Do I need to register it for self-export?

In a situation where the buyer independently organizes the removal of products from the seller’s warehouse, there will be two options regarding the need to draw up a consignment note.

- If you use the services of a transport company to move products, drawing up an invoice is mandatory. It will serve as a reporting document to confirm the provision of transport services by the carrier.

- If transportation is carried out by the buyer himself, an invoice is not issued, since no contract for transportation is concluded.

Read more about when and why you need to draw up a TTN here.

You can familiarize yourself with the consignment note in more detail on our website. Read the following materials:

- Features of working with waybills in EGAIS.

- TTN, delivery note and invoice: comparison of documents.

- What is a TTN number and is it a mandatory requirement?

About the consignor and consignee in TTN and TORG-12

We have a situation, we buy goods from organization A, but under the terms of the Agreement, ownership is transferred at the time of loading onto the vehicle, but transport is hired by organization C, to which our organization B sells this product.

How to correctly fill out TTN and TORG-12 in the lines consignor and consignee.

Thank you. Your personal expert answers: In this case, it is not the TTN that is issued, but the consignment note.

It is the consignment note that confirms the fact of concluding a transportation contract (clause 2 of article 785 of the Civil Code of the Russian Federation, part 1 of article 8 of the Law of November 8, 2007 No. 259-FZ, clause 6 of the Rules approved by Decree of the Government of the Russian Federation of April 15, 2011 No. 272) .

If the shipper has issued a waybill, then in general cases it is not necessary to issue a waybill. If the buyer picks up the cargo at his own expense with the help of a transport company, then in the bill of lading, the buyer (C) appears as the shipper and consignee, who hires the carrier. According to the rules of transportation, the shipper is the one who ordered it (clause

6 Rules, approved. Decree of the Government of the Russian Federation dated April 15, 2011 No. 272). The shipper negotiates the conditions and cost of transportation, enters into a transportation agreement and submits an order application. He, unless otherwise provided by the contract, draws up a transport bill of lading in three copies (clause 6 of Rules No. 272). The consignor in TORG12 will be the supplier from whose warehouse the buyer takes the goods - , the consignee will be buyer “C”.

According to the Ministry of Finance, during transit

Who issues the consignment note?

The forms and rules for filling out the consignment note are determined by Decree of the Government of the Russian Federation dated April 15, 2011 No. 272 “On approval of the Rules for the transportation of goods by road.” Paragraph 6 of these rules states that the consignment note is issued by the shipper.

- If a transport company is hired to move goods, the shipper is the buyer, who must issue a waybill. In this case, the buyer himself will also be the consignee. In such conditions, from the moment the products are shipped from the warehouse, the seller no longer bears any responsibility and is not obliged to draw up and issue a TTN.

- If the buyer carries out transportation using his own transport, then he may not issue a waybill. Then the products are registered in accordance with TORG-12, and transportation costs are confirmed by waybills and documents for the purchase of goods.

Whom should the shipper indicate when picking up?

According to the official position expressed in Letters from the Ministry of Finance of Russia, if delivery is carried out by the buyer’s own forces, the submission of a TTN to confirm the validity of expenses is not mandatory. There are judicial acts confirming this approach. At the same time, there are judicial acts containing a conclusion that it is impossible to recognize expenses for the purchase of goods without a consignment note.

According to other clarifications of the regulatory authorities, if, when picking up goods, the buyer engages a specialized carrier and the ownership of the goods passes to the buyer at the supplier’s warehouse, then the shipper is the buyer, who must issue a waybill.

In the case under consideration, in our opinion, if a waybill is issued, the buyer must be indicated as the shipper.

When releasing goods from the supplier's warehouse on the terms of self-pickup of the goods by the buyer's transport, the seller is obliged to issue the buyer only a consignment note of form N TORG-12 and issue an invoice or, instead of the two specified documents, issue a UPD.

If the goods are exported by the buyer with his own transport, then a waybill is not issued, and the document confirming the fact of transportation of the goods is a waybill for the vehicle. Similar explanations are given in Letter of the Ministry of Finance of Russia dated December 22, 2011 N 03-03-10/123.

If the buyer engages a carrier to deliver the goods, he will independently issue a bill of lading. In paragraph 2 of Art. Article 8 of the Charter states that the consignment note, unless otherwise provided by the contract for the carriage of goods, is drawn up by the shipper; a similar rule is duplicated in paragraph 6 of Rules No. 272, which we have already discussed in the article.

Let us remind you that the shipper, on the basis of clause 4 of Art. 2 of the Charter recognizes an individual or legal entity who, under a contract for the carriage of goods, acts on his own behalf or on behalf of the owner of the goods and is indicated in the waybill. In other words, the shipper can be both the supplier of goods and their buyer, persons authorized by the seller and buyer, as well as a freight forwarder.

In the Letter of the Federal Tax Service of Russia for Moscow dated August 11, 2011 N 16-15/ [email protected] it is explained that when goods are self-pickup through a specialized carrier, when ownership of the goods passes to the buyer at the supplier’s warehouse, the shipper is the buyer, who must issue a waybill.

Features of filling out form 1-T

The waybill consists of two parts:

- product section, where all product data is indicated;

- transport section, where information about the carrier is entered.

In a situation where the goods are picked up from the supplier by pick-up, the product section is filled in by the buyer . In the form, he must fill in the appropriate data columns for both the shipper and the consignee (points 1-7, 16, 17).

The document is drawn up in two copies and handed over to the carrier for him to fill it out, and after that one of the copies is returned to the buyer.

All copies of the TTN must be originals and not copies.

It is important to note that in reality the shipper may have some problems when filling out paragraphs 3 “Name of cargo”, 4 “Accompanying documents for cargo” and 6 “Reception of cargo”. Since to fill them out you need to know in advance:

- place;

- date and time;

- condition of the cargo;

- product labeling number at the time of loading;

- number of cargo spaces;

- series and numbers of quality certificates, etc.

This information can be obtained directly from the supplier, or if you are present at the time the goods are shipped from the warehouse.

In such cases, two options are possible.

- The buyer personally or an employee of the recipient company accepts the products from the seller using the TORG-12 consignment note and then transfers it to the carrier’s representative using the TTN, independently entering information into paragraphs 3, 4 and 6.

- You can also write out a power of attorney for an employee of a transport company (most often the driver) to accept the cargo, according to which he can fill out the relevant items.

We wrote about how to fill out the TTN using Form 1-T in this article.

On our website you can familiarize yourself with other types of TTN:

- CMR consignment note.

- TTN for dairy products, animals and other types of documents.

- TTN for grain according to the SP-31 form.

Nuances of filling out a new waybill

The article from the magazine “MAIN BOOK” is relevant as of October 7, 2011. Questions answered by: E.A. Sharonova, economist A.A. Komandirov, consultant of the freight road transport department of the Department of state policy in the field of road and urban passenger transport of the Ministry of Transport of Russia At the end of July, the Rules for the transportation of goods by road (hereinafter referred to as the Rules) came into force.

Together with them, the form of the consignment note was approved, which must be drawn up when concluding a transportation contract; (hereinafter referred to as the Motor Transport Charter). When accountants began to understand the new document, they had a lot of questions: who should fill out the waybill and when, what to write on which line, whose signatures to put, is it necessary to put a stamp, etc.

d. The procedure for using and processing documents related to road transportation is under the jurisdiction of several departments, including the Ministry of Transport of Russia. Therefore, together with us, a representative of this department answered questions about filling out the bill of lading. I.V. Egorova, Penza Our purchasing organization, under a supply agreement, itself picks up the goods from the supplier’s warehouse.

For this we hire a carrier.

Since our supplier has nothing to do with the transportation contract, he refuses to sign and stamp the bill of lading as the shipper. If our organization indicates itself both as a shipper and as a consignee, will this be correct? What are the items of the invoice?

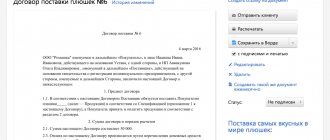

Accounting in 1C

In the 1C:Accounting 8 rev.3.0 program, a printed form of the new waybill has been implemented (as of release 3.0.88). The document can be printed in the same way as before by clicking the Print from a sales document with a date starting from 2021 (Sales - Sales - Sales (acts, invoices, UPD)).

Consignment note 2021 - example of filling

In the program, part of the TN data is filled in automatically ( Delivery at the bottom of the Implementation document (act, invoice, UPD) ), new details, if necessary, are specified manually in printed form.

- If the Contractor himself acts as a Carrier: The Shipper (p. 1) indicates the Client under the contract, and p. 1a is not filled out.

- The Client under the contract is indicated in section 1a Client (Customer of the transportation organization);

In section 3, manually enter the declared value of the cargo.

The person from whom the cargo is collected (p. 6) manually indicate the Client or the shipping warehouse (with details of the legal entity).

In section 10, the Carrier indicates (filled in automatically, if necessary, can be adjusted manually):

- the contractor under the contract (if the Contractor himself acts as a Carrier);

- owner of the vehicle (specified in clause 11) with whom the Forwarder has concluded a transportation agreement.

Section 11 states:

- data about the vehicle (filled in automatically - Delivery link in the sales document);

- vehicle ownership type - filled in manually.

If the Client issues a Bill of Lading on his own, it is necessary to obtain from the Contractor information about the type of ownership of the vehicle, as well as information about the direct carrier.