With foreign buyers and suppliers, settlements most often occur in foreign currency. A regular current account is not suitable for this, but a foreign currency account is used. Today we will tell you about working with foreign currency accounts from the tax side.

When you contact a bank to open a foreign currency account, the bank always opens a transit foreign currency account for it. Thus, it turns out that you have two foreign currency accounts - transit and current. Initially, all proceeds in foreign currency will go to the transit account; it is intended for the bank to carry out currency control. After which, income from the transit account is transferred to the current foreign exchange account or the currency is sold.

Transit bank account - what is it?

If we consider the terminology, then this is an account in the currency of another state, which is used to transfer payment for a service or product.

Until 2007, every businessman who conducts business throughout the state gave away part of his profit: in different years this amount ranged from 10 to 50%, depending on legal requirements. To the great joy of entrepreneurs, this percentage is now 0%, thanks to such a banking profile.

This is interesting

To use a transit account, you need to pay a set commission fee and sell on the domestic market a set portion of the currency from the profit received at a fixed exchange rate. Also, one of the conditions for using a bank account is the transfer of part of foreign money into the domestic equivalent, according to the current exchange rate.

At the same time, this is not easy to do: in order to sell/exchange currency, the owner must write a special application, where it is necessary to indicate the amount of the transfer in banknotes. Amounts are redirected to cover losses. This is mandatory for legal entities when establishing business contacts with non-residents of the state. For convenience, insurance companies from other countries also use this method.

Transfer of funds from transit to current currency account

Initially, money from foreign counterparties will always go to the transit account.

Only after the bank carries out currency control and receives the necessary documents from you, will you be able to transfer money to a current foreign exchange account or immediately sell the currency. When you pay your expenses in foreign currency, payments will go from the foreign currency account directly to the counterparty, bypassing the transit account. For transactions in foreign currency, the bank is obliged to carry out exchange control. Your interaction with the bank will be structured as follows: when money arrives in your transit account, you will receive a notification about this. Foreign currency account is the Field “Account number for debiting the commission is available for selection: If the User has not selected the account number from which the transfer will be made (field “Account No. block “Payer”), then all client accounts are displayed in the list , available to the user. Settlement documents for transactions related to the transfer (credit) of funds by a credit institution to clients, other organizations, collection of funds from client accounts, are drawn up in accordance with the requirements of the Bank of Russia rules for non-cash payments (paragraph 5, paragraphs.

1. 9. 5 clause 1. 9 part III of the Appendix to Regulation N 385-P). Accordingly, funds from the transit currency account will be transferred to the current currency account or to the organization’s ruble current account, depending on the content of the application (i.e., depending on whether you simply want to transfer currency from the transit account to the current account or sell it).

An order of a resident legal entity is signed by two persons who have the right to sign settlement documents, or by one person (in the absence of a second person in the state who may be granted the right to sign), stated in the card with sample signatures and a seal imprint, with the seal of the legal entity attached - resident To identify foreign currency receipts in favor of residents and for the purpose of accounting for foreign exchange transactions, including when selling part of foreign currency earnings, authorized banks open a current and, at the same time, transit foreign currency account for residents (legal entities and individual entrepreneurs) on the basis of a bank account agreement accounts. The latter is credited with the organization's export foreign currency earnings. Settlement documents for transactions related to the transfer (credit) of funds by a credit institution to clients, other organizations, collection of funds from client accounts, are drawn up in accordance with the requirements of the Bank of Russia rules for non-cash payments (para.

5 pp. 1. 9. 5 clause 1. 9 part III of the Appendix to Regulation N 385-P). Based on clause 1. 12 of the Regulations on the rules for transferring funds (approved by the Bank of Russia on June 19, 2012 N 383-P), settlement (payment) documents are payment orders, collection orders, payment requests, payment orders, bank orders.

The procedure for the sale of foreign currency is established by Instruction of the Central Bank of the Russian Federation dated March 30, 2004 N 111-I “On the mandatory sale of part of foreign currency earnings on the domestic foreign exchange market of the Russian Federation (hereinafter referred to as Instruction N 111-I). After the abolition of the mandatory sale of a portion of foreign currency earnings, the very procedure for submitting an order and transferring currency from a transit account to a current account was retained in many banks. Transfer of Funds from Transit to Current Currency Account

Read on the Russia-Ukraine website:

- Transfer of Documents to the Tax Office for Payment of Indirect Taxes

- Leg Fracture What Severity Is Harmful to Health

- Transfer of Accounts Payable from One Agreement to Another

- Is Relocating Walls and Sewers Legal?

- Revaluation of Securities in Tax Accounting

Attention!

Due to recent changes in legislation, the legal information in this article may be out of date! Our lawyer can advise you free of charge - write your question in the form below.

What is it for?

So what is a transit bank account and what is it for? It is used so that fiscal (tax) authorities can control the activities of a businessman. It is also an “intermediate point” for currency exchange, according to the exchange rate: that is, first the money is transferred to the transit number, and then only from it to the regular one. This applies to both entrepreneurs and individuals.

It is used for transfers for the following services:

- Transportation of goods to another country;

- Insurance payments;

- Transfer of goods.

You may be subject to commission and administrative fees.

Do you want to start using the money that came to you? Confirm the reality of the transaction by performing identification. To do this, just bring the bank to the tax office:

- Certificate of currency transaction.

- A contract stating the reason for the transfer of finances.

The bank may charge a commission because it is a currency control agent whose services are not free. All tariffs are specified in the agreement for settlement and cash services.

The rules for using accounts are defined in the special instructions of the Central Bank under number 111-I, dated March 30, 2004. The main conditions for transactions with currency within the Russian Federation are regulated by Federal Law No. 173 “On Currency Regulation and Currency Control” (the law came into force on December 10, 2003). Any person who will conduct transactions with dollars or euros must know these rules.

Why is it necessary?

Transit details can only be used by those enterprises that also have the ability to carry out transactions with currency. It is possible to withdraw funds only after converting them. Despite the many features of use, it is worth highlighting the capabilities of a transit account:

- The organization has an “intermediate point” for currency exchange.

- Fiscal authorities could control the activities of a businessman.

- Carry out activities abroad.

- Have insurance benefits.

- Transfer of products.

Account decryption

Important! Companies can also pay commissions and fees from transit. On the other hand, the state has the opportunity to obtain and verify information about the organization’s activities in the foreign market.

Structure

Everyone knows that the legal currency of Russia is the ruble, but when export relations arise, it is allowed to use other banknotes. For convenience and data recording, intermediate accounts are used. A transit bank account is an example of an accumulating (savings) account, and a person will be able to dispose of the amount only 15 days after receipt.

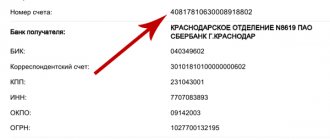

It consists of the following elements (details):

- a unique number, usually consisting of 20 digits;

- BIC - banking institution code;

- the agreement on opening a transit currency account must contain your data - INN and KPP;

- correspondent bank number (also twenty-digit).

The number is often called a bank identifier, since each group of numbers defines encrypted information. So, the first three digits mean the number of group I. The second two are number II of group. The sixth, seventh and eighth digits determine the currency code. The ninth is the verification number. The next four digits determine which financial institution this account belongs to. The types of institutions are indicated by the next two numbers after them. The last five digits are an internal bank reference point by which the client is identified.

Purpose

A transit currency account is used to make payments for:

- Transportation of goods across the territory of another country.

- Insurance.

- Cargo delivery and other services.

It is also allowed to pay commissions from credit institutions and customs duties.

A special account is opened simultaneously with the opening of the main currency account. In simple terms, a transit currency account plays the role of an intermediate link in the process of currency transfer. In addition, if a legal entity transfers the currency of another country from bank to bank, the funds are also credited to the transit account, and after that they go to the main account intended for the currency.

What is the difference between a current account and a transit account?

If we have already figured out why currency numbers are needed, then it is worth deciding on their characteristics and fundamental differences.

To do this, let's take a look at the table with a description:

| Characteristic | Calculated | Transit |

| 1. Purpose | Recording and accounting of performed transactions | Short-term savings of funds in foreign currency |

| 2. Shelf life | Limited by the duration of the contract | 15 days |

| 3. Applications | No restrictions | Used for: profit accumulation; payment of customs duties and duties; converting some part of the profit into foreign currency (10-50%); when paying for services for transporting goods across the border. |

| 4. Difference in account (digit in seventh position) | 0 | 1 |

| 5. Currency control | Not obligatory, as it usually accumulates amounts of money in national currency | Required |

What is money transit?

The word itself speaks of a certain movement, and in relation to monetary units it is the transfer of a certain amount of money from one account to another. To transfer amounts of funds from a transit number, for example, to pay a state fee, you, as the owner, must issue an order for this operation. This is not necessarily a written notification - the entire process can be carried out through the “Personal Account”. There you need to fill in the details - there are special input fields for them - and indicate the transfer amount, so you will confirm the operation.

Thus, you give permission to write off the specified amount. After this, the report will be available to you.

Transfer from transit to foreign currency account

Settlement documents for transactions related to the transfer (credit) of funds by a credit institution to clients, other organizations, collection of funds from client accounts, are drawn up in accordance with the requirements of the Bank of Russia rules for non-cash payments (paragraph 5, paragraphs 1. 9. 5 paragraphs. 1. 9 Part III of the Appendix to Regulation No. 385-P).

Based on clause 1. 12 of the Regulations on the rules for transferring funds (approved by the Bank of Russia on June 19, 2012 N 383-P), settlement (payment) documents are payment orders, collection orders, payment requests, payment orders, bank orders. According to clause

Regulatory framework for foreign exchange transactions of enterprises

The development of legislation on the regulation of foreign exchange transactions was initiated by Decree No. 213 of November 19, 1991, which laid the foundations for the liberalization of foreign economic relations between Russia and foreign countries. Later, in October 1992, the Federal Law “On Currency Regulation and Currency Control” was adopted. He defined the rules of the “game” not only in the foreign exchange market, but in the activities of international enterprises and companies, and also indicated the functions and role of regulatory services.

The law stipulates that payment for goods or services by non-residents must be made within 30 days. The regulation also provides for the provision of information about the recipient and sender of funds, as well as the details of the transfer being carried out.

The regulatory document states that domestic organizations can open a foreign currency account only if they have permission to do so from the Central Bank of the Russian Federation. At the same time, it is the Central Bank that considers whether it is necessary to open an additional account for a business entity in one of the foreign banks, because in this case it must provide a report on the flow of funds at certain periods.

Features of using a transit currency account

Along with the current (current) bank account of a legal entity or individual entrepreneur (IP), a transit currency account is used in the course of everyday business transactions (payments, transfers). From the point of view of users and legal norms, a transit account has a number of features.

- Duration of storage of funds. Russian legislation allows funds to be stored in a transit account for 15 calendar days, then the company or individual entrepreneur must provide the bank with the documents required by currency control. After checking the papers, funds should be transferred to a current account for further operations or storage.

- Available account operations. Funds stored in a transit currency account are intended for transfer to the current (settlement) account of a legal entity or individual entrepreneur. Company owners cannot withdraw money, convert currency, or pay for goods and services using the amount of funds in the transit account.

- Account details. The transit account number differs from the current account details by one digit, occupying the seventh place. In current accounts the seventh digit is always 0, in transit accounts it is indicated as 1.

- Additional services. Most banks charge a monthly fee for maintaining a transit account, issuing and servicing transaction passports for currency control. For example, at Alfa Bank the cost of maintaining a transit currency account is more than three thousand rubles per month, the owner is offered regular consultations and free registration of transaction passports.

In practice, a transit currency account is an intermediate link for conducting transactions between a counterparty and a company. All funds received to the transit currency account are verified before being credited to the company's current account. Typically, the accountant should provide the bank with a certificate of currency transactions carried out, a copy of the agreement with the counterparty, as well as an invoice confirming that the payment has been credited to the client’s details.

How to open a transit currency account

For organizations that are involved in export or import operations, or are in partnership with non-resident firms, opening a foreign exchange office is a prerequisite.

List of documentation:

- a completed form where the client automatically gives his consent to the creation and activation of the number;

- a notarized copy of the statutory documents of the enterprise or company;

- card with a corporate stamp imprint and sample signatures;

- a decision with a notary’s seal on the foundation (legal registration of the legality of work in the business sector) of a business entity.

You must fill out an application in which you indicate that you need to conduct transactions in foreign currency. In addition to the application, you must show additional extracts and certificates that determine the status of the person (the company’s statutory documents).

note

Important information: upon activation, the account is immediately opened to convert profits into national currency.

Once you have prepared a list of documents for opening, you need to take care of the evidence that the currency that comes in has legal sources of origin. The bank will also have to make sure that your enterprise (firm) has qualified personnel to carry out financial transactions required by the practice of using currency and transit accounts.

After this, after some time, the financial institution will evaluate the prospects and make a “verdict”. Please note that the above list of documents is not final: the bank may change it by adding or deleting items, depending on internal policies and other factors.

How to work with foreign currency accounts?

Source : https://kibanki. com/products/valyutnyy_schet/ Currency account (BC) (eng.

This is an internal bank account; it is needed for the bank to control the receipt of money from abroad.

| Dear visitors! The site offers standard solutions to problems, but each case is individual and has its own nuances. |

| If you want to find out how to solve your particular problem, call toll-free ext. 504 (consultation free) |

Initially, money from foreign counterparties will always go to the transit account. Only after the bank carries out currency control and receives the necessary documents from you, will you be able to transfer money to a current foreign exchange account or immediately sell the currency. When you pay your expenses in foreign currency, payments will go from the foreign currency account directly to the counterparty, bypassing the transit account. For transactions in foreign currency, the bank is obliged to carry out exchange control.

Your interaction with the bank will be structured as follows: when money arrives in your transit account, you will receive a notification about this.

How to close a transit account

As stated earlier, it opens along with the main one and is needed to identify the currency that is received by the client. Money is not stored on it 24/7 - in the future it can be transferred to a regular card. You can close it in the same way as a bank account.

After a business entity no longer needs to use this account, he needs to close it. This happens after filing:

- applications for closing, according to the form;

- amounts on the balance sheet.

According to the norms of Russian laws, an agreement between an entrepreneur and a banking institution can be terminated if there is mutual agreement or an objective requirement of one of the parties. Closing is considered valid from the moment the client or his authorized representative submits a special application for termination of the contract.

The rest of the money can be received immediately in cash or in the form of a transfer. After completing the closing procedure, you must notify the tax service about this as soon as possible (for late notification you will receive a fine of 1,000 rubles or more). To avoid problems, you must write about the closure within 7 business days. The main thing is to warn them about your plans in time.

How does the bank carry out currency control of client transit accounts?

In the modern financial services market, there are several large banks that provide cash and settlement services for foreign currency accounts. Such banking institutions act as currency control agents, issue transaction passports and allow foreign banknotes to be stored in transit accounts.

As a rule, the bank commission for conducting foreign exchange transactions is about 0.15% of the transaction amount; the control procedure is carried out online. For example, at Tinkoff Bank, notifications of receipts to a transit currency account and a list of required documents are sent through the application. The bank client submits scanned copies of documents, receives approval and the funds are automatically transferred to the current account.

Currency control of transactions of legal entities is carried out in several stages.

Checking the agreement between the account holder and the counterparty. Russian legislation in the field of currency regulation requires the execution of agreements with foreign counterparties, indicating the validity period of the agreement, currency, name and place of registration of the parties. You should also indicate the date of conclusion of the contract. Bank clients working under an offer (a contract for the provision of services or work without a fixed validity period) must provide the bank with a letter indicating the expected completion date of the contract. In practice, banks publish samples of agreements with foreign counterparties on the official website, and the form of the agreement can also be checked with an employee of the currency control department.

Receipt of funds to the transit currency account. Most banking organizations send a notification to clients the next business day after the currency is received in the transit account. The account owner must provide documents for currency control within 15 calendar days to avoid fines and transfer funds to the current account. The best option is to provide the documents in advance so that the bank employee has time to check the papers and not impose fines.

Collection and submission of documents for currency control. The client needs to submit to the bank a completed certificate of currency transactions on the account, an agreement with the client, a payment order or an invoice (invoice). If the payment amount exceeds the equivalent of 50 thousand US dollars, you will additionally need to issue a transaction passport from the bank. The client should check with the bank in advance for which organizations the “green corridor” is open - a simplified scheme for confirming transactions. Typically, banks open a “green corridor” for large foreign companies (for example, Google, Apple). If the counterparty is included in the list of such organizations, the bank client will need to provide a screenshot of the login to their personal account or payroll. The procedure for submitting documents for currency control depends on the specific bank. Usually you need to provide scanned copies of documents by sending files through your personal account; some banks require printed documents to be sent to the office.

Receiving funds. Typically, documents for currency control are checked within two to three business days, then the funds in the transit account are transferred to the current (settlement) account. The bank informs about the successful completion of currency control in an email, or can send an SMS. The procedure for filling out and the period for reviewing documents varies depending on the specific bank. Many financial institutions independently fill out the transaction passport, using an agreement with the counterparty and an invoice provided by the client.