Features of SZV-M adjustment

Any enterprise is obliged to make pension contributions to the Pension Fund. This rule also applies to activities.

Regardless of the employee’s form of work, payments must be made. Contributions to the Pension Fund are mandatory for all employees: employed, part-time or under contract. Since they receive official earnings, the employer must ensure timely payments to the extra-budgetary fund.

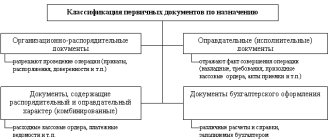

Data on employees is generated in the form of a report, which is sent to the fund. The document can be created electronically or on paper. The latter option can only be used by a company whose number of employees does not exceed 24 people. If the staff consists of 25 or more hired employees, then an electronic report is generated.

The form must be sent to the Pension Fund no later than the 15th of the month. This requirement was introduced in 2021. Previously, the need to submit a report arose before the 10th. The report is submitted on a monthly basis.

What to do if the SZV-M protocol has not arrived

Situations when a protocol does not arrive via SZV-M are not uncommon. Reasons may vary, including technical difficulties and failures. In any case, the employer needs to clarify whether the form has been accepted or not.

According to Law No. 27-FZ of April 1, 1996, SZV-M must be provided no later than the 15th day of the month following the billing month. For failure to comply with the established deadlines, the violator faces considerable sanctions. The fine is 500 rubles. for each insured person for whom a report was not submitted on time. The fact of submitting the document is confirmed by the protocol. If it is not there, then the policyholder also has no evidence of acceptance of the form.

If you find yourself in such a situation, the first step is to contact the territorial division of the Pension Fund. Check whether the report has been received or not. Perhaps the fund's employees are aware of what is happening and they have an explanation for what is happening. Most likely, you will be confirmed that the form was accepted, but the protocol was not sent due to glitches. There is no need to re-submit the SZV-M or provide it with the correction code “DOP”. This will confirm that the report was sent after the due date. This means that the Pension Fund will have grounds for collecting fines.

Read:

What to do with a specific type of error

There are several codes that contain a decoding of the error made. For each type of inaccuracy, the system assigns a certain score, which should be taken into account to correct specific errors. To make this information easy to understand, we have prepared a table for you.

| Code | Protocol | Status | What should be done |

| 10 — 20 | Positive | The document is accepted | Repeated submission of the report is not typical. This means that SZV-M will be received with errors. Errors are minor or non-existent. |

| 20 — 30 | Positive | Pension Fund form accepted | It is necessary to correct only the mistakes made and resubmit the report only for employees whose information has been corrected |

| 30 — 40 | Positive | The report is partially taken into account | It is necessary to correct all incorrect data on employees and send only corrected information for verification |

| 50 | Positive | Refusal to accept the form | Any inaccuracies should be corrected and the report sent again. |

If the encoding is 10 or 20, then such a report is accepted by the fund and does not require any clarification. These numbers may draw your attention to minor inaccuracies, taking into account which you will need to submit the form for the next month. The protocol is a kind of assessment of the work of the employee who generated the report. It identifies errors in the SZV-M form and dictates consequences for supplementary or secondary reports.

Errors 30 and 40 imply resending the report only for employees whose information contained errors. An error with code 50, identified during the check, means that your report has not been accepted in full, and you need to redo it again for all insured personnel.

Codes 10 - 20

Let's look at which sending errors are encrypted under the numbers 10 - 20:

- The employee's full name is indicated in Latin letters;

- an empty column for entering a TIN;

- the letter “е” is printed;

- use of open/close quotes, parentheses, hyphens, apostrophe and other special characters;

- an error in the first name, last name or patronymic associated with the use of letters from two alphabets: Latin and Russian;

- dot among the letters full name;

- error in TIN;

- no middle name.

The organization that compiles the report does not always have all the data on employees. The most common example is the lack of a TIN. His employee may simply forget to bring it; it is also possible that the number is not in the tax office database.

In this case, no information is entered in the report, that is, the columns remain empty. The system will send the code with an error, but this does not mean that you need to insert zeros into the columns. This will also be considered an error.

If the employer has data on the TIN of employees, then they must be maintained correctly. This follows from the fact that the Pension Fund contains all the data on the company’s employees. And if the fund is aware that the employee has a tax identification number, but you did not indicate it, then such an invoice will not be accepted.

Another common reason for cats 10 - 20 is a mistake in the surname in SZV-M. Use only letters of the Russian alphabet.

Error code 30 - 40

The list of inaccuracies, encrypted under the digital interval 30 - 40, is as follows:

- large space between words;

- a period placed after the surname;

- the hyphen is surrounded by a space;

- a hyphen placed after the full name;

- the checkpoint is incorrectly marked;

- SNILS number is not true;

- the numbers indicating the line number are not in ascending order;

- zeros instead of TIN;

- missing first or last name;

- space before the TIN or SNILS number.

To clarify the correctness of the entered SNILS, you can go to the website of the insurance fund. In the “Benefits” section you will enter 11 digits, and the system will produce a result that will tell you whether such SNILS is in the database.

You will not receive any information about the employee, knowing his SNILS number, from this request to the site. This is considered confidential information. In other words, you can only find out whether such a combination of numbers actually exists.

SZV-M error code 50

If the protocol is negative with number 50, then the form contains the following errors:

- incorrect structure of the file itself;

- electronic signature is not in the correct format;

- The TIN of an individual entrepreneur or company contains numbers that do not correspond to reality;

- in the adjusted report, instead of the mark “additional”, “output” is indicated;

- incorrect numbers in the registration number assigned by the Pension Fund;

- error in the period (the reporting period is indicated incorrectly (for the next month, for example).

The report is sent in the form of an XML document, which must include:

- registration number of the fee payer;

- code of the Pension Fund that accepts the form;

- date of compilation (first put the year, then the month and day);

- an identifier that allows you to determine the degree of uniqueness of the compiled electronic form.

Reverse

Submitting an incorrect report on the SZV-M form to the Pension Fund office results in a negative report being received in return. This means that the electronic SZV-M was compiled with critical errors. Their code is 50.

The legislation obliges you to send a completed form with already corrected errors that were in the previous report a negative SZV-M protocol

Keep in mind: in the event of a critical error, the fund will not accept the form in any form. Even if all parameters were specified correctly, a negative protocol was received. For example, in case of a system failure.

What is provided for those who made a mistake

Inaccuracies when sending a report are punishable by fines. If the Pension Fund does not accept your form, then expect penalties.

The fine amount is 500 rubles. It is charged for each employee for whom there is an inaccuracy. No matter how many errors there are in the report for one employee, the amount of the fine does not change. And if you made gross errors about 10 employees in one report, then you will pay 500 * 10 = 5000 rubles. Errors in the process of processing the report are summed up for each employee.

If the company has a small number of employees, then the fine will not be impressive. But for companies with several dozen people on their staff, this amount can be large. Therefore, carefully fill out all the fields to avoid unpleasant consequences.

Penalties for errors are assessed not only for the codes specified in the protocol, but also for late submission of the report. Try to approach the question of filling out the form in advance.

Error code 30 in SZV-TD

An error with code 30 is not considered critical and means that the SZV-TD report will be partially accepted, but information will need to be submitted again for the employees for whom the error occurred.

For a complete list of reasons for error code 30, see the Pension Fund Resolution at the link at the beginning of the article.

We will look at the most common errors:

- The full name and SNILS of employees must correspond to the data in the Pension Fund (code VS.B-ZL.1.1). An error may occur, for example, when changing an employee's last name. SZV-TD data , but no changes have yet occurred in the Pension Fund database.

- Code VS.B-MP.1.1 may appear if, when submitting adjustment information for SZV-TD, it turns out that a unique identifier (UUID) was not found in the Pension Fund database for the canceled event. For more details, see SZV-TD: adjusting or canceling information about work activity in 1C: ZUP 3 using examples

- Code VS.B-MP.1.2 means that in SZV-TD there is an event with a unique identifier (UUID), which was previously registered in the Pension Fund database.

- An error with code ETC.SZV-TD.1.17 may occur if a reason was not specified for the personnel event “TERMINATION”.

To ensure that this error does not occur in the Dismissal , do not forget to fill out the details Grounds for dismissal .

To correct error code 30, you will need to create a new SZV-TD for the employees for whom the problem arose.

How to fix errors without penalties

To prevent the system from giving you a negative protocol, follow the recommendations:

- Submit your report strictly before the 15th;

- Correctly use the marks “iskhd”, “o;

- To preview the generated report and eliminate errors during verification, download the free program owned by the Pension Fund of Russia - CheckPFR. The download link can be found on the PF website. The SZV-M error will be identified by you even before sending the report. Changes are periodically made to the program, so do not forget to update it on your computer in a timely manner.

Errors with code 10, 20

These are the most harmless mistakes that an insured can make. Therefore, if they are available, the report is still considered submitted.

If the SZV-M inspection protocol contains warnings with code 20, this means that there was:

- <or> the TIN of the insured person is incorrectly specified, which is checked using the TIN control number;

- <or> the TIN of the insured person is not indicated at all.

If the TIN of the insured person is indicated incorrectly

Despite the fact that the report was accepted by the Pension Fund, it is better to correct the incorrect TIN. To do this, you need to simultaneously submit two SZV-M forms: canceling (with the “cancel” type) and supplementing (with the “addition” type). In the first, indicate the data on an individual with an incorrect TIN, and in the second, indicate the data on him, but only correct ones. It is safer to correct all shortcomings before the end of the reporting campaign, i.e. before the 10th day of the next month (in 2021 - before the 15th day). If this is not done, then for each “erroneous” employee you will have to pay 500 rubles. fine (Article 17 of Law No. 27-FZ).

Note! It is quite possible that in order to correct the TIN, your Pension Fund branch will only need to receive one complementary form instead of two. This point should be clarified with fund specialists.

Example. The accountant of Retro LLC in SZV-M for December 2021 mistakenly swapped the last two digits in the TIN of Igor Semenovich Parfenov. It should be 760700613663, but he wrote down 760700613636. See below how the accountant corrected the error.

You can find out a person’s TIN at. Follow the “All services” link on the main page. From the proposed list of electronic services, select “Find out TIN”. Fill in the full name, date and place of birth, and passport details of the citizen. After submitting your request, you will receive his TIN. If the identification number is missing, it means the person did not apply to the tax authority to obtain it.

If the TIN of the insured person is not indicated

This situation is possible if the “physicist” did not provide his TIN. Therefore, the policyholder simply has nothing to record in the corresponding column of the form and leaves it blank. In accordance with paragraph 3, paragraph 2.2, Article 11 of Law No. 27-FZ, the TIN of the insured person in the SZV-M is optional and is indicated only if available. Therefore, even if the Pension Fund warns about the absence of such information in the report, nothing needs to be corrected.

Note! An employer does not have the right to demand a TIN from an employee just because he now provides such information to the Pension Fund. The list of mandatory documents for employment is defined in Article 65 of the Labor Code of the Russian Federation. And the TIN certificate is not named in it.

By the way, if the policyholder has data on the TIN of the citizens working for him, but does not indicate it in the report, then the Pension Fund of the Russian Federation will definitely reveal this when reconciling with the tax authorities. Then there is a high probability that the payer of contributions will be fined under Article 17 of Law No. 27-FZ for unreliability of the information provided (). Therefore, if information about the TIN is available, it must be included in the form. This is the requirement of clause 3, clause 2.2, article 11 of Law No. 27-FZ.

Deadlines

June 6 is the deadline to submit the canceling or supplementing SZV-M (PFR letter dated May 4, 2021 No. 04/406/1984).

The deadline for submitting new monthly reports to the Pension Fund is no later than the 10th (15th from 2021) of the next month. For example, the first report for April 2021 must be submitted by May 10.

| Month for which reporting is submitted | Submission deadline |

| December 2016 | from January 1 to January 17, 2017 |

| January 2017 | from 1 to 15 February 2017 |

| February 2017 | from March 1 to March 15, 2017 |

| March 2017 | from April 1 to April 17, 2017 |

| April 2017 | from May 1 to May 15, 2017 |

| May 2017 | from 1 to 15 June 2017 |

| June 2017 | from July 1 to July 17, 2017 |

| July 2017 | from 1 to 15 August 2017 |

| August 2017 | from 1 to 15 September 2017 |

| September 2017 | from October 1 to October 16, 2017 |

| October 2017 | from November 1 to November 15, 2017 |

| November 2017 | from December 1 to December 15, 2017 |

| December 2017 | from January 1 to January 15, 2018 |

* If the date of submission of reports to the Pension Fund falls on a weekend (or non-working) day, the deadline is postponed to the next working day

In advance

You can submit from the 1st (May) of the following month. However, the law does not prohibit submitting reports in advance (early). Therefore, the Pension Fund of Russia will begin accepting such reports on April 15. However, you need to submit such a report before the end of the month only if you are sure that you will not have another employee (any) before the end of the month. Otherwise, you will still have to submit an amendment or pay a fine of 500 rubles. for every new one.

Who is responsible for delivery?

Before clarifying the main issue - when there is no protocol from the Pension Fund for SZV-M - you need to understand the terminology.

What is "SZV-M"? This is a special form according to which a company or individual entrepreneur keeps a report to the Pension Fund of the Russian Federation. Stands for incoming information about the insured. That is, which the company submits to the fund. And the letter “M” indicates that this reporting is monthly (PFR Resolution No. 83p dated 02/01/2016).

Also see “New SZV-M report form from 2021”.

The head of the company appoints the person responsible for maintaining such documentation at his own discretion. But, as a rule, this is done by someone from the HR department (or an accountant): they have access to all personal affairs and contracts with employees.

Every month, SZV-M provides a list of all employees who worked for the organization during the reporting period (month). Even if a person worked for the company for only one day, information about this still needs to be reflected.

Also see “Instructions for filling out the SZV-M form in 2021.”