In what cases does the tax office block an account?

There are four grounds for blocking a company account:

- Based on the results of the tax audit, additional taxes were assessed and a decision was made to impose tax liability. If there is reason to believe that the company will not pay additional taxes, the inspectorate may take interim measures in the form of suspending transactions on bank accounts.

- The company did not submit a tax return within 10 days after the last deadline.

- Within 10 days, the company did not provide the opportunity to receive tax documents in electronic form.

- The inspection sent the company a request to provide documents or explanations, but the company did not send a receipt to the inspection for acceptance of this request within 10 days.

Letter to the tax office about unblocking an account: sample

A ban on transactions on bank accounts of a business entity can lead to significant material damage. The bank is exempt from liability by law if an enterprise or individual entrepreneur suffers losses due to such temporary blocking of current accounts. The only way to restore their functioning is to comply with the requirements of the tax authorities. After the Federal Tax Service employees receive information about the solution to the problem, they provide the banking institution with a notification about the resumption of operations on the entrepreneur’s accounts.

The taxpayer's appeal to the Federal Tax Service will help speed up the procedure for notifying the tax authority that there are no grounds for freezing accounts. A letter to the tax office about unblocking an account is drawn up in any form. The law has not introduced a unified or standard form for such a written statement. The document is drawn up on the business entity’s letterhead and must contain the following data:

- information by which one can identify a division of the Federal Tax Service;

- information about the applicant (name of enterprise or full name of private entrepreneur, registration data);

- date of registration of the document in the outgoing correspondence journal, assigned outgoing number;

- a text block that reflects the essence of the appeal to the fiscal structure;

- the final fragment, which contains a request to restore the ability to carry out money transfers on accounts (the details of current accounts, the movement of which needs to be restored in an accelerated mode, must be indicated);

- contact details of the applicant for prompt communication with the tax inspector;

- signature and seal.

The main part of the letter may contain arguments in favor of partial “unfreezing” of funds in the accounts. This is possible if:

- the reason for blocking was the fact of non-payment of taxes;

- the total amount of blocked money in the bank account exceeds the amount of outstanding obligations to the budget.

It is necessary to submit a letter to the tax office about unblocking the account along with supporting documents attached to it. This is required in order to support your request with objective arguments. The justification for unlocking may include:

- a payment order indicating payment of the arrears, or a bank statement indicating the presence of sufficient funds in the account;

- documents confirming the submission of the declaration, sending a receipt in response to the electronic request of the Federal Tax Service.

The letter can be submitted to the tax authority personally by the head of the company, or through proxies. It can be sent by mail or through an electronic document management service with the fiscal service. The latter option allows you to do without a paper version of the letter, which speeds up the procedure for communicating the necessary information to the tax inspector.

The Federal Tax Service must convey to the bank the decision to cancel the blocking no later than the next day after its adoption (clause 4 of Article 76 of the Tax Code of the Russian Federation).

Reasons for blocking a current account

The legislation allows you to suspend (block) transactions on the account of a company or entrepreneur. In this situation, spending funds from the account becomes virtually impossible, although the flow of money into it is not limited. Blocks are mainly imposed by the tax office, but can also come from the bank itself.

Let's consider what most often becomes the reason for blocking the account of an organization or individual entrepreneur:

- failure to file tax returns;

- various arrears of taxes, fees, unpaid fines or penalties;

- lack of organization at a legal address;

- failure to provide documents requested during a desk audit;

- carrying out transactions with signs of cashing out funds, terrorist financing, etc.

Application form for unblocking a current account

Russian legislation does not regulate the form and does not establish a specific example of a letter to unblock a current account. This means that, if necessary, the taxpayer needs to prepare this document in free form, based only on general rules.

Let's consider what information must be present in the application to lift the restriction:

- name of the tax authority - recipient of the letter;

- applicant's details (name or full name, address, INN, OGRN/OGRNIP, telephone);

- outgoing number and date;

- the text of the request itself (reasons why the account should be unblocked);

- directly request to cancel the decision to suspend operations on the account.

You need to know that sometimes the blocking has to be partially removed. For example, if the tax service has blocked several accounts, but one of them has a sufficient amount to pay the debt, then the remaining accounts can be unblocked at the request of the taxpayer.

How to submit a letter about unblocking a current account to the Federal Tax Service

It is necessary not only to prepare an application using a sample letter to remove the block from a current account, but also to correctly submit it to the Federal Tax Service. The best option is a personal visit by the tax director or chief accountant of the enterprise. This will allow you to resolve the issue as quickly as possible and, if necessary, take action faster.

You can submit a letter for unblocking to the Federal Tax Service through a representative, providing him with the appropriate power of attorney from the organization. He will not be able to fully explain the situation, but the tax office will accept the application for unblocking. Finally, you can send a letter by mail, but this will significantly delay solving the problem, given the long delivery times for items even within the same locality.

Note . It is also possible to send a letter about removing the restriction from the account through an electronic document management system if it is not possible to visit the tax office in person.

What is needed to remove the blocking

Blocking an account practically paralyzes a business, and the situation needs to be resolved as quickly as possible. To do this, the first step is to clarify who made the decision to suspend operations. If the blocking occurred at the initiative of the bank, then you must provide all the requested documents to prove the legality of the origin of the funds and the legality of their expenditure.

In a situation where the suspension of the operation occurred by decision of the tax service, it will be necessary to deal with it. First you need to find out the reason for the blocking. The tax inspectorate sends a copy of the blocking decision to organizations via electronic communication channels and regular mail, but not everyone responds to it in a timely manner. To unblock the account, you will need to find out and eliminate the reason for the restriction, and in some cases write a letter asking to unblock the current account.

If the suspension of operations is due to the lack of tax returns on time, then they need to be prepared and sent, and if it was due to unpaid taxes, then they will have to be paid.

In a number of cases, the tax service goes far beyond its powers and freezes an account for far-fetched or invalid reasons. In this case, you can and should challenge its decision by filing a corresponding complaint and attaching documents confirming that you are right.

For example , if the declarations were submitted, but due to a failure, the tax office considers them not sent within the prescribed period, then you will need to draw up a complaint and attach to it a receipt from the EDF operator about sending the documents.

When the account is unblocked

Having received an application from the taxpayer to remove the restriction from the current account, the Federal Tax Service will check whether the reasons for the blocking have been eliminated and make a decision on lifting the restrictions. This will happen no later than the next day after the actual fulfillment of the requirements.

If the taxpayer decides not to agree with the demands of tax officials and appeals the decision, the procedure may be delayed. According to the law, 15 days are given to consider a complaint filed administratively, and if this does not give the desired result, you will have to appeal the decision in court, and the consideration of the case will take longer.

Even after making a decision to lift the restrictions, the tax office will not be able to automatically unblock the account. She needs to send a corresponding request to the bank. In most cases, the credit institution receives data from the Federal Tax Service in electronic form, and the blocking is lifted the next day after the decision is made. But sometimes the bank has to wait for the original decision, for example, due to technical problems, and in this case the account is unblocked only after 5 days allotted for delivery of the original.

Also read: Certificate of open current accounts from the tax office: sample, how to obtain and issuance deadlines.

When is it illegal to block an account?

Judicial practice knows cases where companies managed to prove that blocking an account was illegal.

The company did not submit the declaration, despite the fact that there was no obligation to submit it

The company was registered. Along with the registration documents, a notice of the transition to a simplified system was submitted. However, in fact, the company did not switch to a simplified system. During the year, she provided tax reporting under the general taxation system, including VAT returns.

The tax office accepted these reports without any questions, but at the end of the year, when the company did not submit a declaration under the simplified tax system, it blocked its current account.

The company went to court to challenge the decision to block the account. The court supported this requirement, since the company, despite the fact that it submitted a notice of transition to a simplified taxation system, did not actually switch to it and worked on the general taxation system.

Consequently, the company had no obligation to file a declaration under the simplified tax system. In this case, the inspectorate blocked the account illegally.

The company did not provide advance income tax calculations; the inspectorate blocked the current account

In this case, the Federal Tax Service relied on subparagraph 1 of paragraph 3 of Article 76 of the Tax Code.

The company had to go all the way to the Supreme Court, which, unlike previous instances, noted that this legal norm does not provide the tax authorities with the opportunity to block an account in case of failure to submit an advance payment calculation.

A tax return and an advance payment calculation are different documents. In case of failure to submit a tax return, the inspectorate may block the account, but for failure to submit an advance payment calculation, it cannot.

The inspectorate assessed additional taxes based on the results of the audit. The value of the company's property exceeded the amount of the arrears, but the tax authorities still took interim measures in the form of suspending transactions on bank accounts. However, by virtue of the law, if the value of the company’s property exceeds the amount of debt, then the inspectorate cannot block the account. She can block the account only for the amount of the difference between additional charges and the value of the assets.

The inspectorate blocked the account due to procedural violations

For example, the inspection revealed tax arrears. After that, she made a demand for payment of arrears. The company has 10 days to make voluntary payment. As long as the period allotted for voluntary payment of the debt has not expired, the tax office cannot block the company’s account. Blocking becomes possible only if the company voluntarily fails to pay the tax.

The tax office has blocked the current account: the company’s action plan

The account is blocked due to non-payment of income tax calculated in the declaration.

However, the tax was actually paid one day earlier than the day the tax return was filed. It is assumed that there was a technical discrepancy between departments in the inspection. The company asks for clarification of the procedure for unblocking the account and appealing the unjustified actions of the tax inspectorate, which led to direct losses for the company.

The mechanism for canceling such a decision is provided for in paragraph 9 of Art. 76 of the Tax Code of the Russian Federation: If the tax authority does not cancel the decision to suspend transactions on the current account, its actions can be appealed first to a higher tax authority, and then to the court, as provided for in clauses 1, 2 of Art. 138 Tax Code of the Russian Federation. In accordance with paragraph.

2 tbsp. 103 of the Tax Code of the Russian Federation, losses caused by unlawful actions of tax authorities or their officials during tax control are subject to compensation in full, including lost profits (lost income). The Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 31, 2011 No. 145 explains the following: To recover losses, an enterprise must prove the totality of the following circumstances: For example, the following cases were decided not in favor of the taxpayer:

Application to the tax authority to lift the seizure of property in connection with the payment of taxes, penalties, fines (filling sample)

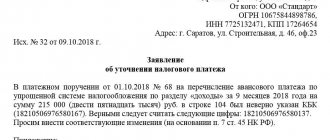

To the head of the Inspectorate of the Federal Tax Service of Russia No. 55 for Moscow, Y. Kh. Strogov. from the limited liability company "Alpha", OGRN 1047712345678, TIN 7755134420, KPP 775501001 173000,

Moscow, st. Malakhova, 30 According to this resolution, to ensure the collection of arrears of income tax in the amount of 65,000,000 rubles, penalties in the amount of 1,500,000 rubles. a partial seizure of the organization’s property was imposed (protocol of seizure of property dated 04/09/2012 No. 15). Alpha LLC by payment orders dated 06/01/2012 N 132 in the amount of 35,000,000 rubles, N 133 in the amount of 30,000,000 rubles.

and payment order dated 06.06.2012 N 134 in the amount of 1,500,000 rubles.

paid off the existing income tax debt.

In accordance with paragraph 13 of Art. 77 of the Tax Code of the Russian Federation, the decision to seize property is canceled by an authorized official of the tax authority upon termination of the obligation to pay taxes, penalties and fines. Based on the above, Alpha LLC requests that the previously seized property be canceled in connection with the payment of arrears of income tax.

1) a copy of the payment order dated 06/01/2012 N 132; 2) a copy of the payment order dated 06/01/2012 N 133; 3) a copy of the payment order dated 06.06.2012 N 134; 4) a copy of the resolution to seize the property of the taxpayer (payer of fees) or tax agent dated 04/02/2012 No. 9; 5) a copy of the seizure protocol dated 04/09/2012 No. 15.

How to unblock an account?

Essentially, there are only two options:

- comply with tax requirements. In this case, you need to take a certified account statement and payment from the bank and submit them to the tax office;

- prove that the tax office blocked the account illegally. To do this, you need to carefully analyze the situation, see what the tax office refers to when blocking, and especially carefully check the deadlines - was the inspectorate too hasty in blocking the account? Maybe the deadline for voluntary repayment of tax debt has not yet expired?

The simplified company did not report VAT

A simplified company must report VAT if it, for example:

— issued an invoice with tax (clause 5 of Article 174 of the Tax Code of the Russian Federation);

— leases state or municipal property (clause 3 of Article 161 of the Tax Code of the Russian Federation);

— the company conducted general affairs under a simple partnership agreement (clause 2 of Article 346.11 of the Tax Code of the Russian Federation).

If some of these transactions took place in the first quarter and the company filed a VAT return, then the tax authorities can expect it at the end of the second quarter. And they will block the account if these reports are not submitted on time.

How to unblock an account. Apply for unlocking. Write that transactions on the account were suspended illegally. And if so, then the company has the right to demand interest for each day when it could not use the account.

In what cases is it written?

The Tax Service is authorized in special cases (to influence unscrupulous taxpayers) to block their current accounts. These rights are indicated in

What to do if your current account is blocked?

The main reason for blocking taxpayer funds is non-payment of mandatory payments to the budget.

But before freezing, the tax inspector must send a demand for payment of the debt, which must be repaid before a certain date specified in the document.

There are also other reasons for blocking:

- judicial arrest;

- lack of tax return;

- the location of the company does not correspond to the legal address;

- failure to provide documents requested during a desk audit;

- cash withdrawal, terrorist financing.

Seizure is permitted if there is a court decision. This measure is used when large amounts of taxpayer debt arise or to collect a fine.

This method guarantees the execution of a court verdict to confiscate the company’s property if the bailiffs are involved in the collection.

To speed up the procedure for lifting the seizure of bank accounts, submitting a corresponding request to the Federal Tax Service will help.

If operations on the account are stopped due to outstanding debt or violation of reporting deadlines, then the decision is canceled no later than one day from the date of fulfillment of obligations or submission of the declaration, respectively.

How to write to remove the arrest and restriction from the account?

The application to the tax office is drawn up in any form.

At the legislative level, a unified form of such a form has not been introduced.

The document is generated on the company’s letterhead and contains the following data:

- name of the Federal Tax Service (details, address), to whose address the application is sent;

- Full name of the head of the tax service;

- information about the applicant (name, TIN, location);

- serial number of the letter in accordance with the log of outgoing documentation;

- text part that reflects the essence of the appeal;

- the final block, including a request to restore the ability to carry out transactions on the current account;

- seal, signature of the head of the company.

For faster communication, you can indicate the contact phone number of the chief accountant.

Sample text of the main message:

“By decision of the head of the Federal Tax Service No. 8, on August 25, 2021, operations on the current account of Spectr LLC in the bank Vostochny JSCB (account No....) were suspended for failure to submit Form 6-NDFL for the first half of 2021.

In this regard, we report the following. For the period from January 1 to June 30, 2021, no accruals were made in favor of individuals. Accordingly, there were no withholdings or transfers of tax amounts to the budget.

There is no obligation to submit zero tax reporting in Form 6-NDFL ().

In connection with the above, we ask you to unblock the current account No.... Spectr LLC, opened at the Vostochny JSCB. We also remind you that for each calendar day of unlawful blocking, Spectr LLC has the right to demand interest from the Federal Tax Service No. 8 ()"

Arguments may also be made in favor of a partial “unfreezing” of funds. This is possible if the reason for the arrest was non-payment of mandatory payments, and their total amount does not exceed the money available in the company’s current account.

Sample letter to the tax office regarding the removal of seizure from a current account

When a verdict is rendered by the courts, the seized property may be released from restrictive measures.

Before drawing up a document, a person must take into account the reasons for the original court decision.

It is worth noting that if the seizure is imposed by the tax authorities, the seizure can only be lifted after the owner of the apartment or vehicle has paid the fiscal debt. If the inspection did not manage to remove the seizure from your account in time, it is obliged to pay you interest (clause

9.2 Art. 76 of the Tax Code of the Russian Federation). After the decision to cancel the blocking of the account has been made, the inspection must forward it to the bank and give a copy to the taxpayer. Application to the tax authority to lift the seizure of property in connection with the payment of taxes, penalties, fines (sample filling) a partial seizure was imposed on the organization’s property (Protocol of seizure of property dated 04/09/2012 No. 15).

Alpha LLC by payment orders dated 06/01/2012 N 132 in the amount of 35,000,000 rubles, N 133 in the amount of 30,000,000 rubles. and payment order dated 06.06.2012 N 134 in the amount of 1,500,000 rubles.

paid off the existing income tax debt. In accordance with paragraph 13 of Art. 77 of the Tax Code of the Russian Federation, decision to seize Illegal seizure of an account most often occurs in the event of a struggle between competitors for markets or some kind of personal hostility between tax inspectors and the management of the company.

In such cases, contacting the bank for clarification about the reasons for blocking the account is pointless, since, according to current legislation, the bank is only an executor of orders from an authorized government body. Application to the tax authority to lift the seizure of the organization's property in connection with the payment of taxes, penalties, fines (filling sample) Application to the tax authority to lift the seizure of the organization's property in connection with the payment of taxes, penalties, fines (filling sample) Application to the tax authority on the return of an overpaid (collected) amount of tax (fees, penalties and fines) to a liquidated organization Application to the tax authority for a refund (offset) of an overpaid (collected) amount of tax (advance payments, fees, penalties and fines) Application to the tax authority on a refund (or offset) of the overpaid (collected) amount of tax (fees, penalties and fines) to the legal successor of the reorganized legal entity Complaint to a higher authority for control over the payment of insurance premiums regarding the demand for payment of arrears on insurance premiums, penalties and fines Response to the arbitration court on the application of the body control over the payment of insurance premiums on the collection of insurance premiums, penalties and fines Application to the tax authority to revoke the order to write off and transfer arrears, penalties, fines from funds in the taxpayer’s bank accounts (sample filling) A current account can be blocked for several reasons. If a taxpayer does not submit a return on time, his account may be blocked.

This nuisance also threatens those who do not pay any fine or penalty on time. Many companies are faced with the problem of blocking their current account.

This trouble threatens that the work of the organization may even be completely frozen.

Does the bank have the right to request documents under 115-FZ?

Yes, the bank has the right to request documents under 115-FZ, this right is granted to the bank in clause 14, art. 7, 115-FZ.

information to organizations carrying out transactions with funds or other property

necessary for the specified organizations to fulfill the requirements of this Federal Law, including information about their beneficiaries, founders (participants) and beneficial owners.

How to properly provide documents to the bank?

Documents at the request of the bank must be provided strictly according to the inventory, or the act of acceptance of the transfer of documents

. I’ll explain why to do this, as practice shows, especially since 2021, the bank’s main goal is to withhold from you a commission of 10-25% of the amount in your current account, and after submitting the documents you will receive the standard phrase “That the documents presented do not explain the economic meaning transactions you carry out, we suggest closing the account and transferring funds to another bank, the transfer fee will be 20%"

And the most important thing here is not to make a fatal mistake,

especially if you have not provided all the documents upon request, it will be a fatal mistake if you follow the bank’s lead and transfer money to another account with a commission, this will not solve your problem, because when the funds arrive in another bank, they will not be will be blocked, because when the client’s account is blocked, you end up on the Central Bank of the Russian Federation 550-P list (Black List), it is available to all credit institutions, and when you did not provide documents upon request, but decided to withdraw money with deduction of commission, the bank employee who will carry out the transfer will send the money to another bank with code 6001.

Appeal to the interdepartmental commission of the Central Bank of the Russian Federation.

An interdepartmental commission under the Central Bank of the Russian Federation was created on March 30, 2018, with the aim of rehabilitating legal entities and individuals who were blacklisted by banks (550-P).

In order for the right to appeal to the interdepartmental commission under the Central Bank of the Russian Federation to arise, it is necessary to provide evidence of filing a claim against the bank. That is, in order for you to have the right to appeal, you must exhaust all possible options for communicating with the bank.

The Interdepartmental Commission is provided with an application, evidence of the transfer of documents to the bank upon request, a claim, and the bank’s response is not a claim, the period for consideration of the application is 30 days.

Why is the account blocked?

The suspension of transactions on bank accounts, as well as transfers of electronic funds from organizations and individual entrepreneurs, is regulated by the Tax Code of the Russian Federation No. 146-FZ of July 31, 1998, paragraph 1 of Art. 76.

1) Suspension of transactions on invoices for non-payment of tax

If the Company or the Entrepreneur has not complied with the Tax Inspectorate’s Request to pay taxes, penalties, and fines, a Decision is made to suspend transactions on bank accounts. And not before the decision on collection has been made. In this case, debit transactions are suspended only within the amount specified in the Decision on suspension of account transactions.

UNBLOCK YOUR ACCOUNT WITH ROSCO!

The company has the right to use funds in accounts that exceed the amount of debt at its discretion.

2) Suspension of transactions on accounts for failure to submit a tax return

If the account blocking is caused by late filing of a tax return, the decision to suspend operations can be made no earlier than 10 business days after the expiration of the deadline established for filing reports. This right is retained by the Inspectorate for three years.

At the same time, there are no restrictions on the amount of blocking, i.e. The Federal Tax Service has the right to block all money in the accounts, and the company cannot carry out expenditure transactions both with the money that is in the accounts and with the funds that will be transferred to it in the future.

3) Suspension of transactions on accounts for non-compliance with the rules of electronic document management

Since 2015, Companies and Individual Entrepreneurs who submit reports electronically are required to ensure the acceptance and confirmation of acceptance of electronic documents sent by the Federal Tax Service - requirements for the submission of documents (explanations), as well as notifications of a call to the inspectorate. A receipt of receipt of such requests and notices is sent to the Inspectorate electronically within six business days from the date of receipt.

RESTORATION OF ACCOUNTING

If within the allotted time the Company or the Entrepreneur has not confirmed the receipt of documents, then within the next ten working days the Inspectorate has the right to block the current account.

In addition to the three above cases, the Inspectorate may suspend operations on an account if there are grounds to believe that the Company or Entrepreneur may hide its property from forced collection to pay off debts to the budget.

4) Suspension of transactions on the account based on the results of an on-site inspection (as an interim measure to counter the concealment of property)

If, based on the results of an on-site inspection, taxes, penalties, and fines are assessed on the Company or the Entrepreneur, the Inspectorate has the right to make a decision prohibiting the alienation (pledge) of certain types of property belonging to the Company or the Entrepreneur (real estate, vehicles, etc.) without it consent. If the value of the property does not cover the amount of the accrued debt, then the Inspectorate may block funds in the settlement accounts of the Company or the Entrepreneur for the balance of the debt.

Algorithm of actions to unblock an account:

1) Provide all documents at the bank’s request and hand them over to employees according to the inventory or transfer acceptance certificate;

2) If your access to remote banking services has not been restored, write a written complaint and send it to the bank;

3) If after the claim the RBS was not restored to you, contact the interdepartmental commission created under the Central Bank of the Russian Federation;

4) If appealing to the interdepartmental commission does not help, then you need to file a claim with the Arbitration Court at the location of the bank or its branch.

If your bank card opened for an individual has been blocked. face read how to unlock it in this article.

I hope the information provided will be useful for you, do not forget to subscribe to the channel in order to regularly improve your legal literacy.

Situation No. 1: “We’ll transfer dubious money, but keep 10-20% for ourselves”

The above procedure. But the logic is simple and smacks of nonsense: “You launder proceeds through criminal means and look like a terrorist, but so be it, we will transfer your criminal money to another bank. Just give us 10-20% of the amount.” Sometimes banks don’t even inform you about the “special” tariff. They keep silent... Or they write it in small print in the banking service agreement. Therefore, read the contract carefully. What do the courts think?

- If the bank did not notify the client about special tariffs, did not indicate which transactions it considered suspicious, and did not make a request for explanations and documents, then the bank’s actions in charging a commission are illegal: Resolution of the Moscow District Court of August 24, 2018 in case No. A40 -201153/17. Just read these lines: “The court concluded that, by writing off the disputed funds, the Bank illegally usurped the functions of a government body and established a fee not provided for by law and agreement in the form of a “protective tariff” for conducting banking operations without providing documents, which is contrary the meaning of Federal Law No. 115-FZ “On combating the legalization (laundering) of proceeds from crime and the financing of terrorism .

- Increased commissions are not a form of control, even if this is provided for in the contract: Resolution of the Far Eastern District Court No. F03-3404/2018 dated August 27, 2018 in case No. A73-18762/2017. The enterprising bank, of course, in the fight against terrorism, stipulated in the contract individual conditions for suspicious clients: a commission of 12% when closing an account. The court put the bank in its place, and the businessman returned his honestly earned money: “Law No. 115-FZ, as well as other federal laws, does not contain provisions allowing credit institutions to establish a special commission as an anti-money laundering measure. in an increased size. Collection of a commission for transactions with funds related to the legalization (laundering) of proceeds from crime and the financing of terrorism is not a form of control.”

Situation No. 2: “We will limit access to the Internet bank without requesting documents”

A bank employee calls and says: “We have grounds to block your account under No. 115-FZ . Provide us with documents confirming the legality of the operation.” Or tells you the same thing when you come to the bank. What will you do: run to collect papers or ignore the demand? The bank's requirement in this form is contrary to the law. The bank is obliged to request documents in the following ways:

- “by delivering to the Client or his Representative a request drawn up on paper, certified by the signature of the Authorized Person and the seal of the Bank (branch), containing a list of necessary documents and the period within which the documents must be submitted to the Bank;

- by sending a similar request to the Client via electronic communication channels (if the form of contractual relations with the client involves the exchange of electronic messages)" ( clause 8.2.2. "Model Rules of Internal Control of a Credit Institution", approved by the Regulations of the Bank of Russia dated March 2, 2012 year No. 375-P )

A similar situation occurred in the Resolution of the Moscow District Court of August 13, 2018 in case No. A40-227570/2017. Of course, the businessman won: a telephone request is not a request. Therefore, the bank’s actions to restrict access to the Internet bank are illegal.

Situation No. 3: A “terrorist” is someone who transfers money between his accounts.”

Bank “A” offered you more attractive terms of service than bank “B”. And you decided to open a current account in bank “A”. Bank “B” was notified about the termination of the contract and the transfer of money to a new current account. Who are you after this? Of course, it's a "terrorist". Justify “why - why - how” and bring a suitcase of documents. And anyway, how could you do this, you bastard! Or, your company, which has an account in bank “A”, transfers you money to your “physicist” account in the same bank. Or your company has 2 current accounts in different banks. There are definitely “terrorist” notes...

In all the described cases, there is a risk of blocking if you do not justify the economic meaning of the transactions and provide supporting documents. Although, the bank can find 1000 and 1 reasons to still add you to the ranks of dangerous clients... All that remains is the court. And the courts support businessmen. For example, in the Resolution of the Arbitration Court of the North-Western District dated June 13, 2018 in case No. A56-51915/2017, the court stated: “Since, according to the evidence presented in the case, the Company explained to the Bank the economic meaning of the operation being carried out and provided supporting documents, the refusal to carry out the controversial operation on the grounds of paragraph 11 of Article 7 of Law No. 115-FZ, in the absence of evidence of the Bank’s compliance with the requirements of paragraphs 2, 3 of Article 7 of Law No. 115-FZ, the courts rightfully declared illegal and unfounded.” A similar situation occurred in the Resolution of the Moscow District Court of July 25, 2018 in case No. A40-173510/2017.

Former employee of one of the large banks:

- I worked in a large bank in Russia for more than 4 years as a manager of VIP clients, and during this time I saw enough of everything (I mean negative situations with clients).

But the most difficult situations are precisely the blocking of accounts of individuals engaged in entrepreneurial activities. They were not saved even by the fact that they had service packages open for privileged clients, which allowed them to withdraw millions of sums from their accounts and cards.

BUT!!! As soon as funds began to flow on their cards, even within the limit, their accounts were immediately blocked! Naturally, the question arises: why then do banks allow clients to open platinum cards for large amounts if these cards and accounts are immediately blocked? And then clients cannot “get” their money out of their accounts for months, because... For this you need permission from the Rosfinmonitoring service! The financial monitoring service requires supporting documents about the client’s financial activities, the client provides them... But the saddest thing is that the accounts remain frozen.

It's a vicious circle... Once you get there, you can't get out. In my practice, not a single client’s account has ever been unblocked and not a single client has been excluded from the so-called “STOP LIST”, except for one person: a friend of the bank manager (there are still loopholes for such “friends”). It is not surprising that the bank has lost many important clients, but the reality today is what it is...

Situation No. 4: “We will not unblock the current account / we will charge a commission / we will refuse banking services for an incomplete set of documents, or for conflicting information”

If the documents are indeed fakes, contain gross irregularities in their design, and do not fully reflect the essence of the transactions, then you will definitely be denied service. As happened in the Resolution of the Central District Court of August 1, 2018 in case No. A36-14507/2017. The bank conducted a study not only of documents, but also of the activities of the client’s employees. The general director is on maternity leave, but he signed the documents. Is that possible? No, unless there is a corresponding statement. After all, according to Art. 256 of the Labor Code of the Russian Federation , while on maternity leave, a woman can work part-time or at home only upon application.

And the documents are a mess: contracts for the provision of information and consulting services without attachments, identical loan agreements with “physicists” of non-identical content: different conditions and details, changed dates. In addition, the company did not pay taxes and insurance premiums. The bank refused service and terminated the contract. The court agreed: “Transfer of funds between their accounts for subsequent transfer of funds to the accounts of individuals, issuance of loans to individuals, lack of evidence of the return of funds by borrowers within the prescribed period, failure to provide the requested information, documents confirming the payment of personal income tax, insurance premiums, taxes, the presentation of documents containing contradictory information indicates that the client’s transactions fall under the criteria confirming the possible legalization (laundering) of proceeds from crime...”

And the commission will be charged for contradictory documents if the contract stipulated special tariffs and conditions for closing a current account. And in requests for the provision of documents, they will not forget to refer to the corresponding clause of the contract: Resolution of the Moscow District Court of July 17, 2018 in case No. A40-126172/2017.

The commission can also be withheld for an incomplete set of documents: Resolution of the Moscow District Court of August 15, 2018 in case No. A40-215812/2017. The court considered the 20% commission to be completely legal, since it was provided for in the contract.

By the way, sometimes a link to an incomplete set of documents does not work if the client actually provided the set that the bank requested. But the bank, either due to its inattention or harmfulness, still did not retreat. You can’t do this - the client is right. The businessman turned out to be very attentive and meticulous in Resolution of the Eighteenth AAS No. 18AP-10806/2018 dated August 23, 2018 in case No. A76-3461/2018 . Won.

Blocking an account by a bank under Federal Law 115 - what the dangers are, consequences

Some entrepreneurs are faced with account blocking in their activities. And often it occurs on the basis of Federal Law 115.

But not all businessmen know what the reasons for such action on the part of the bank are. This legal act talks about the legalization of funds that were obtained illegally. And if at least once a legal entity’s account was “frozen” on suspicion of such fraud, then it is blacklisted by all banks.

However, there are precautions that can be taken to avoid blocking. We'll talk about them today.

You will also learn what to do if your account has already suffered an unpleasant fate. One fine day, a businessman may discover that his account is blocked.

What to do in this case, is it possible to get your money and how to make payments with counterparties? The reasons for freezing an account are dubious transactions that are carried out on your account. For example, you have deposited a large amount into your account in small payments over a long period of time or, conversely, you are constantly withdrawing large limits.

Banks do not like such transactions and are often grounds for blocking. According to Federal Law 115, a credit institution has the right to freeze any account if it suspects that you are engaged in money laundering, that is, you are trying to carry out transactions that make illegally obtained funds legal. It follows from the law that. Each of them has a financial monitoring service that closely monitors transactions on the accounts of all clients.

Most often, individual entrepreneurs and small businesses are subject to account freezes.

It is their activity that involves frequent withdrawals and deposits of cash, which arouses the suspicions of banks. True, credit institutions also employ people who can make mistakes.

And often accounts are blocked without reason.

For example, you are a law-abiding citizen, running a “correct” business and are in no way connected with criminal blockings. In this case, a claim for illegal blocking of your account by the bank will help.

However, the consequences of freezing even when drawing up such a document will be disappointing.

You will have to prove that the transactions on the account are legal. To do this, you will need to provide all documents confirming this fact.

They should reflect all amounts that passed through your account before the blocking. Only after carefully studying the documents provided do banks decide to unfreeze the client’s account.

Let's take a closer look at the reasons for account blocking. The legislation gives this right to banks if there are the following reasons: if one of the counterparties is a terrorist (their base is located in any bank. And even if you didn’t know who you were dealing with, then blocking definitely cannot be avoided); when carrying out transactions amounting to more than 600,000 rubles (this is the limit that raises suspicions among Rosfinmonitoring.

It doesn’t matter whether you withdraw money, deposit it or transfer it to someone); the parties to the transaction conduct operations on behalf of wanted persons; the bank has suspicions that the documents you submitted to confirm the legality of the transaction carried out on the account are real;