The universal transfer document takes on the role of a primary document and an invoice. What details are considered mandatory in this collection document? What is the difference between filling out an invoice, act, invoice and UPD based on them? Is there a unified form of UPD? Let's answer these questions and look at samples of filling out the UPD 2021 for various operations that can be downloaded.

Also see:

- Who should sign the UPD and how?

- How to organize the transition to UPD

By whom and when is it used?

The UPD form was developed by the Federal Tax Service of the Russian Federation on the basis of an invoice at the end of 2011. When creating the new form, the obligatory consignment note, TORG-12 and other papers that confirm the transfer of inventory items were taken into account.

Thus, the UPD document is an invoice expanded by introducing additional details. Including information from other primary accounting documentation:

- TN;

- TTN;

- document confirming shipment;

- act of acceptance and transfer of goods and services.

When understanding how to fill out the UPD according to all the rules, you should remember that any trade organizations and private entrepreneurs can use it. The tax system applied to them does not matter. Thus, companies and individual entrepreneurs operating under special tax regimes also have the right to use the UTD form in their work. In addition, taxpayers who work without charging VAT can also adopt this type of paper. For them, the form is a sample of primary documentation.

UPD without VAT sample

A new form of accounting and tax documentation - a universal transfer document - combines the functions of an invoice and a primary accounting document, which greatly facilitates the company’s document flow.

Universal transfer document: what it is and how it is filled out in 2021

The symbiosis of an invoice and a primary document has become a new type of accounting documentation - a universal transfer document (UDD).

It was developed and put into use thanks to the full support of the legislative initiative by the country's accounting community.

And this initiative was connected with solving the issue of ineffective document flow: when filling out the “primary form” and invoice, many data are duplicated, since they are required by law for all accounting documents. In this regard, the “Shipping Document”, later renamed UPD, was proposed as a solution.

What is this document? The UPD developed on its basis contains a completely unchanged invoice form, edged with a black line.

Around the frame there are additional fields and data required for primary documentation under Part 2, Article 9 of Federal Law No. 402-FZ. namely:

- Title: “Universal transfer document”.

- The date of creation, which duplicates the date of the internal invoice.

- Full name of the organization that compiled the document.

- Information about the registered fact of economic activity (indicated in several fields).

- The size of the transaction in physical or monetary (value) equivalent, indicating the units of measurement used.

- Name list of officials from both sides: those responsible for the preparation of this UPD;

responsible for the acceptance of the FCP by the buyer.

You can see all of the above points using an example in the image below:

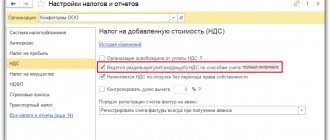

Is UPD convenient for companies using the simplified tax system?

In fact, this document was developed specifically for companies that pay VAT to the treasury, as it saves resources, time and helps avoid duplication of data. As for the “simplified” people who do not issue an invoice because they do not pay VAT, then for them the benefits of using UTD are questionable.

If desired, each company can use a universal transfer document. So it all depends mainly on the personal preferences and habits of employees...

In addition, it is possible that a company using the simplified tax system is engaged in calculating VAT for the sake of a large client for whom it is not profitable to cooperate on normal terms. In this case, the “simplifier” finds himself in the same situation as the owner of an organization with a general taxation regime and can write out the UTD in order to save time.

In this case, it will replace both TORG-12 and the invoice.

Samples of filling out UPD

Companies are increasingly moving from primary documents and invoices to a universal transfer document, but difficulties arise with filling out the UPD. Samples of filling out the UPD in various situations are in this article.

The article contains examples of filling out the UPD instead of:

- TORG-12 and invoices

- overhead

- act and invoice

- certificate of completion of work

UPD instead of delivery note and invoice

Most often, companies use a universal transfer document (UTD) with status 1. In this case, the document replaces the invoice and primary document. For example, an invoice. It is necessary to fill in the required details of both documents being replaced.

You can download all samples from the link at the end of the article.

Sample of filling out UPD, replacing TORG-12 and invoice

UPD instead of an invoice

Nobody prohibits using a universal transfer document only as a primary document. In particular, instead of TORG-12. Using the form in this way is convenient for simplified companies. The main thing is not to highlight the VAT rate and the tax amount in it. In the document status box you need to put 2.

A sample of filling out the UPD, replacing the invoice

What is it for?

The scope of this document is very broad. So, it is used:

- when supplying goods, carrying out contract work, providing services;

- during the conclusion of property agreements;

- in order to confirm the implementation of transactions involving intermediaries, etc.

When collecting information about the UPD details and figuring out how to fill out the form according to all the rules, it is important to know that this form is not mandatory. Managers of commercial companies and individual entrepreneurs decide for themselves whether to use it in registering business activities. If an organization decides to use a document in its work, this is reflected in its accounting policies.

At the same time, you can use the UTD form only for certain types of transactions and operations. All others can be issued using standard invoices. So, for example, a company has the right to make the transition to working with a universal transfer document under contract agreements, but for other types of contracts continue to use s/f and ordinary primary accounting papers. In addition, according to data from the Federal Tax Service, it is possible to combine various documentation within one transaction. The first batch of goods is registered using a UPD document, the second using a consignment note, and then alternately.

UPD form and its application

Federal Law No. 402-FZ “On Accounting” simplified the forms of primary accounting documents, but determined a list of mandatory details for them (Article 9 402-FZ), because every fact of economic life is subject to mandatory registration.

The details of the primary accounting document are:

- Name;

- Date of preparation;

- name of the economic entity of the compiler;

- content of the fact of the operation;

- the measurement value of the operation in physical and (or) monetary terms (indicating the units of measurement);

- the name of the position of the person who completed the transaction, operation and is responsible for the correctness of its execution;

- signatures of persons, indicating surnames and initials or other details necessary for their identification.

The form was developed by the Federal Tax Service based on the requirements of the accounting law No. 402-FZ and Government Decree No. 1137 and proposed for use by Letter of the Federal Tax Service of Russia dated October 21, 2013 N MMV-20-3 / [email protected] Rules for filling out the UPD, relevant for the supply of goods and performance of work (services).

The UPD combines the specifics of several primary documents - it can be used instead of the following documents:

- waybill;

- invoices;

- act of acceptance and delivery of works (services).

IMPORTANT!

The form developed by the Federal Tax Service is advisory. The company can develop its own and approve it in its accounting policies. It is important to follow the rules for filling out the UPD in 2021 and use all the required details listed above.

From July 1, 2021, changes were made to Government Resolution No. 1137, therefore, from July 2021, the UPD form differs from the invoice by the line that was included in the invoice form.

Line 8 of the invoice “Identifier of the state contract, agreement (agreement)” is a distinctive indicator between the invoice form and the UPD. The use of the UPD is recommended, and the heads of organizations independently decide how to correctly fill out the UPD and what forms of documents to use. Despite the fact that the UPD contains invoice details, it can be used by organizations for any form of taxation.

Organizations and individual entrepreneurs that are not VAT payers are not required to pay this tax when applying the UTD form. For organizations that are on the general taxation system, the UTD, like an invoice, gives the right to offset input VAT when paid to the budget. You can use a universal transfer document when:

- transfer of goods;

- transfer of property rights;

- provision of services;

- transfer of work results,

and in a number of other operations.

It is important to use statuses “1” or “2” correctly:

- 1 - if it is necessary for the document to replace both the invoice and the primary document;

- 2 - the UPD invoice does not replace, it is only a replacement for the primary document.

replaces both the invoice and the primary document

In what situations is it used?

When studying the question: how to correctly fill out the UPD, according to line numbers, you should understand the capabilities of this document. Companies and individual entrepreneurs can engage as:

- invoices;

- overhead transfers;

- combined documentation.

The use of the form is advisable when:

- documenting the work done or services provided to the client;

- shipment of commodity items;

- property transactions.

Do you want to implement Warehouse 15? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted!

Invoice or UPD form

Many organizations and individual entrepreneurs still cannot decide what exactly to use in their activities: a s/f or a new universal form. But here it should be noted in advance that the UTD document is not required for registration, unlike an invoice. At the same time, it allows commercial organizations and private entrepreneurs to:

- use it as accounting documentation;

- accept VAT for deduction, since it largely copies the details corresponding to the contents of the invoice;

- used as confirmation of costs incurred when forming a tax basis.

When getting acquainted with the procedure and rules for registering a UPD for services, and considering the required fields to fill out, it is important to understand that it cannot be used exclusively as a s/f. The form can be used in two situations:

- when it replaces the invoice and primary document;

- only a transfer document.

According to information provided by the Federal Tax Service of the Russian Federation, the UTD form of the first status can be used to generate a deduction. However, its use as a single account is prohibited, since there is no separate status position for this.

Rules and sample for filling out the UPD

For the UPD, the filling rules are approved in the second appendix of the Letter of the Federal Tax Service dated October 21, 2013 No. ММВ-20-3/ [email protected] Let's consider the basic rules:

| Line, indicator | Explanation |

| Status | We indicate “1” if the UPD is drawn up as an invoice and a statement or invoice. If the UPD is formed exclusively as an act of completed work, a delivery note, indicate “2”. |

| Lines 2 to 7 | We fill in the registration information about the contractor and the customer. We write down the name, tax identification number, checkpoint, address. We add information about the shipper, if necessary. Then we enter the unit of measurement (usually 643 - Russian ruble). |

| Tabular part | We write down information about the product, work, service for which the transfer document is drawn up. |

| Signatures of responsible persons | The document must be certified by the manager and chief accountant or other responsible persons by proxy. |

| A document base | Indicate the supply contract or agreement for the provision of work or services, or another document basis on which the transaction is carried out. |

| Signatures of the contractor and the customer | The position and full name are indicated. the person responsible for the transfer and acceptance of goods, works, services. Then the responsible persons sign and seal them with the seals of the organization (if any). |

What does a UPD document consist of?

The details that must be reflected when drawing up the paper transfer of goods, services, and property rights include:

- name of the form and date of registration;

- information about the organization or private entrepreneur;

- name and information about the transaction being carried out, the validity of which is confirmed by the transfer documentation;

- information about the person responsible for the transaction;

- signature of a representative of the management team or responsible employee with a full transcript.

When forming a document according to the procedure for filling out the UPD in accordance with the line-by-line recommendation, you must remember that the “Status” position, located on the top right of the form, is of particular importance. It directly determines how the universal UTD form is to be used.

Change the shape to suit your case

Each company can continue to use traditional documents to confirm the receipt of goods or services. You can also use UPD, and it is also possible to modify the form in accordance with the characteristics of your case. This means that a person can supplement this paper with any columns (rows, columns) to reflect more information about the object.

However, when changing a document, you must remember that at least 2 of its elements must be preserved:

- Invoice form - this paper has a single sample, and its correction is not allowed.

- All mandatory details - a complete list of them is prescribed for each type of document in the relevant legislative acts.

For example, for a primary report it is necessary to indicate the fact of economic life being described, its unit of measurement, etc.

And for an invoice, it is important to reflect the number, name of the product, quantity, price per unit, etc.

Status Definition Meaning

This detail can be reflected under the number “1” or “2”. By indicating the unit in the required field, you confirm that the paper is used simultaneously as an invoice and a form of primary accounting (primary).

According to the information presented in the annex to letter 20-3/96 from the Federal Tax Service of the Russian Federation, the status acts only as an information category. In fact, it depends on the absence or presence of data required for accounting documentation and accounts. Thus, in a situation where the seller makes a mistake when filling out the form and puts a two instead of a one, the buyer still has the right to take advantage of the deduction.

Correct filling of the UPD: instructions for registration

The easiest way to figure out how to fill out the form line by line is in the table below:

| Line numbers/graph | Requisites | Recommended data |

| Status | 1-2 | A one or a two is indicated depending on the purpose of the paper being compiled. |

| Page No. 1-7 Gr. No. 1-11 | — | The first status value implies filling in all fields. When registering the second one, it is allowed to enter information only in some lines and columns. |

| A-graph | Order number | Intended for affixing the record number. |

| B-graph | Coding of goods, services provided, work performed | For product items, an article number is prescribed. In other cases, OKUN or OKVED is indicated. |

| 8 | Basis of reception and transfer | Data characterizing the relationship between the parties entering into a transaction. |

| 9 | Information about the transportation process and the cargo being transported | Accompanying documentation (waybill, TTN), additional documents. |

| 10 | Delivery confirmation | It is recorded with the signature of an official with a full transcript or an authorized employee. |

| 11 | Date of shipment/transfer | The day of the transaction is entered. |

| 12 | Additional data | Additional information. For example, information about passports, certificates, quantities and types of accompanying documentation. |

| 13 | Responsible for registration | The official responsible for completing the transaction, concluding an agreement, carrying out work, etc. is indicated. |

| 14 | The name of the entity composing the paper. Including agent | The name of the organization or information about the individual entrepreneur who generated the UTD document on the part of the seller is indicated. It is allowed not to fill out this position if the form is endorsed with the seal of an individual entrepreneur or company. |

| 15 | Confirmation of receipt of goods/services, property rights, work performed | The position of the employee who received the cargo, recorded the service or transferred ownership of the property on behalf of the buyer is noted. |

| 16 | Receipt date | The day of delivery and acceptance of the results of work activities is recorded. |

| 17 | Other data | Marks are made indicating the absence of claims, as well as additional papers generated by the purchasing party at the time of receipt, which are attached to the UTD form. |

| 18 | Responsible for the correct execution of the transaction/operation | An official is designated who is responsible for the formalities under the agreement. His signature must be affixed with a full transcript. |

| 19 | Name of the economic entity generating the documentation | The name and details of the organization involved in drawing up the UTD document on behalf of the buyer are indicated here. If there is a seal, you can skip the line. |

| M.P. | Place for stamps, tax identification number, checkpoint. |

Options for using UPD

There are two options for using UPD:

- instead of invoices and transfer documents. In this case, when transferring goods, services or works, only a universal transfer document is drawn up. It is used both for value added tax calculations and for recognizing expenses when taxing profits. The document is assigned status 1 and must be issued in paper and, if necessary, electronic form.

- instead of transfer documents. In this case, the UPD is used only to recognize expenses, and the invoice is issued separately. The document is assigned status 2 and can only be issued electronically.

UPD form from 10/01/2017: what has changed?

According to Decree of the Government of the Russian Federation No. 625 of May 25, 2017, from July 1, 2021, a new invoice form is being used in Russia - a line for the government contract identifier has appeared in it. The new format for filling out the invoice is given in the Order dated March 24, 2016. No. ММВ-7-15/155.

Since the universal transfer document includes invoice details, its form has also undergone changes - column 8 has appeared in it to indicate the identifier of the government contract. It is filled out if organizations or an entrepreneur perform work or supply goods under government orders. In other cases, a dash is placed in the column.

ATTENTION! If you or your counterparties continue to use the old invoice and universal transfer document forms after October 1, 2017, you risk not receiving VAT deductions. Tax inspectors will not accept the documents you provide.

We offer free filling out and a new form of a universal transfer document dated 10/01/2017.

How to fill UPD form 2021

In 2021, the UPD is filled out as before - according to the previously existing rules for the shipment of goods and the transfer of works and services.

Rules for filling out the universal transfer document form

Most of the UPD form coincides with the forms of the invoice and delivery note or certificate of work performed. But filling out some form fields related to the details of the universal transfer document itself may cause difficulties. Use our recommendations:

- Date in UPD. The universal transfer document indicates three dates: the date of execution of the document (line 1), the date of completion of the act of economic activity (line 11) and the date of receipt of goods or acceptance of work/services (line 16).

- UPD status. If the universal transfer document performs the functions of an invoice, then status 1 is assigned. In this case, line 7, columns 6, 7, 10, 10a, 11 must be filled in. If the UPD performs the functions only of a consignment note or act, then status 2 is assigned to it , and the specified lines and columns are not filled in.

- UPD number. Universal transfer documents with status 1 are numbered in chronological order in accordance with the numbering of invoices. Universal transfer documents with status 2 are numbered in chronological order in accordance with the numbering of the primary documentation.

- Signatures in the UPD. The upper part of the universal transfer document corresponding to the invoice is signed by the head of the enterprise (or individual entrepreneur) and the chief accountant. At the bottom of the form, corresponding to the act or invoice, the signatures of the persons responsible for the shipment of goods/transfer of services, for receiving goods/services, for recording the facts of the economic life of the seller and buyer are placed.

How to fix an error in UPD

Mistakes made can lead to problems related to the recognition of income tax or difficulties in obtaining tax deductions for VAT.

The method for correcting an error depends on the document with which status it was made - 1 or 2, and whether the error will become an obstacle for tax specialists in the process of identifying important data (seller, buyer, goods and their characteristics, etc.).

Depending on the situation:

- the error can be crossed out (marked with the inscription “corrected);

- you can create a new UPD;

- If necessary, issue an additional invoice.

How to fill out the UPD in the KUB service?

To minimize the risk of errors when drawing up a universal transfer document using the new form and to simplify this process, use the free multifunctional KUB service. Automatic formation of UPD in it will take only a few minutes. You will need:

- enter data about counterparties and the transaction in the appropriate fields of the form;

- check the information is correct;

Your document is ready! Now you can save it to your computer’s hard drive or immediately send it to your counterparty by email.

Start using the KUB service and fill out universal transfer documents according to the 2021 form automatically, store documents systematically in your personal account and send to counterparties in one click! Register now and get free access to all system functions for 14 days.

UPD with status 1 (2)

Depending on the purpose of the UPD, status 1 or 2 is assigned.

- Status 1 is assigned to UTD issued as both an invoice and an invoice (for transactions with VAT);

- Status 2 is assigned to UTD issued as exclusively an invoice or exclusively an act (for transactions without VAT).

QUICKLY AND EFFICIENTLY

Sending invoices to your clients' e-mail. The invoice status will always tell you whether it is paid or overdue. A short introductory text about the invoice for payment. Invoicing with logo, seal and signature. Sending invoices to your clients' emails. The invoice status will always tell you whether it is paid or overdue.

- Convenient online invoicing

- Instantly send invoices by e-mail to your buyer

- Debt control for each customer

Stop wasting time filling out templates and forms

The KUB service helps you issue invoices in 20 seconds and prepare other documents without a single error, due to the complete automation of filling out templates.

KUB is a new standard for issuing and sending invoices to customers.

Start using the CUBE right now 14 days FREE ACCESS

Types of universal transfer documents

This documentation can be used in two versions:

- simultaneously as an account-f and a primary account (one is entered in the status);

- solely as confirmation of the transfer of goods and materials (a two is registered).

Depending on how exactly the application is recorded, you will have to fill out the forms differently.

Rules for filling out UPD 1

In this case, all details are required (for s/f and transfer papers). This is the only way to use the completed form to receive VAT deductions and account for income tax expenses.

UPD document with status 2

In the second option, there is no need to enter information for the invoice. This UPD form is used exclusively as transfer documentation to confirm the conduct of business transactions. And the account-f, if necessary, is generated additionally.

Do you want to implement “Store 15”? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted.

Rules for registration of UPD

Appendices No. 2-4 to the Federal Tax Service letter No. ММВ-20-3/96 provide instructions for filling out the UPD, including a list of transactions for which this form can be used. The design features of the UPD vary depending on the status of the document:

- Status “1” means that the UPD combines an invoice and a transfer act, which means that all lines required for these documents are filled in (the fields of the invoice are drawn up taking into account the rules for filling them out, approved by Government Decree No. 1137 dated December 26, 2011 latest edition). Our example of filling out the UPD is given for status “1”.

- Status “2” – UPD includes only the transfer deed and is used as a primary document. In this case, the fields required for the invoice are not filled in: line 5, columns 6, 7, 10, 10a, 11; the remaining fields must be filled in. Incorrect indication of status “2” instead of “1” does not deprive the buyer of the right to a VAT deduction if the rules for filling out all indicators related to the invoice in the UPD are followed. Status “2” is applicable for “simplified” people and those who are not VAT payers, since issuing a UTD does not entail for them the obligation to pay this tax.

Correct execution of the UTD (a sample of which we provide) assumes that a document with status “1” is assigned a number according to the chronology of invoice numbering.

UTD with status “2” are numbered in the order corresponding to the numbering of the “primary”: acts, invoices, etc.

Document of the first status in the purchase/sales books, accounting journal

Knowing where the contract number is indicated in the UPD, what to write in the basis of the transfer, you should consider the rules for registering universal forms with the status value “1”.

On the selling side

When the transfer paper is drawn up during the delivery of commodity items, provision of services, re-registration of property rights, the moment of approval of the tax basis is considered the day of the business transaction.

Accounts are registered in the established chronological order in the first part of the ledger, according to the government decree of 2011. When generating the UTD document, the exact date is determined when the goods are to be received and transferred.

If the days of preparation and shipment coincide

In such a situation, when preparing the transfer documentation, the value of the first line is actual for sending and registering the invoice. They ship commodity items, provide services, or re-register rights to property at the same time. At the same time, the issuance of the s/f to the purchasing party is dated. The document is registered in the accounting book upon simultaneous delivery and the generation of documentary evidence in the form of an invoice.

When actions are performed at different times

In this case, the transfer paper is formed in a similar way. Line No. 1 indicates the day the UPD form was issued. In this case, the actual date of shipment is noted in the 11th. It is also the factual one, according to which the tax period is registered. The immediate moment of issuing a paper confirmation remains simply an indicator that simplifies identification.

Rules for filling out the UPD by the consignee (buying party)

Buyers also record invoices according to chronology. Only records are kept in the second part of the accounting journal. Registration is considered the day of signing an agreement for the supply of commodity items, provision of services, transfer of rights to property. The information is reflected in line No. 16.

In the purchase book, the consignee carries out registration actions in relation to accounts-f.

How to apply for UPD with status 1

The universal transfer form with status 1 combines the invoice and the source document. The seller reflects in it all the mandatory details of the invoice and the primary document.

Sample of filling out a universal transfer deed

The buyer fills out the universal transfer form only in part of the primary document. The table contains a line-by-line description, on the basis of which it is easy to correctly design the UPD.

| Line in the invoice section | How to fill out a universal transfer document |

| (1) | Number (in chronological order) and date of compilation of the UPD. The maximum period for issuing an invoice is five calendar days from the date of shipment of goods, provision of services (GWS), performance of work, transfer of property rights. |

| (2a) | Seller - name of the organization. |

| (2b) | TIN, checkpoint. |

| (3) | Enter information about the consignor - to be filled in when selling goods. If the invoice is issued for services or work, a dash is added. If the organization is both a seller and a shipper, then write “aka” in line 3. |

| (4) | Enter information about the consignee - to be filled in when selling the goods. If the invoice is for services or work, put a dash. If the consignee and the buyer are the same person, indicate the name and address of the consignee. You can't write "he". |

| (5) | Enter the payment order number. Filled out if there was an advance payment, i.e. an invoice for an advance payment. If there was no prepayment or it was transferred on the day of shipment, put a dash. |

| (6) (6a) (6b) | Enter information about the seller: name, tax identification number, checkpoint. |

| (7) | Enter the name and code of the currency. An invoice is issued in foreign currency only if prices and calculations under the contract are expressed in it (Clause 7, Article 169 of the Tax Code of the Russian Federation). |

| (8) | Fill out the line if you have data - write the government contract ID. If not (that is, if you are not working with a contract or your contract does not have an identifier), a dash is placed in the line. |

| Column in the table section | How to fill out a universal transfer document |

| A | Numbering of table rows. |

| B | The TRU code is entered if you need to indicate tax benefits or other special conditions:

|

| 1, 1a and 2 | Name of goods or description and units of measurement of work performed, services provided, property rights transferred. Column 1a contains the code of the type of goods according to the unified HS of the EAEU. Its completion is mandatory from 10/01/2017 in relation to goods exported from Russia to the EAEU states - to Belarus, Kazakhstan, Armenia or Kyrgyzstan (otherwise a dash is added). The product code is taken from the reference book of HS codes (approved by decision of the Council of the Eurasian Economic Commission dated July 16, 2012 No. 54). |

| 3 | Quantitative parameters of TRU. If it is impossible to determine, a dash is added. |

| 4 | Price per unit of measurement (if possible to indicate) without VAT (if possible to indicate). |

| 5 | The total cost of GWS and transferred rights excluding VAT. |

| 6 | The amount of excise tax is indicated. when selling excisable goods. Otherwise, write “Without excise tax.” |

| 7 | The VAT rate is applied. If an organization is exempt from VAT (Article 145 of the Tax Code) or when issuing an invoice to a company that does not work with VAT, write “Without VAT.” |

| 8 | Enter the VAT amount in rubles and kopecks without rounding. If an organization is exempt from VAT (Article 145 of the Tax Code) or when issuing an invoice to a company that does not work with VAT, write “Without VAT.” |

| 9 | The total cost of the entire quantity of GWS and transferred rights is entered, including VAT. |

| 10, 10a and 11 | Filled out for imported goods. Name of the country of origin (10) and its OKSN code (10a), customs declaration number (11). |

Reflection of a document of the first status in tax accounting

The selling and buying parties determine expenses and profits using UTD documents.

Seller's income tax

The date of recognition of official income is the period of sale of goods, services, and property rights of ownership. The amount of material benefit received is determined on the basis of accounting documentation and other papers subject to tax accounting.

Buyer's income tax

The situation is similar with the recipient. The day of expenditure transactions is considered to be the actual moment when goods items, works were accepted according to the UTD transfer papers, and the services provided were consumed.

Why do many organizations and entrepreneurs refuse to use the UTD document?

The block of signatures on the universal transfer form is quite voluminous. It is not always possible to place all the required information on one sheet of paper. Because of this, small fonts are often used when typing, making them difficult to read.

In addition, the new documentation does not enjoy much confidence among accountants (this is mainly due to the deduction of VAT). When switching to working with UTD papers, find out in advance whether this option is suitable for your counterparties. It would be a good idea to coordinate the implementation of the updated form with regular partners.

Separately, it should be said about the need to automate internal processes in any commercial organization, regardless of whether it works with UPD documents or not. You can make the work of enterprise employees easier and automate reception and transfer using special mobile accounting systems. The right decision in this case would be to purchase software for solving business problems in wholesale or retail trade in our company. The software presented in the catalog is compatible with most models of modern trading and accounting equipment. All the information you are interested in can be obtained on the official website cleverence.ru.

Conclusion

For many who are just beginning to understand the nuances of designing a universal form, this task seems too difficult.

And since the document is not mandatory, not everyone uses it - and in vain. In fact, studying the intricacies of creating documentation, figuring out how to fill out column B in the UPD, finding out what the content of the operation is is much easier than it seems at first glance. But it is the UPD form that allows you to significantly reduce the volume of document flow and thereby facilitate the work of an organization or individual entrepreneur. Number of impressions: 867