Last modified: January 2021

Unreasonable assessment of tax payments, unlawful imposition of financial sanctions and delays in the return of erroneously established taxes are the most frequently recorded violations by the tax inspectorate. Both individuals and entrepreneurs are faced with actions that contradict legal norms.

According to Article 137 of the Tax Code of the Russian Federation, every taxpayer can officially file a complaint against representatives of the inspectorate. With its help, the inaction or action of employees is challenged, as well as documents and decisions made are appealed. In this article we will look at who and how to file a complaint against the tax office, what pitfalls and deadlines the procedure has.

What is a complaint and how is it filed?

A complaint is a document drawn up in writing for the purpose of protesting actions/inactions or papers issued by tax authorities. This is how paragraph 1 of Article 138 of the Tax Code of the Russian Federation interprets this concept. There are several ways to file a complaint :

- to the window for receiving documents from the tax authority;

- to the tax office.

The first two methods involve filing a complaint in person. Contact the department that conducted the inspection. :

- by mail;

- online on the Federal Tax Service website;

- using telecommunication channels.

The complaint procedure is valid for 90 days from the moment the violation was discovered. But if the taxpayer does not meet the deadline, he has the right to request an extension for compelling reasons (evidence required). The procedure for submitting and reviewing a document generally takes up to 33 days. The first three days are spent on acceptance and registration of the document, the remaining 30 days are spent on consideration. The deadline for making a decision on a complaint may be extended by another 30 days, of which the taxpayer must be notified in advance.

Important! If the taxpayer considers the decision made following the appeal to be incorrect, in accordance with legislative norms, he can challenge it in court within the next 10 days.

How to submit correctly

In practice, two types are used: classic written and electronic. The filing rules are enshrined in Art. 139 of the Tax Code of the Russian Federation. There is no need to discuss your complaints about deductions, miscalculations and other issues and call the hotline - the operator will inform you about the need to submit documentation.

Know! Anonymous complaints are not considered by tax authorities. The applicant must disclose personal information, otherwise there will be no proceedings.

Personally

This involves a visit directly to the Federal Tax Service department and the transfer of documentation. The applicant is not required to make an appointment - it is enough to visit the inspection, wait for his turn and hand over the papers. Advantages of personal appeal: the applicant will be able to talk with the violator, and the review process will not be delayed.

Through the Internet

The delivery method involves three possible ways:

- official site;

- government services portal;

- Email.

The Federal Tax Service has its own online service that allows you to submit claims via the Internet. To do this, you will need to log in to your personal account. A similar mechanism of action is present on the State Services portal. The public service performs an intermediary function - it does not directly examine claims, but redirects them directly to the addressee.

The extreme case is email. It is acceptable to submit messages by email, but it is extremely busy - it is not a fact that the act will not get lost among hundreds of other requests.

Who is required to accept a complaint about the tax structure?

According to paragraph 1 of Article 139 of the Tax Code of the Russian Federation, a complaint against the Federal Tax Service is filed in the name of a higher tax authority, but is sent to the inspectorate that committed an unlawful action (inaction) or made an unfounded decision. After submitting the application, the responding party forwards the document to a higher authority. In other words, when violations committed by regional branches are recorded, the application is initially submitted to the local authority, and then the complaint is received by the Federal Tax Service Office for the city (the Federal Tax Service).

Also accepts complaints:

- Court . The authority has the right to make a decision on any claims from any applicants. Filing an application to the court has one significant drawback - the length of the procedure. Therefore, it is resorted to in 97% of cases by legal entities, not individuals;

- Prosecutor's office . The government body of the Russian Federation monitors the correct operation of all government agencies. But its activities extend only to offenses of a criminal nature. Therefore, the government rarely intervenes in tax disputes.

Important! It is worth contacting the prosecutor's office or court if an appeal to a higher authority of the Federal Tax Service did not give the desired result. When submitting an application, the taxpayer must be confident that he is right and have in his hands irrefutable evidence of the offense. Consideration of the case in court will last at least 90 days according to legal norms. In difficult situations, a decision will take at least 6 months.

Complaint to a higher tax authority

Taxpayers have the right to appeal:

- acts of tax authorities of a non-normative nature;

- actions or inactions of their officials, -

if, in their opinion, acts, actions (inaction) violate their rights. The appeal can be filed as an appeal (filed against a decision that has not entered into legal force) or as a traditional complaint. A traditional complaint is filed to challenge:

- an act of a non-normative (i.e. individually determined, one-time, related to a specific taxpayer) nature that has already entered into legal force;

- actions (inactions) of officials, including decisions to conduct a tax audit or offset, “freeze” accounts, prosecution, additional tax and penalties, etc.

Both types of complaints are sent strictly through the tax office that made the contested decision or committed illegal actions (inaction), which, within three days from the date of receipt, forwards both the complaint and its materials to a higher tax authority.

Please note: having received a regular (not appeal) complaint, tax authorities are obliged to take measures to eliminate violations of the applicant’s rights and report this to a higher tax authority within three days from the date the violations were eliminated (clause 1.1 of Article 139 of the Tax Code of the Russian Federation).

A regular complaint is filed within a year from the date:

- when the taxpayer learned (should have known) about the violation of his rights;

- making a decision if an appeal is made against a decision to prosecute that has entered into force or a decision to refuse to prosecute, which has not been appealed;

- making a decision if an appeal is made against a decision that has entered into force and was made based on the results of consideration of the materials of a tax audit of a consolidated group of taxpayers, which was not appealed.

An appeal is filed only before the day the appealed decision comes into force.

The requirements for the form and content of both complaints are identical, but the appeal itself can only be submitted in writing, through a personal account or via telecommunications channels (not via email). In addition to general information (full name, name, address, methods of receiving a response, etc.) are indicated:

- details of the appealed act of a non-normative nature, action (inaction);

- the name of the tax authority, the act, actions (inaction) of whose officials are being appealed;

- the grounds on which the person filing the complaint believes that his rights have been violated;

- applicant's requirements.

The following may be attached to the complaint:

- documents confirming the circumstances on which the taxpayer bases his claims;

- calculation of disputed amounts of taxes, fees, penalties, fines, tax deductions claimed by the taxpayer, and other calculations;

- power of attorney or other documents confirming the authority of the person who signed the complaint (if the complaint was not signed by the taxpayer-applicant himself).

There is this kind of nuance with documents: documents submitted along with the complaint, and additional documents presented during the consideration of the relevant complaint before a decision is made on it, are considered by a higher tax authority if the person who filed the relevant complaint provided an explanation of the reasons why it was impossible timely submission of such documents to the tax authority whose decision is being appealed (clause 4 of Article 140 of the Tax Code of the Russian Federation). Tax officials often understand this this way: documents can be taken into account only if the applicant can justify the reasons why it was impossible to previously submit them to the inspectorate, whose decision is being appealed. This does not mean that documents cannot be accepted. The law does not require the taxpayer to document the fact that it was impossible to timely submit such documents to the tax authority whose decision is being appealed. The courts indicate that:

- The Tax Code of the Russian Federation (clause 4 of Article 140 of the Tax Code of the Russian Federation) obliges the applicant to provide explanations regarding the reasons for the impossibility of submitting these documents during the inspection (resolution of the Volga District Autonomous District of August 12, 2015 N F06-26273/2015 in case N A55-22321/2014);

- Tax authorities do not have the right to refuse to consider the submitted documents due to the taxpayer’s failure to document the fact stated in the explanations provided: in essence, this is the presentation of additional requirements not provided for by the Tax Code of the Russian Federation, the provisions of which oblige the submission of only explanations (resolution of the Eleventh Arbitration Court of Appeal dated April 6, 2015 N 11AP -2554/2015).

“Explanations” are not the same as “documentary evidence” (see, for example, Article 88 of the Tax Code of the Russian Federation). So if a higher tax authority refused to consider additional documents with the reference to the fact that there was no documentary evidence of the absence of disputed documents at the time of the audit and the adoption of a decision on its results, then the court will most likely consider this position to be unlawful. Moreover, if additional evidence is presented, tax officials have the right to ask the court to declare a break or postpone the meeting, giving them the opportunity to familiarize themselves and present evidence refuting them (clause 78 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 N 57).

Challenging does not suspend the execution of the act being appealed, but there is an exception. In the event of an appeal against a decision to prosecute that has entered into force (or a decision to refuse to prosecute), the execution of the appealed decision may be suspended. To do this, in addition to the complaint, you must submit:

- application for suspension;

- a bank guarantee under which the bank undertakes to pay an amount of money in the amount of the tax (fee, penalty, fine) not paid under the appealed decision.

Options for solutions based on the results of consideration of the complaint:

- leave without satisfaction;

- cancel the act of the tax authority of a non-normative nature;

- cancel the decision of the tax inspectorate (in whole or in part);

- cancel the decision and make a new one;

- recognize the actions (inaction) of inspection officials as illegal and make a decision on the merits.

It should be noted that the decision of a higher tax authority can be appealed (to the Federal Tax Service of Russia within 3 months from the date of adoption).

Are there special requirements for filing a complaint?

Yes, they do exist. The following information must be included in the document :

- Full name and full address of the person (legal or individual) filing the complaint;

- information about the action or inaction of the tax inspectorate that violates the rights of the taxpayer, about the act/decision being refuted;

- complete information about the tax department that committed the offense;

- grounds for filing a complaint;

- method of notification of the decision on the application. It is chosen by the taxpayer. The decision can be received by mail, telecommunication channels or in your personal account on the website of the Federal Tax Service.

The appeal must contain the contact information of the person filing the appeal. It is accompanied by evidence of the offense and copies of the documents served. For example, if a taxpayer accuses tax officials of inaction, he must describe them in a letter (the descriptive part of the document is reserved) and attach evidence.

Important! A complaint can be drawn up and filed by an authorized person (lawyer). In this case, an act certifying the rights of the representative is attached to it.

What documents are involved?

In the process of electronic document management, when submitting a complaint to the tax authority and sending a decision (notice) on it via TKS, the following technological electronic documents also participate:

- confirmation of the date of sending the electronic document;

- acceptance receipt;

- notification of refusal of admission;

- notification of receipt (generated automatically by the recipient’s software for subsequent transmission to the sender for each document and technological electronic document listed above);

- information message about the representative in tax relations.

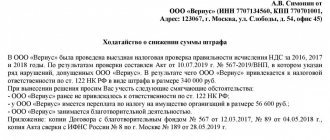

How to write a complaint without errors: samples

The exact data on drawing up the application are set out in paragraph 2 of Article 139 of the Tax Code of the Russian Federation. The document must have a header, contact, descriptive and final parts. To avoid mistakes when drawing up a complaint, use the samples.

Technical requirements

Sending and receiving a complaint, decision (notice) on a complaint in electronic form via TKS is permissible with the mandatory use of certified means of enhanced qualified signature, allowing:

- identify the owner of the verification key;

- establish the absence of distortion of information in these documents.

In this case, any special qualified certificates for electronic signature verification keys are not needed.

Of course, sending a complaint and, in response, a decision (notice) on it in electronic form via TKS occurs in encrypted form.

Consideration

The inspectorate initiates a review of documentation from an individual or organization only in one case - if there are indeed grounds for unlawful actions on the part of tax officials. It is permissible to submit additional papers throughout the duration of the proceedings, but you will need to explain why they could not be submitted on time.

The head of the Federal Tax Service is obliged to notify the applicant of the time and place of consideration of the case. Possible outcomes: cancellation of illegal acts, making a new decision or leaving the complaint without satisfaction.

When they can refuse

Return cases are no different from the situation with other legal papers. If the act is drawn up incorrectly or its contents are unreadable, it will remain without consideration. The same will happen with obscene expressions or the absence of arguments indicating violations by tax officials.

Another reason is the delay in sending the appeal. The applicant must remember that he has exactly 1 year to appeal the misconduct, otherwise justice can only be restored for good reasons.

Know! The Federal Tax Service must decide to leave the claim without investigation within 5 days from the date of registration of the appeal.

Deadlines

The review period is 15 days (clause 6 of Article 140 of the Tax Code of the Russian Federation). If it is possible to eliminate the deficiencies, the violator is obliged to report the result of studying the complaint to a higher authority within 3 days. It is permissible to extend this period if the circumstances of the case require additional investigation.

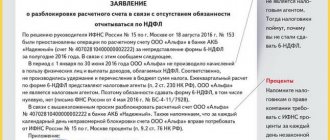

Filing a claim

You can write an application to submit to the court yourself. Guidelines for drafting this document:

- You can submit your application on paper or electronically;

- it is important to comply with all formal requirements for the content of the application;

- in the main part, set out the arguments to understand why the taxpayer does not accept the arguments of the tax service;

- Attach evidence in the form of documents or copies thereof to the application.

A preliminary analysis is made of all violations committed by tax authority employees during an audit or during pre-trial consideration of the issue. Example: if the taxpayer did not receive notification of consideration of his objections based on the results of the audit and could not provide explanations on the issues that arose, this must be indicated in the application. The court will take this circumstance into account during the hearing. Any facts indicating violations committed by tax officials will help sway the judge on the side of the taxpayer.

It is important to complete the application correctly. The document must contain the following information:

- the name of the body that adopted the contested act, or the details of the person who, as a civil servant, committed unlawful actions or, through inaction, violated the rights of the applicant;

- name, date of preparation, number of the contested act;

- those interests and rights of the taxpayer that were violated by the contested act or action (inaction) of a tax authority employee;

- laws or legal acts that, in the opinion of the applicant, are violated by the contested act;

- the applicant's demand to declare the contested act illegal.

It is advisable to support each controversial point with documents proving the applicant’s correctness. The document should include references to:

- current norms of the Tax Code, legislative acts;

- clarifications from the Ministry of Finance and the Federal Tax Service, if they clarify the controversial issue;

- judicial acts issued by arbitration courts.

It is necessary to indicate the provisions that may influence the court decision if it is not in favor of the applicant. These are the circumstances:

- due to which prosecution is excluded (expiration of the statute of limitations, etc.), according to Article 109 of the Tax Code of the Russian Federation;

- which can be considered as mitigating the measure of responsibility (Articles 112 and 114 of the Tax Code of the Russian Federation);

- excluding guilt (Article 111 of the Tax Code).

The following documents must be attached to the application:

- a copy of the disputed document;

- the answer received during the pre-trial settlement of the issue;

If the tax inspectorate did not respond to the taxpayer’s complaint in a timely manner and did not provide its decision on the objections raised earlier, a copy of the application submitted to a higher tax authority and a notice of acceptance of the documents by the regulatory authority should be attached to the lawsuit.

A copy of the application to the court with copies of the attachments must be sent to the tax authority and to all persons participating in the trial. You can send it by mail with mandatory receipt of receipt. Shipping receipts must be attached to other documents prepared for submission to the court.