Acceptance: definition of the concept

Acceptance is an official response to the seller that the buyer is ready to accept the offer (offer to sign a contract based on its terms). When signing a contract, before acceptance is made, both parties need to discuss all the nuances of the future agreement.

According to the legislation in force in the Russian Federation, an acceptance can be considered executed only if it is complete.

The transaction will be concluded unconditionally only upon receipt of acceptance. Thus, in order to conduct a successful business and avoid misunderstandings between partners, it is necessary to determine the criteria for the possibility of paying invoices with full acceptance.

What does invoice accepted mean?

If acceptance is accepted, the contractor should begin to fulfill his duties specified in the signed agreement. Since the value of an accepted invoice will indicate a guarantee of receiving payment on time. This procedure significantly saves time, which can no longer be spent on reviewing, agreeing, and signing documents related to the offer. Acceptance can be implemented in various ways; there is no possibility of defining a unified method. However, you can consider an approximate option:

Receipt of an offer for the supply of goods or provision of services.- Consideration of the proposal on its merits. In this case, no counter adjustments or demands will be made to the proposal received, and it, as well as the form of the contract, will be completely satisfactory to both parties.

- Compiling a response letter. In this letter, you must voice your consent to cooperate and indicate the obligation to pay for the services provided in full, subject to their full implementation.

- The documents are marked “accepted”, as well as the signature of the head of the organization and its stamp.

Definition of acceptance, its purpose

When concluding an agreement, both parties read each clause in detail, familiarizing themselves with the terms and discussing them. If the counterparty is satisfied with the agreement without making adjustments or changes to it, this means that the document has been accepted.

Thus, acceptance means satisfaction with the written terms provided by the other party to the transaction and written confirmation of consent to make payments under the obligations of the agreement.

Also, acceptance is the inscription “accepted” on any document with the signature and seal of the party who agrees to pay its obligations enshrined in it in full.

The legislation of the Russian Federation also provides some clarifications regarding the definition:

- the absence of any response from the other counterparty cannot be considered acceptance. The agreement to accept must be voluntary and confirmed, if this clause is not specified in the already concluded agreement;

- in conditions where the second party fulfills the terms of the agreement, but has not given consent to acceptance, the agreement is recognized as accepted automatically.

In addition, the letter of the domestic law states that acceptance must be complete and unconditional, that is, only part of the obligations under the contract cannot be accepted.

The need for the procedure

According to the current legislation, the acceptance procedure has a number of significant points:

Acceptance will not be the absence of refusal by the party to whom the offer was sent.- In the event of full fulfillment of obligations by the offeree within the prescribed period, such fulfillment can be considered acceptance (even in the absence of an official response). This scenario is usually possible in long-term relationships.

Thus, the need to carry out the acceptance procedure is determined by minimizing disagreements between partners, as well as confidence in the timely fulfillment of contractual obligations.

Use of acceptance

The concept of “use of acceptance” is very widespread in accounting, as well as in international legal relations. And here the acceptance will be:

- Indisputable confirmation of the intention to conclude a transaction, as well as approval of all provisions of the agreement.

- Unilateral acceptance of obligations under a concluded agreement.

- Agreement with the bill of exchange coverage period and acceptance of bill settlement obligations.

- Positive decision on settlement for monetary documents.

Video on how to make a deal:

When using acceptance, issues of payment of receipts or bills of exchange are addressed. This method of payment is also typical when paying for a product, service, or a certain type of work.

The acceptor is the person who accepted the terms of the transaction and agreed with their execution.

ACCEPTANCE OF INVOICE

See what “INVOICE ACCEPTANCE” is in other dictionaries:

- invoice acceptance - The payer’s consent to full payment of the invoice issued for collection at the bank, presented by the supplier for inventory, work performed and services rendered. Accounting topics... ... Technical Translator's Directory

- ACCEPTANCE OF INVOICE - the payer’s consent to full payment of the invoice issued for collection at the bank, presented by the supplier for inventory, work performed and services rendered ... Legal encyclopedia

- Invoice Acceptance - the payer’s agreement to pay the supplier’s invoice for goods, work or services. Dictionary of business terms. Akademik.ru. 2001 ... Dictionary of business terms

- ACCEPTANCE OF INVOICE - the payer’s consent to full payment of the invoice issued for collection at the bank, presented by the supplier for inventory, work performed and services rendered ... Encyclopedic Dictionary of Economics and Law

- invoice acceptance - consent to full payment of the invoice issued for collection at the bank, presented by the supplier for inventory, work performed and services rendered ... Large legal dictionary

- ACCEPTANCE OF INVOICE - the payer’s consent to full payment of the invoice issued for collection at the bank, presented by the supplier for inventory, work performed and services rendered ... Large accounting dictionary

- ACCEPTANCE OF INVOICE - the payer’s consent to full payment of the invoice issued for collection at the bank, presented by the supplier for inventory, work performed and services rendered ... Large Economic Dictionary

- INVOICE ACCEPTANCE - ACCEPTANCE OF INVOICE ... Legal encyclopedia

- ACCEPTANCE OF INVOICES - (see ACCEPTANCE OF INVOICE) ... Encyclopedic Dictionary of Economics and Law

- partial acceptance - incomplete acceptance The buyer’s consent to partial payment of the supplier’s invoice. Topics accounting Synonyms incomplete acceptance... Technical Translator's Directory

“Acceptance has been received for you”, “accepted” - such expressions can be heard when applying for a loan, shopping in an online store or when concluding contracts. We will analyze what acceptance is, who, when and under what conditions can use it, and how to correctly accept a contract.

Restrictions on action

In acceptance, as in any financial procedure, there are some restrictions on action. All restrictions or prohibitions will always follow from international regulations, as well as the legislation of the Russian Federation. In order not to violate the law during this procedure, it is necessary to remember that acceptance will be a confirmation of the intention to pay, but not a guarantee of its implementation. However, immediate settlement cannot be required. But the very meaning of the restriction will not only be the fulfillment of the obligations specified in the contract. You also need to issue an invoice. At the same time, this account must be accepted by the second party to the transaction for accounting.

Further, all settlement transactions are carried out through the cash settlement centers of the transaction participants. On the part of the recipient of the service, a payment transaction will be completed and the funds will be transferred to the performer’s RCC. There is a mandatory intermediary - a financial organization (bank). To ensure that the transaction is not regarded by regulatory authorities as an illegal financial fraud, only this payment method is used.

Deadline for acceptance

According to Art. 440 of the Civil Code of the Russian Federation, the contract will become “concluded” only if the acceptance is approved within the deadline. And now Art. 441 of the Civil Code of the Russian Federation clarifies the provisions of the previous article. Moreover, if, when sending a written offer, the sending organization did not determine the period for acceptance, then the contract will receive the status “concluded” if the sending organization received acceptance before the expiration of the period established by law or other regulations.

An agreement without specifying a specific period for acceptance will be concluded upon acceptance by the party to whom the offer is addressed orally, with an immediate application for acceptance under this agreement.

Current deadlines

Accept - what does it mean? As we said above, this mark indicates the acceptance of all obligations in accordance with the framework of the agreement. However, there are situations in which it is almost impossible to indicate specific deadlines for fulfilling obligations. As a rule, each entrepreneur independently sets the deadlines necessary for a comprehensive study of the received documents.

Experts also recommend taking into account the specifics of commercial legal relations. In the absence of specific deadlines allotted for making a decision, the entrepreneur needs to contact the counterparty in order to agree on the duration of the time period allotted for making the final decision. It is important to note that acceptance received after this period can be considered as agreement to the terms of the contract.

What does preliminary acceptance mean?

Preliminary acceptance will mean that the organization making the payment provides its permission to pay for the supplier’s document before the procedure for debiting funds from its current account. The document will be accepted if the payer does not submit an application to the bank to certify the refusal to transfer funds within three working days.

In addition, according to general banking rules, the date of receipt of the payment document by the bank is not taken into account, and the countdown will begin from the next business day.

Types of acceptances, scope of their application

The following types of acceptances are distinguished:

with the participation of an intermediary. This type of acceptance implies the presence of a third independent party who agrees to execute the counterparty’s instructions on the basis of the agreement;- with the participation of a guarantor. This type of acceptance assumes that obligations will be transferred to a third party when he signs the bill;

- unconditional acceptance. It implies complete adherence to the contract by both parties, without violations or disputes, in conditions where a statement of acceptance is not required and the contract is accepted by default;

- limited acceptance. It implies the readiness of the second counterparty to fulfill its obligations, but with adjustments and changes. One of the most common changes made is the adjustment of demand payment terms;

- conditional acceptance. It involves concluding an agreement when making major adjustments or completely changing the terms.

Important fact

If the transaction is carried out using bills of exchange, then this type of acceptance will annul the legality of the transaction;

- local acceptance. Means that the counterparty must return the borrowed funds in a specific prescribed place;

- partial acceptance. It assumes that only part of the amount indicated on the papers will be required for payment.

Today, acceptance is widespread and is used by many organizations to carry out various transactions, among which are:

- banking transactions;

- confirmation of the offer;

- agreement to the terms of the agreement;

- agreement to the terms of the letter of credit.

Thus, acceptance is used to speed up settlements between counterparties, who are guaranteed the inviolability of financial assets and their mandatory return after a clearly defined period. In addition, the presence of such a document greatly facilitates the control of all financial documentation.

Important fact

To conclude and sign an acceptance, the parties do not have to meet in person, which saves time and speeds up the process of fulfilling the terms of the agreement.

Acceptance of an invoice from a supplier of goods/services

This is a confirmation of the intention to pay the accepted financial document. An invoice paid by non-cash method will be considered accepted. The exact date of payment is established by the signed agreement.

An example of such an operation is payment for the services of an Internet provider, which almost everyone encounters.

First, an agreement will be concluded for the provision of the provider’s services, all conditions will be stipulated in it, including payment terms. An additional agreement is concluded to this agreement, according to which all invoices for payment will be sent immediately to the bank. But the bank repays this acceptance by debiting the required amount of funds from the account of the service recipient to the account of the Internet provider.

The concept of acceptance in accounting

The concept of acceptance, based on the above definition in the Civil Code of the Russian Federation, is applicable to an offer. In turn, an invoice for payment can be considered as an offer in which the seller (supplier) offers the buyer to purchase a certain product or service for a certain amount. According to Art. 435 of the Civil Code of the Russian Federation, an offer is recognized as a specific proposal sent to addressees (one or more), which fully expresses the intention of the person who sent it to enter into a contractual relationship with the addressee. In the case of acceptance of an invoice, such an action is its full or partial payment. Thus, in order to reflect the acceptance of the invoice, it is necessary to reflect the entries for the accrual of debt, the accrual of VAT, if necessary, and the payment made on this invoice.

In the business tradition, in particular, an approach is used according to which an invoice is called accepted if the responsible person has agreed to pay it (the invoice has been endorsed for drawing up a payment order to the bank).

Accepted letter of credit

Otherwise called a fixed-term letter of credit, it differs from an acceptance in that in its terms the supplier organization includes a draft addressed to the advising (paying the invoice) bank. This draft will have an essential payment term: “within a certain number of days.”

In practice, this will mean that instead of making an immediate transfer of funds, the draft will first be sent by the bank to the seller with the account marked “accepted”. Such acceptance will mean that the funds will be credited to the seller’s account within the time period established by the contract.

Types of acceptance

Acceptance is a standard procedure during which payment orders and other acts of a financial nature are considered . Upon completion of the review of documents, the transaction participant must make decisions on payment and timing of repayment of financial obligations. Agreement with the terms of the agreement is confirmed by a personal seal, signature or digital signature.

According to current laws, the issuance of acceptance implies full and unconditional agreement with the requirements of the second party. This means that the party using this tool cannot fulfill only part of the points set out in the contract. The Civil Code contains complete information about the deadlines for fulfilling obligations, according to the issued acceptance.

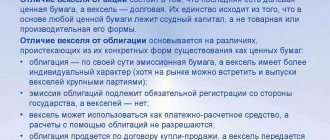

Bill of exchange

In order to express consent to the payment of financial obligations on the basis of a bill of exchange, the party acting as a debtor must put its signature on this document. The need to confirm consent to pay the debt arises only when using bills of exchange. Here it is necessary to highlight the fact that the date of acceptance of the bill is the day on which the debtor put his signature on the document. In the case of a promissory note, there is no need to mark it, since the countdown of the period for repayment of the debt begins from the day the paper is received.

It is necessary to confirm agreement with the terms of the bill only in cases where the party that drew up this document indicated the clause on the issuance of acceptance. Payment for bills of exchange is carried out within a certain time period from the moment the document is presented.

In banking practice

We have already said above that the instrument in question is often used in banking practice. In this area, “acceptance” means the bank’s consent to issue funds as a loan . Before giving permission to apply for a loan, employees of a banking organization carefully study the client’s credit history.

As an example of how this tool works, let's look at a small practical example. An entrepreneur who is a client of the bank wishes to make payment according to the agreement. The funds must arrive in the counterparty's account within a certain period. However, the entrepreneur himself does not have enough financial resources in his account. In this case, the entrepreneur can ask the bank to make a transfer in the name of the counterparty. Bank employees, having analyzed the credit history of their client, make a decision on this issue. Next, the bank waits until new funds arrive in the depositor’s account in order to deduct the amount spent.

It should be noted that in banking practice terms such as preliminary and subsequent consent are used. The credit institution that received the payment order must receive confirmation from the payer. After receiving consent, funds intended for payment are frozen for three days. This period is provided so that the payer can change his decision and refuse to transfer funds. If there is no withdrawal of funds after the above-mentioned period, the bank carries out the transaction.

Acceptance can be transmitted to the sender of the document through an electronic signature, an inscription on the document or other means of communication

Offer

Acceptance with the terms of a public offer should be understood as confirmation of consent to the execution of a contract in accordance with the conditions recorded in the document . As a rule, a public offer consists of several large sections, including many different points. The second party to the transaction may need a long period of time to study all the conditions proposed by the counterparty. It should be noted here that receipt of a notice with notes on the meaning of certain points and questions about the terms of the agreement cannot be considered as official consent to conclude an agreement.

According to lawyers, it is unacceptable to conclude contracts upon receipt of notifications containing not only acceptance, but also comments on various sections of the public offer. This nuance must be taken into account before you begin to fulfill your obligations under a contract where the signature of the second participant is missing . Before starting work, it is recommended to settle all legal details and make appropriate adjustments to the contract.

Check

The term “invoice accepted” implies the agreement of the second party with the requirements of the participant in the contractual legal relationship who drew up the payment order. This mark confirms agreement with both the invoice amount and the deadlines for the execution of the contract object. Receipt of such confirmation means a quick transfer of funds to the account of the sender of the goods or the organization providing the service. It should be noted here that obtaining consent to a payment order cannot be regarded as the fact that payment will occur earlier than the deadlines specified in the contract.

Acceptance of an invoice must be considered as a preliminary agreement on the amount and timing of payment. If the participant who accepted the payment order does not agree with its content, he may require his counterparty to make adjustments. This participant also has legal grounds for refusing to pay. If acceptance is issued, this company undertakes to make payment within the time limits specified in the payment order.

Agreement

Entrepreneurs who use various acts that require acceptance in their practice must use certain accounting techniques. After concluding the contract, the participant in the transaction, acting as the seller, sends the goods or provides the service. After this, this party generates a payment slip, which is sent by mail or delivered in person.

It takes five business days to issue an invoice. An acceptance confirming agreement with the total amount to be paid and the terms of repayment of the debt is recorded in the payment order or sent as a separate notification. Receipt of such a document is official confirmation that all clauses of the contract will be fulfilled on time.

According to Russian legislation, acceptance is complete (it is impossible to accept part of the obligation) and unconditional (unconditional)

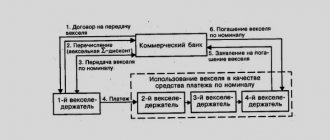

Acceptance of bill

This is the procedure for using bills of exchange. This procedure is characterized by the fact that the recipient of the bill (remitee) or another person holding this bill makes an offer to the payer (drawee) to pay this bill. Since the payer of such a bill is a third party, his written consent is necessary to make the payment. Such consent will become acceptance. The entity authorized to leave on the bill of exchange is the acceptor.

Current legislation limits the period for filing for bill acceptance. The period will be one year from the date of its preparation. When working with a bill of exchange, you can accept not the entire amount specified in it, but only a part. To do this, you also need to make a corresponding entry on it.

An important detail will be the date of acceptance. This condition is necessary if payment must be made within a certain period.

A protest can be applied to the bill. Protest is carried out in two cases:

- Refusal to reflect information about the date on the title of the bill (if there is a payment condition in the existing agreement within a certain period of time, after the date of acceptance).

- Refusal of the subject of payment to accept the bill. The amounts under the bill are withheld from the drawer or the one who endorsed the endorsement.

Endorsement is an inscription on a bill of exchange that transfers and establishes the legal transfer of rights to the bill of exchange to third parties. Such an entry is made on the reverse side of the bill or an additional sheet is attached.

The protest procedure itself when working with a bill of exchange is of great importance. Upon signing and issuance, the very fact of the existing debt is automatically established. Therefore, there is no possibility that it will be necessary to prove the right to collect debt in court.

But a bill that has already been protested must be submitted to court. In this case, no court hearing will be scheduled, the secretariat will automatically initiate enforcement proceedings, and the writ of execution will be handed over to the bailiffs for subsequent collection.

What is the invoice acceptance procedure?

Due to the rapid pace of development of modern financial and banking systems, there is an urgent need for the creation and formation of special confirming mechanisms for monitoring monetary transactions. A similar instrument is acceptance.

The acceptance process is based on obtaining consent from the purchaser of securities to make payment or to undertake obligations for timely payment for such documents.

The acceptance procedure is a process within which the main aspects relating to financial, payment, and other types of securities are considered, together with a decision on their payment. Acceptance is conveyed to the person who transferred the document through an electronic signature, certain inscriptions on the documents themselves and through other means of communication.

Current Russian legislation regulates that acceptance can only be complete and unconditional. This means that within the framework of it there is no possibility of carrying out the procedure for accepting any part of the obligations received, and also that it is unconditional.

The Civil Code of the Russian Federation defines specific deadlines that determine the moment when various kinds of securities and documents acquire the status of accepted.

The use of the acceptance procedure in the banking sector most often has a direct relationship with the reputation of the banking structure within the financial community.

Due to the fact that acceptance is a negotiable short-term document, it, like any other financial instrument, can be assigned or resold to third parties.

In other cases, the parameters are regulated by requirements that are developed within a specific banking institution.

At its core, the acquirer asks the banking structure to receive funds, for which the bank itself generates urgent expenses, which will have a slightly smaller amount of the nominal value of acceptance. The purchaser has the opportunity to purchase products whose cost should not exceed the amount of money specified in the urgent expenditure.

After this, the acquirer will be obliged to return funds to the banking institution in the amount that was specified in the acceptance agreement. At the same time, the banking institution undertakes the obligation to issue an acceptance upon direct application by the bearer.

Banker's acceptance provides many different benefits.

This type of financial leverage does not have risks associated with the fact that the payer will spend all the funds placed in his bank account before the end date specified in the acceptance agreement.

Acceptance of offer

An offer will be an offer from a supplier/seller sent to the buyer with the opportunity to purchase a product or use a service. Almost all advertising offers are considered an offer and any citizen can take advantage of it. Such an offer will be considered public. The offer always contains basic information about the product.

The buyer’s positive decision to take advantage of the offer will be called acceptance. When expressing acceptance, the buyer confirms his interest in purchasing the offered product.

There are several ways to accept an offer:

- Sending a written response-consent to purchase the goods

- Immediate purchase of the offered product

Irrevocable offer - the seller cannot unilaterally change the conditions for the provision of services or the sale of goods.

Free offer - the seller can change the conditions at any time before signing the contract or completing the transaction.

Forms of expression of acceptance

Now it is difficult to imagine that the person concluding an agreement will go out into the middle of the square and solemnly inform those around him of his intention. Over the centuries, the forms of expression of acceptance have changed. Nowadays, acceptance is consent, expressed in writing or in another way. Let's look at how to correctly accept an offer:

- Written acceptance. This is the name given to sending a written notification of acceptance to the opposite party or directly signing the agreement as a document. You were provided with an agreement form - you signed it. It's simple. By the way, the written form implies not only the execution of a single contract form. Written acceptance is considered received if a scan of the document is transmitted via email, fax, telex, or other modern communication channels.

- Public form of acceptance. A new method that allows you to confirm your consent to an offer made to an unlimited number of people. Examples of a public offer are goods in a store, contracts posted on websites, vending machines. When purchasing in an online store, you will accept (agree with the public offer) when you check the special box on the site. This way you confirm your agreement with the terms of sale and the properties of the selected product.

- Actual actions of the person for whom the offer is intended. In some cases, you can express your consent to the terms of the contract at the time of performing certain actions. If you bought a ticket to travel on a bus, you have agreed to the terms and conditions for the carriage of passengers. We filled out the guest card at the hotel - in fact, we accepted the rules of living in it.

- Conclusive actions of a person. This is the behavior of a party that shows its desire to enter into an agreement. An excellent example of such actions is paying a received invoice. Regardless of the conclusion of a paper contract, the person who paid the invoice agrees that the goods or services specified in the invoice will be provided to him.

Sometimes a dispute arises about how to speak correctly - to accept or to accept. The meaning of the word “accept” is similar and means the same thing as “accept”. The common verb is to accept.

Acceptance of the contract

The acceptance of the agreement will be concluded as an addition to the main agreement. At the same time, the specifics of acceptance will directly depend on the agreement. This procedure will be considered approval of all terms of the agreement.

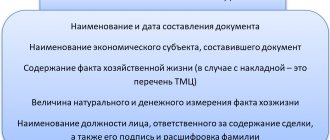

When using acceptance, the agreement must reflect the following details:

- ABOUT

- Visa of the accepting organization

If you disagree with certain clauses of the contract, acceptance cannot be concluded.

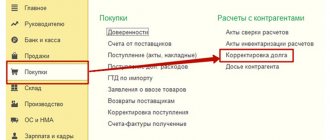

Postings of acceptance

Table 1. Reflection of the transaction in accounting.

| Category | Operation | Dt | CT |

| When purchasing materials | Acceptance of an invoice received from the supplier carrying out the delivery | 10 19.3 | 60 (excl. VAT) 60 (VAT only) |

| Acceptance of an invoice received from a third party organization for the supply of materials providing consulting services | 10 19.3 | 76 (excl. VAT) 76 (VAT only) | |

| Subject to availability and movement of goods | Acceptance of invoices for goods received Acceptance of invoice for delivery of goods | 41 19.3 | 60 (excl. VAT) 60 (VAT only) |

| In case of availability and movement of goods using account 44 | Acceptance of invoices for goods received | 41 19.3 | 60 (excl. VAT) 60 (VAT only) |

| Acceptance of invoice for delivery of goods | 44 19.3 | 60 (excl. VAT) 60 (VAT only) | |

| If there are invoices from suppliers supplying electricity, heat and water for the needs | Main production | 25.2 | 76 |

| Auxiliary production | 23 | 76 | |

| General purpose | 26 | 76 | |

| Acceptance of invoices for communication services | 26 | 76 |

Examples of operations reflected on video:

Accepted bill for electricity, gas, water

Dt 20, 23, 25, 26 Kt 60 – debt accrued to suppliers for work performed and services rendered, incl. provision of energy, gas, steam, water for production needs, experimental work and maintenance.

Dt 60 Kt 50, 51 – the utility bill has been paid.

From the above examples it is clear that in order to reflect an accepted invoice from suppliers of materials and services, it is necessary to reflect in accounting the accrual of debt on a loan and the occurrence of a corresponding asset in debit, the accrual of VAT on purchased values and payment of the invoice.

Can the bank revoke consent?

The situation when a bank can withdraw its consent to acceptance should be considered from the point of view of receiving loan funds.

In banking practice, as a rule, there are no situations when a bank first approves the issuance of credit funds and then withdraws its approval. But there is a right to this. Any credit institution will willingly take advantage of such a right when identifying additional unwanted and compromising data about the prospective borrower.

Taxes and law

To calculate VAT in this case, you need to use the formula - SM / 1.18 * 0.18, where SM is the amount including VAT. DBT 68 KDT 19 – VAT credited (posting 50,400). Dbt 60 Kdt 51 – payment to the delivery person (posting 330 400). Task 2 The delivery person sent materials by rail (through a third party - Russian Railways).

The materials have arrived and been received. The cost of materials is 200,000 rubles. with VAT on top of 18%, railway tariff - 45,000 rubles. Reflect on accounting accounts. DBT 10 KDT 60 – the supplier’s invoice for received materials has been accepted (railway tariff for goods = 245,000). DBT 19 KDT 60 – VAT (36,000). In this problem, VAT is not included in the cost of the material and must be calculated differently.

Related publications

Direct debiting of funds

What does not accepted mean?

In economic and legal practice there is also the concept of “unaccepted invoice”. This concept means that one of the participants in contractual legal relations did not agree to their terms.

In this case, it is necessary to completely rework the contract. Otherwise, such relations will not have legal force, and the transaction itself will never be completed. If the situation continues unfavorably, the invoice, bill or offer is considered invalid.

The concept of acceptance is widely used in both accounting and banking. The considered nuances of the procedure do not cause difficulties in their application. The accounting entries are clear and simple. Working in the banking sector using acceptance significantly speeds up the process of processing payment orders.

Top

Write your question in the form below

The supplier's invoice has been accepted by the bank - what does this mean?

Acceptance represents agreement, acceptance of the terms of any written document.

This could be an invoice, agreement, bill of exchange, etc. In most cases, acceptance is used if the parties to the transaction cannot meet and personally approve its terms. A special document is drawn up indicating that one of the parties fully agrees with all the conditions.

According to regulatory documents approved on the territory of the Russian Federation, acceptance must be:

- Full. It is impossible to accept only part of the terms.

- Unconditional.

The concept under consideration can have the following meanings:

- Consent of one of the participants to make payments according to the agreement, this can be payment by letter of credit.

- Payment of obligations on time (in transactions with a bill of exchange).

- Acceptance of the requirements and obligations of the contract without making changes.

- Voluntary assumption of the risks and obligations of another party.

The interpretation of the term depends on the specific situation.

Acceptance is acceptance of the terms of any written document.

Having a problem? Call our customs specialist:

Moscow and region (call is free)

Saint Petersburg