Basic composition of the declaration

The report form was approved by Order of the Federal Tax Service of the Russian Federation dated October 29, 2014 No. ММВ 7-3/558, the last changes were made to it on December 20, 2016.

The same regulatory act has developed instructions for its formation. The report consists of 12 sections. You can use a simplified version, consisting of a title and section 1 with dashes, in the following cases:

- if during the reporting period the enterprise had no activity;

- the company had no transactions subject to VAT;

- there were no activities of the reporting enterprise on the territory of Russia;

- the production cycle for the manufacture of goods is more than six months;

- the reporting entity applies special tax regimes.

How to fill out the VAT return for the 3rd quarter

The current form of the document was approved by order of the Federal Tax Service MMV-7-3 / [email protected] as amended in December 2021. It can be downloaded from the websites of information and legal systems; it is loaded into accounting programs, for example, 1C.

In order for tax authorities to accept the report without any complaints, you must follow the following general recommendations for its preparation:

- Enter data from left to right.

- Do not leave blank cells. Fields where there is nothing to indicate are crossed out.

- Round sums to the nearest full ruble according to the standard rules of mathematics.

- Write down on each page of the VAT declaration form for the 3rd quarter of 2021 its number in the format “00N”, INN and KPP of the business entity.

- Enter current data that corresponds to the real state of affairs into the report cells.

The finished report is certified by an enhanced digital signature, issued in advance to an authorized person of the company. If the compiler belongs to the category of beneficiaries and submits data on paper, the declaration is signed by the director or his authorized employee, and a seal is affixed next to it.

The VAT declaration form for the 3rd quarter of 2021 can be filled out in the 1C accounting program or specialized applications that carry out primary control of data correctness, for example, “My Business”, “Contour”. Their use allows us to minimize the likelihood of errors due to which the Federal Tax Service will not accept the report.

Purpose of sections of the declaration

The table below contains general information on all modules of the declaration, as well as the conditions under which they need to be filled out.

| VAT declaration section | Section Contents |

| Title | General information about the reporting entity |

| 1 | VAT payable according to taxpayer data |

| 2 | VAT tax agent |

| 3 | Calculation of VAT payable |

| 4 | Calculation of VAT at a rate of 0% in the presence of supporting documents |

| 5 | Calculation of deductions for transactions for which the validity of the zero rate was previously documented (not confirmed) |

| 6 | Calculation of VAT on transactions for which the validity of the zero tax rate is not documented |

| 7 | VAT-free transactions |

| 8 | Information from the purchase book |

| 9 | Information from the sales book |

| 10 | Information from the journal of issued invoices for intermediary operations and transport expedition contracts |

| 11 | Information from the log of received invoices for intermediary operations and transport expedition contracts |

| 12 | Information from invoices issued by VAT evaders |

Additional appendices are provided for sections 3, 8, 9 of the report.

Who must fill out which sections of the declaration?

To fill out the VAT return for the 3rd quarter of 2021, you need to study the procedure for filling it out. We will tell you the main points in this article.

Number of sheets required to submit a VAT return for the 3rd quarter of 2021. depends on:

- Who designs it?

- What transactions were completed in the reporting quarter.

The required minimum and maximum number of declaration sheets are described in the order in which it is completed, which reads:

- all taxpayers fill out the title page and section 1;

- when carrying out relevant operations in the 3rd quarter of 2019, sections 2-12 and appendices to sections 3, 8 and 9 are completed.

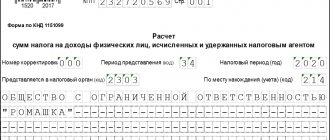

An example of filling out a declaration for Corrugated Tara LLC

As an example, let’s look at the operations of the organization Corrugated Tara LLC, which produces corrugated cardboard, and find out how they will be reflected in the VAT return.

The initial data is as follows:

- in the 3rd quarter, products were sold in the amount of 2,714,000 rubles, including VAT (rate 18%);

- the goods were shipped to one buyer;

- raw materials were purchased from a supplier in the amount of 980,000 rubles (including VAT 18%);

- an advance was received in the amount of 2,500,000 rubles for goods taxed at a rate of 18%,

- in the previous quarter, VAT was charged on advances in the amount of RUB 302,000.

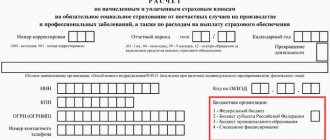

Title page

To fill out the title page, you should indicate the INN and KPP of the company at the top of it, which will be duplicated on each subsequent page. Entrepreneurs do not indicate checkpoints. All unfilled cells must have dashes.

Next, the filling algorithm will be as follows:

- In the “adjustment number” field for the first submission of the report, indicate “0”; when submitting an update (if necessary), indicate “1”, “2”, etc. (depending on how many times the corrective declarations will be submitted ).

- The tax period code for the 3rd quarter is 23.

- Indicate the reporting year - 2021.

- 4-digit tax authority code: the first 2 digits are the region code, the remaining 2 digits are the tax office code.

- The code at the place of registration depends on the status of the legal entity and is taken from Appendix 3 of Order No. MMV 7-3/558. Since in our example the company is a resident of the Russian Federation and does not belong to large payers, the code for it is 214.

- Company name without abbreviation, skipping a cell between words.

- Code of economic activity - they are approved by Order of Rosstandart dated January 31, 2014 No. 14-Art.

Next, you need to indicate how many sheets the report is submitted on, and the person responsible for its preparation. If the report is submitted on paper, please include a date, signature and stamp.

Completing section 1

When filling out this section, please indicate line by line:

- Field 010 - territorial OKTMO.

- Field 020 - KBK tax.

- Field 030 - tax payable, calculated in accordance with clause 5 of Art. 173 of the Tax Code of the Russian Federation (for our example, a dash must be entered in this field).

- In cell 040 we enter the results of section 3.

- The amount in field 050 is formed by the totals of sections 3, 4, 5, 6. In our example, this information is not filled in, since there will be no VAT refund from the budget for the 3rd quarter.

- Fields 060, 070, 080 must be filled in only for companies that are participants in investment partnerships (for them, code 227 is indicated on the title in the field at the place of registration). In our example, these fields are crossed out.

Section 2 of Corrugated Tara LLC is not completed because it is not a tax agent.

Completing Section 3

Let's start drawing up the most important part of the declaration: this is the key section for our example. To fill its cells, we take our initial data:

- In fields 010-040 we indicate the tax base for the 3rd quarter. In our example, product sales were only at a rate of 18%, so only field 010 should be filled in. In the remaining cells we put dashes. Our tax base is 2,300,000 rubles, VAT 18% on it is 414,000 rubles.

- In cell 070 we indicate the amounts of advances received for future deliveries of products. As we remember, in the 3rd quarter an advance payment for future deliveries in the amount of RUB 2,500,000 was received in the settlement account of Corrugated Tara LLC. VAT on advances is calculated at the estimated rate. In our case - 18/118, which will be 381,356 rubles.

- In cells 080 to 100 indicate the tax that is subject to restoration. Corrugated Tara LLC did not have such amounts in the 3rd quarter, so we cross out the corresponding cells.

- Lines 105-109 show the implementation adjustments. We don’t have such amounts either.

- Boxes 110 and 115 are intended for VAT calculated during the customs declaration of goods. In our example there were no such operations.

- The total amount of VAT payable must be indicated in field 118. For our example: 414,000 + 381,356 = 795,356 rubles. This same figure will be the bottom line in our sales book for the 3rd quarter.

The second part of section 3 is filled out on the basis of deductions supported by documents. When forming indicators, one should be guided by Art. 171, 172 of the Tax Code of the Russian Federation.

Algorithm for filling out the second part of section 3:

- Lines 120-185 are filled in based on data from the purchase book. In our example, in field 120 it is necessary to indicate the tax that the company paid when purchasing raw materials - 149,492 rubles.

- In field 170, indicate the amount of tax for advance VAT, accepted as offset in the 3rd quarter, but accrued in previous periods. According to the conditions of the example, we accept previously accrued VAT for offset - 302,000 rubles.

- In field 190 we present the total amounts of VAT that are taken for deduction. The sum of lines 120-185 was 451,492 rubles.

- Line 200 reflects the amount of VAT payable, calculated according to the formula: line 118 - page 190 (if this difference is ≥0). For our example in numbers it will look like this: 795,356 – 451,492 = 343,864.

- If the difference between lines 118 and 90 were negative, the result should be indicated in field 210. This means that this amount should be returned from the budget.

Other sections of the declaration

Corrugated Tara LLC did not sell goods with a zero VAT rate in the 3rd quarter, so there is no need to fill out sections 4-6.

Section 7 provides information on operations:

- not subject to VAT,

- conducted outside the Russian Federation,

- advances for the supply of goods whose production is characterized by a long production cycle.

In our example, such operations were not carried out, so we also skip this section and move on to the next one.

Filling out section 8 of the VAT return

This section is filled out based on information from the purchase book for invoices received in the 3rd quarter. The total VAT amount indicated in this tax register will reduce the tax payable.

Line-by-line filling is performed in the following order:

- Cell 001 - all cells are crossed out since the declaration is being submitted for the first time. This field must be filled in only in case of an updated report.

- Cell 005 is the transaction number in the purchase book.

- Cell 010—operation type code. In our example, goods were shipped corresponding to code 01 (Appendix to the order of the Federal Tax Service of the Russian Federation dated March 14, 2016 No. ММВ-7-3/). In the purchase book this is column 2.

- Field 020 reflects the invoice number presented by the seller.

- The invoice date is reflected in cell 030. In the purchase book this is column 3 (the invoice number is also given here).

- If the invoice was subsequently corrected or adjusted, information on it should be entered in fields 040-090.

- In fields 100 and 110 you should indicate the number and date of the payment order corresponding to the invoice.

- Cell 120 reflects the date of receipt of goods.

Next, you need to fill in information about the seller:

- In field 130 - INN/KPP of the seller, taken from his invoice. In the purchase book this is column 10.

- Field 140 is intended to indicate information about the intermediary. We did not have any intermediary operations.

- Field 150 contains information from the customs declaration. Since our product was purchased in the Russian Federation, we put a dash.

- In cell 160 indicate the currency code. For Russian rubles - 643.

- Fields 170 and 180 indicate the purchase price and VAT, respectively, indicated on the seller's invoice. These lines are filled in with kopecks. Information for these fields must be taken from columns 15, 16 of the purchase book.

- Column 190 indicates the total data on the VAT presented in the purchase book for deduction.

To correctly fill out sections 8 and 9 of the report, we recommend that you first check mutual settlements with counterparties. If, after submitting the report, tax authorities find discrepancies, tax deductions will be excluded from the declaration.

Filling out section 9 of the VAT return

This part of the report includes information from the sales ledger. The data is taken from invoices issued by Corrugated Tara LLC, VAT on which increases the company’s tax base for the 3rd quarter.

In this section, it is necessary to reflect the amount of the advance received against future shipment of goods and the corresponding VAT.

Let's move on to line-by-line filling:

- Field 001 is not relevant for the initial filing of the declaration, so we put a dash.

- In fields 005 and 010 we enter the transaction number and transaction type code from column 2 of the sales book.

- In cells 020 and 030 we indicate the number and date of the invoice presented to the buyer.

- Information in field 035 is entered from the customs declaration.

- Fields 040 to 090 are filled in in case of correction or adjustment of the invoice.

- In cell 100 indicate the buyer’s INN/KPP.

- Cell 110 provides information about the intermediary. In our case, we put a dash.

- In fields 120 and 130 indicate the date and number of the payment order (column 3 of the sales book).

- In field 140 we indicate the payment currency code, for the Russian ruble - 643.

- Cells 150 and 160 reflect the sales amount including tax in the invoice currency and in rubles. Since in our example the transaction was made in rubles, we did not fill out line 150. The amount for this field is taken from the invoice and entered with pennies.

- In cells 170-190 you should enter the sales amount excluding VAT (separately for each rate). In our example, the sale was carried out at a rate of 18%, so we fill in only field 170 and indicate the amount of RUB 2,300,000.

- In fields 200, 210 and 220 indicate the amount of tax on issued invoices. For our company, you only need to fill out the line 200 - 414,000 rubles.

For each subsequent sale, Section 9 is filled out in the same way, only the number and date of the transaction in the sales book, information about the buyer and the amount of the transaction are changed.

To reflect the advance payment, you need to enter code 02.

To generate sales totals, fill in the following lines:

- 230-250 — total sales cost without tax (for each rate separately);

- 260-280 — final VAT separately for each rate.

Features of the formation of sections 10-12 of the VAT return

Sections 10 and 11 need to be completed only by commission agents, agents, developers and freight forwarding companies. Data for their registration should be taken from the invoice journal.

Section 12 is formed by VAT non-payers, as well as companies that are exempt from paying it, but still issue VAT invoices. In our example, these sections are left blank.

A sample VAT return for the 3rd quarter of 2021 can be downloaded here .

What you need to know

The VAT return form for the 3rd quarter includes several sections that are required to be completed:

- title page;

- VAT calculation, which is subject to transfer to the budget.

At the same time, you need to remember that reporting documentation with a simplified generation option can be provided in situations such as:

- conducting transactions in a specific period that are not subject to taxation;

- employment is carried out outside of Russia;

- there are production operations of a long period - if the final result of the work takes up to six months;

- the taxpayer’s use of special regimes, in particular the Unified Agricultural Tax, Unified Internal Revenue Service, PSN, and the simplified tax system;

- at the time of issuing an invoice with the allocated tax amount, there is a fact of exemption.

If these situations exist regarding preferential types of commercial employment, the facts must be indicated in section 7.

Responsibility

If an accountant for some reason does not file a VAT return or sends it late, the company will be fined. An amount of sanctions equal to 5% of the accrued tax is charged for each “overdue” month, and even for incomplete ones. The maximum possible fine is 30% of the arrears, the minimum is 1,000 rubles.

If within 10 days after the deadline for submitting the report it is not submitted, the Federal Tax Service has the right to block the accounts of the violator.

The tax authorities will not accept the declaration if it is submitted in an unspecified format (electronic filing is mandatory for almost all taxpayers). Tax officials regard this as failure to submit a report.

Deadline for submitting the VAT return

The VAT return for the 3rd quarter of 2021 must be submitted no later than October 26 (Monday).

We will hand over the 4th quarter next year - no later than January 25, 2021. Let us remind you about the liability for failure to submit a VAT return on time. It is provided for in Article 119 of the Tax Code of the Russian Federation.

For each full or partial month of delay - a fine of 5% of the tax not paid on time. In this case, the maximum fine is 30% of the amount not paid for a late declaration.

If your declaration is zero, a minimum fine of 1,000 rubles will be charged.

Read in the berator “Practical Encyclopedia of an Accountant”

Types of tax offenses and liability for their commission are established by the provisions of Chapter 16 of the Tax Code of the Russian Federation.