Who is required to register a cash register (cash register) with the tax authority?

Tax Code of the Russian Federation in Art.

11 calls a separate unit located in a territory different from the location of the parent organization, with independent workplaces equipped for at least a month. The opening of a separate division requires its mandatory registration with the territorial tax authority at its location. To do this, fill out a message in form SO-09-3-1. A cash register in such a department does not always need to be registered. So, according to clause 2. Art. 2 of the Law “On the Use of Cash Register Equipment...” dated May 22, 2003 No. 54-FZ, it is possible to make cash payments and use plastic cards without using a cash register, provided that the buyer is issued a document to confirm the payment:

- payers of the single imputed income tax (UIIT), who are not engaged in retail trade and do not provide public catering services;

- organizations and individual entrepreneurs on OSNO or simplified tax system that provide services (except for catering services);

- when selling tickets on public transport.

However, this opportunity exists only until 07/01/2019. Next, this category of taxpayers will have to worry about purchasing and registering cash register machines.

Also exempt from the obligation to use cash register systems are organizations and entrepreneurs that provide certain types of services and are engaged in established types of activities, for example:

- sale of securities;

- selling ice cream in kiosks;

- shoe repair, etc.

At the same time, engaging in such activities is not an unconditional basis for refusing control technology. Location features are also taken into account.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Cash register for a separate division

A separate division is a separate office of the company. For example, the main office is on Tverskaya, and the division is on Arbat. If you work in an office using new-style cash registers, then in a separate department you also need to work with a cash register. Which one exactly depends on the business.

The standard ModulKassa meets the requirements of 54-FZ and is suitable for any office, but does not accept cards for payment. In order for clients to pay by bank transfer, they need to buy a terminal or ModulKassa with built-in acquiring. There is also a stationary cash register, but it is more expensive and is more suitable for grocery stores, so there is no point in overpaying.

To operate the cash register you need to pay a fee. The cheapest ModulKassa tariff costs 490 ₽ per month when paid annually. The cash register will work with any number of workshops and transfer data to Excel or other accounting services. Support works around the clock, responding by phone, email and chat. SIM card for free.

To select an online cash register for a separate department, write to the chat. The manager will help you choose equipment and tariff, then arrange delivery. Delivery within Moscow takes 1 day, to the regions - up to 7 days.

Buy Module Cashier

cash register in a separate division online cash register for a separate division fine for the lack of a cash register at an LLC in 2021 is it necessary to use a cash register for UTII in 2021 online cash registers for an LLC for UTII deferment until 2021 use of a cash register for a simplified tax system in 2021 for an LLC registration cash register in the Federal Tax Service and the Office of Revenue, cost of operating cash register equipment, enter into an agreement with the office for connecting and registering cash register, registering cash register in the office of cash register, what is registering cash register in the office of the Astral, rules for operating cash register when making cash settlements with customers, tax deduction when purchasing cash register online in 2021 tax deduction when purchasing a cash register 54 FZ operation of a cash register TB and maintenance of a cash register tax deduction for the purchase of a cash register online tax deduction for the purchase of a cash register online tax deduction for the purchase of a cash register online tax deduction for a cash register 54 federal law operation of cash register equipment and settlements with customers on the use of cash register equipment in HOA LLC repair and maintenance of cash register equipment types of cash register equipment used in the store concept and types of cash register equipment commissioning of cash register equipment preparation and operation of cash register equipment operation of cash register equipment of various types procedure for operating cash register equipment operation of cash register equipment video rental cash register equipment types of cash register equipment market of cash register equipment requirements for cash register equipment requirements for a cash register machine types of cash register equipment equipment for the cash register area of a store safety precautions when operating cash register machines standard rules for operating cash register machines how much does a cash register machine cost equipment for LLC rules for operating cash registers when making cash settlements with the population standard operating rules for cash registers when making cash payments rules for operating cash registers operating procedure on cash registers registering cash registers for an online store repairing cash registers documents fine for working without cash registers for LLC 2020 what to choose for a pos terminal store or KKM KKM in 2021 changes latest news USN cost of KKM with data transfer to tax prices Is it possible to sell beer without KKM with UTII LLC car service on UTII KKM 2021 deferment 2021 fine for work without KKM for LLC application of KKM in 2021 for LLC is KKM needed for LLC on USN 54FZ on the use of KKM 2021 for UTII 54FZ on the use of KKM 2020 for USN for a beauty salon. Is KKM 2021 required for KKM used in retail trade? Is KKM needed for the retail trade of oil? Application of KKM for USN in 2021 when will applications for renewal be renewed? subsidy for April extended the deadline for submitting an application for a subsidy extended filing an application for a subsidy fiscal data operators in Russia list of the Federal Tax Service Federal Tax Service checking the labeling of goods made from natural fur Federal Tax Service labeling system for products made from natural fur Federal Tax Service measures to support business coronavirus according to tax identification number Federal Tax Service official website coronavirus measures to support business website Federal Tax Service of Russia coronavirus business support measures punishment for accepting cash at the cash register SNT law change in the tax code refund for an online cash register tax deduction for a cash register in the amount of 18 thousand rubles how to choose an online cash register that is suitable for your business buy a mobile cash register with built-in acquiring is it possible to take for rent an online cash register which online cash register to buy when providing services deduction for an online cash register purchased in 2021 deduction for an online cash register when combining modes how to get a deduction of 18,000 for an online cash register which online cash register to choose for your business which online cash register to choose for a small store which cash register to choose for small UTII store accounting for cash transactions in retail trade; procedure for registering cash registers; use of cash registers for UTII in 2021; use of cash registers for UTII in 2021; use of cash registers for UTII in 2021; types of cash transactions and documents in a pharmacy; installation period for online cash registers for UTII law on the use of cash registers in housing and communal services who is exempt from cash registers in 2021 types of cash registers and operating procedures news about cash registers from 2021 use of cash registers in 2021 order on organizing testing of employees for coronavirus requirements for cash registers organizations 2021 non-profit organizations online cash registers requirements for at the organization's cash register, registering a cash register with the tax office, accounting for the costs of testing employees for coronavirus, accounting for a cash register during the registration of a cash register, registering a cash register, what is needed for registration in an honest mark, what to do after registering in an honest mark, registration deadlines in an honest mark for shoes, assistance in registration in Honest Mark registration service in the Honest Mark system step-by-step instructions for registration in Honest Mark registration services in Honest Mark Honest Sign shoe labeling registration deadlines cash register registration period cash register registration address cash register registration deadlines Honest Sign logbook for employee testing for covid 19 deregister from the UTII register for the duration of quarantine, a logbook for employee testing for coronavirus, a logbook for employee testing for covid, unpaid coronavirus, deregistered deregistered deregistered unregistered unregistered coronavirus, unregistered coronavirus, deregistered coronavirus labeling of medicines from October 1, 2021 labeling of medicines from October 1, 2021 labeling of shoes from October 1, 2020 labeling shoes October 1 fine for accepting cash without a cash register accepting cash without a cash register 2021 accepting cash without a cash register accepting cash without a cash register accepting cash without a cash register honest sign of the Russian Federation official website registration honest sign of the Russian Federation personal account registration registration on the website honest sign RF honest sign of the Russian Federation shoe labeling registration cash registers registration with the tax inspectorate honest sign of the RF registration instructions cash registers for UTII in 2020 deadlines cash registers for LLC in 2021 cash registers for LLC on USN 2021 cash registers for UTII in 2021 cash registers for taxis in 2021 who needs to install cash registers from 2021 who needs to install cash registers in 2021 new generation cash registers connected to the Internet accepting funds without a cash register honest sign of the Russian Federation documents honest sign of the Russian Federation official website how to register honest sign of the Russian Federation official website personal account how to register on the website Honest Sign of the Russian Federation https Honest Sign of the Russian Federation business projects medicines Honest Sign of the Russian Federation is not installed root certificate Honest Sign of the Russian Federation official website labeling of medicines regulatory documents regulating the operation of cash registers Honest Sign MDLP documents Honest Sign documents cash register equipment and other types of cash register equipment cash register equipment and cash register equipment taxes on insurance premiums reduced measures to support businesses coronavirus taxes

How is KKM registered?

In accordance with Art. 4.2 of Law No. 54-FZ, an application for registration of a cash register organization can be submitted to any tax authority or through the cash register office. However, attempting to register a cash register in the tax department at the place of registration of the head office does not make sense, since the application will be refused. In accordance with clause 21 of the Administrative Regulations, approved. By order of the Ministry of Finance of Russia dated June 29, 2012 No. 94n, cash register equipment of a separate division is registered at its location.

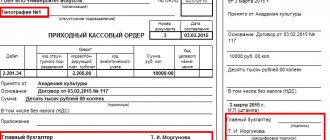

The package of documents required for this includes:

- application for registration of cash register in the form approved by order of the Federal Tax Service of Russia dated May 29, 2017 N ММВ-7-20/ [email protected]

- KKM passport;

- agreement on technical maintenance of the cash register with the service center.

All documents, except the application, will be returned to the applicant along with the equipment registration card. The tax authority is given 5 working days from the date of acceptance of the documents to enter the necessary information into the register of cash register equipment.

We draw your attention to the fact that it is impossible to register a cash register without first submitting a notification about the opening of a separate division in the form SO-09-3-1. The fact is that now, during registration, the inspector does not have the opportunity to enter the address manually, since it is issued automatically by the program based on the entered information about the addresses registered for the enterprise.

Ufreg | Registration of a separate division

A separate division is understood as a part of a company located outside the address of the parent company, i.e. territorially isolated from it. There are several concepts of separate divisions: branch, representative office and other separate divisions .

| Service list | Price | Period of execution |

| Registration of a branch/representative office | 5000* rubles | 10 days |

| Registration of a separate division (for setting up a cash register and/or registration of workplaces) in Moscow/in the Moscow region | 2500 rubles/3500 rubles | 1-2 weeks |

| Registration of a branch, representative office in Moscow/Moscow region | 2500/4000 rubles | 10-12 days |

* state duty of 800 rubles is paid separately

Registration of another separate division (for setting up a cash register and/or registration of workplaces) occurs differently than registration of a branch/representative office.

To register a separate division, it is necessary to prepare an application in the approved form, which indicates the name of the separate division (can be the same as in the parent organization or additionally include the territorial location) and the address of the location.

The form is submitted to the tax office at the legal address of the parent organization. The registration period for a separate division can be from 5 to 10 days, depending on the work of the tax authority. We receive a notification about the registration of a separate division with the tax office, where the division is registered.

For this type of separate division, no state duty is paid, and notarization of documents is not required.

What kind of reporting will need to be submitted to the tax office upon establishing a separate division can be found here.

Branch - includes the functions of a representative office and carries out all the functions of the parent organization or part of them, maintains an independent balance sheet.

Representation – represents and protects the interests of the parent organization.

Before registering a branch/representative office, you must decide:

- – with the legal address of the separate division;

- – with name: may include the name of the parent organization or additionally include the territorial location;

- – with the head and chief accountant of a separate division. The manager acts on the basis of a power of attorney with the powers specified in it, which are not limited to the constituent documents and regulations on the branch/representative office.

Registration of branches and representative offices in Moscow for Moscow companies is carried out by tax inspectorate No. 46 (link), the data is entered into the Charter of the parent company.

The following list of documents is submitted to the tax office for registration of a separate division for a branch/representative office:

- – application form P13001, certified by a notary;

- – new edition of the Charter or Amendments to it;

- – paid state duty for 800 rubles;

- – letter of guarantee from the owner at the location of the branch/representative office.

Documents can be submitted to the tax office No.46 by proxy or by the director of the parent organization in person.

After registration steps we receive:

- – Record sheet for making changes;

- – New registered version of the Charter or Amendments to the Charter.

An extract from the Unified State Register of Legal Entities with amendments has not been issued since 2014; it must be ordered after registration of the changes.

Do not forget to provide documents proving changes have been made to the bank where the company is serviced.

The next step will be to register the branch or representative office for tax purposes with the territorial tax office at their location.

There is no clear list of documents that must be submitted to the tax office of a separate division, but the main list remains unchanged:

- – request for registration of a branch/representative office (written in free form)

- – copies of documents of the parent organization (certificates of OGRN and TIN, Charter and amendments to it, record sheets, order for director, Extract from the Unified State Register of Legal Entities)

- – protocol/decision on the creation of a separate unit

- – order for the head and accountant of the branch/representative office

- – power of attorney on the basis of which the head of the department acts

- – regulations on the branch/representative office.

The branch and representative office maintain a separate balance sheet and have a separate estimate. The parent organization pays the balance for the separate division as an additional address. Other separate divisions that are a separate part of the parent organization and are located in a place different from the legal address.

Such divisions are created for various reasons: technological, economic, etc.

More often, separate divisions are registered when there is a need to register and register a cash register for the full functioning of retail outlets, stores, for the provision of services, or for the location of working personnel during the expansion or division of a business.

For more detailed information, including about our other services, you can contact us by phone.

This information is for informational purposes only and is not a public offer.

Source: https://www.ufreg.com/registraciya/registraciya-obosoblennogo-podrazdeleniya.html

Is it possible to avoid registering at the address of a separate subdivision?

Some entrepreneurs trade using one device in several places or simply do not want to re-register it later and are looking for ways to bypass specifying the address during registration. Let's look at some of these “methods”.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Registration of cash registers for outbound trade

There is an opinion that this is possible if you enter the phrase “outbound trade” in the address line of the application. However, this is not true. The popularity of this opinion is due to the incorrect interpretation of the letter of the Department of Tax Administration in Moscow “On the use of cash register machines...” dated 04/17/2002 No. 29-12/17513, which explains the procedure for using cash register machines exclusively for outbound sales (that is, the letter is simply not applicable for other types of sales).

There is a rather narrow definition of the very concept of outbound trade, which can be found in GOST R 51303-2013, approved by order of Rosstandart dated August 28, 2013 No. 582-st. According to this document, distribution trade is understood as small-scale retail trade outside a stationary retail chain, subject to the use of equipped transport and special mobile equipment to be used exclusively in the vehicle.

This significantly narrows the range of possibilities in which such registration will be justified and legal. In particular, if an entrepreneur uses such a device in the office, there is a violation of the law. After all, the method is acceptable only if trade is carried out directly using vehicles.

However, it must be recognized that the law does not really limit the number of checks that can be issued in one place, and such a solution may well be suitable for those who trade on an ongoing basis using transport (even if he does not move during sales). At the same time, the cash register itself must be able to operate on battery power, that is, be mobile.

Registering a cash register as a backup

The second option is to register the cash register as a backup. Indeed, in accordance with the explanations given in the letter of the Federal Tax Service for Moscow dated February 11, 2005 No. 22-12/9705, it is possible to register a spare cash register marked “reserve” in the address line. However, it is not indicated that it is necessary to register the main cash register before registering the reserve one.

However, there is one caveat: in accordance with clause 21 of the Administrative Regulations, approved by Order of the Ministry of Finance dated June 29, 2012 No. 94n, KKM is subject to use in the service territory of the tax division that registered it. This means that if the cash register is used outside this territory, the organization risks being punished in the form of a fine under Part 4 of Art. 14.5 Code of Administrative Offenses of the Russian Federation. Thus, this should not be considered a way to avoid registration at the unit address.

What is the fine if the cash register is not registered?

From 02/01/2017, in the event of detection of violations related to the use of an unregistered cash register or non-compliance with the procedure for its use, the norms of Part 4 of Art. 14.5 Code of Administrative Offenses of the Russian Federation. The provisions of this article provide for liability in the form of a fine in the amount of:

- 1500–3000 rub. - for officials;

- 5000–10,000 rub. - for legal entities.

As an alternative to a fine, the rule allows tax officials to limit themselves to warning the violator. However, such a measure is usually applied only when violations are first detected and only if this is the only violation detected. It seems that these measures should encourage entrepreneurs to register cash registers in a timely manner.

***

So, registration of a cash register of a separate subdivision takes place in the territorial body at the place of registration of the subdivision itself, but you should not evade it, since administrative liability is provided for violating the registration rules.