Requirements for the profession of chief accountant

As a specialist included in the ETKS directory, qualification requirements are established for the chief accountant according to which an employee can be appointed to this position. The list of requirements includes the following:

- diploma of higher education in the field (accounting);

- work experience as an accountant or auditor for at least 3 years, included in the last 5 years of total work experience;

- if you have a diploma of secondary specialized education in a specialized specialty (accounting) - at least 5 years of experience, included in the last 7 years of total work experience;

- absence of a criminal record, including an expunged one, for which an original certificate from the relevant law enforcement agencies must be presented;

- knowledge of legal regulation of the organization’s activities in various areas, including accounting, tax, labor and civil legislation;

- compliance with the professional standard “Accountant”, which is checked and confirmed by appropriate certification;

- analytical mind and ability to process large amounts of information;

- ability to manage subordinate employees, including resolving conflict situations;

- rules of business etiquette for communication both within the organization and outside it;

- use of office equipment, PCs and computer programs at the level of a confident user;

- resistance to stress and the ability to make competent professional decisions in difficult situations.

These requirements are specified in the ETKS and the Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ, and they are accepted for organizations of a certain line of activity:

- public and non-public joint stock companies (not credit);

- insurance companies;

- mutual investment funds (UIF);

- non-state pension funds;

- commercial entities whose securities are traded, etc.

The chief or leading accountant knows general qualification requirements even before hiring, but specific requirements at a particular enterprise can be presented directly when a vacancy is posted or already at an interview.

Assignment of responsibilities of the chief accountant

What education should a chief accountant have?

Having a higher education is a requirement that is imposed under the Law “On Accounting” No. 402-FZ only for the chief accountant of certain types of enterprises. This list includes:

- companies and enterprises in the form of OJSC (except for credit institutions),

- insurance organizations

- some types of funds, their management companies and governing bodies - non-state pension, joint-stock and mutual investment, state off-budget

- economic entities involved in securities trading (except for credit institutions)

In other enterprises, small and medium-sized businesses, and government organizations, a person without a university diploma can work as a chief accountant.

In credit institutions, the requirements for the head of accounting were established by the Central Bank - a degree in law or economics.

Often accountants with extensive practical experience, but without a specialized diploma - accounting, economics, finance - apply for the position of chief accountant. In this case, employers take into account the decision of the certification commission, which assesses the level of professional skill of the applicant.

Of the two applicants, the applicant with a higher specialized education has a higher qualification than the one with a higher non-core education. It is allowed to hire a chief accountant with a diploma of professional retraining.

Requirements for the chief accountant of a credit organization

In accordance with the legislation of the Russian Federation, a chief accountant who will be hired by a credit or other financial institution must meet the requirements established by the Central Bank of the Russian Federation. They are specified in the Federal Law “On Banks and Banking Activities” dated December 2, 1990 No. 395-1, and this particular specialist of the highest category must meet the following requirements:

- have a higher economic, accounting or legal education;

- work experience in the banking sector, namely experience in managing any department or work experience as a manager of any department for at least 1 year;

- If you have a higher education in another specialty not listed in the list, your work experience must be at least 2 years in a credit institution.

It turns out that only an employee who has work experience in such an organization, and especially experience in managing employees of a department, division or office, can be appointed chief accountant in a credit or financial organization.

From April 6, 2021, by order of the Ministry of Labor dated February 21, 2019. No. 103n approved a new professional standard, which expands the range of requirements for the qualifications of accountants. Standard approved by order of the Ministry of Labor dated December 22, 2014. No. 1061n, no longer valid.

According to the document that has entered into force, every accountant, regardless of qualification level, must have a specialized secondary vocational or higher education. At the same time, the answer to the question: “What kind of education is considered specialized?” I can’t find it in the professional standard itself.

Article 2, paragraph 25 of the Federal Law of December 29, 2012 comes to the rescue. No. 273-FZ “On Education in the Russian Federation”, which states that the focus (profile) of education is the orientation of the educational program towards specific areas of knowledge and (or) types of activity, determining its subject-thematic content, the predominant types of educational activities of the student and requirements for the results of mastering the educational program.

In other words, specialized education exactly corresponds to the industry and specialty, everything else is non-core. For example, if a chief accountant has a higher education (specialty) in the specialty “Finance and Credit,” then he needs to receive additional professional education under the professional retraining program “Accounting.”

Another difficult question regarding education is what document do you need to have in order to be considered “a person with secondary vocational and (or) higher education” and be allowed to undergo professional retraining (Part 3 of Article 76 273-FZ)? This issue is especially relevant for specialists who received their education before 1992. We suggest looking for the answer to it in the article “Documents on vocational education: historical and practical aspects”, published in the journal “Additional vocational education in the country and the world” (No. 4, 2017)

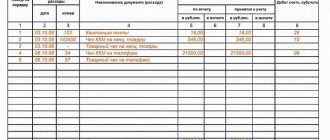

Below are summary tables from this article containing the types of educational institutions and the types of documents issued by these institutions:

Table 1 - Types of documents issued upon receipt of primary vocational education

Table 2 - Types of documents issued upon receipt of secondary vocational education

Table 3 - Types of documents issued upon receipt of higher education

Professional retraining and advanced training courses:

- For public sector accountants

- For accountants of commercial organizations

Requirements for the chief accountant of a non-state pension fund

When applying for a job as a chief accountant at a non-state pension fund, a specialist, in accordance with the Federal Law on such organizations dated 05/07/1998 No. 75-FZ, must meet the following criteria:

- he must have a good business reputation in society;

- absence in the work book of a record that the previous employment contract was terminated at the initiative of the employer;

- there must be no criminal record;

- the candidacy for this position must be confirmed by the Central Bank of the Russian Federation.

When applying for employment in an organization of this type, it is necessary to present an extensive package of documents confirming the candidate’s compliance with the requirements for it.

Job responsibilities of the chief accountant

In addition to the requirements for a chief accountant, an applicant for a vacancy should also be aware of his functional responsibilities. Basically they consist of the following points:

- general management of accounting department employees with division of responsibilities between employees;

- development of regulatory and methodological documentation for company accounting and taxation;

- development of rules and methods for all areas of accounting, including payroll calculation, assessment of property and liabilities, creation of a cost calculator, determination of depreciation groups and deductions for them, calculation of taxes and fees, transfer of payments to counterparties, etc.;

- providing assistance to accounting staff, including an accountant-cashier, for example, when registering a cash register with the tax office, a leading accountant when assessing property and liabilities, a payer when calculating personnel benefits, etc.;

- development of accounting and economic measures aimed at reducing the financial and tax burden and reducing unproductive expenses of the enterprise;

- generation of accounting and tax reporting required for submission to government agencies;

- jointly with a lawyer, transferring an organization from one taxation regime to another or to another form of ownership, for example, to an LLC or PJSC;

- interviews with candidates for work in the accounting department before their direct admission to the institution;

- creating presentations on the financial activities of the company;

- control over compliance with the correctness of accounting, which is established in accordance with the current legislation of the Russian Federation and local regulatory documentation of a budgetary or commercial organization.

The requirements for the chief accountant, as well as the responsibilities that apply to a highly qualified specialist, are contained in the qualification directory, and therefore its provisions cannot be ignored, but can be supplemented.

For example, management can increase the overall length of service in a specific organization or for a specific position, expand the list of responsibilities, but must indicate all these points in the job description. This document must certainly be shown to the employee before he is hired, so that in the future there will be no disagreements, conflict situations or misunderstandings.

A well-developed instruction will allow the chief accountant to perform his professional duties efficiently and in a timely manner and effectively manage a fairly large department.

Similar articles

- Accountant materialist job responsibilities

- Job responsibilities of an HOA accountant

- Responsibilities of an accountant for primary documentation

- Professional standards for accountants 2018

- Lead accountant at ETKS

What kind of work experience is required for the position of chief accountant?

To become a chief accountant, you need to work for at least 5 years as an accountant, auditor or other specialist in this field. This minimum is established in the “Qualification Directory of Managerial Positions.”

The “Professional Accountant Standard” allows that an employee with at least 3 years of work experience over the last 5 calendar years can be appointed to the position of chief accountant, if he has a specialized university diploma. Without higher education, you must work for at least 5 years out of the last 7 years.

The standards specified in these documents are advisory in nature for employers.

In credit institutions, the chief accountant must have more than 1-2 years of management experience in similar institutions in different situations.