Tax consequences of a loan agreement: what is important for the lender to know?

Accounting, taxation, reporting, IFRS, analysis of accounting information, 1C: Accounting

03/04/2014 subscribe to our channel

The previous article* discussed the main legal issues that arise when concluding and executing a loan agreement. Depending on the terms of the concluded agreement, various tax consequences are possible for its parties.

In this article, 1C:ITS specialists talk in detail about what a lender should pay attention to when concluding a loan agreement.

Note: * Read more in No. 12 (December) “BUKH.1S” for 2013. Under a loan agreement, property (things or money) is transferred to the borrower, and he undertakes to return what he received in the same amount. In this case, it is necessary to take into account possible tax obligations.

VAT In relation to this tax, it is important in what form the loan is provided. So, if it is issued in cash, then the lender does not have an obligation to pay VAT, since the ownership of the property does not pass to the borrower ().

In addition, the lender is not obliged in this case to issue an invoice (letter from the Russian Ministry of Finance). In turn, it does not provide for exemption from VAT for non-monetary loan transactions.

Moreover, regulatory authorities believe that when providing non-cash loans, the lender must pay VAT (letter of the Ministry of Finance of Russia dated October 24, 2007 No. 03-07-11/515).

In addition, no later than 5 days from the date of transfer of property to the borrower, an invoice with allocated VAT () should be issued to him. The moment of calculation of VAT will be the day the property is transferred to the borrower ().

However, if the lender is ready for disputes with the tax authorities, VAT may not be paid when issuing a non-monetary loan.

Your position can be justified by the fact that the transfer of property under a loan agreement is repayable in nature, which follows from. Accordingly, when providing a non-monetary loan, the subject of the agreement does not occur, therefore there is no VAT object. This position is confirmed by judicial practice - the resolution of the Federal Antimonopoly Service of the Moscow District.

Income tax Cash or other property transferred under a loan agreement is not recognized as an expense for income tax purposes (). This is discussed in. Insurance premiums The payment of funds to an individual, including an employee, under a loan agreement is not subject to insurance premiums for compulsory pension, medical and social insurance, as well as contributions for “injuries” (,).

However, difficulties may arise if the organization subsequently forgives the debt on a loan issued to an employee (we will consider this situation in more detail below).

The lender has the right to receive interest from the borrower on the amount of the loan issued by him, unless otherwise established by agreement of the parties ().

In relation to this interest, it is worth paying attention to the following tax consequences.

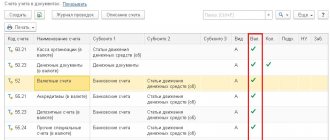

Loans provided: accounting and reporting

The company has the right to issue a loan to another company or individual.

This transaction is formalized in writing - a loan agreement. The interest that the recipient must pay on the loan is usually specified in the agreement. If there is no such condition in it, then they are calculated based on the refinancing rate in effect at the time of loan repayment.

The company has the right to issue an interest-free loan. However, such a condition must be specified in the contract.

An exception is provided only for loans issued not in cash, but in kind.

By default, they are considered interest-free. At the same time, the company has the right to establish in the contract the borrower’s obligation to pay interest on them as well.

Please note that the amount of interest-free loans is not taken into account as part of financial investments. Therefore, they are not reflected on line 1170 of the balance sheet. Lines 1190 (for long-term) or 1230 (for short-term) of the balance sheet are intended for such loans.

Any additional costs associated with the issuance of borrowed funds (for legal review of the contract, payment for consulting services, etc.) are taken into account as part of other expenses (). Operations for issuing loans in cash are not subject to VAT.

Tax is not charged on the amount of interest accrued on them. Therefore, “input” VAT on certain costs associated with the issuance of funds to third parties is not deductible. The tax amount is included in the company's other expenses.

Interest accrued on loans is recorded as either sales revenue (if such transactions are an ordinary activity) or other income (if these receipts are not related to the ordinary activities of the company). They are accrued at the end of each reporting period (month) in accordance with the terms of the agreement. This is provided for in paragraph 16 of PBU 9/99. The fact that the lender pays interest does not matter.

The amount of interest is reflected in the accounts for accounting settlements. It does not affect the size of financial investments.

This is due to the fact that PBU 19/02 provides for a limited list of cases when certain operations lead to an increase in the cost of investments. However, it does not provide for the accrual of interest on borrowed funds.

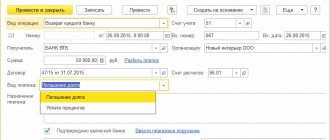

Such interest can be accounted for in account 76 “Settlements with various debtors and creditors” (if the loan is issued to a third party) or 73 “Settlements with personnel for other transactions” (if the loan is issued to a company employee). The procedure for paying interest by the borrower is also determined in the agreement. If it is not indicated there, then the borrower is obliged to transfer them monthly until the loan amount is repaid. Example In January, a company issued a long-term loan to another company in the amount of 4,000,000 rubles.

It is provided at 24% per annum. Interest is accrued for each day the loan is used. The borrower pays interest no later than the end of each quarter.

Additional costs associated with issuing the loan amounted to RUB 11,800. (including VAT - 1800 rubles).

The procedure for debt forgiveness under a loan agreement for an individual

- 19.03.2017

Forgiveness of debt to citizens in legal practice is much more common than in ordinary life.

Operations for issuing a loan will be reflected in the following entries: Debit 58 Credit 51 - 4,000,000 rubles. — the loan amount is transferred to the borrower; Debit 19 Credit 60 - 1800 rub.

Most often, debt cancellation occurs in the field of entrepreneurial activity, for example, in relation to an employee or founder. What features does the debt forgiveness procedure have, what form the relationship is formalized in, and what tax consequences they are associated with, all in detail in the article.

The most common situation is when an employee borrows money or goods from the company.

The procedure for debt cancellation will be regulated in this case by the company’s internal rules. For example, such a promotion may be announced in connection with certain events: payment of half of the debt by a citizen, a significant date in the activities of the enterprise - the anniversary of the formation of a holding company, etc. An employee also has the opportunity to forgive a debt if he has a difficult life situation or has been experiencing financial problems for a long time difficulties.

Credit institutions of any form do not write off debts to borrowers: banks, microfinance organizations, pawnshops, etc.

Debt forgiveness can also be applied to a citizen who is the founder of a company.

It is also possible to cancel debts owed by an enterprise in relation to an employee under contracts for the purchase of goods, works or services, assessed as the amount of the contract. Debt forgiveness is also possible if the organization is declared insolvent – bankrupt.

The procedure for canceling debt in this case is regulated by Law No. 127-FZ. Elimination of debt is also possible by concluding a settlement agreement during the judicial review of the dispute. Again, the rules on forgiveness apply only in cases where such an action does not violate the rights of other creditors.

Donation must be distinguished from debt forgiveness. While the donee loses material goods, and the donee receives, debt cancellation is mutually beneficial for the debtor and creditor. In exceptional cases, credit institutions liquidate debt.

The conditions of such promotions are stipulated in the loan program, which is implemented on a temporary basis and is available to certain citizens: those who find themselves in a difficult life situation (unemployed, chronically ill, etc.) Banks and other lending organizations are forced to forgive the debt after the statute of limitations expires. The accumulated debt is written off as hopeless and is not subject to collection in court.

The debt write-off transaction is carried out in the same form as the conclusion of a loan agreement, that is, in writing.

The following indicates that the creditor plans to forgive the debt without trial:

- there is no legal proceedings on the issue of debt collection;

- the subsidiary company is being rehabilitated;

- the creditor does not receive property benefits from the debtor under other obligations;

- in other cases when forgiveness does not have the characteristics of a gratuitous transaction.

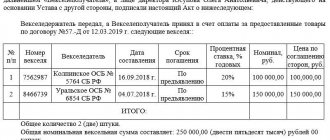

Loans

Under a loan agreement, one party (the lender) transfers into the ownership of the other party (borrower) money or other things determined by generic characteristics, and the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal number of other things received by him of the same kind and quality (Clause 1 of Article 807 of the Civil Code of the Russian Federation). The loan agreement is a real contract, that is, it is considered concluded from the moment of transfer of money or other things.

A loan agreement can be concluded by both legal entities and individuals; if the agreement is concluded between individuals, then the mandatory written form must be observed when the loan amount is from 1000 rubles, when concluding an agreement with the participation of a legal entity - the lender - always, regardless of the amount (clause 1 Article 808 of the Civil Code of the Russian Federation).

Contents of the article: The agreement is always interest-bearing, unless otherwise specified in the agreement itself.

The opposite rule applies in cases where an agreement is concluded between citizens for an amount not exceeding 5,000 rubles and is not related to the entrepreneurial activity of at least one of the parties, and also when under the agreement the borrower is not given money, but other things determined by generic characteristics - in these cases, the loan agreement is considered interest-free, unless otherwise provided in the agreement itself. Please note that if the agreement does not contain conditions on the amount of interest, their amount is determined by the existing bank interest rate at the lender’s place of residence, and if the lender is a legal entity, at the place of its location (as of 02/10/2014).

The refinancing rate is 8.25 percent per annum. Directive of the Bank of Russia dated September 13, 2012.

N 2873-u) on the day the borrower pays the amount of the debt or its corresponding part (clause 1 of Article 809 of the Civil Code of the Russian Federation). Funds under a loan agreement can be transferred both in cash and using non-cash payments. When paying in cash, it is necessary to take into account that, in accordance with paragraph.

1 instructions of the Central Bank of Russia dated June 20, 2007 N 1843-U, cash settlements in the Russian Federation between legal entities, as well as between a legal entity and a citizen carrying out business activities without forming a legal entity, between individual entrepreneurs related to the implementation of their business activities, within of one agreement concluded between these persons may be made in an amount not exceeding 100,000 rubles. RECEIPT FOR RECEIPT OF THE LOAN AMOUNT: SAMPLE Important! There are no restrictions on cash payments involving citizens not related to their business activities.

We recommend reading: How much is the fine if you park your car on the lawn?

Legal entities and individuals who are not individual entrepreneurs can make such payments among themselves in Russian currency without restrictions. When issuing and repaying loans and borrowings, cash register equipment is not used and cash receipts are not required (Letter of the Ministry of Finance of Russia dated February 21, 2008 N 03-11-05/40).

The procedure for writing off a loan agreement (nuances)

> > July 11, 2021 Writing off a loan agreement is a situation that almost every company has to face in business practice.

It is important for accounting professionals to understand that writing off loan debt comes with some tax implications.

This is discussed in our article. As a general rule, a company can write off the funds due to it under a loan agreement if the existing debt has become classified as bad.

When can a debt be considered bad? As follows from paragraph 2 of Art. 266 of the Tax Code of the Russian Federation, this is possible when any of the following circumstances occur:

- The statute of limitations on the contract has expired. In this case, the company must remember that if, after 3 years (clause 1 of Article 196 of the Civil Code of the Russian Federation) from the moment the debt was formed, the loan has not been repaid, the company has the right to write it off. But only if the company has not sued the debtor over the past 3 years.

ATTENTION!

If the debtor company acknowledges by its actions that it must pay the amount of the debt under the contract, the statute of limitations will be interrupted and will have to be counted again. For more information on writing off overdue debt, see

in the article.

- The debt obligation was terminated under the Civil Code of the Russian Federation due to the fact that it is no longer possible to fulfill it (for example, if the debtor, an individual, died).

- The company that borrowed the money was liquidated. At the same time, the company should understand that the legality of writing off the loan agreement is best confirmed by an extract from the Unified State Register of Legal Entities on the liquidation of the debtor. Tax authorities may refuse to consider a debt uncollectible until the company provides confirmation (clause 1 of Article 252 of the Tax Code of the Russian Federation).

- The bailiff announced the end of enforcement proceedings due to the fact that either the debtor could not be found, or he did not have property that could be recovered to pay off the debt under the loan agreement.

In taxation, writing off a bad debt allows a firm to reduce its taxable income by the amount of the principal amount owed plus interest accrued up to the date of bad debt.

ATTENTION! Interest that continued to accrue after the debt became hopeless should be expensed only if the statute of limitations under the contract has expired.

If the borrowing company has been liquidated, interest should no longer accrue after liquidation. At the same time, the company should remember that the above is true if it is on the general taxation system.

If the company applies the simplified tax system, then it will not be possible to write off the outstanding loan debt, since such expenses are not included in the closed list of expenses for “simplified people” (Art.

346.16 Tax Code of the Russian Federation). However, for tax purposes, regulatory authorities may impose some additional requirements:

- In particular, the company needs to be prepared for the fact that the very right to write off the loan will need to be defended in court. In sub.

How to write off debt correctly

You can write off bad receivables on the basis of the following documents (Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n):

- Report of the results of the inventory of calculations No. INV-17.

- Documents confirming the hopelessness of the debt.

- An order or instruction from a manager in any form.

In order for an organization to take into account bad debt when calculating income tax, the accrual method must be fixed in the accounting policy (clause 7, clause 1, article 265, clause 1 and clause 3, article 266 of the Tax Code of the Russian Federation). Under the cash method, income is recognized upon receipt—there are no overpayments.

The debt can be attributed to the reserve for doubtful debts or to the financial result.

Write-off against reserve

The reserve for doubtful debts allows you to write off 50% of the debt after 45 days of delay and 100% after 90 days. The reserve is written off only to cover losses from such debts. Register the posting:

| Dt 63 | Kt 62 (76, 60) |

Write-off to financial result

There may be no reserve for doubtful debts at all or may not be enough to fully cover the debt - write off the difference as a loss. Complete the wiring:

| Dt 91.2 | Kt 62 (76, 60) |

For five years, reflect the amount of the written off bad debt in the debit of off-balance sheet account 007. If the debt is returned, include the amount received in income and write off the debt as a credit to account 007.

How to write off and account for accounts payable on loans

This is the situation. The organization's account contains accounts payable for loans received (account 67.3) and accrued interest (account 67.4).

How can you write off accounts payable for loans received and accrued interest so that there is no need to pay income tax?

How to reflect in the accounting and tax accounting of the Lender and our Borrower Organization transactions to write off accounts payable for loans received and accrued interest? To write off accounts payable for loans received and accrued interest without tax consequences, the following steps should be taken: 1.

Transfer accounts payable to the founder - a legal entity. 2. The founder forgives the debt. In this case, debt forgiveness must be done in order to increase the net assets of your Organization. Let's consider the procedure for accounting and tax accounting for the operation of writing off accounts payable for loans received and accrued interest in accordance with the above procedure. Assignment of the right of claim (debt transfer) for loans and interest Tax accounting for the debtor-borrower VAT Income tax When the creditor assigns a claim to another person from the debtor under an agreement the loan does not have any tax consequences for VAT, since there is no transaction that is the object of taxation (clause 1 of Article 146 of the Tax Code of the Russian Federation).

The assignment by the creditor of the claim does not terminate the obligations of the debtor; therefore, when the creditor changes, the debtor under the loan agreement does not have any consequences for the purpose of calculating income tax. For the creditor-lender, the fact of replacing the debtor under the obligation arising from the loan agreement does not entail for creditor of any VAT consequences.

This is due to the fact that loan transactions in cash, including interest on it, are exempt from taxation. For the creditor-lender, replacing the debtor under the obligation does not have any significance, since upon entry into force of the agreement on the transfer of debt, the obligation to return the amount of the principal debt and Interest payments on the loan are retained. Funds received from a new debtor to repay the principal debt are not income for profit tax purposes (clause

10 p. 1 art. 251 of the Tax Code of the Russian Federation). As for interest under a loan agreement, both before and after the transfer of debt, they are taken into account in tax accounting as follows. Interest on the loan is included in non-operating income on the date of their recognition in accordance with Chapter.

25 Tax Code of the Russian Federation. When applying the accrual method under a loan agreement, the validity of which falls on more than one reporting (tax) period, income in the form of interest is recognized at the end of each month of the corresponding reporting (tax) period. In the event of termination of a loan agreement (repayment of a loan obligation) during a calendar month, interest is included in income on the date of termination of such an agreement (repayment of a loan obligation) (paragraph 3, clause 6, article 271 of the Tax Code of the Russian Federation).

How to write off microloan debts?

Loan restructuring in MFOs . Debt restructuring refers to procedures when the borrower and the MFO enter into an agreement to change the method of fulfilling the obligation. The structure and nature of debt is changing. Penalty obligations under the loan agreement and obligations to pay penalties are replaced in accordance with such an agreement with loan obligations. Replacing an obligation in accordance with civil law is called novation. Restructuring is a term that was introduced by banks and used by microfinance organizations.

In this regard, restructuring in practice means:

- Replacing an obligation with another, replacing the currency of payment, the method of fulfilling the obligation - the so-called “innovative” approach to debt restructuring.

- Increasing the payment period under the contract, deferring payment repayment (is not an innovation in accordance with judicial practice).

- Disadvantages of restructuring: the consumer agrees to an increase in the payment period, deferment of payment, or agrees with the penalty calculated for him, seduced by a reduction in the interest rate. Restructuring is the most profitable way for an MFO to resolve a problem with a client. The fact of restructuring (depending on its type) affects the credit history negatively.

LEARN MORE about MFO debt restructuring via the link on our website, and also watch a video with legal advice

Accounting for loans and borrowings in accounting

> > > August 28, 2021 How a loan differs from a loan and how to keep records of loans and borrowings in accounting - this primarily depends on who asks these questions - the lender or the borrower.

It is this condition that determines which accounts will be applied.

How these transactions are reflected in the accounting records of each party to the transaction and how a loan differs from a loan will be discussed in our material. A loan represents funds transferred by a credit institution to a borrower.

In this case, the latter pays interest for the use of such borrowed funds.

Taking into account these definitions, we can highlight how a loan differs from a loan:

- a loan is issued only by a bank, and a loan can be provided by individuals, organizations and individual entrepreneurs;

- a loan implies payment of interest to the lender for using the amount issued; the issuance of loans does not contain such a mandatory condition: they can be interest-free;

- a loan is issued exclusively in cash, a loan - both in money and in the form of an equivalent in kind (in goods, for example).

Cm.

An important difference between a loan and a credit is that a loan is borrowed funds from organizations and individuals, expressed in money or their equivalent in kind.

Also . In accounting there are no special differences between a loan and a loan. Thus, the rules for accounting for loans and borrowings in accounting are described in PBU 15/2008 “Accounting for expenses on loans and credits.” The costs should include:

- other associated costs: payment for consulting and information services, expert assessment of the loan agreement, etc.

- interest on loans and borrowings;

Interest, according to paragraph.

8 PBU 15/2008, are taken into account in one of the following ways:

- in the manner prescribed by the terms of the contract, if this does not violate the uniformity of their accounting.

- evenly throughout the entire term of the contract,

Other costs associated with loans and borrowings should be taken into account evenly throughout the entire term of the contract.

Accounting for borrowed assets is carried out using the following accounts:

- 67 — under contracts valid for more than 12 months.

- 66 - under contracts valid for 12 months or less;

We recommend reading: Database of deportees from Russia

We will consider the accounting procedure for received loans and borrowings using examples.

Example 1 An organization received a loan on February 2 in the amount of RUB 1,500,000. Interest rate - 10%. The term of the loan agreement is 24 months.

The monthly payment amount is RUB 62,500.

The agreement with the bank provides for payment of interest and repayment of the loan amount monthly on the last day of each month.

Interest accrues from the next day after receiving the loan.

In February, the organization will make the following entries: February 2 Dt 51 Kt 67.1 - a loan was received to the organization’s current account in the amount of RUB 1,500,000.

February 28 Dt 91.2 Kt 67.2 - interest accrued on the loan: 1,500,000 / 365 × 26 × 10% = 10,684.93 rubles.

prednalog.ru

As the Ministry of Finance interprets, an unrepaid loan can be written off as expenses (letter N 03-03-06/1/23763 dated April 24, 2015). Moreover, this rule applies to both interest-bearing and interest-free loans and assignment of claims.

Loan debts are written off as non-operating expenses when calculating corporate income tax. Based on paragraphs. 2 p. 2 art. 265 of the Tax Code of the Russian Federation, when calculating income tax, non-operating expenses include losses received by the taxpayer in the reporting (tax) period, incl.

and the amount of bad debts. If the taxpayer creates reserves for doubtful debts, then the amounts not covered by the reserve funds are considered bad debt. Based on clause 2 of Article 266 of the Tax Code of the Russian Federation, bad debts are debts for which the debt has expired or is impossible to repay due to the liquidation of the organization or an act of a government agency. According to the general rules, the limitation period is three years from the date determined in accordance with Art.

200 of the Civil Code of the Russian Federation (Article 196 of the Civil Code of the Russian Federation). The list of grounds for recognizing a debt as bad is exhaustive. The amount of debt under interest-bearing and interest-free loan agreements, if it is recognized as bad, is included in non-operating expenses (clause

2 clause 2 art. 265 of the Tax Code of the Russian Federation). According to paragraph 3 of Art. 279 of the Tax Code of the Russian Federation, amounts under an agreement for the assignment of rights of claim are not considered bad debt.

Postings for writing off an unrepaid loan (if you issued the loan). D-t 58-3 K-t 51 – provision of a loan and transfer from the current account D-t 91-2 K-t 58-3 – writing off unrepaid debt as non-operating expenses. By analogy, we can also consider the situation regarding loans received.

Only income from outstanding loans is included in non-operating income. Accounting entries for an unrepaid loan (if you received the loan). D-t 51.50 K-t 66.3 – receipt of a short-term loan D-t 66.3 K-t 67 – short-term loan transferred to long-term D-t 67 K-t 91.1 – accrual of non-operating income on an outstanding loan.

How to calculate vacation pay correctly and have time to relax.

Go on vacation soon! To receive a free book, enter your information in the form below and click the “Get Book” button. Your e-mail: * Your name: *

Income tax

The Ministry of Finance of Russia, in letter dated April 24, 2015 No. 03-03-06/1/23763, explained that the amount of debt under interest-bearing and interest-free loan agreements is considered uncollectible for profit tax purposes and is included in non-operating expenses in accordance with subparagraph 2 of paragraph 2 of the article 265 of the Tax Code of the Russian Federation.

As for accounting for accrued but not received interest, you need to be guided by the explanations of the Ministry of Finance of Russia, given by the department in letter dated November 15, 2005 No. 03-03-04/2/116. Financiers then explained: the enterprise has the right to include interest on an outstanding loan as non-operating expenses if they were previously taken into account in income. The basis can be reduced in the period in which the debt was recognized as bad.

The grounds for recognizing a debt as uncollectible in tax accounting are determined by Article 266 of the Tax Code of the Russian Federation. According to paragraph 2 of Article 266 of the Tax Code of the Russian Federation, these are: expiration of the limitation period (Article 196 of the Civil Code of the Russian Federation); impossibility of fulfilling an obligation for reasons beyond the control of the parties (Article 416 of the Civil Code of the Russian Federation). For example, due to force majeure circumstances (natural disasters, military operations, terrorist attacks, etc.); termination of an obligation on the basis of an act of a state authority or local government (Article 417 of the Civil Code of the Russian Federation); liquidation of the debtor organization (Article 419 of the Civil Code of the Russian Federation); by a decree of the bailiff about the impossibility of collecting the debt due to the fact that it was not possible to establish the location of the debtor, property, there is no information about the debtor’s funds and other valuables in banks.

From January 1, 2021, amendments made to Article 266 of the Tax Code of the Russian Federation expanded the list of grounds for recognizing a debt as bad. These now include the debts of Russians declared bankrupt. The company has the right to include in non-operating expenses the amounts of receivables if one of the grounds listed in paragraph 2 of Article 266 of the Tax Code of the Russian Federation exists. If the basis is declaring an individual bankrupt in accordance with Federal Law No. 127-FZ of October 26, 2002 “On Insolvency (Bankruptcy),” the company has the right to write off receivables as expenses.

advokat-martov.ru

For debt forgiveness for an employee who is likely to quit, forgiving the debt after the employee's employment ends may reduce the likelihood of disputes. Insurance premiums for compulsory social insurance against industrial accidents and occupational diseases. The legal, economic and organizational basis of compulsory social insurance against industrial accidents and occupational diseases are established by Federal Law of July 24, 1998 N 125-FZ.

“On compulsory social insurance against accidents at work and occupational diseases”

(hereinafter referred to as Law No. 125-FZ).

In accordance with paragraph 1 of Art. Civil Code of the Russian Federation, an agreement for the donation of movable property must be concluded in writing only if the donor is a legal entity and the value of the gift exceeds three thousand rubles or if the agreement contains a promise of donation in the future. In other cases, the gift agreement may be concluded orally.

Taking into account the above explanations regarding insurance premiums, it seems advisable to formalize debt forgiveness through a gift agreement. Debt forgiveness operations are facts of economic life within the meaning of Art.

3 of Law No. 402-FZ, therefore, are subject to registration as primary accounting documents (Part 1, Article 9 of Law No. 402-FZ). The composition and forms of primary accounting documents are determined by the head of the economic entity on the proposal of the official who is entrusted with maintaining accounting records (Part 4 of Art. Such conditions for the possibility of recognizing a tax benefit as unjustified are given in paragraph.

3 Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 53.

The tax authorities will try to prove that the true economic content of the transaction is a gratuitous transfer of funds, and possibly for the purpose of extracting tax benefits.

And the tax benefit, in accordance with paragraph.

9 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 53, cannot be considered as an independent business goal. With regard to establishing the presence of reasonable economic or other reasons (business purpose) in the actions of a taxpayer, paragraph 9 of Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 53 states the following.

The presence of such a goal is carried out taking into account the assessment of circumstances indicating intentions to obtain an economic effect as a result of real business or other economic activity.

Let us note that the disputed reserve amounts were created in 2002 and 2003, when, in accordance with the wording of clause 1 of Art. 266 of the Tax Code of the Russian Federation, it was possible to create reserves for any debt, including loan agreements.

That is, it was possible to write off doubtful debts under such contracts in advance through the amounts of the created reserve, and not include them in non-operating expenses only after the expiration of the statute of limitations. The tax authorities' arguments for additionally assessing the organization's income tax, which the arbitration court agreed with, were as follows.

The taxpayer provided interest-free loans to organizations that already had significant

Write-off procedure

When calculating income tax, bad receivables can be written off in two ways: through the created reserve for doubtful debts (clause 5 of Article 266 of the Tax Code of the Russian Federation); reflected in non-operating expenses (subclause 2, clause 2, article 265 of the Tax Code of the Russian Federation).

The Resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 17, 2014 No. 4580/14, No. A27-1862/2013 explain that the Tax Code provides companies with the opportunity to simultaneously take into account as part of non-operating expenses the amount of deductions to the reserve for doubtful debts. Any debt to the company arising in connection with the sale of goods, performance of work, provision of services is recognized as such a loan, if this debt is not repaid within the time period established by the agreement and is not secured by a pledge, guarantee, or bank guarantee (clause 1 of Art. 266 Tax Code of the Russian Federation).

If a bad debt arose outside of connection with the sale of goods, performance of work or provision of services and could not, due to direct instructions of the law, participate in the formation of a reserve for doubtful debts, the provisions of subparagraph 2 of paragraph 2 of Article 265 of the Tax Code of the Russian Federation allow the amount of bad debt to be taken into account directly as part of non-operating expenses when calculating the taxable base for income tax. At the same time, paragraph 5 of Article 266 of the Tax Code of the Russian Federation, which provides that if an organization has decided to create a RSD, then debts are written off at the expense of the reserve amount and only the part of the debt not covered by it is included in non-operating expenses, is applicable only to a situation where a bad debt arose in connection with the sale of goods (works, services).

Forgiveness of a debt to an employee: how to reflect it in accounting

Polyakov Maxim Author PPT.RU July 24, 2021 How to record debt forgiveness on an interest-free loan issued to an employee, formalized by a gift agreement? ConsultantPlus TRY FOR FREE The loan was provided in the amount of RUB 800,000.

Subsequently, a gift agreement was concluded with the employee, providing for the release of the employee from the obligation to the organization to repay the loan. In the current calendar year, the employee did not receive gifts or financial assistance from the organization. Under a loan agreement, one party (the lender) transfers into the ownership of the other party (borrower) money or other things determined by generic characteristics, and the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal number of other things received by him of the same kind and quality .

The loan agreement is considered concluded from the moment of transfer of money or other things (clause 1). The condition for providing a loan without paying interest for the use of borrowed funds must be fixed in the loan agreement (clause

p. 1, 3). The debtor's obligation to repay the loan can be terminated by the creditor by forgiving the debt, if this does not violate the rights of other persons in relation to the creditor's property (clause 1). Note that gratuitous debt forgiveness is considered by the courts as a gift (Guide to Judicial Practice). In this case, a gift agreement was concluded between the employee and the organization, providing for the gratuitous release of the employee from the obligation to the organization to repay the loan ().

Since the donor is a legal entity and the value of the gift exceeds 3,000 rubles, the gift agreement is concluded in writing (clause 2). The gift agreement comes into force from the moment of its conclusion (signed by both parties) (clause 1). When an employee is free of charge from the obligation to repay the loan, he or she receives economic benefit (income) in the amount of the amount of the loan debt forgiven (clause

1 ). Such income is recognized as an object of taxation and is taken into account when determining the tax base for personal income tax (clause 1, clause 1). Personal income tax is calculated at a tax rate of 13% (p.

1 ). The cost of gifts received by an employee from an organization does not exceed 4,000 rubles. for the tax period, is exempt from personal income tax (p.

28). Since the employee did not receive any other gifts from the organization in the current calendar year, the amount of gratuitously forgiven debt in excess of 4,000 rubles is subject to personal income tax.

An organization that has forgiven an employee a debt free of charge, as a tax agent, is obliged to calculate and withhold the calculated amount of personal income tax from the employee’s income when paying income and pay the amount of personal income tax to the budget (clauses 1, 2, 4). Personal income tax is calculated on the date of actual receipt of income by the employee, determined in accordance with (clause

3 tbsp. 226 of the Tax Code of the Russian Federation). This article does not establish special rules for determining the date of actual receipt of income in case of gratuitous debt forgiveness. Since the employee receives this income in non-monetary form, the date of its receipt is determined in accordance with paragraphs.

Personal income tax (NDFL)

When an employee is gratuitously released from the obligation to repay the loan, he or she receives economic benefit (income) in the amount of the forgiven loan debt (Clause 1 of Article 41 of the Tax Code of the Russian Federation).

Such income is recognized as an object of taxation and is taken into account when determining the tax base for personal income tax (clause 1 of article 209, clause 1 of article 210 of the Tax Code of the Russian Federation).

Personal income tax is calculated at a tax rate of 13% (clause 1, article 224 of the Tax Code of the Russian Federation).

The cost of gifts received by an employee from an organization does not exceed 4,000 rubles. for the tax period, is exempt from personal income tax (Clause 28, Article 217 of the Tax Code of the Russian Federation).

Since the employee did not receive any other gifts from the organization in the current calendar year, the amount of gratuitously forgiven debt in excess of 4,000 rubles is subject to personal income tax.

An organization that has forgiven an employee a debt free of charge, as a tax agent, is obliged to calculate and withhold the calculated amount of personal income tax from the employee’s income when paying income and pay the amount of personal income tax to the budget (clauses 1, 2, 4 of Article 226 of the Tax Code of the Russian Federation).

Personal income tax is calculated on the date of actual receipt of income by the employee, determined in accordance with Art. 223 of the Tax Code of the Russian Federation (clause 3 of Article 226 of the Tax Code of the Russian Federation). This article does not establish special rules for determining the date of actual receipt of income in case of gratuitous debt forgiveness. Since the employee receives this income in non-monetary form, the date of its receipt is determined in accordance with paragraphs. 2 p. 1 art. 223 of the Tax Code of the Russian Federation as the day of entry into force of the gift agreement.

Withholding personal income tax when paying income in kind is made from any funds paid to the employee, for example, from the wages due to the employee. At the same time, the withheld amount of personal income tax cannot exceed 50% of the amount of income paid in cash (clause 4 of Article 226 of the Tax Code of the Russian Federation).

The transfer of the amount of calculated and withheld personal income tax is made no later than the day following the day of payment to the employee of the income from which personal income tax was withheld (clause 6 of Article 226 of the Tax Code of the Russian Federation).

We also note that in the case under consideration, the employee was issued an interest-free loan, under which the employee generates income in the form of material benefits from savings on interest for the use of borrowed funds (clause 1, clause 1, article 212 of the Tax Code of the Russian Federation).

The tax base for income in the form of material benefits on an interest-free loan is determined as the amount of interest calculated on the basis of 2/3 of the current refinancing rate established by the Bank of Russia on the date of actual receipt of the specified income (which follows from paragraph 1, paragraph 2, article 212 of the Tax Code of the Russian Federation ).

The date of actual receipt of income in the form of material benefits from savings on interest is determined as the last day of each month during the period for which the borrowed funds were provided (clause 7, clause 1, article 223 of the Tax Code of the Russian Federation). In this case, it does not matter how the loan obligation is repaid - in cash or otherwise (for example, as in this case, debt forgiveness).

The procedure for taxing personal income tax on income in the form of material benefits on an interest-free loan is discussed in detail in the consultation of M.S. Radkova.

In this consultation, records on the deduction of personal income tax from an employee’s income from material benefits from savings on loan interest are not provided.

Insurance premiums

Forgiveness of a debt arising from a loan agreement is not related to the employee’s performance of work duties, does not depend on the results of his work, is not an incentive or compensatory payment, and is not provided for by an employment (collective) agreement.

In this regard, the amount of the forgiven debt is not a payment made within the framework of the employment relationship, i.e. does not apply to payments provided for in paragraph 1 of Art. 420 Tax Code of the Russian Federation, clause 1, art. 20.1 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against accidents at work and occupational diseases” (hereinafter referred to as Law N 125-FZ). Accordingly, such payment is not subject to insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, as well as compulsory social insurance against industrial accidents and occupational diseases. The same conclusion (with regard to insurance premiums provided for in Chapter 34 of the Tax Code of the Russian Federation) can be drawn from Letter of the Federal Tax Service of Russia dated April 26, 2017 N BS-4-11/8019. This approach, in our opinion, can also be applied to insurance premiums provided for by Law N 125-FZ.

At the same time, this Letter explains that in cases where the issuance of loans to employees with subsequent debt forgiveness is of a systemic nature, the tax authorities may have a question about the validity of the tax benefit received by the payer of insurance premiums.

It should also be noted that in the case where debt forgiveness is formalized by a gift agreement in writing, the object is subject to insurance premiums provided for in Chapter. 34 of the Tax Code of the Russian Federation, does not arise on the basis of clause 4 of Art. 420 Tax Code of the Russian Federation.

For additional information on the issue of taxing the value of gifts to employees with these insurance contributions, see the Encyclopedia of Disputes on Personal Income Tax and Insurance Contributions.