There are a lot of non-cash payments going on in Russia these days. They have become common practice. This includes payment from a current or card account online, and transfer of funds directly from a mobile phone. But payment orders occupy a special place in the mechanism for sending money. Throughout Russia, this calculation method is used very actively. But this does not exempt you from complying with strict requirements when filling out a payment form. In particular, such details as the checkpoint in the 2021 payment order.

Payment

Based on the prescription of paragraph 1 of Article 863 of the Civil Code of the Russian Federation, the payment order acts as a written order sent to the bank by the owner of the funds. According to the contents of the payment order, the credit institution transfers the money to the recipient’s account.

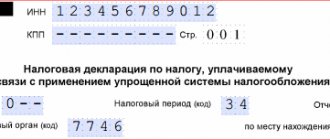

The payment order did not appear by itself, but was developed by the Central Bank of Russia on the basis of Regulation No. 383-P of June 19, 2012. The approved form of this form requires that all mandatory details be included in it. Including KPP - the code for the reason for registering the enterprise for tax purposes.

Simply put, everything must be filled out in the same way as the Central Bank of Russia explains in its regulations.

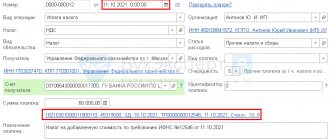

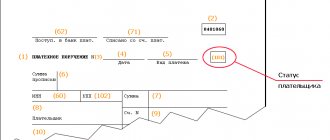

This Regulation contains Appendix No. 3, which states that the code in question in the payment form should be displayed in the following lines:

- field 103 is intended to enter into it the checkpoint of the person who is to receive the funds;

- field 102 is used to indicate in it the code by which the source of payment - the obligated person - is registered in tax records.

Together with the TIN of legal entities, the checkpoint attribute is used to display information regarding the basis for tax accounting of the company.

The reason code in the payment order must consist of 9 digits. They give the following information:

| Decoding checkpoint | |

| Number order | What does it mean |

| First two | Russia region number |

| 3rd and 4th | Tax authority number |

| 5th and 6th | Shows registration code number |

| remaining 3 digits | Record number |

What is a checkpoint in an organization’s details: explanation

- News

- Supporting documents

What is a checkpoint in the organization’s details: decoding

July 10, 2021 Elena Mavritskaya Leading expert, chief accountant with 10 years of experience

An accountant needs to understand what a checkpoint is in an organization’s details and how to decipher it. Our article will help you understand what each digit of this code means. In addition, we will tell you where to find out your company’s checkpoint and in which documents to indicate it.

KPP is an acronym. Its decoding sounds like “Registration reason code”. We are talking about tax accounting, and it is the tax authorities who assign this code.

In general, this code consists of nine digits.

- The first and second characters indicate the code of the subject of the Russian Federation in which the inspectorate that assigned the code is located. So, for the capital's Federal Tax Service, the first two digits are 77, for those near Moscow - 50, etc. If the code was assigned by the interregional inspectorate for the largest taxpayers, then the first two digits will be 99;

- the third and fourth characters indicate the number of the Federal Tax Service that assigned the code. For example, for inspection No. 23 in Moscow, the third and fourth digits will be 23.

- the fifth and sixth digits show the actual reason why tax authorities register the organization. If this occurs at the location of the organization, then the fifth and sixth digits will be 01; at the location of separate units - 02, 03, 04, 05, 31, 32; at the location of the property - 06, 07, 08; at the location of the vehicles - from 10 to 29. To register an organization as the largest taxpayer, the fifth and sixth digits will be 50;

- the seventh, eighth and ninth digits represent the serial number of the organization’s registration with the tax office on the appropriate basis.

Fill out a payment form for free in the accounting web service

Why do you need a checkpoint?

A legal entity can be registered simultaneously with several Federal Tax Service Inspectors: one - at its location, another - at the location of its unit, a third - at the location of the real estate, etc. To reflect information about a particular reason for registration, each of them is assigned a separate code.

IMPORTANT. An organization always has only one TIN, and it remains unchanged. But there may be several checkpoints, and under certain circumstances they will change. For example, if a change of legal address entails a transfer to another inspection, tax authorities will assign a new checkpoint to the organization to replace the previous one.

To whom is the checkpoint assigned, and in what documents is it indicated?

The Federal Tax Service assigns a reason code for registration only to legal entities. Individual entrepreneurs do not have this requisite.

Organizations must indicate the checkpoint (as well as the tax identification number) in all documents that are related to taxes and insurance premiums. Among these documents:

- Declarations and calculations, income certificates in form 2-NDFL.

- Payment orders for the payment of taxes, fees, insurance premiums, as well as penalties and fines for them. In such payments, the checkpoints of the payer and the recipient are mandatory bank details. If money is transferred to a counterparty, this code does not need to be specified.

- Invoices, sales books and purchase books, journals of received and issued invoices. Here it is necessary to indicate the checkpoints of both the supplier and the buyer.

ATTENTION. For legal entities that have several checkpoints, it is important to choose the correct code when filling out the document. In particular, when issuing an invoice by a separate division, it is necessary to indicate the code of this division. If an employee is registered in a branch, the 2-NDFL certificate for such an employee must indicate the branch code.

Fill out and submit 2‑NDFL online for free with new codes

How to find out the checkpoint of an organization

The reason code for registration can be found from the certificate or notification issued by the inspectorate. In addition, the checkpoint is indicated in the entry sheet of the Unified State Register of Legal Entities (USRLE). The organization receives this sheet upon registration.

To summarize, we note: an accountant needs to understand what a checkpoint is in an organization’s details and how to decipher it. This will help you avoid mistakes when preparing important documents, such as invoices and bank payment orders.

Errors when filling out payment slips can be eliminated if payment documents are generated automatically. Some web services for submitting reports (for example, “Kontur.Extern”) allow you to generate a payment in 1 click based on data from the declaration (calculation) or the request for payment of tax (contribution) sent by the inspectorates.

All necessary data (recipient details, including checkpoint, current budget classification codes - KBK, account numbers of Federal Treasury departments, codes for payer status) are promptly updated in the service without user participation.

When filling out a payment slip, all current values are entered automatically.

Discuss on the forum BookmarksPrint 26,974

26 974

Discuss on the forum BookmarksPrint 26,974

Filling rules

Appendix No. 1 of Regulation No. 383-P explains that in the case of transfers of money to the budget, each “Checkpoint” field in the payment order must be correctly filled out.

In particular, you must enter the following data:

- purpose and purpose of payment;

- information about the payer who is transferring the money, along with his checkpoint;

- the addressee who will receive the corresponding amounts, with his checkpoint displayed on the payment slip.

These same positions must be filled when money is transferred to private companies. That is, which are not related to the budget system of the Russian Federation.

Also see “Checkpoint of a separate unit: how to find out and receive.”

What can result from an error in the checkpoint in a payment order? It is important to note that fields 102 and 103 of this document are filled out in strict compliance with the registration reason code assigned to the sender and recipient of the money. Other information in these fields that does not reflect reality indicates erroneous data in the payment.

In such a situation, the Ministry of Finance of Russia indicates that an erroneous or missing checkpoint of the recipient in the payment order gives grounds to classify the entire transfer amount as a group of unknown receipts (based on clause 14 of the Procedure approved on December 18, 2013 No. 125n).

Thus, the answer to the question about the obligatory checkpoint in the payment becomes clear. Yes! Otherwise, the money simply won’t arrive. The sender must indicate it if:

- transfers funds to the budget system (writes his reason code in field 103 of this payment order);

- the money is addressed to a person not from the public sector (the law still obliges him to enter his checkpoint on the payment form).

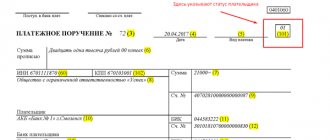

Error in field 102

The payment is filled out by payers, strictly following the recommendations of the Central Bank of the Russian Federation; accordingly, all fields must display only truthful information about both the payer and the recipient of the money transfer. Any violation of legal norms entails unpleasant consequences. Field 102 and field 103 in the payment order must display the registration reason code that was assigned to the legal entity. Data discrepancy indicates the invalidity of the payment document. In accordance with Procedure No. 125n, the absence or unreliability of details is the basis for treasurers to classify the amount in the payment document as uncleared transfers.

At the same time, the question of whether checkpoint is required in a payment order is considered ambiguous, since it is completely related to the status of the recipient of the money transfer. Consequently, all legal entities that do not belong to the public sector do not have a checkpoint code; accordingly, financial transfers to their details do not require filling out field 102 (entered “0”).

Similar articles

- Payer status 08 or 24 for individual entrepreneurs

- Field 104 in the payment order

- Property tax payment

- Unique accrual identifier in a payment order

- Does the individual entrepreneur have a checkpoint or not?

Incorrect checkpoint in the payment order for payment of taxes

If, when sending a tax payment to the bank, the checkpoint of the recipient or payer was incorrectly indicated, such an error is not considered critical, and the tax obligation is considered fulfilled. Significant errors entailing the accrual of financial sanctions in accordance with paragraphs. 4 p. 4 art. 45 of the Tax Code, only incorrect indication of the recipient's account (treasury) and the name of the bank are recognized - in this case, the payment is considered unfulfilled, it will have to be made again, and penalties must be transferred for failure to pay the tax or insurance premium on time.

In practice, if there is an error in field 102 (payer checkpoint), payments are credited to the Federal Tax Service and are considered executed, but an incorrect checkpoint does not allow you to accurately identify the recipient or sender of the budget payment - therefore, if the checkpoint is incorrectly indicated in field 103 or 102, the money will be classified as unidentified receipts. The taxpayer will need to write a letter to the Federal Tax Service to clarify the payment in any form and attach a payment order with a bank mark. Or write a request for payment, also attaching a payment receipt. Within 30 days, the inspector will find and update the payment with the date of debiting the funds. No penalties will be charged in this case.

Similar troubles arise when making payments to the Social Insurance Fund account: the fund will not be able to accurately determine the sender of the money, and the transfer will have to be clarified. When clarifying payments sent to the FSS, the application is written using a specially developed form posted on ]]>website]]> of the Fund, to which a copy of the payment slip is also attached.

Thus, an error when filling out the checkpoint in a payment order is not critical. It is important to remember that while the payment is being processed for execution, everything can be easily corrected by sending a clarifying letter to the bank. The situation is more complicated with already executed erroneous payments, but in this case the problem can be solved.

What is checkpoint in the organization details

The bank's checkpoint is a detail consisting of 9 digits, which encrypts information about the organization's registration with the Tax Service. Let's figure out what information can be obtained with their help, including by analyzing bank details.

ConsultantPlus TRY FREE

Get access

According to the requirements of the Tax Code of the Russian Federation, every payer of taxes and fees - be it a legal entity or an individual - is registered and registered. to the Federal Tax Service.

Upon registration, he is assigned an identification number (TIN). In addition, the taxpayer-organization is assigned a reason code for registration.

It contains a lot of information if you can read it.

In accordance with the Appendix to the order of the Federal Tax Service dated June 29, 2012 No. ММВ-7-6/ [email protected] , the checkpoint is always 9 characters (NNNNPPXXX):

- the first 4 (NNNN) allow you to determine the specific tax office where the legal entity was registered. Look for codes using the free online service from the Tax Service “Determining the details of the Federal Tax Service, the state registration body of legal entities and/or individual entrepreneurs serving this address”;

- the next 2 characters (PP) directly indicate the reason for registration. In accordance with the reference book “Reasons for registering taxpayer organizations with the tax authorities,” Russian companies are assigned values from 01 to 50, and foreign companies - from 51 to 99

- the remaining 3 digits ({XXX) indicate how many organizations have already registered for a specific reason.

Let's look at a specific example: decoding a checkpoint made for a bank code. When registering, Sberbank PJSC was assigned code 773601001. The first 4 digits (NNNN) are 7736. This is the number of the Federal Tax Service of Russia No. 36 for Moscow in the South-Western Administrative District. The next 2 digits (PP) are 01.

In accordance with the departmental directory, this value is assigned in case of registration at the location of the taxpayer. If the taxpayer is registered as a branch, the PP values are 02, 03 and 43 (you will see these numbers in the table of codes for regional bank offices).

The last 3 digits (ХХХ), 001, show that Sberbank PJSC is the first taxpayer whom the capital’s Federal Tax Service No. 36 registered at its location.

Main bank codes

All large Russian banks have regional branches, and each branch has its own set of numbers. Let's combine the examples into a table

| Sberbank, branches | checkpoint |

| Moskovskoe | 773643001 |

| North-West | 784243001 |

| South-West | 616143001 |

| Siberian | 540602001 |

| Far Eastern | 272143001 |

| Povolzhskoe | 631602001 |

| Central Russian | 775002002 |

| Baikal | 380843001 |

| Volgo-Vyatskoe | 526002001 |

| Ural | 667102008 |

| VTB, branches | |

| Moscow | 770943002 |

| Saint Petersburg | 783543011 |

| Ekaterinburg | 665843003 |

| Yuzhno-Sakhalinsk | 650143001 |

| Novosibirsk | 540643001 |

| Nizhny Novgorod | 526043001 |

| Stavropol | 263443001 |

| Rostov-on-Don | 616443001 |

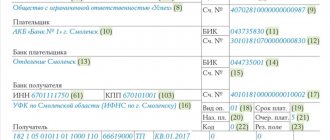

Details in corporate documentation

Please note that contracts allow several options for specifying information. Details are mandatory data, without which the document becomes invalid. The exact list depends on the type of document. Among the obligatory ones:

- legal address;

- TIN, checkpoint;

- details of the bank where the organization is serviced;

- telephone and email address.

Since the code is issued simultaneously with the TIN, often these two digital combinations: TIN and KPP, are written together in the details, separated by a slash. In the contract it looks like this:

But this is not the only correct option. It is also possible to record data separately. Like this:

Does the IP have a code?

By law, this identifier is assigned only to organizations. The IP does not have it. But if, when concluding an agreement, you see a checkpoint among the information, this is information about the bank where the entrepreneur has an account.

Why does an individual entrepreneur indicate it? It's simple: when filling out a payment order, you must indicate the checkpoint of the recipient - in this case, the recipient bank.

If, when drawing up documents, it remains unclear what a bank’s checkpoint is and where to find these numbers in the details, the easiest thing is to ask your partner. He must have all the information about the credit institution where his money is stored.

The second option is to use the TIN to find information about the bank, for example, on the Federal Tax Service website. Another way is to contact the bank’s call center directly or look for information on its official website, but this method is the most labor-intensive.