Which organizations use the statement?

This type of statement can be used in a variety of institutions: state and non-state. Most often it is used in educational institutions, scientific and medical centers. Sometimes this document can also be found in commercial companies, since it is convenient in that it contains all the necessary information for accounting for a certain group of inventory items.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

In what cases is form 0504210 used, and in what cases is form 0504230

The use of these forms directly depends on the operations and types of material assets:

√ Reporting form 0504210 “statement” is used if material assets are written off at the time of use and such materials are issued for economic, scientific and educational needs, i.e. this form is essentially a demand invoice;

√ Reporting form 0504230 “act” is used when there is a phased (not one-time) write-off of material assets, such MTs can include fixed assets. That is, this write-off is carried out under control and in accordance with legal norms.

What materials are included in the document

Not all materials used in the activities of the organization are subject to reflection in this type of documentation. Only those items that are used to carry out work to achieve the goals and solve the professional tasks of the institution and whose price per unit does not exceed three thousand rubles should be included here. In particular, these are office supplies (office paper, pens, markers, pencils, hole punches), office equipment, consumables and replacement accessories, etc.

The regulatory legal acts of the institution must necessarily indicate the category of inventory items recorded on the statement, with a detailed description of them.

Accounting for material assets

Inventories are assets used as raw materials in the production of products, performance of work, provision of services, for resale, as well as for the needs of the organization. It is also acceptable to use the term “inventory assets”.

Accounting for inventories in accounting is regulated by Guidelines for accounting of inventories (approved by Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n) and PBU 5/01 “Accounting for inventories” (approved by Order of the Ministry of Finance of Russia dated June 9, 2001 No. 44n).

If the need arises and there are sufficient grounds, the organization can write off inventory items. Reasons for writing off material assets (clause 90-132 of Order of the Ministry of Finance of the Russian Federation No. 119n):

- release of materials into production;

- sale of materials by the organization to individuals and legal entities;

- write-off of materials that have become unusable after expiration of storage periods;

- write-off of obsolete equipment;

- write-off when shortages, theft or damage are identified, including due to accidents, fires, and natural disasters.

Documentation of these operations is carried out through accounting documents, including the act of writing off the inventories. An organization can develop the form independently or use a unified one approved for public sector organizations (No. 0504230 according to Order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n).

Why do you need a statement?

A statement is a reporting document on the basis of which an organization carries out accounting, write-off of material assets and fixed assets worth up to three thousand rubles.

The main advantage of this document is that its formation does not require convening a special commission (as in the case of writing off goods and materials with a higher value).

The statement itself is not particularly complicated, but, nevertheless, its preparation should be taken extremely carefully and seriously, since during control actions carried out by supervisory authorities, it is such documentation that is checked first. Identification of even the slightest inaccuracies in the completed form in comparison with information from other papers is fraught with the imposition of an administrative fine on management and financially responsible employees.

Statement or act

The write-off of inventory items in organizations of this type can also be formalized by an alternative document - an act on the write-off of inventories, the form of which is also approved by the above-mentioned order of the Ministry of Finance. But unlike a statement, the materials on which are written off at a time, write-offs based on an act require the adoption of an appropriate decision by a special commission.

The act itself, according to the principle of its completion, is similar to the statement for writing off inventory items. But in accordance with the specifics of the document, it additionally contains the conclusion of the commission that makes the decision to write off materiel. It is not the general director who signs the act, but the members of the commission and its chairman.

One way or another, each institution must independently approve the list of cases in which one or another document is used. Traditionally, such information is fixed in the accounting policies of the organization.

How to make a statement

The list of issuance of material assets for the needs of the institution refers to the primary documentation used mainly, as mentioned above, in state budgetary organizations. That is why its unified form is used, developed relatively recently - in 2015 (the previously valid form was no longer valid) and filled out in a certain order

The statement can be made in “live” form or in printed form, but in the second case it must be printed (for approval). If the statement is made on paper, the remaining empty lines should be crossed out; if in electronic format, then the empty lines must be deleted (to avoid all kinds of manipulations with the document)

It is formed in one original copy, which is initially compiled in the department for issuing inventory items, and then transferred to the accounting department.

Information about the finished statement must be entered into a special accounting document - a journal, and then handed over to the responsible employee for storage. The storage period for the statement is determined either by the accounting policy of the institution or by the laws governing the creation of this type of documentation. After the statement loses its significance, it can be disposed of (subject to the procedure also established by law).

The document is the basis for writing off materials (Obukhova T

As we said above, according to the Methodological Instructions, the statement is approved by the head of the institution and serves as the basis for reflecting the disposal of inventories in the accounting records of the institution. Clause 36 of Instruction No. 174n also states that operations for the disposal of materials from one MOL to another may well be reflected in the statement. When writing off these materials from the accounting accounts, an act is drawn up, unless the accounting policy of the institution establishes otherwise. According to Resolution No. 71a, the invoice is used to record the supply of material assets to the farms of one’s organization located outside its territory, or to third-party organizations on the basis of contracts and other documents. The invoice is issued by the employee of the structural unit in two copies on the basis of agreements (contracts), orders and other relevant documents, and the recipient presents a power of attorney to receive valuables, filled out in the prescribed manner. The first copy is transferred to the warehouse as the basis for the release of materials, the second - to the recipient of the materials. Taking into account the provisions of clause 36 of Instruction No. 174n, materials are not written off on the basis of the invoice. This primary document is used when reflecting transactions for accounting for the supply of material assets to the farms of one’s organization located outside its territory, or to third-party organizations on the basis of contracts and other documents. To reflect the operation of transferring materials (pencils and pencils), a statement is used, and on the basis of it, as we said above, materials are written off when they are transferred from MOL. The write-off of materials from accounts is usually documented in an act.

Please note => Kamchatka single mother benefits

Sample statement

- On the right, at the top of the statement, several lines are reserved for the signature of the head of the institution.

- Below is the date of formation of the statement, the name of the organization (full) and the structural unit in which it was issued.

- Next, enter information about the financially responsible person: it is enough to indicate here his last name, first name and patronymic.

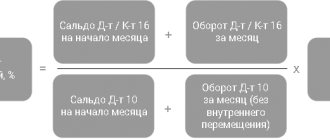

- Then comes the main section. It begins with accounting records of the postings of inventory items entered on the form.

- Below, the chief accountant and the employee who issued the goods and materials according to this statement put their signatures; the document is dated again.

- The second part of the form contains the actual information about inventory items, formatted in the form of a table.

- The full name of the employee who received them is entered in the first column, and he also signs at the end of the corresponding line.

- The vertical columns contain data about the objects to be accounted for (their name and code) and the unit of measurement (also in the form of name and code).

- After the statement is completed, its results are summed up: the issued quantity of each item of materials, as well as their cost per piece and the total cost for all columns.

Write-off of materials step-by-step instructions for accounting

Please note that this applies not only to materials that go into production, but also to any property, including stationery used for administrative needs. Materials should not be issued “in reserve”. They must be used immediately. Therefore, a one-time operation to write off 10 calculators for an accounting department of 2 people, during an audit, will certainly raise questions as to what purpose they were required in such quantities. However, in the warehouse the storekeeper or warehouse manager is responsible for them, and the materials are taken into account on account 10. When the materials leave the warehouse, the situation will change: the account and the person in charge will change. In this article we will analyze the write-off of materials with step-by-step instructions for this procedure for you.

Please note => Categories of citizens who have benefits for transport tax in Tolyatti

What form of the act of acceptance and transfer of material assets should be used?

It is not mandatory, but there are standard ones, that is, the most common and universal ones - we will consider them below.

MX-1: features of its filling

It looks like this:

Pay attention to the number and location of fields - they are designed so that you can clearly present all the important data. And the law does not prohibit removing some of them or adapting them to your needs. Why? Because the document itself is proof of a change in the user of the asset - it confirms an already accomplished fact, and does not give permission to carry out a transaction, so it is not subject to particularly strict requirements.

This form is convenient to use as a basis when concluding agreements, leases or temporary possession agreements. When you own the asset, be sure to leave space to record your complaint so that if you receive an item back that is defective, you can state your dissatisfaction and take the matter to court to resolve the dispute. And so that the chances of winning the case are subsequently as high as possible, it is worth immediately indicating as much information as possible about the parties to the transaction and its object (quality characteristics, consumer properties, etc.).

Attention, the document will not be considered valid if it is signed by persons who do not bear any obligations in the event of theft, damage, or partial damage to property.

Sample act of acceptance and transfer of goods and materials between financially responsible persons

Again, the legislation does not provide for one form as mandatory. But a certain practice still exists: for example, catering enterprises and related fields most often use the OP-18 form, and other companies can also adopt it. It is convenient enough to become the basis on which you can easily develop your own primary document, including details in it in accordance with paragraph 2, paragraph 9, article of Federal Law No. 402. The main thing is that it has legal force, and for this it should be approved in the accounting policy by order of the manager and make sure that he gives a whole range of information.

The act of transfer of material assets between MOL organizations must contain:

- name, place and date of filling;

- Full name, passport details of persons receiving and donating assets;

- an employment contract, order, other papers explaining the need to change the user of the property;

- a list of objects, which is most conveniently presented in a table - with serial and inventory numbers, name of the item, units of measurement, number of pieces in the batch, cost;

- confirmation of a competent inspection and absence of claims on both sides;

- a note about how many copies have been created; usually there are two of them, but you can make three - for accounting or inspection authorities.

At the end - the signatures of the manager (or his authorized subordinates) and the MOL. In general, the document looks like this:

Form for the act of acceptance and transfer of material assets to the employee (sample)

It is relevant when the asset remains on the balance sheet of the enterprise, but the one who bears the obligation to store it quits or goes on vacation. In such a situation, it is necessary to appoint a new MOL - according to the following scheme:

- An inventory is carried out to find out if there is a shortage, and its results are included in special reports. You can simplify this process using software from Cleverence, for example, Sklad15.

- The first person signs that he is parting with the agreed upon items, the second - that he receives them.

All this can be done not only directly, but also through a third party, which is the company itself. In this option, more bureaucratic work and confirmation will be required: first, that the objects have returned to the balance sheet of the enterprise and there are no claims against the subordinate who held them, then, that their next custodian has been found and appointed.

Developed on the basis of OP-18, the document looks like this: