Forward to IFRS

First of all, it should be said that FAS 6/2020 is undoubtedly another very important step towards bringing together the methodological content of domestic regulatory legal acts and the provisions of IFRS. Following the norms on consolidated reporting implemented in Russian accounting practice, this standard reflects the most significant shift in the rules for recognition and valuation of assets towards the ideas of priority of economic content over the legal form of economic phenomena reflected in accounting.

The entire complex of rules for accounting for fixed assets determined by the new Federal Accounting Standards is based on one general principle: the presence of ownership rights in the accounting entity is no longer considered as a mandatory condition for recognizing fixed assets as an asset of the organization.

Why is it important? The fact is that the rule, which lingered for a very long time in domestic accounting practice, according to which only the property that belongs to the organization by right of ownership is shown in assets, determined the practice of creating a balance sheet in developed countries of Western Europe and North America until approximately the end of the first half of the 19th century . This was typical for economic relations in which a company’s profit was understood as an increase in the volume of its assets, free from debt encumbrances, and the main “issue” for accounting reporting was the company’s solvency. This practice, later called the static approach to the formation of the balance sheet, developed in conditions where the main external users of companies' statements could be their creditors. The assets were thus required to meet the criterion of potentially covering the firm's debts. Something that cannot be sold and the proceeds used to pay off the company’s debts could not be considered an asset.

Already from the middle of the 19th century the situation began to change. This was the time of the third industrial revolution, the economic support of which was the institution of joint stock companies. The functions of owning and managing companies have become increasingly separated. The central question asked of accounting by users of its data external to the company is the question of what is the amount of profit for the reporting period. Consequently, the key indicator of the success of a company’s activities is no longer its solvency, but its profitability.

FSBU 6/2020 FIXED ASSETS

27. The cost of fixed assets is repaid through depreciation, unless otherwise established by this Standard.

28. The following are not subject to depreciation:

investment property assessed at revalued value;

fixed assets whose consumer properties do not change over time (in particular, land plots, environmental management facilities, museum objects and museum collections);objects of fixed assets used for the implementation of the legislation of the Russian Federation on mobilization preparation and mobilization, which are mothballed and not used in the production and (or) sale of products (goods), when performing work or providing services, for provision for a fee for temporary use, for management needs .

29. Depreciation on fixed assets is calculated regardless of the results of the organization’s activities in the reporting period.

30. Accrual of depreciation on fixed assets is not suspended (including in cases of downtime or temporary cessation of use of fixed assets), except for the case when the liquidation value of an item of fixed assets becomes equal to or exceeds its book value. If subsequently the liquidation value of such an item of fixed assets becomes less than its book value, depreciation on it is resumed.

For the purposes of this Standard, the liquidation value of an item of fixed assets is considered to be the amount that the organization would receive in the event of disposal of this item (including the value of material assets remaining from disposal) after deducting the estimated costs of disposal; Moreover, the fixed asset item is treated as if it had already reached the end of its useful life and was in a state characteristic of the end of its useful life.

31. The liquidation value of an item of fixed assets is considered equal to zero if:

a) receipts from the disposal of a fixed asset item (including from the sale of material assets remaining from its disposal) are not expected at the end of its useful life;

b) the amount expected to be received from the disposal of an item of fixed assets is not significant;c) the amount expected to be received from the disposal of a fixed asset cannot be determined.

32. The amount of depreciation of an object of fixed assets for the reporting period is determined in such a way that by the end of the depreciation period the book value of this object becomes equal to its liquidation value.

33. Accrual of depreciation of an object of fixed assets: a) begins from the date of its recognition in accounting. By decision of the organization, it is allowed to begin accrual of depreciation from the first day of the month following the month of recognition of the fixed asset item in accounting;

b) ceases from the moment it is written off from accounting. By decision of the organization, it is allowed to stop accruing depreciation from the first day of the month following the month the fixed asset item is written off from accounting.

34. The method of calculating depreciation is selected by the organization for each group of fixed assets from those established by this Standard. In this case, the chosen method of calculating depreciation should:

a) most accurately reflect the distribution over time of expected future economic benefits from the use of a group of fixed assets;

b) be applied consistently from one reporting period to another, except in cases where the distribution over time of expected future economic benefits from the use of a group of fixed assets changes.

35. Depreciation on fixed assets, the useful life of which is determined by the period during which their use will bring economic benefits to the organization, is accrued using the straight-line method or the reducing balance method.

Depreciation is calculated using the straight-line method in such a way that the cost of a fixed asset subject to depreciation is repaid evenly over the entire useful life of this object. In this case, the amount of depreciation for the reporting period is determined as the ratio of the difference between the book value and liquidation value of an item of fixed assets to the value of the remaining useful life of this item.

Depreciation is calculated using the reducing balance method in such a way that the amount of depreciation of an item of fixed assets for the same periods decreases as the useful life of this item expires. In this case, the organization independently determines the formula for calculating the amount of depreciation for the reporting period, ensuring a systematic reduction of this amount in the following periods.

36. Depreciation on fixed assets, the useful life of which is determined based on the quantity of products (volume of work in physical terms) that the organization expects to receive from the use of a fixed asset item, is accrued in a manner proportional to the quantity of products (volume of work in physical terms).

Depreciation is calculated using the method proportional to the quantity of products (volume of work in physical terms) in such a way as to distribute the cost of a fixed asset item subject to depreciation over the entire useful life of this item. In this case, the amount of depreciation for the reporting period is determined as the product of the difference between the book value and liquidation value of the fixed asset item by the ratio of the indicator of the quantity of production (volume of work in physical terms) in the reporting period to the remaining useful life of the fixed asset item.

When applying the method in proportion to the quantity of products (volume of work in kind), it is not allowed to determine the amount of depreciation for the reporting period based on the amount of receipts (revenue or other similar indicator) from the sale of products (work, services) produced (performed, provided) using this main facilities.

37. The useful life, salvage value and method of calculating depreciation (hereinafter referred to as the elements of depreciation) of an object of fixed assets are determined upon recognition of this object in accounting.

Elements of depreciation of a fixed asset object are subject to verification for compliance with the conditions of use of the fixed asset object. Such a check is carried out at the end of each reporting year, as well as upon the occurrence of circumstances indicating a possible change in the elements of depreciation. Based on the results of such a check, if necessary, the organization decides to change the relevant elements of depreciation. The adjustments arising in connection with this are reflected in accounting as changes in estimated values.

38. The organization checks fixed assets for impairment and takes into account changes in their carrying value due to impairment in the manner prescribed by International Financial Reporting Standard (IAS) 36 “Impairment of Assets”, put into effect on the territory of the Russian Federation by order of the Ministry of Finance of the Russian Federation dated December 28, 2015 No. 217n (registered by the Ministry of Justice of the Russian Federation on February 2, 2021, registration No. 40940).

Compensation for losses associated with the depreciation or loss of an item of fixed assets provided to the organization by other persons is recognized as income in the profit (loss) of the period in which the organization has the right to receive such compensation.

39. In accounting, the amounts of accumulated depreciation and impairment for an item of fixed assets are reflected separately from the initial cost of this item and do not change it.

From solvency to profitability

The general logic of calculating profitability indicators is to correlate the accounting estimate of the company's profit with the assessment of those elements of the statements that represent what can be called profit factors, that is, objects whose management allowed the company to obtain the corresponding income and profit. The most common indicator here (and the most obvious) is return on assets, where such a factor is assets, the average value of which for the reporting period in question falls into the denominator of the calculated fraction.

However, the return on assets indicator will make sense only if we recognize as assets precisely the objects whose management brought profit to the company, that is, the entire complex of funds used in business activities, and not just those to which the company has ownership rights.

Indeed, one can, for example, imagine a company that, located in rented premises on equipment also rented, will produce products from customers’ raw materials. This, it should be said, is a fairly common option for organizing production activities. According to the accounting rules of the 19th century, all property involved in the activities of our company that does not belong to it by right of ownership must be reflected on the balance sheet. Consequently, its cost will not be taken into account when determining the profitability of our company. Thus, the denominator of the corresponding indicators will become negligible in comparison with the data of those companies that choose the policy of acquiring property in ownership. At the same time, their activities can be comparable from an economic point of view, where the costs associated with the chosen option for organizing a business will be of importance, and not the ownership of the property used to produce products.

However, with almost complete coincidence of the costs of operating the companies, our company will look super-profitable in comparison with its competitors who acquire fixed assets and materials as their own. It is obvious that such indicators will veil the real state of affairs, and the criterion for recognizing assets based on the existence of ownership rights to them will no longer meet the requirements for assessing profitability.

New cost limits for calculating asset depreciation

According to paragraph 39 of the Federal Accounting Standard for Public Sector Organizations “Fixed Assets”, approved. by order of the Ministry of Finance of Russia dated December 31, 2016 No. 257n:

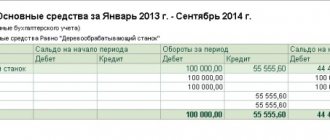

Previously, in accordance with paragraph 92 of the Instructions for the Application of the Unified Chart of Accounts, approved. By order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n (as amended on September 27, 2017) (hereinafter referred to as Instructions No. 157n), depreciation for fixed assets was accrued in the following order:

|

Impact of USSR accounting practices

The entire history of IFRS is the approval of methods for recognizing assets that are not related to the existence of ownership rights to them. At the same time, this criterion lingered for so long in the accounting practice of our fatherland, since during the Soviet period of its development it was successfully transformed into a rule for reflecting on the balance sheets of enterprises property owned by them under the right of economic management.

For the post-Soviet period of development of our economy, the return of the institution of economically independent legal entities with the right to be owners of property became a revolutionary innovation, which, in turn, extended the practice of recognizing assets on the basis of ownership.

And those changes in the accounting of fixed assets that we need to talk about in connection with the release of the Federal Accounting Standards under consideration are a reflection of the ongoing processes of incorporation of the domestic economy into global processes of social development.

So, let's turn to the provisions of FSBU 6/2020 “Fixed Assets”.

Accounting for workwear

Many experts are wondering about the new rules for accounting for workwear in connection with the entry into force of FSBU 5/2019 and the cancellation of the corresponding guidelines. However, no fundamental changes in accounting will occur on this issue.

According to the norms of the new standard, workwear can be accepted for accounting as part of inventories at actual cost, which is determined according to the general rules (paragraph “b”, paragraph 3, paragraph 9, paragraph “a”, paragraph 11, paragraph “a” clause 12 FSBU 5/2019). At the time of transfer of workwear into operation, its cost is written off at a time to the debit of the corresponding cost accounting accounts (subsection “b” clause 41, subsection “b” clause 43 of FSBU 5/2019).

At the same time, if the criteria for useful life and cost are met, workwear should be classified as fixed assets.

According to FSB 6/2020 on accounting for fixed assets, which will come into force for mandatory application from 2022, an organization may decide not to apply this standard to assets with a useful life of more than 12 months, but having a value below the limit established by the organization (p 5 FSBU 6/2020). At the same time, the costs of acquiring such assets are recognized as expenses of the period in which they are incurred (clause 5, , , , 18 PBU 10/99 “Organization expenses”). Consequently, the cost of workwear will be written off as a lump sum or accounted for through depreciation.

In 2021, while PBU 6/01 remains in effect, to recognize an asset as a fixed asset, one should be guided by its norms. Workwear, which is not classified as inventory due to its long service life, should be taken into account as part of fixed assets. Such accounting rules were in effect before, before FAS 5/2019 came into force (Letter of the Ministry of Finance of Russia dated May 12, 2003 N 16-00-14/159).

Recognition Criteria

According to paragraph 4 of FSBU 6/2020, “for accounting purposes, an object of fixed assets is an asset that is simultaneously characterized by the following features:

a) has a material form;

b) is intended for use by the organization in the normal course of business in the production and (or) sale of products (goods), when performing work or providing services, for environmental protection, for provision for temporary use for a fee, for management needs or for use in activities of a non-profit organization aimed at achieving the goals for which it was created;

c) is intended for use by the organization for a period of more than 12 months or a normal operating cycle of more than 12 months;

d) is capable of bringing economic benefits (income) to the organization in the future (to ensure that the non-profit organization achieves the goals for which it was created).”

It should be noted that the signs, the combination of which was considered sufficient to recognize the corresponding object as a fixed asset, according to the latest edition, in paragraph 4 of PBU 6/01 “Accounting for fixed assets” also did not contain a direct indication of ownership as a criterion for recognition. However, sign “c” sounded like “the organization does not intend to subsequently resell this object.” This instruction indirectly preserved the status of ownership as a necessary criterion for recognizing fixed assets, since only the organization’s own property can be “resold.”

In a new way, FSBU 6/2020 also addresses the issue of determining the cost criterion for recognizing an accounting object as a fixed asset.

According to paragraph 5 of FAS 6/2020, “an organization may decide not to apply this Standard in relation to assets that are simultaneously characterized by the characteristics established by paragraph 4 of this Standard, but have a value below the limit established by the organization, taking into account the materiality of information about such assets. In this case, the costs of acquiring and creating such assets are recognized as expenses of the period in which they are incurred. The specified decision is disclosed in the accounting (financial) statements indicating the value limit established by the organization.”

The general idea of recognizing fixed assets in accordance with the definition of an asset given by IFRS is also consistent with the reference of paragraph 7 of FAS 6/2020 to the provisions of FAS 25/2018 “Lease Accounting”.

Criteria for classification as fixed assets

In the FSBU, as part of the criteria, legislators added the presence of a material form; previously there was no such criterion in the PBU.

As one of the criteria, they added that a fixed asset is also considered an asset intended to be leased. Previously, PBU 6 classified assets for use as profitable investments in tangible assets. The new FSBU states that the items of lease agreements must be accounted for in accordance with FSBU 25/2018 “Lease Accounting” (clause 8 of FSBU 6/2020).

The legislator removed the criterion that stipulated that in order to be recognized as a fixed asset, an asset should not be intended for sale.

Please note that FAS does not apply to this type of asset as “long-term assets for sale.” This type of asset is being introduced into PBU 16/02 “Information on discontinued operations” from January 1, 2021. Long-term assets for sale are an item of fixed assets or other non-current assets (except for financial investments), the use of which has been discontinued due to a decision to sell it and there is confirmation that the resumption of use of this item is not expected (an appropriate management decision has been made, actions to prepare an asset for sale, a sale agreement has been concluded, etc. (clause 10.1 of PBU 16/02). Table 1. Criteria for classification as fixed assets

| PBU 6/01, paragraph 4 | FSBU 6/2020, paragraph 4 |

| An asset is accepted by an organization for accounting as fixed assets if the following conditions are simultaneously met: the object is intended for use in the production of products, in the performance of work or provision of services, for the management needs of the organization, or for provision by the organization for a fee for temporary possession and use or for temporary use. use; the object is intended to be used for a long time, i.e. a period of more than 12 months or a normal operating cycle if it exceeds 12 months; the organization does not intend the subsequent resale of this object; the object is capable of bringing economic benefits (income) to the organization in the future | For accounting purposes, an object of fixed assets is considered to be an asset that is simultaneously characterized by the following characteristics: has a tangible form; is intended for use by an organization in the normal course of its activities in the production and (or) sale of its products (goods), when performing work or providing services, for temporary use for a fee, for management needs or for use in the activities of a non-profit organization aimed at achieving the purposes for which it was created; is intended for use by the organization for a period of more than 12 months or a normal operating cycle of more than 12 months; capable of bringing economic benefits (income) to the organization in the future (ensure that the non-profit organization achieves the goals for which it was created) |

Accounting for leased fixed assets

According to paragraph 5 of FAS 25/2018, “accounting objects are classified as lease accounting objects if the following conditions are simultaneously met:

1) the lessor provides the lessee with the leased item for a certain period;

2) the subject of the lease is identified (the subject of the lease is defined in the lease agreement, and this agreement does not provide for the right of the lessor, at its discretion, to replace the subject of the lease at any time during the lease term);

3) the lessee has the right to receive economic benefits from the use of the leased asset during the lease term;

4) the lessee has the right to determine how and for what purpose the leased item is used to the extent that this is not predetermined by the technical characteristics of the leased item.”

According to paragraph 10 of FAS 25/2018, “the lessee organization must recognize [reflect in accounting - M.P.] the subject of the lease on the date of granting the subject of the lease as the right to use the asset with the simultaneous recognition of the lease liability.”

From this prescription we can conclude that the asset reflected by the lessee organization is the right to use the leased property, valued at the amount of the lease obligation reflected in the liability. At the same time, the same paragraph of FAS 25/2018 establishes that “the organization must apply a uniform accounting policy in relation to the right to use an asset and in relation to assets similar in nature of use (in-progress capital investments, fixed assets and others), taking into account the features established by this Standard "

Further, the requirements regarding the rules for assessing leased property in the lessee’s accounting are clarified by the following provisions of FSBU 25/2018.

According to paragraph 13 of FAS 25/2018, “the right to use an asset is recognized at its actual cost. The actual value of the right to use the asset includes:

a) the amount of the initial measurement of the lease liability;

b) lease payments made on the date of provision of the subject of lease or before such date;

c) the tenant’s costs in connection with the receipt of the leased item and bringing it into a condition suitable for use for the planned purposes;

d) the amount of the estimated obligation to be fulfilled by the lessee, in particular, for dismantling, moving the leased item, restoring the environment, restoring the leased item to the condition required by the lease agreement, if the occurrence of such an obligation for the lessee is due to the receipt of the leased item.”

At the same time, it is specifically established that “the lessee, who has the right to use simplified accounting methods, can calculate the actual cost of the right to use the asset based on subparagraphs “a” and “b” of this paragraph. When such a decision is made, the costs specified in subparagraphs “c” and “d” of this paragraph are recognized as expenses of the period in which they were incurred.”

According to paragraph 14 of FAS 25/2018, “the lease liability is initially measured as the sum of the present value of future lease payments as of the date of this measurement.

A lessee that is eligible to use simplified accounting may initially measure the lease liability as the sum of the nominal amounts of future lease payments at the date of that measurement.”

Paragraph 15 of FSBU 25/2018 establishes that “the present value of future lease payments is determined by discounting their nominal values. Discounting is performed using a rate that makes the present value of future lease payments and the non-guaranteed residual value of the leased item equal to the fair value of the leased item. In this case, the unguaranteed liquidation value of the leased asset is considered to be the estimated fair value of the leased asset that it will have by the end of the lease term, minus the amounts specified in subparagraph “e” of paragraph 7 of this Standard, which are included in lease payments.” At the same time, “if the discount rate cannot be determined in accordance with the first paragraph of this paragraph, the rate at which the lessee attracts or could attract borrowed funds for a period comparable to the lease term is applied” [ibid. - M.P.] .

Here the question arises: does it follow from the above instructions that leased fixed assets should be reflected in the accounting records of the lessee company as part of other fixed assets (similar to the property of the company) or should they be presented separately in the reporting? Next we will try to find the answer to it.

FSBU 6/2020: new rules for accounting for fixed assets

FSBU 6/2020 “Fixed assets” was approved by Order of the Ministry of Finance of Russia dated September 17, 2020 No. 204n (hereinafter referred to as the Order). This standard must be applied starting with reporting for 2022. But an organization may decide to start using it before the specified date. Let's see how the new standard differs from the current procedure for accounting for fixed assets.

Federal Accounting Standard 6/2020 replaces PBU 6/01 “Accounting for Fixed Assets,” which will expire on January 1, 2022 (clause 3 of the Order). The standard establishes requirements for the formation of information about fixed assets in accounting. Public sector organizations do not apply FSBU 6/2020.

What is considered the main means

According to clause 4 of FSBU 6/2020, a fixed asset is an asset that simultaneously satisfies the following criteria:

- has a material form;

- intended for use in the normal course of business in the production and (or) sale of products (goods), when performing work or providing services, for environmental protection, for temporary use for a fee, for management needs or for use in the activities of a non-profit organization, aimed at achieving the goals for which it was created;

- intended for use greater than 12 months or a normal operating cycle greater than 12 months;

- capable of bringing economic benefits (income) to the organization in the future (to ensure that the non-profit organization achieves the goals for which it was created).

The difference between this definition of fixed assets and that given in paragraph 4 of PBU 6/01 is the addition of a provision on the material form of the object and the absence of an indication that the organization does not intend to subsequently resell the object.

Note that from the examples given in paragraph 5 of PBU 6/01, it follows that fixed assets, according to the rules of this provision, have a material form. And the absence of a condition for acquiring an object not for resale is compensated by the fact that FAS 6/2020, in principle, does not apply to long-term assets for sale (clause 6). Thus, we can talk about the actual identity of the definitions.

As in PBU 6/01, the unit of accounting for fixed assets according to the rules of FSBU 6/2020 is an inventory item, the definition of which is similar to that given in paragraph 6 of PBU 6/01. The innovation is that independent inventory items are recognized as the significant costs of an organization for repairs, technical inspection, and maintenance of fixed assets with a frequency of more than 12 months or more than the usual operating cycle exceeding 12 months (clause 10 of FSBU 6/2020).

Another innovation concerns objects that meet the criteria for recognizing fixed assets, but whose value is below the limit established by the organization. According to clause 5 of PBU 6/01, such objects can be reflected as part of inventories. In this case, the cost limit established by the organization cannot be more than 40,000 rubles. for a unit. According to the rules provided for in paragraph 5 of FAS 6/2020, an organization may not apply this standard to assets that meet the criteria for recognition of fixed assets, but have a value below the limit established by the organization, taking into account the materiality of information about such assets. In this case, the costs of acquiring and creating such assets are recognized as expenses of the period in which they are incurred.

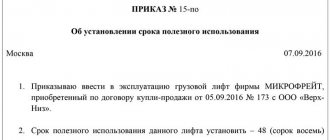

Useful life

The concept of “useful life” has not changed. This period is considered to be the period during which the use of a fixed asset item will bring economic benefits to the organization (clause 8 of FSBU 6/2020, clause 4 of PBU 6/01). But the criteria for determining this period have been adjusted.

Thus, according to clause 20 of PBU 6/01, the useful life is determined based on:

- the expected life of the facility in accordance with expected productivity or capacity;

- expected physical wear and tear, depending on the operating mode (number of shifts), natural conditions and the influence of an aggressive environment, the repair system;

- regulatory and other restrictions on the use of this object (for example, rental period).

Paragraph 9 of FSBU 6/2020 contains the first two criteria from PBU 6/01 and two more new ones:

- expected obsolescence, in particular as a result of changes or improvements in the production process or as a result of changes in market demand for products or services produced by fixed assets;

- plans for the replacement of fixed assets, modernization, reconstruction, technical re-equipment.

That is, regulatory and other restrictions on the use of an object (for example, the lease term) will no longer determine the useful life of the object.

Classification of fixed assets

FAS 6/2020 introduced a requirement for the mandatory classification of fixed assets, which was not in PBU 6/01. Clause 11 of FSBU 6/2020 stipulates that fixed assets are subject to classification by type (for example, real estate, machinery and equipment, vehicles, production and business equipment) and groups. A group is considered to be a collection of fixed assets of the same type, combined based on the similar nature of their use.

Fixed assets, which are real estate intended to be provided for a fee for temporary use and (or) to generate income from an increase in its value, form a separate group of fixed assets called “investment real estate.”

Valuation of fixed assets

According to the rules of PBU 6/01, an item of fixed assets is accepted for accounting at its original cost. At the same time, a commercial organization has the right to revalue groups of similar fixed assets at current (replacement) cost no more than once a year (clause 15 of PBU 6/01). That is, the company may decide to revaluate fixed assets even after several years of accounting for these objects at their original cost.

FSBU 6/2020 establishes the following rules. At the time of recognition in accounting, an item of fixed assets is valued at its original cost (clause 12 of FSBU 6/2020). After its recognition, the company evaluates the object in one of the following ways:

- at original cost;

- at a revalued value.

The selected valuation method applies to the entire group of fixed assets (clause 13 of FSBU 6/2020).

Valuation at original cost

The initial cost of an item of fixed assets is considered to be the total amount of capital investments associated with this item incurred before recognizing the item as part of fixed assets (clause 12 of FAS 6/2020). Which costs are classified as capital investments is determined by FSBU 26/2020 “Capital Investments” (for more information about the standard, see p. 7 of the current issue). Therefore, FSB 6/2020 does not contain a list of costs included in the initial cost contained in PBU 6/01.

If the company has decided to evaluate fixed assets at historical cost, such cost and the amount of accumulated depreciation are not subject to change, except in cases established by the standard (clause 14 of FSBU 6/2020). Thus, the initial cost increases by the amount of capital investments associated with the improvement and (or) restoration of the facility at the time of completion of such capital investments (clause 24 of FSBU 6/2020). If the initial cost takes into account the amount of the estimated liability for future dismantling, disposal of the object and restoration of the environment, then a change in this amount (without taking into account interest) increases or decreases the initial cost of the fixed asset item (clause 23 of FSBU 6/2020).

Valuation at revalued amount

When measuring fixed assets at a revalued cost, regular revaluation is carried out so that the cost of the fixed asset is equal to or does not differ significantly from its fair value. Fair value is determined in the manner prescribed by IFRS 13 “Fair value measurement”, put into effect on the territory of the Russian Federation by Order of the Ministry of Finance of Russia dated December 28, 2015 No. 217n (clause 15 of FSBU 6/2020).

The procedure for revaluing investment real estate and other objects differs.

For fixed assets other than investment property:

- The frequency of revaluation for each group of fixed assets depends on the extent to which their fair value is subject to change. If an organization decides to revaluate fixed assets no more than once a year, then this is done as of the end of the corresponding reporting year (clause 16 of FSBU 6/2020);

- revaluation is carried out by recalculating the historical cost and accumulated depreciation so that the book value of the fixed asset after revaluation is equal to its fair value. It is also acceptable to first reduce the original cost of the object by the amount of depreciation accumulated on it at the date of revaluation, and then the resulting amount is recalculated so that it becomes equal to the fair value of the object. For fixed assets included in the same group, one revaluation method must be used (clause 17 of FSBU 6/2020).

For investment properties:

- revaluation is carried out for all objects at each reporting date;

- the initial cost of the object (including previously revalued) is recalculated so that it becomes equal to its fair value (clause 21 of FSBU 6/2020).

Accounting for revaluation results

For investment real estate, revaluation or depreciation is included in the financial result of the company as income or expense of the period in which the revaluation was carried out (clause 21 of FSBU 6/2020).

For fixed assets other than investment property:

- revaluation amounts are reflected as part of the total financial result of the revaluation period separately without inclusion in the profit (loss) of this period (clause 18 of FAS 6/2020);

- revaluation, restoring the amount of depreciation of an object in previous periods, is recognized as income of the period in which the revaluation was made (clause 18 of FSBU 6/2020);

- the amounts of the markdown are included in the expenses of the period in which the revaluation was made;

- a markdown that reduces the amount of revaluation of an object in previous periods is reflected as part of the total financial result of the markdown period separately without inclusion in the profit (loss) of the period (clause 19 of FSBU 6/2020).

The accumulated revaluation is written off to retained earnings in one of the following ways:

- at a time when writing off a fixed asset item;

- as depreciation is calculated. In this case, the part of the accumulated revaluation to be written off represents the positive difference between the amount of depreciation for the period, calculated based on the original cost of the fixed asset item, taking into account the latest revaluation, and the amount of depreciation for the same period, calculated based on the original cost of the object without taking into account revaluations.

The method adopted by the company applies to all objects other than investment real estate (clause 20 of FSBU 6/2020).

Revaluation or depreciation of investment real estate is included in the financial result of the organization as income or expense of the period in which the revaluation was carried out (clause 21 of FSBU 6/2020).

Book value

In the balance sheet, fixed assets are reflected at book value, which is their original cost reduced by the amount of accumulated depreciation and impairment (clause 25 of FSBU 6/2020).

If, as a result of a change in the purpose of an object assessed at a revalued value, it ceases or begins to be classified as investment property, the book value of such an object as of the date of change in its purpose is considered to be its original cost (clause 26 of FSBU 6/2020).

Depreciation

FSBU 6/2020 defines the start and end dates of depreciation calculation differently. Thus, depreciation begins to accrue from the date of recognition of an item of fixed assets and stops from the moment it is written off from accounting. But by decision of the organization, it is allowed to accrue depreciation in the same way as now, from the 1st day of the month following the month of recognition of the fixed asset object, and stop it from the 1st day of the month following the month the object was written off (clause 33 of FAS 6 /2020).

Liquidation value

The standard introduces a new concept - the liquidation value of an item of fixed assets. It is considered the amount that the organization would receive in the event of disposal of the object (including the cost of material assets remaining from disposal) after deducting the estimated costs of disposal. In this case, the fixed asset item is considered as if it had already reached the end of its useful life and is in a state characteristic of the end of this period (clause 30 of FSBU 6/2020).

The liquidation value is recognized as zero if:

- proceeds from the disposal of the object (including from the sale of material assets remaining from its disposal) are not expected at the end of its useful life;

- the amount expected to be received from the disposal of the object is not significant;

- the amount expected to be received from the disposal of an object cannot be determined (clause 31 of FSBU 6/2020).

Depreciation amount

The calculation of depreciation for the reporting period has also undergone changes. According to clause 32 of FSBU 6/2020, the amount of depreciation is determined so that by the end of the depreciation period the book value of the fixed asset becomes equal to its liquidation value.

Depreciation accrual is not suspended (including in cases of downtime or temporary cessation of use of fixed assets), except for the case when the liquidation value of the object becomes equal to or exceeds its book value. If subsequently the liquidation value of the object becomes less than its book value, depreciation on it is resumed (clause 30 of FSBU 6/2020).

Methods for calculating depreciation

Unlike PBU 6/01, which provides for four methods of calculating depreciation, FSBU 6/2020 uses only three. The new standard does not provide for a method of writing off cost based on the sum of numbers of years of useful life.

The linear method or the reducing balance method can be used only for objects whose useful life is determined by the period during which they will bring economic benefits (clause 35 of FSBU 6/2020).

With the straight-line method, depreciation is calculated so that the cost of the object is paid off evenly over its entire useful life. In this case, the amount of depreciation for the reporting period is determined as the ratio of the difference between the book value and liquidation value of the object to the value of its remaining useful life.

Depreciation is calculated using the reducing balance method in such a way that the depreciation amounts for the same periods decrease as the useful life of the asset expires. In this case, the organization independently determines the formula for calculating the amount of depreciation for the reporting period, ensuring a systematic reduction of this amount in the following periods (clause 35 of FSBU 6/2020).

If the useful life is established based on the quantity of products (volume of work in physical terms) that the organization expects to receive from the use of the facility, depreciation is charged in proportion to the quantity of products (volume of work in physical terms) (clause 36 of FSBU 6/2020). Depreciation is calculated using this method in such a way as to distribute the cost of the object over its entire useful life. In this case, the amount of depreciation for the reporting period is determined as the product of the difference between the book value and liquidation value of the object by the ratio of the indicator of the quantity of production (volume of work in physical terms) in the reporting period to the remaining useful life. It is not allowed to determine the amount of depreciation for the reporting period based on the amount of receipts (revenue or other similar indicator) from the sale of products (work, services) produced (performed, provided) using fixed assets (clause 36 of FSBU 6/2020).

Damping elements

FSBU 6/2020 introduces the concept of depreciation elements. They are considered to be the useful life, liquidation value and method of calculating depreciation, determined when recognizing an item of fixed assets in accounting.

Depreciation elements must be checked for compliance with the conditions of use of the fixed asset. Such a check should be carried out at the end of each reporting year, as well as upon the occurrence of circumstances indicating a possible change in the elements of depreciation. Based on the results of the audit, if necessary, the organization decides to change the relevant elements of depreciation. The adjustments that arise in connection with this are reflected in accounting as changes in estimated values (clause 37 of FSBU 6/2020).

Impairment

The company must test its property, plant and equipment for impairment. Accounting for changes in their book value due to impairment is carried out in the manner prescribed by IAS 36 “Impairment of Assets” (put into effect by Order of the Ministry of Finance of Russia dated December 28, 2015 No. 217n).

Compensation for losses associated with depreciation or loss of fixed assets provided to the company by other persons is recognized as income in profit (loss) of the period in which the right to receive such compensation arises (clause 38 of FSBU 6/2020). In accounting, the amounts of accumulated depreciation and impairment for an item of fixed assets are reflected separately from the initial cost of this item and do not change it (clause 39 of FSBU 6/2020).

Write-off

Just as now, an item of fixed assets that is retired or is not capable of bringing economic benefits to the organization in the future is written off from accounting (clause 40 of FSBU 6/2020).

When writing off, the amounts of accumulated depreciation and accumulated impairment on an object are included in the reduction of its original cost (revalued value) (clause 42 of FSBU 6/2020). The difference between the sum of the book value of the written-off object and the costs of its disposal and proceeds from disposal is recognized as income or expense in the profit (loss) of the period in which the object is written off (clause 44 of FSBU 6/2020).

Costs for dismantling, disposal of the facility and restoration of the environment are recognized as expenses of the period in which they were incurred, except for cases where an estimated liability was previously recognized in relation to these costs (clause 43 of FSBU 6/2020).

Adjustments upon transition to FSBU 6/2020

According to the provisions of paragraph 49 of FAS 6/2020, in the reporting from which the standard is applied, a one-time adjustment is allowed to the book value of fixed assets at the beginning of the reporting period (the end of the period preceding the reporting period). For adjustment purposes, the book value of a fixed asset is its original cost (taking into account revaluations) less accumulated depreciation. The amount of accumulated depreciation is calculated according to the rules of FAS 6/2020 based on the specified initial cost, liquidation value and the ratio of the expired and remaining useful life.

If a company evaluates objects at a revalued cost, it must carry out a revaluation at the date of adjustment and recognize the result of the revaluation (if any) in equity, adjusting (if necessary) a similar indicator formed before the application of the standard.

If an object was previously accounted for as part of fixed assets, but in accordance with FAS 6/2020 is not included in them, the cost of such an object is written off to retained earnings, except in cases of reclassification of such objects into another type of asset.

You may admit it, or you may not.

According to paragraph 11 of FAS 25/2018, “the lessee may not recognize the leased item as a right to use an asset and not recognize a lease liability in any of the following cases:

a) the lease term does not exceed 12 months on the date of provision of the subject of lease;

b) the market value of the leased item without taking into account depreciation (that is, the cost of a similar new object) does not exceed 300,000 rubles, and the lessee has the opportunity to receive economic benefits from the leased item primarily independently of other assets; [It should be noted that this value can be considered by organizations as a reference point for the “cost limit” for recognition in accounting for their own fixed assets. After all, the above requirement for unity of accounting policies regarding the rights to use property and similar proprietary property of companies makes it possible to call the choice of a cost limit for own fixed assets, for example, below 300,000 rubles, incorrect. However, since the adoption of FSBU 25/2018, prices in Russia have changed significantly. And from this point of view, this very requirement of FSBU 25/2018 is increasingly losing its economic meaning. Here we can recommend taking as a basis the provisions of the later edition of FSBU 6/2020 - M.P.].

c) the lessee is an economic entity that has the right to use simplified accounting methods, including simplified accounting (financial) reporting (hereinafter referred to as simplified accounting methods).”

In this case, “lease payments are recognized as an expense on a straight-line basis over the lease term or on the basis of another systematic approach reflecting the nature of the lessee’s use of the economic benefits from the leased asset” (clause 11 of FSBU 25/2018).

Clause 12 of FSBU 25/2018 introduces restrictive conditions that make it possible to account for leases “in the old way”:

a) the lease agreement should not provide for the transfer of ownership of the leased item to the lessee and the possibility of the lessee repurchasing the leased item at a price significantly lower than its fair value on the date of repurchase;

b) the leased item is not intended to be subleased.

Regarding paragraph “b” of these conditions, it should be noted that the wording “not expected” actually deprives it of restrictive force, since a change in what was assumed can always be justified by changes in the conditions of economic activity.

New standard – when to apply?

The new FSBU 6/2020 “Fixed Assets” was approved by Order of the Ministry of Finance dated September 17, 2021 No. 204n.

It is mandatory for reporting for 2022, and voluntary in 2021. First, let's remember what's new in the new standard in terms of determining the tax base for property tax.

Firstly, the OS classification needs to be done in a new way. They must be distributed by type and group (clause 11 of FSBU 6/2020). Kinds:

- real estate;

- vehicles;

- cars and equipment;

- production equipment, etc.

Objects of the same type and equally used are combined into groups. In the OS type “Real Estate”, for example, it is necessary to take into account investment real estate. This includes objects intended for rental or purchased with the expectation of increasing their value.

For groups, a single method of subsequent valuation is established: at the original or revalued cost (previously it was the current (replacement) cost).

Secondly, the initial cost of the OS is being redefined.

Fixed assets are still taken into account at their original cost. But there is no list of costs included in it in FSBU 6/2020. And there is a general definition of the initial cost: this is the amount of capital investments associated with the object made before the object was registered (clause 12 of FSBU 6/2020).

Together or separately?

Let's return to the question asked above. Paragraphs 13-16 of FSBU 25/2018 talk about the rules for recognizing and assessing the right to use the objects of lease agreements, and not, for example, “fixed assets in the form of the right of use.” At the same time, according to paragraph 17 of FAS 25/2018, “the cost of the right to use an asset is repaid through depreciation, except in cases where assets similar in nature of use are not depreciated. The useful life of the right to use the asset should not exceed the lease term, unless the transfer of ownership of the leased item to the lessee is expected.”

So, what kind of answer do we get about the type of assets that should be recognized as leased fixed assets, taking into account that, according to paragraph 7 of FAS 6/2020, “features of accounting for the items of lease agreements (sublease), as well as other agreements, the provisions of which are separately or in conjunction, provide for the provision of property for temporary use for a fee, are established by the Federal Accounting Standard FSBU 25/2018 “Accounting for Leases”?

Please note that paragraph 7 of FSBU 6/2020 is not about the specifics of accounting for fixed assets, but the items of the lease agreement. FSBU 25/2018 itself (clause 1) “establishes requirements for the formation in the accounting of organizations of information about accounting objects when receiving (providing) property for a fee for temporary use, acceptable methods of accounting for such objects, the composition and content of this information, disclosed in the accounting (financial) statements of organizations.”

Let us note once again that paragraph 10 of FSBU 25/2018 speaks of the recognition by the lessee of “the subject of the lease on the date of granting the subject of the lease as the right to use the asset.”

As for FAS 6/2020, here, according to paragraph 4, a tangible asset is reflected primarily as a fixed asset, but not the right to use it.

From a formal analysis of the provisions of FAS 25/2018 and FAS 6/2020, it follows that when recognized as non-current assets of a company, own and leased fixed assets are subject to separate presentation in its balance sheet: own property as fixed assets, and leased property as “rights to use leased property.”

How to determine the property tax base

In a letter dated December 22, 2021 N 03-05-05-01/112530, the Ministry of Finance clarified the issue of calculating the tax base and paying corporate property tax when applying the new FSBU 6/2020 “Fixed Assets”.

The general procedure for determining the tax base for property tax, determined by the average annual value, is established in Article 375 of the Tax Code of the Russian Federation.

When calculating tax on assets taxed at their average annual value, the tax base is determined based on accounting indicators based on its residual value. If the fixed asset is not depreciated, its value is taken to be the difference between the original cost and depreciation, the amount of which is calculated according to the established depreciation rates for accounting purposes at the end of each tax (reporting) period.

The Ministry of Finance has formulated the following rule for determining the tax base for property.

Since the book value of an asset according to the new FAS 6/2020 is the original cost, reduced by depreciation and impairment, and also taking into account that capital investments during the period of use of the asset increase its initial cost, to calculate the taxable base for property tax, you need the purchase price asset, subtract depreciation and impairment and add the cost of investments associated with the improvement and (or) restoration of fixed assets.

Once an asset is recognized as fixed asset, it can be revalued. But since fixed assets are distributed and accounted for by groups, all fixed assets from the corresponding group (including investment property) will need to be revalued.

With regard to investment real estate, FSBU 6/2020 establishes the following.

If such real estate is accounted for at a revalued value, depreciation is not charged on it (clause 28 of FSBU 6/2020). But its price is regularly updated so that it is equal to or does not differ materially from fair value. In this case, wear does not need to be determined.

The idea is clear, but what about the implementation?

The next question arises: how can this be realized?

In the positions of Section I “Non-current assets” of the current form of the balance sheet, in addition to the line “Fixed assets” for reflecting leased property, the line “Other non-current assets” should be considered the most “suitable”.

At the same time, if the volume of leased fixed assets is so significant that it significantly determines the picture of the financial position of the lessee company, the presentation of their assessment as part of “Other non-current assets” can be considered as masking the real state of affairs.

FSBU 25/2018 establishes a number of rules for disclosing information about leased property in the reporting of the tenant organization (Section IV). Based on their content, the reflection of leased facilities as part of fixed assets, with appropriate disclosure of this data in the reporting, can be considered as not concealing the real state of affairs of the company.

Thus, given the inconsistency between the provisions of FAS 25/2018 and FAS 6/2020, we recommend that lessees record in their accounting policies the chosen option for recognizing leased fixed assets in the balance sheet.