspection. If you do not have convincing evidence of the transparency of business, you will receive a fine of up to 20 thousand rubles, although the main trouble is the possible blocking of the company’s activities for a period of 1 to 3 years. Plus, if the violation is considered gross, from a tax point of view, you will be charged an additional 10 to 40 thousand rubles.

In addition, it is better to carry out audits regularly to optimize your work. Because it will give an idea of the real state of assets, the amount of stored products and raw materials, the obsolescence of equipment and many other important things.