Who can use BSO instead of cash register

In what situations can a strict reporting form be used instead of a cash receipt and until what date can this be done according to the old rules?

A strict reporting form (SRF) can be used to replace a cash receipt when making payments to the public for services rendered (Article 1.1 of the Law “On the Application of CCP” dated May 22, 2003 No. 54-FZ as amended by the Law “On Amendments...” dated July 3, 2016 No. 290 -FZ, clause 2 of article 2 of law No. 54-FZ until amendments are made to it). According to the updated requirements, BSO, like cash receipts, must be generated in an automated manner using online devices.

However, for persons who have not previously used cash registers (and these include those who make payments through BSO), Law No. 290-FZ, which contains the rules for the transition to the application of the updated Law No. 54-FZ, set the start date for the mandatory use of cash registers later than the total (07/01/2017) – from 07/01/2018 (clause 9 of article 7). At the same time, legal entities and individual entrepreneurs issuing BSO to customers were given a separate clause in Law No. 290-FZ (clause 8 of Article 7), and it also contained the date 07/01/2018.

However, Law No. 290-FZ has undergone an adjustment (Law “On Amendments...” dated November 27, 2017 No. 337-FZ), which resulted in a change in the text of clause 8 of Art. 7. In it, the date 07/01/2018 was replaced by the date 07/01/2019, and the text included a clarification that services performed with the registration of BSO should not be related to catering services provided by both legal entities and individual entrepreneurs with hired employees.

Thus, BSO for services for the population could be applied according to the old rules (which were in force before the update of Law No. 54-FZ by Law No. 290-FZ) until 07/01/2019.

After the specified period, entrepreneurs and organizations that can issue BSO instead of cash register checks are required to generate strict reporting forms using automated settlement systems.

Read about what other innovations have led to changes in cash register legislation in the following articles:

- “Latest changes in 54-FZ “On the use of cash register equipment””;

- “Current amendments to the law on online cash registers.”

For whom does the abolition of BSO and CCP apply in 2021?

Last year, the State Duma adopted a draft law that stipulates the use of online cash registers and strict reporting forms by certain categories of businessmen. Officials were afraid that there would be a shortage of cash registers on the market, so they had the opportunity to postpone the implementation of them in companies.

Full list of categories for which CCP and BSO were canceled in 2018:

- Individual entrepreneurs and legal entities on the patent taxation system (does not apply to catering and retail sales). If the client requires a document of purchase, it can be written out on a form, sales receipt, or receipt.

- Legal entities and private entrepreneurs who pay a single tax on imputed income (does not apply to public catering and retail trade).

- Private entrepreneurs, companies on the patent taxation system and UTII (applies to the field of catering and retail sales). At the same time, there should be no officially registered employees at the enterprises.

- Business entities that pay simplified taxes and provide services to individuals, but not public catering.

- Private entrepreneurs who do not have hired labor. They must use vending devices to sell products.

Companies that offer services to citizens of the country and perform work must issue strict reporting forms in accordance with the legal framework of the country.

Who is exempt from using CCT?

The list of cases when you can work without a cash register is exhaustive and is indicated in paragraphs. 2, 3, 5, 6 tbsp. 2 of Law No. 54-FZ. These are the situations:

- issuing (receiving) cash using automatic devices for settlements in credit institutions (including electronic means of payment);

- sales of printed media and related products, if the share of sales of printed products is at least half of the turnover, and related products correspond to the assortment list approved by the constituent entity of the Russian Federation;

- sales of securities;

- sales of tickets, coupons, travel documents giving the right to travel on public transport, in vehicle salons;

- sale of food in educational institutions;

- trade at fairs, retail bazaars, exhibitions, at specially designated areas, excluding trade in trading places equipped and ensuring the demonstration and safety of goods;

- fair trade in non-food products, the list of which is established by the Government of the Russian Federation;

- peddling trade (except for the sale of technically complex goods and food that require special storage and sale conditions) in passenger train cars, from trays and hand carts, and other small-scale mechanization equipment;

- sales of ice cream, draft soft drinks in kiosks;

- sales of kvass, milk, vegetable oil, live fish and other excise-free draft goods from tank trucks, sales of seasonal vegetables and fruits by rummage;

- acceptance of waste materials from the population, excluding scrap metal, scrap of precious metals and precious stones;

- providing shoe repair and painting services;

- providing metal repair services - making keys and small metal haberdashery;

- provision of nanny and nurse services;

- sales of handicrafts, if sales are carried out by the manufacturer himself;

- providing services for plowing gardens and cutting firewood;

- providing porterage services at train stations, ports, and airports;

- leasing of real estate (housing) from individual entrepreneurs;

- work in remote settlements, the list of which is approved by a special resolution of the Government of the Russian Federation;

- sales of medicines and medical products by medical organizations located in rural areas where there are no pharmacies, or by FAP pharmacies located in villages and towns;

- sales of goods, services and products for religious and ritual purposes by religious organizations that have the appropriate license in the places where they carry out their activities.

See also the article “Who should switch to online cash registers from July 1, 2021?”

Issuance of BSO in electronic form

The seller will have to issue the BSO electronically. After all, if before settlement the client asks to send the BSO to his email or subscriber address (telephone), then this must be done if technically possible (clause 2 of article 1.2 of Law No. 54-FZ). If such a request was received from the buyer after the calculation and issuance of a paper BSO, then there is no need to send him an electronic BSO. You can do otherwise: send the client electronically information about such a BSO - the registration number of the cash register, the amount, date and time of calculation, the fiscal sign of the document and the address of the site where such a BSO can be obtained free of charge (clause 3 of Article 1.2 of Law No. 54 -FZ). The BSO received by the client in electronic form and printed by him on paper is equal to the BSO printed on the cash register (Clause 4, Article 1.2 of Law No. 54-FZ).

Postings in organizations using BSO for calculations

If an organization uses a strict reporting form instead of a cash receipt, then such a form must be stored and accounted for according to the rules established by Decree of the Government of the Russian Federation dated May 6, 2008 No. 359. Strict reporting forms are kept in the appropriate journal (stitched and numbered). To control the movement of such material assets, an accounting card is created.

Typical transactions when using BSO in an organization are as follows:

| Debit | Credit | The essence of the operation |

| 10 | 60 | Purchase from the BSO printing house, posting them to the organization |

| 19 | 60 | VAT has been allocated from the amount of purchased forms |

| 68 (VAT) | 19 | Value added tax on purchased forms is accepted for deduction |

| 20 | 10 | BSO were transferred to the relevant units or financially responsible persons |

In addition, BSO are reflected on the balance sheet in account 006. Its use allows you to keep track of the receipt and write-off of forms by departments and financially responsible persons (MRP). Thus, the debit of account 006 reflects the receipt of forms to the corresponding department and to a certain MOL. According to the credit of account 006, strict reporting forms are written off from the unit or MOL upon their disposal (use, damage).

The identified shortage is documented in an act drawn up by an authorized commission. The write-off of BSO in case of damage is also carried out by an act.

BSO is stored in safes or fireproof cabinets designed for storing such documents. BSO inventory is carried out regularly (at least once a year).

Read more about accounting and inventory of BSO in the article “What applies to strict reporting forms (requirements)?” .

How to keep records of strict reporting forms

Resolution 359 (keeping a book of records of strict reporting forms is regulated by this normative act) defines the requirements for maintaining a book. The following are required:

- lace the sheets;

- number;

- Submit the signature of the manager and chief accountant;

- seal or stamp.

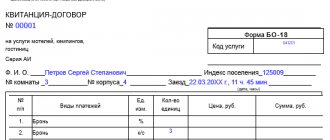

Let's consider a template for filling out the book, taking into account the main task: to provide accounting in the context of names, series and numbers of BSO. To do this, we define the required fields and columns:

- Name of the form - for example, Receipt BO-3, Work Order BO-1.

- Date of movement, day, month, year - this is the date of receipt from the printing house, the date of transfer to the person responsible for accepting money from the public.

- From whom it was received or to whom it was issued – we indicate the name of the printing house upon receipt, and when issued, the full name of the person responsible.

- Basis (name of the document, number, date) - when receiving receipts, this can be an acceptance certificate, a receipt order M-4, when releasing - a demand invoice, an act, a receipt - depending on the established document flow schedule.

- Receipt, Expense (quantity, series and form number, amount) - in these columns it is not necessary to rewrite all the numbers and series of printed receipts received, it is enough to indicate, for example, 10 pieces AK series No. 980500-980509 30 rub. 00 kopecks.

- Balance (quantity, amount) – determined after each receipt or issue of forms = Balance before the start of movement + Income-Output.

Instead of BSO - POS terminal

Operations for carrying out payment transactions through a POS terminal are subject to the Law “On activities for accepting payments from individuals carried out by payment agents” dated 06/03/2009 No. 103-FZ. Note that POS terminals include devices that allow you to use bank cards when paying for purchases.

If payment is made using a POS terminal, then a strict reporting form does not need to be issued instead of a cash receipt if the terminal is connected to a cash register that generates a receipt. If equipment is used that does not generate a cash receipt, then a BSO is issued.

More information about postings when using POS terminals at an enterprise can be found in the article “Posting debit 57 credit 57 (nuances)” .

When using a POS terminal by taxpayers specified in clause 8 of Art. 7 of Law No. 290-FZ provide buyers with BSO generated by cash register or an automatic payment system in the form used by such a taxpayer before the entry into force of Law No. 290-FZ (or printed forms approved by the accounting policy of the enterprise or (for some cases) by law).

Results

For organizations and entrepreneurs that provide services to the public and issue strict reporting forms when making payments to them instead of a cash receipt, a special deadline has been set for the transition to the mandatory use of online devices - 07/01/2019. Before this date, they have the right to issue BSO according to the old rules.

Sources:

- Federal Law of May 22, 2003 N 54-FZ “On the use of cash register equipment when making payments in the Russian Federation”

- Decree of the Government of the Russian Federation of May 6, 2008 N 359

- Federal Law of June 3, 2009 N 103-FZ “On the activities of accepting payments from individuals carried out by payment agents”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Cash registers as before

Until 2021, the procedure for working with strict reporting forms (SSR) for cash settlements with individuals was determined by the Decree of the Government of the Russian Federation “On the procedure for making cash payments...” dated 05/06/2008 No. 359. In accordance with it and the previously valid version of the law “On the use of cash registers” ..." dated March 25, 2003 No. 54-FZ, entrepreneurs and legal entities could issue BSO instead of cash receipts when receiving money from the population for services rendered.

There were two options for manufacturing BSO - printing and printing using automated systems (clause 4 of resolution 359). The forms were stored in a safe (or metal cabinet) and recorded in a special journal. In addition, copies or BSO counterfoils confirming the receipt of money and the amount of receipt had to be kept for 5 years.

If an automated system was used to print the BSO, then it was not required to register it with the tax office. But the taxpayer was obliged to provide tax authorities with information from this system upon request.