Simplified tax system for individual entrepreneurs and legal entities: conditions of application in 2019

To be able to apply the simplified tax system, entrepreneurs must meet the following requirements:

- there should be no more than 100 employees;

- income should not exceed 150 million rubles;

- the residual value should also not exceed the limit of 150 million rubles.

Additional conditions have been established for organizations:

- according to Art. 346.12 of the Tax Code of the Russian Federation, based on the results of nine months of the year in which the organization submits a notice of transition to the simplified tax system, its income does not exceed 112.5 million rubles;

- the share of participation of other organizations does not exceed 25%;

- organizations that have branches cannot apply the simplified tax system.

The use of the simplified tax system relieves individual entrepreneurs from paying personal income tax, personal property tax, and VAT (with the exception of VAT paid when importing goods at customs, as well as when executing a simple partnership agreement or a property trust management agreement).

For organizations, the use of the simplified tax system replaces the corporate income tax (with the exception of the tax paid on income from dividends and certain types of debt obligations), corporate property tax, and VAT.

Tax rates for the simplified tax system depend on the object of taxation. If the object of taxation is “income,” the rate is 6% (tax is paid on the amount of income). The object of taxation “income minus expenses” assumes a rate of 15% (income reduced by the amount of expenses is taken into account).

Please note that in 2021, tax holidays continue to apply for individual entrepreneurs.

The simplified tax system does not exempt from the calculation, withholding and transfer of personal income tax from employees’ wages.

Main changes to the simplified tax system in 2021

The main change that simplifiers can expect is the abolition of the simplified tax system tax return. This norm will affect those taxpayers who apply this special regime and meet the following requirements:

- the object of taxation is “income”;

- The receipt of funds is recorded through the online cash register.

Thus, the receipt of funds occurs under the control of the tax office. In this case, the tax authority will have access to all income of the company or individual entrepreneur. In the event that these taxpayers also continue to file returns using the simplified tax system, it will turn out that they are duplicating the data already sent.

Important! Those taxpayers who pay the simplified tax system on income minus expenses will have to continue reporting to the tax office as before.

Organizations and individual entrepreneurs using the simplified tax system have lost the right to reduced tariffs

Some “simplified” people, until recently, had the right to pay insurance premiums at a reduced rate - in the amount of 20% (in the Pension Fund of the Russian Federation - 20%, in the Federal Social Insurance Fund of Russia - 0%, in the Federal Compulsory Medical Insurance Fund - 0%). But the benefit applied only to those operating in the production and social spheres. Moreover, the share of income from this type of activity should have been at least 70% of the total amount of income, determined according to the rules of Art. 346.15 Tax Code of the Russian Federation. And income for the current year should not exceed 79 million rubles.

From January 1, 2021, the benefit for reduced tariffs will be transferred to a general basis, that is, the contribution rate for them increases to 30%.

Changes to the simplified tax system 2021: memo

All innovations are in the table. Use it at work to avoid problems and sanctions from regulatory authorities.

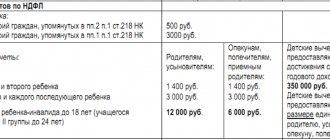

| Brief summary of the innovation | Until 12/31/2018 | From 01/01/2019 |

| Labor Relations | ||

| Increase in minimum wage | The minimum wage from May 1 is 11,163 rubles. | The minimum wage from January 1, 2021 is RUB 11,280. |

| Tax obligations | ||

| The right to reduced tariffs is canceled | Simplified residents who carried out certain types of business activities could pay contributions at a reduced rate of 20% instead of 30% | From January 1, this benefit is canceled, the contribution rate increases to 30% - according to general principles |

| Increase in taxes for individual entrepreneurs, which businessmen pay for themselves | In 2021, fixed payments are: to the Pension Fund of Russia - 26,545 rubles, FFOMS –— 5,840 rub. If income exceeds 300 thousand rubles, the merchant pays insurance premiums in the amount of 1% of the excess amount. | From January 1, 2021, individual entrepreneurs’ contributions for themselves will increase - they will be: to the Pension Fund of the Russian Federation 29,354 rubles, in the Federal Compulsory Medical Insurance Fund - 6,884 rubles (Article 430 of the Tax Code of the Russian Federation). There will also be a 1% payment on income. |

| Cancellation of movable property tax | There is a tax on movable property | The tax on movable property has been completely abolished, and mention of this tax is completely excluded from the Tax Code of the Russian Federation |

| OPS insurance rate | The rate is 22% until 2021, from 2021 - 26% | The Duma adopted a law that fixed the contribution rate for all years at 22% |

| Increase in VAT on certain categories of transactions | VAT rate - 18% | VAT rate - 20% |

| Increasing the contribution limit | In the Pension Fund of Russia - 1,021,000 rubles. In the Social Insurance Fund - 815,000 rubles. In FFMOS - no restrictions | OPS - RUB 1,115,000. VNiM - 865,000 rub. |

| Online cash registers | ||

| Product code in the receipt | No, there are no special conditions | A new item “product code” will appear in the online receipt. The code will need to be printed on the receipt if the company sells goods that are marked, for example, fur products and medicines |

| Using online cash registers | There are a number of payers who are exempt from using online cash registers until 2021. | From July 1, 2021, these payers must use online cash registers |

| Reporting | ||

| Declaration according to the simplified tax system | The declaration is submitted by all payers of the simplified tax system - organizations and LLCs | From January 1, those who use the income object will not submit a declaration under the simplified tax system, subject to the use of online cash registers |

| Balance deposit | The balance must be submitted to the Federal Tax Service and Rosstat | Only at the Federal Tax Service |

| Blocking of accounts if the company fails to submit payment payments on time | Inspectors do not have this right | Tax officials received the right to block employers’ accounts for failure to submit the ERSV. Being 10 days late will result in immediate blocking. The State Duma adopted such a law in the third reading. |

| New ERSV form | Firms and individual entrepreneurs fill out the ERSV using the current form, which was approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/ [email protected] | They plan to change sections 1 and 3 in the calculation of contributions, but the Federal Tax Service has not yet developed a new form |

Insurance premiums for individual entrepreneurs on the simplified tax system

In 2021, entrepreneurs will have to pay more insurance premiums, as their size has increased.

According to paragraph 1 of Art. 430 of the Tax Code, the amount of insurance contributions for compulsory pension insurance is now 29,354 rubles, if the income of an individual entrepreneur does not exceed 300,000 rubles.

If the income of an individual entrepreneur is more than 300,000 rubles, then the fixed amount of insurance premiums is calculated as follows: 29,354 rubles. + 1% of the amount of income exceeding RUB 300,000.

Insurance premiums for compulsory medical insurance in a fixed amount in 2021 will amount to 6,884 rubles.

How to calculate tax according to the simplified tax system for individual entrepreneurs on the simplified tax system of 6% without employees in 2021?

Good afternoon, dear individual entrepreneurs!

Every year, a lot of questions arise on the topic of tax deduction of insurance premiums of individual entrepreneurs from the tax under the simplified tax system for individual entrepreneurs on the simplified tax system of 6% (“income”) without employees.

The comments constantly ask questions about how to correctly calculate tax according to the simplified tax system, how to correctly make a tax deduction, and so on and so on... The flow of questions does not stop =)

In this article we will look at several examples and calculate on a calculator so that all this is clear. And, I hope, I will immediately answer most of your questions.

To begin with, I would like to note that it is better to make mandatory contributions to compulsory pension and health insurance quarterly. Yes, I know that these fees can be paid at once, for the whole year (they often do this). But the vast majority of individual entrepreneurs prefer to make these payments quarterly in order to evenly distribute the burden of individual entrepreneur payments throughout the year.

The vast majority of programs for individual entrepreneurs on the simplified tax system offer to pay insurance premiums “for yourself” quarterly. Also, if you have an individual entrepreneur’s bank account, I also strongly recommend paying contributions “for yourself” quarterly, and only from the individual entrepreneur’s bank account.

You can read about how much and when you need to pay contributions for compulsory insurance “for yourself” in 2021 in this article:

https://dmitry-robionek.ru/calendar/pro-obyazatelnyye-vznosy-ip-2019.html

I remind you that you can subscribe to my video channel on Youtube using this link:

https://www.youtube.com/c/DmitryRobionek

Before moving on to specific examples, I will make a small clarification. In order not to write a long wording every time “mandatory contributions to pension and health insurance of individual entrepreneurs,” I will write “mandatory contributions” or simply “contributions for myself.” But what is meant is the mandatory contributions of individual entrepreneurs for pension and health insurance “for themselves.”

So, let’s consider a specific example for an individual entrepreneur on the simplified tax system of 6% without employees

For example, an individual entrepreneur has a simplified taxation system (USN) of 6% and he works WITHOUT employees. It is important that without employees, since for individual entrepreneurs with employees the algorithm for tax deductions is different.

The individual entrepreneur has been operating for the first year, he has no reporting debts, taxes or contributions for previous years. The individual entrepreneur paid mandatory insurance premiums “for himself” for the first quarter of 2021 BEFORE March 31, 2019.

This is important, because if you pay these contributions AFTER March 31, 2019, then the advance payment under the simplified tax system for the first quarter of 2021 CANNOT be reduced.

But below, in the examples, the situation for those who were late is considered... Read and consider carefully.

Let the income of our individual entrepreneur from the example for the first quarter of 2021 amount to 400,000 rubles. But first, let me remind you that mandatory contributions to pension and health insurance “for yourself” for individual entrepreneurs for the full year 2021 are the following amounts:

- Contributions to the Pension Fund “for yourself” (for pension insurance): RUB 29,354.

- Contributions to the FFOMS “for yourself” (for health insurance): RUB 6,884.

- Total for 2021 = 36,238 rubles.

- Also, don’t forget about 1% of the amount exceeding 300,000 rubles of annual income (but I’ll tell you about this a little later)

If you make these mandatory contributions quarterly, then the numbers given above must be divided into four quarters:

- Contributions to the Pension Fund: 29354: 4 = 7338.5 rubles.

- Contributions to the FFOMS: 6884: 4 = 1721 rubles.

- Total for the quarter: 9059.5 rubles.

So let's go back to our example

The individual entrepreneur received income of 400,000 rubles for the first quarter. And by March 31, 2021, he paid mandatory contributions for the first quarter of 2021 in the amount of:

- Contributions to the Pension Fund: 29354: 4 = 7338.5 rubles.

- Contributions to the FFOMS: 6884: 4 = 1721 rubles.

- Total for the quarter: 9059.5 rubles.

What will be the advance payment under the simplified tax system for the first quarter of 2019?

We calculate the advance according to the simplified tax system: 400,000 * 6% = 24,000 rubles

From these 24,000, our individual entrepreneur has the right to make a tax deduction for the amount of paid mandatory contributions to pension and health insurance for the first quarter:

24,000 – 7338.5 – 1721 = 14,940 rubles. 50 kopecks. That is, we have made a so-called tax deduction from the advance payment under the simplified tax system and with a clear conscience we are reducing its size.

But please note that this scheme only applies if contributions to compulsory pension and health insurance were made strictly BEFORE March 31 of the current year. Of course, this rule also applies for the following quarters, only the deadlines for paying mandatory contributions will be different (see below).

What happens if I pay mandatory contributions to pension and health insurance after March 31?

You will NOT be able to make a tax deduction from the advance payment under the simplified tax system for the first quarter. That’s why I’m writing that the contribution must be made in advance, BEFORE the end of the quarter. But this does not mean that this amount, as they say, will “burn out.” Read on and you will understand how to count correctly.

Where and how should I pay?

You can pay from an individual entrepreneur’s account or in cash using a receipt at Sberbank. The receipts and payment orders themselves can be generated in an accounting program (for example, in 1C or in popular online accounting for individual entrepreneurs). Therefore, I will not dwell on this issue in detail, since everyone keeps records in different programs and services.

Just remember that starting from January 1, 2021, these contributions must be paid not to the Pension Fund and the Federal Compulsory Medical Insurance Fund, as was the case in past years, but to the Federal Tax Service. Thus, under no circumstances use details from old payments and receipts for previous years. And in general, do not use old templates when paying taxes and contributions, as the KBK and the details of the Federal Tax Service may change...

And one more important point:

Please note that if you have an individual entrepreneur account with a bank, it is strongly recommended that you pay contributions (and taxes) only from it. The fact is that banks, starting in 2021, control this moment too. And if you have a bank account for an individual entrepreneur, then be sure to pay all taxes and contributions only from the individual entrepreneur’s account, and not in cash.

What if mandatory contributions are greater than the quarterly advance payment under the simplified tax system?

Indeed, such situations often occur. For example, the advance payment under the simplified tax system for the first quarter amounted to 1,000 rubles, and the amount of mandatory contributions amounted to 9,059.5 rubles.

Since the advance payment under the simplified tax system for the first quarter is less than the contributions, you don’t have to pay anything. According to the simplified tax system, of course.

1000 – 9059.5 = –8059.5 (The value is negative, we do not pay an advance according to the simplified tax system).

And what? Will these 8059.5 rubles “burn out”?

No, they won't burn. They will carry over to the next quarter for deduction. You need to understand what we consider the cumulative total for 3, 6, 9 and 12 months.

For example, how will we calculate the deduction in the second quarter if the situation arises that in the first quarter mandatory contributions were more than the advance payment under the simplified tax system.

quarter 2021

- Income 16,660 rubles;

- The individual entrepreneur paid mandatory contributions in the amount of 9059.5 rubles for the first quarter;

- 16660*6% =999.6 rubles, which is less than 9059.5 rubles. This means that our individual entrepreneur does not pay the advance according to the simplified tax system.

quarter 2021

- Income 300,000 rubles;

- Individual entrepreneurs paid mandatory contributions in the amount of 9059.5 rubles for the second quarter;

- (16660+300,000)*6% =18,999.6 rubles; (we sum up the income from individual entrepreneurs for two quarters and calculate 6% of this amount)

- Let's sum up the mandatory contributions for the first and second quarters: 9059.5 + 9059.5 = 18119 rubles.

- We make a deduction: 18,999.6 - 18,119 = 880.6 rubles. you need to pay an advance according to the simplified tax system based on the results of the first half of 2021.

I hope I didn't confuse you =)

In general, I recommend that you do not calculate all this manually, but buy a good accounting program for individual entrepreneurs. Now there are a lot of solutions for such problems. Both programs for a regular computer and online services. All this is calculated automatically in the programs. Personally, I use the 1C program. Entrepreneur”, which fully meets my requirements.

Let's consider another example for an individual entrepreneur on the simplified tax system of 6% without employees

First quarter of 2021

- The entrepreneur received an income of 60,000 rubles in the first quarter.

- I did NOT make contributions to compulsory insurance “for myself.”

- But I paid an advance payment under the simplified tax system of 60,000 * 6% = 3,600 rubles.

Second quarter 2021

- Income 400,000 rubles

- I paid mandatory contributions “for myself” immediately for the first and second quarters of 2021 in the amount of 18,119 rubles (must be paid strictly before June 30!)

How to calculate an advance payment under the simplified tax system for the first half of 2021?

We count:

- Let’s sum up all income for the six months: 60,000 + 400,000 = 460,000

- We calculate 6% of this amount: 460,000 * 6% = 27,600

- From this number we subtract the mandatory contributions that the individual entrepreneur paid for six months. And we subtract the advance payment according to the simplified tax system, which the entrepreneur paid in the first quarter:

27,600 - 18,119 - 3,600 = 5,881 rubles. you need to pay based on the results of the first two quarters (more precisely, for six months)

We calculate similarly for 9 months of 2021. I think that the scheme is clear, and you will need it to control accounting programs that calculate all this automatically.

But, of course, you need to understand what algorithm is used to make the calculations.

And one more example.

Let's calculate the advance payment under the simplified tax system for 9 months of 2021

In order not to complicate the calculations, let's continue the example discussed above:

First quarter of 2021

- The entrepreneur had an income of 60,000 rubles in the first quarter.

- I did NOT make contributions to compulsory insurance “for myself.”

- But I paid an advance payment under the simplified tax system of 60,000 * 6% = 3,600 rubles.

Second quarter 2021

- Income 400,000 rubles

- I paid mandatory contributions “for myself” immediately for the first and second quarters of 2021 in the amount of 18,119 rubles (must be paid strictly before June 30!)

- I paid an advance payment under the simplified tax system in the amount of 5881 rubles. (we just calculated this value when we calculated the advance payment under the simplified tax system for the half-year)

Third quarter 2021

- Income 200,000 rubles

- Paid mandatory contributions “for myself” for the third quarter in the amount of 9059.5 rubles. That is, for 9 months our individual entrepreneur paid a total of 9059.5 * 3 = 27178.5 rubles for compulsory pension and health insurance.

How to calculate an advance payment under the simplified tax system for 9 months of 2021? The same as how they counted for half a year.

- Let's sum up all income for 9 months: 60,000 + 400,000 + 200,000 = 660,000

- We calculate 6% of this amount: 660,000 * 6% = 39,600 rubles.

- From this number we subtract the mandatory contributions that the individual entrepreneur paid for 9 months. And we subtract the advance payments under the simplified tax system that the individual entrepreneur made for six months:

39,600 – 27178.5 – 3600-5881 = 2940.5 rubles will need to be paid in advance under the simplified tax system for 9 months.

Please note that we counted everything strictly, down to the penny. I did this on purpose so as not to completely confuse newbie entrepreneurs with rounding to whole rubles =) But accounting programs calculate tax amounts according to the simplified tax system, rounding to whole rubles, according to the rules of arithmetic. So, don’t be surprised when the accounting program rounds the total amount to whole rubles.

I understand that calculating all this is quite tedious, even for an experienced accountant or individual entrepreneur. Therefore, I made a special calculator for individual entrepreneurs using the simplified tax system “Income” without employees.

Carefully read the instructions for its use and try it: Watch the video, but just keep in mind that the video instructions show the amounts for mandatory payments in 2018. But the calculation algorithm remains the same.

I also draw your attention to the fact that this calculator will not replace the accounting programs and services that I constantly encourage you to use. This is more of a simulator for beginners. In order to understand how tax is calculated according to the simplified tax system and to understand the algorithms by which this tax is calculated in programs.

What about the 1% that must be paid for revenues of more than 300 thousand?

Indeed, an individual entrepreneur is required to pay 1% of the amount exceeding 300,000 rubles per year for pension insurance. Personally, I prefer to make this payment at the end of the year following the reporting year. And I will do it from January 1 to April 30, 2021.

It can also be deducted from the tax according to the simplified tax system, but only for the year in which 1% of the amount was paid, over 300,000 rubles per year. For example, I will pay 1% in 2021. This means that I will be able to reduce the tax under the simplified tax system only for 2021, since the payment will occur in 2020.

I remind you that you can subscribe to my video channel on Youtube using this link:

https://www.youtube.com/c/DmitryRobionek

If you pay 1% during 2021, you can reduce advance payments under the simplified tax system for 2021. Of course, if you exceed the annual income of 300,000 rubles in 2021. If you use accounting programs, they automatically calculate all this. Please note that 1% of the amount exceeding 300,000 rubles of the annual income of an individual entrepreneur must be paid before July 1, 2021.

And when do you need to pay tax according to the simplified tax system for the 4th quarter (more precisely, “at the end of the year”)?

Indeed, if everything is clear and understandable in the first three quarters regarding the timing of advance payments under the simplified tax system:

- for the 1st quarter of 2021: from April 1 to April 25;

- for 6 months of 2021: from July 1 to July 25;

- for 9 months of 2021: from October 1 to October 25;

When should I pay tax according to the simplified tax system at the end of the year?

I answer: it must be paid no later than April 30, 2021, when you prepare a declaration under the simplified tax system. Once again, everything is considered a cumulative total. Here we will already calculate based on the results of the year.

When do you need to pay quarterly contributions for compulsory pension and health insurance?

- for the 1st quarter of 2021: from January 1 to March 31;

- for the 2nd quarter of 2021: from April 1 to June 30;

- for the 3rd quarter of 2021: from July 1 to September 30;

- for the 4th quarter of 2021: from October 1 to December 31.

Important:

Don't wait until the last day to pay your taxes and fees. Taking into account all kinds of holidays and weekends, the money may simply get stuck in the bank and not reach its destination on time.

For example, you made a payment for insurance premiums on the evening of March 31, and the money was “stuck” somewhere in the bank for some unknown reason for several days. A technical glitch occurred and the payment was sent, for example, on April 1st. Accordingly, you will no longer be able to make a tax deduction from the tax under the simplified tax system for the first quarter. Therefore, it is better to pay all taxes and fees at least a week before the deadline.

A little advice:

In fact, all this is automatically calculated in accounting programs. They already have built-in calendars that will notify you about upcoming tax events and generate receipts for paying taxes and contributions. Form a declaration and KUDIR.... And so on and so forth.

Your task will be to accurately enter cash flow transactions into such programs. And the program itself will generate reports based on these operations.

Therefore, you MUST buy an accounting program for individual entrepreneurs and do not bother yourself with unnecessary information :) But nevertheless, you must understand how taxes and contributions are calculated.

And be able to check the correctness of their calculations. In fact, that is precisely why this short article arose.

Best regards, Dmitry Robionek

Dear entrepreneurs!

A new e-book on taxes and insurance contributions for individual entrepreneurs on the simplified tax system of 6% without employees is ready for 2021:

“What taxes and insurance premiums does an individual entrepreneur pay under the simplified tax system of 6% without employees in 2021?”

The book covers:

- Questions about how, how much and when to pay taxes and insurance premiums in 2021?

- Examples for calculating taxes and insurance premiums “for yourself”

- A calendar of payments for taxes and insurance premiums is provided

- Frequent mistakes and answers to many other questions!

Find out the details!

Dear readers, a new e-book for individual entrepreneurs is ready for 2021:

“Individual Entrepreneurs on the simplified tax system 6% WITHOUT Income and Employees: What Taxes and Insurance Contributions must be paid in 2021?”

This is an e-book for individual entrepreneurs on the simplified tax system of 6% without employees who have NO income in 2021. Written based on numerous questions from individual entrepreneurs who have zero income and do not know how, where and how much to pay taxes and insurance premiums.

Find out the details!

Dear readers!

A detailed step-by-step guide to opening an individual entrepreneur in 2021 is ready. This e-book is intended primarily for beginners who want to open an individual entrepreneur and work for themselves.

This is what it's called:

“How to open an individual entrepreneur in 2021? Step-by-Step Instructions for Beginners"

From this manual you will learn:

- How to properly prepare documents for opening an individual entrepreneur?

- Selecting OKVED codes for individual entrepreneurs

- Choosing a tax system for individual entrepreneurs (brief overview)

- I will answer many related questions

- Which supervisory authorities need to be notified after opening an individual entrepreneur?

- All examples are for 2021

- And much more!

Find out the details!

Receive the most important news for individual entrepreneurs by email!

Stay up to date with changes!

By clicking on the “Subscribe!” button, you consent to the newsletter, the processing of your personal data and agree to the privacy policy.

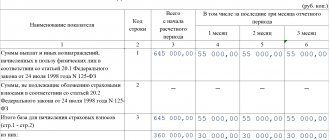

Limits on insurance premiums

The maximum value of the base for calculating insurance contributions for compulsory pension insurance (MPI) and compulsory insurance in case of temporary disability and in connection with maternity will change in 2021. According to paragraphs. 3, 6 tbsp. 421 of the Tax Code of the Russian Federation, it is established annually by the Government of the Russian Federation.

The amount of the base for calculating insurance premiums in case of temporary disability and in connection with maternity is set at RUB 865,000. (Resolution of the Government of the Russian Federation dated November 28, 2018 No. 1426).

The maximum base for calculating insurance premiums for compulsory health insurance is determined for 2021 in the amount of 1,150,000 rubles.

USN: revenue restrictions

In addition to the conditions given above, future “simplified” companies need to monitor the amount of their revenue. The income limits established by the Tax Code of the Russian Federation must be observed not only for the transition to the simplified tax system, but also in the process of working in this mode. Let's take a closer look at them.

Simplified tax system 2021: limit for switching to a special regime

In order to switch to the simplified tax system from the beginning of next year, the company’s income for the first nine months of the current year must “fit” into the established limit - this maximum revenue for the simplified tax system in 2018 is 112.5 million rubles. (Clause 2 of Article 346.12 of the Tax Code of the Russian Federation). This restriction does not apply to individual entrepreneurs.

Until 2021, the “transitional” limit was indexed annually (by a deflator coefficient), but for the period 2017-2019. indexation has been suspended, so the limit will remain so in the future 2019 (law of 07/03/2016 No. 243-FZ). When calculating the amount of “transitional” revenue, the income received should be taken into account according to the rules established by Art. 248 Tax Code of the Russian Federation.

Maximum income under the simplified tax system for 2021

Those who already work under the simplified tax system must comply with one more restriction - the maximum allowable income under the simplified tax system. In 2021 it is 150 million rubles. This limit will be the same for those who will work on simplified wages in 2021.

The amount of income received during the year on the simplified tax system is determined according to the rules of Art. 346.15 et pt. 1, 3 p. 1 art. 346.25 Tax Code of the Russian Federation. In relation to this limit, the deflator coefficient is also not applied in 2017-2019.

If the specified maximum income under the simplified tax system for 2021 is exceeded, the right to apply the special regime is lost. Starting from the quarter in which the income limit was exceeded (as well as if any of the above criteria were violated), such taxpayers will have to switch to OSNO, paying additional taxes.

Online cash registers for the simplified tax system

From July 1, 2021, legal entities and individual entrepreneurs using the simplified tax system, providing services to the public and issuing BSO, will have to switch to online cash registers.

Previously, this had to be done by “simplified” employees providing catering services.

Questions and expert answers on online cash registers for the simplified tax system.

Haven't switched to online checkouts yet? Connect to Kontur.OFD now and transfer data to the Federal Tax Service for free for 3 months.

Find out more

What awaits us in 2021

The draft Law “On Amendments to Ch. 262 part 2 of the Tax Code of the Russian Federation (regarding the implementation of certain provisions of the national project “Small and Medium Enterprises and Support for Individual Entrepreneurial Initiatives”)”, in accordance with which changes are planned in the limits and rates under the simplified tax system.

If this bill becomes a full-fledged law, then everyone who meets the new criteria will be able to use the simplified system: income no more than 200 million rubles, average number of employees no more than 130 people. But tax rates will rise and will depend on income and number of employees.

Organizations and individual entrepreneurs on a simplified basis with an “income” base that exceeded the income limit of 150 million rubles. no more than 50 million rubles. or an average number of no more than 30 people, must apply a rate of 8%.

Moreover, you need to switch to it from the quarter in which the excess occurred. The same tax rate will apply in the next tax period. But if, at the end of this year, income does not exceed the “old” limits on number and income, then it becomes possible to reapply the 6% rate.

Simplified workers with the “income minus expenses” base will be required to apply a rate of 20% if the limits are exceeded, and if they return to previous volumes, they will be able to again use a rate of 15%.

When this project comes into force, I see more positive consequences than negative ones, since many entrepreneurs will no longer have the fear of exceeding limits and transferring to the main taxation system.

I also think that entrepreneurs will no longer need to hide part of their staff and “get” cash to pay wages.

It will become a little easier to work and you will be able to concentrate directly on running your business, which should lead to increased profits.

Conclusion

These are the most relevant and significant changes that influence and will continue to influence the fate of simplifiers in our country.

However, our government still has time until the new year 2020 to please or disappoint businessmen with innovations and changes to tax legislation.

| Baranova Yulia, lawyer and senior tax consultant legal (Moscow) |

Back

Forward

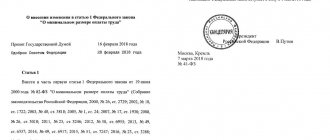

Certificate 2-NDFL is submitted in a machine-oriented form

Order of the Federal Tax Service of the Russian Federation dated October 2, 2018 No. ММВ-7-11/ [email protected] approved two forms of certificate. One is intended for employers submitting tax reports on paper (form 2-NDFL) and has a machine-oriented form. And the other is a certificate of income and tax amounts of an individual (issued to individuals upon application for presentation at the place of request).

Machine-oriented form 2-NDFL includes:

- main sheet (it reflects the amounts of income and personal income tax);

- application (it contains information about income and corresponding deductions, broken down by month of the tax period, indicating codes for types of income and codes for types of deductions).

Thanks to the machine-oriented form, tax authorities can now automate the process of scanning, recognizing and digitizing 2-NDFL certificates received on paper.

The Federal Tax Service warned that changing the 2-NDFL form will have virtually no effect on the employer, since XML files are generated using a special program.

Certificates using the new form will be submitted starting with reporting for 2021.

Reasons and timing of changes

Providing declarations and reporting has always entailed additional costs on the part of entrepreneurs; therefore, it was decided to develop and simplify ways of providing financial information. Along with this, individual entrepreneurs were required to introduce online cash registers.

These innovations will come into force on 01/01/2019. At the same time, entrepreneurs will be able to provide reports for the current year without submitting a declaration only if they use cash register equipment. This will greatly simplify the system for providing information on income.

Insurance of accounts and deposits of small businesses

According to Federal Law No. 322-FZ dated August 3, 2018, from January 1, 2019, the system of insurance of deposits and accounts of individuals in Russian banks extended to micro-enterprises and small businesses. The right to receive an insurance payment in the event of revocation of a bank's license arises if, on the day the insured event occurs, information about the enterprise is contained in the Unified Register of Small and Medium-Sized Enterprises.

Learn more about how to get a refund on your deposits.

Utility payments: conditions for exempting intermediaries from tax

From January 1, 2021, subparagraph 4 of paragraph 1.1 of Art. 345 Tax Code of the Russian Federation. It exempts intermediaries who accept utility payments from property owners (owners) from paying a single “simplified” tax on the amounts received. Such intermediaries include real estate owners' associations (RTN), homeowners' associations (HOAs), management companies (MCs), housing and other specialized consumer cooperatives. To be exempt from tax, two conditions will need to be met simultaneously. First, TSN, HOA, management company or cooperative has a resource supply agreement (provision of services for the management of municipal solid waste) with a specialized organization. And secondly, TSN, HOA, management company or cooperative directly provides the relevant public services to the owners (owners) of real estate. As we can see, the new norm assumes that the intermediary does not simply organize the provision of services by a specialized company. To obtain the right to exemption from tax on payments received, he must, on his own behalf and for an appropriate fee, accept garbage from the owners (owners) of real estate, or transfer energy resources to them, having previously purchased these services from a specialized organization.

Legally, this approach is absolutely correct. Let us explain why. In a situation where the owners (owners) of real estate receive services directly from a specialized company, and the role of TSN, HOA, management company or cooperative is reduced only to organizational issues (drawing up contracts, collecting money, etc.), it cannot be said at all that the incoming amounts are the proceeds from the sale of services of the TSN, HOA, management company or cooperative. This means that in this case there is no need to apply the provision of subparagraph 4, paragraph 1.1 of Article 346.15 of the Tax Code of the Russian Federation. However, the version of this rule valid until 2021 assumes that in such a situation the intermediary receives revenue, but does not need to include it in income. The new edition of this norm lawfully classifies as revenue only those payments that were received for the direct provision of utility services.

However, in practice, such a legally correct clarification may result in additional difficulties for these organizations. This will happen if the Federal Tax Service requires proof that it is the TSN, HOA, management company or cooperative that provides utility services. And in the absence of such evidence, it will include the received amounts of utility payments in income.

Check the counterparty for signs of a shell company, bankruptcy and the presence of disqualified persons

True, legislators have provided a certain protective mechanism here. Subclause 1 of clause 2 of Article 346.17 of the Tax Code of the Russian Federation has included a provision prohibiting TSN, HOA, management company or cooperative from taking into account as part of material expenses funds transferred in payment for services under contracts with resource supply organizations (waste management operators), if in relation to these funds there was the exemption provided for in subparagraph 4 of paragraph 1.1 of Article 346.15 of the Tax Code of the Russian Federation was applied. In other words, the material costs of a TSN, HOA, management company or cooperative do not include utility payments received from the owner (owner) of the property and transferred to the resource supply organization (waste management operator), if these payments were not taken into account in the income of this intermediary.

This means that as soon as the Federal Tax Service includes the corresponding amounts in income, it will immediately have to take them into account in expenses, which will offset all additional charges. However, it is obvious that this protective mechanism will not work for taxpayers who have chosen “income” as the object of taxation. Therefore, by the end of the year, they need to determine how they will draw up documents confirming the fact that relevant services have been provided to the property owners (owners) directly on behalf of the TSN, HOA, management company or cooperative.

Submit a free notification of the transition to the simplified tax system and submit a declaration under the simplified tax system via the Internet

Features of the simplified tax system “income” 6% in 2020-2021

In terms of general principles of taxation, nothing distinguishes the simplified tax system (6 percent) in 2020-2021 from the simplified tax system of previous years.

The key change for 2021 is the transition of most simplifiers to paying insurance premiums at general rates. This change affected not only the simplified tax system of 6%, but also the income-expense simplification with a rate of 15%. Reduced tariffs remained only for a small number of simplified tax payers.

In 2021, small and medium-sized businesses received the right to apply reduced insurance premium rates from 04/01/2020.

As for the simplified tax system for 2021, increased limits on personnel and income should be taken into account.

For more information on how the simplified tax system is calculated for the object “income”, read the article “The procedure for calculating tax under the simplified tax system “income” in 2021 - 2021 (6%)” .