Land tax legislation

The main document regulating land tax issues is the Tax Code of the Russian Federation, in which Chapter is devoted to this tax. 31. However, due to the fact that this tax is a local level tax, for its introduction and abolition, municipalities adopt their own regulations. With the same legal acts, local authorities have the right to make independent decisions on a number of issues regarding the calculation and payment of land taxes (clause 2 of Article 387 of the Tax Code of the Russian Federation). They can:

- introduce a system of additional tax benefits;

- determine and differentiate tax rates, provided that they do not exceed those established by the Tax Code of the Russian Federation;

- determine the procedure and deadlines for paying taxes for legal entities.

If the local authority has not established its rates, then the rates established by the Tax Code of the Russian Federation are applied (clause 3 of Article 394 of the Tax Code of the Russian Federation):

- 0.3% - for lands for agricultural, residential, dacha purposes or related to security tasks of the Russian Federation (subclause 1, clause 1, article 394 of the Tax Code of the Russian Federation);

- 1.5% - for all other lands (subclause 2, clause 1, article 394 of the Tax Code of the Russian Federation).

ATTENTION! Tax officials will be informed about the misuse of agricultural land. And if inappropriate use is established, then the standard tax rate of 1.5% is applied.

Payment period and tax base

Article 55 of the Tax Code of the Russian Federation states that the calendar year should be considered as the reporting period for calculating tax collection. In the case of individual taxes, the period may be changed. During this time, the tax base must be formed and the payment amount calculated.

By the way, both the payer himself and a third party can calculate the tax. In some cases, the tax authorities themselves resort to calculations (especially often in the case of prolonged non-payment of contributions).

In the case of some payments, the period compiled may be shorter. For example, Article 163 of the Tax Code of the Russian Federation states that VAT must be calculated once a quarter. In the case of UTII, the tax period may be equal to a quarter (according to Article 346 of the Tax Code of the Russian Federation).

However, it is impossible to pay the required amount without knowledge of the tax base. In Clause 1 of Article 53 of the Tax Code of the Russian Federation, this base is characterized as any characteristic of the taxable object (including physical and cost).

There are several methods by which this database is formed.

Cash method. According to this method, the entire amount actually received as income and all expenses incurred by the payer are calculated.

Cumulative method. Here the entire amount of income received is calculated, regardless of whether they were actually received. Expenses are also calculated, taking into account all property obligations, regardless of the extent of their payment.

There are also several ways to determine the existing base. What methods are we talking about?

- A direct option, during which the recorded data is taken into account.

- An indirect option, which takes into account the area of taxation in comparison with other payers.

- A conditional method, in the process of using which secondary characteristics of the existing conditions for the formation of profitability are taken into account.

- The lump sum method, the essence of which is to take into account secondary characteristics to determine not income, but the amount of tax immediately.

The features and nuances of choosing one or another method of calculating the base are set out in Clause 3Art.54 of the Tax Code of the Russian Federation. Often the payer himself determines the method of calculation. If you are interested in which budget the land tax is credited to, click on the link.

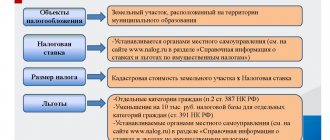

Land tax object

The object of taxation of land tax is defined in Art. 389 Tax Code of the Russian Federation. This tax is imposed on all land plots located in regions that have adopted a law introducing a land tax. In this case, the following areas are not subject to taxation:

- withdrawn from circulation or limited in circulation;

- intended for logging;

- located under apartment buildings.

The tax is calculated based on the cadastral value of the plot (clause 1 of Article 390 of the Tax Code of the Russian Federation), established as of January 1 of the year for which the calculation is made (clause 1 of Article 391 of the Tax Code of the Russian Federation). If the right to a plot arose in the current year, then its value for tax purposes is accepted as determined as of the date of cadastral registration.

During the year, the value of the plot for tax purposes does not change. The exceptions are the following cases:

- identifying a technical error in cadastral registration - then the tax is recalculated starting from the year in which such an error was made;

See details here .

- changes in the value of a plot when considering controversial situations - then the tax is recalculated from the year the application for change in value was submitted, but not earlier than the date of changes in the cadastral registration information.

our material about what to do if the characteristics of a land plot have changed

If a plot is located within several regions, then each part of it is subject to land tax according to the rules established by the law of the corresponding region (clause 2 of article 389 and clause 1 of article 391 of the Tax Code of the Russian Federation). Moreover, the share of the cost of a plot for each region depends on the share of its area in this region.

When does the obligation to pay for land arise?

The obligation to pay land tax arises for the taxpayer (organization or individual) when an object of taxation arises, formalized under the terms of one of the following rights (clause 1 of Article 388 of the Tax Code of the Russian Federation):

- property;

- use without a specified period;

- possession by right of inheritance.

If a plot of land has a right to use free of charge or for a fee under a lease agreement, then it is not subject to taxation (Clause 2 of Article 388 of the Tax Code of the Russian Federation).

Organizations themselves calculate the tax separately for each plot, using information about the established cadastral value.

We talked about how to calculate the tax if the cadastral value of the land is not determined here .

Read about the specifics of organizations reporting on land tax in the material “For some taxes, declarations may not be submitted .

For plots of land owned by individuals, tax calculations are carried out by the tax authorities. If an individual does not receive a notification from the Federal Tax Service to pay land tax, then since 2015 he is obliged to inform the tax inspectorate about this (clause 2.1 of Article 23 of the Tax Code of the Russian Federation). If this obligation is ignored, the Federal Tax Service will impose penalties in the amount of 20% of the unpaid tax amount.

The form for reporting undeclared property can be downloaded here.

How the tax is calculated by individual entrepreneurs, read the article “Land tax for individual entrepreneurs since 2015”.

For a plot of land, the right to which exists for less than a full year (i.e., the right to a plot of land arose or disappeared in the current year), the tax is calculated taking into account a coefficient that takes into account the proportion of months the taxpayer actually has a plot of land in the current year (clause 7 of Article 396 Tax Code of the Russian Federation). Moreover, if the right to the plot arose before the 15th day of the month, then the month is considered full, and if after the 15th, then the month is not taken into account in the taxation period.

Documents required to obtain tax benefits

Benefits cannot be applied automatically; therefore, in order to apply the established benefits, taxpayers are required to submit an application to any tax authority. In addition to the application, you must attach documents confirming the taxpayer’s right to apply for the appropriate benefit:

- disabled people confirm their right to benefits by submitting a certificate from a medical institution of the established form;

- pensioners present a pension certificate;

- large families - a certificate from the social protection department of the city administration or a certificate of a large family.

A complete list of documents for different categories of citizens is posted on the website of the Federal Tax Service.

Features of taxation of common land

A land plot can be in common ownership: joint or shared. In this case, the tax is paid by each owner separately from the value of his share (clause 2 of Article 389 of the Tax Code of the Russian Federation):

- For shared ownership, the value of the share will be determined in proportion to its part in the total cost of the site (clause 1 of Article 392 of the Tax Code of the Russian Federation).

- For joint ownership, these shares will be the same (clause 2 of Article 392 of the Tax Code of the Russian Federation).

How to find out the land tax debt , we tell you in this material.

Possible benefits for land tax

The application of benefits to an object of taxation by land tax is possible upon receipt of a plot for a specific purpose, provided that it is used for this purpose (Article 395 of the Tax Code of the Russian Federation). The provision of benefits must be documented (clause 10, article 396 of the Tax Code of the Russian Federation).

Organizations have the right to take advantage of benefits on sites intended for placement of:

- institutions of the penal system;

- public roads;

- religious buildings;

- public organizations of disabled people and companies with their participation;

- organizations of folk arts and crafts;

- special and free economic zones;

- objects of innovation.

Benefits for public organizations of disabled people and companies with their participation are applicable with certain restrictions on the types of activities and the number of disabled people in them. For special and free economic zones, the possibility of applying benefits is limited in duration.

Individuals in relation to the object of taxation can use only one benefit: for plots intended for leading the traditional way of life by small peoples of the Russian Federation (clause 7 of Article 395 of the Tax Code of the Russian Federation).

At the same time, legislators of municipalities have the right to establish additional benefits and differentiated land tax rates.

Results

Land tax is imposed on all land plots in the region where this tax is levied. The Tax Code of the Russian Federation establishes a list of tax-free lands. The amount of the fee depends on the cadastral value of the site.

Legislators are preparing a number of changes to the land tax:

- “The State Duma adopted in the first reading a bill introducing a “tax on unfinished construction””;

- “The Ministry of Finance is preparing changes to the property tax and land tax.”

Follow all the innovations in our Land Tax section.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Which areas are recognized as objects of taxation?

Objects of taxation are understood as land plots. In this case, only those lands that are located in the Russian Federation are subject to taxation. Plots outside the Russian Federation are not subject to Russian land tax. Thus, if a citizen of the Russian Federation acquires a land plot located on the territory of a foreign state, then in the Russian Federation such land plot will not be recognized as subject to land tax and, accordingly, no tax is required to be paid in respect of it.

The Tax Code of the Russian Federation contains an exhaustive list of land plots that are the object of taxation, and, despite the fact that land tax is recognized as a local tax, municipalities under no circumstances have the right to introduce new objects of taxation.

The current trend is that municipalities are more willing to establish benefits based on who the taxpayer is, rather than on what object is subject to taxation. First of all, this is due to the need to support socially vulnerable segments of the population.

Some regulatory legal acts of municipalities provide for special benefits. For example, decisions of the representative bodies of the municipalities of the Khabarovsk Territory, the Novosibirsk Region and the Chelyabinsk Region established that residents whose lands fall into the flood zone do not pay land tax in respect of such lands.