What are profitable investments?

The legislation determines that profitable investments in material assets should be considered financing the purchase of objects with a long period of use, which are endowed with a tangible form and are transferred to other entities for use in their economic activities for a certain period of time for a fee established by the contract.

These include, for example:

- Building.

- Facilities.

- Equipment.

- Vehicles, etc.

That is, in essence, these are fixed assets (fixed assets). But they have a main distinguishing feature - these assets are used in activities not by the owner himself, but by those who lease these assets. Thus, income-generating investments represent leased assets.

The company must carry out separate accounting of fixed assets and income-generating investments, since they have a different nature of use by the entity.

The rules of law require that objects acquired and transferred by an organization to another entity under a rental or leasing agreement must still be reflected in the accounting and reporting of the direct owner.

In this case, it does not matter for what funds the property was acquired - from own sources or from borrowed capital.

These objects must be registered at their original cost, which is the sum of the actual costs incurred for their purchase or construction.

Attention! However, like fixed assets, these assets should be reflected in reporting at their residual value, that is, the amount of depreciation accrued during their use is subtracted from the original cost. A separate line 1160 is provided in the balance sheet to reflect information about these objects.

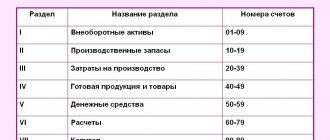

Which accounts are considered off-balance sheet according to accounting rules?

The list of off-balance sheet accounts is given in our table:

| Check | Purpose |

| 001 | Rented OS |

| 002 | Inventory accepted for storage |

| 003 | Materials accepted for recycling |

| 004 | Goods accepted for commission |

| 005 | Equipment accepted for installation |

| 006 | BSO |

| 007 | Written off debt of insolvent debtors |

| 008 | Security for obligations and payments received |

| 009 | Security for obligations and payments issued |

| 010 | OS wear and tear |

| 011 | Leased operating systems |

IMPORTANT! In case of economic necessity, companies can open sub-accounts or additional off-balance sheet accounts, securing them in the working chart of accounts.

A sample of a working chart of accounts can be found in the article “Working chart of accounts for accounting - sample 2015.”

What is taken into account on account 03 of accounting

The current Chart of Accounts provides that income-generating investments must be accounted for separately from fixed assets in a special account 03.

Here you can see the objects that the company receives to generate income from renting them out for temporary use by third parties. These objects have the same cost as an OS and have a useful life of more than one year.

An important characteristic for this kind of objects is also established in the form of the presence of a material form. Thus, intangible assets (intangible assets) cannot be reflected in this account.

Thus, in account 03 it is necessary to take into account the costs of purchasing buildings, structures, equipment, vehicles, inventory, etc.

Attention! In addition, on this account it is necessary to show objects that are transferred to other counterparties under a leasing agreement, in cases where the material value is listed on the lessor’s balance sheet. If, according to the provisions of the concluded agreement, such property is included in the balance sheet of the lessee, then off-balance sheet account 011 is used to reflect such funds.

You might be interested in:

Accounting account 76 - in what case is it used, characteristics, postings

Characteristics of account 03 – “Profitable investments in material assets”

As indicated in the Chart of Accounts, account 03 is active. The debit balance of such an account reflects the presence at the beginning of the period of certain profitable investments in assets. The debit of the account reflects the receipt of objects, and the credit reflects their disposal.

The balance at the end of the period is calculated by adding the balance of profitable investments at the beginning of the period with the turnover on the debit of the account, and subtracting the turnover on the credit of this account from the resulting amount.

Analytics for the account under consideration is built by type of objects of profitable investment in assets, by tenants and lessees, and also by separately accounted assets.

In addition, a sub-account can be created on this account, which can be used to account for the disposal of objects reflected as profitable investments in tangible assets.

The debit of this subaccount must reflect the cost of the retiring material asset, and the credit - the amount of accumulated depreciation for this object. After this, this sub-account is closed, and the result obtained is applied either to other income or to other expenses of the company.

Attention! However, a business entity has the right not to use it, but to determine the financial result from the disposal of such an object directly on account 91. The chosen method must be fixed in the company’s Accounting Policy.

Specifics of profitable investments in real estate

Real estate is a special kind of property. According to the law, it is necessary to register ownership with the issuance of an appropriate certificate.

In this regard, accountants sometimes have a question: in what period of time to transfer the value of an object from account 08 to account 03 - before receiving the certificate, or after that.

There is one more feature associated with real estate objects. The law obliges to calculate and transfer property taxes to the budget. This must be done for the first time on the 1st day of the month, which follows the month of its acceptance for registration in the business entity.

PBU 6/01 establishes the rule that an object begins to be accounted for in account 01 or 03 from the moment it fully meets the criteria of a fixed asset. At the same time, this document does not say a word about the need to wait for official paper from a government agency - a certificate. The Ministry of Finance and the Federal Tax Service adhere to the same position in their letters.

Attention! At the same time, it is recommended that the organization itself does not have any confusion - which object has already received state registration and which has not, and that they be taken into account in different sub-accounts. For example, within the group, open two sub-accounts - “Objects that have passed state registration” and “Objects awaiting state registration”.

Accounting for processing operations at the dealer

The outsourcing of materials or raw materials for further transformation is typical not only for manufacturing enterprises. This system is widely used in construction and trade organizations, in service sector enterprises.

The peculiarity of operations with customer-supplied materials is that the raw materials transferred for processing retain ownership, and the finished products remain with the transferring party.

The function of the processor is to provide the necessary services for the production of the necessary products with the subsequent transfer of the finished product to the customer.

Accounting at the dealer

The main operations reflected in accounting for the acquisition of raw materials for further reproduction.

The transfer of materials is processed only using an invoice for the release of materials from the warehouse. Invoice form M-15, signed by both parties.

Upon completion of the work performed by the contractor, the finished products are transferred from the processor to the supplier according to the acceptance certificate for the work performed. At the same time, the processor reports on the material used.

Business transactions reflected by the supplier after receiving the Acceptance Certificate for completed work

Accounting for customer-supplied raw materials from the supplier in construction

Accounting for customer-supplied raw materials from the customer in trade

Reflection in accounting of goods packaging operations

Postings for this operation are similar to operations for processing customer-supplied raw materials by industrial institutions.

In cases where a trade establishment does not use account 20 “Main production” in accounting, you can open a subaccount in account 41 “Goods”, which will accumulate the costs of manufacturing finished products.

Accounting with the dealer on the general taxation system

Simplified taxation system

Unlike system-wide enterprises, the accounting of toll material from a simplified toller has a number of features.

In other words, all material costs are documented, must be economically justified and aimed exclusively at generating income.

According to Art. 254 of the Tax Code of the Russian Federation, material costs include:

It is prohibited to include remnants of inventory items transferred as full-fledged material to other departments for the manufacture of other goods as returnable waste; associated packaging, which is obtained as a result of the technological process.

Processing of raw materials is considered to be the actual use of raw materials in the production process. Therefore, simplified institutions have the right to include the costs of purchasing and processing materials as expenses.

After receiving from the processor a report on the use of raw materials and an Acceptance Certificate for completed work, enterprises using the simplified taxation system reflect the following transactions in the book of income and expenses:

- The entire amount of services paid to the processor;

- The cost of purchased and paid materials does not include the cost of returnable waste and residues.

If processed products entered further production in the next period after their receipt from the processor, then these products must be written off at zero cost, since these expenses have already been taken into account earlier.

No comments yet!

A raw material processing agreement was concluded between the two enterprises. Moreover, the movement of raw materials and products occurs bypassing the warehouses of the supplier. In other words, purchased raw materials are immediately supplied to the processor directly from the supplier. And the finished products, by order of the seller, are shipped by the processor directly to customers. This scheme is convenient, but it raises a lot of questions for the accountant. What primary documents are needed? And how to reflect the movement of raw materials and products in accounting accounts? Let's figure it out.

Raw materials in transit

Let's start with the procedure for accounting and documenting operations on the movement of raw materials.

REFLECTION IN ACCOUNTING

The buyer and owner of the raw materials is the supplier. Even though the raw materials are supplied directly to the processor, bypassing the warehouses of the supplier. Therefore, it is the seller who must take these materials onto his balance sheet and take them into account in account 10 “Materials”.

Moreover, paragraph 157 of the Methodological Instructions for Accounting for Inventories (approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n) says the following. An enterprise that has transferred its materials to another organization for processing as customer-supplied does not write off the cost of such materials from the balance sheet, but continues to reflect it in the account for the corresponding materials (in a separate sub-account). In practice, for these purposes, the subaccount “Materials transferred for processing to third parties” is used, opened to account 10. In turn, the processor must accept the received materials belonging to the supplier for off-balance sheet accounting (to account 003 “Materials accepted for processing”).

DOCUMENTING

Let us turn to paragraph 51 of the Methodological Instructions. It says that in cases where, in the interests of production, it is advisable to send materials directly to a division of the organization, bypassing the warehouse, such batches are reflected in accounting as received at the warehouse and transferred to the division of the organization. At the same time, a note is made in the incoming and outgoing documents of the warehouse and the incoming documents of the organization’s division that the materials were received from the supplier and issued to the division without delivering them to the warehouse (in transit). In this case, the list of materials that can be imported in transit directly to the organization’s divisions must be drawn up in an administrative document for the organization.

According to the author, in the situation under consideration, one must be guided by the same instructions, but taking into account the specifics. So, in order to correctly reflect the movement of materials, the seller needs to have the following primary documents: - receipt order form No. M-4 in order to accept these materials on his balance sheet in the debit of account 10 subaccount “Raw materials and materials (in transit)”; – invoice for the release of materials on the side of form No. M-15. It does about. This reflects the fact that the materials are actually held by the recycler. Based on this, the company can debit them to account 10, subaccount “Materials transferred for processing to third parties.”

EXAMPLE 1 In May 2010, a raw material processing agreement was concluded between Astra CJSC (seller) and Margaritka LLC (processor). And in accordance with the terms of the contract for the supply of raw materials concluded by Astra CJSC with the supplier Khrizantema OJSC, the raw materials are supplied to Margaritka LLC (to the processor) directly from the supplier.

How to evaluate profitable investments

When assessing income-generating investments, the same rules are used as for fixed assets.

You might be interested in:

Account 28 in accounting: how defects in production are taken into account, characteristics of the account, postings

Initially, the value of such an asset is collected from its direct value, reduced by the amount of taxes, as well as all related expenses.

The latter may include:

- Transportation costs;

- Costs of engaging third-party specialists (for example, appraisers);

- Travel and fuel expenses, if they were associated with the acquisition of this object;

- Mandatory deductions, customs payments and state duties;

- Cost of materials used;

- etc.

Thus, all costs associated with the purchased object are collected in account 08. This is done until it is ready to be rented out or leased to generate income. After completion of all necessary work, the accumulated costs for the facility are transferred in one amount to account 03.

Attention! The state duty, if it was paid before the cost was transferred to account 03, can also be included in the costs of the object. Otherwise, it should be taken into account in account 91.

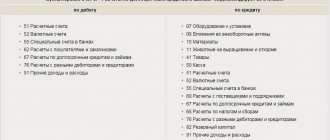

Which accounts does account 03 correspond to?

From the debit of account 03, postings can be made to the following accounts:

- 08—acceptance of acquired property for accounting as an income-generating investment;

- 76 - the value of the property for rent is being clarified due to a previously made mistake;

- 80 - property for rent was received from the participant as a contribution to the authorized capital.

On the credit of account 03, debit correspondence entries can be made with the following accounts:

- — transfer of property from the category of profitable investments to fixed assets;

- — write-off of depreciation of a retiring income investment;

- 76 - compensation for part of the cost of a profitable investment through insurance due to its damage;

- 80 - property was transferred to the founders upon their withdrawal from the company;

- 91 - the value of property is written off upon disposal or sale;

- 94 - the shortage of income-generating property is reflected;

- 99 - write-off of the value of an income-generating investment as a result of its loss due to an emergency.

Postings to account 20.02 “Production of products from customer-supplied raw materials”

When registering customer-supplied raw materials, you should select an agreement with the type “With the buyer”.

When drawing up the document “Sales of processing services”, in the “Price” field you need to indicate the price of the services set by the processor, and in the “Planned price” field - the planned cost of the service.

Example of filling out document 1C 8.3 “Sales of processing services”:

Example of postings for raw materials supplied by a processor:

Accounting entries for account 03

The postings that are made with account 03 are in many ways similar to those made for fixed assets.

| Debit | Credit | Operation description |

| Acquisition of property | ||

| Property purchased for further rental | ||

| 19 | 60 | VAT is deducted from the sales amount |

| 68 | 19 | VAT credited |

| 03/1 | 08 | The acquired property is accounted for as an income-generating investment. |

| Renting, leasing | ||

| 03/2 | 03/1 | Transfer of property for rent or leasing |

| 02 | Depreciation has been calculated | |

| 03/1 | 03/2 | Return of property previously leased, leasing |

| Disposal of property | ||

| 03/Disposal | 03/1 | The value of the property is written off |

| 02 | 03/Disposal | Accrued depreciation on retiring assets was written off |

| 91 | Property sold | |

| 91 | 68 | VAT accrued on the sale of property |

| 91 | 03/Disposal | Residual value written off as expenses |

Account 03 - what is it for?

Account 03 is called “Profitable investments in material assets.”

On it, accountants keep records of inflows and outflows of such assets. An important condition is the material form. Intangible assets cannot be taken into account in account 03. Do not confuse count 03 with count 01. They are similar, but are intended for different purposes. Account 01 records fixed assets that the company purchased to use for the production of goods, performance of work, provision of services or management of these processes. An additional purpose for the purchase may be rental or leasing.

On account 03, you can only take into account those objects on which the business will earn money by renting or leasing to other companies. If the object is used in the production process, it is sent to account 01. The accountant, together with management, decides on which account to record the fixed asset.

Example . A large supplier of medical equipment, MedSi LLC, purchased a building in the city center and medical equipment for a dental office. He will rent out his property to a group of dentists for a monthly fee, and they will work in his building and on his equipment. Such an investment by MedSi LLC will be reflected in account 03.