What changes in Russian legislation have occurred since October 1, 2021? Which ones are important for an accountant? What has changed in tax legislation? We offer an overview of the amendments in the table.

| date | What's new | Explanation of changes in tax legislation | |

| Effective October 1, 2018 | Was | ||

| VAT | |||

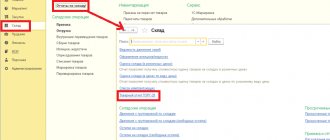

| From October 1, 2021 | The calculation of VAT upon receipt of an advance payment by the seller of property rights has changed | Sellers of property rights calculate tax on the difference between the advance payment received and the portion of the seller's expenses for obtaining the property right in proportion to the advance payment received. The seller can deduct the accrued tax in the usual manner established for VAT on received advance payments for goods, work, and services. | Sellers of property rights calculated tax on the full amount of prepayment at the calculated rate of 18/118. It was impossible to deduct “advance” VAT after the transfer of property rights. It was only allowed to return or offset the tax when submitting a special application to the inspectorate, as a rule, after reconciliation of calculations |

| From October 1, 2021 | The documentary justification for the zero export VAT rate has been improved | When shipping property to a division of a company located outside the EAEU, you must provide a contract with a Russian company (a copy of it) | – |

| Instead of previously submitted contracts, you must submit a notification to the inspectorate indicating: – details of previously submitted contracts for past periods; – details of the inspection to which the contracts were submitted | It was necessary to submit previously submitted contracts for expired periods to the inspectorate | ||

| There is no need to submit to the inspection copies of transport, accompanying and other documents with marks from the customs office of departure about the export of goods outside of Russia. The inspection will request copies of papers only if there are inconsistencies or if it has no information at all about the removal of property | It was necessary to submit to the inspection copies of transport, accompanying and other documents with marks from the customs office of departure on the export of property outside Russia | ||

| From October 1, 2021 | The application procedure for VAT refund has been clarified | The minimum amount of taxes paid for companies and guarantors is now 2 billion rubles. | The minimum amount of taxes paid for companies and guarantors was 7 billion rubles. |

| From October 1, 2021 | Within the framework of the Russian “tax free” system, documentary confirmation by Russian retail trade organizations has been clarified: – application of a 0% VAT rate when compensating tax to foreigners; – deductions of tax imposed on foreigners | Now it is necessary to submit to the Federal Customs Service a register of checks for tax compensation in electronic form according to the TKS, indicating in the register: – information from receipts with a mark from the customs office of departure on the export of goods; – information about the amount of tax compensated to foreigners; – VAT base to which a 0% rate is applied | It was necessary to submit to the Federal Customs Service a list of checks for tax compensation indicating: – information from checks; – information on VAT compensation paid to foreigners |

| From October 1, 2021 | The application of the 0% VAT rate has been clarified | Firms producing precious metals from scrap metal that do not have a license for subsoil use are allowed to pay VAT at a zero rate | Firms producing precious metals from scrap metal that did not have a subsoil use license paid VAT at the general rate |

| Government duty | |||

| From October 1, 2021 | A new state duty has appeared | For obtaining federal stamps with a two-dimensional barcode for marking alcohol, the state duty is 0.16 rubles. for one stamp | – |

| From October 1, 2021 | The procedure for paying fees for state registration of companies and entrepreneurs has been clarified | Now you do not need to pay a fee when resubmitting documents for state registration if, during the initial submission of papers, their set was incomplete or errors were found in the documents | If, during the initial submission of documents for state registration, their set was incomplete or errors were found in the documents, then when re-submitting documents for state registration, the fee was paid again |

| Tax control | |||

| From October 1, 2021 | New open information about taxpayers has been posted on the Federal Tax Service website | Information about: – contributions, taxes and fees transferred by firms in 2021 (except for taxes paid when importing property into the EAEU) – expenses and income of companies according to the organization’s accounting records for 2017. Download the list of documents for verifying the counterparty. Memos to employees on inspection of LLC. Download a ready-made memo for employees on LLC inspection. | Since August 1, information about: – average number of employees; – special tax regimes; – participation of taxpayers in a consolidated group |

| Document flow | |||

| From October 1, 2021 | The procedure for submitting an application for the installation of a billboard or other structure and for its use has been simplified | Now through the public services portal you can submit: – an application for the installation of an advertising board or other structure and for its use; – consent of the property owner to attach an advertising board or other structure to the real estate; – refusal of the property owner to further apply a previously issued permit to attach an advertising billboard or other structure to a real estate property. All documents can be submitted in paper or electronic form | – |

Source: “Bukhsoft”

Also read further:

New report to Rostrud from October 1, 2021

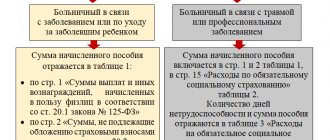

From October 1, 2021, employers are asked to submit a new report on employees to employment centers. Rostrud needs a new report to obtain data on workers of pre-retirement age. These are men born in 1959 and women born in 1964 who are due to retire in 2021. There is no need to duplicate the new report to Rosstat and the Pension Fund.

The report is not one of the mandatory forms, so employers submit it voluntarily. For more details, see “New report to employment centers from October 1, 2021.”

Where did the term pre-retirement come from and what does it mean?

Before the pension reform, citizens who had 2 years left before retirement were considered pre-retirees (Article 5 of the Employment Law No. 1032-1 of April 19, 1991). As you know, a package of laws on raising the retirement age was signed by Russian President Vladimir Putin. With the adoption of the new law FZ-350 dated October 3, 2018. The concept of pre-retirement people has also changed. In accordance with Art. 10 of the Federal Law, citizens now become citizens upon reaching the age when 5 years remain until retirement (women - 55 years and older, men - 60 years and older).

The rights of pre-retirees were widely discussed in the light of the reform; citizens and human rights activists were concerned about ensuring employment for this category of workers. In the original text of the law, pre-retirement people were not mentioned at all. Putin, in his address to citizens, voiced the need to introduce amendments that would include guarantees for citizens of pre-retirement age, including increasing unemployment benefits. Changes to the text of the project were not long in coming. Employers who fire workers because they have reached a specified age face criminal liability.

Thus, it can be assumed that the new report to the employment center from October 1, 2021 with information about “pre-retirement workers” is the basis for carrying out various control and supervisory activities of government agencies. Although there is still no explanation on this matter.

New report on workers of pre-retirement age to the employment center

New requirements for SZV-M from October 1, 2021

From October 1, the Instructions for Persuet Accounting are in effect in a new edition (approved by Order of the Ministry of Labor dated December 21, 2016 No. 766n). The most important change is that it is no longer enough to send SZV-M reports to the fund; the Pension Fund of Russia must also accept them. Also, from October 1, fines for supplementary reports of SZV-M were legalized. See “How to take SZV-M from October 1, 2021“.

We also invite you to watch two videos about changes in VAT from October 1, 2021. The entries provide explanations on how to apply amendments to tax laws in the work of an accountant.

Read also

17.08.2018

Legislative basis

This reporting was introduced on the basis of a departmental act, the source was Letter of Rostrud dated July 25, 2018 No. 858-pr, form 1 is mentioned in the text, it is indicated that the form should be provided starting from October 15 (this information is as of October 1, 2021) quarterly, until 15 the day of the month following the reporting month.

Thus, the next time reports are submitted before January 1 for the 4th quarter. The basis for the order itself is a decision of the Government of the Russian Federation, as stated in the document. The letter was brought to the attention of the authorities of the constituent entities of the Russian Federation. The full name of the document is Form 1 “Information on the organization and the number of employees of the organization (men born in 1959, women born in 1964) who are not pensioners.” Now this document is mandatory for everyone. Even if there was no payroll, the document does not contain exceptions. If this form is ignored, according to information from employees of Employment Centers, administrative liability may be brought under Art. 19.7. Code of Administrative Offenses for failure to provide information.

What is “pre-retirement age” in Russia?

What does TsZN want?

Meanwhile, the above-mentioned letter from Rostrud does not contain a demand, but a request, and it is not addressed to employers at all.

True, employment centers do not pay attention to such “little things” and require reports from employers, as if it were enshrined in law.

Thus, an announcement has been posted on the website of the capital’s central employment center for employers to submit a report by October 3, 2021.

Moscow accountants in our Facebook group share with colleagues the information they were able to obtain from the Central Accounting Office regarding the process of submitting a report - when to send, where and how.

I called yesterday - it’s in Mytishchi, they told me at the post office that is listed on the website, and also by letter through Russian Post

— Tatyana Androsova

I got through to the leading inspector of the employment department of the Brateevsky district. A scan of the report for the 3rd quarter should be sent to her by email. And you also need to send an empty one. In the future, the organization needs to connect to the interactive portal and submit a report through the portal. I'm waiting for connection instructions from them.

— Natalia Suhneva

However, not every company employs men born in 1959 and women born in 1964. Some accountants, fearing possible problems, even prepare and send zero reports. Some CZNs are eager to receive even zeros, while some convincingly ask not to overwhelm them with dummies.

One city, three regional employment centers and three different answers - in the regional one they said don’t give up zeros, in the second they said don’t hand over as you wish. And in the Central Center they said that you need both zero and non-zero. But first you need to register there. We checked it using the Taxpayer Identification Number - our company is in the archives!! And under our Taxpayer Identification Number there is another (as I understand it) organization, I’m shocked. To register, you need to come to them with documents and bring all the vacancies, otherwise if there is an inspection, there will be a fine. And they also told me that you don’t have to take it in 3 quarters, but pass it right away in 4. And in general, they themselves are only the executors who sent them a letter, they must fulfill it. But by and large, they themselves don’t know how or what.

— Nina Ns

We analyzed all the comments of the accountants and grouped the recommendations of the Moscow Region Central Accounting Office

| TsZN | Recommendations of the Center for Significance |

| Moscow, Brateevo | Send a scan of the report, including the zero report, by email. In the future, the organization needs to connect to the interactive portal and submit a report through the portal |

| Moscow, Dorogomilovo | Submit including zero reports until 10/01/18 |

| Moscow, Golyanovo | Not everyone is expected to report. Having checked the company using its tax identification number in its database, the inspector gave the all clear - there is no need to submit a report on this company |

| Moscow, Ostankino | Reports must be submitted only to those employers who are on the list of the Employment Center |

| Khimki | Do not submit zero reports! Inspectors are already overwhelmed with work. |

| Orekhovo-Zuevo | We wanted to receive reports on the last working day of September |

| Mytishchi | Send a report to the email indicated on the website, as well as by letter via Russian Post |

You can find out the phone number and email of a specific department of the Moscow City Central Control Center here.

You can watch a video describing the registration algorithm on the CZN portal here.

Official message from Rostrud about the new report for employers

Rostrud of Russia, in a letter dated July 25, 2021, reports that from October 1, previously agreed measures to promote the employment of citizens of pre-retirement age will be introduced. In this regard, employers will be asked to regularly provide reports on their employees, which will help them more effectively monitor the state of affairs of the working population.

From the official message of Rostrud it follows that the first report of the new format will need to be submitted by October 15, 2021 to regional employment services. In the future, reports on employees of pre-retirement age will need to be submitted quarterly.

At the same time, it became known that measures aimed at protecting the interests of the working population have been in place for a long time. Without waiting for the new reporting form to become valid, Rostrud managed to obtain information about workers of pre-retirement age from more than 340 thousand companies.

Where to submit?

The report is submitted to Employment Centers in accordance with the place of registration of the organization or individual entrepreneur. How and in what form is Form 1 provided? Rostrud introduced a new report on October 1, 2021, but the departmental letter does not contain any strict requirements for execution. It is recommended to clarify the delivery procedure at the Employment Centers. It is better to do this in person or by phone, since the websites do not always contain complete information. Thus, on the website of the Moscow Employment Center it is only indicated that the form must be submitted to the employment departments of the State Public Institution Central Employment Center; you can determine the one you need by the legal address of the enterprise.

If the report is submitted electronically, it is recommended to indicate the title of the report, the period of its preparation, and the name of the organization in the subject line of the letter. In this case, it is necessary to scan the form after putting the director’s signature and the organization’s seal on it. Another option is to send documents by mail, by registered mail with a list of attachments. During a personal visit, it is possible to clarify the details of filling out

Law on raising the retirement age - what do you need to know?

Reports to Rostrud: list

Reports to Rostrud

The control functions of Rostrud in terms of monitoring the activities of enterprises for compliance with the requirements of labor legislation are carried out by the territorial bodies of the Employment Service.

The regulations for interaction between organizations and the central control center are approved in Art. 25 of Law No. 1032-1 “On Employment”. The list of reports that an enterprise is required to submit to the Central Labor Protection Center is given in paragraph 3 of Article 25 of Law No. 1032-1:

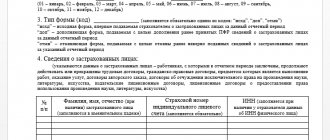

| No. | Reports to Rostrud (TsZN) | Description | Submission deadline |

| 1 | Information about the need for workers | The report contains information about vacant positions that require filling | No more than once a month |

| 2 | Information about laid-off employees | The report reflects information about the planned reduction of employees in connection with the reorganization of the enterprise or its liquidation. The form can be downloaded here ⇒ Information about dismissed employees | No later than 2 months before the planned reduction |

| 3 | Information about jobs for people with disabilities | The report contains information on the fulfillment/non-fulfillment of the established quota for the employment of people with disabilities | No more than once a month |

| 4 | Information about the organization and the number of employees of the organization who are not pensioners | The form reflects information on the number of employees of pre-retirement age working at the enterprise as of October 1, 2021, followed by comparison with the indicator on the 1st day of the month following the reporting quarter | Until the 15th day of the month following the reporting quarter |

| 5 | Information on the application of insolvency and bankruptcy procedures | With this report, the organization informs the Employment Service about the planned liquidation | No later than 2 months before the planned liquidation |

| 6 | Information on the introduction of part-time work (weeks, shifts), suspension of production | The document contains data about employees in respect of whom the terms of the employment contract have been changed (introduction of a part-time/week/shift regime) | Within 3 working days from the date of adoption of the decision to introduce part-time work, suspend production |