Do I need to submit a zero assessment according to the simplified tax system for 2021?

The simplified declaration is submitted to individual entrepreneurs and organizations applying this regime, regardless of:

- Availability of income during the tax period.

You need to report even if you suffered a loss. In this case, it will not be zero, but with indicators, since those who use the “income” object calculate the tax on the income received (without taking into account expenses), and those who use the “income minus expenses” object take into account the resulting loss when calculating the tax.

- Availability of hired workers.

The fact of having employees affects only the procedure for reducing the tax on insurance premiums. It does not affect the obligation to submit reports.

- The fact of conducting business in general.

Even if no activity was carried out during the tax period, there was no income, and nothing was received into the current account, the declaration will still have to be submitted. In this situation, the legislator gives the simplifier a choice: to submit a zero according to the simplified tax system or a single simplified declaration (USD).

Thus, if there is no activity during the tax period, the simplifier must submit a zero declaration, and if there is no income or employees, he must submit a regular one, with indicators.

Zero declaration for individual entrepreneurs

At the end of the tax period, individual entrepreneurs submit declarations to the tax service. In particular, an individual entrepreneur fills out a declaration on the simplified tax system regardless of whether income was received or not. The service can significantly simplify the maintenance of a simplified tax system.

In the absence of income, entrepreneurs on a “simplified account” issue the so-called zero income.

Entrepreneurs using the simplified tax system submit declarations once a year. A zero declaration for individual entrepreneurs is submitted in the following cases:

- there was no income during the reporting period;

- registration of individual entrepreneurs has recently been completed (financial activities have not yet been carried out);

- The work is seasonal.

Zero declaration form under the simplified tax system for 2021

A zero declaration under the simplified tax system is drawn up in the form approved by Order of the Federal Tax Service dated February 26, 2016 No. ММВ-7-3 / [email protected] It is the same for simplifiers of both types: those who calculate income tax and those who pay it from the difference between income and expenses.

The composition of zero reporting depends on the object used:

| simplified tax system 6% (income) | STS 15% (income minus expenses) |

| Title page | |

| Section 1.1 Section 2.1.1 | Section 1.2 Section 2.2 |

What does the zero reporting of individual entrepreneurs consist of?

The declaration depends on the chosen form of taxation.

Under the simplified taxation system, a declaration is submitted in the simplified tax system form and a report to ROSSTAT.

In the general mode - a VAT declaration, a report in form 3-NDFL and a report to ROSSTAT. Not all entrepreneurs submit to ROSSTAT. Only those chosen by the extras. If an entrepreneur is included in the sample, ROSSTAT sends an official letter to the address indicated in the Unified State Register of Legal Entities. If the letter has not arrived, there is no need to go to statistics.

Those who work on a patent do not report at the end of the year. When combining a patent with a simplified patent or OSN, the filing of zero reporting by the individual entrepreneur is required.

For individual entrepreneurs working under the single tax system on imputed income, there is no zero. Owners of UTII keep records based on physical indicators. The amount of tax depends, for example, on the area of the sales floor or the number of employees, and not on the actual income of the enterprise. Therefore, business owners file regular tax returns on imputation.

Choose a bank

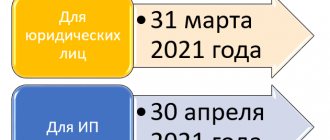

Deadline for submitting a zero declaration under the simplified tax system for 2021

Zero statements according to the simplified tax system are submitted within the same time frame as reporting with the following indicators:

- until March 31 - organizations;

- until April 30 - individual entrepreneur.

If the deadline for submitting the report falls on a weekend or holiday, it is postponed to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). The deadline for submitting reports under the simplified tax system for 2021 does not fall on a weekend and therefore will not be postponed.

Thus, organizations must submit a zero declaration under the simplified tax system for 2021 by 03/31/2020, and individual entrepreneurs by 04/30/2020.

What to choose: simplified taxation system or EUD declaration?

Based on clause 2 of Art. 80 of the Tax Code of the Russian Federation, every simplifier who did not conduct business formally has a choice:

1. Submit a zero declaration of the simplified tax system in 2021.

2. Submit a single simplified declaration (approved by order of the Ministry of Finance dated July 10, 2007 No. 62n):

However, in the second case, you need to do it before January 20 of the year that follows the reporting year.

Therefore, in terms of timing, it is more profitable to submit a zero declaration on the simplified tax system on the “native” form, which was approved by order of the Federal Tax Service of Russia dated February 26, 2021 No. ММВ-7-3/99:

Also see “Declaration under the simplified tax system” (you can download the current form).

Let us remind you of the deadlines for submitting a zero report under the simplified tax system. They are exactly the same as a regular declaration with calculated indicators for 2021. Namely:

- for individual entrepreneurs - no later than April 30, 2021 inclusive (note that officially this is a short day!);

- for LLC – no later than April 1, 2021 inclusive (postponement from March 31).

Also see “Deadline for submitting a declaration under the simplified tax system for 2021 in 2021.”

Requirements for filling out the zero simplified tax system for 2021

Requirements for completing the simplified taxation system declaration are given in the Procedure for filling it out, approved. By Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/ [email protected] :

- The declaration can be filled out by hand, on a computer, using special programs.

- When filling out a declaration on paper, use only black, purple or blue ink. If you enter information, for example, in red, the machine will not be able to recognize it, and the declaration will be returned.

- You cannot correct errors in a printed zero using putty or other similar means. If you made a typo, it is better to redo the sheet again, this will save you in the future from possible disputes with the inspection inspector.

- Enter the information in the declaration in capital block letters, regardless of whether you fill it out by hand or on the computer. The machine only recognizes printed letters.

- If you fill out the zero on the computer, use the Courier New font with a height of 16-18.

- Double-sided printing is prohibited; each page of the declaration must be printed on a separate sheet.

- Do not staple the report sheet, as this may damage the barcode in the upper corner of the page. The machine will not be able to read reports with a damaged barcode. It is advisable not to fasten the sheets of the document with anything at all and submit them to the inspection inspector in a file.

- Enter the indicators in the declaration from left to right, starting from the first acquaintance.

- Include in the zero sheet only those sheets that we wrote about above. The rest do not need to be attached to the declaration.

- Page numbering is continuous, starting from the title page. A zero declaration (for any object) will have only 3 sheets.

- In all empty lines you need to put dashes: we will tell you which ones specifically below.

Sample of filling out the zero form according to the simplified tax system 6% for 2021

Title page

Information is entered into it in the same order as in reporting with indicators. The title page is filled out equally by those who use the “income” object and by those who work on the “income minus expenses” object. You can familiarize yourself with the procedure for filling out the Title Page for the simplified tax system of 6% in this article.

Section 1.1

In this section you only need to fill out a few lines:

- INN/KPP.

Transfer them from the title page; when filled out on the computer, they will be reflected on all remaining sheets.

- page 010 (030, 060, 090).

Indicate OKTMO at your location. Organizations indicate it by their legal address, and individual entrepreneurs by the address of their place of registration. You can find it out on this site.

If you did not change OKTMO during the year, fill out only line 010, and put dashes in all the rest. If a code change occurred in a certain quarter, enter it in line 030 (if the OKTMO was changed in the 2nd quarter), 060 (if the change occurred in the 3rd quarter) and 090 (if the change occurred in the 4th quarter).

- Reliability and completeness…..

Sign and date the declaration.

In all other lines of section 1.1, put dashes.

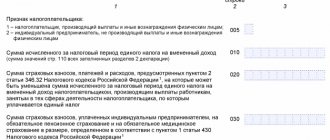

Section 2.1.1

In addition to the INN/KPP and page number in this section, fill in:

- page 102.

If there are no employees, enter the value “2”, if there are any, “1”.

- pp. 120-123.

Specify the rate according to the simplified tax system. If you are not using a discounted rate, enter "6.0" in these lines.

Place dashes in all other lines in the section.

Sample zero declaration of simplified tax system 6% 2019

How to fill out a zero declaration for individual entrepreneurs on the simplified tax system of 6% without employees for 2021?

Important information! Pay special attention to the fact that they promise to write off taxes and contributions for the second quarter of 2021 for those individual entrepreneurs who belong to the most affected areas of the economy. They also promise to reduce insurance premiums by 12,130 rubles for such individual entrepreneurs (read more at this link). Read about other measures to support individual entrepreneurs in connection with the pandemic at this link. Important update. The declaration under the simplified tax system is expected to be updated. The procedure for filling it out will change slightly, as I wrote about at this link:

The declaration under the simplified tax system will change in 2021. This is important, take note.

What form should I use to submit a declaration under the simplified tax system for 2021? Old or new?

But we submit the declaration under the simplified tax system for 2021 using the “old” form, which I describe below.

Good afternoon, dear individual entrepreneurs!

Before starting the article, I note that the form of the declaration under the simplified tax system may change in 2021.

Therefore, I recommend using accounting programs and services that are regularly updated by developers. And in no case do I recommend keeping records completely manually, since everything changes too quickly.

Let's consider the input data for our example of filling out a zero declaration under the simplified tax system:

- Individual entrepreneur on a simplified basis (USN 6%);

- The individual entrepreneur is not a payer of the trade tax (trade tax is paid by some individual entrepreneurs from Moscow);

- Throughout the year, the rate of 6% for the simplified tax system was maintained;

- There was NO income for the past year (this is important);

- The IP existed for a full year;

- All insurance premiums “for yourself” were paid on time (before December 31 of the reporting year);

- The individual entrepreneur did not receive property (including money), work, services as part of charitable activities, targeted income, or targeted financing.

- You must submit a zero declaration to the Federal Tax Service by April 30 of the year following the reporting year;

- This is not a declaration when closing an individual entrepreneur.

- The declaration is submitted during a personal visit of the individual entrepreneur to the tax office.

What program will we use?

We will use an excellent (and free) program called “Legal Taxpayer”.

Don't be alarmed, I have detailed instructions on how to install and configure it. Read this article first and install it on your computer:

https://dmitry-robionek.ru/soft-for-biz/nalogoplatelshhik-jurlic.html

We will assume that you have installed the program and entered your individual entrepreneur details correctly.

The program itself can be downloaded here: https://www.nalog.ru/rn77/program/5961229/

Important. The “Legal Taxpayer” program is constantly updated. This means that it must be updated to the latest version before completing the declaration.

Step 1: Launch the “Legal Taxpayer” program

And immediately in the menu “Documents” - “Tax reporting” we create a tax return template according to the simplified tax system. To do this, click on the icon with the “Create” icon

And then select form No. 1152017 “Declaration of tax paid in connection with the application of the simplified taxation system”

Yes, another important point

Before drawing up the declaration, it is necessary to indicate the year for which we will draw it up. To do this, you need to select the tax period in the upper right corner of the program.

For example, for the declaration for 2021 you need to set the following settings:

By analogy, you can set other periods for the declaration. For example, if you are creating a declaration for 2021, then it is clear that you need to indicate 2021.

Step 2: Fill out the Cover Sheet

The first thing we see is the title page of the declaration, which must be filled out correctly.

Naturally, as an example, I took the mythical character Ivan Ivanovich Ivanov from the city of Ivanovo =) You insert your REAL details for the individual entrepreneur.

Some data is pulled up automatically. For example, full name and tax identification number... Let me remind you that the “Taxpayer Legal Entity” program must first be configured, and once again I refer you to this article: https://dmitry-robionek.ru/soft-for-biz/nalogoplatelshhik-jurlic.html

Fields highlighted in brown need to be corrected.

1. Since we are making a declaration for the year, then the period must be set accordingly. Just select the code “34” “Calendar year” (see picture)

It should look like this:

Next, you need to add your BASIC code according to the OKVED classifier. Let me remind you that when registering an individual entrepreneur, you indicated the main and additional activity codes for your business.

Important: Please note that in the summer of 2021, new activity codes under OKVED-2 were introduced. This means that in the declaration for 2016 (and for subsequent years) it is necessary to indicate new codes, according to OKVED-2. If you indicate the old OKVED-1 code, the declaration will not be accepted. Read more here:

Here you need to specify the main activity code . For example, I indicated code 62.09 Of course, it may be different for you.

We don’t touch anything else on the title page, since we will submit the declaration during a personal visit, without representatives.

Step: Fill out section 1.1 of our zero declaration

At the very bottom of the program, click on the “Section 1.1” tab and you will see a new sheet that also needs to be filled out.

Many people are scared because it is inactive by default and does not allow you to fill in the necessary data.

It’s okay, we can handle it =) To activate this section, you need to click on this “Add section” icon (see the picture below), and the sheet will immediately be available for editing.

Everything is quite simple here: you just need to register your OKTMO code (All-Russian Classifier of Territories of Municipal Entities) in line 010.

If you don’t know what OKTMO is, then read it here. In my example, the non-existent OKTMO 1111111 is indicated.

You indicate your real OKTMO code, which you can check with your tax office.

We don’t touch anything else on sheet 1.1 of our declaration.

But if OKTMO has changed during the year, then you must indicate the new code in the appropriate lines. This can happen, for example, when changing the details of the tax office, or when changing the place of residence of the individual entrepreneur.

Step: Fill out section 2.1.1 “Calculation of tax paid in connection with the application of the simplified taxation system (object of taxation - income)”

Again, at the very bottom of our document, select the appropriate tab:

“Section 2.1.1” and activate the sheet with the “Add Section” button (in the same way as we activated the previous sheet)

And we fill it out.

Let me remind you that our individual entrepreneur had no income, which means in the lines:

- in line No. 113 we write zero;

- in lines No. 140, No. 141, No. 142 we do not change anything;

- in line No. 143, we also write zero, despite the fact that the person paid mandatory insurance premiums “for himself” for the past year. I registered zero because insurance premiums “for yourself” WILL NOT take part in the tax deduction from the simplified tax system; Otherwise, we will end up with a negative value on the declaration (we suddenly subtract contributions to the Pension Fund from zero income =)

- In line 102 we write code = 2 (individual entrepreneur without employees);

And, the most important change compared to the previous declaration form. We need to indicate the tax rate according to the simplified tax system in lines 120, 121, 122, 123 for the quarter, half-year, nine months and tax period.

This is done very simply. To do this, just click on the desired field and select a rate of 6% (let me remind you that we are considering individual entrepreneurs on the simplified tax system of 6% without income and employees).

We save the declaration

Let's save the declaration, just in case, by clicking on the icon with the image of a floppy disk.

The printer icon, I think you know what it means =)

Step: Print and submit the tax return

But first, we check that the declaration is filled out correctly using the program.

- To do this, click on the button with the “P” icon - “Document calculation”.

- And then on the button with the “K” icon - “Document Control”

If there are filling errors, you will see them at the bottom of the program screen. We print TWO copies and go to your tax office, where you are registered. Now you don’t need to file anything (this has been the case since 2015).

You give one copy to the inspector, and he signs the other, stamps it and gives it to you. Try not to lose this copy of yours =)

To be honest, I had to read more here than to make the declaration itself in this wonderful program. Try to do it once, and then everything will be stamped automatically.

And you’ll also save a couple of thousand rubles instead of giving them to intermediary companies =)

An example of a completed zero declaration

For clarity, I saved the resulting example of a zero declaration as a PDF file. This is what should ultimately happen for our mythical Ivanov Ivan Ivanovich, who submits a zero declaration for 2021 under the simplified tax system:

Frequently asked questions about zero declarations

Often individual entrepreneurs do not submit zero declarations, because they believe that since there was no income, then there is no need to submit anything.

In fact, this is not so and you risk getting fined and having your account blocked. Insurance premiums will also be calculated at the maximum amount... Read more about this situation here:

PS The article contains screenshots of the “Legal Taxpayer” program. You can find it on the official website of the Federal Tax Service of the Russian Federation at this link: https://www.nalog.ru/rn77/program/5961229/

Don't forget to subscribe to new articles for individual entrepreneurs!

And you will be the first to learn about new laws and important changes:

Subscribe to news by email

Sample of filling out the zero simplified tax system 15% for 2021

Title page

The data on the title page is entered regardless of which declaration is submitted: with indicators or zero. You can familiarize yourself with the procedure for filling out the Title Page for the simplified tax system of 15% in this article.

Section 1.2

In this section you only need to fill in the INN/KPP, page number and OKTMO code. If the code has not changed during the year, indicate it in line 010, and put a dash in the rest. If the code has changed, enter it in one of the lines corresponding to the period in which it changed: 030, 060 or 090. In the remaining lines, put dashes.

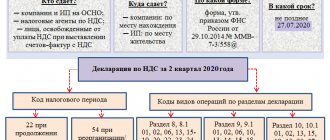

A single simplified declaration instead of a zero according to the simplified tax system

Instead of a zero declaration under the simplified tax system, you can submit a single simplified tax return (SUD). But for this the following conditions must be met:

- Absence of an object of taxation in the tax period.

The object of taxation under the simplified system is income (for the simplified tax system 6%) or the difference between income and expenses (for the simplified tax system 15%).

- No transactions on the current account.

There should be no transactions at all - not even payment of utilities.

The EUD consists of only one sheet and is submitted to the Federal Tax Service no later than January 20 of the year following the reporting year. That is, the EUD according to the simplified tax system for 2021 must be submitted by 01/20/2020.

The most optimal solution in the absence of activity in the tax period would be to submit a zero declaration under the simplified tax system. Filling it out is no more difficult than filling out a EUD, but the deadline for submitting information is longer and the risk of controversial issues arising is less.

The essence of zero reporting form

The legislation of the Russian Federation does not contain the term “zero declaration”. This concept is used among individual entrepreneurs.

A zero declaration under the simplified tax system is a document reflecting data on the tax period during which there was no movement of funds in individual accounts. As a result, the creation of tax base amounts for calculating payments to the state is excluded.

Failure to file a return with the Federal Tax Service may result in fines, even if an audit has not been carried out.

Calculating tax according to the simplified tax system taking into account “net” income (when all expenses are deducted) leads to losses from the previous period. Regardless of the presence of losses, the entrepreneur will still have to pay a tax amount of 1% (of income) - the minimum amount.

The only exception can be an individual entrepreneur who uses income as an object of taxation. Lack of income in this case does not mean paying tax.

Despite the lack of income, some payments to the budget of an individual entrepreneur must be made in all cases. These payments include fixed one-time contributions from individual entrepreneurs for pension and health insurance.

Important! If a simplifier does not conduct any activity for the year, he has no income from his current account, then he can only submit a simplified reporting form of the simplified tax system, which consists of only one sheet.