From your employees' salaries, you withhold personal income tax or personal income tax - 13%, transfer it to the state, and give the remaining money to the employee. This is how it happens in life.

You hired an employee and agreed that you would give him 20 thousand rubles a month. The employment contract must indicate a salary of 22,990 rubles. This amount includes 13% personal income tax, which you will transfer to the state. Every month you pay 20 thousand rubles to the employee and 2,990 rubles to the tax office.

What is 6-NDFL?

You must report for withheld and transferred personal income tax. For this, they came up with two reports: 6-NDFL, which is submitted every quarter, and 2-NDFL, which the tax office expects only once a year.

In addition to employee salaries, personal income tax must be paid on other income that individuals receive from you:

- remuneration under civil law contracts,

- dividends,

- interest-free loans,

- gifts, the total value of which exceeds 4,000 rubles during the year.

If the physicist received income from you at least once during the year, you need to submit 6-NDFL.

In the report, indicate general data for all physical entities. persons who received income from you. There is no need to separate information for each person; there is another report for this - 2-NDFL.

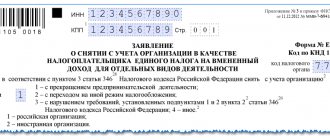

Report form 6-NDFL

Rules for filling out 6-NDFL

Individual entrepreneur on the simplified tax system and UTII - where to submit 6-NDFL?

The Federal Tax Service of Russia in a letter dated August 1, 2021 No. BS-4-11/ [email protected] “On sending clarifications on the issues of submitting and filling out the calculation of the amounts of personal income tax calculated and withheld by the tax agent (Form 6-NDFL)” commented on the rules regarding the procedure for preparing and submitting quarterly calculations in form 6-NDFL.

This Letter from the Federal Tax Service answers the most frequently asked questions. I strongly advise anyone who has employees and pays remuneration to individuals under employment contracts or GPC (civil law) agreements to read it in its entirety.

But in this article I would like to draw your attention to the issue concerning individual entrepreneurs combining activities subject to the simplified tax system and UTII.

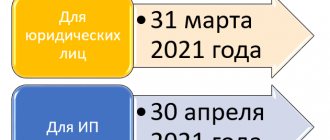

Deadlines for submitting 6-NDFL

6-NDFL should be submitted once a quarter:

- for the 1st quarter - until April 30

- for half a year - until August 2

- 9 months before November 1

- for a year - until March 1 of the next year.

If you paid an individual for the first time only in the 2nd quarter, submit 6-NDFL for six months, 9 months and a year.

Anton is an individual entrepreneur and works alone. In June, he turned to a copywriter who wrote 5 articles for the site. Everything was formalized under a copyright contract. Anton paid 10,000 rubles to the copywriter and 1,495 rubles in personal income tax to the state. In July, Anton needs to submit 6-NDFL for six months, 9 months, and then report for the year.

How and where to report on 6-NDFL

Like other documents for the tax office, 6-NDFL is submitted to the tax office at the place of registration of the individual entrepreneur. However, if the individual entrepreneur uses a combined system, then the report will also be provided at the place of actual activity, if it does not coincide with the place of registration. The combined taxation system must be registered with the tax office.

Personal account in the Federal Tax Service

You can submit reports either by mail, online, or in person. The best way is electronic sending through your personal account. It is necessary to submit 6-NDFL in advance, because the tax inspector may discover errors that need to be promptly corrected.

How to fill out section 1 of the 6-NDFL report?

Summarizes data for all months of the reporting period - from January 1 to June 30.

Line 020: indicate the income of individuals from January 1 to June 30 - before personal income tax was deducted from it. Salary from January to June, including salary for June, which you paid already in July. Vacation pay and sick leave benefits paid from January to June - it doesn’t matter for what period. Other income that the physicist received from January to June and from which you must withhold personal income tax.

Line 030 - the amount of deductions for income from line 020. For example, children's, property, social deductions.

Line 040 - the amount of personal income tax on income from line 020.

Lines 025 and 045 - fill out only if you paid dividends.

Line 050 - fill in if there are foreign workers with a patent.

Line 060 - the number of people whose income you reflected in 6-NDFL.

Line 070 is the amount of personal income tax that has been withheld since the beginning of the year. It may not coincide with the amount in line 040. For example, it is not possible to withhold personal income tax until the end of the year, or income was received in one quarter, and tax was withheld in another.

Line 080 is personal income tax, which you will not be able to withhold until the end of the year. For example, personal income tax on a gift worth more than 4,000 rubles to a person who does not receive cash income from you.

Line 090 - fill in if tax was returned to employees.

Calculation according to form 6-NDFL in 2018

In accordance with paragraph three of paragraph 4 of Article 83 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), if several separate divisions of an organization are located in the same municipality, the federal cities of Moscow, St. Petersburg and Sevastopol in territories under the jurisdiction of different tax authorities, registration of an organization can be carried out by the tax authority at the location of one of its separate divisions, determined by this organization independently.

How to fill out section 2 of the 6-NDFL report?

Indicate only payments for the third quarter - from July 1 to September 30, separately for each month.

Line 100 - date of receipt of income:

- Salary is the last day of the month for which you pay it.

- Remuneration under a civil contract, vacation pay and sick pay - the day the income is paid.

Line 110 is the tax withholding date. Usually matches line 100. Exceptions:

- With advance payment - the day of payment of the final salary for the month.

- For material benefits, gifts worth more than 4,000 rubles - on the next salary day.

- For excess daily allowances - the nearest salary payment day for the month in which the advance report is approved.

Line 120 is the date when the tax must be paid. Determined according to Article 226 of the Tax Code. If this date is in the 4th quarter, do not include income in section 2, even if you have already shown it in section 1. For example, do not include in section 2 a salary for June that was paid in July.

Line 130 is the entire amount of income for the 2nd quarter, before personal income tax was withheld from it.

Line 140 - the amount of personal income tax withheld for the 2nd quarter.

In one block of lines 110-140, show income for which all three dates coincide: receipt of income, withholding and payment of tax. You can submit a report on paper if you have no more than 10 employees. And only electronically - if you have more than 10 employees.

Deregistration as a UTII payer: where is an entrepreneur required to submit 6-NDFL?

An individual entrepreneur is obliged (in case of deregistration as a UTII payer) to submit a report to the inspectorate at the place of residence

11/07/2017Russian tax portal

Author: Tatyana Sufiyanova (tax and duties consultant)

The Federal Tax Service considered the issue of submitting a report in Form 6-NDFL by an entrepreneur who, at the time of filing the report, had already been deregistered as a UTII payer (Decision of the Federal Tax Service of the Russian Federation dated August 2, 2017 No. SA-3-9 / [email protected] ) .

The Tax Service received an online request from an entrepreneur who, until December 30, 2021, carried out activities and paid UTII. It is worth noting that the individual entrepreneur was registered in two inspections - at the place of residence and at the place of business on UTII. When the reporting deadline approached, namely, on February 27, 2021, the entrepreneur submitted the 6-NDFL report for 2021 to the tax office, in which he was registered as a UTII payer.

But he was refused to accept the report, which is why a controversial situation arose. Is the entrepreneur right or wrong? As the tax service said, par. 6 paragraph 2 art. 230 of the Tax Code of the Russian Federation establishes that tax agents - individual entrepreneurs who are registered with the tax authority at the place of activity in connection with the application of the taxation system in the form of UTII, submit a document containing information about the income of individuals for the past tax period, and the calculation of amounts Personal income tax to the tax authority at the place of registration in connection with the implementation of such activities.

The basis for refusal to accept a tax return (calculation) is, inter alia, the submission of a tax return (calculation) to a tax authority whose competence does not include the acceptance of this tax return (calculation).

Thus, since the taxpayer on December 30, 2021 was removed from tax registration at the place of activity in connection with the application of the taxation system in the form of UTII, the calculation in form 6-NDFL should have been submitted to the tax authority at the place of registration as an individual entrepreneur.

Since on the date of submission of the report (which was February 27, 2017), the entrepreneur had already been deregistered as a UTII payer, he had to report to the tax office at his place of registration.

Let us remind you that deregistration of a UTII payer upon termination of business activities subject to single tax or transition to a different taxation regime is carried out on the basis of an application. The application is submitted to the tax authority within five days from the date of termination of business activity subject to a single tax, or from the date of transition to a different taxation regime, or from the last day of the month of the tax period in which violations of the requirements established by subsection. 1 and 2 clause 2.2 art. 346.26 Tax Code of the Russian Federation.

The date of deregistration of a taxpayer is considered to be the date indicated in the application for termination of business activities subject to UTII taxation, or the date of transition to a different taxation regime.

The tax authority, within five days from the date of receipt from the taxpayer of an application for deregistration as a single tax payer, sends him a notice of deregistration.

How to fill out an application for deregistration as a UTII payer?

In order for an entrepreneur to be deregistered, he must fill out an application using the UTII-4 form, the form of which was approved by order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/ [email protected]

On the title page of the application, under the title, there is a field “I request, in accordance with paragraph 3 of Article 346.28 of the Tax Code of the Russian Federation, to deregister an individual entrepreneur in connection with”, which consists of one acquaintance. In this cell you need to put the corresponding number:

– “1” – with the termination of entrepreneurial activity subject to a single tax on imputed income;

– “2” – with a transition to a different taxation regime;

– “3” – in violation of the requirements established by subparagraph 1 of paragraph 2.2 of Article 346.26 of the Tax Code of the Russian Federation;

– “4” – other. Number 4 is indicated if an individual entrepreneur reports the termination of a particular type of business activity and the address of the place where this activity is carried out.

For example, an entrepreneur conducted two types of activities, one of which was subject to UTII. The individual entrepreneur decided to stop engaging in activities that were transferred to “non-menu”. But the entrepreneur himself continues to work and is not deregistered as an entrepreneur, in which case we must put “1” in the specified cell.

The application consists of a title page and an Appendix. If the number of types of business activities and (or) places of business activity is more than three, the required number of sheets of the appendix to form No. UTII-4 is filled out.

Downloads

- Decision of the Federal Tax Service of the Russian Federation dated August 2, 2017 N CA [email protected] (82Kb)

Post:

Comments

What will be the violation?

Failure to submit the report on time: a fine of 1,000 rubles for each month of delay, blocking of the bank account after 10 days. Provide false information: 500 rubles for each false document.

Submit reports in three clicks

Elba is suitable for individual entrepreneurs and LLCs with employees. The service will prepare all the necessary reporting, calculate salaries, taxes and contributions, and generate payments.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

How and where to submit the last report when closing (liquidating) an individual entrepreneur with employees

Strictly speaking, an individual entrepreneur is not closed or liquidated - it simply ceases its officially declared entrepreneurial activity. There is also a nuance here: the deadlines for submitting reports during liquidation are fixed in Art. 55 of the Tax Code of the Russian Federation, but only for organizations. Explanations for submitting the latest 6-personal income tax were also issued by the Federal Tax Service for organizations (see letter dated March 30, 2016 No. BS-3-11 / [email protected] ). What should an individual entrepreneur do?

In all likelihood, before the release of appropriate comments from the Federal Tax Service, when terminating activities in 2021 and subsequent years, individual entrepreneurs and employees should act in a similar manner to organizations. This is also supported by the fact that, being a tax agent in relation to its employees, the individual entrepreneur is obliged to fulfill his agency duties in full before he ceases his activities completely. That is, individual entrepreneurs should withhold and pay personal income tax on settlements with dismissed employees, and also report on this.

Then the last 6-personal income tax will be generated by the individual entrepreneur and submitted to the tax office for his last personal income tax billing period. For example, if an individual entrepreneur submitted an application for deregistration in June 2020, made the last payments to employees in July 2020, and in the same July 2020 withheld and paid personal income tax on these payments to the budget - he needs to submit the last report for January - July 2020, for the period up to and including the date of the last tax payment. Submission of the latest report is carried out similarly to the current ones - at the place of payment of personal income tax on the income of individual entrepreneurs. As for the deadline for submission, it can be assumed that the individual entrepreneur must meet the general reporting deadline for 6-NDFL.

Read about the deadlines for submitting the 6-NDFL report here.

Place of submission of 6-NDFL for individual entrepreneurs on UTII and PSN with employees in different regions

In practice, there are situations when an individual entrepreneur operates in several regions and each has hired employees. In such circumstances, there are nuances of the current legislation regarding individual entrepreneurs:

- By virtue of the provisions of Art. 55 of the Civil Code of the Russian Federation, individual entrepreneurs are not those legal entities that can have separate divisions. Thus, an individual entrepreneur has no obligation to go to the tax office to register a division, even if he actually works in several regions and there are jobs there. The only exceptions to this rule are:

- When an individual entrepreneur buys commercial real estate in another region, then he needs to register as the owner of the property. And only for paying taxes related to real estate.

- When an individual entrepreneur registers a UTII in another region, he is registered with the regional Federal Tax Service, since this special regime is “tied” to the place of activity and the tax is paid at the place where the individual entrepreneur is registered in the jurisdiction of the tax authority related to this specific place. At the same time, individual entrepreneurs conduct settlements with the regional Federal Tax Service Inspectorate both on UTII and on personal income tax of employees engaged in activities on UTII in a given location (clause 7 of Article 226 of the Tax Code of the Russian Federation).

- When an individual entrepreneur issues a patent in another region, the need to register with the tax authorities follows the same principle as UTII. Payment of personal income tax for hired individuals is carried out in the same manner (clause 7 of article 226 of the Tax Code of the Russian Federation).

- Consequently, in any case, individual entrepreneurs do not and cannot have separate divisions, as they are interpreted by the Tax Code of the Russian Federation. Therefore, individual entrepreneurs are not subject to the requirements of the Tax Code of the Russian Federation for submitting a separate 6-NDFL report for each division. That is, if an individual entrepreneur has the duties of a tax agent for personal income tax, the individual entrepreneur reports and transfers the tax only to the tax authority at the place of his registration, regardless of where his employees actually work.