From June 1, 2021, a special instruction of the Bank of Russia dated October 14, 2019 No. 5286-U “On the procedure for indicating the type of income code in orders for the transfer of funds” (hereinafter referred to as Instruction No. 5286-U) is in effect. According to it, from this date, when transferring income to the purpose of payment, the payment order must indicate which category it belongs to. In this consultation we will help you cope with this problem.

Also see:

- Payment order to transfer wages to a card: sample for 2021

Why were new codes introduced?

Directive No. 5286-U establishes the procedure for indicating the type of income code in orders for the transfer of funds. It applies not only to employers, but in general to persons paying:

- wages;

- other income in respect of which Art. 99 of Federal Law No. 229-FZ “On Enforcement Proceedings” establishes restrictions and/or which, in accordance with Art. 101 of this Federal Law cannot be levied.

The codes were introduced so that the bank and bailiffs immediately understand that the debtor’s income cannot be touched at all, or that the debt can be collected from them, but with certain restrictions (see below).

Change in payer status and payment grounds when transferring to the budget from 10/01/2021

The program has added the ability, when transferring funds to the budget, to indicate information about the payment according to the rules in force from 10/01/2021 (Order of the Ministry of Finance of the Russian Federation dated 09/14/2020 N 199n).

Changes have been made in accordance with Order of the Ministry of Finance of the Russian Federation dated September 14, 2020 N 199n (from release 3.0.86):

- the list of payer statuses has been reduced (101);

- the list of payment grounds (106) when transferring to tax and customs authorities has been reduced;

- document number format (108), if the payment basis is “ZD”.

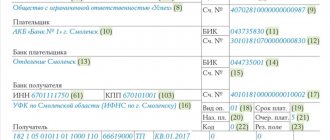

Starting from 10/01/2021 in the Payment order document (Bank and cash desk - Payment orders) Payment details are filled in taking into account the changes.

Please indicate:

- Payer status —select status from the list, taking into account changes; PDF

- Basis of payment - select the basis of payment from the list, taking into account changes; PDF

- When indicating the basis for the payment of the DA (for example, at the request of the Federal Tax Service): Date - date of repayment of the debt upon request;

- Document number —requirement number in the new format;

- Document date —request date.

Income type codes from 2021

According to Directive No. 5286-U, from June 1, 2021, the following codes of the type of income are indicated in orders for the transfer of funds:

| Code | Legal basis | Explanation |

| «1» | When transferring funds that are:

| When transferring wages and other income (for example, payments under GPC agreements), for which there is a limit on the amount for withholding debts. As a general rule, no more than 50% of wages and other income can be withheld from a debtor-citizen. Alimony for minor children, compensation for harm caused to health, compensation for harm in connection with the death of the breadwinner and compensation for damage caused by a crime - the amount of withholding is not more than 70%. |

| «2» | When transferring funds that are income, for which, in accordance with Art. 101 of Law No. 229-FZ cannot be foreclosed on | For 2021, these are 18 types of income. Exception: income to which, in accordance with Part 2 of Art. 101 of Law No. 229-FZ, restrictions on foreclosure do not apply. Let us remind you that, according to this norm, alimony for minor children or compensation for damage due to the death of the breadwinner can be recovered from the amounts of compensation for harm to health or compensation received from budgets by citizens injured in radiation and man-made disasters |

| «3» | When transferring funds that are income, to which, in accordance with Part 2 of Art. 101 of Law No. 229-FZ, restrictions on foreclosure do not apply | When paying amounts that are exceptions mentioned above |

Read also

15.07.2020

New rules for filling out payment orders will come into force in 2021

The Ministry of Finance has amended the rules for filling out orders for transferring funds to the budget. The corresponding order No. 199n dated September 14, 2020 was published on the Official Internet portal of legal information.

Let us remind you that the current rules for indicating information in the details of orders for the transfer of funds to the budget were approved by Order of the Ministry of Finance dated November 12, 2013 No. 107n (as amended and supplemented).

Now the ministry has introduced a number of new provisions into these rules. In particular, it is established that in the “TIN” details of the payer it is allowed to indicate the value zero (“0”) by foreign organizations (individuals) (with the exception of taxes, fees for the performance of legally significant actions by tax authorities, insurance premiums, and other payments administered by tax authorities ) in the absence of their registration with the tax authority.

In this case, payers who are foreign persons who are not registered with the tax authorities of the Russian Federation will have to indicate the alphanumeric code of the foreign person in the “Purpose of payment” details of the order for the transfer of funds.

At the same time, a requirement is introduced according to which, when drawing up orders for the transfer of funds to the budget accepted from individuals (without opening an account), it is not allowed to indicate the TIN value of a credit organization (branch of a credit organization) in the “TIN” detail of the payer.

When drawing up orders for the transfer of funds to the budget, withheld from the salary (income) of a debtor - an individual to pay off his debt on payments, it is not allowed to indicate the value of the TIN of the organization that made the order in the “TIN of the payer” detail.

Changes are also being made to the rules for filling out details when paying customs duties and payments, as well as when transferring funds from special election accounts and special referendum fund accounts to the budget.

The order of filling out field 106 (basis of payment) and its dependent fields 107-109 is changing for certain conditions (especially for customs payments).

In addition, the amendments introduce rules for checking the value of a unique accrual identifier, as well as rules for generating a unique assigned transaction number.

According to the order, the new rules will come into force on January 1, 2021, with the exception of certain provisions.

In 1C:Enterprise solutions, the necessary changes will be supported by the time the amendments come into force with the release of the next versions. For deadlines, see “Legislation Monitoring.”

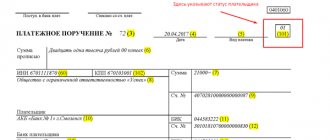

Codes in payment order 2021

In accordance with the Directives of the Central Bank of the Russian Federation, from June 1, 2020, when transferring wages in favor of an individual, the following codes must be indicated in the payment order:

- Code "1". It should be used in calculations for those categories of income for which a limit on the amount of recovery is established on the basis of Art. Federal Law No. 229-FZ of October 2, 2007. These include wages, including not only salary, but also additional payments/allowances, vacation pay and bonuses, severance pay, financial assistance, sick leave payments, settlements with individuals under civil law contracts. Thus, code 1 in a payment order is used most often.

- Code "2". The second code of the type of income in the payment order is used when it comes to the income of individuals, from which it is unacceptable to make deductions based on writs of execution. The full list of income in this category is defined in Art. 101 of Federal Law No. 229-FZ. These include maternity payments, alimony, compensation payments (for the use of a vehicle, reimbursement of travel expenses, etc.), amounts issued for reporting.

- Code "3". The third code in the payment order from June 1, 2021 is provided for income, from which only alimony for minor children and compensation for damages in connection with the death of the breadwinner are allowed to be withheld. These are amounts received in connection with compensation for harm to health, and state compensation for victims of man-made and radiation disasters (subclauses 1 and 4, clause 1, clause 2, article 101 of Federal Law No. 229-FZ).

How will the introduction of salary codes in payment orders affect the work of an accountant?

Salary payment orders - what codes to indicate

The Central Bank explains in instruction No. 5286-U when and what codes to enter in field 20.

- code 1

when paying wages and income for which restrictions on the amount of deductions apply (according to Article 99 of Law No. 229-FZ of October 2, 2007). These include wages, bonuses, sick leave benefits, and vacation pay. - code 2 when paying funds from which debts cannot be collected (according to Article 101 of Law No. 229-FZ dated October 2, 2007). These are, for example, maternity benefits and child benefits.

- code 3 when paying money that is indicated as an exception in Part 2 of Art. 101 of the Law of October 2, 2007 No. 229-FZ. Income with code 3 includes two types of payments: compensation payments from budget funds to persons affected by radiation or man-made disasters and compensation for harm caused to health. Payments upon the death of the breadwinner (as well as alimony) can be withheld from income with code 3. It should be noted that these are the only deductions that can be made from them.

What to consider when filling out payments to the budget from 2021

According to the order of the Ministry of Finance dated September 14, 2020 No. 199n, when transferring money to the budget starting from 2021, a number of innovations must be taken into account. In addition, a number of previously made amendments to the basic Order No. 107n dated November 12, 2013 have become invalid.

The contents of some details have also been clarified. New transaction codes have been introduced.

Please note that there will be a gradual introduction of innovations in the rules for filling out payments: from January 1, July 1 and October 1, 2021.

“TIN” details

It is also established that when drawing up a payment, a bank client cannot indicate the payer’s TIN, which differs from the TIN of the bank client (account holder) who drew up this order to transfer funds.

If an order is drawn up to transfer money in payment of payments withheld from the salary (other income) of a debtor - an individual, in order to repay the debt on such payments, it is not necessary to indicate in the payer's "TIN" details the TIN of the organization (usually the employer) that made the order.

From 2021, the payer’s TIN must be indicated when paying customs duties. If they are paid by an organization that is not registered with the tax authorities of Russia, the “TIN” details of the payer of the payment should indicate the value “0” or a special alphanumeric code of a foreign person. But there is an exception - the transfer by such a foreign company of payments administered by the Federal Tax Service of Russia (taxes, fees, insurance premiums, etc.).

CONCLUSIONS

When filling out orders for payment of payments to the budget for 3 persons, it is unacceptable to indicate in the details “TIN of the payer” the TIN of the organization that compiled the order.

If an employer withholds personal income tax from an employee and transfers it to the budget, the TIN of this tax agent (employer) cannot be indicated on the payment slip. Similar prohibitions have been introduced for banks and the Russian Post, so that instead of the client’s TIN, they do not indicate their TIN.

From 2021, it is possible to indicate someone else’s TIN in the payer’s “TIN” details only in cases specifically stipulated by the Rules from Order No. 107, as amended.

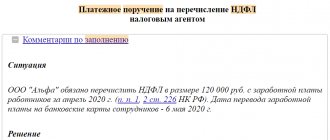

A sample of filling out a payment form for the payment of personal income tax from employees’ salaries with an example can be found in the Ready-made solution in ConsultantPlus.

Details "Payer"

If an organization has opened a personal account with the Federal Treasury (financial authority), when transferring funds withheld from the income of the debtor - an individual, only the name of the organization is given in the “Payer” detail.

Please note that until 2021 the name of the Federal Treasury body (financial body) must also be indicated.

The specifics of filling out a payment for transferring funds to a bank account that is part of the single treasury account are also determined.

New requirements

From July 1, 2021, the rules for checking the unique accrual identifier (UIN) and the rules for generating a unique assigned transaction number (UNO) come into effect. Credit institutions include the latter in an electronic message containing an order to transfer money.

They describe the procedure for calculating the UIN check digit. The UIN value will be considered correct if the last digit corresponds to the check digit calculated in accordance with this order.

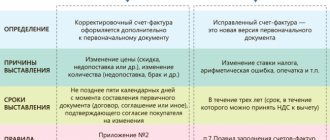

Props 106

From October 1, 2021, it will become easier to fill out detail 106 when paying taxes and other mandatory payments supervised by the tax authorities.

For example, there will be no option for repaying the debt on demand. Instead of “TR” you will have to indicate the value “ ZD ” (the number of the Federal Tax Service's request for payment of tax/fee/insurance contributions), which in 2021 and earlier is used only for voluntary payment of debt.

Also, starting from 2021, there will be repayment of debt under the inspection report, as well as “PR” and “AR” codes. Instead, you need to indicate the code “ZD”.

In detail “106” of the order for the transfer of funds when repaying debts on customs duties, special, anti-dumping, countervailing duties, interest and penalties, the value of the basis for payment is indicated. It has 2 characters and can take on the following values (the list has been shortened since 2021):

| BASIS OF PAYMENT (CODE) | WHAT DOES IT MEAN? |

| UV | Notification of unpaid amounts of customs duties, special, anti-dumping, countervailing duties, interest and penalties |

| IL | Performance list |

| PB | Instruction from the customs authority for undisputed collection |

| TG | Request for payment of funds by the guaranteeing association (association) |

| TB | Request for payment of the amount under a bank guarantee or surety agreement, if the payment of funds is made under a bank guarantee |

| TD | Request for payment of the amount under a bank guarantee or surety agreement, if the payment of funds is made under a surety agreement |

| PV | Resolution on the collection of customs duties, special, anti-dumping, countervailing duties, interest and penalties at the expense of property |

If the payment basis indicator is “ZD”, the first 2 characters in the document number indicate the type of document. Here are some examples for the code “ZD”:

- “TR0000000000000” – number of the Federal Tax Service’s request for payment of tax (fees, insurance contributions);

- “PR0000000000000” – number of the decision to suspend collection;

- “AP0000000000000” – number of the decision to prosecute/refuse to prosecute for committing a tax offense;

- “AR0000000000000” – number of the executive document (executive proceedings).

In addition, the procedure for filling out payment details “101”, “106”, “108” has been changed and supplemented.

So, in field 108 (document number), taking into account the above changes, you will need to indicate:

- number of the tax authority's request for payment of tax (fees, insurance contributions) (TR);

- number of the decision to suspend collection (PR);

- number of the decision to prosecute for committing a tax offense or to refuse to prosecute for committing a tax offense (AP);

- number of the executive document and the enforcement proceedings initiated on the basis of it (AP).

Code for private practice specialists

From October 1, 2021, the payer code for entrepreneurs (IPs), lawyers, notaries and heads of peasant farms will change when transferring taxes, fees, insurance premiums and other payments administered by the Tax Service to the budget. All these payers will have to indicate code “ 13 ”, which is used by ordinary individuals until 10/01/2020. And for the latter, nothing will change.

Read also

28.06.2019

Payment order: field 110 in 2021

Filling out detail 110 today is provided only in cases where the payment is addressed to an individual, and he receives funds from the country’s budget. Such payments are considered:

- Salary/salary/remuneration/ of government employees;

- Remuneration of personnel of state institutions, municipal organizations, as well as state extra-budgetary funds;

- State scholarships;

- Pensions, compensation and other social payments from the Pension Fund;

- Lifetime imprisonment for judges.

If the payment falls under any of the categories indicated in the list, then the type of payment in the 2021 payment order in field 110 o. It is quite possible that over time this list will expand, since Law No. 161-FZ does not exclude such a possibility.

When making other payments, the rule still applies - field 110 in the payment order is not filled in. This is true even for:

- Mandatory transfers to the treasury;

- Settlements made by companies, entrepreneurs and individuals.

So, filling out line 110 in a payment order in 2021 has so far become mandatory only for transactions involving the transfer of money to individuals from budget funds.

New in filling out field 110

More details about the innovations for fields 110 and 107 are described in the material “New details have been introduced into the payment card.” Here is a brief summary of the new rules for filling out payment orders (latest news) in 2020.

Based on the Regulation of the Bank of Russia dated June 19, 2012 No. 383-P, in field 110 in the payment order in 2021, it is necessary to enter a payment code when transferring funds from the budget in favor of individuals. This innovation was introduced by the instructions of the Central Bank of the Russian Federation dated July 5, 2018. Until this moment, the field remained empty.

The changes were required so that banks could track compliance with legal requirements for non-cash payments from the budget only for issued Mir payment cards. Currently, when making a transfer in favor of individuals using budget funds, senders are required to record this in field 110.

When and what type of payment 110 to indicate in a payment order is easy to remember:

- when transferring funds from the budget, the number 1 is placed in the required place;

- when carrying out regular operations using own funds, field 110 is not filled in.

Filling out this field is necessary to verify whether the account owner has a Mir card. The bank's further actions depend on whether such a card is available or not. If the owner does not have it, the bank is obliged to reflect the transfer amounts on the account for accounting for amounts of unknown purpose with all the ensuing consequences.