Why do you need a 2nd personal income tax certificate?

It should be noted that a certificate may be required for 2 purposes:

- In personal cases - at the request of the employee.

- As a form of reporting by a tax agent to the tax authorities on the amounts of taxes withheld from the employee’s income.

NOTE! For 2-NDFL certificates for 2021, each of these purposes has its own form. For more information about the procedure for submitting 2-NDFL, see the material “Filling out the new 2-NDFL form for 2021 - submitting it in 2021.”

In turn, the employee’s personal goals may be related to:

- In order to confirm income (for submission to a credit institution or tax authorities in order to take advantage of the personal income tax deduction).

See: “Checking by banks of the 2-NDFL certificate for a loan.”

- In order to confirm the non-receipt of non-taxable personal income tax income.

See also: “Why and where do you need a 2-NDFL certificate?”

Will there be sanctions if an organization mistakenly issued a certificate in an unspecified form, explained 1st Class Advisor to the State Civil Service of the Russian Federation D. A. Morozov. Get to know the official's point of view by getting trial access to ConsultantPlus.

Actions if the document is not issued upon dismissal

It happens that for one reason or another (conflicts, reluctance to part with an employee, accounting errors, excessive “busyness”) the document is not issued. The best way to be on the safe side is to write a statement. The very fact of its preparation already takes the situation out of the ordinary, since in most cases such requests are oral.

The appeal is written in a free format, and the main task of the compiler is to clearly present the request. In addition, it is important to register an application for the issuance of a 2nd personal income tax upon dismissal. The accounting or human resources department may refuse, then you must send the application by registered mail. In this case, refusal will mean a direct violation of the law with all that it entails, in the form of a complaint to Rostrud and (or) the prosecutor's office.

In this case, a fine is provided, reaching 1-5 thousand rubles for officials, and 30-50 thousand rubles for a company. Sanctions are applied in accordance with Art. 5.27 Code of Administrative Offences.

Where to order and get a 2-NDFL certificate for a working person

In accordance with Art. 62 of the Labor Code of the Russian Federation, the employer’s powers include the obligation to issue employees information on income, including a 2-NDFL certificate. The responsibility for issuing a 2-NDFL certificate is assigned to the employer as a tax agent, which he is by virtue of the provisions of Art. 226 Tax Code of the Russian Federation.

Therefore, for citizens working in certain positions, the question is “Where can a working person get a 2-NDFL certificate?” does not cause any difficulties, and the problem is solved very simply: you need to contact your employer - current or former - for the document. He must issue a certificate within 3 days, without being interested in the employee’s motives for obtaining the document.

How and where to get a 2NDFL certificate?

When leaving a job, personal income tax certificate 2 automatically falls into the list of papers that are issued to the person who quits. If this does not happen, the employee has the right to demand it. Based on the fact that the certificate is signed (ideally) by the head of the organization/enterprise, the employer, either former or current, should apply for it.

At the place of work

Purely theoretically, it is easiest to obtain personal income tax at your place of work. An application is drawn up addressed to the director/manager with a request to provide a certificate (TC Article 62, TC Article 230, paragraph 3).

The request must be satisfied within 3 days (TC Article 62 as amended 2006/30/06 and 2014/21/07).

Refusal serves as a reason to contact the labor inspectorate and demand compensation for moral damage (Labor Code Art. 237).

The refusal is usually due to the fact that the employee was not officially hired, and therefore there is no information. Another reason is accounting irregularities. If the enterprise is “clean” in all respects, then there is no reason to refuse to issue a document. You can request personal income tax as many times as you like; there is no fee for issuing the document.

In the case of obtaining a certificate from a former employer, the algorithm of actions is the same.

If the organization is liquidated

If a company is liquidated, then there is no organization - no leader, even an ex. The information covered in the certificate is available to only two entities - the employer (accounting) and the tax authority (Tax Code Art. 230). But the duties of the tax authorities are not the issuance of personal income tax (NC Art. 32). Vicious circle?

Explanations are given in Letter of the Federal Tax Service No. BS-3-11/ [email protected] 2015/05/03.

To obtain a certificate in this case, you should contact the Federal Tax Service at the place of registration of the enterprise that was liquidated.

In an application requesting the necessary information, it must be indicated that the company has been liquidated and there are no other options for obtaining 2NDFL.

Copies of the employment record with the mark and seal of the disappeared office and passport are attached to the application. If the details of the company and the manager’s TIN are attached (check the seal in the work book), the situation will be significantly simplified. You should keep a copy of the application to the tax office for yourself.

Unemployed and unemployed

Where can I get a personal income tax certificate 2 for an unemployed person? An unemployed person due to circumstances, registered in the Employment Employment Center, makes a request to the accounting department of the employment center.

A temporarily unemployed person (due to dismissal) and not registered in the SZ can receive 2NFDL from an ex-employer or from the tax office (if the office is liquidated).

Anyone who has never worked or has never officially applied for a job has no chance to receive a certificate at all. The reason is obvious: due to the lack of a tax agent, no deductions were made (Tax Code Art. 208).

A non-working student must be issued a personal income tax upon his request at the dean's office of the educational institution.

For an individual entrepreneur

An individual entrepreneur himself is a tax agent, and therefore cannot issue himself a personal income tax of the 2nd form (Tax Code Ch. 23; Tax Code Art. 346.11).

For individual entrepreneurs, instead of 2NDFL, 3NDFL is used, which must certainly be endorsed by the tax office. Without marks from the Federal Tax Service, a declaration in Form 3 cannot replace 2 personal income taxes.

The second document, comparable in importance to 2 personal income taxes, for an individual can be a declaration form according to the simplified tax system. Marks on the acceptance of the “simplified” tax inspection must be made without fail.

The individual entrepreneur must take care of copies of these two documents in advance (when submitting) and ask the inspector to put tax authority marks on them.

Where can I get a 2-NDFL certificate for an unemployed person?

Now let’s look at where to get a 2-NDFL certificate in a situation where an individual is not employed anywhere. The specified income statement form can be obtained as follows:

- For students - in the dean's office of a higher educational institution.

- Unemployed, but registered with the employment service - at the employment center.

Read about the 2-NDFL certificate for individual entrepreneurs here.

In each case given, the application is written in the form recommended by the authority to which the certificate is applied.

In other cases, due to the absence of a tax agent who can withhold personal income tax, at the place of request it is necessary to present documents confirming the impossibility of submitting a certificate.

Thus, if you do not work, before determining a specific place where to get a 2-NDFL certificate for a non-working person, you should figure out what sources you receive income from and whether you are an individual entrepreneur.

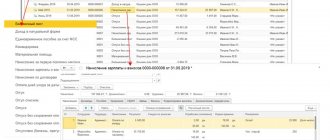

Contents of the document

The 2-NDFL certificate states only those amounts that are subject to taxation, and the document itself is drawn up in a special form.

At the very top the period for which it is issued and from what date is indicated. And then there is a column called “Data about the tax agent”, it contains all the information about the organization. After this comes information about the employee, namely:

- Full name, which is written without abbreviation;

- citizenship of the person;

- taxpayer status;

- passport details;

- registration and place of actual residence.

After this comes information about the employee’s income, which was subject to taxation, and they are all listed on a monthly basis. The form indicates not only the amount, but also the income code . Next comes data on the required deductions of various types. And at the very bottom the amount of tax withheld is indicated.

The document must be certified by the chief accountant, as well as the head of the company or enterprise. And it should bear the seal of the organization. Only in this case will it be considered valid.

Severance pay is not shown in 2-NDFL, since it is not taxed. Also, this document does not indicate the following payments:

- Benefits related to pregnancy and childbirth.

- Benefits that were paid upon liquidation of an enterprise or in connection with a reduction in the number of employees.

- Compensation for physical and moral harm caused.

Many people do not know where to get a 2-NDFL certificate if they have left the organization. You can take it at any time at your former job; the employer is obliged to issue it. Only this must be reported in writing.

You can write such an application in any form , but you must state your request and indicate the deadline for submission. You can take the form to work yourself and register it with the HR department there or send it by registered mail.

The organization is obliged to provide the former employee with a certificate of income within three days. If the manager refuses to issue a document, then the employee can contact the labor inspectorate.

How long does it take to get a 2-NDFL certificate?

By virtue of the provisions of Art. 62 of the Labor Code of the Russian Federation 2-NDFL is issued by the employer based on the employee’s application. The preparation period is limited to 3 days.

Is there any liability for the employer for violating the 3-day deadline? The answer to this question is in ConsultantPlus. Get free trial access to the system and move on to the Ready-made solution.

Moreover, if an error is made in the document, it is necessary to promptly make corrections and submit corrective certificates. Changes are made both to the employee’s certificate, at whose request it was issued, and to the certificate sent to the tax authority. If the error is identified by the tax authority before the corrections are submitted, then from 2021 the employer may be fined for unreliability of the submitted information under the new Art. 126.1 Tax Code of the Russian Federation.

For more information about making changes to 2-NDFL, see the material “2-NDFL: a “physicist” will not be fined for an error in the passport and address if the correct TIN is indicated.”.

Why you may need Form 2 Personal Income Tax

This type of certificate is usually provided under the following conditions:

- at a new place of work;

- when filing tax deductions;

- when calculating pensions;

- to participate in any litigation;

- during the procedure of adoption of a child;

- when calculating the amount of alimony or other payments;

- before applying for a visa (not always);

- to draw up a 3-NDFL declaration, which is filled out on the basis of a 2-NDFL;

- to provide a certificate to the tax office;

- when taking out a large amount on credit to purchase, for example, a car or an apartment. This helps the bank determine whether the borrower will be able to repay the borrowed amount later.

Many nuances for specific cases when taking form 2 personal income tax

Important! If an individual entrepreneur wants to take out a loan as an individual. person, Form 2 of personal income tax can be replaced by an extract from the Book of Income and Expenses.

A person is not obliged to talk about why he needed a certificate. It must be issued within 3 working days after writing an application for its receipt. If the tax agent is unable to provide this certificate for any reason, an administrative penalty will be imposed on him.

Form 2 personal income tax is not needed if:

- during the last reporting period the individual did not receive income;

- upon taking office at the first place of work;

- if the individual does not claim any deductions;

- employment took place on the first working day of the year;

- An individual does not have the right to reduce the tax base. In this case, the accounting department will not even ask for a certificate.

Results

Many citizens are interested in where to order a 2-NDFL certificate, and it is no coincidence: this calculation is an important document that allows you to judge the income of an individual received over the required period. Thus, in order, for example, to take advantage of personal income tax benefits or get a loan from a bank, you must be able to obtain it. In the absence of such a certificate, many of the services for which it is required may not be available to the citizen.

Sources:

- Labor Code of the Russian Federation

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Purpose of income certificate

An employee can receive a 2-NDFL certificate from the organization upon written request, or simply by contacting the manager or the human resources department orally.

In this case, the organization does not have the right to refuse to issue it to the employee. This form is an important document for a working person, as it reflects the average earnings and income tax paid. Upon dismissal, a 2-NDFL certificate is issued on the employee’s last working day. But it is not included in the list of mandatory documents, therefore it is provided at the request of the dismissed person.

This document may be needed in the following cases:

- While applying for a new job. Thanks to the data contained in this certificate, the employer will calculate payment if the employee was on sick leave.

- To calculate unemployment benefits. If an employee joins the Labor Exchange after dismissal, then benefits are calculated using the 2-NDFL certificate. And it is paid based on average earnings.

- When contacting a banking organization to obtain a loan.

This document may also be needed to process various government payments, for example, when applying for child benefits. The tax office may also request this form to confirm payment of income tax. To apply for a visa to another country, you must also submit such a document.

A 2-NDFL certificate for a dismissed employee is submitted to the tax office at the end of the year, when other documents are submitted. At the same time, it must have the same number and the same date as on the form that was handed over to the employee at his request.

Why is this certificate needed?

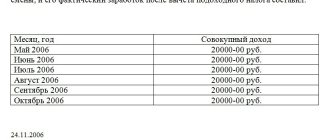

A non-working citizen may need a certificate of income in a number of cases.

In some cases, you may need to verify your income. Most often this happens in the following cases:

- When receiving a loan. The bank wants to be sure that the borrower has sufficient income so that he can repay the loan received.

- In some cases, when applying for a visa to another country, its consulate thus wants to make sure that the citizen has sufficient financial capabilities to support himself during the upcoming visit.

- Sometimes such a certificate may be required when an employee wants to use information about his income received at a previous job.

In the latter case, we are talking about the fact that when registering certain types of averages when calculating payments (in particular, this is allowed when calculating maternity leave pay), you can use data from a previous place of work if the employee expresses such a desire and provides supporting documents.

This certificate does not in all cases reflect the level of a person’s financial condition. Situations are possible when he works without registration, lives off an inheritance, or someone in the family has an income that allows others not to work.