Introductory information about maternity pay

Maternity benefits paid by employers are not indexed annually. However, the maximum benefit will increase on 1 January 2021 because the accountant will need to take the new maximum average daily earnings into account when calculating benefits.

Let us remind you that maternity benefits are paid in a lump sum and in total for the entire period of maternity leave, which is (Part 1, Article 10 of Law No. 255-FZ):

- 140 days (in general);

- 194 days (with multiple pregnancies);

- 156 days (for complicated births).

When is the minimum wage taken for calculation?

In some cases, to calculate maternity benefits, you need to take the current minimum wage as the employee’s average monthly earnings:

- less than six months of experience;

- lack of income in the billing period, for example, there was no official work in the last 2 years, being on maternity leave with a previous child;

- The average monthly income is below the minimum wage - the reasons are the same: there was no work for the entire period or partly, or there was work, but it was unofficial, low wages, maternity leave.

Important! If there were maternity leaves in the calculation years (for pregnancy and childbirth, for child care), then these years can be replaced with previous ones. How to change years correctly?

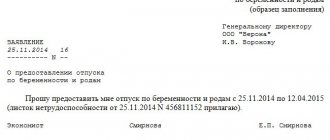

To select convenient years for calculation, a statement is written according to this sample.

Examples of calculating sick leave for pregnancy when leaving from one maternity leave to another can be found here.

Maximum benefit amount for BiR in 2020

Maternity benefits, in general, should be calculated from the average earnings for the billing period, that is, for the two years preceding the onset of illness, maternity leave or vacation (from January 1 to December 31).

Accordingly, if an employee goes on maternity leave in 2020, then the billing period will be 2021 and 2021 (Part 1, Article 14 of Federal Law No. 255-FZ of December 29, 2006). Earnings include all payments to the employee for the billing period, from which the employer calculated contributions in case of temporary disability and in connection with maternity (Part 2 of Article 14 of the Federal Law of December 29, 2006 N 255-FZ). As for the number of calendar days in the billing period, there can be either 730 or 731 (if the billing period falls on a leap year). Excluded days include calendar days falling within the following periods:

- illness;

- holidays according to the BiR;

- maternity leave;

- releasing an employee from work with full (partial) retention of salary, if insurance contributions were not accrued on this salary.

The maximum maternity benefit that a worker can receive is limited to the maximum average daily earnings. In 2021 it is 2301.36986 rubles. (RUB 815,000 + 865,000) / 730.

In 2021, take the employee's earnings for 2021 and 2021 to calculate maternity benefits. The maximum amount of payments that can be taken into account in the calculation is RUB 1,680,000. (815,000 + 865,000).

Thus, the maximum amount of maternity benefits in 2021 will be:

- RUR 322,191.78 – during normal childbirth (2301.36986 x 140);

- RUB 359,013.69 – for complicated childbirth (2301.36986 x 156);

- RUB 446,465.75 – with complicated multiple births (2301.36986 x 194).

The indicated maximum sizes will not change from January 1, 2021 due to the increase in the minimum wage. An increase in the minimum wage only affects the change in the minimum maternity leave. Also, the indicated amounts are not subject to indexation from February 1, 2021. These amounts will remain unchanged throughout 2021.

The size of the minimum maternity leave in 2021

The minimum wage regulates the lower threshold of payments, including in the case of maternity benefits for pregnancy and childbirth. The calculation is based on two options: daily and monthly.

There are several established minimum security values for 2019:

- monthly federal minimum wage - from January 1, 2021 - 11,280 rubles;

- regional wages, which are set independently in the constituent entities, are always greater than or equal to the federal amount;

- The average daily minimum wage is 370.85 rubles from January 1.

The minimum sick leave benefit for pregnancy and childbirth is calculated using the formula:

Formula:

P min. = Minimum wage * 24 / 730 * Days of maternity leave

When going on maternity leave from January 1 to April 30, 2021, the minimum maternity leave for pregnancy is RUB 51,919.

The amount of the minimum benefit for BiR in 2021 - link.

Minimum benefit amount for BiR in 2020

To determine the minimum amount of the BiR benefit, if the maternity leave began in 2021, the new minimum wage from January 1, 2021 is relevant - 12,130 rubles.

If maternity leave began on 01/01/2020 or later, then the minimum average daily earnings will be 398.794521 rubles. (RUB 12,130 x 24/730). Accordingly, the minimum amount of the BiR benefit for a standard maternity leave (lasting 140 days) will be 55,831.23 rubles. (RUB 398.794521 x 140 days).

Therefore, with different durations of maternity leave in 2021. There will be different minimum maternity payments:

- RUB 55,831.23 (398.794521 × 140 days) – in the general case;

- RUB 77,366.14 (398.794521 x 194 days) – in case of multiple pregnancy;

- RUB 62,211.95 (398.794521 x 156 days) – for complicated childbirth.

However, keep in mind that an employee can receive a BIR benefit less than the minimum value in 2021 if she works part-time.

Also, if the length of service of an employee going on maternity leave is less than 6 months, then she is paid a B&R benefit in an amount not exceeding the minimum wage for a full calendar month (Part 3 of Article 11 of Federal Law No. 255-FZ of December 29, 2006). This case will be discussed in detail in this article .

Read also

20.12.2019

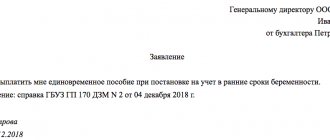

One-time payment up to 12 weeks of pregnancy

Once you understand that pregnancy has occurred, you should take care of receiving the first payment - one-time pregnancy assistance. This maternity benefit is available to those who register at the antenatal clinic before the 12th week of pregnancy. Follow the instructions of your attending physician, because he will give you an idea of whether or not to assign a one-time payment up to 12 weeks of pregnancy (for example, due to the threat of miscarriage and the pregnant woman’s refusal to stay in the hospital - non-compliance with the doctor’s recommendations).

The amount of this payment will be 675.15 rubles, and is issued on the basis of a certificate from the antenatal clinic.

One-time regional payments depend on decisions made for a specific region.

Constant maternity benefits

Payments will be monthly until the child reaches three years of age.

Please note that for a period of up to thirty weeks, officially employed women and registered individual entrepreneurs who have entered into an agreement with the social insurance fund have the right to receive maternity benefits.

Upon reaching the 30th week of pregnancy, a sick leave certificate is issued, which must be presented at the place of work to receive maternity benefits. If pregnancy occurs with more than 1 child - at 28 weeks. The size of these payments depends on your average salary for the billing period. The statutory deadline for assigning payments to women on maternity leave is 10 days from the date of submission of the full package of documents, the payment falls on the nearest salary payment date.

Along with the sick leave, you receive a birth certificate, which is intended for: healthcare institutions, maternity wards and clinics.

Payments upon birth of a child 2021

- A one-time benefit for the birth of a child is 18,004.12 rubles.

- Until the child reaches one and a half years old, a benefit will be paid in the amount of 40% of income for the billing period - 2 years.

- Maternity capital is assigned to mothers for their first child in the amount of 466,000. Maternity capital is subject to verification of the intended use of funds (i.e., the amount can be debited from the account to spend on housing, education, health, etc.). Maternity capital can also be obtained in additional amounts – at the regional level.

- When your child reaches a more conscious age, consider using an electronic queue for preschool institutions.

- At the birth of children, parents are entitled to some tax deductions: part of the salary is not subject to income tax, and part of the amount spent on the education of older children is also returned.

An example of calculating maternity benefits based on the minimum wage

Let's consider several situations.

Example 1

Lawyer Stepanova A.S. is pregnant with her first child. Worked in the organization for 7 months. I had no earnings in 2021 or 2021. The birth took place without complications.

Let's calculate the BIR allowance that she needs to pay in 2020: (12,130 x 24: 730) x 140 = 55,831.23 rubles.

Example 2

The conditions are the same, but the employee is pregnant with twins, and the birth was complicated.

The amount of the benefit in this case will be: (12,130 x 24: 730) x 194 = 77,366.13 rubles.

Example 3

The employee is pregnant with one child, the birth was without complications. In 2021 and 2021, I worked under an employment contract and had a small income:

- 2018 - 130,000 rub.

- 2019 — 140,000 rub.

In this case, the benefit must be calculated in two ways:

- Based on average earnings.

- According to the minimum wage.

Then choose the largest benefit amount.

- Amount of benefit for average earnings: (130,000 + 140,000: 730) x 140 = 51,780.82 rubles.

- Amount of minimum wage benefit: (12,130 x 24: 730) x 140 = 55,831.23 rubles.

Since maternity leave according to the minimum wage is greater than the benefit calculated based on average earnings, the employee will receive 55,831.23 rubles.

The following articles will help you calculate benefits in other situations:

- “How to calculate maternity benefits in 2021: an example”;

- “How to calculate maternity benefits without length of service”;

- “From maternity leave to maternity leave: benefit calculation in 2021”;

- “Pregnancy benefit for workers in 2021”;

- “How to calculate maternity benefits when working part-time.”

Calculation procedure

A woman during her pregnancy, as well as immediately after its completion, is given sick leave for a duration of 140 days.

This period of time is called maternity leave .

Then she has the right to take leave to provide direct care for the newborn until he is one and a half years old. This type of exemption from work can be taken not only by the mother, but also by any other family member if he will directly care for the child. These two periods are called maternity leave and are subject to payment in accordance with current legislation.

They are paid according to the following algorithm :

- The basis for calculation is two years before the start of the current year in which the sick leave was issued.

- The average daily earnings are calculated, then multiplied by the number of days of the paid period.

- Leave related to pregnancy and subsequent childbirth is paid in full, regardless of whether the woman has an insurance period.

- Parental leave is paid at 40%, also regardless of length of service and who takes it.

Both of these payments are limited by minimum and maximum limits , which change almost annually, depending on the minimum wage and the cost of living.