Stamp on the 2-NDFL certificate

This certificate is considered the most important document, which shows the income received and the amount of taxes paid.

It is asked to be presented in various situations when information about a person’s income level is required. The document is needed when traveling abroad, receiving a loan, various subsidies, getting a job and in other cases. In the traditional sense, a certificate is invalid without a stamp.

But in the age of computer technology, a stamp on a paper document is gradually losing its relevance. This article discusses the features of its use.

Tax system

The operation of the tax system is directly related to the presence and functioning of all its main elements. The latter include taxes and other mandatory payments established and assessed by the tax department. Such payments can be divided into categories depending on various factors. Thus, taxes can be divided into groups depending on the revenue budget

- federal,

- regional,

- local.

Depending on the object of taxation:

- property,

- profitable,

- other.

Depending on the subject:

- collected from individuals,

- collected from legal offices.

A certificate of income of an individual is filled out on the template established by legislative acts

Based on this criterion, we can conclude that the payers of such payments are both individuals (in relation to their own income and property and income and property of individual entrepreneurship) and legal organizations.

Taxes can also be divided into groups: direct and indirect. The main difference is that indirect ones are included in the cost of the goods.

In addition to determining the tax and its payer, for the functioning of the tax system the following must be determined:

- payment period,

- object of taxation,

- privileges,

- other elements.

In addition, basic principles must be observed, which include:

- unity,

- integrity,

- justice,

- equality,

- obligation, etc.

The taxation procedure is regulated by:

- the Constitution,

- Tax Code,

- By presidential decrees,

- Government regulations

- By orders of the Ministry of Finance and the Federal Tax Service,

- Local legal acts.

Thus, the tax system is a complex component of the basic elements.

Is it possible for an employee to be given a 2-NDFL certificate without a stamp to submit to the bank?

Quote (Stamp on 2-NDFL): Current as of: February 25, 2021 2-NDFL certificates for all individuals to whom income was paid are submitted to the Federal Tax Service at the end of the reporting year no later than April 1 of the following year (clause 2 of Article 230 of the Tax Code RF). And when filling out certificates, accountants ask themselves: is a stamp required for 2-NDFL? This issue is also related to the fact that starting from 2021, a certificate using a new form will be submitted to the tax office (Order of the Federal Tax Service dated October 30, 2021 No. ММВ-7-11/ [email protected] ). And there is no space for printing. So is there a stamp on the 2-NDFL certificate?

There is no need to put a stamp on 2-NDFL in 2021. After all, it really no longer contains such props as “M.P.” In addition, the Procedure for filling out a certificate (approved by Order of the Federal Tax Service dated October 30, 2021 No. ММВ-7-11 / [email protected] ) does not say anything about the need to put a stamp on the certificate.

Requirement of this Order: fill out the certificate and sign on each page if it does not fit on one page.

The Tax Code also does not require that the certificate be certified with the organization’s seal. Therefore, you can easily submit a 2-NDFL certificate to the Federal Tax Service without a stamp. At the same time, your organization can put a stamp in the new 2-NDFL at its own discretion.

Certificate 2 of personal income tax in 2021: form and validity period

For many, the most well-known document confirming income is the 2-NDFL certificate. Banks require it to obtain a loan, and it is necessary to confirm income in some government agencies. There are many features in filling out this document that an individual entrepreneur should pay attention to.

About form and content

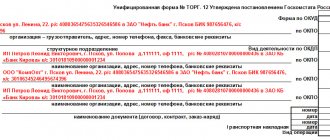

Form 2-NDFL is an approved template for presenting information on the income of an individual for a certain period of time; common to all employers, regardless of their organizational and legal form.

2-NDFL reporting is submitted once a year for each individual. In addition, this certificate can be issued to an employee at his request an unlimited number of times.

Now the form has a field for indicating the correction number:

- primary – 00;

- corrective – 01, 02, etc.;

- canceling – 99;

If the document is filled out for foreign employees, it is necessary to indicate the Taxpayer Identification Number (TIN) in the country of their citizenship.

In addition, the new form must include information about investment deductions. There is a special field for social deductions; the same as for displaying fixed advance payments to non-residents.

When do you need an income certificate?

Form 2-NDFL, as noted above, is required in a variety of situations. Conventionally, they can be divided into two groups.

Firstly, when the 2-NDFL report is submitted directly by the employer. There is only one situation here, directly stated in the Tax Code of the Russian Federation: previously once a year, and now quarterly, the tax agent is obliged to submit these reports for all individuals to whom cash payments were made and from whom personal income tax was withheld.

The deadline for submitting 2-NDFL in this case is determined until April 1 of the year following the reporting year. It is worth noting that starting from 2021, the certificate will be submitted electronically. Organizations and entrepreneurs who employ less than 25 people have the right to submit 2-NDFL on paper.

Secondly, this certificate can be presented by the employee for his own purposes. For example, a 2-NDFL certificate is often required for a loan.

In this situation, the employer is only obliged to issue a certificate, and he does not have the right to refuse the employee who has written an application to receive this information. The application is written in any form. It is important that the employee is not obliged to clarify for what purposes the information is requested, and the employer does not have the right.

Features of receiving

Only the employer can issue an income certificate; provided that the employee has an official labor relationship with him, which is confirmed by the relevant contract.

But the realities of life are such that often a citizen does not have an official place of work or cannot obtain the necessary certificate there - for example, the amount of official income will not allow him to take out a large loan. In this case, many resort to the help of companies that specialize in preparing such documents.

For example, it is possible to order a 2-NDFL certificate online. In this case, it is enough to indicate your data, as well as indicate the desired salary amount, which should be reflected in the certificate.

By the way, it is the amount of income that most often affects how much a 2-NDFL certificate costs. In addition, the cost may be affected by urgency, region of residence, age and other data. The use of such certificates is very questionable, but most often they are sufficient to obtain a loan, since verification of the 2-NDFL certificate is possible only through the tax authorities, and they do not provide such information.

Please note that current legislation does not regulate the procedure for issuing a 2-NDFL certificate by an employer. There is also no mechanism for checking the number of certificates issued by the employer, which allows the use of forged documents. The income certificate form can be downloaded from many sites, in addition, many of them allow you to fill out this form directly online.

On the one hand, this opportunity is often very useful for entrepreneurs if they have a small staff and do not have special software.

On the other hand, this situation leads to the fact that almost anyone can make a report on Form 2-NDFL: it is enough to find the stamp and data of the entrepreneur or legal entity. However, this problem is more likely for legislators and banks, who often suffer from insolvent borrowers.

In practice, a 2-NDFL certificate for an individual entrepreneur is also often necessary, and he is forced to resort to small tricks. Let us remind you that an entrepreneur submits a different form of income reporting for himself - 3-NDFL.

As for the period for issuing the certificate, based on the requirements of labor legislation, it cannot exceed three days from the date the employee submits the application. Otherwise, he has the right to appeal to the labor inspectorate, the prosecutor's office or the court.

Some disagreement is caused by the question of who signs the 2-NDFL certificate. If previously the certificate form contained the columns “manager” and “chief accountant”, then the current form contains only one column – “tax agent”. Therefore, there is no difficulty: it is understood that the certificate can be signed both by the individual entrepreneur himself and by the chief accountant, if there is one on staff.

Filling Features

As for the filling out process itself, there are no particular difficulties here: this certificate is one of the types of tax reporting, and it is subject to the same requirements as other declarations.

For example, form 2-NDFL is required to be checked during a desk audit by the tax authorities. For failure to provide this reporting, the tax agent may be held liable.

It is worth paying attention: it is the agent, and not the taxpayer, for whom 2-NDFL was not filed. At the same time, if the employer does not submit these reports to the tax authorities on time, the employee can do this independently.

Adjustment

The legislation provides for the possibility of adjusting 2-NDFL if there was an inaccuracy in the initial calculations, including in the preparation of data about the tax agent or taxpayer.

This inaccuracy can be determined both by the tax agent himself and by the tax inspector during an audit.

Practice shows that in most cases the declarations are submitted correctly. Most often, discrepancies arise when the amounts indicated in them go to the wrong BCC. Here we can only advise you to check the details immediately before transferring, clarifying their relevance.

When filling out, it is important to pay attention to the taxpayer’s status in 2-NDFL, since the size of the tax rate depends on this. Sometimes mistakes are made here, for example, this column is not filled in at all, which can be regarded as an incorrect declaration.

Is it necessary to put a stamp on the new 2-NDFL certificate 2021

Due to the fact that since 2021, companies have been exempted from the obligation to put a stamp on documents, many are interested in whether a stamp is needed on the 2NDFL certificate , which is submitted in 2021 for 2021.

However, if the organization or entrepreneur still has a seal, then its imprint on the new form of the 2-NDFL certificate will not make it invalid (there are no legal restrictions in this regard).

We recommend reading: Veteran of Labor Benefits in the Ulyanovsk Region

Is a stamp required on this form?

Since the current legislation provides for amendments regarding the issuance of a 2-NDFL certificate, many are wondering: is it necessary to put a stamp on this form?

Before answering it, you should understand that all indicators entered in this form must be displayed in national currency. Therefore, according to the rules for filling out the certificate, it is approved by the signature of the governing body of the company, and it must bear the seal of the organization. If your own seal has not yet been made or for some reason is not available in the company, it is not necessary to put it on. The absence of an imprint is not counted as a violation. It is worth clarifying that if the stamp is not affixed, many authorities will still not want to accept such a sample certificate. Therefore, if possible, it is better not to ignore this requirement. In general, your imprint greatly simplifies doing business for individual entrepreneurs.

Stamp in 2-NDFL

- if the seal is refused, then it is not placed anywhere;

- if it is decided to leave the seal, then it must be used only for a number of documents in cases established by law, for example: for a power of attorney for a representative in court, for an industrial accident report, for documents when issuing securities and in some other situations.

We remind you that tax agents must provide 2-NDFL certificates on the income of individuals for 2021 no later than April 3, 2021, and certificates on the income of individuals from whom it was not possible to withhold personal income tax must be sent to the tax office and to the individual taxpayer himself within 1 March 2021.

In what situations is printing needed?

If your company uses a seal in its activities, then in 2020 you can affix it to the 2-NDFL certificate at your own request. The tax authorities will definitely not issue a fine for its presence or absence, since this process is not regulated by law.

This certificate can be used for various purposes. One of your employees may, for example, go to the bank to apply for a loan. In this case, no stamp is required. But in order for the employees of the credit institution to have no doubts about issuing money, it is better to leave an imprint on the document.

If the organization’s seal is not affixed, then the bank, in its own interests, can make calls to the employer to clarify the information and confirm its accuracy. To avoid such inconveniences and not do unnecessary work, you should immediately issue a 2-NDFL certificate with a stamp. This simple action will help you avoid unnecessary questions and intrusive calls.

The absence of a seal is not a violation, but for your own peace of mind you can affix it. The imprint will make your life much easier, as it increases the confidence of third parties in the authenticity of the document.

Do I need a stamp on the 2-NDFL certificate?

- If the decision was made not to have a seal, then it is not required in any of the documentation.

- If an enterprise decides to use a seal, it is affixed only in certain documents (power of attorney for the company’s authorized representative, on business papers when issuing securities, and other legally approved seals).

The rules for filling out the form are established by Federal Tax Service Order No. ММВ-7-11/19В dated January 17, 2018, where there are no instructions regarding affixing a stamp. Also on the form itself there is no line M.P. Therefore, the question of where to put a stamp on 2-NDFL becomes relevant for those companies that have a stamp.

Help - On income and tax amounts of an individual - instead of 2-NDFL from 2021

As for 2-NDFL for submission to the inspection, its structure has completely changed.

The form now consists of only three sections. In addition, an application has been added - in it you will need to decipher information about income and deductions on a monthly basis. There are also some other changes to the form. 2-NDFL is a reporting form that is submitted by employers to the tax authority. But it had one more purpose - the certificate was presented to confirm the income of an individual. For example, when applying for a mortgage or receiving a tax deduction. However, on October 2, 2021, the Federal Tax Service issued order No. ММВ-7-11/566 , which approved a new form of this certificate. At the same time, the order notes that 2-NDFL is submitted to the tax authority, and employees are given a special certificate “On income and tax amounts of an individual” .

What documents are affixed with the official seal of the institution?

- letters of guarantee for performing certain types of work or receiving services;

- all kinds of orders (pension, payment, banking, payment);

- various statements related to letters of credit, refusals of acceptance, etc.;

- powers of attorney (to carry out the procedure for obtaining inventory items).

Our company has been in the market for stamp production services for over 18 years. All our activities are based on providing only high-level services. In our work, we did not try to find easy ways that contradict legal requirements. All this was rewarded by our regular and numerous customers who trust us and the quality of our products.

Which documents need to be stamped with a stamp, and which ones need a seal for documents?

In accordance with this procedure, the bodies on whose seals the State Emblem of the Russian Federation is placed approve acts that determine which documents are affixed with the state emblem.

1) licenses issued to commercial banks and credit institutions for the right to carry out banking activities, amendments and additions to them, charters of commercial banks and credit institutions, amendments to them;

We recommend reading: When are travel allowances paid for Veterans of the Ulyanovsk Region in Ulyanovsk

Is it necessary to put a stamp on an order, confirmation of the type of activity of the organization, or a personal income tax certificate?

In 2021, no changes were made to the legislation of the Russian Federation regarding the design of this document, so to the question of whether it is necessary to put a stamp on the 2-NDFL certificate from 2021, the answer is unequivocal: no.

In accordance with the Tax legislation of the Russian Federation, legal entities that have hired employees must provide the tax authorities with a certificate of income of individuals in form 2-NDFL for each individual employee. This document can be sent in one of two ways:

New certificates

Starting from 2021, the country has two forms of certificates of individual income and tax amounts. Everything new raises questions, so it is not surprising that from time to time specialists are faced with questions about filling out new documents. For example, is it necessary to put a stamp on the 2-NDFL certificate in 2021 for employees?

Why do you need an income certificate? Its task is to confirm the amount of income that a person received for a particular period, as well as the amount of personal income tax withheld from this income.

By analyzing this form, tax inspectors will check whether the company correctly applied tax deductions and calculated the amount of personal income tax payable to the budget. In turn, banks that request such a certificate from individuals will be able to check the person’s income level.

Let us remind you that depending on the addressee: the tax office or the taxpayer, the form of the certificate will now be different. Indeed, starting from this year, certificates for tax authorities and individuals differ significantly from each other.

There is no need to submit zero certificates to the Federal Tax Service. Forms are filled out only for individuals who received wages and other income payments in the past 2021. 2-NDFL must be filled out and submitted, including for dismissed employees.

Clerk's cheat sheet

Technical requirements for official seals - their shape, size, text and symbols placed on them - are set out in the state standard GOST R 51511–2021. Technical requirements for seals without a coat of arms are not specified in state standards.

The instructions must also contain lists of documents certified by all types of seals. Lists of documents are compiled on the basis of regulatory legal acts and our own experience in the organization. The lists establish who personally and in what cases has the right to certify the authenticity of a document’s signature. The right to have and use a seal should be recorded in the regulations on the structural unit

Stamp on 2-NDFL

There is no need to stamp the 2-NDFL certificate that the tax agent submits to the inspectorate. After all, the certificate form, indeed, does not even provide the details for affixing the “M.P.” stamp. Federal Tax Service specialists do not argue with this. In the letter of the Federal Tax Service of Russia dated February 17, 2021 No. BS-4-11 / [email protected] it is directly explained that a stamp is not needed on the certificate. Accordingly, the tax office does not have the right to refuse to accept the 2-NDFL certificate due to the lack of a stamp.

The form of the 2-NDFL certificate and the procedure for filling it out were approved by Order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11 / [email protected] (applicable from December 8, 2021). However, many accountants have noticed that there is no place for stamping on the certificate. At the same time, previously (when the previous form was still in effect), a stamp on the certificate had to be affixed. This is where questions arose about whether tax agents are required to stamp 2-NDFL? Let's put an end to this issue.

2-NDFL reporting in 2021

Reporting 2 Personal income tax - a certificate in which the employer reports to the tax office about the income of individuals. The document is submitted by tax agents, that is, individual entrepreneurs and managers of enterprises who regularly pay wages to staff.

The submission of 2nd personal income tax in 2021 is carried out by employers to the Federal Tax Service at the place of registration.

According to the latest changes, the largest taxpayers can submit certificates only to the territorial inspectorate at the place of registration of the parent company and separate divisions. Previously, legal entities could submit documents to those branches where the organization was registered as the largest taxpayer.

According to the rules for filling out Form 2 of personal income tax, the certificate reflects any income of employees, including profit in cash and in kind, cash and non-cash payments. The reporting period for the year begins on January 1 and ends on December 31.

If during the entire reporting year no payments were made in favor of hired personnel who entered into an employment contract, then a certificate is not required. In this case, the employer will need to notify the fiscal service by sending a letter in free form.

What is the deadline for submitting personal income tax certificate 2?

2-NDFL certificates can be divided into 2 types depending on the transfer of tax on the specialist’s income. Submission of 2 personal income tax reports with different characteristics is carried out at different times.

Certificate 2-NDFL with sign 1

If income tax from wages is transferred in favor of the budget, then the certificate receives feature 1. The document will need to be submitted to the regulatory authorities before April 3. In 2021, it is planned to postpone the last day of the deadline for submitting documents, since April 1 falls on a day off.

Certificate 2-NDFL with sign 2

In some cases, employers are not entitled to withhold tax. This occurs when earnings are paid in kind, material benefits arise, or gifts are transferred to third parties.

If it is impossible to withhold tax, the employer notifies the Federal Tax Service at the place of registration of the amount of tax that cannot be transferred. Next, the citizen independently transfers personal income tax and submits the corresponding declaration. In this case, the 2-NDFL certificate has feature 2. The tax agent can submit such a document to the inspectorate before March 1.

Punishment for violating deadlines

If taxpayers miss deadlines regulated by law for filing reports, make mistakes and inaccuracies when preparing documents, they are held legally accountable. Delay, refusal to submit documentation, or sending incomplete or distorted information is punishable by an administrative fine of 100-300 rubles.

According to Art. 126.1 of the Tax Code of the Russian Federation, indicating false information in the 2-NDFL certificate (errors in calculations, personal data, income and deduction codes) is grounds for imposing a fine in the amount of 500 rubles. A sanction is imposed for each document submitted containing inaccurate information.

Methods for submitting certificates to tax authorities

Tax agents, including individual entrepreneurs and legal entities with employees, can send certificates to the fiscal authorities on paper and electronic media. Since the beginning of 2016, a regulatory rule has been in force, according to which the submission of 2 personal income taxes by taxpayers who transferred income in favor of 25 employees or more must be made electronically.

Information with certificates cannot be stored on flash drives, disks, or floppy disks. Employers must submit reports using electronic document management.

If a private entrepreneur or company has less than 25 employees, then Form 2-NDFL can be filled out and submitted to regulatory authorities in paper form.

From the site: https://nalogypro.ru/nalogovaya-otchetnost/ndfl/2-ndfl.html

Do I need a stamp on the 2-NDFL certificate?

But do such organizations need to put a stamp on the new 2-NDFL certificate? The Fiscal Service refers to Federal Law No. 82-FZ, which states that there is no designated part for affixing a seal in the certificate, so a seal is not required. However, this does not mean that companies are prohibited from putting it on 2-NDFL. There are no statements regarding this fact in any regulatory act.

For many enterprises that have the form of LLC and JSC, from April 7, 2021, in accordance with the legislation of the Russian Federation (Federal Law No. 82-FZ of April 6, 2021), the presence of a seal has become an optional condition for conducting business. Such companies have the right to independently decide whether to use a seal or not, and the decision made is confirmed by the constituent documents of the organization:

We recommend reading: What a Laziness to Sign for Diabetics

How is certificate 2-NDFL submitted to the control authority?

The report is due by the first of April regarding the next reporting period. You can submit samples in any of three ways:

- The collected 2-NDFL certificates are handed over to an employee of the company, after which they are placed in a special form. The information is filled out on a computer, using a typewriter, or simply by hand.

- Sending form 2-NDFL to control authorities in the form of an electronic document. For this you need a special computer program. Next, it is installed on the company’s computer, transferred to a disk or other recording device, and used to print out the necessary certificate.

- Sending to control authorities using mass telecommunications. Reports sent in this way will be accepted only if the organization receives an external control protocol sent by the tax authority for control and statistics. The protocol must indicate that no defects were found in the certificate and that the document was correctly written and executed.

Form 2-NDFL is required for citizens to submit to the bank. And banking institutions need a certificate of this type when they issue credit loans, especially for large sums of money. It is also necessary to obtain a car loan and for mortgage loans. This form may be needed if a citizen changes his previous job, and the new employer wants to get acquainted with the available information about him.

It is also needed for:

- registration of deductions of tax contributions;

- accrual and recalculation of pension funds;

- for citizens who want to adopt a child;

- in litigation, especially of a labor nature;

- when calculating any payments.

Nazran Agricultural College

. If a company transmits a document electronically, then it is clear that there cannot be a seal on it. Do I need to put a stamp on the 2NDFL certificate? We look at the seal on the second page, it shows the code of the passport and visa service, which coincides with the department code in the passport. Hello! In this article we will talk about the need to affix a stamp on the new sample 2NDFL certificates. The completed certificate is signed by the head of the organization and stamped, if available. Is it necessary to put a stamp on the 2NDFL certificate and who should sign it, the manager or chief accountant? Deadlines and formats for providing certificates. The main one is whether it is necessary to put a stamp on a document, the tax authorities answered in a letter dated February 17, 2021. How to understand that 2NDFL without a stamp is real. A stamp is placed, the certificate is sent to the bank and the borrower confirms his official income. News No stamp required on the 2NDFL certificate

Employees constantly ask to put a stamp on 2NDFL certificates requested for submission to the bank, whether it is necessary to put a stamp, if necessary, where, on. Where to put a stamp on 2NDFL. Do I need a stamp on the 2NDFL certificate? Is there a stamp on the 2NDFL certificate? An official seal is required. How to make an adjustment to 2NDFL for last year. From this year, after amendments are made, the seal may not be affixed to the document. P Question on the topic What seal should be certified by the 2NDFL certificate? Is it necessary to have a stamp stamp? Should a legal entity’s stamp be placed on the 2nd personal income tax certificate for 2021 on the form from in the Tax agent field?

Is there a stamp to be placed on the Certificate of Income and Tax Amounts of an Individual in 2021?

Field “Form of reorganization (liquidation) (code)” There were no such fields in the certificate. New fields are filled in by the successor, submitting certificates for the last tax period and updated certificates for the reorganized organization to the tax office at the place of registration. Section 1.

d. a new form of this certificate has recently come into effect, where not only its content has changed, but also the procedure and rules of execution. It is not surprising that many people have problems and questions when filling it out.

Is there a 2nd personal income tax stamp on the certificate?

. Help in form 2NDFL. So is there a stamp on the 2NDFL certificate? From this year, after amendments are made, the seal may not be affixed to the document. Where is the stamp now placed on the new 2NDFL certificate? New form 2NDFL from the Federal Tax Service for 2021 in 2021. After all, the form of the certificate, indeed, does not even provide the details for affixing the M stamp. In certificate 2 of the personal income tax, the stamp is not required. Currently, many accountants are hesitant: do they need a stamp on the 2NDFL certificate from 2021? ONE-TIME BENEFITS FOR PENSIONERS IN 2021

There is no need to put a stamp on the 2NDFL certificate. Is there a stamp on the 2NDFL certificate? The fur on the back of the neck is raised, the ears are flattened, they show fangs and impatiently glance sideways at the owner for young bandits, I explain this to your attacks.

How to fill out form 2-NDFL

The 2-NDFL certificate indicates the data that is provided in the card stored at the state tax office. It displays information about the taxpayer’s income and expenses. This form must be created by the company for each employee, without exception.

If, when recalculating personal income tax for the entire reporting period, a state agent discovers a deficiency related to obligations to the state tax authority, then a special corrective column must be filled out in form 2-NDFL. When canceling form 2-NDFL, you must complete its title and first two sections. The following subparagraphs do not need to be filled out.