Why is it needed?

Until 2021, tax agents only had to fill out and submit 2-NDFL certificates. On January 1, a new form of quarterly reporting appeared - calculation of 6-NDFL. Accordingly, you also need your own tax register for 6-NDFL. The fundamental difference between these two documents is that the new report contains information about all individuals at once, while 2-NDFL contains information about each individual separately.

All tax agents for personal income tax in accordance with Art. 230 of the Tax Code of the Russian Federation must keep records of income issued to individuals for the reporting period. They are also required to include in the report information about tax deductions received by employees and the amount of calculated and withheld income tax. To fill out this data, a tax register is provided for 6-NDFL .

While completing this document, tax agents may have questions. To display information correctly and completely, you need to familiarize yourself with the procedure and form for filling out this register.

Tax card for personal income tax in 2021

When an enterprise employs hired employees who carry out their activities on the basis of an employment agreement, it is mandatory to carry out an accounting policy regarding the income side in the form of wages paid to employees, including the amount of personal income tax.

To avoid confusion, there is a unified procedure that requires the creation of tax cards for taxes. Another name for such cards is tax registers, and they are maintained by the chief accountant. 02/08/2016

The role of tax cards for personal income tax accounting

Cards are filled out separately for each employee; to accurately reflect the results, the following data is needed:

- values taken from reporting 2-NDFL and 6-NDFL;

- the balance calculated from personal income tax is calculated in accounting, and all this is reflected in the balance sheet;

- penalties accrued for late payment of taxes.

Regularly, for the purpose of control, inspectors of the territorial branch of the tax service carry out inspections, which also involve the provision of completed tax registers by the accountant.

Personal income tax card format

If you wish, for your own convenience you can create forms yourself, but it is better to use generally accepted cards that any accounting program contains. They reflect the most complete information taking into account the requirements of the current domestic tax legislation. These requirements primarily refer to the mandatory details that must be present in the register form.

So that you don’t rack your brains over this again, for convenience, the details for filling out are presented below in tabular form.

Values reflected in the personal income tax card

| General indicators | Name of the organization - tax agent Taxable period |

| Information about the income recipient | Last name, first name and patronymic TIN (if available) or passport details Taxpayer status (tax resident or not) |

| Income information | Name date Sum Code according to the directory approved by order of the Federal Tax Service of Russia dated 09/10/2015 No. ММВ-7-11/ [email protected] (Appendix No. 1) |

| Information about deductions and non-taxable expenses | Code according to the reference book approved by order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/[email protected] (Appendix No. 2) Sum |

| Information about personal income tax | The amount of calculated personal income tax and the date of its calculation The amount of personal income tax withheld and the date of its withholding The amount of personal income tax transferred, the date of its transfer Details of the payment order for personal income tax payment |

Penalties

Beginning entrepreneurs are interested in the question of whether there are penalties for the lack of tax registers in the organization? Experts say that ignorance of the laws in this case is clearly punishable. It is impossible to name a single amount that the company will have to pay in relation to the tax inspectorate, because the amount of the fine takes into account the number of tax reporting periods during which the violation took place.

So, if we are talking about the 1st tax period, in 2021 the amount of fine payments fluctuates around 10,000 rubles, and if the violations lasted for several years, you will have to pay at least 30,000 rubles.

What does a personal income tax card look like in 2021 (example)

Post:

Comments

Love

April 26, 2021 at 9:46 pm

I liked the register, would it be difficult for you to give it in Excel???

Monica

October 10, 2021 at 8:31 pm

If sick leave and vacation pay were paid in February, we can no longer reflect this income on the tax card for January. In 2021, income recognition dates have changed, so the card is compiled incorrectly

Irina

November 15, 2021 at 10:18 am

Would it be difficult for you to give it in Excel?

Free form and mandatory positions

Only in the fall of 2015, the tax service adopted an order stipulating the need to submit reports to the Federal Tax Service in accordance with Form 6-NDFL. Its sample has been developed, but the tax accounting register for 6-NDFL does not have a ready-made and legally established form. Essentially, this makes it possible to fill out information freely. Also see “Where is the 6-NDFL calculation submitted?”

Article 230 of the Tax Code of the Russian Federation confirms this conclusion. It says that register forms should be developed by responsible persons within the organization. It is important that the document contains mandatory information. Thus, a tax register for 6-personal income tax, a sample of which you can create yourself, must contain the following data:

- information that allows you to determine who exactly is the taxpayer (it may be similar to that indicated in 2-NDFL for each employee separately);

- types of income received by each individual;

- available tax deductions;

- exact values and names (codes) of those expenses that reduce the tax base;

- the size of each type of income and the date of their receipt;

- status of an individual (resident / non-resident / non-resident with specialization and high qualifications; respectively - codes 1, 2 and 3);

- the amount of personal income tax withheld and the corresponding date of this action, indicating the details of the payment document.

Also see “Period codes in form 6-NDFL”.

What is the responsibility in the absence of a document

The report must be filled out according to the register, so its absence is a violation of the law, and the culprit is liable in accordance with Art. 120 Tax Code of the Russian Federation. This is punishable by fines in the amount of 10–40 thousand rubles. A fine is imposed on each offender individually, depending on the duration of the violation and how it affected the calculation of the tax base.

A tax agent may challenge the sanctions imposed on him in court in the following cases:

Help 2 Personal income tax: design features that an individual entrepreneur should know

- Registers exist and are maintained in the organization, but they are not recorded in the accounting policies. In this case, the claims of the controllers are not legitimate, since this requirement is not mandatory. However, in order to avoid legal disputes, it is better to approve the document forms in the UP;

- The document is being maintained, but the information in the columns is not completely filled out. The inspectorate may consider such a document invalid, since it violates the requirement for completeness of records. An invalid register is equivalent to the absence of a document, and this is subject to a fine. But, if we are talking about additional information and not mandatory information, this cannot serve as a basis for declaring such a register invalid;

- Lack of “line-by-line” registers. During the audit, tax officials may have questions about filling out a particular line, and they may request an additional document deciphering it. If this is not the case, a fine will be imposed. However, the Tax Code of the Russian Federation does not contain such a requirement, which means that this position of the Federal Tax Service is illegal.

Important! If the required information is missing, the register will be considered invalid and you will not be able to challenge the fine.

Correct reflection of overpayment of income tax in the report

Additional positions

An organization can make filling out the tax register for 6-NDFL even more detailed. The following information may be included in the document:

- date of actual receipt of income;

- personal income tax amount;

- the amount of tax calculated and withheld from an individual separately for each type of income;

- the amount of advance payments that are fixed in nature (indicated in the case of foreigners who work at an enterprise using PSN and make income tax deductions on their own);

- the amount of personal income tax that was not withheld;

- the amount of personal income tax that was returned by the tax agent;

- the period within which income tax must be transferred by law to the treasury.

A detailed data register will allow you to fill out a report on Form 6-NDFL quickly and efficiently: this document will reflect all the necessary data, which will greatly simplify the task for accountants.

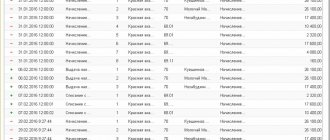

Here's what the tax register for 6-personal income tax might look like:

Why is this document needed?

Organizations are required to create tax registers and reflect in them the generalized information necessary for calculating fees to the budget. A separate document is filled out for personal income tax. Its compilation pursues the following goals:

Verification by regulatory authorities, timeliness and correctness

- paying taxes;

- verification of data provided by the Federal Tax Service by taxpayers themselves;

- simplification of the process of filling out tax reporting.

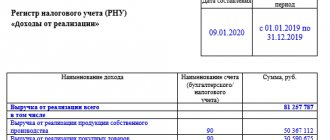

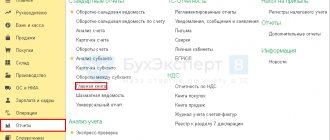

How to correctly generate a personal income tax report 6 in the 1C: ZUP program

There are no standard forms of tax registers established by law. This means that an enterprise can develop a document independently, in free form.

Important! It is recommended to approve the document forms in the organization’s accounting policies.

The following requirements apply to the preparation of the document:

- Data must be completed continuously in chronological order;

- the register structure should be simple and understandable;

- all information influencing the formation of the tax base is included;

- filled out in specialized electronic programs or on paper.

The tax agent details are indicated on the main page of the form. The form itself is presented in table form. It is convenient to use Excel to fill out documents in tabular form. Thanks to the search function in the document, you can easily find the necessary data. The table also has other features that make working with data easier:

- Sorting and filters;

- Mathematical formulas. Using program formulas allows you to largely automate data entry. Thanks to the appropriate Excel settings, when filling in the profits of individuals, you can automatically calculate the tax, taking into account deductions and other nuances.

Despite the fact that the personal income tax register is independently developed and approved by each organization, a procedure is provided where the following must be reflected:

- Information about the company’s employees, allowing to clearly identify each taxpayer (full name of the employee, date of birth, Taxpayer Identification Number, address, etc.);

- employee tax status;

- list of income;

- information on tax deductions and amounts that may reduce the basis for calculation;

- date of payment of remuneration;

- the amount of calculated and withheld tax;

- dates of withholding and transfer of personal income tax;

- details of the payment order for tax payment.

Declaration 6 personal income tax: filling out line 060 in the report

In addition to the specified data for filling out the tax register, you can reflect additional information:

- Tax rate;

- advance payments (if foreigners work under a patent);

- tax that could not be withheld;

- tax returned by the enterprise;

- date of receipt of income;

- deadline for tax payment, according to law.

Attention! If an organization already uses a similar document for 2nd personal income tax, it can simply be kept further and used when submitting 6th personal income tax. Or, if desired, a separate document is created.

When the accountant nevertheless decides to draw up a separate register for 6 personal income taxes, it is advisable to indicate in it the same information that is contained in the report form. Since the form is submitted for all employees of the company, the column with information on the taxpayer (employee) must be replaced and the column with the number of employees to whom income was paid must be indicated.

Other features of filling out the report that need to be taken into account when compiling the tax register:

- Rented every three months;

- filled in with a cumulative total of tax rates;

- filled out for each type of income.

Sample of filling out the tax register for 6 personal income taxes

tax register for 6 personal income taxes.

Do I need to fill out a zero personal income tax certificate 2

General requirements

Regardless of what form entrepreneurs approve in their accounting policies, it must comply with general standards:

- chronological sequence of uninterrupted creation of tax accounting;

- full reflection of the tax base;

- accounting in spreadsheets or in barn books;

- simplicity and ease of formation and perception of information.

In addition to the general requirements for the formation of analytical accounting of tax amounts, the legislation (Article 230 of the Tax Code of the Russian Federation) imposes special criteria. The tax register is also required to display:

- name of the tax payer;

- status;

- type of income;

- the amount of benefits that reduce the tax base;

- the nature of tax deductions;

- dates (wage compensation, personal income tax withholding, personal income tax payment to the Treasury).

All obligations for the creation, compilation, and maintenance of registers rest with the leading accountant and the direct head of the enterprise. These persons are also responsible for storing documentation and guaranteeing access to it for inspectors. Corrections to the register can only be made by responsible persons, and any adjustment is accompanied by the signature of the responsible person and the date of the adjustment with the necessary explanations.